It is a great pleasure to submit an internship report on “Investment Performance of Islami Bank Bangladesh Ltd (IBBL)” A Study on Islami Bank Bangladesh Ltd (IBBL). It has been concentrated efforts to achieve the objectives of the practical orientation and the hope that the effort will serve the purpose. I would like to express my gratitude to the respected supervisor, Faculty of Business Administration &.

The report is mainly prepared to measure investment performance analysis of Islami Bank Bangladesh Limited". Face to face interview and online interview was the main primary source. Investment related books and websites were the main secondary source in this regard. This study has been conducted. by collecting data from the period of three months.

Chapter-2

Organizational Profile

Introduction

- Table 1: Corporate Profile at a Glance

The main purpose of traditional banking is to make money by borrowing and lending money in exchange for interest. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Quran and Sunnah. The establishment of Islami Bank Bangladesh Limited on 13th March 1983 is the true reflection of this inner urge of its people which started functioning upright from 30th March 1983.

Now a question may arise - "what is Islami Banking?" According to OIC- "Islamic bank is a financial institution whose status, rules and procedures expressly declare its commitment to the principle of Islamic Shariah and to the prohibition of receiving and paying interest on any of its operations."

Objectives of Islamic Bank

Chapter-3

Theoretical Framework

- Investment

- Partnership or ‘Share’ Mechanism o Musharaka

- Trading or ‘Bai’ Mechanism o Bai- Murabaha

- Leasing or Ijara Mechanism o HPSM (Commercial)

- Partnership or ‘Share’ Mechanism

- Leasing or IjaraMechanism

- Investment Process of IBBL

- Application stage

- Document stage

- Selection of the client

- Cash/Goods-

- Collateral: Immovable properties

- Cash/Goods security: In allowing Murabaha investment and amount of cash security is generally realized from the client (amount depends on the nature of goods,

- Urban Poor Development Scheme (UPDS)

Definition of investment funds by the Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI) is- “Funds are investment vehicles, which are financially independent from the institutions that establish them. Funds take the form of equal participating shares/units, which represent the shareholders'/unitholders' share of the assets, and entitlement to profits or losses. It is an agreement whereby bank provides capital which is mixed with the funds of the business enterprise and others.

Bai-Salam can be defined as a contract between a buyer and a seller under which the seller pre-sells certain goods permitted under the Islamic Shari'ah and the law of the country to the buyer at an agreed price to be paid in execution of the said contract and the goods . delivered according to specifications, size, quality, quantity at a future time in a certain place. This makes it easier for the producer sometimes to get the price of goods in advance, which he can use as capital for the production of goods. The part, part or part of the asset owned by the Bank is leased to the customer partner for a fixed rent per unit of time for a specified period.

Finally, the Bank sells and transfers the ownership of its share to the customer upon payment of the price fixed for it either gradually in part or in lump sum within the period or after the expiry of the lease agreement. Certified copy of the Memorandum of Association (MOA) & Articles of Association (AOA) for the joint stock company. Firstly, customer approaches to any of the branches of Islami Bank Bangladesh Limited (IBBL).

After the successful completion of the conversation between the client and the bank, the bank selects the client for the proposed investment. Protection of cash/goods: When the Murabaha investment is approved, the amount of cash security is generally realized from the customer (the amount depends on the nature of the goods, as a rule it is realized from the customer (the amount depends on the nature of the goods, the customer's creditworthiness, collateral). collateral obtained, etc. .), which is converted into a security for goods after the purchase of goods purchased from the bank's investment, and the customer's cash security is pledged with the bank, is kept in the custody of the bank before it is handed over to the customer upon payment. the poor from charities like Zakat, Sadaqa of any other charity fund like money waqf of a bank with no cost or low profit.

Chapter-4

Analysis and Findings

Overall Investment Scenario of IBBL

- Year Wise Investment

- Year wise deposit of IBBL

- Investment to Deposit (ID) Ratio

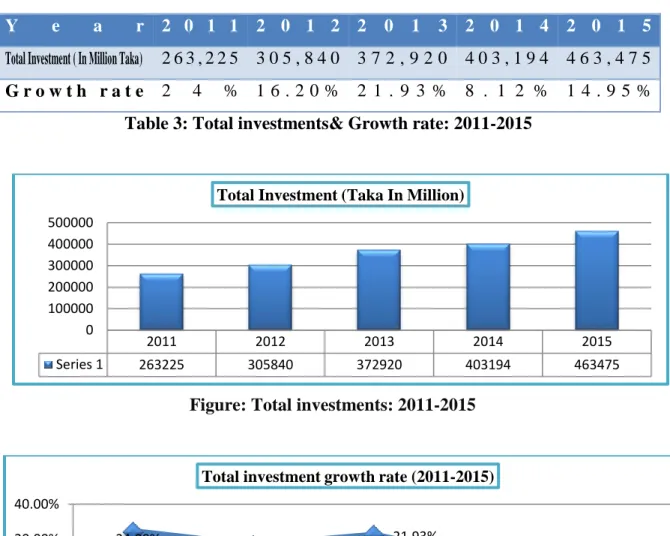

Interpretation: As indicated in the above graph, the amount of disbursed investment in different sectors reached BDT 463475 million as on 2014 based on Annual Report 2014. The report further said that, Investment in the different sectors achieved 24% growth in 2010 after 2011 -2014 the growth of investments decreased & the overall Investment growth rate was minimum in the year 2013 due to different reasons like- political unrest,. By properly diversifying the investment sector, IBBL can achieve higher growth rate and profit margin.

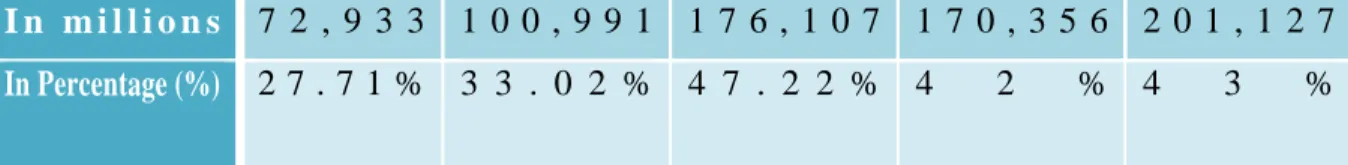

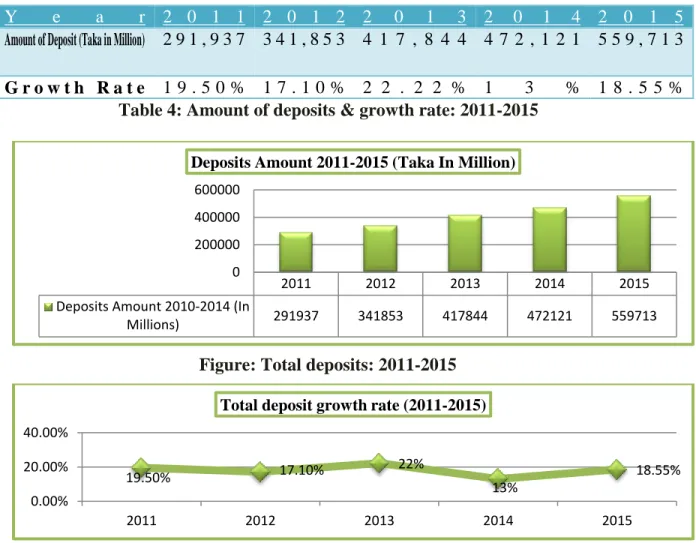

Therefore, when analyzing the investment activities of IBBL, it is important to know the deposit performance of the bank. Explanation: The above graph shows that the annual deposit of IBBL has been increasing gradually. The investment-to-deposit ratio measures the proportion of deposits used to invest in loan products.

Interpretation: The graph shows that the ratio of investments to deposits of Islami Bank Bangladesh Limited has decreased continuously during the year.

Mode Wise Investment

- Trend Analysis

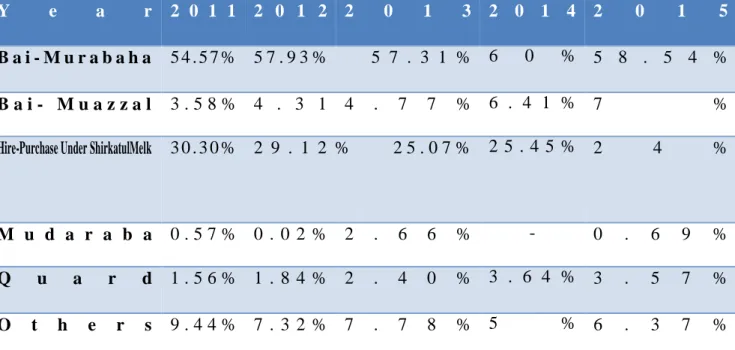

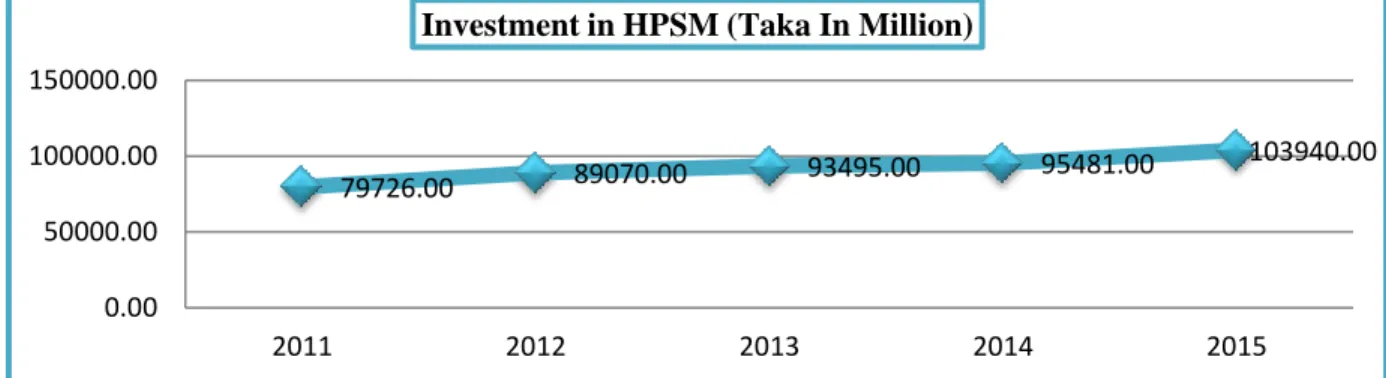

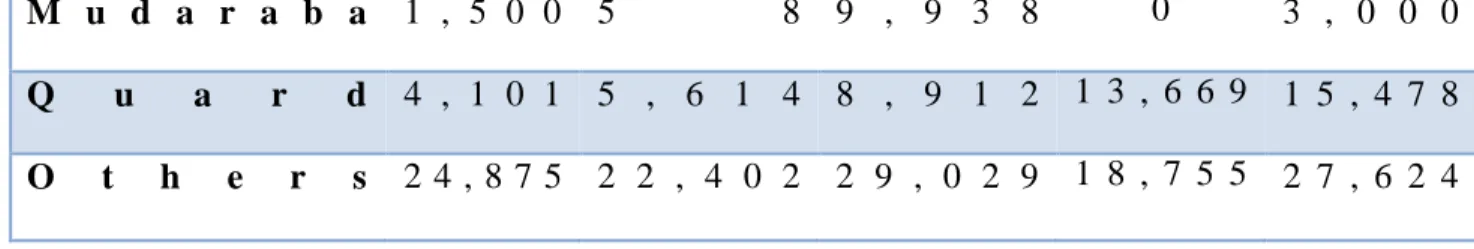

Interpretation: IBBL invests its maximum amount in Bai-Murabaha mode from 2011 to 2015 and from 2011 to 2012 the bank invests its lowest amount in Mudaraba mode. In 2014 they did not invest any amount in Mudarabamode and in 2015 they invested small amount in Mudaraba mode.

Sector Wise Investment

- Trend analysis

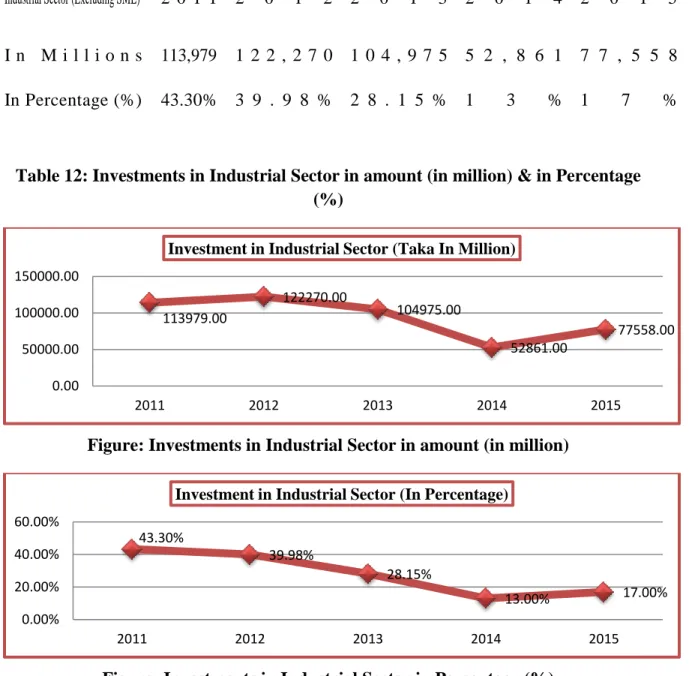

- Trend analysis of Industrial Sector

- Trend analysis of Commercial Sector

- Trend analysis of SME Sector

- Trend analysis of Dhaka region

- Trend analysis of Chittagong region

Interpretation: The graph above shows the investment in the industrial sector in quantity and as a percentage of the total investment. In quantity the curve is downward from the year 2011 to 2014 on the other hand, in percentage also downward. In 2015, the amount invested increased by DKK 77,558 million. and as a percentage it was 17%, which has increased by 4% from the previous year.

Explanation: The graph above shows investment in the commercial sector in terms of amount and percentage (%) of total investment. Quantitatively, the curve goes down from 2011 to 2013, and then the curve was up. On the other hand, it also decreased in percentage from 2011 to 2013, after which the curve was upward.

In 2015, the amount invested rose in 129,544 million and in percentage it was 28% which decreased by 3% from the previous year in this sector. Interpretation: The above graph shows the investment in SME sector in amount and in percentage (%) to the total Investment. In the year 2014, the investment in this sector is decreasing in quantity and also in percentage.

The bank should increase the investment in these regions and they should diversify the investment through this region to earn more profit. Although the investment in Dhaka region increased during the year but in percentage it was almost parallel since 2013 to 2015. Although the investment in Chittagong region increased during the year but in percentage it was almost parallel since 2011 to 2015.

Trend of Investment income

In 2014 the income was minimal and not in 2013 and 2015 due to political unrest and other economic recession. Although there is an upward curve in the amount of investment income, but in percentage (%) there was a negative profit in 2015.

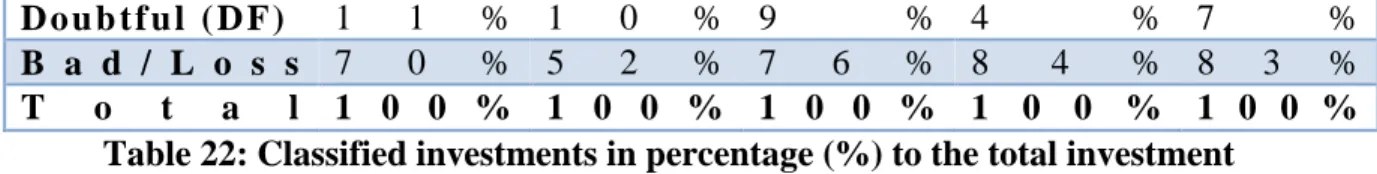

Trend of Percentage of Classified of total Investment

Explanation: The graph shows the percentage of classified investment relative to total investment in the period 2011-2015. The percentage therefore increases with each year, so the bank should focus on it.

Status of Classified Investment

- Trend Analysis

Interpretation: The figure shows that the maximum portion of the bank's total classified investment is in the bad and loss category, which is too risky for the bank. On the other hand, the Doubtful and Substandard rate true minimum from the year 2013 to 2015. Figure: Bad & Loss of total classified investments in amount (in million) . Figure: Bad & Loss of total classified investments) in Percentage.

Although the curve is upward in millions, it fluctuated in percentages throughout the year. To prepare this report, I have tried to find out the overall investment scenario of IBBL and its growth rate over the year, deposit collection and growth rate over the year, mode and sectoral investments over the year. IBBL's investments and deposits have increased over the years and their growth rate has also increased in 2015.

IBBL invests major portion under Bai-Murabah and installment purchase in ShirktulMelk mode as per total investment in 2015. IBBL investment is highest in SME sector and lowest in Transport sector. The largest share of the bank's total classified investment is in the bad and loss category, which is too risky for the bank.

Chapter-5

Recommendations & Conclusion

IBBL) is performing well but there are some crucial areas for improvement which are outlined below:. With the increase in investment and deposits of Islami Bank Bangladesh Limited during the year, they should try to maintain it by offering attractive schemes and quality service. IBBL's investment to deposit ratio has continuously declined and in 2015 it was 82.81% which is not a good sign for the bank.

IBBL should concentrate in Mudaraba mode as they invest lowest in this mode as well as other modes like; Bai-Muajjal, Quard and other modes instead of Bai- Murabaha&. As IBBL invests the most in the SME sector and the second highest was in the industrial sector. They should diversify their investments in other sectors such as Transport, farm properties to earn more profit.

The percentage of classified investments was increasing during the year, therefore the bank should focus more on it. As the maximum share of the total classified investment of the bank is in the bad and loss category, so the Bank should use a proper and strict investment guideline and should monitor the customer properly to recover the money. IBBL) is trying to create the maximum welfare of the society while maintaining the principles of Islamic Sharia, which is based on the Quran and Sunnah.

The special feature of the Bank's investment policy is investment on the basis of a profit and loss sharing system, in accordance with the tenets and principles of Islamic Sharia. Making profits is not the only motive and goal of the Bank's investment policy. Rather, emphasis is placed on achieving social objectives and creating employment. Considering the efficiency nature of Islamic banking and its beneficial effects on the economy, government policies in Muslim countries should favor the transformation of the conventional banking system to Islamic banking.

Bibliography