Lampiran i

POPULASI, KRITERIA PERUSAHAAN, SAMPEL

No Nama Perusahaan I II III IV Sampel

34 MTSM - -

35 NIRO - - -

36 MORE - -

37 PLIN Sampel 10

38 PUDP - -

39 PWON - -

40 RBMS - -

41 RDTX - -

42 RODA - -

43 SCBD - -

44 SMDM - -

Lampiran ii

Data Variabel Penelitian

Tahun

Kode perusahaan

X1 X2 Y

ROI (%)

arus kas operasi

(Rupiah) DPR (%)

Tahun 2011

ASRI 10.03 1419007133264.00 11.96

CTRA 4.29 886887354440.00 28.57

CTRP 3.91 286041381217.00 26.92

CTRS 5.65 269366414497.00 15.66

GMTD 10.07 87320230591.00 7.86

GPRA 3.63 9319357493.00 8.77

JRPT 8.49 311723404000.00 25.16

LPKR 4.46 374527460106.00 13.72

MTLA 9.05 103934683000.00 5.64

PLIN 1.96 353039836000.00 9.78

Tahun 2012

ASRI 11.11 2030764133000.00 10.08

CTRA 5.65 1728003003225.00 17.95

CTRP 5.38 476534148682.00 16

CTRS 6.18 632112158786.00 17.98

GMTD 7.15 255948620894.00 5.99

GPRA 4.29 -40794147555.00 10.39

JRPT 8.56 283290266000.00 132.88

LPKR 5.32 1288793481006.00 16.76

MTLA 10.11 39612962000.00 10.46

PLIN 5.94 519219269000.00 122.98

Tahun 2013

ASRI 6.16 2337050459000.00 32.72

CTRA 7.03 308069121746.00 18.75

CTRP 5.78 510404743107.00 22.86

CTRS 7.15 605248008607.00 20.79

GMTD 7.02 -462940933984.00 5.52

GPRA 7.99 21605667371.00 8.66

JRPT 8.86 352184687000.00 127.86

LPKR 5.09 -2078824228757.00 21.97

MTLA 8.5 5498958000.00 16.87

PLIN

9.81 644519372000.00

372.15

Tahun 2014

ASRI 6.95 653035948000.00 12.53

CTRA 7.7 2549819944851.00 21.83

GMTD 7.87 40065235627.00 4.17

GPRA 6.04 75002346091.00 9.55

JRPT 10.68 113990308000.00 24.6

LPKR 8.3 731470095313.00 12.56

MTLA 9.51 8965918000.00 18.38

Lampiran iii Statistik Deskriptif

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

return on investment 40 1.96 11.11 7.0897 2.20542

arus kas operasi 40 -2.08 2.55 .4829 .77525

DPR 40 4.17 372.15 34.1085 62.85361

Valid N (listwise) 40

Uji Normalitas

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 40

Normal Parametersa,,b Mean .0000000

Std. Deviation .92001889

Most Extreme Differences Absolute .188

Positive .188

Negative -.072

Kolmogorov-Smirnov Z 1.187

Asymp. Sig. (2-tailed) .120

a. Test distribution is Normal. b. Calculated from data.

Uji Multikolinearitas

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) 1.779 .510 3.487 .001

return on investment

.153 .069 .332 2.224 .032 .988 1.012

arus kas operasi .323 .196 .245 1.643 .109 .988 1.012

a. Dependent Variable: Dividen

Uji Autokorelasi

Runs Test

Unstandardized Residual

Test Valuea -.06302

Cases < Test Value 20

Cases >= Test Value 20

Total Cases 40

Number of Runs 22

Z .160

Asymp. Sig. (2-tailed) .873

a. Median

Koefisien Determinasi

Model Summaryb

Model R R Square

Adjusted R Square

Std. Error of the

Estimate Durbin-Watson

1 .433a .188 .144 .94456 2.039

a. Predictors: (Constant), arus kas operasi, return on investment b. Dependent Variable: Dividen

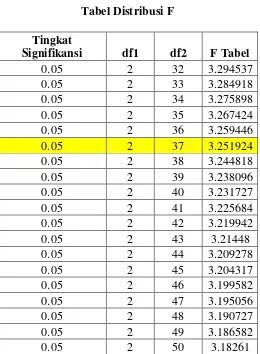

Uji Pengaruh Simultan (Uji f)

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression 7.629 2 3.814 4.275 .021a

Residual 33.011 37 .892

Total 40.639 39

a. Predictors: (Constant), arus kas operasi, return on investment b. Dependent Variable: Dividen

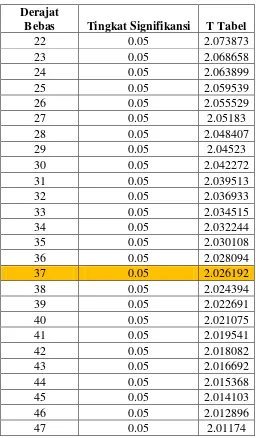

Uji Pengaruh Parsial (Uji t)

Model

Unstandardized Coefficients

Standardized Coefficients

T Sig.

B Std. Error Beta

1 (Constant) 1.779 .510 3.487 .001

return on investment

.153 .069 .332 2.224 .032

Tabel Distribusi T

Derajat

Bebas Tingkat Signifikansi T Tabel