073 Pertumbuhan Bank

Teks penuh

Gambar

Garis besar

Dokumen terkait

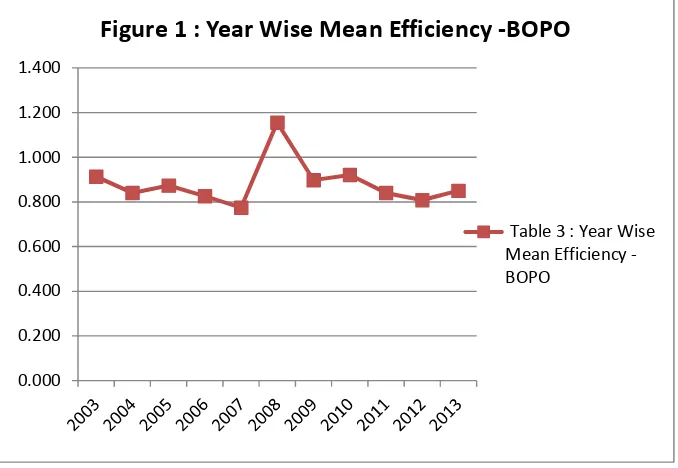

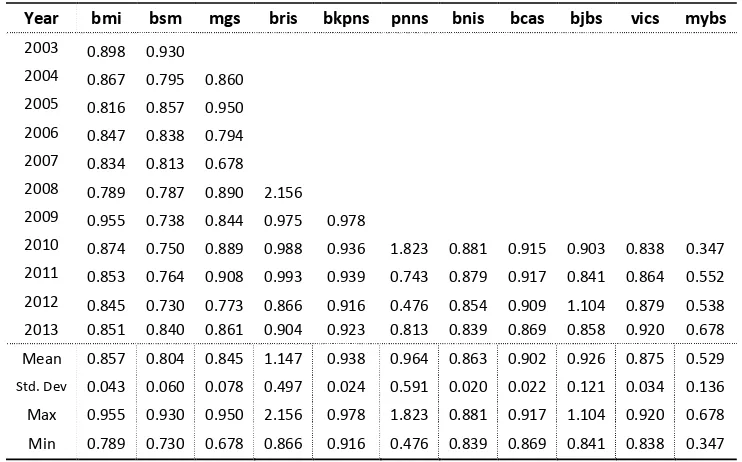

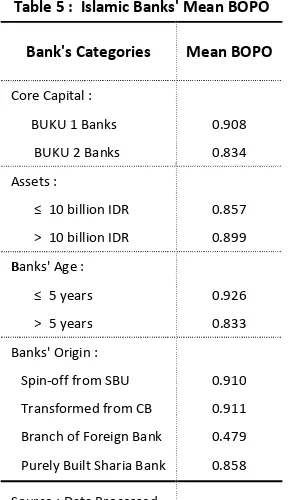

The aim of this research is to analyze the influence of operational expenses to operating income ratio (BOPO), Capital Adequacy Ratio (CAR), and Financing to Deposit Ratio (FDR)

The overall results show that efficiency of Islamic Banks is affected significantly by return on assets (ROA), operational efficiency ratio (OER), and inflation

ANALISIS OPERATIONAL EFFICIENCY DAN COST EFFICIENCY RATIO TERHADAP NET PROFIT MARGIN..

However, based on the results of research NPF UUS OF BANK SUMUT, no significant effect on ROA because UUS OF BANK SUMUT in its activities can do the operational cost emphasis

Operational Variables This study uses the independent variables, namely Capital AdequacyRatio CAR, Net Interest Margin NIM, Ratio of Operating Expenses to Operating Income BOPO,

The study assigned each of the ratio with percentage point composed of CAR 20%, NPL 20%, ROA 15%, ROE 15%, BOPO 15%, LDR 15% of four main banks in Indonesia namely Bank Mandiri BMRI,

Effect of company size, liquidity and operational efficiency on bank profitability with problem credit risk as a moderating variable at commercial banks that are listed on the Indonesia

H3a : Bank size has a positive effect on management efficiency in Islamic banks H3b : Bank size has a positive effect on cost efficiency in Islamic banks H3c : Bank size has a