In March 2002, the New Zealand and Australian governments published a joint discussion paper,1 The Transtasman Triangular Tax. It is clear that tripartite tax reform requires a two-pronged approach that preserves Australia and New Zealand's tax base and is acceptable to business and government in both countries.

Previous analysis

The hypothetical example

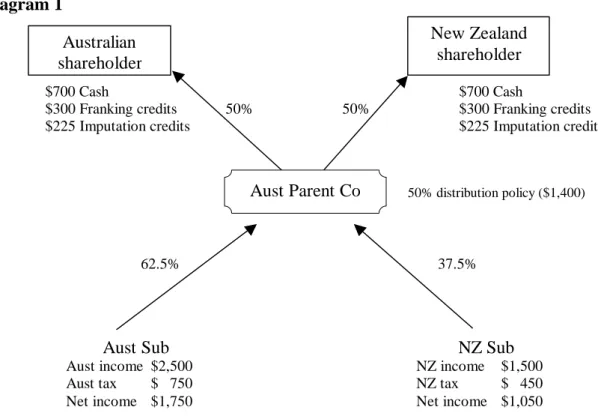

Aust Parent Co owns 100% of the capital of the Australian subsidiary (Aust Sub) and the New Zealand subsidiary (NZ Sub). After-tax income of $1,050 is paid as a dividend (including an additional dividend) to Aust Parent Co.

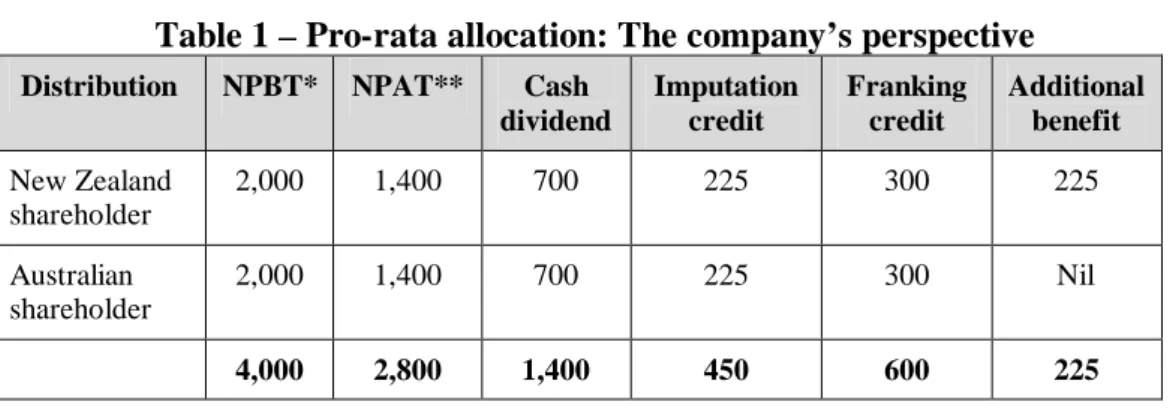

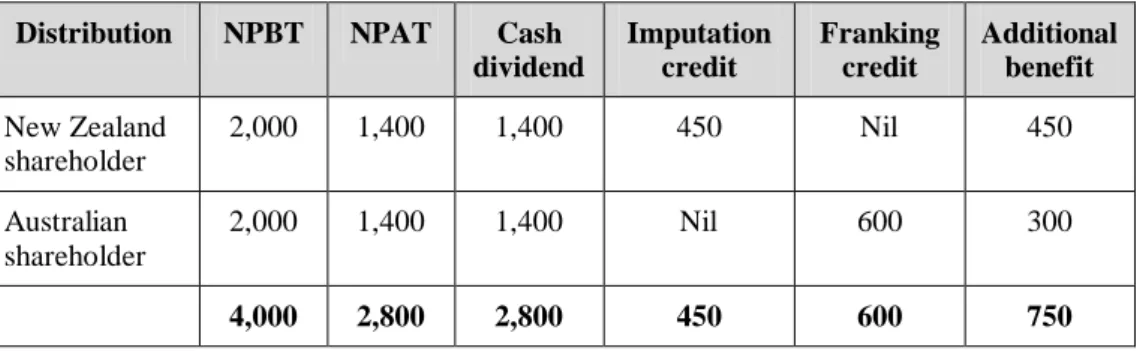

Parent company’s perspective

In addition to the net New Zealand cash dividend of $1,050, Aust Parent Co receives a dividend from its Australian operating company of $1,750. In cases where Australian resident shareholders dominate the ownership of an Aust parent company, there appears to be little (if any) incentive for this type of company to support the pro rata allocation model.

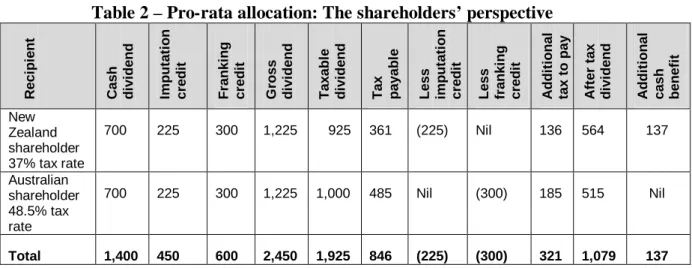

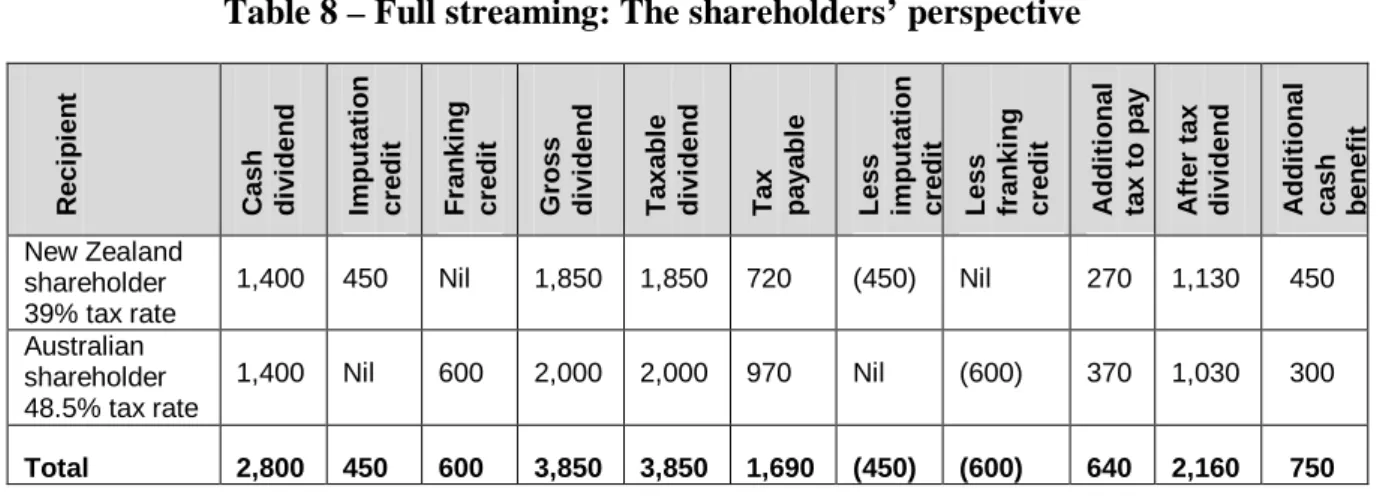

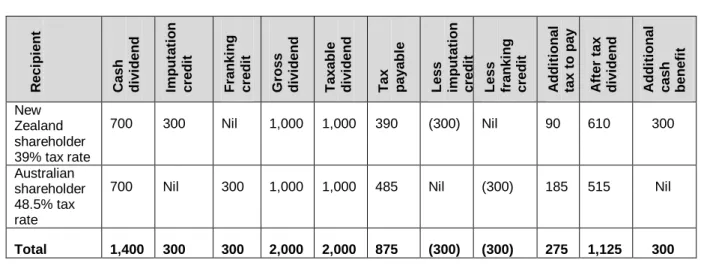

The shareholders’ perspective

To enable Aust Parent Co to distribute the tax paid by its two lower-tier operating subsidiaries, each subsidiary will have to pay a dividend with the corresponding credit attached.

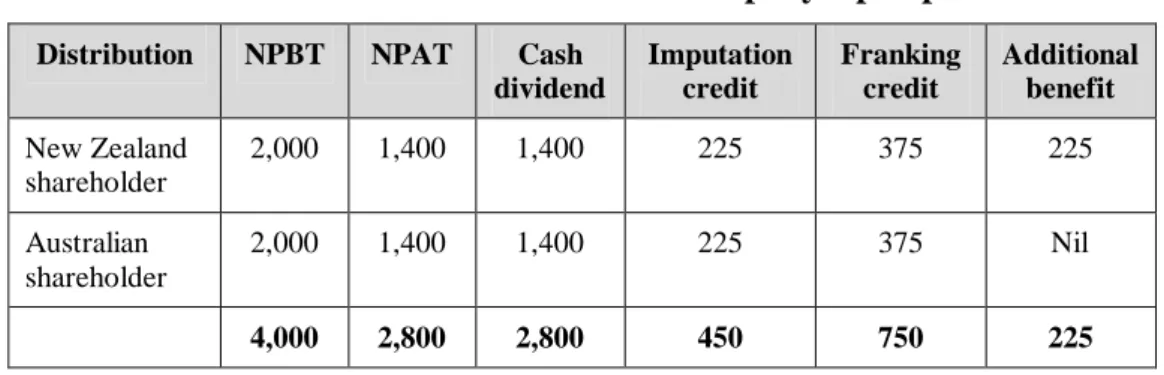

Full distribution of net profit after tax

Payee Cash Dividend Accrual Credit Franking Credit Gross Dividend Taxable Dividend Tax Payable Less Imputation Credit Less Franking Credit Additional Tax Payable After Tax Dividend Additional Cash Benefit.

Creditable taxes

The parent company’s perspective

The shareholders’ perspective

However, note that the amount of New Zealand tax ($450) is insufficient for Aust Parent Co to fully calculate the cash dividend of $1,400. This happens because the New Zealand subsidiary NPAT is $1,050 and the available imputation credits of $450 cannot cover a cash dividend of $1,400.

The superiority of streaming

The combined effect of wasting credits associated with a proportional allocation solution, its complexity and coordination costs will limit its appeal. The rejection of full streaming by both governments is likely to mean the continuation of ad hoc solutions that achieve the same basic benefits associated with full streaming.

Criticism of full streaming

Second, both governments have also stated that they are concerned about the fiscal risks associated with the full-flow model, since the available credits are only allocated to shareholders of the country where the basic corporate tax was paid. Third, both governments were concerned that the adoption of a full streaming alternative could be misinterpreted as a sign that credit streaming would become acceptable.

Allocation of credits that are disproportionate

This would violate one of the fundamental design features of both countries' attribution rules, which is the ban on credit streaming to different groups of taxpayers based on their ability to use the credit.

Fiscal risks

Anti-streaming rules

Historical background

For example, Lion Nathan and Goodman Fielder Wattie are no longer New Zealand domiciled companies and therefore the concerns about the impact of the CFC and FIF regime on these taxpayers no longer apply. Finally, the discussion paper does not refer to the following anti-avoidance provisions designed to prevent inappropriate use of the streaming model.

New Zealand

Australia

Introduction

The Westpac share issue

Key features

The funds raised by the Issue have been lent by the Issuer to the Borrower, which is a New Zealand resident company which is another wholly owned subsidiary of Westpac Holdings NZ Ltd. paid to New Zealand holders.

Key taxation issues to be resolved

Sections CF 2(11) and (12) of the Act deal with the quantification and derivation of any deemed dividends arising from the operation of section CF 2(1)(e) of the Act. Licensing of copyright in software by Aust Parent Co to its New Zealand subsidiary.

The ANZ share issue

Commercial objectives

ANZ Banking Group (New Zealand) Limited (“ANZNZ”) which is wholly owned by ANZ Holdings and incorporated in New Zealand. This is why two new separate companies (i.e. ANZ Sub I and ANZ Sub II) will be incorporated in New Zealand.

The unit trust

If the transactions described in the binding judgment were to proceed, the following steps would be taken.

Forward sale and purchase agreement

Loan to ANZ Sub I

Loan to ANZ Sub II

Loan to ANZBG NY

Swap

Anti-credit streaming rules

Historical rationale for the existing rules

Full streaming option

Streaming of dividends

Section GC 22(1)(a)(iii)

Section GC 22(1)(a)(iv)

It is not the motives of the parties that are taken into account, but the effect achieved by their actions. If there is an income-tax benefit, it must be determined whether that benefit is merely an incidental purpose or effect of the arrangement or not.

Section GC 22(1)(b)

Stapled stock arrangements

Section GC 23

Introduction

Interest-free loans

Debentures

The structure

Summary of interest and dividend flows

NZ Holding Co can offset the FDWP payment against the NRWT liability on the dividend. Aust Parent Co can then reinvest the periodic dividend in the Australian group of companies.

Comparative advantages of floating rate debenture loan

Under New Zealand's accrual regime, a tax exposure will also arise from foreign currency fluctuations on the principal amount of the $A loan. The table above shows the overall tax savings to the Australian group associated with the annual cash flows used to overcome any potential New Zealand NRWT created by New Zealand deemed dividend rules.

Commercial characteristics of a Section FC 1 FRD

If the original available tax-free cash was transferred to Australia via a floating rate debenture (FRD), there would be no adverse New Zealand or Australian corporation tax implications. From a New Zealand perspective, the New Zealand operating grant is considered to have acquired equity in a "grey-listed" country.

Taxation features of the Section FC 1 FRD

The same applies to Article 13 in the DTA between Australia and the USA and Article 13 in the DTA between New Zealand and the Netherlands. Section BH 1 of the Act describes the relationship between the DTA and New Zealand domestic law.

Taxation features of interest paid under FRD

Payment of interest by New Zealand holding company

Introduction

A guidance tax relief company that receives a dividend subject to FDWP may be partly or wholly relieved of the obligation to deduct FDWP by section NH 7 of the Act. The extent of the tax relief is dependent on the percentage of the company's shareholders who are not resident in New Zealand.

An example

In relation to periodic cash flows that are made to avoid any potential deemed dividends, the New Zealand group of companies can be fully relieved of their FDWP liability by benefiting from the conduit tax regime.

An unresolved problem

A hypothetical example

A possible solution

Aust Parent Co would deposit the proceeds from the sale of the NTBI with the Australian Bank, which would have loaned the money to New Co 1. New Co 1 would use the cash dividend to repay principal and interest to the Australian Bank.

Diagrammatic summary

NZ Sub would pay a $100 cash dividend to New Co 2 which would come from realized capital gains.

Anti-avoidance issues

Furthermore, the company may attach imputation credits to that dividend in accordance with subpart ME of the Act. The company does not frustrate the scheme and purpose of the Act by simply choosing to make the most tax efficient form of distribution.

Recent cases

If the company elects to declare a taxable bonus issue and does not attach attribution credits, resident withholding tax must be paid by the company. If the company were to undertake a buyback of shares or if the company were to be liquidated, the NTBI cannot be distributed as a tax-free dividend to the shareholders.

Consequences

It may be more fruitful to focus on the nature of the concepts on the basis of which the tax is imposed. On the other hand, the adoption of a course of action which avoids tax should not fall within [s BG 1] if the legislation, on its true construction, intended to give the taxpayer the choice to avoid it in that way.

Introduction

A compound transaction such as the Russell scheme, which may not give rise to any tax liability if due consideration is given to the legal autonomy of each of its parts, can be seen in commercial terms as a unitary scheme that excludes the company's net profit makes possible. to be divided between the shareholders and Mr. Russell (Compare MacNiven v Westmoreland Investments Ltd [2001] 2 WLR 377.) Their Lordships view this as a paradigm of the kind of arrangement that [s BG 1] was supposed to counter.

Impact of profit repatriation strategies

Computer software

If the hypothetical transaction were a royalty for New Zealand tax purposes, the New Zealand subsidiary would be required to deduct 10% of the gross payment, which would reduce the franking credits.

Previous IRD ruling

Draft interpretation guideline IG007

A Trans-Tasman example

This transaction would constitute a royalty for New Zealand tax purposes, and given the commercial relationship between the parties, is unlikely to occur in practice. This transaction is unlikely to occur in practice because it could expose Aust Parent Co to a New Zealand NRWT liability.

The provision of labour

A second possibility would involve the Aust Parent Co granting the New Zealand subsidiary a license to use its copyright, thereby allowing the New Zealand subsidiary to modify the source code. The copyright will remain with the Aust Parent Co, and the New Zealand subsidiary will acquire the right to use, for its own internal business purposes, the computer program.

Wise v CIR (1992) 14 NZTC 9,032

The contractual relationship as to what work was to be done existed between SSINZ, not SSI, and the Maui field operators or their contractors. The recruiting of the necessary personnel was done by SSINZ and initially the field operators would oversee SSINZ in case of deficient work in the first instance.

Conclusions

Introduction

Back-to-back funding: AIL

Key points and issues

As the AIL does not create a foreign tax credit, the payment of NRWT would be the optimal solution if the foreign lender can "absorb" the New Zealand NRWT credit. In that scenario, the foreign lender, all else being equal, will be better off with the AIL savings.

Detachable coupons

Additional tax issues concerning detachable coupons

Derivation of interest

Validity of the assignment

However, she claimed the protection of the corporate earnings article in the Australia/Netherlands DTA. All commentators agree that the assumed interest is not interest in the sense of the Dutch Treaty.

Potential New Zealand tax liability for Aust Parent Co on the

Introduction

One of the major differences between the two Trans-Tasman tax systems is the absence in New Zealand of a capital gains tax (CGT). All else being equal, the Australian CGT regime represents an additional layer of Australian tax that will not create any imputation credits in New Zealand.

A hypothetical investment

Second, the allocation of franking credits under the proportional allocation solution to New Zealand shareholders will still encourage Trans-Tasman companies to avoid Australian CGT.

Australian CGT

This conclusion is based on the following brief summary of the scheme of the Act of 1997. The expression "assessable income" is defined as including amounts included in assessable income under the provisions of the Act (ie statutory income).

Dual company structures: Option A

If NZ Parent Co were to sell the Tax Haven Company (Tax Haven Co), that transaction would not be caught by any of the charging provisions contained in the 1997 Act. However, the buyer may feel uncomfortable buying a tax haven company as a means of gaining control of the Australian property.

Dual company structures: Option B

In the context of the DTA between Australia and the Netherlands, the main point is that there is no reference to capital gains in Article 2 (taxes covered). The answer can be found in paragraph 8 of the OECD Commentary on Article 5 (discussing the concept of a PE).

Article 13 of the New Zealand-Australian DTA

Lamesa

Lamesa acquired an Australian company (Aust Holding Co – 1st tier) called Australian Resources Limited (ARL). Lamesa made a profit of more than $A200 million from the sale of its stake in ARL (Aust Holding Co – 1st tier) in two parts.

Article 13 of the Australian-Netherlands DTA

Article 13 of the New Zealand-Netherlands DTA – a double-edged

The judgement of the Federal Court in Lamesa

The significance of Lamesa structures

Moveable property

Further support for this interpretation is found in Article 6(a) of the First Protocol to the DTA between Australia and the Netherlands. The exemption also applies to capital gains generated by the disposal of shares in a foreign subsidiary.

TR 2001/2

Taxes covered

If Article 2 were applicable today, then there would be a strong case for arguing that the reference to “Australian income tax” in this treaty covers capital gains for the reasons stated above. Article 26AAA is a form of capital gains tax and was in effect at the time the Dutch treaty was concluded.

Practical considerations

For example, Professor Vogel40 has stated that capital gains tax is usually dealt with within income tax law and any new capital gains tax will normally be regarded for treaty purposes as at least similar to income tax. Part IIIA added net capital gains to the classes of income which are taxable under the 1936 and 1996 Acts.

Article 7 business profits

When one of the States has the right to tax the profits of an enterprise, that State may treat as profits from the alienation of capital goods of the enterprise as profits of an enterprise, other than profits consisting of income to which paragraph 1 of Article 13 applies.

Would the activities of a Dutch dividend trap company constitute

Will the Dutch treaty apply if there is no double taxation because

Treaty shopping

Participation exemptions

These are some of the reasons why Dutch holding, finance and royalty companies are becoming a common feature in international tax structures. For example, the rate of withholding tax on dividends under the Netherlands Treaty Network varies between zero, 5%, 10% or 15%.46 With respect to interest and royalty payments, the withholding tax rate is zero where the shareholding qualifies for the capital contribution exemption and the shares form part of a company whose activities are carried out in the Netherlands.

The Netherlands participation exemption

Netherlands-Antilles

A key feature of Netherlands Antilles domestic law is that dividends received from foreign holdings are taxed at one-tenth of the company's ordinary tax rate, provided that the profits from which the dividends are derived have been taxed in the country of origin. The primary test is that a share is considered a participation if it represents 10% or more of the foreign company's share capital.

The Danish participation exemption

Provided that a member of the consolidated group earns sufficient active income, the structure will not constitute a "financial company". In the context of Trans-Tasman repatriation strategies, it appears to be an advantage to include a Danish holding company in the structure due to the lower effective tax costs, compared to an 8.3% rate applicable to a Dutch, Dutch -Antilles structure is associated.

Introduction

However, there is an important limitation known as the "same country holding company."51 In the context of Trans-Tasman investment structures, the exemption will apply to a structure whereby a Danish company owns an Australian holding company which in turn have a second possession. Australian company. The only apparent disadvantage of a Danish holding company is that the exemption from Danish capital gains tax only applies if the Danish subsidiary has held its 25%.

Domestic law solutions – Australia

The third report, Double Taxation Conventions and the Use of Conveyance Companies, analyzes a number of ways in which treaty shopping could be countered.

Do Treaties override the New Zealand position?

The 1982 legislation and the current regimes redefine the property rights of landlord and tenant. The lessee was considered the legal owner of the asset and the lessor was considered the financier.

Collco Dealings Ltd v IRC

Woodend (K V Ceylon Rubber Tea Co Ltd) v IRC

Domestic law: a specific GAAR

In effect, that provision provides that reduced treaty rates under U.S. DTAs will only apply if the payment to the entity is treated as income derived by a resident of the applicable treaty country, the resident is the beneficial owner of the income, and all other requirements under the treaty have been fulfilled.

Bilateral solutions

In the case of the Australia-US treaty, there is a similar clause which contains an additional requirement that the shares be traded on a recognized stock exchange. Important is the activity test, which states that reduced treaty rates are available if the content of the business in the country of residence and the income in the country of source are related to active business.

The New Zealand experience

In the case of a company that derives income from the United States, it is only entitled to the reduced treaty rates if the principal class of its shares is listed on a recognized stock exchange in either state, and the shares are substantially traded on either states. or more recognized exchanges. Second, the treaty benefits will still be available if the company is a headquarters of a multinational corporate group.

Background

A complicated example of the US position against treaty shopping is Article 26 of the 1992 US-Netherlands treaty. This article has formed the basis for subsequent US DTA negotiations.60 Article 26 contains a number of tests, one of which must be met.

Cross-border implications

The re-characterisation regime

The definition of a lease asset

The definition of a specified lease

The definition of a “finance lease”

Guaranteed residual value

Non-resident withholding tax

The impact of double taxation agreements

The 1995 Australian DTA

The impact of the Netherlands DTA

- Article 5

- Commentary on Article 5 of the definition of a PE

- Article 11 (interest)

- Article 12 (royalties)

- Protocol

Article 11, subsection 5, creates real treaty relief because it defines the term "interest" for the purposes of the treaty in a way that cannot be interpreted as including estimated interest income. Accordingly, the lessor's estimated interest income falls outside the scope of Article 12 and New Zealand cannot impose tax under its domestic law.

Conclusion

However, Article 7 of the Dutch DTA provides that if other Articles also apply to the same income, then those Articles will override the positive effect of Article 7. Any cross-border Australian/Dutch lease which provides that the landlord e.g. , pay the stipulated lease on a "take or pay basis", regardless of the actual use of the leased asset, will satisfy the requirements of clause (ix) of the protocol.

The legacy of history

The best solution

Behavioural implications