It gives me great pleasure to submit my internship report on "Credit Management Analysis of Rupali Bank Ltd". I wholeheartedly thank you for experiencing this report and providing your valuable comments. As a matter of first criticality, I should thank Almighty Allah, whose elusive attitude helped me complete this report.

Mostafa Kamal sir who encouraged me to prepare this report and also gave me every central help and attitude. Credit Management Analysis of Rupali Bank Ltd.” Elenga Bus Stand Branch, Tangail under my supervision. He always maintained communication with me and received the necessary advice from me to prepare this report.

Finally, under my guidance and supervision, he successfully prepared this internship report on “Credit Management Analysis of Rupali Bank Ltd. I am Shimul Sarker, degree Master of Business Administration (MBA), under the Business Administration at DIU—University declaring that this entry level position report on the subject of "Credit Management Analysis of Rupali Bank Ltd. I therefore declare that this report is solely arranged by me and as far as I could possibly know and experience compiled by working in Rupali bank Ltd. .

I have prepared my internship report based on the three months internship program that I have successfully completed in Rupali Bank Ltd.

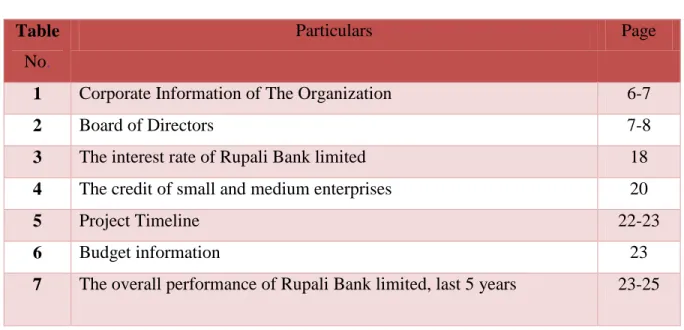

List of Figure

- Introduction to the Report

- Objective of the Report

- Board Objective

- Specific Objectives

- Scope of the study

- Methodology

- Limitation of the Study

- Background of the Organization

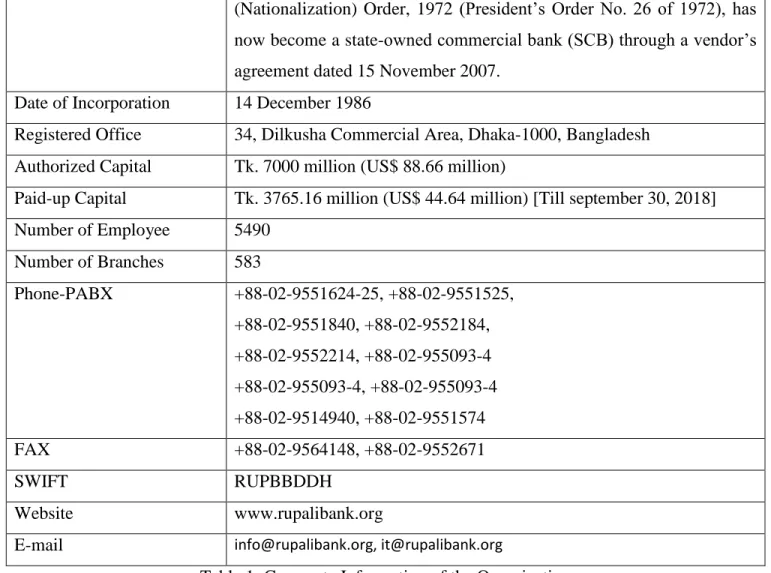

- Corporate Information of the Organization

- Board of Directors

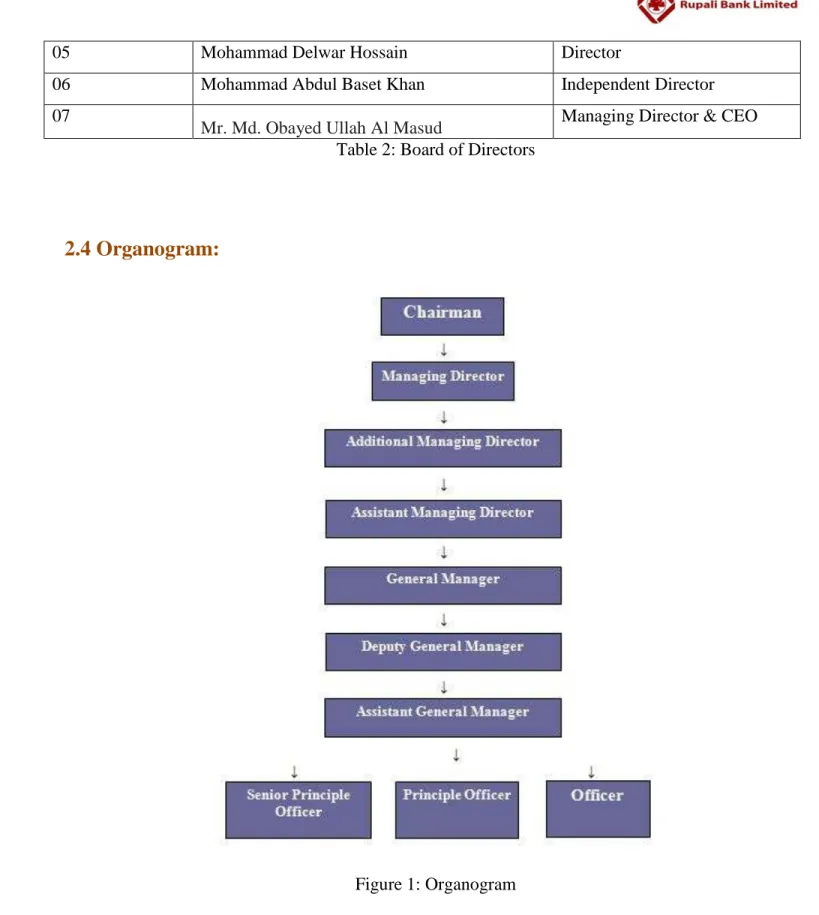

- Organogram

- Mission and Vision

- Our Mission

- Our Vision

- Services of the Organization

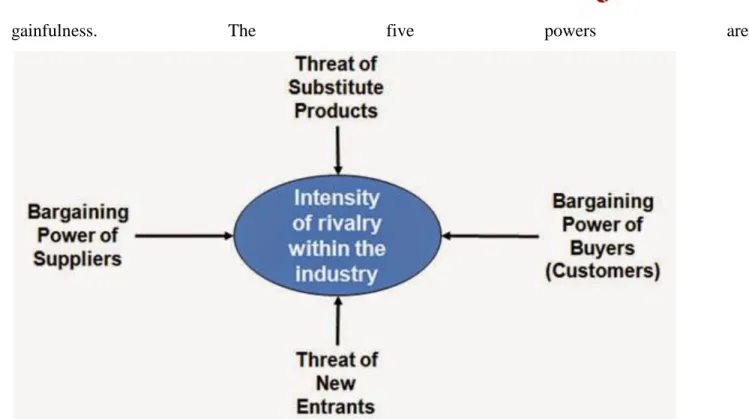

- Porter’s Five Forces

This report focuses on "Credit Management Analysis of Rupali Bank Limited-Elenga Bus Station Branch, Tangail". Rupali Bank provides various loans to the people like business loan, personal loan, micro credit, rural loan etc. But with the flow of decade, it plays an important role in satisfying the urgent needs of businessmen and other parties.

As the size and complexity of business and services are increasing day by day, the banking sector is also offering various innovative services with core functions and trying to scale up its operations and reduce complexity. The overall objective of the study is to know the credit management system in Rupali Bank Limited as well as to see the current state of the overall credit position of RBL. The temporary work report holds the part of the respondent's examination, where I have an investigation of an internal and external factor to obtain some data, in order to communicate the true situation of the bank.

I have an assumption that, the result of my interim work report can be used for the development of the lending framework in the bank's board. However, the underlying motivation behind the report is simply to communicate or evaluate the board's credit framework as opposed to predicting anything, if the bank administration accepts the results of my exploration reports, they can use my findings and suggestions to improve their actions based on the temporary position report. There are several state-owned commercial banks in Bangladesh; among them Rupali Bank Limited is one of the largest commercial banks.

Rupali Bank limited has served millions of people in urban and rural areas across the country with its wider branch network. It is emerging as one of the bank in the country with the spirit to provide services to millions of people. The bank tries to minimize any kind of negative impact on the environment that may be associated with the bank's operations or services and tries to seek the new way to preserve the natural resources.

The main objective of the bank is not only to maximize profitability, but also to try to ensure a sustainable business for the customers, the shareholders and above all for the society in which the bank operates as its activity. Not only the bank's goals, but also vision, mission, strategy and core values articulate the bank's passion for building bridges between people and companies in a sustainable way. Genesis Rupali Bank Limited has been incorporated on 14th December 1986 under the Companies Act 1913 having taken over and acquired as a going concern the business and business of Rupali Bank with all its assets, liabilities, benefits, rights, powers, authorities, privileges, loans and liabilities.

To meet the human asset with the dominant features, administration packages and mechanical framework, he tries to work creatively constantly. The vision of Rupali Bank Limited is to grow its loyal customer base by being known as a monetary associate of decision who consistently exceeds customer expectations.

Threat of new entrants

Bargaining power of buyer/customers

Threat of substitutes

Bargaining power of suppliers/depositors

Competitive rivalry

SWOT Analysis of Rupali Bank Ltd

Strengths

Weaknesses

Opportunities

Threats

- Definition of credit

- Definition of Credit Management

- Objective of credit management process

- Credit policy of Rupali Bank Limited

- Evaluation of credit appraisal of Rupali Bank Limited

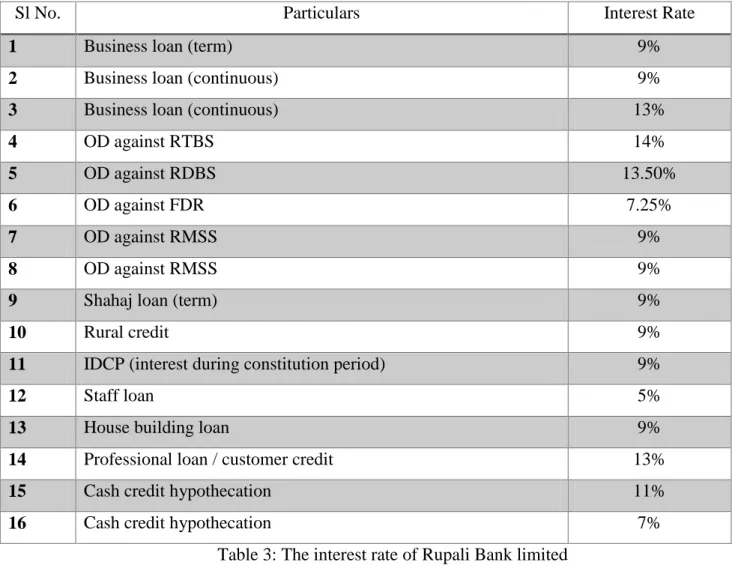

- The interest rate of Rupali Bank limited

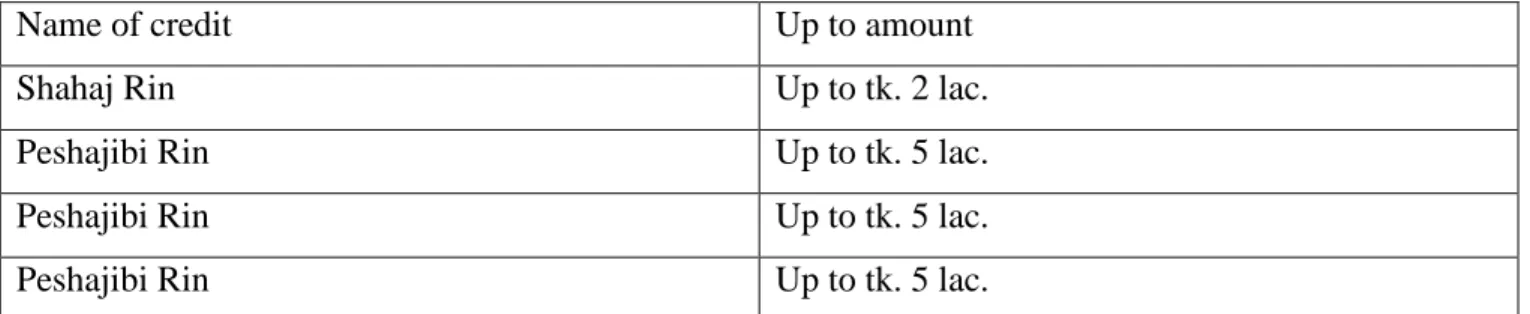

- Different types of credit facility of Rupali Bank limited

- The Credit of Small and Medium Enterprises

- Problem Statement

- Background of the problem

- Project Timeline

Credit means the ability of a bank to make an advance to an individual or group that requires cash and the recipient of the advance guarantees that he will repay the advance in the future with his advantage, commonly known as a "premium" and a partial guarantee. that they are qualified to benefit from the bank. Probably the weakest task of the bank is to collect a demonstrable advance from the customer. Thus, Rupali Bank has a limited credit strategy which follows the lending of cash as credit to its client or customer.

In any case, half of the advance will be suitable for giving credit to the small and medium mechanical area, as indicated in the bank's update and relationship articles. Place resources in that field that give the guarantee to return the recognition, just as you check the previous credit foundation, check the current economic situation of the borrower and the credit value of the borrower. Typically, a customer cannot take over the 10% freehold of the specific bank, but this is conceivable with the confirmation of top management.

The loan is more exercise, which is given by any monetary foundation which includes Rupali Bank limited. Rupali Bank limited is general considering credit as current and long term for business. From time to time, the bank gives a substantial allowance to the business or organization to carry out the day-to-day or ongoing exercises of the specific institution.

Here and there the bank maintains a balance of special resources known as pledge and credit approval. More often than not, banks give credit to the reason for the trade. The motivation behind the credit is to give the vital money the manufacturer needs to make the product commercially viable.

Corporate segment credit is the largest credit arm of Rupali Bank, which is underwritten by the bank's executives and overseen by the bank's mechanical credit department. These types of huge credit are extended as per the credit strategy of Rupali Bank and are limited. The bank consistently places the need for areas of urgent factor that support the public economy of the country.

Small and medium enterprises are recognized as the driving force behind financial development and the business age of economic industrialization in the area of created and agricultural nations of the world. Rupali bank restricted has tried the small and medium enterprises financing exercises by developing credit for the specific areas.

Total = 90days

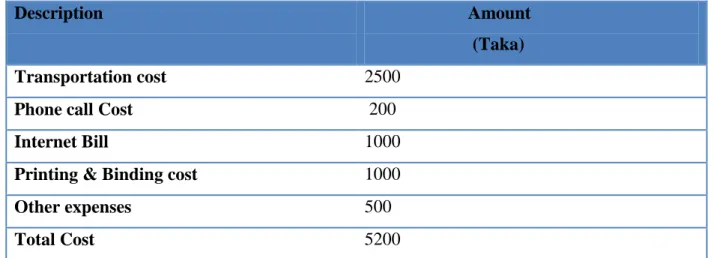

Budget Information

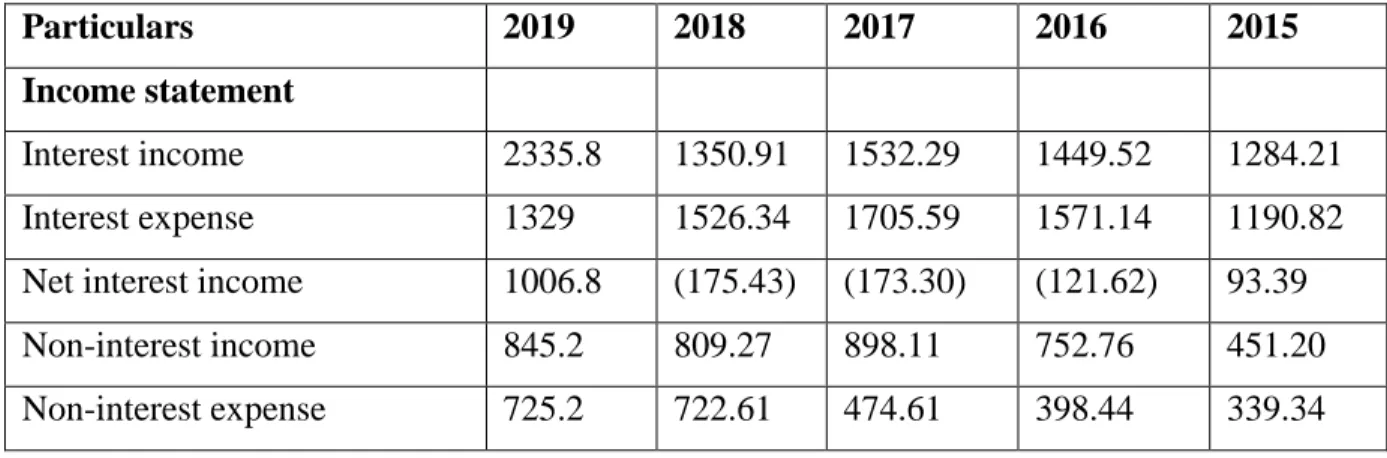

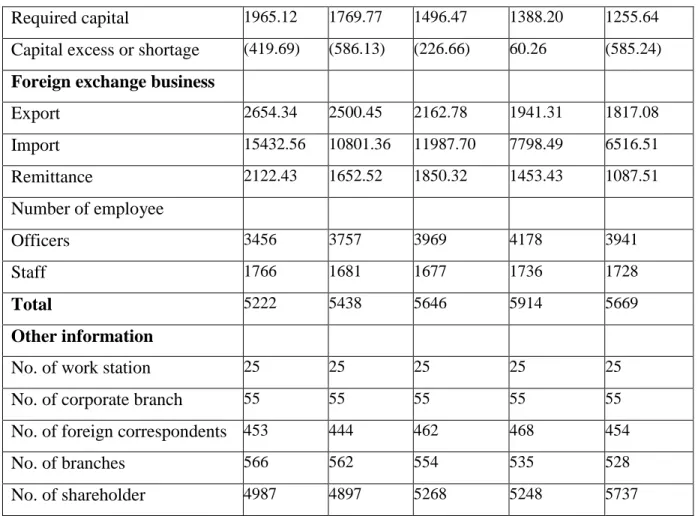

The overall performance of Rupali Bank limited, last 5 years

Year wise capital and reserve of Rupali Bank limited

Net profit of Rupali Bank limited

Net profit

Sector wise credit Distribution of Rupali Bank limited

Credit Distribution

- Findings

- Recommendations

- Conclusion

- References

A large organization, therefore the authority could not properly focus on the credit department. The bank often faces pressure from various political and social figures to consider granting credit to a recommended person. The employees of Rupali bank limited devote sufficient time and adequate attention to the customer during the credit sanction period.

Rupali Bank restricted is a kind of bank that has to do a lot of things for the betterment of our country. Despite the rivalry among the banks operating in Bangladesh, Rupali Bank has narrowed down a solid situation to the lookout and tried to leverage its center qualities with the aim that it can coordinate with the investors' assumptions and then leverage their abundance in the future through moral banking and best value for their customer. Rupali Bank Limited must show drive, with the aim of meeting the desires of the government.

The bank strives to improve more open administrations and develop working groups, which guarantee the provision of the best types of assistance to the bank's customers and related individuals. As the bank strives to achieve an acceptable rate of progress in all areas of the bank. The bank's credit division in particular is highly qualified and tends to provide the best customer support.

The bank consistently tries to contrast the presentation and another bank, through the cycle of looking at the bank the customer discovers acceptance and their administration quality, if there is any hole discovered the bank tries to find the appropriate way to solve the problem reduce and guarantee the better support of the customers. Web based banking is the interest of the present powerful world, to satisfy the interest which has limited the Rupali Bank is going towards the execution of web based banking. During the authorization of credit, the bank tries to guarantee the productivity of the bank and examines the remarkableness or creditworthiness of the customer.

Finally, say that Rupali Bank is effectively standing up for its qualities and commitment to provide the best customer support in this time of opposition.

Appendix Certificate