The capital structure decision will determine the weight of debt and equity and ultimately the overall cost of capital and value of the company. Capital structure is therefore important in maximizing the value of the company and minimizing the total cost of capital. The following approaches explain the relationship between cost of capital, capital structure and firm value:

According to this approach, capital structure decisions are relevant to the value of the firm. Optimal capital structure occurs at the point where value of the firm is the highest and the cost of capital is the lowest.

Modigliani-Miller Approach (MM)

A company with debt in its capital structure has a higher cost of equity than a company without debt. The structure of the capital (financial leverage) has no influence on the total cost of capital. MM has developed formulas for calculating the cost of capital (Ko) and the cost of equity (Ke) for the leveraged company. i) Value of a non-leveraged company = Value of a non-leveraged company + tax benefit.

Valuation of firms

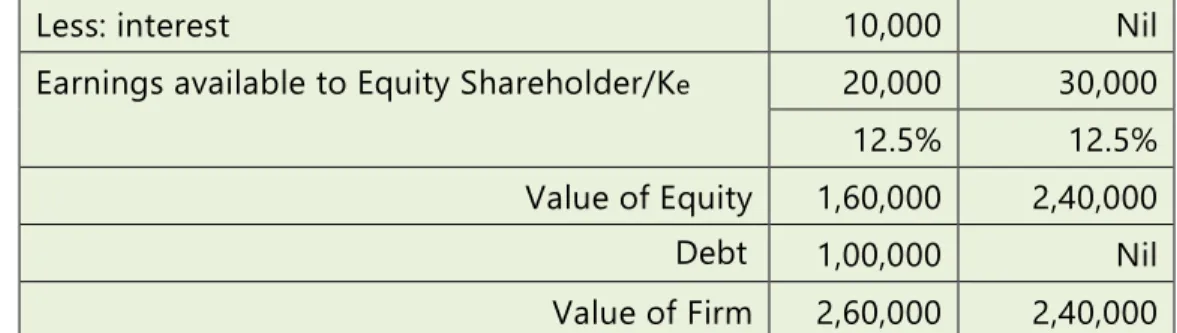

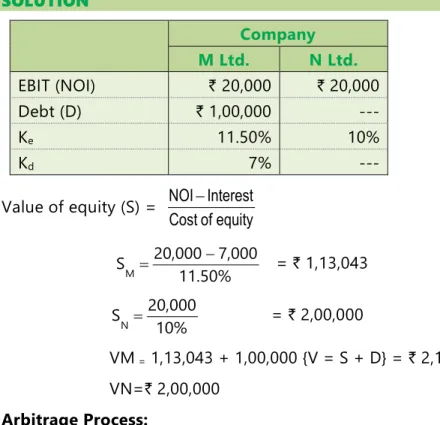

In the example above, you did not invest the full amount you received from the "leveraged sale of the company's stock, plus the amount borrowed". CALCULATE the increase in an investor's annual earnings if he switches his holdings from a leveraged to an unleveraged company. Company Value The value of a leveraged company is greater than the value of an unlevered company, so an investor will sell their shares in a leveraged company and buy shares in an unlevered company.

To maintain the level of risk, he will borrow a proportionate amount and invest that amount also in shares of an unrelated company.

Investment & Borrowings

Change in Return

- The Trade-off Theory

- Pecking order theory

- FACTORS DETERMINING CAPITAL STRUCTURE

- Choice of source of funds

- Factors affecting capital structure

- OPTIMAL CAPITAL STRUCTURE

- EBIT-EPS-MPS ANALYSIS

- Relationship between EBIT - EPS-MPS

- Financial Break-even and Indifference Analysis

Trade-off theory of capital structure basically involves offsetting the costs of debt against the benefits of debt. Trade-off theory of capital structure mainly deals with the two concepts - cost of financial distress and agency cost. An important purpose of the trade-off theory of capital structure is to explain the fact that corporations are usually financed partly with debt and partly with equity.

Later work led to the optimal capital structure given by trade-off theory. Using long-term debt increases earnings per share if the company generates a return higher than the cost of debt. Typically, the higher the rate of sales growth, the greater the use of debt to finance the business.

If the return on assets exceeds the cost of financing, the increasing use of fixed-cost financing (i.e. debt and preferred equity) will result in an increase in earnings per share. On the other hand, if the return on assets is lower than the cost of financing, the effect may be negative and therefore the increasing use of debt and preferred equity capital may reduce the company's earnings per share. Theoretically, the choice is in favor of debt financing for two reasons: (i) the explicit cost of debt financing, i.e. the interest rate to be paid on debt instruments or loans, is generally lower than the rate of fixed dividend to be paid on preference shares getting paid; and (ii) the interest on debt financing is tax deductible and therefore the actual cost (after tax) is lower than the cost of preference share capital.

Thus, the analysis of different types of capital structure and the effect of leverage on expected EPS and eventually MPS will provide a useful guide for choosing a particular level of debt financing. Assume that a firm has an all-equity structure consisting of 100,000 ordinary shares of `10 per share. The firm is able to maximize earnings per share when it uses debt financing.

I 14% additional

OVER-CAPITALISATION AND UNDER - CAPITALISATION

- Over- Capitalisation

- Under Capitalisation

- Over-Capitalisation vis-à-vis Under-Capitalisation

The main sign of overcapitalization is the decrease in dividend and interest payments, which leads to a decrease in the value of the company's shares. Consequences of overcapitalization: Overcapitalization results in the following consequences:. i) Significant reduction in the rate of dividend and interest payments. ii) Lowering the stock market price. iii) Use of "window dressing". iv) Some companies may opt for reorganization. Remedies for overcapitalization: The following steps can be adopted to avoid the negative consequences of overcapitalization: i) The company should go for complete reorganization. iii) Reduction of claims of debt holders and creditors. iv) The value of shares may also decrease.

Consequences of undercapitalization: Undercapitalization causes the following consequences:. i) The dividend rate will be higher compared to companies in a similar position. ii) The market value of the shares will be higher than that of other similar companies because their profit margin is much higher than the prevailing rate for such securities. iii) The real value of the shares will be higher than their book value. Remedies: In order to avoid the negative consequences of undercapitalization, the following steps can be taken: i) Shares of the company should be distributed. By changing the nominal value of the shares upwards in exchange for the existing shares they own.

From the above discussion it can be said that both over capitalization and under capitalization are not good. However, overcapitalization is more dangerous to the company, shareholders and society than undercapitalization. The under capitalization situation can be handled more easily than the over capitalization situation.

Thus, under capitalization should be considered less risky, but both situations are bad and every company should try to have a proper capitalization.

SUMMARY

This will reduce the dividend per share, although EPS will remain unchanged. ii) Issuance of Bonus Shares is the most suitable measure as this will reduce the dividend per share and the average rate of profit. iii). Optimal Capital Structure (EBIT-EPS Analysis): The fundamental objective of financial management is to design an appropriate capital structure which can provide the highest earnings per share (EPS) over the expected range of the firm's earnings before interest and taxes. (EBIT). The level of EBIT varies from year to year and represents the success of a firm's operations.

The purpose of this analysis is to find the EBIT level that corresponds to EPS regardless of the chosen financing plan. Overcapitalization: It is a situation where a company has more capital than it needs, or in other words, assets are worth less than its issued share capital and earnings are insufficient to pay dividends and interest. It is a state when its actual capitalization is lower than its correct capitalization as justified by its earning power.

TEST YOUR KNOWLEDGE

The EBIT-EPS indifference analysis diagram is used to (a) evaluate the effects of business risk on earnings per share. This is a very common mistake. a) It is the debt-to-equity ratio that results in the lowest possible weighted average cost of capital. DISCUSS the concept of debt-equity indifference point, or EBIT-EPS, while determining a company's capital structure.

Alternative-I : 100% equity financing by issuing equity shares of ` 10 each Alternative-II : Debt to equity ratio of 2:1 (Issuance of equity shares of ` 10 each) Debt interest rate is 18% on year. For each plan you have to DETERMINE:- (i) Earnings per share (EPS). ii) Financial Breakeven Point. iii) Indicate whether any of the plans is dominant and calculate the EBIT spread between the plans for indifference. It wants to finance an expansion program and is considering three alternatives: additional debt with 12% interest, preferred shares with an 11% dividend, and the issuance of equity shares at 16 euros per share.

If earnings before interest and taxes are current, DETERMINE the earnings per share for the three alternatives, assuming no immediate increase in profitability. One-third of the total market value of Sanghmani Limited consists of loan stock, which has a cost of 10 percent. Another company, Samsui Limited, is identical in every respect to Sanghmani Limited, except that its capital structure is all equity and its cost of capital is 16 percent.

According to Modigliani and Miller, if we ignored taxation and tax relief on debt capital, CALCULATE the cost of equity in Sanghmani Limited.

ANSWERS/SOLUTIONS

- Calculation of Indifference point between the two alternatives of financing

- Indifference point where EBIT of Plan A and Plan B is equal

- Indifference point where EBIT of Plan A and Plan C is equal

- Indifference point where EBIT of Plan B and Plan C are equal

- EBIT – 4,000 = EBIT – 8,000 There is no indifference point between the financial plans B and C

IDENTIFY the indifference point between the two financing options available and indicate which option will be beneficial in different situations. EBIT = Earnings before interest and taxes I1 = Interest expense in Alternative-I I2 = Interest expense in Alternative-II T = Tax rate. Therefore, with EBIT, the earnings per share are the same for both options. i) Calculation of earnings per share (EPS). ii) Calculation of the financial break-even point.

The financial break-even point is the profit equal to the fixed financial costs and the preferred dividend. Plan A: There is no payment of interest or preferred dividends under this plan, so the financial breakeven point will be zero. Under this plan, the interest payment is 8,000 and there are no preferred dividends, so the breakeven point will be 8,000 (interest expense).

Under this plan, there is no interest payment, but an after-tax dividend of `8,000 is paid. iii) Calculation of the indifference point between plans. The indifference between the two alternative financing methods is calculated by applying the following formula. It can be seen that Financial Plan B dominates Plan C. The forward EPS of plant B is higher.

One would want to be comfortably above this point of indifference before having to make a strong case for debt.

Interest Payable on Debentures

The less likely that actual EBIT will fall below the indifference point, the stronger the case for debt; all other things remain the same.