I present my internship report, "Profitability Analysis: Evidence from IDLC Securities Limited," with all gratitude and respect. I did an internship with IDLC Securities Limited to fulfill the prerequisites for my BBA degree. Romana Islam, ID No. BBA Program, Major "Finance," Daffodil International University, has successfully completed her internship at "IDLC Securities Limited," Dilkhusha Branch.

I also have to thank all the staff of IDLC Securities Limited who helped me complete my report and made my internship special. The topic of my internship is "Profitability Analysis: Evidence from IDLC Securities Limited" and I declare that neither I nor any other person has submitted this report to any institution. One of the best stockbroking companies in Bangladesh is IDLC Securities Limited which has consistently maintained its ranking in the list of best companies.

Chapter-I Introduction

- Introduction

- Statement of the paper

- Objectives of the Study

- Possibilities for the Study

- Methodological aspects of the study

- Limitations of the study

One of the most important metrics that can be used to determine the evaluation of any type of business is profitability. To assess the importance of this sector and its effects on the national economy, this study examines the factors that influenced the profitability of IDLC Securities Ltd., one of the largest listed brokerage firms, from 2006 to 2022. , the author will have a thorough understanding of the data supporting broker market profitability after researching and working with this issue.

The author will have a comprehensive understanding of the facts that support the profitability of brokerage firms after completing this article. This research will provide a thorough account of IDLCSL, one of the leading brokerage firms, in line with the DSE (Dhaka Stoke Exchange Ltd.) report. The validity and trust of the data depends on their belief and reliability of the published data.

Literature Review

Therefore, research on the profitability of brokerage houses, specifically in Bangladesh, is in its infancy. Okay and Kose(2015) used TOPSIS to analyze the profitability measures of various brokerage companies listed on the Istanbul Stock Exchange to assess the financial performance of these firms in relation to these ratios' fluctuations. Hoffmann's (2011) study, which looked at the factors that affected US banks between 1995 and 2007, discovered a relationship between profitability and capital adequacy ratio.

However, Alalaya and Al Khattab (2015) concluded that the logarithm of bank assets has a significant negative relationship with ROA, while the relationship between ROE and ROA is positive and significant. The profitability of commercial banks in Turkey was assessed in a study by Alpaer and Anbar (2011), but no relationship was found between profitability and GDP growth rate or inflation. According to a study by Kadioglo et al(2017) on the relationship between profitability of Turkish banks and asset quality, the number of bad loans causes a decline in asset quality, which in turn lowers return on capital and return on assets.

Furthermore, a positive and significant relationship between bank profitability and size was discovered by Akhavein et al. However, age of the company, financial leverage and productivity have a negative impact on the company's profitability. The average tax rate and the financial leverage factors, on the other hand, showed a negative association with profitability.

Katrikasari and Merianti (2016), in their study on the impact of financial leverage and size of manufacturing firms in Indonesia, found that the proportion of debt has a significant positive impact on profitability, while total assets have a significant negative impact. Based on the above-mentioned literature, we can conclude that despite many researches on this topic, a thorough investigation of stockbroking companies in Jordan has not yet been carried out. In order to determine the profitability of stockbroking business in Jordan, the current investigation was launched.

It was shown that a company's liquidity and operational effectiveness significantly influence the profitability of the non-banking financial sector in Bangladesh.

Organizational Overview

It had 5 staff members, 33 years of operation emerged as one of the largest non-banking financial institutions in Bangladesh. In case of corporate and retail or capital market segment, IDLC finance limited plays a strong role. The group's parent firm, IDLC Finance Limited, concentrated on the SME, consumer and corporate segments.

The company's mission is to focus on quality enhancement, better customer experience and also sustainable business practices. Based on the audited financial statements of IDLC Finance Ltd. for the fiscal years 2009 to 2013 and other information available as of the rating date, Emerging Credit Rating Limited (ECRL) has affirmed IDLC Finance Ltd's AAA. (pronounced Triple A) long-term credit rating and ECRL-1 short-term credit rating. Subsidiaries of IDLC Finance Limited include IDLC Securities Limited, IDLC Investments Limited and IDLC Asset Management Limited.

The company is a wholly owned subsidiary of the largest non-banking financial institution in the country, IDLC Finance Limited (IDLC). The business is a wholly owned subsidiary of IDLC Finance Limited, the largest non-banking financial institution in the country. The firm offers its clients, who are both businesses and private citizens, services in investment banking, portfolio management, margin lending and securities research.

The company is a wholly owned subsidiary of IDLC Finance Limited (IDLC), which was founded through a collaboration between International Finance Corporation, German Investment Corporation, Korea Development Bank, Aga Khan Fund for Economic. Through reliable trading platforms on the Dhaka and Chittagong stock exchanges, the company provides brokerage services to more than 15,834 retail, domestic and international institutional clients. As a panel broker, it also provides services to more than 2,500 clients in the merchant banks it has signed up for.

Additionally, the business has a reliable online trading system, which was created in-house and deployed in 2010 by its Order Management Unit.

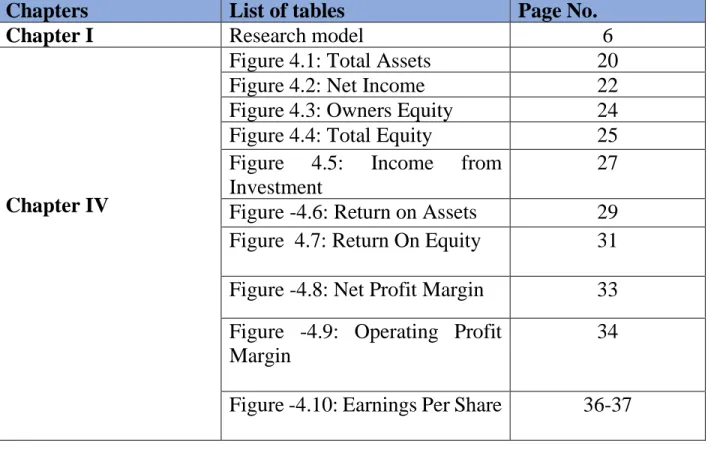

Chapter - iv Analysis of Data

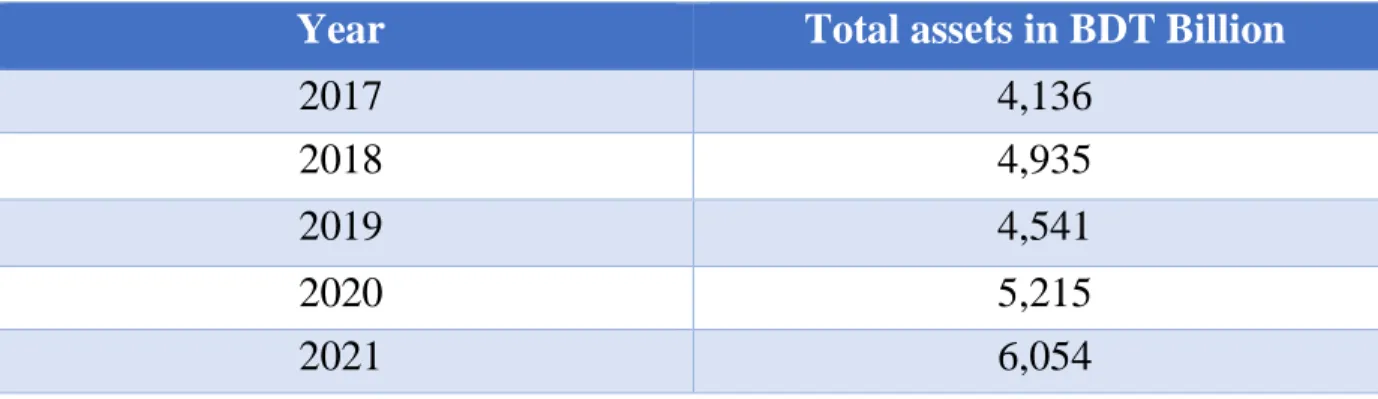

- Total Assets

- Net Income

- Owners Equity

- Total Equity

- Income from investment

- Return on Asset (ROA)

- Return on Equity (ROE)

- Net Profit Margin

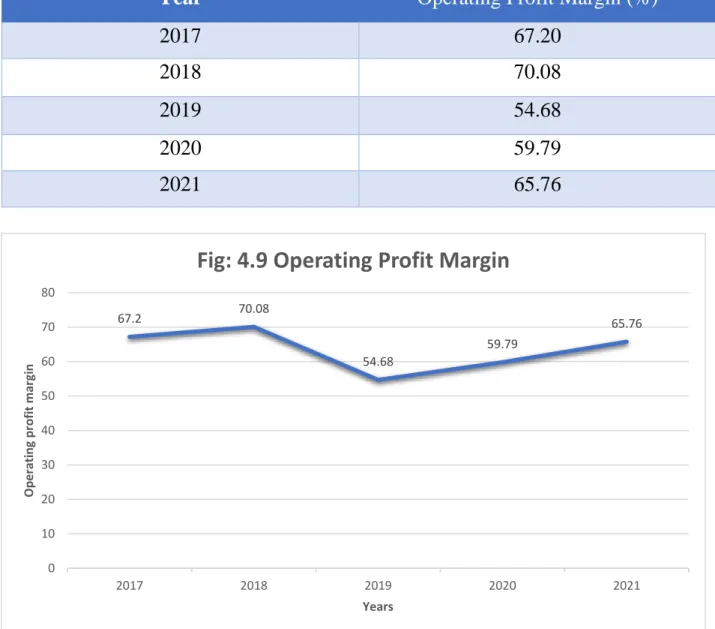

- Operating Profit Margin

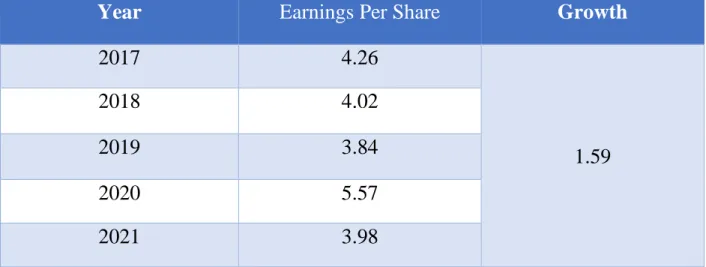

- Earnings Per Share

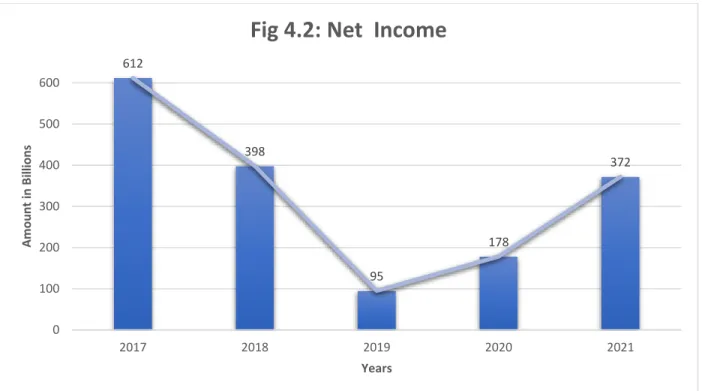

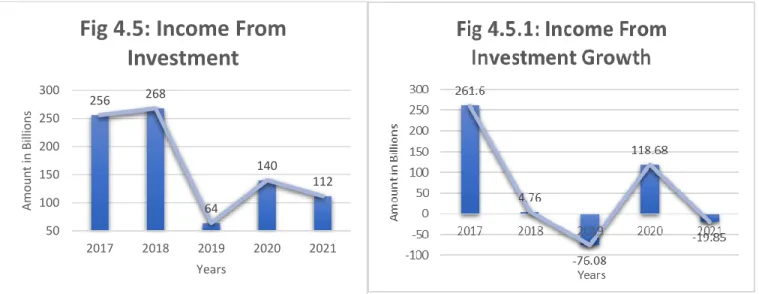

It is especially useful if the company wants to examine how much revenue exceeds the costs of that particular organization. The graph depicts the observation of the amount of net income for IDLCSL during the time period 2017-2021. In 2017 the company was cutting a good figure for their net income, but it decreases to a percentage of about -35% in the year of 2018.

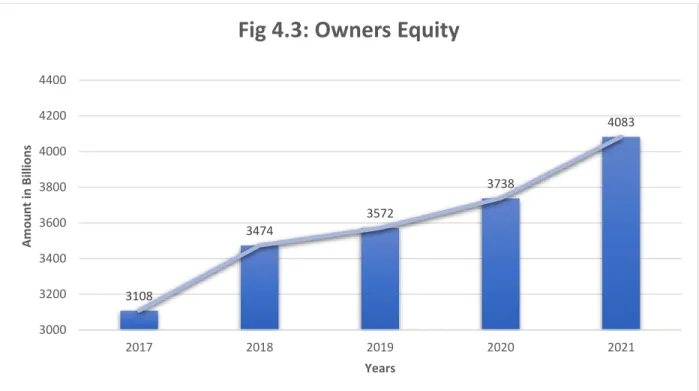

In addition, due to the global pandemic, the company faces a large decrease in net profit in 2019. After that, the company will be able to gradually increase the level of net profit in 2020-2021 and return to the previous level. Equity is the owner's claim on the company's assets after all liabilities have been settled.

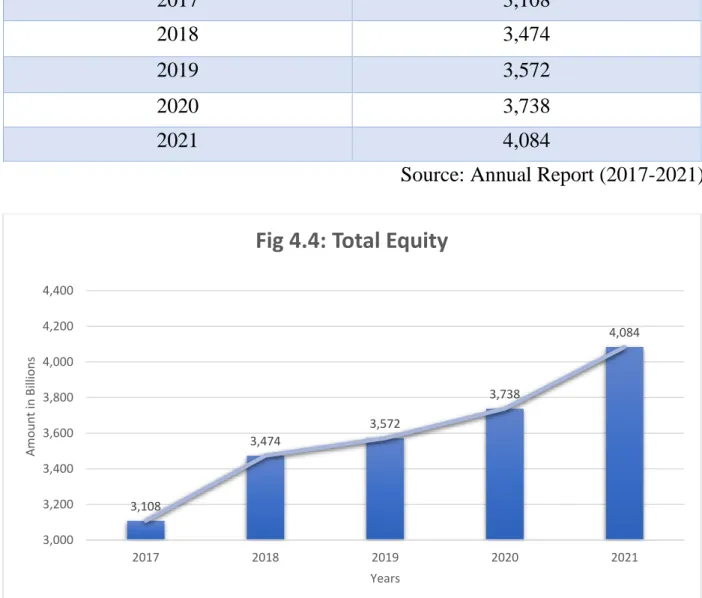

Owner's equity is the owner's initial investment in the business minus any withdrawals or drawdowns by the owner, plus the business's initial net income. Later, the company makes a good figure by increasing its equity and representing the amount of a company's value that can be claimed by its shareholders. Total equity is the sum of the shares owned by the founders and other owners of the company.

Later the Company is cutting a good figure in the growth of its total capital and representing the amount of value of a company that can be claimed by its shareholders. Investors can understand the company's efficiency by looking at return on assets (ROA) statistics. Source: Annual report Interpretation: Return on equity means how good the company is at generating returns on the investment it has received from its shareholders.

In 2017 and 2018, net profit margins were attractive and the company was clearly making good profits as a percentage of revenue. It is calculated by dividing the company's net profit by the total number of shares currently outstanding. During the pandemic, I think the share value went down to a lower amount and the company managed to maintain a higher share value and maintain balance in 2020.

Chapter -V

Findings, Recommendations and Conclusion

- Findings of the Report

- Recommendation

- Internship Experience

- Conclusion

With the exception of 2019, when there were pandemics around the world and it hampered the company's financial operations, IDLCSL's total assets, owner's equity and total shares have risen slowly and steadily over the past five years. I can see from the graph of total assets that the company's assets are growing every year. In the case of margin ratios, operating profit margin plays a significant role in determining the profitability of the company.

By analyzing the company's performance, it has been found that the operating profit margin has maintained a stable value over the past five years, although it deteriorated slightly in 2019. By tracking increases and decreases in net profit margin, the company can assess whether current practices are working and forecast profits based on sales. By analyzing the five-year earnings per share for the IDLCSL company, I can say that the situation is in equilibrium.

It decreased in 2019, but in 2020 it can maintain a higher share value to recover the loss of 2019 and later it returns to the balance sheet situation to maintain a stable performance of the company. My internship experience felt that some small changes can help the company/organization perform more successfully. The company's ROA and ROE are 6.13% and 8.82%, respectively, which are considered to be in good shape, but not outstanding.

The company should put more effort into increasing its profit margin or using its assets to generate sales in order to maximize its return on assets and capital. I worked as an intern at IDLC Securities Limited as part of this program at the company's head office in Dilkhusha, Paltan, Dhaka. My report shows IDLCSL's overall profitability ratios and how the company faced devastating setbacks in 2018 leading into 2019.

On the contrary, I can say that the company is going through its recovery period and is improving day by day.