It gives me great pleasure to submit an internship report on "Financial Growth and Risk Analysis of 2 Full-Fledged Islamic Shariah Bank" as part of BBA program of Sonargaon University for your kind consideration. I have tried my best to make this internship report as productive and informative as possible. Therefore, I hereby announce that the internship report titled “Financial Growth and Risk Analysis of 2 Full-Fledged Islamic Shariah Bank” edited solely by me and submitted to Department of Business Administration, Sonargaon University (SU) for BBA degree.

This is to certify that Nipa Hazra, ID: BBA a student of BBA program at Sonargoan University, has completed the internship report titled “Financial Growth and Risk Analysis of 2 Full-fledged Islamic Shariah Bank” under my supervision. Deep knowledge and great interest of my supervisor in the field of finance to carry out this internship report. His endless patience, expert guidance, constant encouragement, constant and energetic supervision, constructive criticism, valuable advice, reading many inferior drafts and correcting them at all stages made it possible to complete this Internship Report.

I would like to thank all our course mate at Sonargaon University who participated in this discussion while completing the internship report. This internship report has examined and depicted the current status of 2, the most popular full-fledged Islamic bank, and it has also assessed its comparative performance related to financial growth and risk management over the past five years.

INTRODUCTION

- Introduction

- Objectives of the Report

- Methodology of the Report

- Scope of the Report

- Limitations of the Report

The Islamic banking industry in Bangladesh which consists of 8 full-fledged Islamic banks, 19 Islamic banking branches of 9 conventional commercial banks and 25 Islamic banking counters of 7 conventional commercial banks is performing well. The main objective of this report is to successfully complete my BBA program and to gain awareness about the Islamic banking system in Bangladesh. The preparation of this report will primarily use secondary sources in light of the COVID situation where health safety and security are essential.

The validity of this report only for the banking industry of Bangladesh with the concern of the Islamic banking system, they are analyzed here in this particular report. This report will provide a help to those who wish to explore further about the Islamic banking system in Bangladesh, especially in IBBL & SIBL with its critical analysis on financial growth and organizational risk during the last five years period, showing strategic perspective and idea generation of the future perspective in Bangladesh based on this analysis. Although the consideration I have made is of tremendous importance and required me tremendous work for the preparation of this report, yet there are some obvious limitations and limitations hindering the smooth process of work.

One of the biggest obstacles to collecting primary data for this report is the COVID-19 pandemic. For this reason, large-scale analysis for this report cannot be made using only publicly available information.

ORGANIZATIONAL PROFILE

Islamic Bank Bangladesh Limited (IBBL)

- History of IBBL

- Vision Statement of IBBL

- Mission Statement of IBBL

- Core Values & Commitments of IBBL

- Strategic Objectives of IBBL

- Products & Services of IBBL

The vision of IBBL is to always strive to achieve superior financial performance, to be regarded as a leading Islami Bank by reputation and performance. To achieve the desired goal, it is to establish and maintain modern banking techniques, to ensure health and development of the financial system based on Islamic principles and to become a strong and efficient organization with highly motivated professionals who work for the benefit of people, based on accountability, transparency and integrity to ensure stability of the financial systems. It always tries to encourage savings in the form of direct investment and also tries to encourage investment, especially in projects, which are more prone to higher employment.

To establish the Islamic Bank through the introduction of a welfare-oriented banking system and also to ensure equality and justice in all economic activities, to achieve balanced growth and equitable development through diversified investment operations, especially in priority sectors and the most less developed country. To encourage socio-economic development and financial services for the low-income community especially in rural areas. Continuous improvement of products and services to adapt to the changing needs of the customer base to maintain market share.

Islami Bank Bangladesh Limited operates Al-wadeah current account according to Al-wadeah principles. The bank undertakes to repay money deposited in these accounts at the request of customers. On the other hand, the bank takes permission from customers for the bank to use their money.

In the perspective of these accounts, the bank is 'Mudarib' and customers are 'Shahib Al-Mal'. On behalf of depositors, the bank invests their deposited money and distributes a minimum of 65% of the investment income earned through the use of Mudaraba funds among Mudaraba depositors after the end of the year.

Social Islami Bank Limited (SIBL)

- History of Social Islami Bank Limited (SIBL)

- Vision Statement of SIBL

- Mission Statement of SIBL

- Core VALUES and Commitments of SIBL

- Strategic Objectives of SIBL

- Products & Services of SIBL

To be honest is determined by Scripture - we adhere to this value in all our service delivery. To be accountable is to be responsible and above all suspicion - we are conscientious there. Our minds and eyes are open to the evolution in quality of life to innovate further benefits for the service.

Customers should feel confident with all our products and services - we continue to provide that. Modern life depends on technology - we continue to look for the latest developments to offer the best in convenience to our customers.

ANALYSIS & EVALUATION OF FINANCIAL INFORMATION

IBBL-General trend and growth of Investment

There are 8 sectors where IBBL invests, among which is the highest investment in the Industrial sector.

IBBL-Growth in Import & Export Business

IBBL-Financial Performance

IBBL-Operating Performance

IBBL-Statement of Financial Position

SIBL-General Growth of Investment

SIBL-Foreign Exchange Business

SIBL-Financial Performance

SIBL-Statement of Financial Position ( SOFP)

SIBL at a Glance

ANALYZING RISK

- Risk analysis Systems in IBBL

- Investment Risk

- Equity Price Risk

- Liquidity Risk and 6. Value at Risk (VaR) Liquidity Risk

- Capital Structure with disclosure of IBBL

- Risk Analysis Methods in SIBL

- PROFIT RATE & FOREIGN CURRENCY RISKS

- NON-PAYMENT RISK

- MANAGEMENTS RISK

- OPERATIONAL RISK

- BUSINESS RISK

- POTENTIAL OR EXISTING GOVERNMENT REGULATIONS

- POTENTIAL CHANGES IN GLOBAL/NATIONAL POLICIES

- HISTORY OF NON-OPERATION

- PORTFOLIO MANAGEMENT RISK

- CREDIT/INVESTMENT RISK

- CAPITAL BASE of SIBL

The Bank's risk management covers a wide spectrum of risk issues and 6 (six) main risk areas of the bank, i.e. a Risk Management Committee (RMC) has been formed to ensure proper and timely management of risk in every sphere of the bank. In addition, a Management-level Risk Management Committee is actively working to focus the entire bank's risk management system.

Here, the bank's board has carefully analyzed the bank's financial position and assessed the issue of continuity in the bank as a going concern, taking into account some risk factors that can have serious consequences. Increase in profit rates or unavailability of foreign currency can adversely affect the bank's operations. The bank's structured liquidity profile shows that all assets and liabilities are managed and structured well.

In addition, ALCO (Asset Liability Committee) of the bank is a powerful committee entrusted with the overall liquidity management. Since the establishment, the Board of Directors of the Bank have fulfilled their duties and responsibilities through 445 number of board meetings. The internal control and compliance department of the bank controls the operational procedure of the Bank.

So the bank is aware of its operational risk and accordingly the policies and procedures are regularly reviewed by the bank's Board of Directors to ensure risk free operation. The bank operates in a highly competitive market as the modern banking industry has brought greater business diversification. Moreover, to make the operation competitive, the bank has implemented one of the best world-class information technology platforms in the bank to ensure faster and more secure delivery of services to customers on a 24/7 basis.

If any policy change does not adversely and materially affect the industry as a whole, the Bank's business is not expected to be significantly affected. Again, change in existing global or national policies may have positive or negative impacts on the Bank. Taking into account the main elements of credit risk, the Bank has divided the duties of officers/managers involved in credit-related activities.

Based on the above discussion, the bank's board of directors has determined that it is appropriate to accept the assumptions about the operating company and that there is no significant uncertainty in the preparation of the financial statements. The capital base, which consists of the foundations I and II of the bank, as of December 31, 2019, amounted to Tk.

FINDINGS AND INTERPRETATION

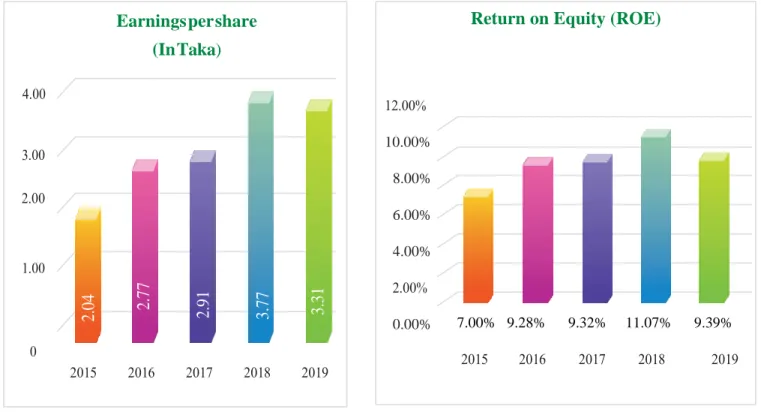

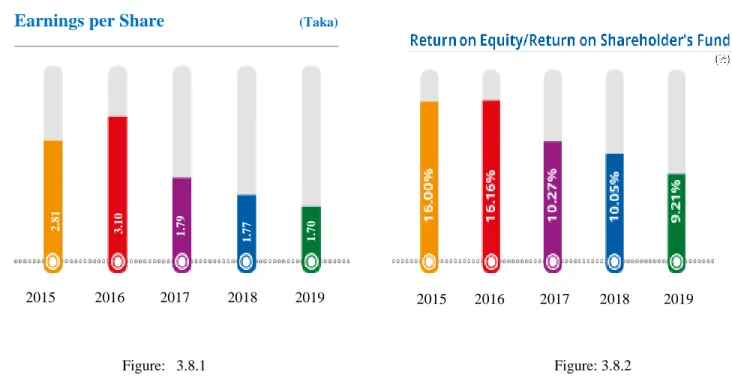

Price Earnings Ratio of IBBL & SIBL

For SIBL: First, it was little and was dramatically increased to a five-year period in 2017, although it dropped to about eight times in 2019. The higher the PE ratio, the higher the growth rate of the organization indicates and therefore the shareholders expect higher growth. the organisation. In this regard, SIBL has outperformed IBBL as its price-to-earnings ratio was 8.10 times as compared to 7.05 times for IBBL in 2019.

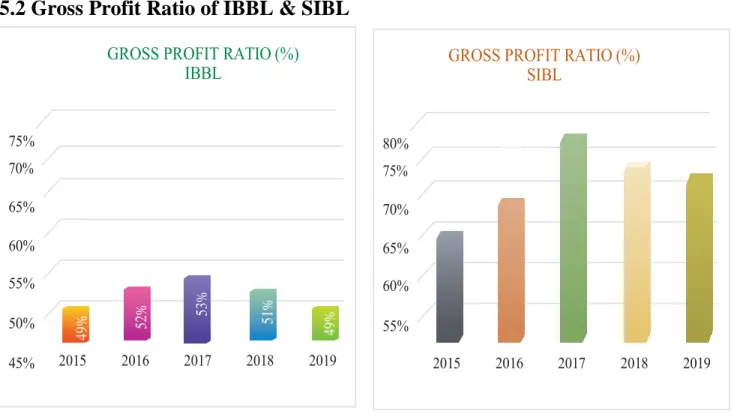

Gross Profit Ratio: For both the banks, the ratio for both the banks has gone up and down during this period. The efficiency of SIBL is higher than IBBL from the analysis of both graphical representations it shows that the gross profit from sales after deducting expenses. Comment: After analyzing the profitability ratio and PE ratio of IBBL and SIBL in last five.

RECOMMENDATIONS AND CONCLUSION

Recommendations

To ensure progress, banks need to set up external oversight sheets and incorporate people in the selection who are preparing for tremendous progress. Both banks need to have aggressive marketing and encouraging people in Bangladesh to attract in Shariah banks. Strong monitoring will help reduce risk, and the top authority must focus on developing its risk management system.

The ratio analysis says that IBBL needs to emphasize its cost management system in relation to its income and perform accordingly to improve financial growth. Both banks must have the dynamics to diversify the dependency income and investment method and establish an alternative investment scheme. The customization of products and services would be a great attraction among customers, and the reality service can be provided from different angles, resulting in high financial growth.

Ethics is the most important topic in the corporate world, as the bank must confirm the ethical view towards its services and customers to have a positive life and transparency in order to ascertain the highest result. No fees for opening a bank account and issuing a debit or master card in that large number.

Conclusion

Acronyms