With honor and humble respect, I am submitting my thesis report on "Evaluation of foreign exchange activities of Agrani Bank Limited". For the partial fulfillment of the requirements for the BBA degree, I completed the internship at "Agrani Bank" [For the partial fulfillment of the requirements for the BBA degree, this thesis was completed] under your supervision. This report is an integral part of our academic courses at the end of the BBA program, which has given me the opportunity to have an insight into the Evaluation of Foreign Exchange Activities of Agrani Bank Limited.

I hope that this report reflects on the contemporary issues regarding the evaluation of foreign exchange activities of Agrani Bank Limited practiced by organizations in our country. Certified that this project report titled “Evaluation of Foreign Exchange Activities of Agrani Bank Limited” is the work of Mahmudul Hasan who conducted the research under my supervision. Chapter three consists of the profile of ABL, vision, mission, corporate slogan, objective, strategy, sponsor, objectives and products of Agrani Bank Limited.

Chapter seven deals with analysis and finding, which analyzes import, export and restriction of foreign exchange activities.

Chapter:1

Introduction

- Background of the study

- Objectives of the study

- Methodology of the Study

- Source of Primary Data

- Secondary Sources

- Scope of the Report

- Limitation of the study

With its 905 branches strategically located in the country, this Agrani Bank provides the customers and clients with the best quality of service. Country location strategizing is about providing the best quality services to clients and customers. The aim of the study is to acquire practical knowledge and experience about the banking activity performed by various officials in the foreign exchange department.

A questionnaire was prepared for the employees of Agrani Bank Limited and collected primary data through survey method. The purpose of the report was to find the financial aspect of the bank's operations. In addition, the report was made to find the effectiveness of the various services of the foreign exchange department.

The scope of this report is limited to the overall descriptions of the bank, its services and its position in the industry, and its competitive advantage.

Introduction

Empirical Studies Conducted Abroad

Batten, Mellor, and Wan (1993) conducted an industry-wide, cross-sectional study of foreign exchange risk management practices and product usage of large Australian-based companies. Research shows that 61 percent of Australian companies manage transaction exposure only, 8 percent manage transactions and translations, and 17 percent manage all three exposures (the remaining 14% did not respond). They found that Australian companies used both physical and synthetic products to offset the cash flows generated by the company's overseas operations and trade.

The synthetic products used by these sample firms included futures, options, swaps, and option products. The physical products included spot, forward, forward and short and long term physical swaps. The survey suggested extensive use of synthetic products by the corporate sector with 35 firms (49 per cent) using both physical and synthetic products, four firms (6 per cent) using only synthetic products and the remaining 33 (46 per cent) using exclusively physical products used.

Chapter: 3

Organization Overview

- Corporate Slogan of ABL

- Vision of ABL

- Mission of ABL

- Motto of ABL

- Values

- Strategic Objectives of ABL

- Product and Services of ABL

- Personal Banking

- Corporate Banking

- Agri & Rural Banking

- SME Banking

- Banking for Nonresident Bangladeshis (NRBs)

- Merchant Banking

- Islami Banking

- Other Product and Services

- Locker Services: For safekeeping of customers' valuables like important documents and goods like jewelries and gold ornaments, Agrani Locker Service is available in most of the

- SMS Banking: Agrani Bank ltd has officially launched SMS banking from December 17, 2007

- Hierarchy of Agrani Bank Limited

Agrani Bank Limited, a leading commercial bank with 960 branches, strategically located in almost all commercial areas in Bangladesh, overseas exchange houses and hundreds of overseas correspondents, was incorporated as a public limited company on May 17, 2007 for the purpose of acquiring its business, assets , liabilities, rights and obligations of Agrani Bank, which came into existence in 1972 as a nationalized commercial bank, immediately after the emergence of Bangladesh as an independent state. Agrani Bank Limited began functioning as a going concern basis through a supplier agreement signed on November 15, 2007 between the Ministry of Finance, the Government of the People's Republic of Bangladesh on behalf of the erstwhile Agrani Bank and the Board of Directors of Agrani Bank Limited, with retroactive effect from July 1, 2007. Agrani Bank Limited is governed by a Board of Directors consisting of 13 (thirteen) members headed by a Chairman.

The Bank has 11 Circle Offices, 29 Head Office Departments, 62 Zonal Branches and 902 Branches including 27 Corporate, 40 AD Branches. To become a leading bank in Bangladesh operating at international levels of efficiency, quality and customer service. Adopt and adapt modern approaches to remain supreme in the banking arena of Bangladesh with a global presence.

Contributing to the economic well-being of the country with a particular focus on SMEs and the agricultural sector. Agrani Bank introduces a debit card for customers who share a network with the other four recognized banks in the country. Agrani Bank offers deposit services such as current accounts and time deposits for its business customers.

So it can be said that ABL is working to promote economic growth in Bangladesh from the very grass root level which is 80% of the national economy. Small and medium enterprises in the country are one of the deserving sectors for financial support. The bank presents microcredits and other support to land less day labor to alleviate poverty by creating employment.

The merchant banking unit of Agrani Bank was converted into a subsidiary entity in 2014 and named as Agrani Equity & Investment Limited. For safe keeping of customer's valuables like important documents and goods like jewelery and gold ornaments, Agrani Locker Service is available in most of the goods like jewelery and gold ornaments, Agrani Locker Service is available in most of the branches in urban areas.

Chapter: 4

Internship position & duties

Duties performed in General Banking division

Duties performed in foreign Exchange division

Chapter: 5

- Foreign Trade

- International Trade Operation

- Foreign Currency Deposit Account

- Foreign Correspondents and Exchange Houses

- Import Business

- Import Procedure

- Applicant has to apply for opening L/C by a prescribed form

- Applicant has to submit the Letter of Intent or Letter of Proforma Invoice

- Applicant has to submit LCAF (Letter of Credit Authorization Form)

- Applicant has to submit insurance document

- Applicant has to prepare FORM-IMP

- Recently, there has been made a provision to give a certificate named TIN (Tax payers Identification Number). Taxation department issues this certificate

- Then after proper scrutiny bank will open an L/C

- Procedures of Opening L/C to Import

- He must have an account in ABL

- He must have Importers Registration Certificate (IRC)

- Report on past performance with another bank. ABL collects this report from Bangladesh Bank

- A proposal approved by the meeting of executive committee of the bank. It is necessary only when the L/C amount is small or there is no limit

- Export Business

- General Incentives

- Other Incentives

- Letter of Credit (L/C)

- Documents of L/C

- Forms of L/C .1 Revocable L/C

- Process of operating L/C in Agrani Bank Ltd

International trade finance is one of the major business activities carried out by the bank. The bank's foreign trade-related activities, conducted through 39 authorized dealer branches across the country, have earned the trust of importers and exporters. In order to encourage wage earners to transfer funds through banking channels and ensure smooth facilities for senders to send money from any corner of the world, the bank is constantly trying to make arrangements with reputed money exchange conduits across the globe.

Due to the effective expansion of a strong correspondence network and the bank's inclusion in the SWIFT membership, interbank transfers have increased, and as a result, the bank can quickly transfer funds to clients. The total number of correspondents and agents of the bank here and abroad was 687 as of 12/31/2013. If the sales contract is concluded between the buyer and the seller's agent, a letter of intent is required.

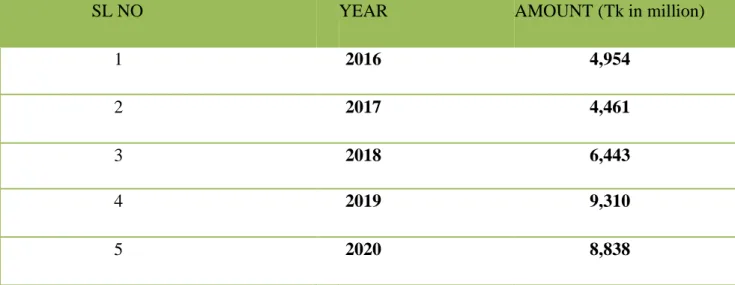

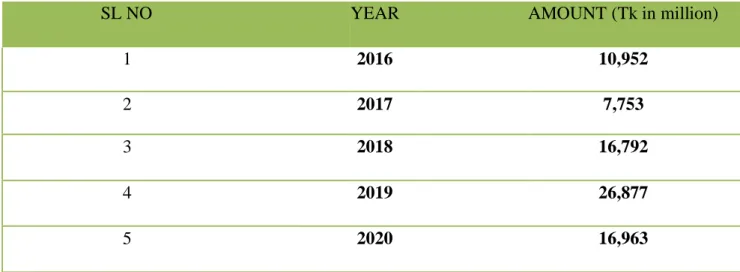

This certificate is required if the contract is concluded between buyers and sellers' representatives. During the opening of the letter of credit, the importer must keep a certain percentage of the value of the document in the bank as a margin. The export transactions carried out by the bank in 2017 amounted to Tk. 8838 crore as against Tk. 9310 crore of the previous year.

The conditions of L/C can be changed at any time without the consent of or notice of the beneficiary. Once this commitment is made, the bank cannot deny its responsibility without the consent of the beneficiary. A revolving credit is one where, under the terms and conditions, some of the amount of the credit is renewed or restored without specific modifications to the credit being necessary.

In this arrangement, the first beneficiary (an intermediary or the importer's foreign representative) can assign part or all of the L/C amount to another beneficiary (the supplier or manufacturer). To be transferable, the L/C must be marked by the issuing bank as instructed by the buyer or importer (the account party).

Chapter: 6

- Outward Remittance

- Inward Remittance

- BACH & BEFTN

- SWIFT

- Endorsement of Cash

- Types of foreign exchange business

- Import

The seller ensures that if the documents are presented on time and in the manner requested that if the documents are presented on time and in the manner requested in the L/C payment will be made and the buyer in In turn it is assured that the bank will review thoroughly these submitted documents and will ensure that they meet the terms and conditions 6.1 Delivery Section. Outward remittance includes sale of foreign currency by TT, MT, dragon, traveller's check and also payment against import into Bangladesh. Inward remittances include purchase of foreign exchange by TT, MT, drafts, purchase of export bills and traveller's cheque.

But due to lack of promotional activities, the branch failed to attract new customers for existing export and import business. As part of Bangladesh Bank's plan for automating the payment system of the country, Bangladesh Automated Clearing House (BACH) has been introduced in the bank. Bangladesh Electronic Fund Transfer Network (BEFTN) is active in the Bank in 70 clearing areas of the country has been successfully brought under BACPS.

For BACH operation, a sophisticated centralized software was customized and installed which facilitated the smooth functioning of the system throughout the country. Agrani Bank Limited Provides (Association for Worldwide Interbank Financial . Telecommunications) facility in its 35 branches to offer services related to foreign exchange/. But the only exception is that the passport holder is not required to be present himself.

Import items financed by the Bank included electronic equipment, sporting goods, rice, wheat, seeds, soybeans, palm oil, chemicals, accessories, etc.

Import

Export Business

Export goods that the bank handles include jute goods, ready-made garments, handicrafts, tea etc.

Export

Foreign Remittance

Since its inception, the bank has been active in remittance operations to facilitate the disbursement of remittances received from Bangladeshi wage earners working abroad. Internal remittances abroad played an important role in reducing the bank's dependence on the interbank market for the payment of import invoices in foreign currency. This bank has a drawing agreement with banks and exchange offices of various important countries of the world.

Findings

Chapter: 8

Recommendation &

Recommendations

The bank should expand their branches in a major commercial area in Bangladesh to increase their business.

Conclusions

Shekder & shekder ,Banking theory and practices, 8 th edition