Shahbub Alam, Lecturer, Faculty of Business Administration, Sonargaon University (SU) certifies that the working report titled “SME Loans and Financial Analysis at IDLC Finance Limited”. was prepared by imtiaz khan ID: Department of Business Administration BBA, Sonargaon University (SU) and submitted as a partial application for the Bachelor of Business Administration degree in FINANCE. The report is an original work prepared as a partial requirement of the Bachelor of Business Administration degree. This is imtiaz khan, a student of Bachelor of Business Administration, ID: ID: BBA1703012038 from Sonargaon University (SU) would like to solemnly declare here that this report on SME Loans and Financial Analysis at IDLC Finance Limited is authentically prepared by me under the supervision of Md.

First of all, I would like to express my deep gratitude to Almighty Allah for His infinite grace that enabled me to complete this internship. I would like to thank her for the kind concern, valuable time, advice and constant guidance throughout the internship and the preparation of the report. Rasel Hawlader, Associate Professor of Business Administration, Sonargaon University, for his endless support as my mentor.

I would like to express my utmost gratitude to the employees and managers of IDLC finance Limited who have helped me and given me their valuable time and given me the most relevant information on the basis of which I have prepared this report. Also, I would like to thank all the other officers for helping and guiding me and for being nice and kind to me.

INTRODUCTION TO THE REPORT

STATEMENT OF THE REPORT

OBJECTIVES OF THE REPORT

Find the differences and specifications And to know about the financial performance of IDLC Finance.

METHODOLOGY OF THE STUDY

LIMITATIONS

IDLC FINANCE LTD

HISTORY OF IDLC

NON-BANK FINANCIAL INSTITUTION

MISSION

VISION

VALUES OF IDLC

STRATEGIC OBJECTIVES OF IDLC

BUSINESS ORIENTATION

Return on Capital: To achieve the highest returns, IDLC allocates their capital to companies &.

CODE OF CONDUCT & ETHICAL GUIDELINE OF IDLC

SHAREHOLDING COMPOSITION OF IDLC AS OF NOVEMBER 30, 2021

SUBSIDIARIES OF IDLC

CORPORATE SOCIAL RESPONSIBILITY

LOCATION OF HEAD OFFICE AND DIFFERENT BRANCHES OF IDLC

PRODUCT & SERVICES OF IDLC FINANCE LTD

CONSUMER

For any big and long term plan without hesitation people can take triple money deposit scheme. By providing a long-term periodic payment system, it will be convenient for people to repay the loan amount. Disbursement/Loan Amount: It is up to 75% of the value of the building (Including Registration). For the professional it may be different).

If the borrower faces any obstacle to repay the loan amount, the insurance company covers a part of the loan. But this is based on the age of the borrower, the term of the loan, outstanding on the principle amount. For any new or existing projects, this loan is suitable to easily get money from IDLC.

The age of the main income earner should be within 65 years at the end of the proposed loan tenure.

WHAT IS SME FINANCING?

SME DEFINITION IN BANGLADESH

SME IN BANGLADESH

Page | 37 need less energy supply, not many infrastructure facilities, but they contribute more in society. The last time a survey was conducted was back in 2013, when the total number of SMEs -- not including the cottages and micro-enterprises, of which there are hundreds and. Which perhaps explains why there is so much debate about the usefulness of the Tk 20,000 stimulus package announced by the government for the sector that contributed at least 25 percent to Bangladesh's GDP and generated as much as 90 percent of private sector jobs in normal times.

At the initiative of the government, there are 9 national fairs that the SME Foundation has held since 2007. They account for about 75 percent of non-agricultural employment and contribute about 25 percent to the national GDP. Private banks like IFIC bank, BRAC bank, Pubali bank, Dhaka Bank, Standard Chartered bank, Islami Bank.

Job creation, production of machines, machine parts; all of these save a large amount of foreign currency. For the development of our country, we should emphasize the SME sectors to increase foreign trade and industry. Small and medium enterprises produce various incentive goods such as toys, small tools, consumer products, paper products for the local market.

SME FINANCING BY IDLC

If the approving authority is not the CEO, then with recommendations the assessment is submitted to the next approving authority.

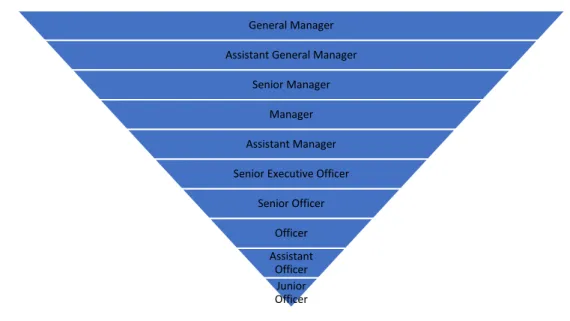

OFFICIAL RANKING IN SME

SME PRODUCTS OF IDLC

Your business should be a going concern with a minimum operational experience of 2 years

Your age should be between 20 to 60 years

You should have a valid trade license from the concerned issuing authority

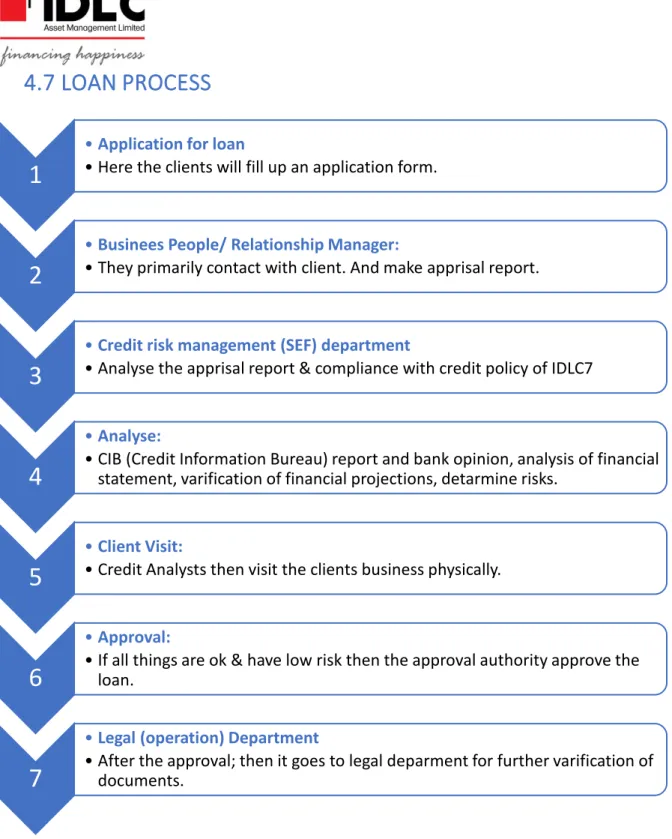

LOAN PROCESS

CIB (Credit Information Bureau) report and bank opinion, financial statement analysis, verification of financial forecasts, mitigating risks. If everything is in order and has a low risk, the approval authority approves the loan.

RATIO ANALYSIS

- PROFITABILITY RATION

- FINANCIAL LEVERAGE RATION

- RECOMMENDATION

- REFERENCES

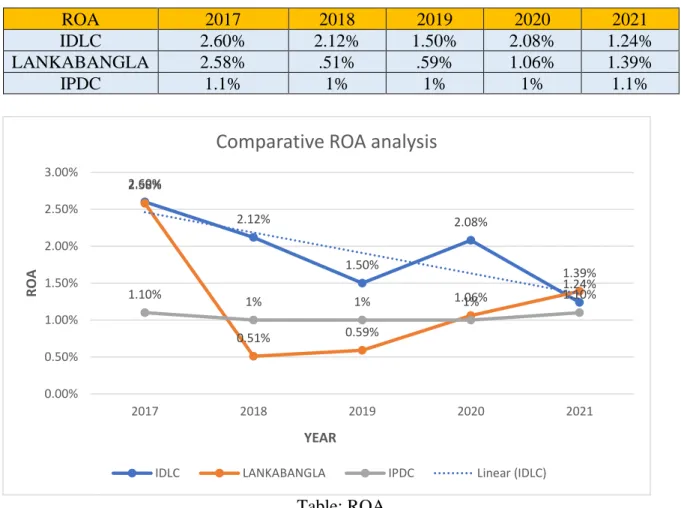

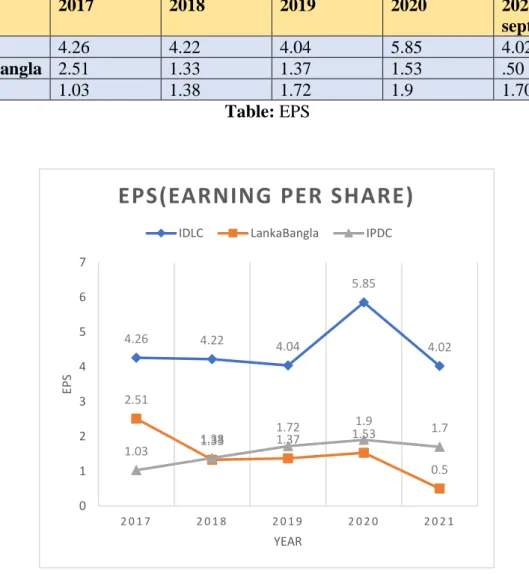

Page | 53 Average total assets: Average total assets = (total assets for the current year) + (total assets for the previous year) / 2. ROA actually shows, using total assets, how much net income the financial institution can generate. ROE actually shows, using total shareholders' equity, how much net income the financial institution can generate.

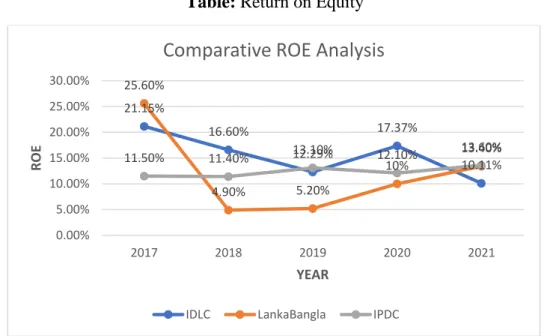

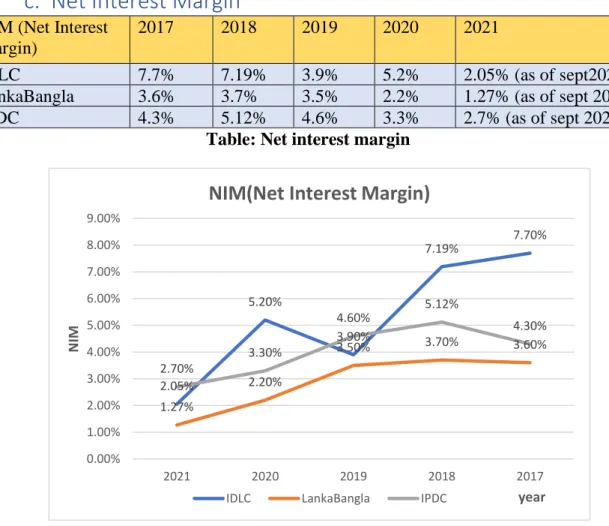

As we can see from the above chart, IDLC's ROE decreased compared to previous year where as LankaBangla and IPDC's ROE is somewhat consistent and actually slightly increased compared to previous year. In this NIM ratio shows that IDLC has always outperformed Lankabangla Finance and IPDC overall. In 2020 LankaBangla was very low but IPDC in 2019 outperformed both IDLC and LankaBangla.

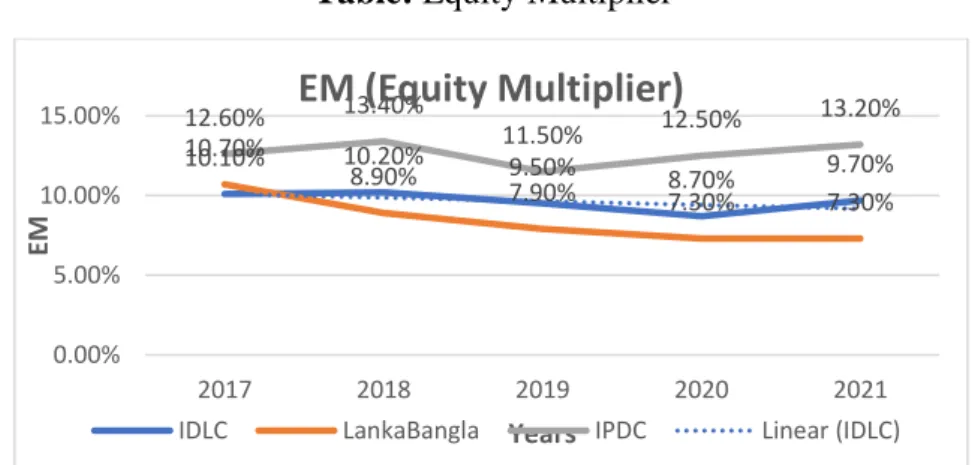

However, it has consistently performed better than LankaBangla in the last 5 years. If we look at the graph, we can see the position of IDLC leading in the first position for most of the years in the last 5 years. Hence the figure shows that in NIM ratio IDLC is better than lankabangl. The equity multiplier reveals how much of the total assets are financed with equity.

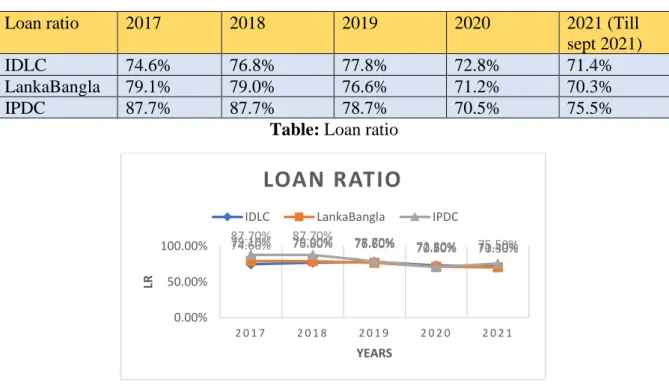

On the other hand, in 2019, IPDC has low EM, but their EM skyrocketed at the end of the year 2020. Among the three companies, IPDC performed better in 2020, but overall, this situation is a bit alarming for three of the company. The three companies, IDLC, IPDC and LankaBangla, are all very good in the financial industry.

However, the report suggests that in some situations, IDLC is slightly better than IPDC and LankaBangla. We recognize the role and great importance of the SME sector in the development of a country's economy. As a result, they are helping many people in rural and urban areas in the development of society.