i

THE EFFECT OF GOOD CORPORATE GOVERNANCE, GROWTH

OPPORTUNITIES AND SALES GROWTH TO ACCOUNTING

CONSERVATISM

(Empirical Study on LQ 45 Companies Listed In Indonesia Stock Exchange )

Undergraduate Thesis

By:

Siti Humaeroh 1112082100009

ACCOUNTING DEPARTEMENT INTERNATIONAL CLASS PROGRAM THE FACULTY OF ECONOMICS AND BUSINESS STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

i

CURRICULUM VITAE

DAFTAR RUWAYAT HIDUP

Siti Humaeroh

Kp. Palayangan RT.01/01 Ds.Jagabaya Parungpanjang Bogor, 16360

TTL/Date of Birth : Bogor, 30 Juni 1992 Jenis Kelamin/Gender : Perempuan/Female Warganegara/Nationality : Indonesia/Indonesian Status Marital/Marital Status : Sudah Menikah/Married Nomor Telpon/Phone Number : 085781553331

Email : siti.humz@yahoo.co.id

Ringkasan/Summarize

I am interested in accounting science. Higly motivated and hard worker personality, with

motto”If there is a will, there is a way”. Good in individual and team work.

Pendidikan Formal/Formal Education

2012 – Current State Islamic University Syarif Hidayatullah Jakarta S1, Faculty of Economics and Business, Accounting ( International Program)

2008 – 2011 SMK Yuppentek – 5 Curug 2005 – 2008 SMPN 1 Parungpanjang 1999 – 2005 SDN Jagabaya O2

Pendidikan Non-Formal/Non-Formal Education

Latanza English Course

Pengalaman Kerja/Work Experinces

Teacher (Math Teacher) in SMK Acasia Fornis and SMK Yastrif Internship at developer companies

Admin in Mega Block

This statement, I create with the truly as the consideration for you.

ii

PENGARUH GOOD CORPORATE GOVERNANCE, KESEMPATAN TUMBUH, DAN PERTUMBUHAN PENJUALAN TERHADAP KONSERVATISME AKUNTANSI

(Studi empiris pada perusahaan LQ 45 yang terdaftar di Bursa Efek Indonesia

ABSTRAK

Tujuan penelitian ini adalah untuk memberikan bukti secara empiris pengaruh Good Corporate Governance yang diproksikan oleh Independent Commissioner dan Managerial Ownership, Growth opportunities dan Sales Growth terhadap Konservatisme Akuntansi.

Populasi penelitian adalah perusahaan yang tercatat di Bursa Efek Indonesia. Sample penelitian adalah perusahaan LQ 45 yang tercatat di Bursa Efek Indonesia. Teknik pengambilan sampel menggunakan metode purposive sampling dengan sample sebanyak 21 perusahaan untuk periode 2011 sampai dengan 2014. Metode analisis data menggunakan regresi linier berganda menggunakan SPSS Versi 17. Variabel independen dalam penelitian ini adalah Good Corporate Governance yang diproksikan oleh Komisaris Independen dan Kepemilikan Manajerial, Kesempatan Tumbuh dan Pertumbuhan Penjualan dan variabel dependennya adalah Konservatisme Akuntansi.

Hasil penelitian menunjukkan bahwa Kesempatan Tumbuh dan Pertumbuhan Penjualan berpengaruh positif signifikan terhadap Konservatisme Akuntansi. Sedangkan Good Corporate Governance yang diproksikan oleh Komisaris Independen dan Kepemilikan Manajerial tidak berpengaruh terhadap Konservatisme Akuntansi.

Kata kunci: Good Corporate Governance, Komisaris Independen, Kepemilikan Manajerial, Kesempatan Tumbuh, Pertumbuhan Penjualan dan Konservatisme Akuntansi.

iii THE EFFECT OF GOOD CORPORATE GOVERNANCE, GROWTH

OPPORTUNITIES AND SALES GROWTH TO ACCOUNTING CONSERVATISM. (Empirical study on LQ 45 Companies Listed in Indonesian Stock Exchange)

ABSTRACT

The purpose of this study is to provide empirical evidence of the effect of Good Corporate Governance proxied by Independent Commissioner and Managerial Ownership, Growth opportunities and Sales Growth to Accounting Conservatism

The population of the research are shares listed on Indonesian Stock Exchange. The sample are LQ 45 companies listed in Indonesian Stock Exchange. The sampling method is purposive sampling that were sampled are 21 companies for the period from 2011 to 2014. Methods used of data analysis was multiple regression analysis using SPSS version 17. Independent Variables of the research are Good Corporate Governance proxied by Independent Commissioner and Managerial Ownership, Growth opportunities and Sales Growth and Dependent Variables of the research is Accounting Conservatism.

The results showed that Growth Opportunities and Sales Growth had positive and significantly effect on Accounting Conservatism. While Good Corporate Governance proxied by Independent Commissioner and Managerial Ownership had no effect on Accounting Conservatism.

Key words: Good Corporate Governance, Independent Commissioner, Managerial Ownership, Growth Opportunities, Sales Growth and Accounting Conservatism

iv FOREWORD

Bismillah Hirrohman Nirrohim

Assalamu’alaikum Wr.Wb.

All praise to Allah SWT as the hearer, the seer and above all an abundance of grace,

Taufiq, as well as his guidance. So, because Allah SWT I can finish this research on time.

And shalawat always gives to our beloved prophet Muhammad SAW and all his families and

friends who always helped him in establishing Dinullah in this earth.

With the strength, intelligence, patience, and strong desire from Allah SWT, I am able

to finish this mini thesis as graduation pre requirement for bachelor degree. I believe there is

an invisible hand which has helped me going through this process.

My special thanks to my Mom, Komyanah, who has been helping and supporting her

daughter to finish this thesis. You are the embodiment of angle in human form. So, I want to

make you aways smile because your smile is the efficacious magic that can boost my spirit to

reach my dream and face the world. You always pray and fall your tears in the mid night in

the front of Allah SWT, you prayed only for the pleasure of your family and your stubborn

daughter. Thanks mom, even a thousand of word can’t explain how really happy I am to be

your daughter.

I also would like to extend my gratitude to my father, Sardi, for everything that you

have gave to me. I just can pray that Allah SWT will give you back for everything that you

have done. Thank you also, you always pray for me in your sholah.

I believe I am nothing without each of you who has helped me in finishing this thesis.

Thus, in this very special moment, let me say many thanks to all of them have been helping

me in this process of this thesis, including:

v 1. Special thanks to My Husband, Nandang Sunandar. You always be my place to say

every problem. Thanks for your patience, your knowledge, your motivation and

support. Thanks for your time and helps. So I can finish my thesis.

2. My relative family. Special thanks to my big sister Siti Ruaedah, you always be my

place to say every problem. Thanks for your patience, your knowledge, your

motivation and support. Special thanks for my lil sister Siti Sarah and My lil brother

Sigit.

3. Mr. Dr. Arief Mufraini, Lc., M.Si as Dean of Economic Faculty

4. Mrs. Yessi Fitri, SE., M.Si., Ak., CA as Head of Accounting Major

5. Mr. Hepi Prayudiawan, SE., MM., Ak., CA as Secretary of Accounting Major and

thesis supervisor. You are the best mentor with your carefulness, specificity and

punctuality. You have given me direction and guided me, share your knowledge to

me, and thank you so much for your time and your help. So I can finish this thesis.

6. All lecturers who have taught me patiently, may they have given are recorded in Allah

SWT almight and all staff UIN Syarif Hidayatullah Jakarta,

7. Special thanks to Mr. Bonik “Thanks a lot you have provide information and official

stuffs that I needed in college”.

8. All my friends in Accounting International Program 2012. Lia, Hadyan, Faiz, Syafiq,

Andhiko and Ody, thanks for every support, motivation to finish my thesis. Thanks

for every foolish thing that you have done, and you made my day full of laugh.

Thanks for the time we’ve been through together for four years. Senior, junior and

management class thanks all who couldn’t mention one by one “thanks for your

prayer.

9. All my teacher friends in Vocational High School, Mr. Madnur, Mrs. Ida, Mr. Ade,

vi Thanks for every support and motivation to finish my thesis. Thanks for your

knowledge which you shared to me.

I realize that this thesis is still far from perfect, thus suggestion and constructive

criticism from all parties are welcome, in order to improve my thesis. Finally, only Allah

SWT will return all and I hope this thesis will be useful to all parties, especially for

writers and readers in general, may Allah SWT bless us and recorded as the worship of

Allah’s hand. Amin.

Wassalammualaiakum Wr. Wb.

Jakarta, May 2016

vii TABLE OF CONTENTS

Curriculum Vitae...i

Abstrak...ii

Abstract...iii

Foreword...iv

Table of Contents...vii

List of Tables...x

List of Figures...xi

List of Appendixes...xii

Chapter I INTRODUCTION A. Background Issues...1

B. Problem Formulation...6

C. Objective Research and Benefits... ...7

1. Objective...7

2. Benefits ...7

Chapter II STUDY LITERATURE A. Theory Development...9

1. Positive Accounting Theory...9

2. Agency Theory...9

3. Signaling Theory... ...10

4. Accounting Conservatism...11

5. Corporate Governance...13

a. Independent Commissioner...14

b. Managerial Ownership...16

6. Growth Opportunities...17

7. Sales Growth... ...17

viii

B. Variables Interrelationship...17

1. Independent Commissioner and Accounting Conservatism...17

2. Managerial Ownership and Accounting Conservatism...18

3. Growth Opportunities and Accounting Conservatism...19

4. Sales Growth and Accounting Conservatism...19

5. Independent Commissioner, Managerial Ownership, Growth Opportunities, Sales Growth and Accounting Conservatism...20

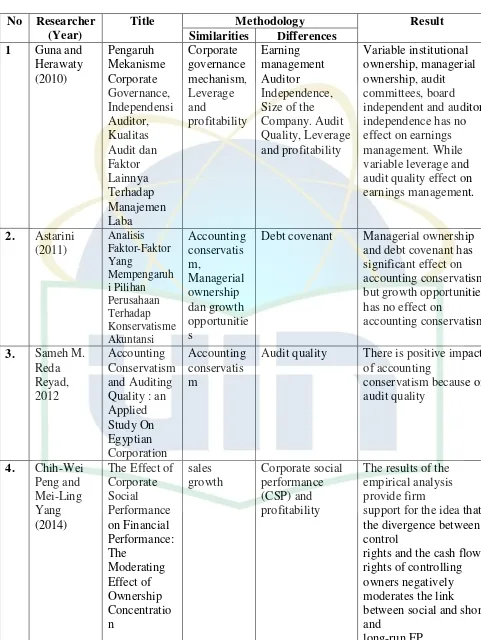

C. Previous Research...21

D. Framework and Hypotesis...23

a. Framework...23

b. Hypotesis...25

Chapter III RESEARCH METHODOLOGY A. Research Scope...26

B. Sampling Method...26

C. Data Collection Method...27

D. Analysis Method...27

1. Descriptive Analysis...27

2. Classic Assumption Test...28

a. Normality Test...28

b. Multicollinearity Test...28

c. Heteroscedasticity Test...29

d. Autocorrelation Test...29

3. Hypothesis Testing...30

a. Coefficient of Determination...30

b. Multiple Linear Regression Analysis...30

c. Simultaneous Significant Test (F-Test)...32

d. Significant Partial Test (T-Test)...32

E. Research Operational Variable...33

1. Dependent Variable...33

2. Independent Variable...34

a. Independent Commissioner...34

ix

c. Growth Opportunities...35

d. Sales Growth...35

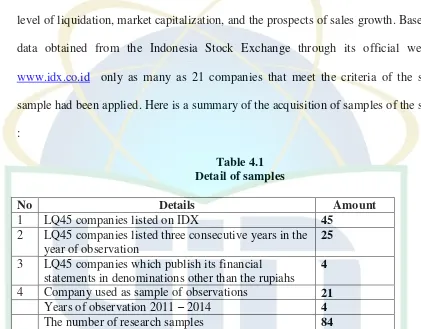

Chapter IV FINDING AND ANALYSIS A. General Description of Research Object...37

B. Analysis and Discussion...38

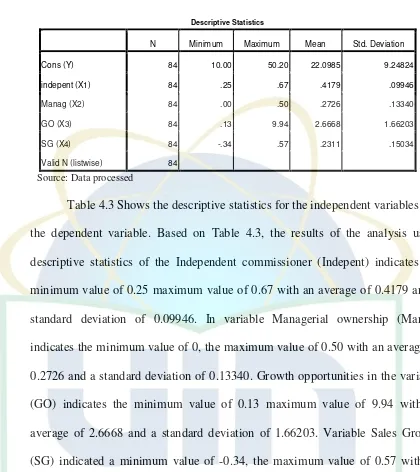

1. Descriptive Statistics...38

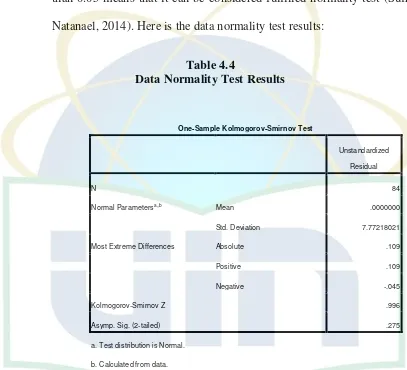

2. The Result of Data Quality Test...40

a. The Result of Normality Test...40

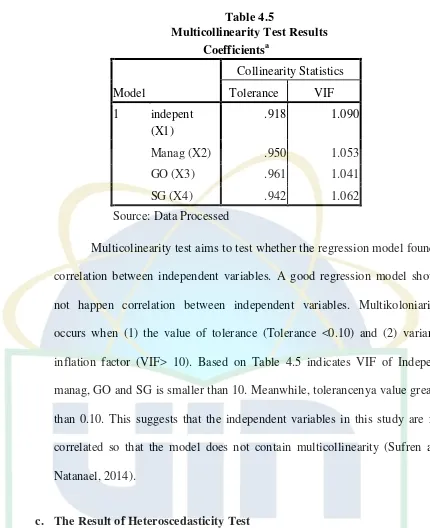

b. The Result of Multicollinearity Test...40

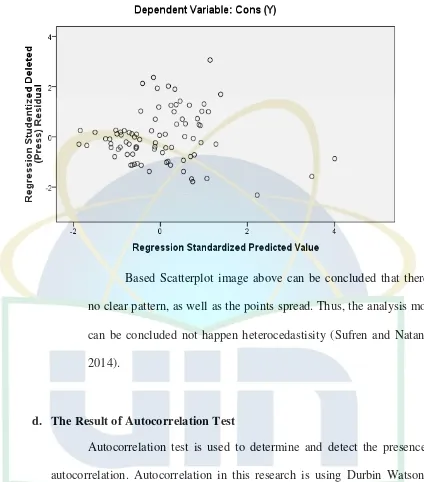

c. The Result of Heteroscedasticity Test...41

d. The Result of Autocorrelation Test...42

3. Hypothesis Testing...43

a. Coefficient of Determination...43

b. Multiple Regression Analysis Result...44

c. Significant Partial Test (T-Test)...47

d. Simultaneous Significant Test (F-Test)...51

Chapter V CONCLUSION A. Conclusion...52

B. Recomendation...53

x LIST OF TABLES

No Description Page

2.1 Overview Preview Research...21

3.1 Operational Variable and Variable Measuring...36

4.1 Sample Research...37

4.2 List of Sample companies...38

4.3 Descriptive Statistics...39

4.4 Normality test by One-Sample Kolmogorov-Smirnov Test...40

4.5 Results Multicollinearity Test...41

4.6 Test Autocorrelation (Durbin Watson)...43

4.7 Results Coefficient Determination...43

4.8 Regression Analysis...44

4.9 Simultanous Test Results (F-Test)...51

xi LIST OF FIGURE

No. Desription Page

2.1 Logical Framework...23

4.1 Heterocedasticity Test (Scatterplot)...42

xii LIST OF APPENDIXES

No. Description Page

1 Sample Description...57

2 Raw Data Description...58

3 Output SPSS That Used for the Result of the Research...63

1 CHAPTER I

INTRODUCTION

A. BackgroundIssues

Enterprise resource management and performance management described the

company through the financial statements. In Indonesia, the financial statements must

be prepared based on Statement of Financial Accounting Standards (SFAS) issued by

the Indonesian Institute of Accountants (IAI). In the financial reporting process,

managers are given the freedom by Generally Accepted Accounting priciples (GAAP)

in selecting accounting methods adapted to the economic conditions in the company.

Unstable economic conditions led to the economic conditions that are faced by every

company were different. In order to not to harm investors and creditors as users of

financial statements information, the company should conservative in making

financial reports.

The concept of conservatism in GAAP (Generally Accepted Accounting

Principles) set at SFAC No. 2 that describes the characteristics that make accounting

information can be useful. Conservatism is a reaction to the uncertainty. Paul Grady

(1965) in Novikasari and Sofyan (2013) describes ten basic concepts that are

considered underlying business and accounting practices in the United States. Grady

describes the basic concepts underlying the concept of quality as the usefulness and

reliability of accounting information or as the limitations inherent in the financial

statements. One of ten basic concept is the concept of conservatism

The principle of conservatism is the precautionary principle to a uncertain

circumstances to avoid excessive optimism of management and owners of the

company. Conservatism has a basic rule, namely: (1) should not anticipate earnings

2 before occurred, but have to admit losses may occur. (2) when faced with two or more

preferred method of accounting, the accountants must choose a method which at least

profitable for the company (Suharli, 2009). Selected technique is generating value of

assets and low income, or who produce value of debt and the cost of the highest.

Consequently, if there conditions that may lead to losses, costs or debt then losses,

costs or debt must be immediately recognized. Then, if there is a condition that is

likely to generate profits, income or assets then profit, revenue or assets should not be

recognized immediately, until the condition has been really realized (Ghozali and

Chariri, 2007).

Conservatism is necessary to minimize or even eliminate the fault recording

and overstatement in the financial statements. Because there are many cases of

recording errors or even fraud that ends by harming one of the parties, especially the

shareholders. As example is the case of the profit mark-up undertaken by the

management of Toshiba revealed in 2015. The company proved do mark up on profit

reached 151.8 billion yen, or around Rp 16 trillion. It’s fraud has happened for six

years since 2008 until march 2014. The amount of profit is marked up for three times

of estimated profit at Toshiba predictions. Tanaka and Sasaki as president and vice

president of Toshiba considered responsible for this case because the cheating

occurred in their period. Because of discovery means that Toshiba should resettle its

financial statements in April 2008 to March 2014 and cause the company's president

and vice president resigned. Because of this incident firm profound to say sorry to

shareholders for causing serious problems for them (beritasatu.com).

This case illustrates that conservatism is needed in order to make user of

3 Because today many case of fraud by inflating the company's profit because of some

motifs such as raising the value of company, stock price and so on. Therefore the

accounting conservatism absolute need to provide better financial reporting and

pressing cheating. As Starling (1970) in Novikasari and Sofyan, (2013) states that the

principle of conservatism is the most influential in accounting valuations. This

principle emphasizes to choose alternative accounting records have the smallest

possibility to re-overstate assets and income. The principle that has become the

standard primary listing in the first three decades of the 20th century applied to offset

optimism management as well as their tendency to overstate clicking financial

statements. Practitioners of accounting and accounting standard setters itself . This led

to the financial statements will generate profits that can be accounted by the company

so that profits are at present not a mark-up and will not harm any of the parties.

Today, companies face greater pressure to provide more reliable financial

statements. Several parties, including the FASB (regulator US accounting) were

advised to abandon the principle of conservatism in the accounting reporting of the

company to provide financial statements that do not bias. Also in recent years, capital

market participants require registration of the company's assets value closer to market

value rather than book value. Demand these actors increasingly lowering the prestige

of the application of the principle conservatism. Conservatism considered no longer in

line with the purpose of accounting standards requiring modern accounting standards

that can predict conditions in future (future-oriented), something that can not be done

by principle accounting.

Although declining prestige of accounting conservatism but still many

4 (Widya, 2005 in Wijayanti 2008), many of Indonesian firms are applying

conservative accounting in the preparation its financial statements. A total of 76.9

percent of the total companies in Indonesia choose the conservative accounting

method. Accounting conservatism applied in several level according Wardhani (2008)

states that the company's accounting conservatism applied in different levels. One of

the factors that determine the level of conservatism in financial reporting of a

company is the commitment of management and the company's internal parties in

providing information that is transparent, accurate and not misleading for investors. It

is a part of the implementation of good corporate governance. Implementation of

corporate governance carried out by all parties within the company, with the main

actor is the top management company is authorized to establish company policy and

implement the policy. One of the policy related to the principle of conservatism that is

used by companies in reporting its financial condition. Therefore, the characteristics

of the company's top management will affect the level of conservatism that will be

used by the company in preparing its financial statements.

Good Corporate Governance mechanism used to ensure that all activities of

the company including accounting method of the company has been run optimally in

order to achieve the ultimate goal required supervisory function well. Implementation

of Corporate Governance made by all parties within the company, with the main actor

is the top management will affect the level of conservatism that will be used by the

company in preparing its financial statements. The management characteristics

include independent commissioner and managerial ownership.

According to Padmawati and Fachrurrozie (2015) managerial ownership can

5 the company will cause the resulting financial interests of management will

implement more conservative of accounting. Independent commissioners is needed in

the company to protect minority shareholders and related parties. With the

independent commissioners, the supervision by the board of commissioners will be

more stringent so that it will tend to require conservative accounting to prevent

opportunistic attitude of the manager. (Padmawati and fachrurrozie, 2015)

The other factor influencing conservatism is growth opportunities. Companies

that have high growth rates have the motivation to minimize profit. As Widya (2004)

that the higher rate of growth of a company, the higher the likelihood that the

company is in choosing conservative accounting. Beside growth opportunities, sales

growth also influencing accounting conservatism. High sales growth expectations are

often increase the market against the future cash flows that will affect accounting

conservatism (Ahmed and Duellman 2002 in Padmawati and Fachrurrozie 2015).

Research of Satya (2013) also stated that the higher sales growth, the more inclined

the company choose a strategy of conservative accounting.

Researches on accounting conservatism have done by previous researchers.

Kootanaee, et al (2013) conducted a study on the influence of corporate governance

mechanism to accounting conservatism. The results showed that corporate governance

mechanism has no significant effect on accounting conservatism. This study is in line

with research Padmawati and Fachrurrozie (2015) which shows that good corporate

governance is proxied by managerial ownership and independent commissioner has

no effect on accounting conservatism but sales growth has significant effect to

accounting conservatism. This research is not in line with the study done Astarini

6 influence accounting conservatism. This result may be caused due to a difference in

research and place (state) research and research sample.

Research conducted by Astarini (2011) on accounting conservatism shows that

growth opportunities are not having a significant effect on accounting conservatism.

This study is not consistent with research Saputro and Setiawati (2004) found that

growth opportunities roomates have a significant effect on accounting conservatism.

This difference may be caused due to differences in study and research sample.

The variables used in this study had been investigated previous. But there are

differences of opinion between the previous researchers. Therefore, the author felt the

need to re-examine these variables to see the consistency of previous studies.

With the pros and cons regarding the application of accounting, the application

of conservatism in accounting increased the past few decades (Givoly and Hayn,

2000). Therefore, the research on this conservatism becomes interesting to discuss

because due to considerations relating to the company in applying conservative

accounting. Based on the background of problems above then I interesting in doing

research on accounting conservatism with the title “The Effect of Good Corporate

Governance, Growth Opportunities and Sales Growth to Accounting

Conservatism”.

B. Problem Formulation

1. Does Independent commissioner influence Accounting Conservatism?

2. Does Managerial ownership influence Accounting Conservatism ?

3. Does Growth opportunities influence Accounting Conservatism ?

4. Does Sales growth influence Accounting Conservatism ?

5. Does Independent commissioner, managerial ownership, growth opportunities and

7

C. Objective Research and Benefits

1. Objective

In accordance with the formula above, this study has the objective to:

a. Provide empirical evidence whether Independent commissioner influence

Accounting Conservatism

b. Provide empirical evidence whether Managerial Ownership influence

Accounting Conservatism

c. Provide empirical evidence whether Growth opportunities influence

Accounting Conservatism

d. Provide empirical evidence whether Sales growth influence Accounting

Conservatism

e. Provide empirical evidence whether Independent commissioner, managerial

ownership, growth opportunities and sales growth simultaneously influence

Accounting Conservatism

2. Benefits

With the research is expected to have benefits can be taken for all interested

parties. Results of the analysis obtained in this study is expected to provide benefits

for:

Theoretical Benefits.

1. Researcher, As a comparison between the theories that have been writers

get during the course with reality. So that can know the problems facing

company and conformity among others obtained so as to obtain solving

8 2. Students of Accounting

- As a source of information for other researchers who are interested in

the same issues and analysis and for those who need the information.

- As a science that could enrich the knowledge about accounting

conservatism

Practical Benefits

1. Company, by doing research on the accounting conservatism

implementation is expected to be used as an evaluation of the importance of

corporate.

2. Investor is hoped that this research can be used as a consideration in

the investment decision on companies that implement accounting

conservatism.

3. Government, by doing this research on the accounting implementation

9 CHAPTER II

STUDY LITERATURE

A. Theory Development

1. Positive Accounting Theory

Positive accounting theory explains that managers have an incentive or

encouragement to maximize welfare. This theory is based on a section that

managers and shareholders are rational. They seek to maximize their utility, which

is directly linked to their prosperity (Nugroho and Mutmainah, 2012)

Positive accounting theory predicts that managers have a tendency to raise

profit to hide poor performance. The tendency of managers to increase their

profits can be boosted by four issues, namely the hiring of asymmetric

information, limited working period managers, limited liability managers, and

asymmetry payment. Shareholders and creditors trying to avoid overpayment to

the manager to ask for the implementation of conservative accounting (Watts,

2003). Therefore it can be concluded that managers tend to organize accounting

liberal, but the lender (in debt contracts) and shareholder (in compensation

contracts) tend to ask the manager held a conservative accounting (Nugroho and

Mutmainah, 2012)

2. Agency Theory

Agency theory assumes that all individuals acting in their own interests.

Agency theory was first introduced by Jensen and Meckling (1976) on Wulandari

et al (2014). Agency relationship arises because of the contract between

shareholders (principal) and management company (agent) who is the manager of

the company, the contract holder authorizes management to run the company's

operations are included in decision-making. Both groups (the agent and principal)

10 are people who seek to maximize utility, then there is little reason for the agent

will not always act in the best interest of the principal.

In the agency theory is an imbalance of information or assymetry

information. The assumption that individuals act to maximize itself, resulting in

agents utilize their information assymetry they have to hide some information that

is not known by the principal. assymetry information and potential conflicts of

interest between principal and agent encouraging the agent to present information

that is not true to the principal, especially when it comes to the performance of

agents by thinking about how the accounting figures are used as a means to

maximize its interests (Wulandari et al, 2014)

3. Signaling Theory

According Fala (2007) Signaling Theory explains that the signaling is

done by managers to reduce assymetry infomation. Managers provide information

through the financial statements that they apply the accounting conservatism

policy which generate profit more qualified for this principle prevents companies

taking action to exaggerate profits and helps users of financial statements to

present the earnings and assets not overtsate. In practice management applying

conservative accounting policies with high computing depreciation will result in

lower profits relatively permanent, which means do not have a temporary effect

on the decline in profits would rebound on the future.

Understatement profit and net assets are relatively permanent in the show

through the financial statements is a positive signal of management to investors

that management has implemented a conservative accounting to generate quality

earnings. Investors are expected to receive this signal and valuing the company at

11 4. Accounting Conservatism

Accounting conservatism is still considered by accountants as one of the

most important principles. Accounting conservatism concept was controversial at

the turn of last century up till now. Despite of the criticism against this principle,

it still plays an important role in accounting practices Watts (2003) on Reyad

(2012)

Francis, et al (2004) on (Kim and Yung, 2007).assumed that conservatism

is one of the desirable attributes of financial statements because it increases

transparency. On the other hand, Penman and Zhang (2002) suggest that

conservatism results in lower quality of earnings because conservative accounting

practices accelerate expensing of investment costs, thus reducing income and

generating hidden reserves, when the firm's investment expenditures grow

Basu (1997) on Kootanaee, et al (2013) defined conservatism as requiring

a higher degree of verifiable to identification good news such as profit vs bad

news, such as loss. as well as the conservatism, defined choice and use of

consistently accounting policies that are resulting in underestimate report net

assets of the company. Basu definition of conservatism is based on loss and profit

and Feltham and Ohlson is based on the balance sheet, so that have try in

assessment underestimate the assets or overestimate report liabilities. Givoly and

Hayn (2000) provided combination definition of conservatism that is based on

balance sheet and income Statement perspective which has been trying in decrease

retain earning. They defined conservatism, choose of accounting policies in

uncertainty terms, so that is resulting minimum amount for assets and incomes

12 Accounting conservatism has long been adopted into accounting

procedures in theory and practice. FASB’s Concepts Statement No. 2 defines

accounting conservatism as a prudent reaction to uncertainty to try to ensure that

uncertainty and risks inherent in business situations are adequately considered

(FASB, 1982). Conservatism can be defined as a downward bias in net book value

of assets than their economic value that due to inconsistent and incomplete

identification economic in accounting profit. Standard sitting and researchers, who

presented various definitions of conservatism, that is similar above definition. For

example, The AICPA has been defined the conservatism through accounting

practice in identification profit and loss; So that the losses recognized upon the

occurrence and profits when realized. Reserves are clearly evident in FASB’s

conceptual framework (FASB, 1980, Para. 95)

As long as for performance reporting, management used the criteria and

accounting standards, moral hazard’s problems always will exist in financial

reporting. The Managers to increase their personal interest in use of accounting

standards that is the basis information to investors, bias functioned and in the

transmission information create noise. If the limits which opportunistic behavior

of the manager confine is not exit, then; the accounting figures contained in

financial reports prepare and present bias. But conservatism by requiring its

verifiable confine opportunistic and bias behavior of the managers. In practice

conservatism is neutral bias behavior of the manager and delay benefit identifiable

as a result less shown net assets and profit Ataheryan (2012) on kootanae, et al

(2013).

Givoly and Hayn (2000) indicates that there is a global trend of increased

13 of conservatism with the issuance of new accounting standards that accelerate the

recognition of costs and delays revenue recognition. Until now there is still

disagreement about the benefits of conservatism in the financial statements. Some

researchers argue that the profits generated from the conservative method of lesser

quality, irrelevant and useless. Most other researchers argue otherwise.

Researchers who have a second view assumes that conservative earnings, which

were prepared using conservative accounting principles reflect minimal profit that

can be obtained so that the profits are compiled with conservative methods are not

an exaggerated profit value, so it can be considered as earnings quality.

5. Corporate Governance

Corporate governance is the system which companies using as guidance

and control, so it is associated mainly with the problems of management and

ownership. Sloan (2001) provides a perspective on financial accounting and

financial economics, corporate governance can be defined as follows: a

mechanism that eliminates the incentive problems arising from the separation of

management and financing companies. Thus, corporate governance is a

mechanism to solve agency problems (kootanaee, et al 2013)

Definition of corporate governance according (Griffin on Susiana and

Herawaty, 2007:7) is The roles of shareholders, directors and other managers in

corporate decision making. Good governance is an effort guided by professional

ethics in business or work. In principle, the purpose of corporate governance is to

create value for interested parties. The parties are internal parties that include

commissioners, directors, employees and external interested parties. Corporate

governance is defined as a set of rules that define the relationship between

14 internal and another external, concerning their rights and obligations, or the

system in which companies set (directed) and controlled (controlled), the purpose

of corporate governance is to create added value for stakeholders (Forum for

Corporate Governance, 2001: 2).

Decision of Minister of State-Owned Enterprises No. KEP-117 / M-MBU /

2002 defines Corporate Governance as a process and structure used by an organ of

state-owned enterprises to improve the success of business and corporate

accountability in order to create shareholder value over the long term by taking

into account the interests of other stakeholders, based on regulations legislation

and ethical values. According to Organization for Economic Cooperation and

Development (OECD), Corporate Governance is One key element in improving

economic efficiency and growth as well as enhancing investor confidence that

involves a set of relationships between a company’s management, its board, its

shareholders and other stakeholders and also provides the structure through which

the objectives of the company, the means of attaining those objectives and

monitoring performance. In this study good corporate governance proxied by two

such as as independent commissioner and managerial ownership.

a. Independent commissioner

The definition of independent commissioner in accordance with the

provisions of Bapepam No. Kep 29 / PM / 2004 is Members of the

commissioner who came from outside the issuer or public company, has

no shares, either directly or indirectly to the issuer or public company, has

no affiliation with the issuer or public company, commissioners, directors

or shareholders the main issuers or public companies and do not have a

15 of the issuer or public company . Independent commissioner aims to

balance in decision-making, especially in the framework of the protection

of minority shareholders and other parties concerned (Susiana and

Herawati, 2007: 9).

According to Weisbach (1988) in Arifin (2005: 40), independence

commissioner in a company to be truly independent so that it can resist the

influence, intervention and pressure from major shareholders who have a

particular interest. As part of the supervisory organ, independent directors

are expected to have full attention and commitment in performing their

duties and obligations. To that end, independent commissioner is people

who have the knowledge, ability, time and integrity.

The existence of independent commissioner has set by Jakarta

Stock Exchange through the JSE regulations July 1, 2000. It suggests that

companies listed on the Indonesia Stock Exchange must have an

independence commissioners which is proportionately equal to the number

of shares owned by the minority shareholders (not controlling

shareholders). In this regulation, the requirements of the minimum number

of independent directors is 30% of the members of the board of

commissioner. Some of the criteria of the independent commissioner is as

follows:

1) independent commissioner has no affiliation with the majority

shareholder or controlling shareholder (controlling shareholders) listed

companies concerned;

2) independent commissioner has no relationship with the director and/or

16 3) independent commissioner does not have a dual position at another

company affiliated with the listed company concerned;

4) independent commissioner must understand the legislation in the field

of capital markets;

5) independent commissioner depreciated and elected by minority

shareholders who are not controlling shareholders (not controlling

shareholders) in the General Meeting of Shareholders (AGM).

b. Managerial Ownership

Midiastuty and Machfoedz (2003: 177) defines managerial

ownership as a percentage of shares owned by management and actively

participate in corporate decision which includes commissioners and

directors. Ownership of shares by companies is a mechanism that can be

used so that managers perform activities in accordance with the interests of

the owner of the company. The percentage of ownership is percentage of

shares owned by management including the percentage of shares owned by

private management.

Jensen and Meckling (1976) on Wulandari et al (2014) states that

the managerial share ownership can help unite the interests between

managers and shareholders, which means increasing the proportion of

managerial ownership, the better the performance of the company. The

existence of managerial ownership in the company can be one of the

efforts to reduce the agency problems between managers and align the

interests of managers and shareholders. The greater the proportion of

managerial ownership in the company, management tends vigorously to

17

6. Growth Opportunities

Growth opportunities are opportunities for growth in a company in the

future (Mai 2006). The company's growth is expected by internal and external

parties, due to good growth signaled for the development of the company. From

the perspective of investors, the growth of a company is a sign the company has a

favorable aspect, and the investor would expect a rate of return (rate of return) on

investments carried out showed good development. (Novikasari and Sofyan,

2013)

Companies that have high growth rates have minimize motivation for

profit. As Widya (2004) that the higher the rate of growth of a company, the

higher the likelihood that the company is in choosing conservative accounting

7. Sales Growth

Sales are the main operating activities of a company. Sales growth can be

interpreted as a change in sales per year. Growth in sales of a product depends on

the product life cycle. According Kotlerdan Armstrong (1997) in Abdul Aziz

(2005) there are four stages of the product life cycle that affect the sales growth

that the company's sales growth will affect the rate of accrual at companies such

as inventory, accounts receivable, and a high sales growth often increases the

market expectation of cash flows the future so that it will affect the market

conservatism (Ahmed and Duellman, 2007) in the Padmawati and Fachrurrozie

(2015).

B. Variable Interrelationship

1. Independent Commissioner and Accounting Conservatism

In carrying out its functions, independent directors will require accurate

18 (particularly the independent commissioner) in carrying out their functions as

decision makers and those who monitor management. A strong board of directors

(board of directors dominated by independent directors) will require more quality

information so that they will tend to be using more conservative accounting

principles. On the other hand, the board of directors dominated by internal parties

or board of directors who has a weak monitoring incentives will provide greater

opportunities for managers to use more aggressive accounting principles (less

conservative) (Ahmed and Duellman, 2007). Based on these descriptions

formulated the following hypotheses :

H1: How Independent Commissioner has positive effect on Accounting

Conservatism

2. Managerial Ownership and Accounting Conservatism

Research conducted by Ahmed and Duellman (2007) shows that there is a

relationship between managerial ownership with conservative accounting policy

of the company. Conflicts within the company can not be resolved when the

contract runs because it will cause huge costs. It is forcing shareholders to

complete the contract term of the contract is completed. The greater portion of

managerial ownership, the greater the pressure from outsider to applying

conservative accounting. Conservatism is considered capable of reducing the

ability of managers to present net income and overstate assets by more recognized

gain. Conservatism is also considered capable of reducing the behavior of

managers who hide information about losses. Based on these descriptions

19 H2: How Managerial Ownership has positive effect on Accounting

Conservatism

3. Growth Opportunities and Accounting Conservatism

At companies that use the principle of conservatism are reserves

Hidden is used for investment, so a conservative company synonymous with

growth companies (Barry and Wilopo, 2002). This growth will be responded

positively by investors that the market value of the company's conservative

greater than its book value that will create goodwill. The market will be

positive rate on the investment made by the company because of the

investments made now expected that the company will gain future cash flows.

Markets positive rate on the investment made by the company, because of the

investment is expected the company will gain a cash flow.

Research Feltham and Ohlson (1995) and Penman (2001) suggest that

conservative accounting is a concept that is appropriate for that concept shows

the growth of a company's net assets reported as lower than market value.

Based on these descriptions formulated the following hypotheses :

H3: How Growth Opportunities has positive effect on Accounting Conservatism

4. Sales Growth and Accounting Conservatism

The sales growth will affect the size of conservatism through the accrual

and market value (Ahmed and Duellmann 2007) .High sales growth will increase

expectations of future cash flows that can affect the conservatism market. The

company's growth in the future is a sign that the company has reached the high

level of profit. So that higher sales growth indicates that the company is more

20 Padmawati and Fachrurrozie (2015) states that the variable sales growth

shows the influence with accounting conservatism and has a positive sign on the

coefficient. Based on the theory of signal, with the investment, the market will be

positive rate on investment by the company because of the investments made

today is expected the company will gain future cash flows. Results of research

supporting research (Feltham and Ohlson 1995 and Penman 2001 in Widya, 2005)

which states that the concept of conservative accounting shows the growth of a

company's net assets are reported as lower than the market value. Companies that

use mostly conservative principles describe a company is grows because there are

hidden investment reserves used for investments. Based on these descriptions

formulated the following hypotheses :

H4: How Sales Growth has positive effect on Accounting Conservatism

5. Independent Commissioner, Managerial Ownership, Growth Opportunities

and Sales Growth and Accounting Conservatism.

Independent commissioner, managerial ownership, growth opportunities

and related sales growth as an indicator to determine the effect on the level of

accounting conservatism on the value of the company's financial statements.

Independent commissioner, managerial ownership, growth opportunities and high

sales growth will likely reporting companies use the concept of a conservative.

Based on these descriptions formulated the following hypotheses :

H5: How Independent Commissioner, Managerial Ownership, Growth

Opportunities and Sales Growth have simultanously effect on Accounting

21

Title Methodology Result

Similarities Differences

Debt covenant Managerial ownership and debt covenant has

Audit quality There is positive impact of accounting

support for the idea that the divergence between control

22 No Researcher

(Year)

Title Methodology Result

Similarities Differences (1) the risk of litigation has significant effect

23

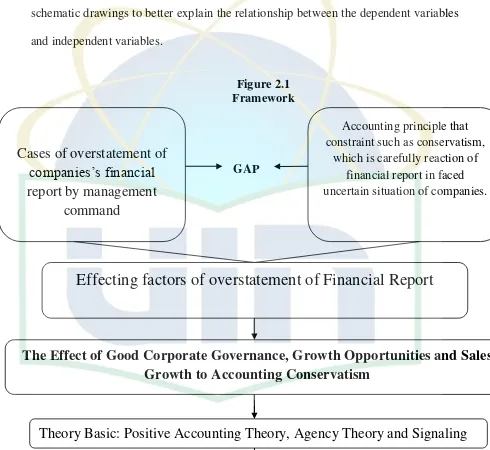

D. Framework and Hypotesis

a. Framework

Dalam penelitian ini peneliti berusaha menganalisis the effect of Good

Corporate Governance proxied by Independent commissioner and managerial

ownership, Growth Opportunities and sales growth on Accounting conservatism can

be seen briefly through the framework thought. The framework is made in the form of

schematic drawings to better explain the relationship between the dependent variables

and independent variables.

Figure 2.1 Framework

GAP

CONTINUE TO THE NEXT PAGE

Cases of overstatement of

companies’s financial

report by management

command

Accounting principle that constraint such as conservatism,

which is carefully reaction of financial report in faced uncertain situation of companies.

Effecting factors of overstatement of Financial Report

The Effect of Good Corporate Governance, Growth Opportunities and Sales

Growth to Accounting Conservatism

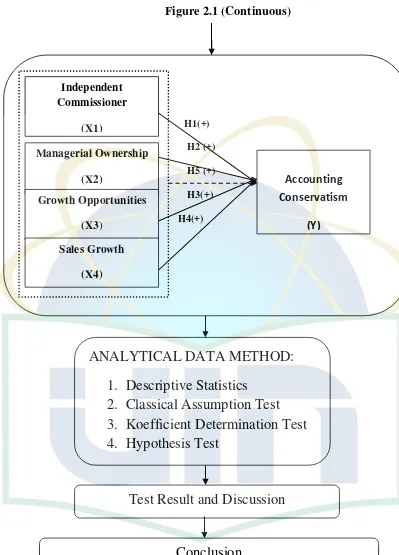

24 Figure 2.1 (Continuous)

H1(+) H2 (+) H5 (+) H3(+) H4(+)

Independent

Commissioner

(X1)

Managerial Ownership

(X2)

Accounting Conservatism

(Y)

Growth Opportunities

(X3) Sales Growth

(X4)

ANALYTICAL DATA METHOD:

1. Descriptive Statistics

2. Classical Assumption Test

3. Koefficient Determination Test

4. Hypothesis Test

Test Result and Discussion

25 b. Hypothesis

Of the framework that has been put forward before it can be concluded hypothesis

of this st

udy are:

1. H1: Independent commissioner has positive effect on Accounting

Conservatism

2. H2: Managerial Ownership has positive effect on Accounting Conservatism

3. H3: Growth opportunities has positive effect on Accounting Conservatism

4. H4: Sales Growth has positive effect on Accounting Conservatism

5. H5: Independent commissioner, Managerial Ownership, Growth opportunities

26 CHAPTER III

RESEARCH METHODOLOGY

A. Research Scope

The population in this study are the companies listed on the Indonesian

Stock Exchange (IDX). The object of this study is a LQ45 companies listed on

Indonesian Stock Exchange. The research period in 2011 - 2014

B. Sampling Method

Samples in this study are LQ45 companies listed on the Stock Exchange in

the period 2011 - 2014. Companies sampled in this study were selected using

purposive sampling method, namely the collection of data by using terms and on

certain criteria. So the sample is selected based on considerations directly

researcher with the terms sample represents the population and in accordance with

the desired characteristics in the study, as follows:

1. The Company is engaged in LQ45, which is listed on the Indonesia Stock

Exchange (IDX) in 2011 - 2014.

2. Companies were listed on LQ45 Companies at least 3 years in research period

3. The Company publishes its financial statements for the period 2011 - 2014.

4. The financial statements used are financial statements audited by independent

auditors.

5. The financial statements used are expressed in Rupiahs.

6. There completeness of the data needed in a row from 2011 - 2014.

27

C. Data Collection Method

In obtaining the data in this study, researchers used data that has been

available. The data will be used in this research is secondary data taken from the

annual financial statements. The data used in this study comes from an external

source, companies’s Financial Report listed on the Stock Exchange in the period

2011 - 2014 were obtained from the company's annual financial report obtained

from the website Indonesian Stock Exchange (IDX) is www.idx.co.id , Indonesian

Capital Market Directory (ICMD).

D. Analysis Method

The analytical tool used in this research is multiple linear regression using

SPSS, where the regression equation contains elements of interaction

(Multiplication of two or more independent variables). This interaction test used

to determine the extent of interaction variables can independent commissioner,

managerial ownership, growth opportunities and sales growth influencing

Accounting Conservatism.

1. Desriptive Analysis

Descriptive Analysis were used to describe the variables in this study, the

level of Accounting conservatism, good corporate governance, growth

opportunities and sales growth on companies listed on the Stock Exchange.

Descriptive statistics will provide an overview of each of the variables. The

analytical tool used is the average value (mean), distribution frequency, minimum

28

2. Classic Assumption Test

Classic assumption test aims to obtain regression results can be

accounted for and have results that are not biased or Best Linear Unbiased

Estimator (BLUE). Assumptions that must be met, of the test are normality

test, autocorrelation test, multicollinearity test and heterocedasticity test.

a. Normality Test

Normality test aims to test whether the regression model, the

disturber variables or residuals have a normal distribution. There are two

ways to detect whether or not residual normal distribution, namely by

looking at the analysis graph normal probability plot and statistical tests.

The regression model that has a data distribution is normal or near-normal

regression model is said to be good (Ghozali, 2011). In principle normality

can be detected by looking at the spread of the data (points) on the

diagonal axis of the graph or to view the histogram of the residual. The

basis for a decision as follows:

a. If the data is spread around the diagonal line and follow the direction of

the diagonal line or histogram graph showing a normal distribution pattern,

then the regression model to meet the assumption of normality.

b. If the data are spread far from the diagonal and does not follow the

direction of the diagonal line or histogram chart, present a normal

distribution, then the regression model did not meet the assumption of

normality.

b. Multicollinearity Test

Multicoloniarity test aims to test whether the regression model

29 in logistic regression analysis when the independent variables are

correlated between. Mutikolonieritas can be seen from:

• The value of tolerance and the opponent

• Variance Inflation Factor (VIF)

The results of these tests can be seen from VIF VIF using the

equation = 1/tolerance. If VIF <10 then there is no multicollinearity.

(Ghozali, 2011)

c. Heterocedasticity Test

Heterocedasticity test aims to test whether the regression model

occurred inequalities residual variance from one observation to another

observation. If the variance of the residuals of the observations to other

observations remain, then called Homoskedastisitas, and if different called

Heteroskidastity. This test can be done by looking at the graph plot

between the predicted value of the variable (ZPRED) with residual value

SREID. A good regression model if the residual variance from one

observation to another permanent, so that there is no identifiable

heteroskedastisitas (Ghozali, 2011).

d. Autocorrelation Test

Autocorrelation test whether a correlation exists between the

regression model error bullies in the current period (t) with an error in the

previous period (t-1). A good regression model is a regression that is free

from autocorrelation. If there is a correlation, then there is a problem

30 observation at all times in relation to each other. This test uses a model

Durbin Watson (DW-Test). The hypothesis to be tested are:

Ho = no autocorrelation (r = 0),

Ha = no autocorrelation (r ≠ 0)

If the value of DW is greater than the upper limit or the upper

bound (du) and less than (4- du) means no autocorrelation (Ghozali, 2011).

3. Hypothesis Testing

a. Coefficient of Determination

Cox and Snell R Square and Nagelkerke R Square is a measure that

seeks to imitate the size of R2 in multiple regression based on Likelihood

estimation techniques. Nagelkerke R Square easier to interpret than Cox

and Snell R Square so as to know how much variability in the dependent

variable that can be explained by the independent variables can be seen

from the Nagelkerke R Square. Nagelkerke's R Square is a modification of

the coefficient Cox and Snell to ensure that its value varies from 0 (zero)

to 1 (one). This is done by dividing the value of Cox and Snell 's R2 with

maximum value. Nagelkerke's R Square value can be interpreted as the

value of R2 in the multiple regression. A small value means the ability of

the independent variables in explaining the variation of the dependent

variable is very limited. Approximate value of the independent variables

provide almost all the information needed to predict the variation of the

dependent variable.

b. Multiple Linear Regression Analysis

The analysis used in this research is multiple linear regression,

31 Independent Commissioner and Managerial ownership, Growth

Opportunities, and Sales Growth to Accounting Conservatism on the LQ

45 companies listed on the Indonesian Stock Exchange (IDX) , The

regression model in this study are as follows:

CONS it= β0 + β1 Indepentit+ β2 Managit+ β3 GO + β4 SGit + e Where :

CONS : The Level of the Accounting Conservatism are

measured using the Feltham and Ohlson Model (Kootanaee, et al 2013)

Indepent : The existence of independent commissioner is measured by

calculated number of independent commissioner divided by total number

of commissioner in the company (Padmawati and Fachrurrozie, 2015)

Manag : Managerial Ownership, measured by the percentage of shares

owned by Management and actively participate in corporate decision

which includes commissioners, directorsand its afiliation (Padmawati and

Fachrurrpzie, 2015)

GO : To measure growth opportunities of the company by

calculated market to book value of equity according to (Novikasari and

Sofyan, 2013)

SG : to measure for sales growth ratio by calculated change of

sales divided by net sales (Padmawati and Fachrurrozie, 2015)

32 c. Simultaneous Significant Test (F-Test)

The statistical test F basically indicates whether all the independent

variables included in the model have influence together on the dependent

variable. The null hypothesis (Ho) to be tested is whether all of the

parameters in the model is equal to zero, or

H0: b1 = b2 = b ... = bk = 0

This means that if all the independent variables is not a significant

explanatory on the dependent variable. The alternative hypothesis (Ha),

not all parameters simultaneously equal to zero, or:

Ha: b1 ≠ b2 ≠ ... ≠ bk ≠ 0

That is, all independent variables simultaneously is a significant

explanatory on the dependent variable. Testing criteria used are:

-If F count> F table then Ho is rejected

-If F count <f table then Ho is accepted

d. Significant Partial Test (T-Test)

T tests were used to determine the effect of independent variables (X1, X2,

X3, X4) alone or each dependent variable Y (Ghozali, 2007: 84-85). The

null hypothesis (Ho) to be tested is whether a parameter (bi) is equal to

zero or:

Ho: bi = 0

This means that if an independent variable is not a significant explanatory

on the dependent variable. The alternative hypothesis (Ha), a variable

parameter is not equal to zero, or:

33 This means that these variables are significant explanatory on the

dependent variable. Testing criteria: -If t <t table then Ho is rejected -If t>

t table then Ho is accepted to measure the value t table, determined

significance level of 5 percent with degrees of freedom df = 4 n is the

number of observations.

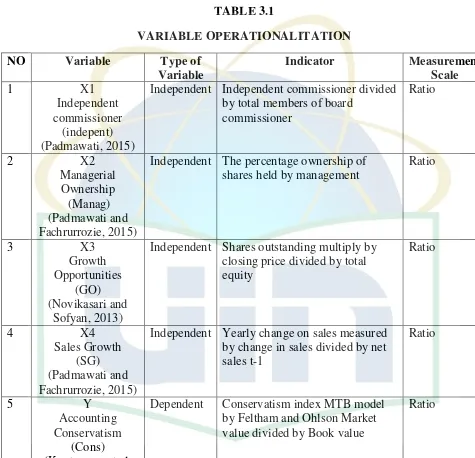

E. Operational Research Variable

The data in this study can be grouped into two variables:

1. Dependent Variable

The dependent variable is the variable that is a major concern of

researchers. In this study, researchers took the Accounting Conservatism

(Y) as the dependent variable component. In this study conservatism

applied to the model of Feltham and Ohlson model (1995).

The idea underlying the use of MTB (or BTM) as a measure of

accounting conservatism is that, ceteris paribus, a conservative accounting

system tends to depress the net book values of a firm relative to the firm

economic value. Therefore, a higher MTB (and a lower BTM) implies a

higher degree of accounting conservatism, and vice versa. The MTB

measure is strongly rooted in the analytical work based on the Residual

Income Valuation Model (RIVM). Feltham and Ohlson first introduced

accounting conservatism in the RIVM context, and characterize

conservatism as a tendency to bias downwards the book value of a firm

relative to its market value. This manifestation of conservatism has been

carried into later analytical works on conservatism such as Beaver and

Ryan (Wang, 2009). Thus, this study was calculated to summarize the

34 CONSit =

In this relationship:

MV it: The market value of equity of firm i in the end of year t.

- Where MV were formulated from :

MV = Outstanding shares x Stock Price

BV it: The Book value of equity of firm i in the end of year t.

- Where BV were formulated from :

BV = Outstanding shares x nominal value of shares

2.

Independent VariablesIndependent variables are variables that affect the dependent variable,

either positively or negatively. If there is a dependent variable, the

independent variables must also be present, and in each unit increase in the

independent variable nature there will be also an increase or decrease in the

dependent variable.

a. Independent Commissioner

Independent commissioner is a commissioner who is not

affiliated with management, other board members and controlling

shareholders, as well as free of a business relationship and other

relationships which may affect its ability to act independently or act

solely semi interests of the company (NCG, 2004 in Guna and

Herawaty, 2010: 6). In this research The existence of independent

35 commissioner divided by total number of commissioner in the

company ( Wardhani, 2008 on Padmawati, 2015)

Independent commissioner

= ∑

∑

b. Managerial Ownership

Managerial Ownership Measured by the percentage of shares

owned by Management and actively participate in corporate decision

which includes commissioners, directorsand its afiliation(Padmawati

and Fachrurrozie, 2015)

Managerial Ownership = ∑

∑

c. Growth Opportunities

Growth Opportunities is an opportunity to grow the company to

expand the company by investing or by creating hidden reserves.

Calculations using the opportunity to grow with the market-to-book

value of equity according to research conducted by Astarini (2011).

The scale of this variable data is the ratio. To measure the growth

opportunities of the company

Market to book value of equity :

d. Sales Growth

Sales growth is defined as the change in sales per year.

Sales growth ratio is used to measure changes in the company's

sales per year. High sales growth often increases the market

36 conservatism (Ahmed and Duellman, 2007). To measure the sales

growth ratio used the following formula:

Sales growth = by total members of board

commissioner

Independent The percentage ownership of shares held by management

Independent Shares outstanding multiply by closing price divided by total equity

Independent Yearly change on sales measured by change in sales divided by net sales t-1

Dependent Conservatism index MTB model by Feltham and Ohlson Market value divided by Book value

37 CHAPTER IV

FINDING AND ANALYSIS

A. General Description of Research Object

The study used a population of LQ 45 companies listed on the Indonesia Stock

Exchange (IDX) in the period 2011-2014. The sample used in this study were selected

by purposive sampling. LQ 45 companies selected in this study because it has a high

level of liquidation, market capitalization, and the prospects of sales growth. Based on

data obtained from the Indonesia Stock Exchange through its official website

www.idx.co.id only as many as 21 companies that meet the criteria of the study

sample had been applied. Here is a summary of the acquisition of samples of the study

:

Table 4.1 Detail of samples

No Details Amount

1 LQ45 companies listed on IDX 45

2 LQ45 companies listed three consecutive years in the year of observation

25

3 LQ45 companies which publish its financial statements in denominations other than the rupiahs

4

4 Company used as sample of observations 21 Years of observation 2011 – 2014 4 The number of research samples 84 Source : Data Processed

Based on purposive sampling method, acquired 21 companies that meet the

specified criteria so that it can be used as a sample in this study during the 4 years of

observation, in order to obtain as many as 21 x 4 = 84 observation data. The list of

companies sampled in this study as follows: