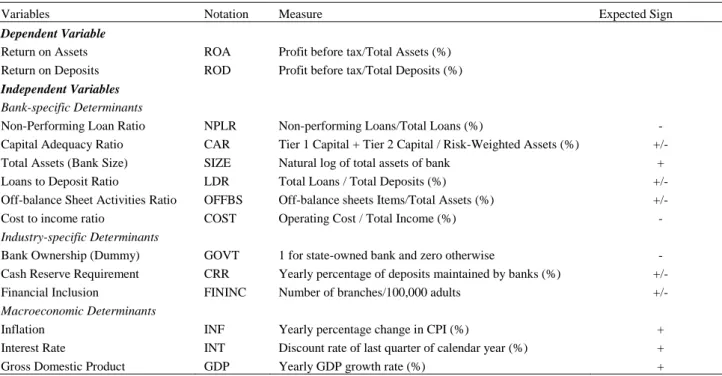

Our study aims to investigate the determinants of profitability of commercial banks in India and China during the period 2004–2014. First, this is the first study to conduct a large-scale comparative study on the determinants of bank profitability in India and China using a large data set. Poor credit quality and strict regulations can have a significant impact on the profitability of banks in India and China.

Seenaiah, Rath and Samantaraya (2015) investigated the determinants of bank profitability in India using a fixed effect estimator over the period 1995 to 2012. The findings show that banks with higher wage levels have a positive effect on bank profitability in India. On the other hand, they found a negative impact of bad loans and deposit costs on bank profitability.

Their results show that bank deposits have a positive and statistically significant effect on bank profitability. Furthermore, they argue that size has no significant effect on bank profitability in China. On the other hand, their findings show that operating costs and liquidity have a negative and statistically significant effect on bank profitability.

The existing literature on India and China provides evidence on the effect of bank-specific, sector-specific and macroeconomic factors on bank profitability.

Empirical Results

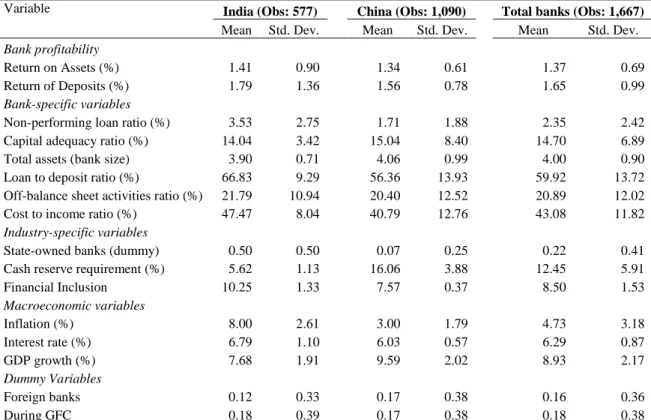

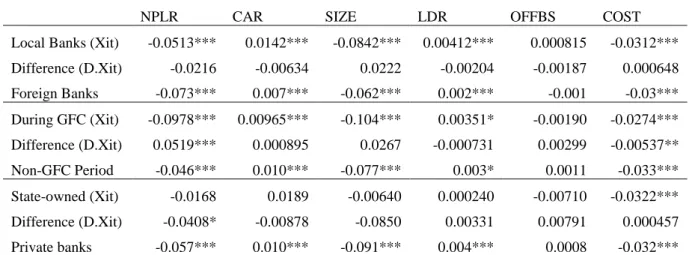

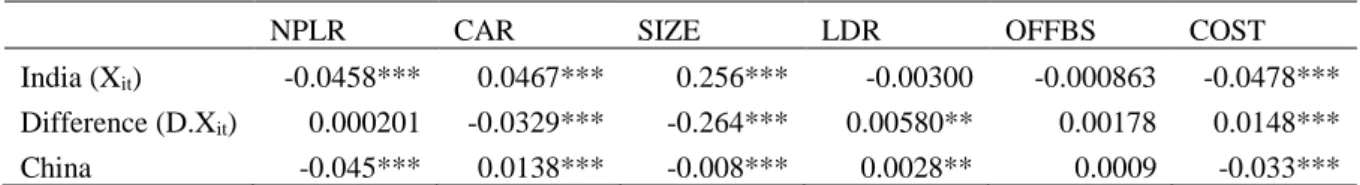

The bank-specific variables NPLR and COST have the same negative impact on ROD as in the case of ROA. Our findings for China show that all bank-specific variables have a significant impact on bank profitability except for bank OFFBS. There is strong evidence of a negative relationship between a bank's NPLR, SIZE and COST with bank profitability in China.

We find weak evidence that FININC has a negative impact on Chinese bank profitability, which is consistent with our findings for India. Consistent with the findings of previous studies, we find that both INF and INT have a positive effect on the performance of Chinese banks. All bank-specific variables have the same impact on ROD as in the case of ROA.

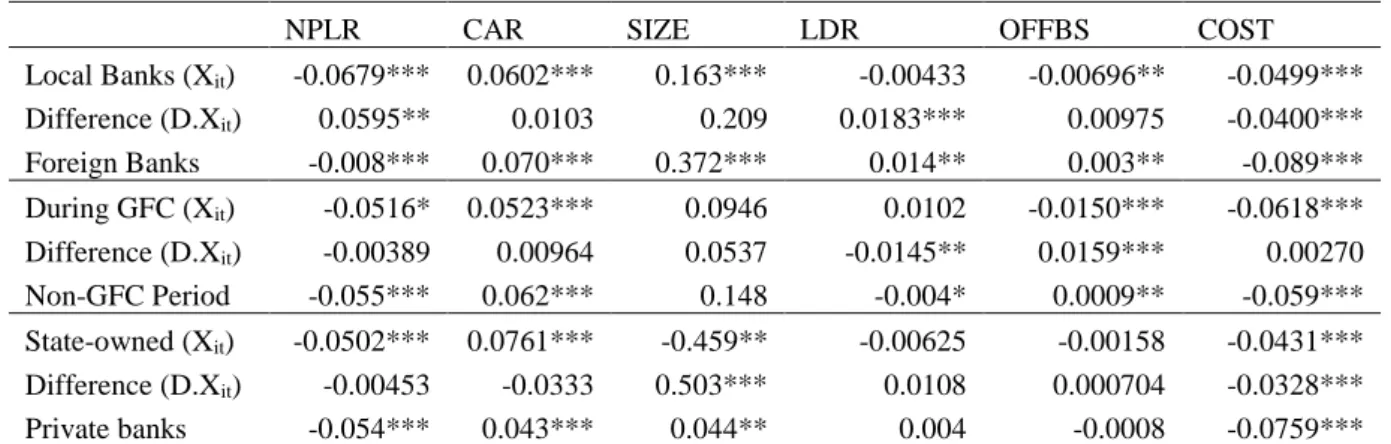

Industry-specific variable FININC had a negative impact on ROA, but the coefficient of FININC is statistically insignificant in the case of ROD. Perhaps the most interesting of these differences is that SIZE has a positive impact on profitability in India, while the effect is negative for Chinese banks. Three of the variables have the same impact on the profitability of the banks across all categories of banks and are consistent with the results we reported for the pooled data: NPLR and COST have a negative impact on bank profits across all categories and the SAR always has a positive impact.

First, NPLR has a much greater negative impact on the profitability of local banks than on foreign banks. Second, COST has a much greater negative impact on the profitability of foreign and private banks than on local and state-owned banks. However, there is one major exception, as SIZE has a negative effect on the profit of state-owned banks, while the usual positive relationship is maintained for private banks.

One finding is that OFFBS had a negative impact on Indian banks' profitability during the GFC, while this relationship was positive during the non-GFC years. Similarly, we found that OFFBS had a negative effect on the profitability of local banks, but a positive effect on the performance of foreign banks. Our analysis shows that NPLR has a much larger negative impact on Chinese banks' profits during the GFC than during the non-GFC period.

Two variables previously found to have a negative impact on Chinese banks' profits are CAR and LDR, and this again largely held for our subsamples. Finally, we previously found that OFFBS had no impact on banks' profitability in China, and this finding holds for all the subsamples.

Conclusion

ROA is the most widely used in the literature as a measure of bank profitability (Golin. Similarly, Bodla and Verma (2006) and Tan and Floros (2012b) found that NPLR had a negative effect on bank profitability in India and China respectively.. On the on the other hand, Dietrich and Wanzenried (2011) and García-Herrero et al., 2009 found a negative correlation between capital ratio and banks' profitability.

Based on the mixed fines to date, we cannot predict the direction of the relationship between CAR and bank profitability. Smirlock (1985) and Pasiouras and Kosmidou (2007) found a positive effect of SIZE on bank profitability in the US and Europe, respectively. In contrast, Athanasoglou et al. 2008) and Tan and Floros (2012a) found that SIZE had a negative effect on bank profitability in Greece and China, respectively.

On the weight of numbers, previous research has found that SIZE has a positive effect on bank profitability, therefore we hypothesize that SIZE will have a positive effect on bank profitability. Pasiouras and Kosmidou (2007) and Molyneux and Thornton (1992) found a negative relationship between banks' liquidity and profitability. 2006) argue that liquid banks are more profitable. Given the existing literature, we are unable to predict the sign of the relationship between LDR and bank profitability.

Casu and Girardone (2005) suggest that the off-balance sheet items can have a significant impact on the profitability of the banks due to risks associated with them. Based on mixed findings to date, we are unable to predict the sign of the relationship between OFFBS and bank profitability. 26 profitability, we are therefore unable to predict the sign of the relationship between CRR and bank profitability.

Demirgüç-Kunt and Huizinga (1999) and Athanasoglou et al. 2008) notes the positive impact of inflation on bank profitability. One recent study by Tan (2016) also shows that inflation has a positive effect on bank profitability in China. On the other hand, Mirzaei et al. 2013) found that inflation has a negative impact on the profitability of banks in emerging and developed markets.

Regarding the weight of numbers, previous research has found a positive relationship between inflation and bank profitability, so we hypothesize that inflation will have a positive effect on bank profitability. Reduced demand for loans can reduce banks' profitability.