Their cooperation, as well as their desire to share information, has been critical in conducting a thorough evaluation. I would like to acknowledge the authors of the study paper titled "Financial Performance Analysis of Selected Banks in Bangladesh: An Examination of Both Islamic and Conventional Banks". I confirm that the details in this thesis are accurate and complete to the best of my knowledge.

Introduction

Scope of the Report

Limitations

Aim

The aim of this project is to examine the financial statements of the five Islamic and five non-Islamic banks in Bangladesh over the past three years. The aim of the project is to assess the performance of these banks using ratio analysis to learn more about their general condition and financial situation.

Objectives

Literature Review

- Financial Statement

- Comparative Analysis

- Steps to an Effective Financial Statement Analysis

- Tools and Techniques of Financial Statement Analysis

Comparison of current financial data with financial data from previous years within the same company is part of the internal analysis of annual accounts. The financial status of the organization is compared to find trends and changes over time. Another necessity for conducting a thorough review of a company's financial statements is to understand the economic dynamics of the business sector in which it operates.

Analysts can gain a better understanding of the firm's competitive advantage as well as its prospects by examining the strategic decisions made by the company. Identifying the industry's economic characteristics: An accurate analysis of financial statements requires knowledge of the economic dynamics of the company's industry. To do this, it is necessary to conduct a value chain analysis of the company's product or service development and distribution processes (Quesada, 2019).

Identifying Company Strategies: A thorough understanding of the company's business plans is necessary for a thorough evaluation of the financial statements. Assessing the quality of the firm's financial statements: A reliable analysis of the financial statements cannot be guaranteed without first determining the reliability of the company's financial statements. Preparation of projected financial statements: To get a forward-looking view of the company's financial performance, it is necessary for financial professionals to also generate projected financial statements.

This method enables a thorough evaluation of the composition and relative importance of different accounting components (Dewi & Hoesada, 2020).

Methodology

- Data Type

- Research Type

- Sampling

- Data Analysis Tools

- Data Presentation

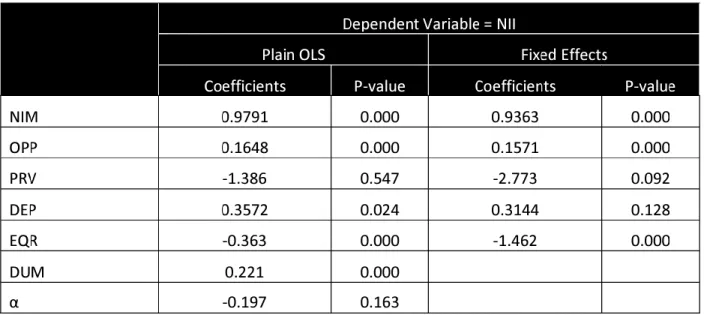

Ordinary ordinary least squares (OLS) and fixed effects models were the primary focus of the investigation as they were used to evaluate the findings that were derived from the panel data estimation. Using these different graphical representations allows readers to evaluate the findings more effectively.

Selected Islamic and Non-Islamic Banks in Bangladesh

Selected Islamic Banks

Banking solutions and customer service at Al-Arafah Islami Bank are heavily influenced by technological advances. It has a significant number of locations and consistently works to respect Islamic banking principles in everything it does. Shahjalal Islami Bank Limited: In 2001, Shahjalal Islami Bank Limited was established and has since grown to become one of the most successful Islamic banks in Bangladesh.

Shahjalal Islami Bank places a strong emphasis on the satisfaction of its customers and has adopted advanced banking technologies to improve the caliber of its services. The bank's growing importance in the Islamic banking market can be attributed, in part, to the extensive branch network and dedicated workforce it maintains. EXIM Bank Limited: EXIM Bank Limited is a fully functional commercial bank in Bangladesh offering traditional and Islamic banking services.

Established in 1999, the bank strives to meet the many financial demands of its customers by combining the best practices of conventional and Islamic banking. Social Islami Bank Limited: Social Islami Bank Limited is a prominent Islamic financial institution in Bangladesh which was established in 1995. The bank adheres to the guidelines of Islamic Shariah in its day-to-day operations and provides its customers with a wide range of Islamic banking products and services to fulfill their various financial needs. (Miah & Sharmeen, 2015).

By providing environmentally responsible financial services, Social Islami Bank hopes to contribute to the expansion of both the social and economic spheres.

Selected Non-Islamic Banks

The bank adheres to Islamic Shariah in its operations and offers a wide variety of financial products that are Shariah compliant to its customers, corporate customers and small and medium businesses (SMEs) (Uddin et al., 2017). To maintain its position in the financial sector, the bank places great emphasis on professionalism, innovation and customer-focused services. Sonali Bank Limited, Agrani Bank Limited, Janata Bank Limited, Dutch-Bangla Bank Limited and BRAC Bank Limited are all examples of prominent non-Islamic financial institutions in Bangladesh.

Agrani Bank Limited: Agrani Bank Limited is yet another commercial bank in Bangladesh that is owned and operated by the state. Dutch-Bangla Bank Limited: Among the commercial banks of Bangladesh, Dutch-Bangla Bank Limited stands head and shoulders above the competition. The bank has everything a customer needs in terms of banking services, for both private and business customers (Hossain et al., 2017).

Janata Bank Limited: Janata Bank Limited, a state-owned commercial bank in Bangladesh, was established in 1971. The bank has a significant presence in both urban and rural areas, contributing to the expansion of the country's economy (Abdullah & Rahman, 2017). Sonali Bank Limited: Sonali Bank Limited is one of the main state-owned commercial banks in Bangladesh.

BRAC Bank Limited: In Bangladesh, BRAC Bank Limited is a financial institution that serves the commercial banking needs of customers and was established in 2001.

Analysis, Findings and Discussion

Analysis

NIM: The acronym "NIM," which stands for "net interest margin," refers to the total amount of a bank's net interest income divided by the bank's total interest income. The ability of a bank to make a profit from interest earned on loans and deposits is measured by a measure known as the Net Interest Margin (NIM). To find out how much of the bank's total interest income comes from net interest income, look at the proportion of total interest income that comes from net interest income.

PRV: To determine the Provision Ratio Value (PRV), divide the total provisions by the total loans. This demonstrates the bank's careful handling of credit risks and its commitment to preserve the quality of its holdings (Uddin et al., 2017). A higher EQR indicates that the bank has a stronger financial position because it implies that a greater proportion of the bank's loans are supported by the bank's capital.

DUM: The value of the Dummy variable, denoted by DUM, is 1 for Islamic banks and 0 for non-Islamic institutions. This null hypothesis implies that none of the independent variables affect the dependent variable in a way that is statistically significant. In other words, all the coefficients () of the independent variables are equal to zero, which indicates that there is no relationship between the independent variables and NII (Rafiq, 2016).

The null hypothesis can be rejected if any of these betas are statistically significant and not zero.

Findings and Discussion

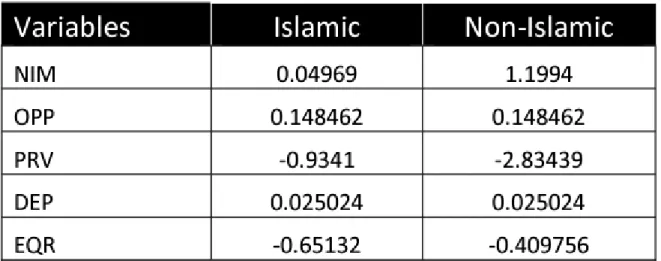

This indicates that Islamic banks generate on average 22% more net interest income than non-Islamic banks. The results of this analysis help shed light on the specific characteristics that lead to the improved performance of Islamic banks with respect to the variables selected. The Dummy variable was then constructed over three carefully chosen independent variables to compare the performance of Islamic and non-Islamic banks.

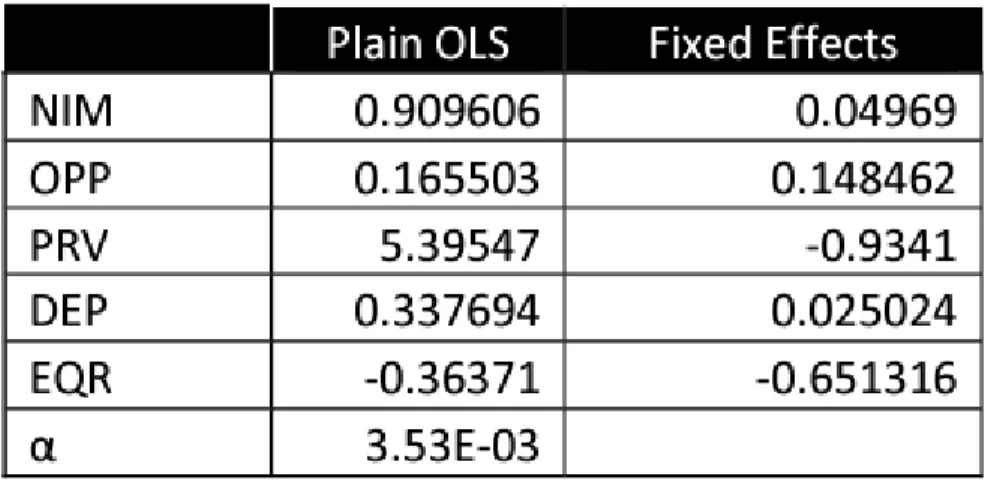

As a result, the net NIM ratio for Islamic banks can be calculated as 0.909606 minus 0.06184. This difference can be partly attributed to the fact that Islamic banks and non-Islamic banks use different definitions of the terms "interest income" and. This would imply that income from non-interest sources plays a significant role in the overall operating income of Islamic banks.

DPRV: Similar to this, Islamic banks may define terms differently than non-Islamic banks do. Islamic banks can use more liquid assets for investment thanks to the terms' flexibility, which increases NII. However, the effect of equity on compound returns for Islamic banks is somewhat different from that of non-Islamic banks.

Islamic banks can generate relatively larger NII than non-Islamic banks because they have larger amounts of liquid capital available for investment.

Further Discussions

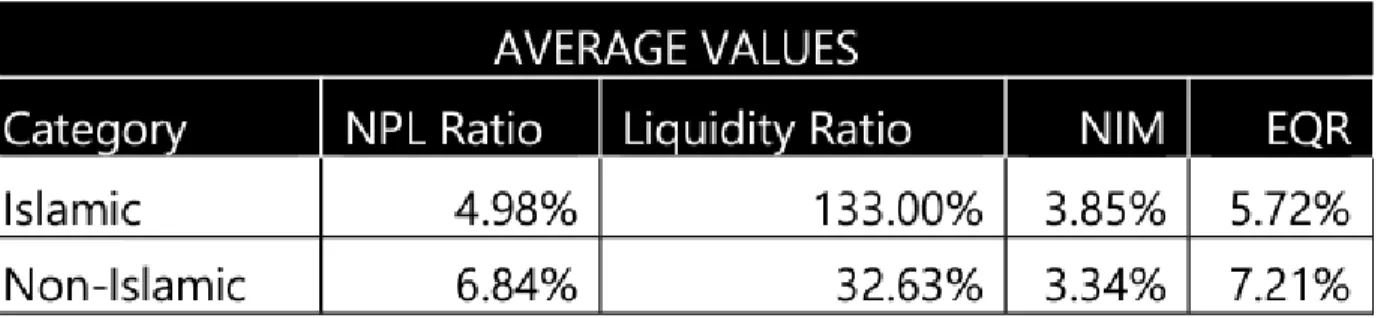

It also implies that Islamic banks have a stable financial base to support their activities and are good at managing risk (Saleh et al., 2017). The average values of these financial variables show that Islamic banks will be more successful and stable in 2020 than their non-Islamic counterparts. The superior financial performance and competitive advantage of Islamic banks can be attributed to their lower NPL ratios, higher liquidity ratios, higher NIM , and lower EKR.

Conclusions and Recommendation

Conclusion

Recommendations

The reduced statutory liquidity ratio (SLR) mandated by Bangladesh Bank is one of the key factors that have contributed to the success of Islamic banks. In contrast, non-Islamic banks are required to have an SLR of 20%, while Islamic banks are only required to have an SLR of 10%. Because of this flexibility, Islamic banks can allocate a greater portion of their liquid assets to investment activities, increasing their net interest income (NII).

Capital Adequacy Ratio (CAR) was subject to the same kind of flexibility, Islamic banks would have a lower proportion of their funds tied up to serve as loss-absorbing stocks. On the other hand, non-Islamic banks had to concentrate on reducing their ratio of non-performing loans (NPL), which was about 2% higher than that of Islamic banks. Because they have larger loan portfolios, non-Islamic banks are more susceptible to risky and adverse loans than Islamic banks.

Therefore, Islamic banks as well as non-Islamic banks should embrace the technological improvements that have taken place and launch their MFS subsidiaries or other online banking services to increase their business turnover. Exploring green banking performance of Islamic banks versus conventional banks in Bangladesh based on Sharia Maqasid framework. Comparative performance analysis between conventional and Islamic banks in Bangladesh - an application of binary logistic regression.

Supporting the benefits of green banking: A comparative study between Islamic and conventional banks in Bangladesh.