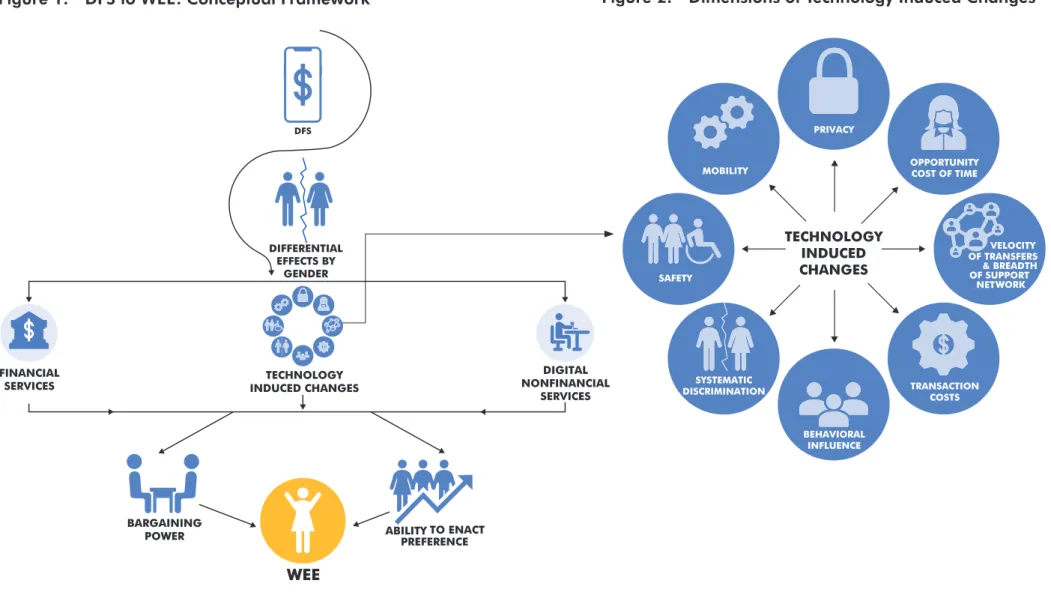

However, this article mainly focuses on the individual-level effects on women's economic empowerment. . features enabled by digitization of financial services on WEE; and c) the effects of DFS on women's access to non-financial services. When women's mobility is limited by security concerns or social norms, DFS can enhance a woman's ability to access financial services from home.

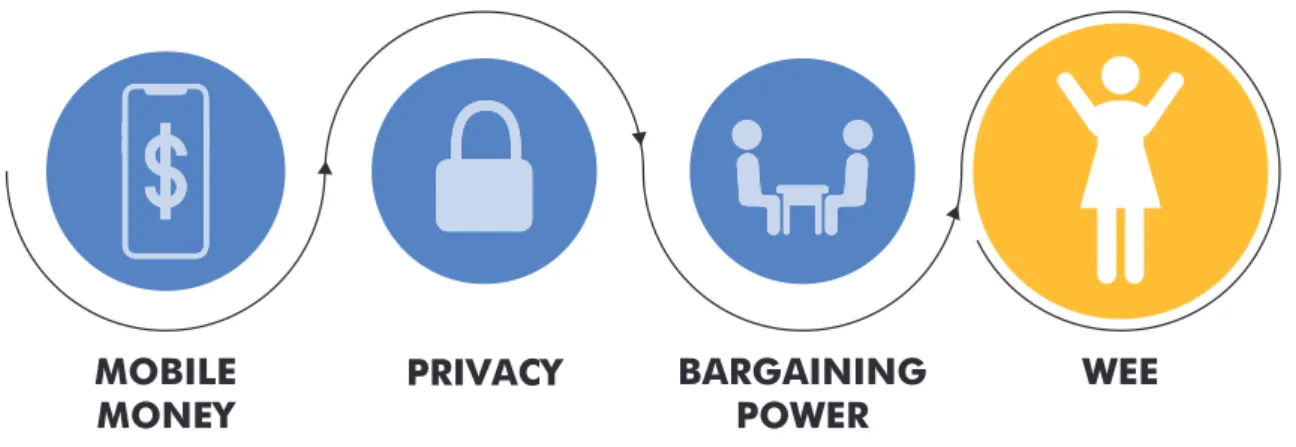

Privacy

Example of causal chain: privacy of information The research also shows that women with lower. bargaining power at the baseline were more likely to save at the bank after receiving the ATM card. To the extent that women who trust banks less also have less bargaining power within the household, the observed heterogeneity in impact may be entirely due to trust and not bargaining power. 2020) are aware of the assumptions embedded in their interpretation of the bargaining power mechanism and state this as. Yet digital services can strengthen women's weaker bargaining position, as shown by Schaner's (2017) experiment with ATM cards in Kenya.

What innovative methods and research designs can be used to differentiate bargaining power from determining one's preference. In a related study, Aker et al. 2016) ruled out hiding information from spouses as a possible effect channel to argue that the impact on WEE of mobile money reflected changes in bargaining power within the household. Considering the evidence on how privacy of financial information affects women's bargaining power and their ability to carry out their preferences, as well as the potential.

Opportunity Cost of Time

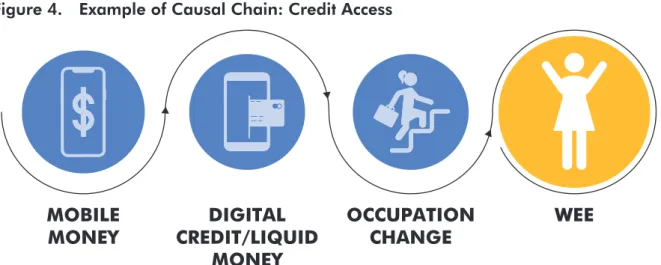

The study also did not find that the second arm of the treatment, where a cash loan disbursement was combined with opening a mobile money account, had any effect. 2016) argued that this time savings and the additional flexibility5 to pay out their transfer when it suits them may have allowed female cash transfer program beneficiaries to spend additional time on more productive farming, such as growing crops for sale, which are primarily cultivated by the women in the study. Harigaya (2016) estimated that mobile money transactions saved 30% of the time spent on remittances and 70% of the time spent on withdrawals in a rural bank trial in the Philippines.

As both studies primarily used female samples, gender differences in the benefits of time saved could not be analyzed.6 Further research should consider the following open questions about the impact of time savings on WEEE. Which type of DFS is more likely to benefit women in terms of time savings. How can research be designed to separately identify the impact of time savings from other sources of DFS impact on WEE.

Velocity of Transfers and Breadth of Support Network

In fact, the processing of moving deposits and repayments by a bank employee and withdrawals from the bank to a mobile phone for all three tasks reduced the amount of money kept in the bank. Vicente (2020) experimented with setting up mobile money agents and disseminating information about mobile money services to find that processing households were better able to smooth consumption mainly by receiving payments. Among a few studies that find negative effects of digital finance on social networks, Harigaya (2016) showed that a shift from cash transactions in a group context to mobile money transactions reduced the importance of group meetings, group cohesion and peer support. of the study sample were women.

If DFS removes the need for group meetings, but those meetings add to women's intrahousehold bargaining power, then DFS may reduce WEE. 2019) looked at the spillover effect of promoting savings through mobile money on informal risk-sharing networks, they found no negative spillover effect on untreated individuals, although participants were more likely to use their own savings to cope with crises. While the effects of DFS on support networks and informal risk sharing are relatively well documented, the gender dimension is not explored in as much detail. Does the informal support network enabled by DFS crowd out any other networks more important to WEE?

Transaction Costs

Does the enhanced ability to tap into informal support networks enabled by DFS benefit men and women equally?

Behavioral Influence

The paper also found evidence that the vault intervention was more effective for married women, suggesting its influence on intrahousehold bargaining power. 2019) used female M-Pesa account holders in Kenya to test the effects of a soft intervention – naming a second account for emergency expenses. They found that an emergency spending account influenced women to save more and rely more on their savings to cope with shocks. A similar experiment in Kenya by Habyarimana and Jack (2018) found that a “closed savings account” with mobile money acting as a commitment device increased savings for children's schooling.

DFS reduces mental costs and improves women's mental health or well-being in an identifiable way. Are there DFS-induced behavioral changes that contribute to women's bargaining power or enactment of preference. Are there behavioral biases particularly relevant to women in poor households that DFS can help overcome.

Systematic Discrimination

Safety

While mobile payments resulted in higher business capital and profits, there was no similar effect in the case of providing cash loans with mobile money accounts. If mobile money provides security, then women in the second treatment group could deposit their cash loan into the account after receiving it, which they did not. In the context of generally high levels of violence and security concerns in Afghanistan, Blumenstock et al. 2014) found that saving with mobile money was less desirable than saving money in the face of greater opportunities for violence.

The study found that in areas with greater violence, people withdraw mobile money to save cash, despite cost benefits of saving with mobile money. In an experiment of randomly matching sellers with customers for mobile money transactions in Ghana, Annan (2020) found that female sellers were 10 percentage points more likely to overcharge their customers than male sellers. How do security considerations differ between DFS platforms, such as mobile money and ATM cards.

Mobility

This is taken as evidence for safety rejection as a potential mechanism. 2016) also found that giving a cash transfer, along with providing a cash-enabled mobile phone, had no effects compared to a cash transfer without a phone. While a lack of physical mobility (due to social norms and time cost) is likely to be a more compelling constraint for women than for men, there is a lack of evidence for gender differences in the role of DHP in mitigating this constraint. . 2020) used distance to financial services agents to measure the impact of access to bKash mobile money services in Bangladesh. Although their study did not explore the specific mechanisms mediating occupational shifts, they suggested several possible channels: women's reduced need for multiple part-time occupations; efficiency gains in their labor distribution facilitated by mobile payments; reduced time pressure on childcare, as children were more likely to attend boarding school; and reduced fertility. 2019) studied the impacts of access to mobile financial services on migration and remittance flows (as well as poverty and consumption effects), finding that access to mobile money affects the number of household members who migrate for work.7 They also found that the DFS intervention had a greater effect on the working hours of female migrants, which can be considered an indicator of WEE.

That said, the effect size (Intention-to-treat of 0.12 person compared to baseline mean of 0.69) is quite substantial given a relatively simple intervention to train household members in the use of mobile money functions. rural-urban migration as a mechanism to absorb shocks. They claimed that the introduction of mobile money brought about a specific occupational shift: a shift from agricultural activities in rural areas to occupations performed by migrants outside the rural areas of origin. Does DFS encourage women to overcome social norms that limit physical mobility, for example by normalizing travel to and interaction with male mobile money agents?

Access to Digital Nonfinancial Services

CHALLENGES IN INVESTIGATING

For example, an analysis of the heterogeneity of effects by gender may show that access to a particular digital financial service is more effective for women with lower baseline bargaining power within the household. However, this result does not necessarily tell us anything about the effects of DFS on household bargaining power, as women with low household bargaining power may also have lower physical mobility, less access to mobile phones, a lower level of personal security , etc. In other words, the variable of interest in the analysis of heterogeneous effects (e.g., baseline level of women's bargaining power within the household) can be correlated with other variables (e.g., level of education), which influences the interpretation of the results limited.

For example, the finding of a DFS effect on household spending on children is sometimes interpreted as an increase in women's bargaining power. And it is not always clear that higher household spending on children is the result of women's bargaining power; it may be driven by effects on DFS income. Research should specifically improve the measurement of bargaining power as distinct from preferences, comparative advantage, and household-level effects of DFS, such as income effects.

CONCLUSION

Since it is not conceivable for a given research study to examine all possible outcomes of women's improved bargaining power, improving the direct measurement of observable manifestations (i.e., proxies) of the putative causal mechanisms should be a priority. Research should specifically improve the measurement of bargaining power, as opposed to preferences, comparative advantage, and household-level effects of DFS, such as income effects. studies found a positive effect on the use of services, showing that mobile literacy is a barrier to the use of the services. None of the studies looked at the influence of heterogeneity on service use by gender to learn whether mobile literacy impairment differs between men and women. 2019) reviewed a graduate program for the ultra-poor that supports businesses and savings groups in using digital finance products;.

On the other hand, Harigaya (2016) found no effect of mobile banking on customer transaction behavior based on their basic level of mobile literacy. Despite this contrast, mobile literacy is likely to be an important factor in accessing and using DFS in most developing countries. Positively, WEE could increase investment in human capital, given that women's marginal propensity to spend on children is greater than that of men (Duflo and Udry, 2004; Qian, 2008; Atkin, 2009), although this finding is not universal (Akresh et al., 2016).

The Effect of Savings Promotion on Informal Risk Sharing: Experimental Evidence from Vulnerable Women in Kenya. Female employment and intimate partner violence: Evidence from Syrian refugee inflows to Turkey [Working Paper]. Digitization of MFI loans and repayments: instead of cash transactions with group members. done individually over mobile money for small fees. only Save -ve Reduced group cohesion,. which reduced peer enforcement effects as well as increased sensitivity to transaction fees.

P2P transfers: training on how to sign up for and use mobile banking and facilitated account setup. migration) +ve Higher payments enabled by mobile money to rural areas increased countryside–. Mobile money (m-money) M-money is a mobile transaction service that can be transferred electronically via mobile networks. This means that microfinance institutions (MFIs) adapt their products and services so that they can be run on a digital platform, alone or with DFS partners. women groups.

The aim is to engage women's groups, including village savings and loan societies and revolving savings and credit societies, to conduct their group's financial transactions on digital platforms. transfers Money is transferred between individuals, including money transfers and payments.