A Study on Rahman Rahman Huq, a Member of KPMG in Bangladesh," and it was approved by my supervisor. The internship report titled "Audit Procedure of a Chartered Accountant Firm - A Study on Rahman Rahman Huq, the Member of KPMG in Bangladesh ” was submitted to the department by Morsheda Akther Ria, Student ID. This is Morsheda Akther Ria hereby declare that the internship report titled “Audit Procedure of a Chartered Accountant Firm-”A Study on Rahman Rahman Huq, a Member of KPMG in Bangladesh” is my original work completed under the supervision of my respected supervisor , Ms.

- Introduction

- Origin of the Report

- Objectives of the Study

- Scope of the Audit

- Methodology of Collecting Data

- Limitations of the Study

The goal of the project was to learn how an authorized accounting firm conducts an audit, and to gain knowledge and practical experience of how audit work is carried out in companies, companies and non-profit organizations. The main objective of the study is to get a general idea about the audit procedures of Rahman Rahman Huq (RRH). Primary Source: The primary source of data for the purpose of the study is as follows -.

About RRH

RRH or the company is the first Bangladeshi company to be a member of one of the four international accounting firms. RRH has been representing KPMG in Bangladesh for more than a decade, and member firm status is the highest level of affiliation with such global firms. RRH has gained a reputation in Bangladesh among national and international companies, public sector corporations and development groups.

Services Provided by RRH

Audit of financial statements - Audits of financial statements are obliged to perform services in the public interest. It is in the public interest as it ensures the accuracy of data used by investors and the financial sector. To ensure that all members of the KPMG network adhere to the highest standards of ethical behavior at all times, KPMG International (a member of RRH) has a comprehensive and robust global code of conduct available to the public.

This section helps companies handle transfer pricing efficiently by providing planning, compliance and documentation, implementation and dispute resolution services. Accountants, tax advisors, specialists, benchmarking professionals and financial professionals are just some of the areas in which KPMG excels in Bangladesh. TP Planning: Transfer Pricing Planning helps develop financially sound transfer pricing plans for foreign transactions, capital restructuring and investments.

Focuses on identifying and advising on potential transfer pricing issues by reviewing draft contracts between related companies. Assistance in Transfer Pricing Analysis and Documentation/Study: Here, experts assist in assisting and analyzing foreign transaction reports between related companies to ensure compliance with market principle for transfer pricing purposes. Preparation of the transfer pricing statement: Provide support in identifying international transactions and compiling the transfer pricing statement.

Settlement of disputes: The transfer pricing experts assist in the resolution of transfer pricing disputes at various levels of the competent authorities by providing various services.

My Responsibility as an Audit Assistant

The auditor's first responsibility is to determine whether a particular aspect of the company's performance is material or not. Therefore, after calculating the importance percentage for the company, I had to use it to randomly select transactions from the general ledger under the assigned subheadings. After that I had to verify their correctness, completion of the transaction, proper registration, protection of company assets and finally liability.

As a result, I had to look at the transaction approval process, internal control system and policy implementation to find loopholes.

It was decided that the success of the audit policy would be measured against criteria other than those specified in the audit practice manual. According to him, the criteria should take into account the leadership and organizational structure of the accounting firm, the independence of the auditor, the importance of the audit to the firm, the expertise of the accounting firm's partners and employees, and the importance of the audit itself . It was decided that audit policies should be designed so that there is a direct correlation between the risks being evaluated and the timeliness, scope and other relevant details of the audit.

In developing additional audit procedures, the auditor should consider the level of risk involved, the likelihood of material misstatement, the type of transaction, account balance or disclosure involved, and the existence of the specific the entity's internal controls, such as whether they are operated manually or mechanically. To reach the correct judgment after evaluating the evidence, the auditor must be qualified to fully understand the criteria and must be informed about the types and amounts of evidence to be collected. The auditor may rely on a wide variety of evidence, such as the auditee's (the client's) own words, letters and emails from third parties, and direct observation.

The auditor is responsible for defining the appropriate level of evidence and verifying that the available data meet the predetermined standards. In order for an audit to be carried out, there must be both information that can be independently confirmed and criteria that can be used to assess the correctness of the information. For example, an audit of a supplier's invoice for the purchase of raw materials can reveal whether the company received the correct quantity and quality of materials, whether the raw material was procured in accordance with the organization's operational needs, and whether or not the price was fair.

The audit report is the final result of an audit and is used to communicate the results to the target group.

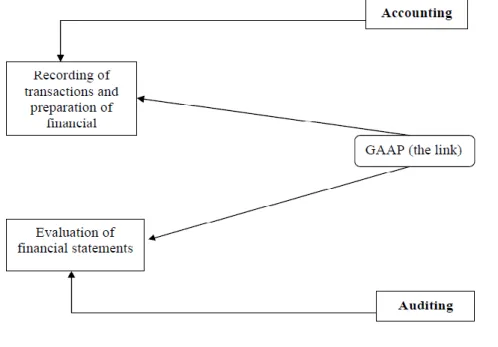

- Accounting vs Auditing

- Organizational Structure of RRH

- Audit Procedure in Bangladesh

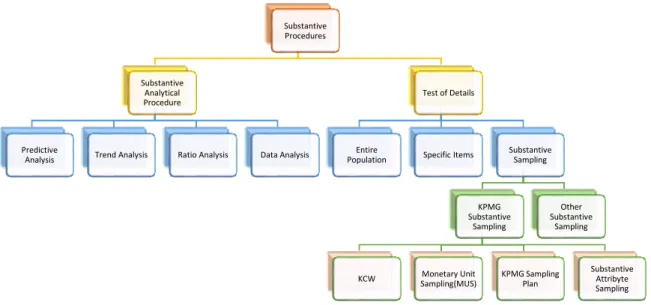

- Audit Procedure of RRH

- Recent Changes in Audit Practices

- Measuring Effectiveness of RRH’s Audit Procedure

- Findings

An audit plan ensures that no stone is left unturned and that the auditor is aware of the audit design and all controls that the teams must perform to complete the audit. In light of the client's context regarding the item being assessed, the auditor must exercise professional judgment. This tool is used to determine whether or not the full audit program method should be skipped in light of the specifics of the audit at hand.

It can be used to evaluate the impact of all potential risks on a particular component of the financial statements. This allows you to focus on the most urgent issues during the audit without losing sight of the big picture. The scope of activities, the most pressing issues to be resolved, the importance of the goal, and the type of involvement all play a role in the planning process.

For the purposes of an assurance engagement, fraudulent is defined as the intentional manipulation of the subject matter. Planning and risk assessment at RRH includes an examination of the nature underlying fraud risks and the selection of relevant tests to mitigate such risks. In the final stages of the audit, RRH will develop and implement final analytical procedures to help determine whether or not the financial statements are consistent with our understanding of the business.

The fundamental process has remained the same, but some changes have been made to increase the credibility, transparency and effectiveness of the audit procedure. To measure the effectiveness of RRH's audit procedure, the following questionnaire has been designed. The purpose of the survey is to gauge how well the RRH carries out its inspection tasks.

Comparable search methodology

Search from Compustat Global Database (KTPE)

- Criteria Selection, Data Sufficiency, and Quantitative Screening

- Qualitative Screening

The purpose of the search is to discover a group of independent entities that participate in similar activities as ABC International Limited and that have functional and risk profiles similar to those of ABC Bangladesh. This search for comparable companies was conducted through a series of processes, which are described in the following paragraphs. We looked for companies based in one of the following Asia Pacific countries.

As different regions have different economic circumstances, we have looked for comparable companies which are from the close economic connection of ABC Bangladesh. The purpose of this step is to improve the reliability of the data by eliminating companies with only three years of financial data, thereby providing sufficient data for the calculation of ratios. The main reasons for exclusion, summary results of the quality review process and other details are presented in Appendix A.

Final Comparable Set

The Three Year Period Weighted Average (PWAVG) of Operating Margin = OP/Net Sales for the expense nature transactions is shown below:-. During the year, ABC Bangladesh has achieved an operating margin of 34.32% (Annexure-B for details) at the unit level, which should be considered within the arm's length range as the operating margin earned by ABC Bangladesh is much higher than the 30 percentile margin of comparable companies .

There are many areas where improvements could be made, which are mentioned in the recommendations section. RRH should conduct training more frequently in a timely manner so that knowledge of audit procedures can be effective. The procedure of cash incentive and its role in the RMG sector in Bangladesh: Evidence from Bangladesh.

The procedure of cash incentive and its role in the RMG sector in Bangladesh: Evidence from Bangladesh (14 February 2019). An audit simulation of the authentication procedures in the revenue process - A teaching case that includes Bloom's taxonomy. To assess the comparability of the remaining independent companies, KPMG Bangladesh reviewed the potentially comparable firms' business descriptions using sources such as Dow Jones Companies & Executives, company websites or the companies' annual reports.

Specifically, we tried to identify companies that engage in similar activities as the tested party and eliminated companies that perform functions, own assets and carry risks significantly different from those of the tested party from the comparable group. Independent companies that are found from various databases for quality screening, are analyzed according to the following criteria-. 4 Reject companies that operate at a loss for 3 consecutive years and 5 Reject companies that have insufficient information.

For the Compustat Global database, we applied the SIC codes and for the Capitaline plus database we applied the NIC codes to search for comparables such as A-TEX International Limited.