Introduction

Background

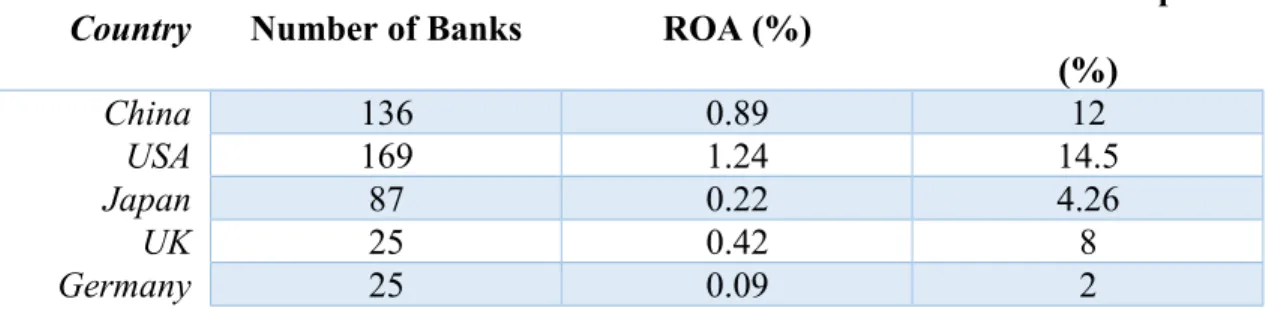

On the side of ROC, we can see banks in the US earn more by investing their capital. So we can say that Central Asian banks are more efficient in making money by investing their money in the right place.

Objectives

Throughout the 1970s, the main role of the credit system was to support trade and the public sector, which absorbed 75% of all loans. Due to denationalization and private sector growth, the Bangladesh Bank and the World Bank have shifted their lending priorities.

Significance

Analysis of the industry

Bangladesh's private commercial banking industry is a significant contributor to the country's economy. Bangladesh's private commercial banking industry is an important part of the country's financial sector.

Size, trend and maturity of the industry

One of the key trends in the private commercial banking industry in Bangladesh is the increasing focus on digital banking. Despite these challenges, the private commercial banking industry in Bangladesh is poised for continued growth in the coming years.

Seasonality

The peak season in the private banking sector in Bangladesh is from January to June. The lean season in Bangladesh's private banking sector runs from July to December.

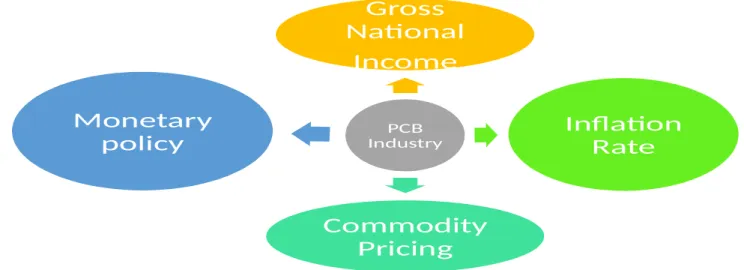

External economic factors

So, we can say the inflation rate has both direction effect in the banking industry. BD remittance fighters send foreign currencies which are also beneficial to the banking industry and our economy.

Technological factors

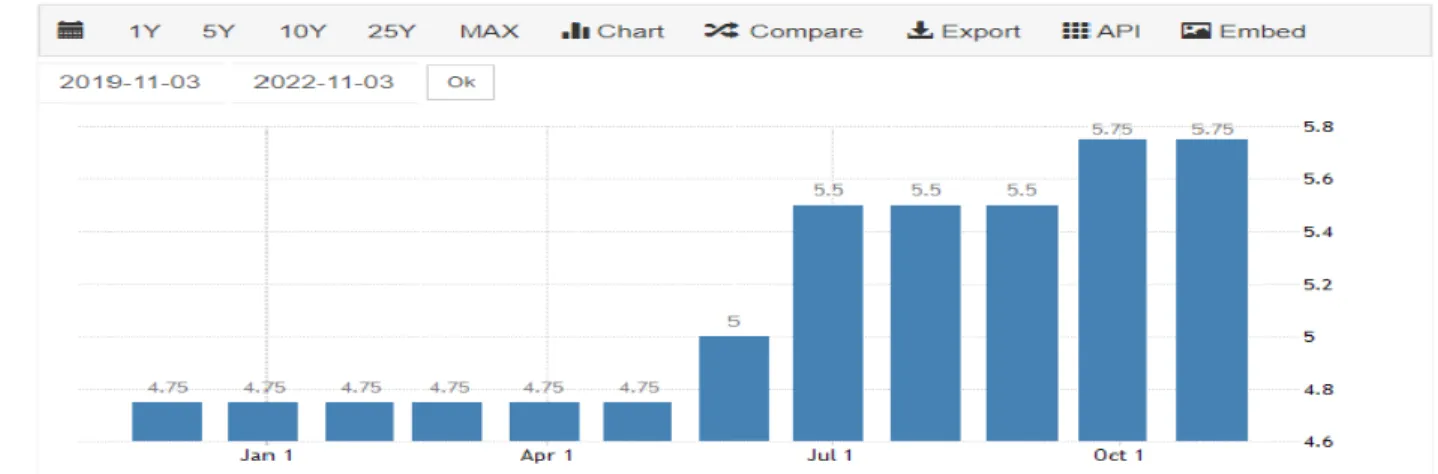

The central bank's lending rate is also very important for banking, if the interest rate is low, banks can make more profit. There are other technological factors like MFS (Mobile Financial Services), digital payment system, digital fund transfer provides a new dimension to the banking industry. KYC (Know your customer) is the most important thing for banks, without KYC customers cannot access any type of banking services.

The outbreak of Covid-19 in early 2020 could not affect banking services due to internet banking.

Political, legal and regulatory factors

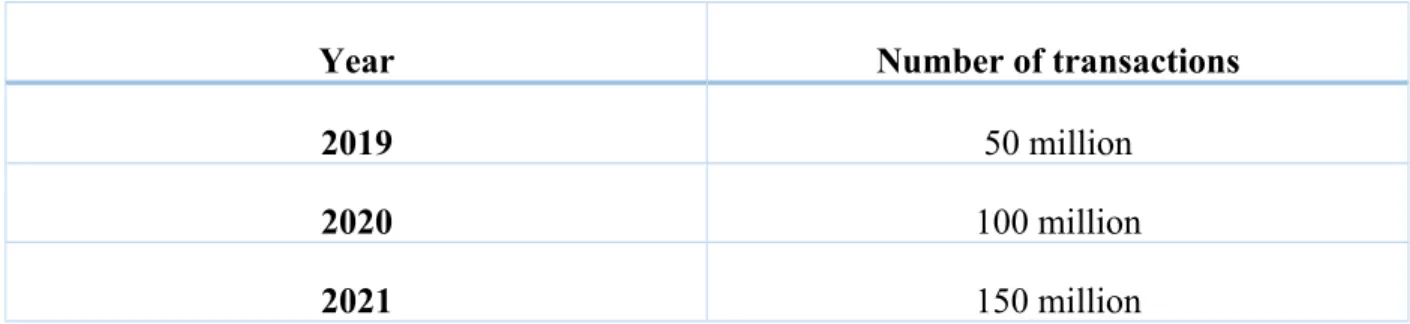

The journey of internet banking started in the year 2010. Banks are encouraging their customers to adopt the digital window. In addition, internet banking services can be used to pay the bills, rent and utility costs. According to the data from BB, the number of customers using internet banking services stood at 5.35 crore in June, an increase of 47 percent from a year earlier in Bangladesh.

Apart from the political party, the government governs the banking industry by passing banking acts.

Barriers to Entry

According to Section 31 of the Banking Companies Act, 1991, no company shall carry on banking business in Bangladesh without obtaining permission from the Bangladesh Bank. 10% can be released in case of setting up a bank as a joint venture with a foreign financial institution. Fund costs are the costs of providing loans to the bank's customers.

New banks do not have the resources to introduce new financial products, therefore they fail to meet the existing market demand.

Threat of substitutes

Today, MFIs have covered many rural areas and offer microcredit to banks. Consumers take the loan and invest in the community-based business and return the money to the MFIs. MFIs are eating away at PCB market share in rural and underdeveloped areas.

Nowadays people in Bangladesh like to invest in stock markets, various companies, real balances instead of depositing money in banks.

Industry Rivalry

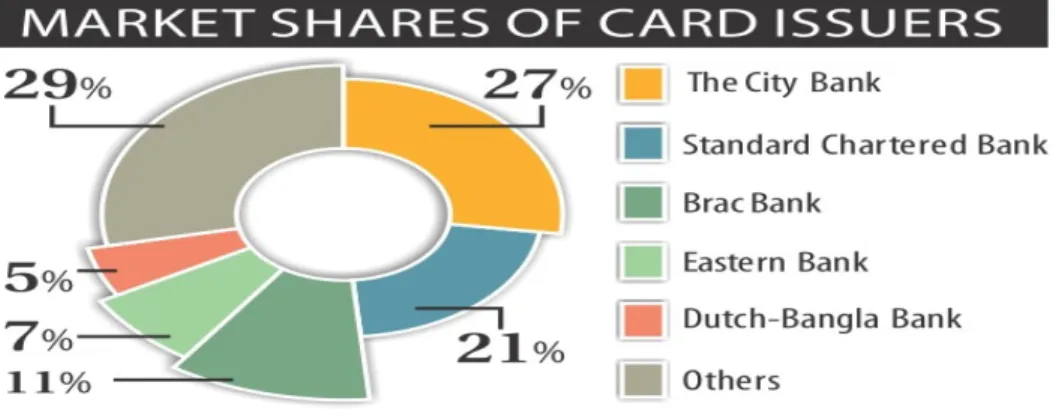

PCBs are also launching various financial products such as credit cards, home loans, car loans, personal loans and various loan packages to gain market share from the substitutes available in the market. SCB, Brac Bank, Eastern Bank & DBL are the main competitors in the card segment of the banking industry. Because the higher operating profit shows that they are struggling in the same segment and their operating costs are close to their industry rivals.

We can see from the picture that Pubali, The City Bank ltd, Eastern bank, Southeast bank, Bank Asia achieved the same amount of operating profit in the year 2020-2021.

Summary of Challenges and opportunities

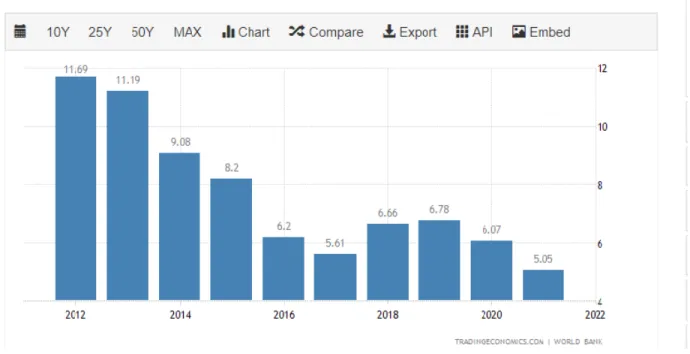

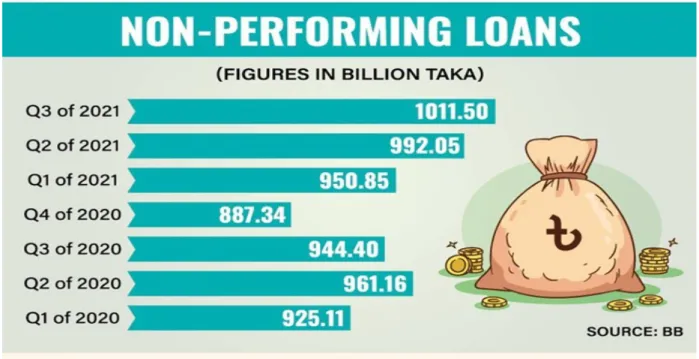

Another challenging situation for the banking sector is non-performing loans which will increase by 16% in the year 2022. As a result, banks can spread their operations to rural area and this affects the financial inclusion for the people of Bangladesh. Youth can be a door of opportunity for the PCBs because 66.38% of Bangladeshi youth between the ages of 14-24 do not have bank accounts.

PCBs may revise their collateral related policy for the entrepreneurs because they are facing difficulties due to not owning any kind of properties.

Analysis of the organization

Overview & History

City Bank Limited is one of the most prominent banks in the private banking sector in Bangladesh. City Bank Limited has already introduced several new banking products such as dual currency credit cards, ATM and Online services, which have created appeal among customers. The vision of City bank Limited "The financial supermarket with a winning culture that offers pleasant experiences".

Mission of "The City Bank Limited"; we can separate the mission of the city bank into four parts; a) Offer a wide variety of products and services that differentiate and excite all customer segments b).

Trend and growth

These figures show the bank's strong growth and its ability to attract more customers and generate more business. This shows the bank's strong financial position and its ability to meet its financial obligations. The bank has also been successful in reducing its non-performing loans (NPLs) over the past few years.

The bank's strong growth and trend is a testament to its ability to provide quality financial services to its customers and generate sustainable business.

Customer Mix

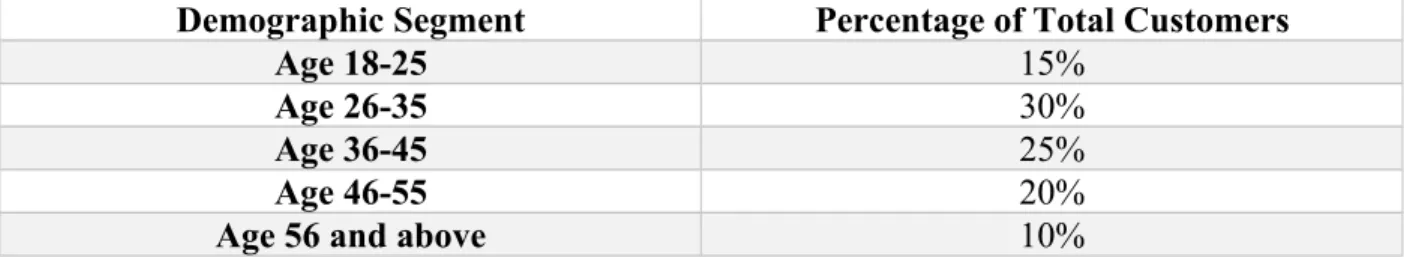

City Bank Limited has also been successful in maintaining its capital adequacy ratio, which is a measure of a bank's ability to meet its financial obligations. According to statistics, City Bank Limited has a total of 132 branches in 38 districts of Bangladesh. So we can say that city bank limited has a great mix of customers in Dhaka districts.

From the above data, it can be observed that City Bank's customer base is diverse and well balanced.

Product and Service Mix

City Bank Limited offers personal loans to its customers, which can be used for a variety of purposes, including debt consolidation, medical expenses and more. City Bank Limited also offers its customers home loans, which can be used for the purchase of a new home, the renovation of an existing home or the construction of a new home. City Bank Limited offers car loans to its customers, which can be used towards the purchase of a new or used car.

City Bank Limited also offers education loans to its customers, which can be used to finance the cost of education, including tuition fees, books and other related expenses.

Operations of the city bank Limited

City Bank Limited provides payment services to its customers to help them send and receive money quickly and securely. City Bank Limited offers digital banking services to its customers through its mobile banking and internet banking platforms. The bank provides investment services such as portfolio management and mutual fund services to its customers.

City Bank Limited conducts its day-to-day operations by providing a wide range of services to its customers.

SWOT analysis for the city bank limited

City Bank has built a strong brand image over the years, which has helped the bank build a loyal customer base. This has helped the bank to make informed decisions and has enabled the bank to remain competitive in the market. This has made it difficult for the bank to remain competitive in the market, especially as its competitors invest in cost-saving technologies.

City Bank has the opportunity to expand its business into international markets, enabling the bank to reach a larger customer base and increase its growth potential.

Step and strategies to meet the challenges and opportunities

The banking industry is subject to regulatory changes, which may affect the operations of City Bank. The economy of Bangladesh is subject to fluctuations, which may affect the operations of City Bank. After analyzing the customer mix we find that CBL in the Mega Cities &.

First world countries have introduced paperless banking worldwide to reduce the delivery time of financial products, resulting in increased customer satisfaction.

Position, duties and responsibilities & contribution to the departmental functions

Provide knowledge of financial products to clients and deliver required checkbooks to clients. One of the highlights of my internship was the opportunity to work with the loan processing team. I was able to observe and assist in the loan processing processes, from initial application to final disbursement.

I was introduced to the bank's daily operations and how they process transactions.

Trainings

Approval or Denial: Once the information is verified, the bank makes a decision on the loan application. Portfolio management: the bank will also take into account the impact of the loan on its overall portfolio. Approval or Rejection: Based on the credit risk assessment, the bank will make a decision to approve or reject the loan.

Continuous Monitoring: The bank will continuously monitor the borrower's credit risk over the life of the loan.

Evaluation of Internship performance

RTGS: This is a real-time interbank electronic payment system that enables customers to transfer large sums of money quickly and securely. The system operates 24/7, making it convenient for customers who need to transfer money outside regular banking hours. The bank then confirms the transaction and sends it to Bangladesh Bank for processing.

The bank offers these services to individuals, businesses and organizations that need to transfer money quickly and securely.

Skills Applied

To make a transfer, the customer must provide the bank with the necessary information such as the beneficiary's name, account number and bank details. The transfer is carried out in real time and the funds are immediately credited to the beneficiary's account. MS-Word skills applied to drafting documentation, assisting bank employees to draft official documents, loan applications, letters, etc.

Leadership and management skills were used when I managed attendants, security guards, suppliers and vendors.

New skills developed

MS-Excel skills used to identify the relationship between a borrower and the term of the loan, determine the installment amount, created invoices, analyzed DBR, analyzed customer accounts. As an intern, I was exposed to real challenges that the bank faces and I have learned to find creative solutions to these challenges. I assigned various tasks and projects that helped me develop leadership, decision making and time management skills.

As an intern I worked with customers, bank employees and other stakeholders, and this helped me learn to communicate effectively and professionally in different situations.

Application of academic knowledge

Knowledge of business communication academics helped me write e-mails, official documents, applications on behalf of bank officials. As an intern I worked in various departments in City Bank limit Shaymoli branch, based on my experience, I write this part of the report. The private banking sector in Bangladesh has experienced significant growth in recent years and City Bank Limited is one of the leading players in this industry.

At the end of the discussion, the private banking sector in Bangladesh is a promising and growing industry and City Bank Limited is well positioned to tap the opportunities in this market.

Recommendations

Recommendations for improving the departmental operations

Customer service department should take regular feedback from the customers and take actions based on the feedback.

Recommendation for improving self-performance

The City Bank Limited has demonstrated a strong commitment to ethical business practices, social responsibility and sustainable development, which has helped build a loyal customer base and enhance its reputation in the marketplace. There are some areas where the City Bank Limited can further improve in order to maintain its competitive edge in the market. The bank can focus on improving its digital banking services to provide a more seamless and user-friendly experience for its customers.

Additionally, City Bank Limited may consider expanding its operations to other countries in the region to tap into new markets and diversify its revenue streams.

Conclusion