Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji] Date: 13 January 2016, At: 00:23

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Accounting History in Undergraduate Introductory

Financial Accounting Courses: An Exploratory

Study

Satina V. Williams & Bill N. Schwartz

To cite this article: Satina V. Williams & Bill N. Schwartz (2002) Accounting History in

Undergraduate Introductory Financial Accounting Courses: An Exploratory Study, Journal of Education for Business, 77:4, 198-202, DOI: 10.1080/08832320209599071

To link to this article: http://dx.doi.org/10.1080/08832320209599071

Published online: 31 Mar 2010.

Submit your article to this journal

Article views: 28

View related articles

Accounting History in

Undergraduate Introductory

Financial Accounting Courses:

An Exploratory Study

SATINA V.

WILLIAMS

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Virginia Commonwealth University

Richmond, Virginia

BILL N. SCHWARTZ

Indiana University-South Bend

South Bend, Indiana

ould introductory accounting stu-

W

dents benefit from the lessons and experiences found in accounting history? Would accounting history motivate students to major in account- ing? According to Albin (1994), accounting students would better under- stand the economic, political, and cul- tural forces affecting the development of accounting if they are exposed to the history and evolution of accounting. Albin (1994) also suggested that learn- ing historical information in the first course in accounting may stimulate stu- dents to learn more about how account-ing actually works. Baldwin and Ingram

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

( I99 I ) proposed that demonstrating how accounting is a historically evolv- ing discipline rather than just computa- tions and rules may attract “more ana- lytically minded and interpretively expressive” students to the accounting major.

The AECC (1990, p. 1) reported that the typical accounting curriculum has not kept pace with “the dynamic, com- plex, expanding, and constantly chang- ing profession for which students are being educated.” Accounting practition- ers criticized accounting educators for focusing on detailed technical knowl- edge rather than developing the broad business knowledge and communica- tion skills needed in today’s workplace (Wilson & Baldwin, 1995). Members of

ABSTRACT. The Accounting Educa-

tion Change Commission (AECC) and

others called for changes in the accounting curriculum and suggested

that instructors bring accounting his-

tory into the classroom. In this study,

the authors surveyed faculty at a sam-

ple of institutions to determine (a)

which faculty members formally

incorporated accounting history into

the undergraduate introductory

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

finan-cial accounting class and (b) their opinions about the usefulness of

incorporating accounting history into

the course. Contrary to the AECC rec- ommendations, the authors found that

the respondents did not overwhelm- ingly support formally incorporating accounting history into undergraduate introductory financial accounting courses. They also discuss implica- tions of their findings and suggest

ways to encourage more instruction in accounting history.

the accounting community have been concerned because the current account- ing curriculum offered by is not attract- ing enough students of sufficient quality (Arthur Andersen et al., 1989). One of the changes that the AECC and other committees recommended to rectify this situation is the incorporation of accounting history into accounting courses.

Because of the potential benefits of this approach, in this study we investi- gated (a) whether accounting programs and instructors of introductory account- ing courses are formally incorporating

accounting history into undergraduate introductory financial accounting class- es and (b), if so, to what degree. We also investigated faculty perceptions on for- mal incorporation of accounting history into undergraduate introductory finan- cial accounting courses.

Need to Bring Accounting History Into the Classroom

Flegm (1991) challenged accounting programs to broaden their curriculum by integrating accounting history into accounting courses so that students could relate the development of ac- counting to changes in the economy and society. He observed that faculty mem- bers at many universities and colleges teach accounting as advanced book- keeping, subject to clear definitions, rules, and regulations. When accounting history is included in accounting educa- tion, Flegm concluded, students should have a better understanding of the deep- rooted traditions of accounting and have the necessary background to evaluate current accounting practices critically.

Baldwin and Ingram (1991) described the first accounting courses as our last opportunity to influence nonaccounting majors. They recommended that ele- mentary accounting instructors include showing how an understanding of past events leads to new decisions regarding

198

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

JournalzyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

of Education for Businessfuture investments, strategies, and actions. Accounting educators should explain how accounting has evolved and has been shaped over centuries in response to economic, political, and

social forces (Baldwin

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

& Ingram).Flegm

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(1991) and Baldwin andIngram (1991) have recommended inte-

grating accounting history into account- ing classes, suggested materials that instructors could use, and described the benefits of incorporating historical accounting topics into undergraduate introductory financial accounting cours- es. Two authors reported how they brought accounting history into their classes. Albin (1994) offered a chart

depicting historical events in the devel- opment of accounting and emphasizing the contributions that various civiliza- tions and cultures have made to accounting. He suggested that an instructor could use the chart as an out- line for teaching a history module in an introductory course. Bloom and Collins

(1988) suggested historical “nuggets”

(i.e., short vignettes) for introducing financial accounting topics in interme- diate and advanced financial accounting courses. For example, they discussed financial reporting in the 1920s and 1930s before they discussed current

approaches to presenting balance sheets and income statements. Possibly, these vignettes could be modified for princi- ples courses.

No study has focused on either (a) the extent to which accounting programs and faculty members have formally incorporated accounting history into their courses or (b) whether they think that including accounting history would be beneficial to accounting education. A survey of accounting faculty members concerning the inclusion of accounting history should be useful in determining whether accounting faculty members have heeded the call for a change in

accounting.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Method

We defined our population as schools that offer a bachelor’s degree in ac- counting, have at least one AACSB accreditation, and have five or more full-time accounting faculty. Using Has-

selback’s 1998-99

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Accounting FacultyDirectory, we determined that 274 insti-

tutions met the criteria for the study. We randomly selected a sample of 100 schools and contacted the accounting department administrators for the names and e-mail addresses of their accounting coordinators. Seventy-nine administrators responded, each giving the name of his or her undergraduate accounting coordinator or another facul- ty member who could respond to our questionnaire.

We mailed questionnaires to the 79

faculty members identified to deter- mine (a) the extent to which the accounting faculty and programs for- mally incorporated accounting history into their undergraduate introductory financial accounting classes and (b) the respondents’ opinions about incorporat- ing accounting history into undergradu- ate introductory financial accounting classes.

[image:3.612.222.566.210.729.2]Our definition of “incorporating his-

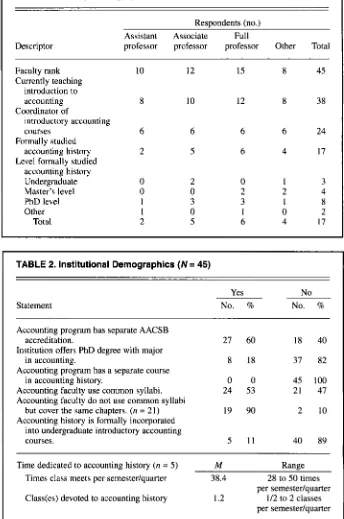

TABLE 1. Faculty Demographics

Resuondents (no.) Assistant Associate Full

Descriptor professor professor professor Other Total

Faculty rank 10 12 15 8 45

Currently teaching introduction to

accounting 8 10 12 8 38

introductory accounting

courses 6 6 6 6 24

Formally studied

accounting history 2 5 6 4 17

Level formally studied accounting history

Master’s level 0 0 2 2 4

PhD level 1 3 3 1 8

Other 1 0 1 0 2

Total 2 5 6 4 17

Coordinator of

Undergraduate 0 2 0 1 3

TABLE 2. Institutional Demographics ( N

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

= 45)Statement

Yes No

No. % No. %

Accounting program has separate AACSB Institution offers PhD degree with major

Accounting program has a separate course

Accounting faculty use common syllabi. 24 53

Accounting faculty do not use common syllabi

Accounting history is formally incorporated

accreditation. 27 60 18 40

in accounting. 8 18 37 82

in accounting history. 0 0 45 100

but cover the same chapters. (n

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

= 21) 19 90 2 1021 41

into undergraduate introductory accounting

courses. 5 1 1 40 89

Time dedicated to accounting history (n = 5) M Range

Times class meets per semestedquarter 38.4 28 to 50 times per semestedquarter

per semestedquarter

Class(es) devoted to accounting history 1.2 1/2 to 2 classes MurcWApril2002 199

tory” into a class was based on Coffman, Tondkar, and Previts’s (1993) definition:

reading historical articles, reading biogra- phies, viewing video tapes, devoting a class period(s) or a significant portion of a class period(s) to accounting history, in- cluding accounting history in the syllabus as a topic to be addressed in the course, giving assignments in accounting history such as reports on historical events, and testing students on accounting history material.

We requested factual information about the institution and the institution’s classroom activities. Respondents used

5-point Likert scales ranging from 1

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(strongly agree) to 5 (strongly disagree)

to record their opinions about formally incorporating accounting history into undergraduate introductory financial accounting courses. These questions were based on articles supporting the use of history in accounting classes

(Flegm, 1991; Fleischman

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

& Tyson,1996) and AECC statements (The First

Course in Accounting, 1992; Objectives

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

of Education f o r Accountants, 1990). Several faculty members knowledge- able about accounting history and sever- al accounting PhD students reviewed the initial draft of the questionnaire. As a result of their comments, we made a

few minor changes.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Results

Demographics

We received 45 usable responses, representing 57% of the questionnaires mailed (79); 45% of the sample of 100 schools we initially contacted; and 16% of the total population listed in the ac- counting faculty directory (see Table 1). Responding faculty members held posi- tions of assistant professor (lo), associ- ate professor (12), and full professor (15). The remaining 8 respondents included lecturers, instructors, teaching professors, and adjunct faculty mem- bers. The faculty members had from 1 to 33 years of experience teaching at the introductory level, for an average of 14 years. Thirty-eight of the responding faculty members indicated that they were teaching Introduction to Account- ing, and 24 coordinated introductory accounting courses. Seventeen faculty members reported they had studied

accounting history formally in their undergraduate, master’s, or doctoral studies. Nearly one half of the faculty members who had studied accounting history formally did so during their doc- toral accounting education.

In Table 2, we show demographic information about the institutions and accounting programs. In addition to the criteria recently discussed, 27 of the institutions had separate AACSB accreditation for the accounting pro- gram and 8 offered a PhD degree with a major in accounting. Faculty at 24 of the 45 institutions used common syllabi in their undergraduate introductory ac- counting courses. Of the 21 who did not use common syllabi, 19 faculty mem- bers covered the same chapters in the accounting classes at their institution. Although there were no accounting cur- ricula that included a separate course in

accounting history, 5 respondents re- ported that they incorporated account- ing history formally into undergraduate accounting courses. The time that they

dedicated

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

to accounting history when itwas incorporated formally ranged from one half to two class meetings.

Analysis

The descriptive statistics for all respondents (see Table 3) indicate that faculty, overall, slightly disagreed with the ideas that (a) students should for- mally study accounting history (3.522) and (b) instructors should formally incorporate accounting history into undergraduate introductory financial accounting courses (3.609). Most respondents agreed that there was no time to include accounting history top- ics (2.174) and disagreed that account-

TABLE 3. Descriptive Statistics

Item

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Ma SD1. Undergraduate introductory financial accounting students should formally study accounting history.

2. Accounting history should be formally incorporated into

undergraduate introductory financial accounting courses. 3. There is no time in undergraduate introductory financial

accounting classes to formally cover topics in accounting history.

undergraduate accounting program.

undergraduate introductory financial accounting will gain a broad view of accounting’s role in satisfying society’s need for information and its function in business. 6. Students formally studying accounting history will better

understand current accounting issues compared with those who do not formally study accounting history.

7. Students formally studying accounting history in undergraduate introductory financial accounting courses will gain an appreciation that accounting, as a discipline, is the focus of constructive debate and intensive rethinking caused by economic and technological changes.

undergraduate introductory financial accounting courses will encourage more business students to major in accounting.

undergraduate introductory financial accounting courses allows instructors to make accounting topics more relevant. undergraduate introductory financial accounting courses will make learning accounting more interesting. 4. Accounting history should be a separate course in the 5. By formally studying accounting history, students in

8. Formally incorporating accounting history into

9. Formally incorporating accounting history into 10. Formally incorporating accounting history into

3.522 3.609 2.174 4.130

2.826 2.761

2.804

3.913 3.239 3.304

0.888 0.906 1.141 0.934

0.996 1.037

1.046

0.784 1.037 0.986

“Faculty members responded on a 5-point Likert scale ranging through 1 (strongly agree), 2 (agree), 3 (neither agree or disagree), 4 (disagree), and 5 (strongly disagree).

200 Journal of Education for Business

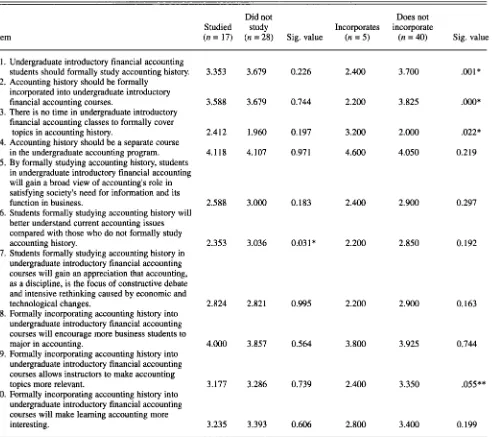

TABLE 4. Mean Values for Differences Between Groups: (a) Studied Versus Dld Not Study

and (b) Incorporates Versus Does Not Incorporate

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Item

Did not Does not

Studied study Incorporates incorporate

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(n =

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

17) (n = 28) Sig. valuezyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(n = 5) (n = 40) Sig. value1. Undergraduate introductory financial accounting

2. Accounting history should be formally

students should formally study accounting history. incorporated into undergraduate introductory financial accounting courses.

3. There is no time in undergraduate introductory

financial accounting classes to formally cover topics in accounting history.

4. Accounting history should be a separate course

in the undergraduate accounting program. 5. By formally studying accounting history, students

in undergraduate introductory financial accounting will gain a broad view of accounting’s role in satisfying society’s need for information and its function in business.

6. Students formally studying accounting history will

better understand current accounting issues compared with those who do not formally study accounting history.

7. Students formally studying accounting history in undergraduate introductory financial accounting courses will gain an appreciation that accounting, as a discipline, is the focus of constructive debate and intensive rethinking caused by economic and technological changes.

undergraduate introductory financial accounting courses will encourage more business students to major in accounting.

9. Formally incorporating accounting history into

undergraduate introductory financial accounting courses allows instructors to make accounting topics more relevant.

10. Formally incorporating accounting history into undergraduate introductory financial accounting courses will make learning accounting more interesting.

8. Formally incorporating accounting history into

3.353 3.588 2.412 4.118 2.588 2.353 2.824 4.000 3.177 3.235

3.679 3.679 1.960 4.107 3.000 3.036 2.821 3.857 3.286 3.393

0.226 0.744 0.197 0.971 0.183 0.03 1

*

0.995 0.564 0.739 0.6062.400 2.200 3.200 4.600 2.400 2.200 2.200 3.800 2.400 2.800

3.700 3.825 2.000 4.050 2.900 2.850 2.900 3.925 3.350 3.400

.oo

1*

.ooo*

.022* 0.219 0.297 0.192 0.163 0.744

.055**

0.199

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Notes. Faculty members responded on a 5-point Likert scale ranging through 1 (strongly agree), 2 (agree), 3 (neither agree or disagree), 4

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(disagree), and5 (strongly disagree). “Studied” indicates respondents who reported having formally studied accounting history. “Did not study” indicates respondents who did not formally study accounting history. “Incorporates” indicates respondents who formally incorporated accounting history into undergraduate intro- ductory financial accounting courses. “Does not incorporate” indicates respondents who did not incorporate accounting history into undergraduate intro- ductory financial accounting courses.

*Significant at p < .05. **Significant at p < .lo. ing history should be a separate course in the accounting program (4.130). There was some agreement that formal incorporation of accounting history into undergraduate introductory accounting courses would help stu- dents broaden their view of account- ing’s role in society (2.826), under-

stand current accounting issues (2.76 l), and appreciate that accounting is the focus of constructive debate (2.804). The faculty members did not

support the notions that incorporating accounting history would attract more business majors to accounting (3.913), make accounting topics more relevant (3.239), and make accounting more interesting to learn (3.304).

Using analysis of variance (ANOVA), we compared the means of respondents who indicated that they had studied accounting history with those of the respondents who had not studied ac- counting history (see Table 4). Peragal-

lo (1974) suggested that faculty mem- bers teaching undergraduate intro- duc- tory financial accounting courses might themselves lack a historical background or lack interest in accounting history. Our results show that faculty members who had formally studied accounting

history

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(M

= 2.353) differed significant-ly 0, c .05) from those who had not

(M

= 3.036) in their responses to the state- ment that formal study of accounting history will help students understandMarcWApriE 2002 201

[image:5.612.65.564.69.506.2]current accounting issues better. How- ever, both groups disagreed with the notions that (a) incorporating account- ing history into undergraduate introduc- tory financial accounting courses would encourage more students to major in accounting and (b) accounting history should be a separate course in an under- graduate accounting program.

We investigated whether faculty members who had formally incorporated accounting history into their courses dif- fered from those who had not (see Table 4). We believed that there would be a difference in their perceptions because those who were already formally incor- porating accounting history may have experienced some benefits from includ- ing it in their courses. However, the

results showed significant differences (p

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

< .lo) for four items only (items 1, 2, 3, and 9 from Table 4). Faculty members who currently incorporated accounting

history in their classes agreed

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

(M

=2.400), whereas those not incorporating

it disagreed (M = 3.700), with the idea that students should formally study accounting history. Faculty members incorporating accounting history in their classes agreed

(M

= 2.200), whereas those not incorporating it disagreed(M

=3.825), that accounting history should be incorporated formally into undergradu- ate introductory financial accounting courses. Those who formally incorporat- ed accounting history into their courses disagreed

(M

= 3.200) with the state- ment that there was an insufficient amount of time for formal coverage of accounting history topics, whereas those who did not incorporate accounting his- tory formally into their courses agreed(M

= 2.000) that there was not enough time. Finally, respondents who used the incorporation of accounting history agreed(M

= 2.400) that formal incorpo- ration of accounting history into under- graduate introductory financial account- ing courses allows instructors to make accounting topics more relevant, where- as respondents not using such incorpora-tion disagreed

(M

= 3.350).zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Conclusions, Implications, and Recommendations

For the most part, the faculty mem- bers who had incorporated accounting

history into their undergraduate intro- ductory financial accounting courses and those who had studied accounting history shared similar views with the faculty members who did not incorpo- rate accounting as well as those who had not studied accounting history. Respondents did not support a separate course for accounting history, did not believe that teaching accounting history would encourage more business stu- dents to major in accounting, and did not believe that there was time to cover accounting history formally.

Surprisingly, those who incorporated accounting history into their undergrad- uate introductory financial accounting courses disagreed with those who did not on only four points. We believed that those who were already using such incorporation in their classes would be advocates for accounting history and agree more often with the items on the questionnaire than those who were not using such incorporation.

Although there is a call for change in the accounting cumculum, our results indicate that accounting faculty do not believe that incorporating accounting history into undergraduate introductory accounting courses will enhance efforts for improvement of accounting educa- tion. However, the requirements for being included in our sample may have excluded other accounting programs that may include accounting history in their introductory courses. Therefore, our results may not apply to the other accounting programs not included in our population.

In 1974, Peragallo discussed chal- lenges facing accounting faculty regarding accounting history instruc- tion. Over 25 years later, instructors are still faced with the same issues. Our challenge is to find ways to make it eas- ier for instructors to incorporate accounting history into undergraduate introductory financial accounting courses and encourage them to do so. Individuals might offer seminars and continuing professional education ses- sions explaining why and how faculty members could make use of such an incorporation and illustrating what the individuals did in their own courses. Those leading the seminars should pro- vide a module that they used them-

selves and include lecture notes, Pow- erPoint slides, reading materials, and an instructor’s manual. Preferably, the module would be geared toward one class session in the introductory course. The instructor also should develop a bibliography of articles that would give attendees some background reading to help them appreciate a historical per- spective on accounting’s role and sig- nificance in business decisions.

ACKNOWLEDGMENT

We gratefully acknowledge the assistance of Professors Ashton Bishop (James Madison Uni- versity), Edward Coffman (Virginia Common- wealth University), Timothy Fogarty (Case Western Reserve University), Finley Graves (Kansas State University), Ronald Huefner (SUNY-Buffalo), John Rigsby (Mississippi State University), and Rasoul Tondkar (Virginia Commonwealth University) at earlier stages of this study.

REFERENCES

Accounting Education Change Commission

(AECC). (1990).

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

Objectives of education .foraccountants. Sarasota,FL: American Account- ing Association.

Accounting Education Change Commission (AECC). (1992). Thejrst course in accounting. Sarasota: American Accounting Association. Albin, M. J. (1994). A cross-cultural look at the

origins and development of accounting.

Accounting Educators’Joumal,

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

6, 1 IC-127.Arthur Andersen & Co., Arthur Young, Coopers &

Lybrand, Deloitte Haskins & Sells, Ernst &

Whinny, Peat Marwick Main & Co., Price Waterhouse, and Touche Ross (The Big Eight). (1989). Perspectives on education: Capabilities for success in the accounting profession. New

York: Authors.

Baldwin, B. A., & Ingram, R.

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

W. (1991). Rethink-ing the objectives and content of elementary accounting. Journal of Accounting Education,

Bloom, R., & Collins, M..(1988). Motivating stu- dents with an historical perspective in financial accounting courses. Journal of Accounting Education, 6, 105-1 15.

Coffman, E. N., Tondkar, R. H., & Previts, G. J. (1993). Integrating accounting history into financial accounting courses. Issues in Account- ing Education, Spring, pp. 18-39.

Flegm, E. H. (1991). The relevance of history in accounting education: Some observations. Journal of Accounting Education, 9, 355-363. Fleischman, R. K., & Tyson, T. (1996). A guide to

the historical controversies and organizational contexts of standard costs. Journal of Account- ing Education, 14, 37-56.

Hasselback, J. R. (1998-99). Accounting faculty directory. Englewoods Cliffs, NJ: Prentice Hall. Peragallo, E. (1974). Challenges facing teachers of accounting history. The Accounting Histori-

an Journal,

zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

1, 2.Wilson, T. E., & Baldwin, E. F. (1995). The Accounting Education Change Commission and accounting principles courses: A survey of accounting programs. Joumal of Education for Business, 70 (3), 157-159.

9, 1-14.