Refer to Important disclosures in the last page of this report

Stock DataTarget price (Rp) Rp3,075

Prior TP (Rp) Rp4,175

Share price (Rp) Rp2,500

Upside/downside (%) +23.0

Shares outstanding (m) 10,590

Market cap. (US$ m) 1,837

Republic of Indonesia 60.0%

Estimate Change; Vs. Consensus

2018F 2019F

PT Indo Premier Sekuritas stephan.hasjim@ipc.co.id +62 21 5793 1168

Slowing profit growth as rate rises

1H18 earnings growth of 12% was below market expectations.

Strong asset growth was offset by lower NIMs, high opex growth.

Stable asset quality, credit cost and provision/NPL coverage.

We cut earnings and TP, due to rising rates, but keep BUY rating.

Modest results.

BBTN reported net profit of Rp1.4tn in 1H18 (+12%), with its

2Q/1Q profits forming only 21%/19% of our FY18F forecast of Rp3.5tn. As such,

its earnings came well below our and market expectations. For comparison, 1H

profit contributed 45% to FY17 profit (excluding extraordinary incomes in 4Q17).

BBTN’s lower than expected profit was due to: 1) its declining NIMs (-29bps yoy);

and 2) high operating cost growth (+17%), which offset its strong asset growth of

20% while its provisions grew modestly by 13%. Meanwhile, the bank’s core profit

(PPOP) grew modestly by 11% to Rp2.2tn in 1H, forming 42% of our full-year

forecast (also below our expectation).

NIM pressure

. BBTN’s strong loan growth of 19% (vs. industry growth of 10%)

was driven by growth of subsidized mortgages (+30%) vs. 13% for commercial

mortgages. We believe the growth outlook for low cost housing in Indonesia will

remain robust in the coming years given strong government support in the form

of liquidity loans (KPR FLPP), interest subsidy (KPR SSB) and Tapera housing

loans. We expect further NIM pressure to be mitigated by new subsidy schemes

such as KPR SSB (where its interest subsidy is linked to 12mth SBI rate) while the

new KPR FLPP scheme (75%:25%) to be implemented from 2H18 should also

lower the bank’s vulnerability to rising rates and reduce operating cost despite the

new FLPP scheme’s potentially lower NIMs vs. previous 90%:10% scheme.

Asset quality

. BBTN’s asset quality is stable with NPL ratio of 2.78% in 1Q & 2Q

(1H17: 3.2%), with NPL ratios improving for housing loans (2.54% vs. 2.83%)

and commercial loans (6.62% vs. 9.28%). Credit cost was also stable at 41bps in

1Q & 2Q vs. (1H17: 44bps), in-line with our assumption, while provision/NPL

coverage improved to 42%, from 39%.

Valuation

. We cut our earnings forecasts by 4-5% for FY18-20F, due to lower

NIMs and higher opex, and reduce our TP to Rp3,075 (from Rp4,175) due to: 1)

our 50bps higher cost of capital assumption to reflect the rise in 10-yr yields

during the second quarter; 2) our lower LT ROAE assumption. Our TP is based on

GGM-derived target FY18F P/B of 1.33x, assuming LT ROAE of 13.8% (from

14.8%), LT growth of 8.5%, cost of equity of 12.5% (from 12%). We estimate LT

ROAE based on DuPont analysis, assuming LT ROAA of 1.15% and asset/equity

leverage of 12x. However, we keep our BUY rating given the steep fall in share

price, the stock’s low valuation and its still robust earnings growth outlook.

Bank Tabungan

(

BBTN IJ

)

19 July 2018

Results Note

BUY

(Unchanged)

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Operating income (RpBn) 9,268 10,805 12,051 13,736 15,509

PPOP (RpBn) 3,881 4,637 4,962 5,776 6,713

Source: BBTN, IndoPremier Share Price Closing as of : 18-July-2018

2

Refer to Important disclosures in the last page of this report

Fig. 1: Net Interest Income (Rp bn) and NIMs (%) Fig. 2: Non-Interest Income (Rp bn; % of Gross Income)

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Operating Expense (Rp bn) and Cost/Income Ratio (%)

Fig. 4: Pre-Provision Profit (Rp bn; % of Average Assets)

Source: Company, IndoPremier Source: Company, IndoPremier

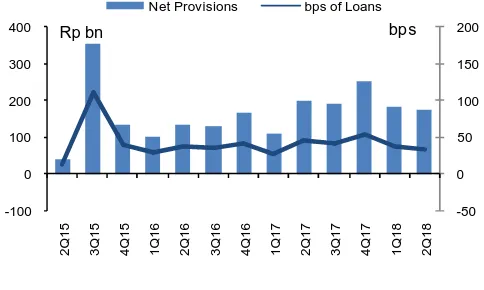

Fig. 5: Net Loan Provisioning (Rp bn; bps of Average Loans) Fig. 6: Net Profit (Rp bn) and ROAA (%)

Source: Company, IndoPremier Source: Company, IndoPremier

0%

Net Interest Income Net Interest Margin

Rp bn

Other Income Other Income % of Total

Rp bn

Operating Expenses Cost-Income Ratio

Rp bn

Pre-Provision Profit Pre-Provision Profit ROAA

Rp bn

Net Provisions bps of Loans

bps

Net Profit Net Profit ROAA

3

Refer to Important disclosures in the last page of this report

1H 2018 Results

Results (Rp Bn) 1H18 1H17 % Y-Y 2Q18 1Q18 % Q-Q

Customer Deposits 189,627 159,130 19.2 189,627 194,163 -2.3

Non-Performing Loans (NPL) 5,876 5,730 2.5 5,876 5,630 4.4

Special Mention Loans 21,127 21,341 -1.0 21,127 21,127 0.0

Loan Loss Reserves (LLR) 2,451 2,222 10.3 2,451 2,380 3.0

Total Assets 268,044 224,067 19.6 268,044 258,739 3.6

Risk-Weighted Assets 124,072 105,545 17.6 124,072 120,199 3.2

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Interest income 17,139 19,272 21,860 25,744 30,484

Interest expense (8,975) (9,931) (11,414) (13,777) (16,930)

Net interest income 8,164 9,341 10,445 11,967 13,554

Fees and commissions 591 750 863 992 1,141

Trading income 282 403 400 400 400

Other operating income 231 311 342 377 414

Total operating income 9,268 10,805 12,051 13,736 15,509

Personnel expenses (2,122) (2,554) (3,014) (3,376) (3,714)

G&A expenses (2,466) (2,953) (3,307) (3,704) (4,075)

Other operating expenses (799) (661) (768) (880) (1,008)

Pre-provision operating profit 3,881 4,637 4,962 5,776 6,713

Provisions (708) (884) (869) (1,031) (1,226)

Current account with BI 10,697 12,555 14,472 17,100 20,215

Placements at BI & other banks 17,903 25,254 17,097 18,251 17,746

Short-term investments 4,172 7,706 13,871 15,258 16,784

Government bonds 9,244 8,184 8,184 8,184 8,184

Gross loans 164,446 198,991 235,611 279,807 333,395

Loan provisions (2,116) (2,356) (2,625) (3,056) (3,682)

Other assets 8,816 10,005 10,763 11,586 12,478

Total Assets 214,168 261,365 298,486 348,446 406,674

Customer deposits 159,988 192,474 222,639 263,082 311,000

Deposits from other banks 3,653 5,445 5,990 6,589 7,248

Securities and borrowings 24,304 32,856 37,347 42,187 47,196

Other liabilities 6,595 7,310 8,041 8,846 9,730

Total Liabilities 194,539 238,085 274,018 320,704 375,174

Share capital 7,349 7,349 7,349 7,349 7,349

Reserves and others 2,773 2,780 2,802 2,802 2,802

Retained earnings 9,008 11,512 14,316 17,590 21,348

Shareholders' equity 19,131 21,642 24,468 27,742 31,500

Minority interest 0 0 0 0 0

Total Liabilities & Equity 213,670 259,727 298,486 348,446 406,674

5

Refer to Important disclosures in the last page of this report

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Growth Ratios (% yoy)

Gross loans 18.3 21.0 18.4 18.8 19.2

Total assets 24.7 22.0 14.2 16.7 16.7

Customer deposits 25.3 20.3 15.7 18.2 18.2

Net interest income 19.9 14.4 11.8 14.6 13.3

Non-interest income 23.3 32.6 9.6 10.2 10.5

Total operating income 32.3 16.1 9.5 16.0 15.0

Operating expense 20.0 14.5 14.9 12.3 10.5

PPOP 20.7 19.5 7.0 16.4 16.2

Net profit 41.5 15.6 12.6 16.0 15.0

Profitability Ratios

ROAA (%) 1.38 1.33 1.22 1.22 1.20

ROAE (%) 15.7 15.1 14.8 15.2 15.4

NIM (%) 4.71 4.52 4.06 4.01 3.89

Credit cost (bps) 35.4 41.8 32.2 32.2 33.5

Cost/income (%) 58.1 57.1 58.8 58.0 56.7

LDR (%) 102.8 103.4 105.8 106.4 107.2

CAR (%) 20.3 18.9 17.9 17.1 16.3

NPL ratio (%) 2.8 2.7 2.3 2.1 2.0

Provisions/NPL (%) 45.3 44.6 47.4 51.2 55.8

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analyst;s personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS