This paper is submitted in partial fulfillment of the degree of BBA, Department of Business Administration, Sonargaon University (SU). In partial fulfillment of the requirements for the BBA degree, this internship has been conducted under your supervision. This report is an integral part of our academic courses in the completion of the BBA program, which has allowed me to gain an insight into the core of the subject.

In completing the report, I tried to blend all my knowledge and gave every available detail and also tried to avoid unnecessary reinforcement of the report. In conclusion, I am grateful to all the respected teachers of Bachelor of Business Administration for the inspiration, continuous help during these years. Finance is one of the main centers of any organization and an essential ingredient for a successful business, it is responsible for obtaining funds for the firm, managing funds within the organization and planning for spending funds on various assets.

Background

Objective

Methodology

Limitation

The Importance of Financial Inclusion

Definition of Financial Inclusion

Measures and Indicators of Financial Inclusion

What ultimately matters is the availability of banking services to finance the mass population. Demographic Penetration: It measures the average number of people served by each bank branch or ATM. Higher numbers mean that there are fewer customers per branch or ATM and also indicates easier access to banking services.

Once the financial services are made available to the customers to ensure easy access, it is important to measure the actual usage of the services by the general public to benefit from financial inclusion. Ease of transaction: Places to open deposit account, places to submit loan account, disclosure requirements and dispute resolution. Outreach dimension: electronic/mobile money transactions; dimension of gender; dimension of access for less privileged people.

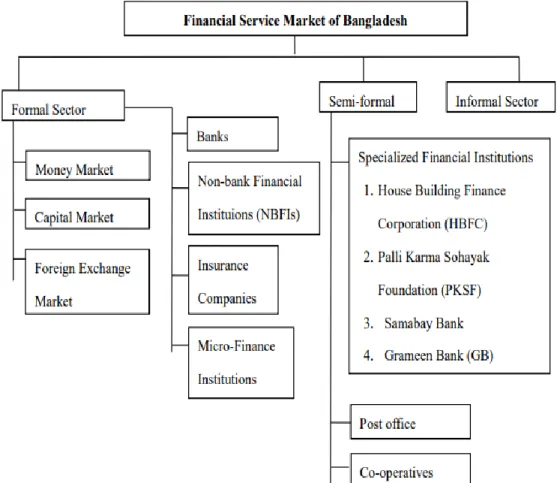

Characteristics of the Financial Services Market in Bangladesh

- The Banking Sector

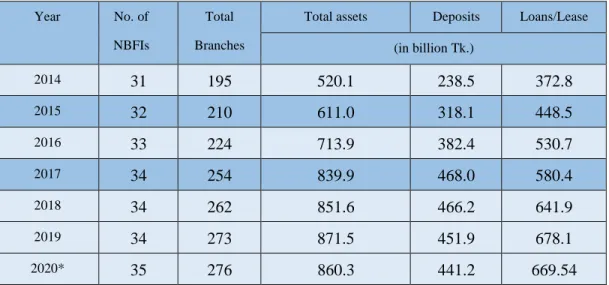

- Non-bank Financial Institutions

- Insurance Companies

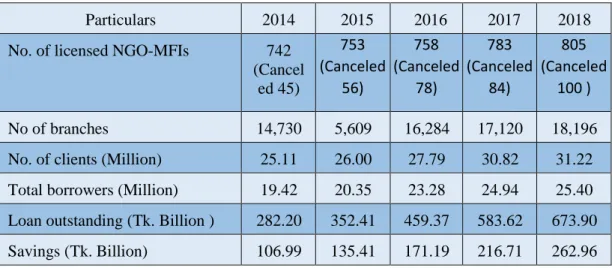

- Microfinance Institutions

- Co-operative Societies

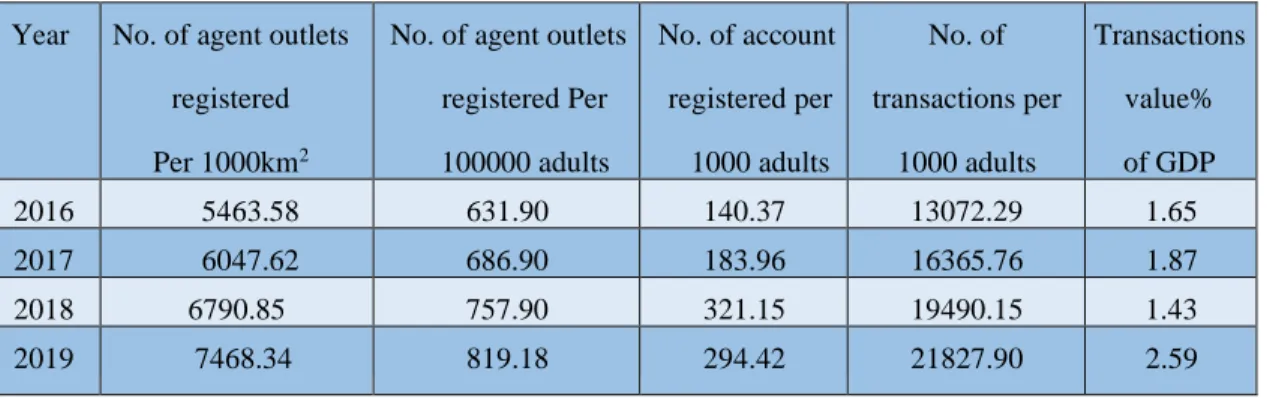

- Mobile Financial Services

- Postal Service

Compared to the banking sector, non-banking financial institutions are small and relatively underdeveloped. Of the total, 2 are wholly owned by the government, 1 is the subsidiary of a SOCB, 15 are initiated by private domestic initiative, and 15 are initiated by joint venture initiative. Despite the large number of insurers and the rapid growth of the industry, there are few insurance services for low-income consumers.

These institutions have reached such segments of the population and sectors of the economy that have little or no access to commercial banks and other financial service providers. According to the latest report, there are 190,360 cooperatives in Bangladesh, among which 22 are at the national level, while 1,160 and 189,181 are in the form of central and primary level cooperatives. Therefore, it can be argued that most of Bangladesh's approximately 160 million population is somehow covered under the umbrella of these cooperative societies.

Bangladesh's health financing strategy proposed to extend health care to the entire population, along with financing mechanisms. The Government of Bangladesh is committed to spread the cooperative movement throughout the country to ensure socio-economic and cultural emancipation of the people. In addition, the Ministry of Cooperatives is preparing a comprehensive marketing plan that will facilitate the production, storage, processing, transportation and marketing of cooperative members' products. In a recent move, in line with the government's decision, Bangladesh Bank has directed all MFS companies to open accounts for garment workers, recipients of government subsidies, grants, scholarships, etc.

Post Office offers savings services on behalf of the Directorate of National Savings (DNS) under the Ministry of Finance through its Post Office Savings Bank. The Post Office also launched a prepaid ATM card known as "The Postal Cash Card" in 2010, as well as a mobile banking service, "Post e-Pay", in 2012. The Post Office Department of the government has been more active recently engage with banks and other external and internal remittance intermediaries to provide faster remittance deliveries to recipients.

Regardless of how the private sector transmission and mail/parcel delivery services improve, the role of the publicly owned postal services is likely to remain necessary to meet the needs of the remote, sparsely populated areas that the private sector would consider expensive. and unprofitable to reach out to.

Access to Financial Services in Bangladesh

- Access to Micro Finance Institutions

- Access to Insurance

- Access to Post Office Services

- Access to Mobile Financial Services

- Access to Co-operatives

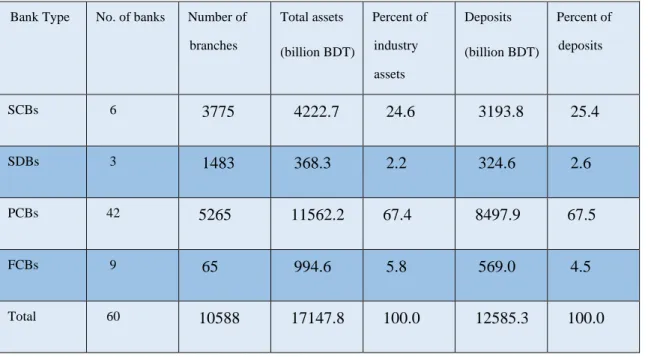

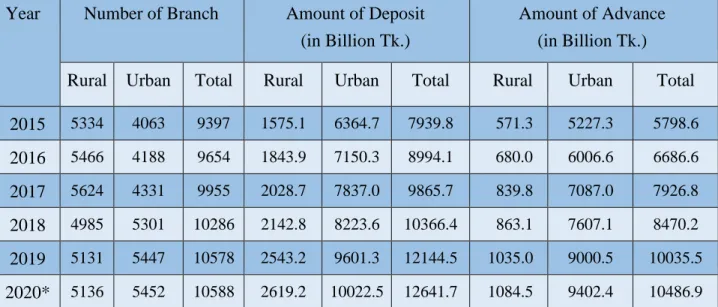

Access to formal banking services consists of savings, credit, digital payment services and mobile banking. From the following table (Table 5) we can observe that although the number of bank branches has increased significantly over the years, the ratio of rural branches to urban branches has decreased over the years. The existing rural-urban distribution of bank branches indicates that banks are largely concentrated in the urban areas.

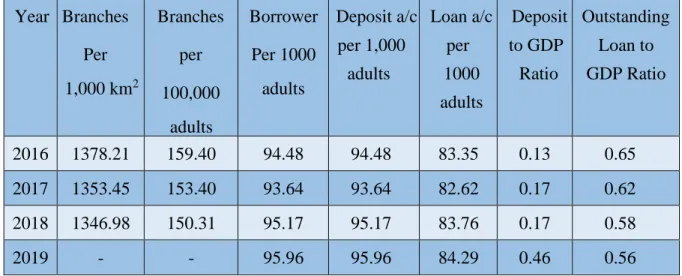

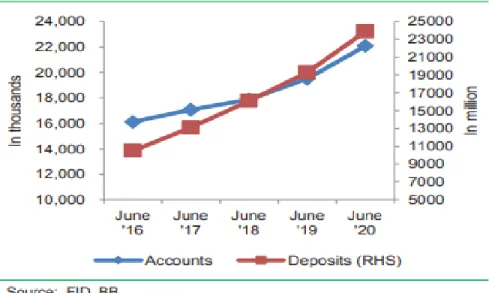

Over the past two decades, bank advances and deposits have increased in both urban and rural areas. As can be seen from the table above (Table-6), the geographic and demographic penetration trends show that access to banking services is increasing rapidly. The number of borrowers, the number of deposit accounts and the number of loan accounts have increased significantly over the years.

Microfinance loans are well targeted in the sense that their ultimate objective is the gradual alleviation of poverty by society. Insurance penetration and density were calculated from (audited) data provided by Bangladeshi insurers As mentioned earlier, despite the large number of insurance providers and the rapid growth of the industry, there are few insurance services for consumers with low income. During the period 2011-2012, the balance of deposits in the Postal Savings Bank amounted to Tk 12.19 billion and the balance of postal life insurance savings was 861.3 million ALL.

Postcard users have access to all member banks' ATMs and merchant networks throughout the country. It enables people to transfer money to any corner of the country within minutes via a PO Box card. It has been able to convey the financial services to the remote areas where people had previously faced great difficulties.

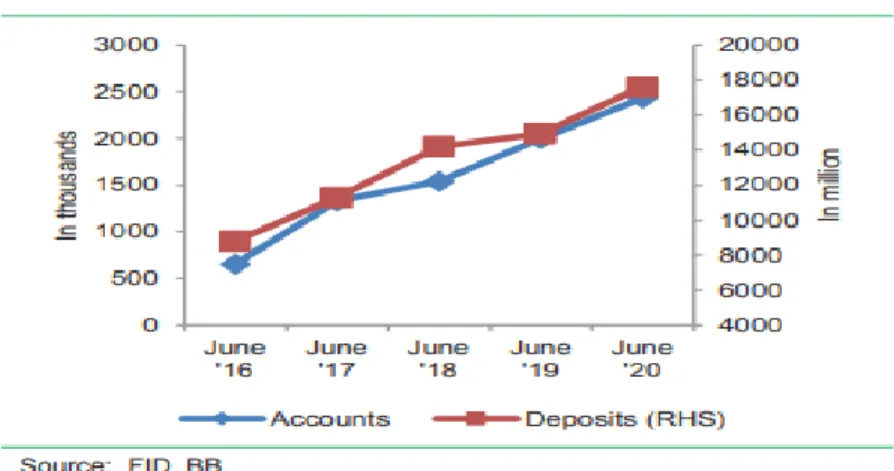

Due to the nationwide coverage of mobile operators' networks and the rapid growth of mobile phone users, their delivery channel has become an important trading tool to extend banking services to the unbanked population.

Financial Innovation and Financial Inclusion

- Agricultural Credit

- Financing Cottage, Micro, Small and Medium Enterprises (CMSMEs) Credit

- No-Frill Accounts (NFAs)

- School Banking

- Banking for Working/Street Children

- Agent Banking

Besides, BB has initiated various refinancing schemes to provide relatively low cost financing to encourage banks and NBFIs in CMSME financing. To develop the CMSME sector, BB has continued its refinancing facilities in FY20 for banks and NBFIs against their funding to CMSMEs. Currently, BB provides refinancing facilities to banks and NBFIs from refinancing schemes to agro-based product processing industry; small business; new entrepreneurs in cottage, micro and small industries; Islamic Sharia-based financing; JICA Assisted Financial Sector Project for Development of SME (FSPDSME) Fund and JICA Assisted Urban Building Safety Project (UBSP).

Banks and NBFIs have come forward to finance and develop CMSMEs under strict monitoring and supervision of the BB. On the other hand, 57,228 women-led CMSMEs received funding of BDT 51.78 billion in FY20 from banks and NBFIs. In the first half (January-June) of 2020, banks and NBFIs disbursed BDT 658.3 billion as credit to CMSME.

In addition to regular financing from their own funds, banks and IFJBs are also providing short-term and long-term financing to CMSMEs through WB refinancing schemes. SMESD of WB, with the help of the government and various development partners, is implementing a total of six pre-financing/refinancing schemes for banks and IFJBs currently against their disbursed CMSME loan. A total amount of BDT 94.30 billion has been provided to various banks and IFJBs under various refinancing/prefinancing schemes till June 2020 against 65,016 enterprises.

Banks and NBFIs are instructed to disburse 50.0 percent of total CMSME loans to the cottage, micro and small sector (CMS) by 2021. Banks and NBFIs are instructed to provide a three (03) month grace period for a one (01) year term loan and a three to six (03/06) month grace period for medium to long term loans, on based on the banker-customer relationship. To guarantee the CMSME female entrepreneur loan facility, banks and NBFIs are instructed to disburse at least 15.0 percent of the total CMSME female entrepreneur loan.

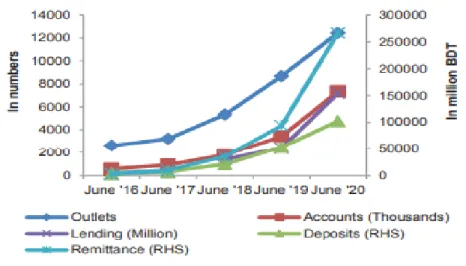

Financial inclusion has gained momentum through Agent Banking in rural areas creating endless opportunities for both banks and their customers.

Findings of the Study

Nature of Financial Exclusion in Bangladesh

The figure speaks for itself, but a few points can be emphasized in the context of this study. Involuntary exclusion may result from several factors that independently or collectively influence the outcome.

Factors behind Financial Exclusion

- Access to Formal and Informal Financial Services

- Access to Credit and Major Barriers

- Access to Savings and Major Barriers

- Access to Insurance and Major Barriers

- Access to Mobile Banking and Agent Banking

Households may not use formal financial services because they do not need to use them or because they have cultural or religious reasons (interest-bearing account) not to use them. The majority of them do not have a national ID card, and even if some of them have one, they cannot use it properly to open an account. However, in the case of disabled, none of them receive loans from banks, as the bank is not enthusiastic to provide loans to the disabled.

Usually, what they get is saved in bank accounts and mobile banking services. Everyone is willing to have insurance, but cannot access it because the providers do not accept them. The tea garden workers know about mobile banking but none of them have opened any mobile banking accounts because they cannot operate mobile well and they can easily access banking services through mobile banking agents.

Agent banking was not employed there and they have no idea about it. They know about mobile banking, but none of them have opened any mobile banking accounts. They don't have mobile bank accounts because they can't operate mobile stuff and they can easily access banking services through mobile banking agents.

They know the services of mobile banking and are also aware of the negative side of mobile banking such as wrong transactions, high transaction fees etc. The main challenge for the transgender people in Bangladesh is that majority of them cannot live without the group because they cannot live outside the group. feel safe. This is one of the reasons why transgender people cannot access bank accounts or other financial services.

Some of them have good skills along with proper training in cooking, embroidery, computer operation, salon beautification etc.

Conclusion