THE CONTRIBUTION ANALYSIS OF RESTAURANT TAX TOW ARDS LOCAL TAX REVENUES IN DEPOK CITY

SVl\Rlf HIOl\YATIJUAH

THESISsubmitted to Faculty of Economics and Business as Partial Requirement for Acquiring the Bachelor Degree of Economics

Universitas Islam Negeri

SYARIF HIDAYATULLAH JAKARTA

'/(}ww(ec(ge, 'Piet_y, 111le1]rily

By:

Asma Hilyah Al-aulia

107082103912

DEPARTEMENT OF ACCOUNTING INTERNATIONAL CLASS PROGRA!V[ FACULTY OF ECONOMICS AND BUSINESS

SYARIF IDDAYATULLAH STATE ISLAMIC UNIVERSITY

THE CONTRIBUTION ANALYSIS OF RESTAURANT TAX TOWARDS LOCAL

TAX REVENUES IN DEPOK CITY

Undergraduate Thesis

Submitted to Faculty of Economics and Business In Partial Fulfilment of the Requirement.51 For Acquiring Bachelor Degree of Economics

By:

Asma Hilyah Al-aulia 107082103912

... Tgl. : .. YNセ@

..

セNセH_NNセNMセゥ_N QNQZZNNNN@. .

No. for!ul< : ...

0.

|NセGNQZ@..

セ@..

9.?.

Nセ@..

セNQセGMjNoN@.... .

Under Supervision of l;lasifikasi . ... . . ... .

Supervisor 1 Supervisor 2

」エAセ@

-Prof. Dr. Margareth Grferer Choirul Anwar, MBA, MAFIS, CPA

DEPARTEMENT OF ACCOUNTING

INTERNATIONAL CLASS PROGRAJVI

FACULTY OF ECONOMICS AND BUSINESS

SYARIF IDDAYATULLAH STATE ISLAMIC UNIVERSITY

CERTIFICATION OF THESIS EXAM SHEET

Today is Wednesday 14, 2011 has been conducted on student thesis examination:

1. Name

2. Student Number 3. Department

Asma Hilyah Al Aulia 107082103912

Accounting

4. Thesis Title The Contribution Analysis of Restaurant Tax Towards Local

Tax Revenues in Depok City

After careful observation and attention to appearance and capabilities relevant for thesis examination process, it was decided that the above student passed and the thesis was accepted as one of requirements to obtain a Bachelor of Economics in the Faculty of Economics and Business Syarif Hidayatullah State Islamic University Jakarta.

Jakarta, September 14, 2011

Prof. Dr. Abdul Hamid, MS

ID. 195706171985031002 Chairman

Yulianti, SE. M.Si

ID. 198203182011012011

Prof. Dr. Azzam Jassin, MBA

Secretary/

O

GMセQ@

L_

セI@-=---=-Examiner Expert

Prof. Dr. Margareth Gfrerer

ENDORSEMENT SHEET

COMPREHENSIVES EXAMS

Today is Wednesday, May 18, 201

l

A Comprehensive Examination has been conducted on student:1. Name : Asma Hilyah Al-aulia

2. Student Number : 107082103912

3. Department : Accounting (International Program)

4. Thesis Title : "Contribution Analysis of Restaurant Tax towards Local Tax

Revenues in Depok City" ·

After careful observation and attention to appearance and capabilities relevant for comprehensive exam process, it

was

decided that the above sl11dent passed and given the opportunity to thesis as one of the requirements to obtain a Bachelor of Economics in the Paculty of Economics and Business SyarifHidayatullah State Islamic University Jakarta.Jakarta, May 18, 2011

Prof. Dr. Abdul Hamid, MS [). 195706171985031002

Prof. Dr. Margareth Grferer

fahmawati, SE. MM

セipZ@ 197708142006042003

Chairman

)

Signature Below:

Name

Student Number

Faculty

Departement

.,

SHEET STATEMENT

AUTHENTICITY SCIENTIFIC WORKS

: Asma Hilyah Al-aulia

: 107082103912

: Economics and Business

: Accounting (International Program)

Hereby declare that in the writing of thesis, I :

1. Not use other people's ideas without being able to develop and accountable. 2. Do not do plagiarism of other people's work manuscript

3. Do not use other people's work without mentioning the original source or without the owner's permission.

4. Do not manipulate and alsify the data

5. Own work and able to work responsible for this work

If in the future there is a demand from the other side of my work, and have been accountably proved, was indeed found evidence that i have violated the above statement, then i am ready to be sanctioned according to rules applicable in the Faculty of Economics an Business Syarif Hidayatullah State Islamic University Jakarta.

Thus statement truly made with sincerely.

Ciputat, August 12, 2011

/HMA \.llL-fAl-1 alMaセ|Lゥa@

'ersonal Data ullName lick Name セ、、イ・ウウ@ .1obile Number l-mail

)ate of Birth

.telationship Status

leligion

flobby

CURRICULUM VITAE

: Asma Hilyah Al-aulia

: Hilyah

: Margonda Raya Jin. Beringin Rt.04/18 No.01 Depok 16423

: 085780301065

: hilyah _ [email protected]

: Bogor, May 5, 1989

: Female

: Single

: Moslem

: Reading, Watching.

Educational Background

:Iementary

unior High School

:enior High School

Jniversity

Computer User Skill

School

SDITNURUL FIKRI

SMPIT NURUL FIKRI

SMAIT NURUL FIKRI

State Islamic University Syarif Hidayatullah, Jakarta.

Major: International Accounting

• Internet User Skill

Year

1995-2001

2001-2004

2004-2007

.,

Vorking Experience

• Internship in Novie Collection Convection (2010)

• Assistant treasurer ofSDIT Al-Qudwah (2009-2010)

" Foundation treasurer ofSDIT AL-Qudwah (2010-present)

• Internship in Bank oflndonesia (2011)

• The Teacher of Economic in SMAIT Al-Qudwah (2011)

)rganization Experience

" Rohls OSIS SMPIT Nurul Filai

" Panitia Propesa Mahasiswa Jurusan Internasional (2009)

" Mentor Orientation Day (2010)

A.ttributes

• Honest, have a good personality, and friendly

• Good leadership

• Ability to adapt to different environments

• Hard working

• Willing to learn

• Motivational

• Able to work independently

Conference Participations

• Towards Palestinian Statehood and Peace in the Middle East, addressed by President of

Palestine, Mahmoud Abbas (October 23, 2007)

• 'Kenaikan BBM dan Irnplikasinya terhadap Bangsa dan Negara', UIN Syarif

Hidayatullah Jakarta (June 10, 2008)

Introduction to The European Union & European Union's Trade Policy, held by The

Delegation of the European Connnission (2008)

Multiculturalism in the US, addressed by US Embassy representative (2008)

::o-curricular Activities

• Company visit to P.T. Indosat Tbk. Jakarta (2008)

• Study visit to Australian Embassy in Kuningan, Jakarta (2008)

ABSTRACT

Name : Asma Hilyah Al-aulia

Study Program: Major in Accounting (International Program)

Title : The Contribution Analysis of Restaurant Tax towards Local Tax Revenues in Depok City

This research aimed to know how big the contributions of restaurant tax during the

last 5 years (2005-2009), the effectiveness of restaurants tax collection, and the effects

or the impact of restaurant tax towards local tax revenues. Analysis used in this study

is the contribution analysis, effectiveness analysis, and simple linear regression

analysis. From the analysis is obtained results that the contribution of restaurants

taxes in the Depok city to the local tax revenue ranged between 24% - 69% and the

biggest contribution came in November 2005. For the measurement of effectiveness,

the restaurant tax collection has been effective with percentage that exceeds 80%. The

effect of restaurant tax on local tax revenues is quite high at 68.2%, while the

remaining 31.8% are explained by the other variables which are hotel tax,

entertainment tax, advertisement tax, street lighting tax, and parking tax.

ABSTRAK

Nama : Asma Hilyah Al-aulia

Program Studi : Mayor dalam Akuntansi (Program Intemasional)

Judul : Pengaruh Kontribusi Pajak Restoran terhadap Penerimaan Pajak Daerah di Kota Depok

Penelitian ini dilakukan dengan tujuan untuk mengetahui seberapa besar kontribusi pajak restoran selama 5 tahun terakhir (2005-2009), efektifitas pemungutan pajak restoran, dan seberapa besar dampak pajak restoran terhadap penerimaan pajak daerah. Analisis yang digunakan adalah analisis kontribusi, analisis efektifitas, dan analisis regresi linear sederhana. Dari analisis diperoleh basil bahwa kontribusi pajak restoran terhadap penerimaan daerah di Kota Depok berkisar antara 24% - 69%. Kontribusi terbesar ada pada bulan November 2005. Untuk pengukuran efektifitas, pemungutan pajak restoran sudah efektif dengan persentase yang melebihi 80%. Pengaruh pajak restoran terhadap penerimaan pajak daerah cukup tinggi yaitu 68,2%, sedangkan sisanya yaitu 31,8% dijelaskan oleh variabel lain di antaranya adalah pajak hotel, pajak hiburan, pajak reklame, pajak penerangan jalan, dan pajak parkir.

PREFACE

Bismillaahirrahmaanirrahiim

Assalamu'alaikum Wr.Wb

First and foremost, I would like to thank to Allah Subhanahu Wa Ta'ala for

giving me a direction and a couple of good health and mind, so that I could finish this

thesis. This research is entitled "The Contribution Analysis of Restaurant Tax towards

Local Tax Revenues in Depok City". First, this research aims to fulfill the prerequisite

for achieving Bachelor Degree of Economics in Faculty of Economics and Business

of Syarif Hidayatullah State Islamic University (UJN Jakaiia). Second, this research

aims to contribute extensive literature for academic discipline so that can be

developed broadly.

The road to complete this thesis is so long, challenging, and tiresome.

Notwithstanding, supports and prayers have become the main drivers in finishing this

research. In this occasion, the researcher would be very grateful to convey deep

gratitude to:

I. Allah Subhanahu Wa Ta'ala and Mohammed the Prophet. The power of

prayer and spirit to strive like the Prophet is the anchor to struggle finishing

this research.

2. My beloved family- Amang Syafrudin (Father), Smyantie (mother), Mush' ab

Zulkarnaen (brother), and Hafiah Mukhsonah, Umamah Nurul Izzah, and

Aisya Nur Al-iffah (sisters) - who give me the love, compassion, and

everything, Luv you all.

3. Prof. Dr. Abdul Hamid, MS as Dean of Faculty of Business and Economics

SyarifHidayatullah State Islamic University Jakarta.

4. Prof. Dr. Margareth Grferer as academic supervisor I and Choirul Anwar,

MBA, MAFIS, CPA as academic supervisor II, whom their counseling and

direction helps making this research feasible.

7. Mr. Sugih Waluyo, SE who assists academic and administrative needs during

the research phase.

8. My fellow friends who help me up when down and encounter debate during research stage, especially Management and Accounting classmates, Hatta,

Wike, Yassa, Adhya, Ika, Ami, Dewi, Fitra, Ariningtyas, Weldan, Kharisma,

Basyir, Fathhy, Rizki Z., Leo, Surya, Kiki, Isma, Tina, Dwi, Ade, Asrul,

Sharah, Liko, Aga, Andrea, Sukria, Very, Yudi, Zahra, and Adel. I owe you

all.

Last but not least, this research has limitation and shortage in some aspects.

The researcher expects feedback and discussion to better imp:rove the building blocks

of fundamental framework in variables employed in this study. The researcher

encourages students to develop framework and replicate study to enrich green

marketing and sustainability literature. Perhaps, this study can contribute to variation

and diversity of research for Faculty of Economics and Business UIN Syarif

Hidayatullah Jakarta.

Wassalamu'alaikum Wr. Wb.

Jakarta, July 2011

Author

LIST OF TABLE

Table 1.1 The Amount of Restaurants Growth 3

Table 4.1 Descriptive Statistics 48

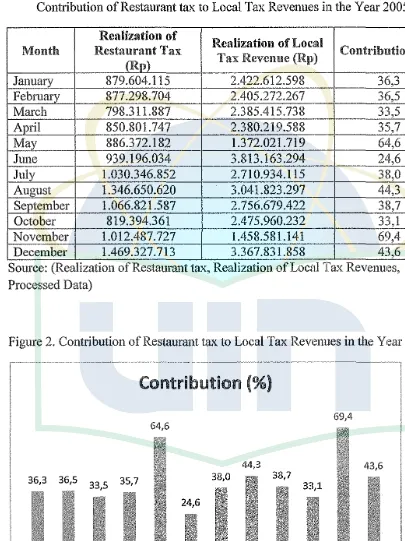

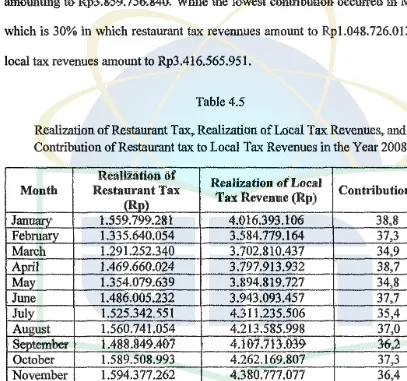

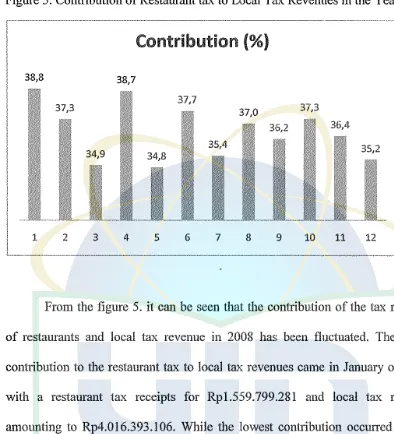

Table 4.2 Contribution of Restaurant Tax to Local Tax Revenues (2005) 50 Table 4.3 Contribution of Restaurant Tax to Local Tax Revenues (2006) 51 Table 4.4 Contribution of Restaurant Tax to Local Tax Revenues (2007) 53 Table 4.5 Contribution of Restaurant Tax to Local Tax Revenues (2008) 54 Table 4.6 Contribution of Restaurant Tax to Local Tax Revenues (2009) 56 Table 4.7 The Effectiveness of Restaurant Tax Collection 65

Table 4.8 R Square Test Table 66

[image:13.595.69.478.119.549.2]LIST OF FIGURES

Figure 1. Logical Framework

Figure 2. Contribution of Restaurant tax to Local tax revenues (2005) Figure 3. Contribution of Restaurant tax to Local tax revenues (2006) Figure 4. Contribution of Restaurant tax to Local tax revenues (2007) Figure 5. Contribution of Restaurant tax to Local tax revenues (2008)

Figure 6. Contribution of Restaurant tax to Local tax revenues (2009) Figure 7. The Overall Contribution of Restaurant Tax to Local Tax

Revenues in the Year 2005-2009

Figure 8. The Contribution of Restaurant tax in June (holiday}, Ramdhan month, and December

Figure 9. The Development of the pecentage of Religious adherents in

DepokCity

35

50

52

53

55

56

58

60

Attachment A

Attachment B

Attachment C

Attachment D

LIST OF ATTACHMENT

Recommendation Paper

Statistics Output

SHEET STATEMENT CURICULUM VITAE

TABLE OF CONTENT

ABSTRACT ... .

ABSTRAK . . . ii

PREF ACE . . . .. . . iii

LIST OF TABLE . . . .. . . .. . .. . . .. . . ... . . . .. . .. . . .. .. .... v

LIST OF FIGURE .. . . .. . . .. . . . .. . . .. . . ... .. . . .. . . .. . . .. . .. . . .. vi

LIST OF ATTACHMENT... vii

TABLE OF CONTENT... viii

CHAPTER I INTRODUCTION A. Background ... 1

B. Problem Formulation ... 5

C. Research Purposes ... ... 5

D. Reserch Benefits ... 5

CHAPTER II LITERATURE REVIEW A. Local Revenue Sources ... 7

B. Taxes... 10

1. Definition of Taxes... 10

2. Functions and Types of Taxes ... 11

3. Tax Collection System... 15

C. Local Taxes... 18

I. Definition of Local Taxes... 18

2. Types of Local Taxes ... 18

D. Restaurant Tax 1. Definition of Restaurant Tax ... 22

2. The Restaurant Tax Object and Subject ... 30

3. Basic of Imposition, Rate, and How to calculate: the tax for Restaurant .. . . .. ... .. . .. .. ... .. . .. .. ... ... .... ... .. . . .. ... . ... .. . .. ... ... ... . .... 31

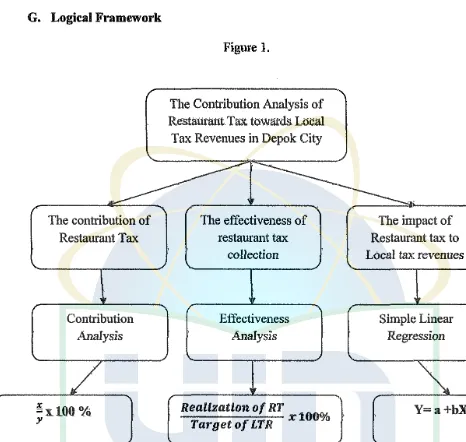

G. Logical Framework... 35

CHAPTER III RESEARCH METHODOLOGY A. Scope of Research... 36

B. Sampling Method... 36

C. Data Collection Method . . . .. . . ... 37

D. Data Analysis Method ... 38

I. Descriptive Analysis ... 38

2. Contribution Analysis ... 38

3. Effectiveness Analysis .... ... .... ... .. . .. ... . .. . . . .. . . .... ... . .. ... .. . . 3 9 4. Simple Linear Regression... 39

E. Operational Variables ... . 40

CHAPTER IV ANALYSIS AND DISCUSSION A. General Description of Research Object... 42

B. Analysis and Discussion . . . ... 48

I. Descriptive Analysis ... 48

2. Contribution Analysis ... 49

3. Effectiveness Analysis ... 64

4. Simple Linear Regression... 66

CHAPTER V CONCLUSION A. Conclusion . . . ... 70

B. Implication . . . .. . . ... 71

C. Recommendations . . . .. . . .. .. . . ... . . .. . . 73

A. Background

CHAPTER I lntroduetioo

Indonesia is a country with abundant natural resources which could be used

for various things. On one side it could be used directly by some people for daily

necessities, but on the other hand natural resources are g€>vemed by the state

through existing legislation. As regulated in the Act of 1945 Article 33 verse (3),

"Earth, water, and natural resources contained therein controlled by the state and

used for the prosperity of the people as much as possible." It also affirmed in

Article 1 verse (2) of Basic Agrarian Law.

Natural resources that are governed by that Act are the potential income

source for the Indonesian g&vernment. Not only the natural wealth that contributes

to state revenues, but also the sources regulated by law and regulations and

monitored by the Ministry of Finance such as taxes, levks, profit state-owned

companies,

customs

and excise, fees, fines and seizure, p1rinting money, lOOI!!f, donations, gifts and grants, and operation of lottery. Out all these sources ofincome supervised and monitored by the Ministry of Finance taxes as a tool of the

national and local fiscal policy play the most important role for the state income. According to the collector, tax is classified into two ty]::ies, namely the central

tax and local tax. Central Tax is a tax levied by the central government and used

Land and Building Tax (PBB), Stamp Duty, and Fees for Acquisition of Rights to

Lands and Buildings (BPHTB). While local taxes are tmtes levied by focal

governments both local, provincial (provincial tax) and local-·level II (tax district)

and

used

to finance each local households. Basically, the central government andlocal g&vernments have their i>wn regulatioos in managing budgets and income

and expenditure of each region.

fu Depok City Regional Regulation No. 05 of2002 Series A of the Hotel Tax, Entertainment Tax, Advertisement Tax, Tax and Parking, said that under article 2,

verse (2) of Act No. 34 of 2002, the type of regional tax district consists of the

Hotel Tax, Restaurant Tax, Entertainment Tax, Advertisement Tax, Road Tax

Information, Tax Collection

Mineral

Group C, and the Parkiug Tax.Tue

tax

mcome of

thecentral and regiOOal govemmt:fifs provide a major

contribution for governments' income. fu the Depok city, \Vest Java, restaurant tax, which is included in localtax,

isone

i>f taxes that contributes ・ュセゥ、・イ。「ャ・@share to the overall local government revenues.

Based on the data from the article "PAD Depok Lebihi Target" (2010), Depok

cify revenues. raise neady o.y

20percent

aoove

file

target Too lligeSi snare of

therevenues come from local taxes, especially the entertainment tax, hotel tax,

parking

tax,

advertisement tax, street lighting tax and restaurant tax. NurMalnnudi Ismail (the Mayor of Depok) revealed, local taxes generated in reach

That data can explain that local taxes have significant iJ11fluence to regional

real income of Depok city, and one of the revenue soorees comes from the

restaurant tax. A restaurant is defined as a place for eating mid/or drink prepared

food and beverages against paying for the food and the service. Typical restaurant

service does not including catering. While the restaurant taJt i,s a tax

on

restaurantservice, but it is not imposed to the catering business service or catering services.

This tax is imposed with the rate of 10% from the base of payment the customer

pay

tc- restaill'fillt.A fund received from the restaurant tax in particular tax sector is certainly

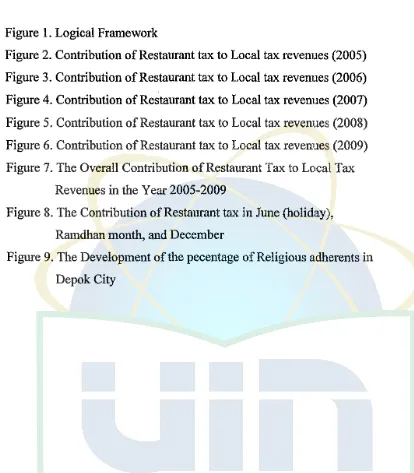

influenced by several factors. The increasing amount of restaurants as well as the

conmlunity's economic grc-wth and wealth are the factc-rs which influence the

[image:20.595.64.467.215.673.2]increasing restaurant tax revenue.

Table 1.1

The Amount c-f restaill'lUlt gmwth in the Year 2005-2009

fhe

Amount

01:

Restaurant

{Unit)pNMセセセセセ[MMセセセセNNNNNュNセL]MMMゥ@

Year

2005

2006

2342007

2552008

272

2009

290

.,

That table shows the amount of restaurant in Depok city increase in every

year. With an increase in the number of restaurant so there is an increase in the

number of taxpayers, who contribute to the revenues of local tax in Depok City.

Based on the research regarding to the contribution analysis of hotel and

restaurant tax in the area of Purworej& conducted by Indra "Widhl Ardhlyansyah (2005), one of the conclusions obtained is the number of hotels and restaurants

have significant positive effect to the revenues in Puworejo. His research can

prove that the increase of the amount of hotel and restaurant will increase the hotel and restaurant tax revenues. While in the research that presented by Moh. Isa

Ashar (2010) on "Restaurant Tax Contribution Towards the Original of Revenue

in the Semarang City Year 2004-2007", highlights that the restaurants tax

revenues affecting the economic condition of a community.

The increase of local tax revenue is also influenced by the performance of

local g{}vemments in achieving the target of restaurant tax revenues. Depok city

government optimizing the reception area of the restaurant tax so that the targets

set can be achieved and can be used for local government household spending as

well as for the regional development of Depok City.

In this research the author will examine the contribution of restaurant tax, its

contribution and its annual increase in comparison to the overall local tax

revenues in last S. (five) years from 2005-2009. This research focuses on to the

In order to approach to the expected results the author conducts the following

research: "THE CON·TRlBUTION· ANALYSIS OF RESTAURANT TAX

TOW

ARDS

LOCAL TAXREVENUES

IN DEPOK CITY".B. Problem Formulation

From the description aoove can be taken a few bask probfoms as folk>ws:

1. How did the restaurant tax develop as a local tax in Depok city area in the

last 5 (:five} years (2005-2009)?

2. Is the restaurant tax collection in Depok city effectively organized?

3. What is the impact of restaurant tax to local tax revenue?

C. Research Purpose

Thi& research i& conducted with the intention to acmeve the :folk>wing

objectives:

1. To analyze and to learn about the contribution and development of

restaurant tax

in

the area ofDepok city in last 5 ye!ll"S.2. To analyze and to learn about the effectiveness of restaurant tax collection

in the area of Depok city.

3. To analyze the impact of restaurant tax on the local tax revenues for the

local government of Depok City.

D. Benefits of research

a. An in-depth understanding of local taxes, especially restaurant tax in

DepokCity.

b. The thesis to finish the study in obtaining Strata 1 (S-1) degree

c. The application of the knowledge obtained during the 8-sernester

study program in aecounting.

2. For the Local Government

As references in making policy and decisions, particularly regarding to

local taxes and the restaurant tax.

3. For the Communities

As an information about local taxes, especially regarding to restaurant tax.

4. For the other Parties

Reference to the development of knowledge and presenting existing

research results in this field, as well as thoughts for studies with similar

CHAPTERH

LlTERATl.JRE REVIEW

In this chapter the author will discuss the theories related to the research

variables. Literature sources are publicatioos on Local Revenues, Taxes, Local

Taxes, and Restaurant Tax.

A. Local Revenue Sources

In an area even the state, the financial factors are the most important and

fundamental to the growth of a region. The government (either central or local

government} has the authority to regulate and optimize the income sources in the respective regions or in the country.

Local revenue includes all receipts of money through the general treasury

account area which adds equity funds that are fluent

in

the local government'sright in 1 (one) year budget that does not need to be transformed by the district.

Budgeted revenues are estimated on a gross basis, which has meaning that the

amount of budgeted revenues should not be reduced by expe:nditures that are used

to generate revenue and I or decreased by the central govemment I other areas in

term of profit sharing.

Sources of regional income according to Law No. 22 of 1999 on Regional

Government consists of:

a. Local tax revenue

Local taxes can be imposed on individuals or entities to areas

without benefit. Local tax collection is conducted by the local

governments with the purpose to finance general government (local

government} expenditures, Their recompensation is net provided

directly, while the payment can be enforced.

b. Local Levy

Levies, hereinafter referred to as retribution, are the regimial levies

as payment for services or certain special permits provided and I or

administered by the regional government for the benefit of the

individual or entity. (Perpajakan, 2009}

LeVies collected

l}y

thelridonesian govemnient are regulated

in theStatute No. 19 year 1997 on Regional Taxes an:d Regional Levy. In

this Act, Levy defined as a payment for services provided by local

governments with the object as follows:

l) Public services, are services provided or administered by the

regional government for the purpose of ゥョエ・イQセウエ@ and pub:lie benefit

and can be enjoyed by the individual or entity.

2) Business services, are services provided by the regional

government wifu the prineiples of the commercial because it

basically can be provided by the private sector.

intended for guidance, regulation, control and supervision of

activities, space utilization, use of naturaJ resources, geooo,

infrastructure, facilities or specific facilities to protect the public

interest and preserving the environment .

2. The results of local g{)<vemment-t>wned enterprisesi and results of the

management of separated wealth regions.

The results of local government-owned enterprises and results of the

management of separated wealth regions is the 。」」エセーエ。ョ」・@ of a form of locally-owned companies and separated wealth management areas,

consisting of income of Regional Water Company, profit of the financial

institution, income of non-bank financial institutions, the other

locally-owned company profits and part of return on iinvestment capital I

investment to third parties.

:J..

Balanced FundA balance Fund is a fund sourced from the revenue budget allocated to

the regions to fund local needs within the ftamework of the

implementation of decentralization. The balances fund has been

established to support the funding of autonomy programs. Equalization

funds include the general allocation fund (DAU}, a special allocation fund

(DAK), and revenue-sharing (DBH).

4. Regional Loan

certain purpose and is incorporated in Regions' income 11\'ith the obligation

to pay back. Short-term loans- provided for trading purposes are net

included.

5. Other areas oflegitirnated income

The sale of region's properties, demand depooit, interest ineome and

commissions, cut or other forms as a result of the sale and I or

procurement of goods and

I

or service provided by the Region are part ofthis kind of income.

B. Taxes

l. Defmition of Taxes

The definition of tax proposed by Prof. Dr. Rochmat Soemitro, SH. in the book entitled Perpajakan: Teori dan Kasus by Siti Resmi (2009):

"Taxes are the dues of the people to the state treasury under the law (which can be enforced) by not getting :reciprocal services (contra) directly demonstrated, and which is used by the state treasury

to

pay for general expenses."The definition was refined later on the same book and has been explored to tl1e

following:

"Tax is the transition of wealth from the people to the state treasury

to pay routine expenditures and the "surplus" was used for public

Prof. Dr P.

J.

A. Andriani formulates:"Tax is a levy to the state (which ean be enfor1:ed} that are owed by the compulsory payment to them under th<: regulations by not getting achievements again, which can be directly appointed, and

the point is to fifll!fice public expenditures

incoooectiort with the

duty of the state to govern

(R.Santoso Brotodihardjo: 2003)"

From those definitions we can say that the tax is a payment rrom the society to

government (local and central government) under the law or regulations and it

is used for government spending.

2. Functions and Types of Taxes

a. The tax has two functions, which are the budgeting functions (the

resources of state finance) and the regulatory func:tion (regulator).

1) The Budgeting Function (resources of state finance)

Taxes have budgeting function, meaning that taxes are the g-0vemment

revenues in order to finance both routim: and development

expenditures. The budgeting function is the primary function of the

tax, the so called fiscal function, namely a function

in

which the tax isused as a tool to incorporate the funds optimally !into the state treasury

under the tax laws and regulations. Inserting an optimal fund of funds

does not mean entering the maximum, or as much as possible, but the

effort not to enter fund is missed, both the taxpayer and the tax object.

The expected amount of tax that

was

supposed to be received by the2) Regulatory Function

Taxes have a regulatory function, meaning that tax M a means to

organize or carry out government policy on nocial and t>.conomic

fields, and achieve certain goals outside the financial sector.

Regulatory

funetion

is aloo called the function set, the tax is a government policy tool to achieve certain goals. Taxes are meant asa government effort to contribute in terms of organizing and where

necesfrary alter the compooition of ineome and wealth in the private

sector.

Some examples of application of tax as a function of the

regulator is:

Higher taxes imposed on luxury goods. Sales. tax on luxury goods

(luxury sales tax)

are

imposed at the time of sale and purchase ofluxury goods. The luxury of good, the hight':r

tax

rate oo that thegoods are more expensive. The taxation is intended for people

not compete to consume luxury goods (reducing the levish

lifestyle}.

Progressive tax rate imposed on income: it is intended for those

who earn high incomes to pay higher tax, resulting in equal

b. The type of tax

Taxes are 」ャ。セゥヲゥ・、@ into- three types, which are ・ャセ、@ by

class/category; nature, and according to collector agency.

I) Based on the category

Whether Taxes are ・ャセゥヲゥ・、@ into- two- types, which are:

(a) Direct Tax: is a tax that must b<: assumed or born by

taxpayers and can not be transferred or charged to another

parties. Tax burden of taxpayers shoold be concerned the

example of direct tax is income tax (P:Ph). Income tax paid

or born directly by the parties who obtained an income.

(I>} Indirect taxes: is a tax that can be shl:fted to others.

(http://www.1040taxservices.com/terminoloqy.htm}

It can be defined as a tax collected by an intermediary (such

as a retail store} from the person WEiO- bears the ultimate

economic burden of the tax (such as the consumer). The

intermediary later files a tax return imd forwards the tax

proceeds to government with the return. In this sense, the

term indirect tax is contrasted with a direct tax which is

collected directly by government from the persons (legal or

natural} on whleh

it

is imposed. Sorne commentators haveargued that "a direct tax is one that cannot

be

shifted by theExample of indirect tax are the Sales Tax, Goods and

Services Tax (GST}, and Value Added Tax (VAT}. VAT is

occurred because there is value added to the original value

of the goods or services.

2) Based on Characteristic

Based on the characteristic taxes can be classified into tw&

parts, which are:

(a} Subjective Tax: The tax impooiiioo considern persooal

circumstances or the taxation ッヲエ。クー。ケセGイウ@ who watched the

state subject. Subjective taxes are taxes that are closely

related to the subject to be taxed, and the amount is heavily

influenced by the conditions of tax subject.

(b) Objective Tax: imposition of tax notice in the form of

objects, things, deeds, or events that gives rise to the

obligation to pay taxes, regardless of personal

circumstances the Subject of Taxation (Taxpayer) as well as

a place to live. Objective taxes are taxes that are elosely

related to the tax object, so it just depends on the amount of

tax to the circumstances the object, and totally ignored and

3) Based on Collector Agency:

Tax based on the collector ageney are classified inti> tw&, which are:

(a) Central Tax: the tax levied by the central government and

used to-finanee the country in general households.

(b) Local Taxes: the tax levied by local governments both local,

provincial (provincial tax) and local-level II (tax district) and

used to-fmance local households.

3. Tax Collection System

The. applied tax collecting systems are the. following: a. Official Assessment System

Official assessment tax system is a system that gave tax officials

authority to determine the respective amount of tax payable each year in

accordance with applicable taxation laws and regulations. In this system,

initiatives and activities to- calculate and collect taxes is entirely in the

hands of the tax authority. Thus, the success of the implementation of tax

collection depends largely on taxation officials (there are a dominant role

in the apparatus of taxation}.

b. Self Assessment System

Self-assessment is· a tax collection system which authorizes taxpayers

in determining their tax payable each year in accordance with applicable

are considered to be capable of calculating taxes, ar·e able to understand

the

tax laws in fOfce, and have high integrity, well aware ofthe

impor!anceof paying taxes.

The collection procedure for the self-assessme11t tax system implicates

that the

public has the knt>wledge and discipline to pay taxes,the

existenceof legal certainty, the calculation comprehensively explained and the tax

as such is considered as fair and equitable. Rimsky K. Judisseno

(Perpajakan, 2009} says

that the

self-assessment system applied providesgreater trust for the community to increase awareness and community

participation in depositing the tax. Consequently,, people should be

familial- with

the

procedure fOf tax calculation and the related t®ulations of tax fulfillment.

The characteristics of self-assessment system are as follows:

- Taxpayer (can be helped by a tax consultant} conducts an active role

in implementing the tax liability.

Taxpayer as a party is fully responsible for the o'\1m taxation liabilities.

- The government, in this case

the

tax agency, conduct training,research, and supervise the implementation of tax liabilities for the

taxpayers, through tax audits and the imposition of sanctions

violations in

the

field oftax

in accO£daneewith

a1iplieable regulations-.Khususnya

Jakarta

Pusat" shows the principle of the self-assessmentsystem of determining the amount of tax payabk that is entrusted to the

respective taxpayers through Notification Letter (SPT). Since the

implementation of the self-assessment system in the tax laws of Indonesia,

lndooesian citizens have received an active role in fulfilling tax liability

(tax compliance). Transparency and implementation of law enforcement

stays with the tax collection offices and the fiscal officers. However, the

success of the implementation of tax collection depends largely on

taxpayers' behaviors (Taxpayers' role).

From those explanations this system gives the authority to the

taxpayer itself to calculate

and

report the tax by themselves, but they haveto be aware and discipline to pay the tax as their compliance towards

taxation law.

c. Withholding System

With holding system is a tax collection system that gives authority to

a third party designated to determine the amount of tax payable by

taxpayers in accordance with applicable taxation laws and regulations. The

appt>intment of a third

party

is done according ti> the tax legislation, presidential decisions, and other regulations to cut and collect taxes,deposit, and be accountable by means of taxation that are available.

C. Local Tues

In regions local governments themselves lead the regional economic growth

by considering the different aspects of supporting the local economic growth.

Local taxes soow considerable revenue potential. Local tax revenues used to

finance expenditure and regional development.

In 1997, the Government finally issued Law no. 18 of 1997 as amended by

Statute No. 34 of 2000 on Local Taxes and Retribution.

1. Definition of Local Taxes

Local taxes are taxes collected by local gov<:rnments both local,

provincial (provincial tax) and local-level II (taK district) and used to

finance the local and provincial households.

The local taxes are classified into two types: Provincial Taxes and

Dismct taxes.

LocalTaxesare regulated

iliSmtiil:e No.34 year

2000Regarding the Amendment Act No. 18 of 1997 on Local Taxes and

Retribution are as follows:

"Local taxes, then referred to as tax, is a mandatory contribution by the individual or regional heads entity without directly well-balanced benefit, which can be imposed by statutory laws and regulations in force,

which

is used to finance the implementation of local government and regional development."2. Types of Local taxes

a. Local Taxes Level I

1) Motor Vehicle Tax and the Vehicle oo the Water

Motor Vehicle and Vehicles in Over Water Taxes are taxes on

the ownership and I or control of motor v1ehicles and vehicles on

the water. Motor vehicles are all wheele<l vehicles with two- or more its connection used in all types of road, and driven by the

motor in the fonn of technical equipment or other equipment that

serves to change a particular energy resource to power the

movement of motor vehicles in question, including the tools heavy

and large equipment moving. Vehicles on the water are an vehicles

driven by a motor in the form of エ・」ィョゥLセ。ャ@ equipment or other

equipment serves to change a particular energy resource to power

the movement of motor vehicles in question are used on the water.

The tax rate of this tax is 5 percent and the bases of motor vehicle

tax is the sale value of Motor vehicles.

2} Duty Beyond the Name of Motor Vehicles and vehicle oo the

Water

This is a tax on the transfer of ownership of motor vehicles and

vehicles oo the water as a result of i'l>ll>-'party agreements or

unilateral actions or circumstances that occur because the: sale and

purchase, exchange, gift, inheritance, or entry into the business

Rate Tax on Motor Vehicles Name on the first delivery is set

at l O. percent.

Rate Tax on Motor Vehicles Names for second and subsequent

submission is set at I percent.

- Rate Tax on Motor Vehicles upon submission of names

because of the legacy established by 0.1 ーQセイ」・ョエN@ 3) Motor Vehicle Fuel Tax

Motor Vehicle Fuel Tax is a tax on fuel which if< provided or deemed to be used for motor vehicles including vehicle fuel used

in the Upper Air. Basic Imposition of this tax is the Value of the

Motor Vehicle Fuel Sales and the tarif is S percent.

4) Tax Collection and Utilization of Ground Water and Surface Water

By the name of Underground Water Use Tax and surface

water, taxes levied on utilization of groundwater and surface water

in region. Tax rate of this

tax

jg. 20. percent and the taxation basis isthe value of the acquisition of water.

b. Local Taxes Level II

l) Hotel tax

Hotel tax is a tax on hotel service. The hotel tax rate is imposed

by multiplying the rate which is IO percent with hotel tax base

which i& the payment amount made to- hotel. 2) Restaurant tax

Restaurant tax is a tax on restaurant se:rvice, but it is not

imposed to the catering bu&iness service or catering services. The

rate of restaurant tax is set by l 0 percent. The base amount of restaurant tax payable is calculated by mul1iplying the tax rate

restaurants (ten percent} and tax bases (the amount of payments

made to the restaurant).

3) Entertainment tax

Entertainment tax is a tax of organizing entertainment

Entertainment Tax Rates at a maximum of 35 percent and

Entertainment tax bases is the number of payment or that should be

paid to watch and

I

or enje-ythe

entertainment.4) Advertisement tax

Advertisement tax is a tax on billboards administration.

Advertisement Tax Rates at a maximum of 25· percent and the

basis of imposition is the rental value of adveJrtisement.

5) Street Lighting tax

Street Ligthing i& a

tax

on receiptt>f

money that use electricityfrom PT PLN or anything that uses jenset (in babasa). Tax Rates

6) Tax Collection and Processing of Mineral Group C

Tax eoUeetioo and processing of mineral group C is a tax on

activity of collecting mineral category C which consists of the

chemical elements, minerals, seeds and all kinds of rock, coal and

peat which is a natural deposits other than oiil and gas. Tax

Rate

Collection and Processing of Mineral Group Cat a maximum of20

percent and tax base of Collecting and Minc:ral Processing Group C

is the value of sales results of mineral exploitation group C.

7) Parking tax

Parking tax is a tax imposed upon individuals or bodies

organizing the Jlfilking lot outside the body l>y the individual or

entity, provided by both related to the principal business and

provided as a business, including the provision of day care vehicles

and garages thai charge a fee. Parking tax rate at maximum

20

percent and tax base of parking tax is the payment amount has to

be paid to use the parking lot.

D. Restaurant tax

1.

Definition

of Restaurant TaxRestaurant is a place for consuming prepared food and/or drinks against

payment. Catering is not including. The resta1111ar.t tax is the tax on

.,

According. to source of

www .

N「Mセ。」NゥョOウ、・N⦅「ッッャイO「ウ」⦅「・カ・イ。ァ・Nー、ヲ⦅@Restaurant is a retail establislnnent that serves prepared food to customers.

Service is generally for eating at the premises, though the term has been ·

used to include take-out establishments and food delivery services. The term

covers many types of venues and a diversity of styles of cuisine and service.

Bmh

defifiltions. explliili

thatrestaurant is a place prepares fOOd and

beverage for customers with a fee and exclude the catering business.

With the existence of Law No. 18 year 1997

as

amended by Law No.34, year 2000, Local oo.vemrnent

is.autoomed

to levy

taXeson restaurant

food and beverages served in hotels, restaurants, re&iaurants, shops, etc.

Implementation was governed by law.

a} FOOd

andBeverage

Tax

Food means any and all edible refreshments or nourishment, liquid

or otherwise, including alcoholic beverages, pUl'chased in or fmm a restaurant or from a caterer, except snack food. \Vhile beverage means

any potable liquid, especially one other than water, as tea, coffee, beer,

or milk.

All businesses that come under the defini1tion of res1aurant or

caterer must coUect this tax from their cllStomers-when the charge :fur the food and beverages is paid. The tax is to be paid whether the

in any way suggest or indicate that they will relieve the customer of

payment of part or all of this tax. The customer alone must pay the

total tax amount due. (www.roanokeciviccenter.com)

b) Classification of restaurant

In the same resource of www.b-u.ac.inlsde_bo<'>klbsc_beverage.pdj

there are three classification ofrestaurants.

a. Quick Service - Also known as fast-food restaurants. They offer

limited menus that are pFepared quickly. Tiiey usually have

drive-thru windows and take-out. They may also be selfservice outfits. b. Mid scale - They offer full meals at a medhun price that customers

perceive as "good value." They can be of full service, buffets or limited service with customers ordering at th€: counter and having

their food brought to them or self service.

c. Upacale - Offer high quality euisine at a high end pFice. They offer

full service and have a high quality of 。ュ「ゥ・ョ」セN@

c) The type of Restaurant

Restaurants are often specialized in certain types of food or

present a certain unifying, and often entertaining, theme. For example,

there are seafood restaurants, vegetarian restaurants or ethnic

restaurants. Generally spealcing, restaurants selling "local" food are

SYAlllF Hl!lAYA'!llLIJIH

origin are called accordingly, for example, a Chinese restaurant and a

French restaurant. (www.b-u.ac. in!sde _ booklbsc _ b'f!verage.pdj}

a. Cafeterias

A cafeteria is a restaurant serving mostly ready cooked food

arranged behind a food-serving counter. There is little m· JM> table

service. Typically, a patron takes a tray and pushes it along a track

in front of the counter. Depending on the establishment, servings

may be ordered ftom attendants, selected as ready-made portioos

already on plates, or self-serve of food of their own choice. In

some establishments, a few items such as ste:aks may be ordered

specially prepared rare, medium and well don;;: ftom the attendants.

The patron waits for those items to be prepared or is given a

number and they are brought to the table. Beverages may be filled

ftom selfserviee dispensers or ordered from tlile attendants. At the end of the line a cashier rings up the purchases. At some

self-service cafeterias, purchases are priced by weight, rather than by

individual item. (www.b-u.ac. inlsde _ booklbse _beverage.pdj}

b. Fast-food Restaurant

Fast-food restaurants emphasize on the spe<:d of service and low

coots dominate (}Ver an other eoosideratioo. ... A COOJ:m-On feature (}f

newer fastfood restaurants that distinguishes them from traditional

to eat the food directly from the disposable container it was served

in using ilieir finger&.

There are various types of fast-food restaurant:

one collects food from a counter and pays, then sits down and starts eating (as in a self-service restaurant or cafeteria} one collects ready portions

one serves oneself from containers one is served at ilie countel'

a special procedure is that one first pays at the cash desk, collects a coupon and ilien goes to the fo<>d counter, where one gets the food in exchange for the coupon.

one orders at the counter; after preparation the food is brought

to

one's table; paying may be on ordering or after eating. a drive-through is a type of fast-food restaurant without seating; diners receive their food in their cars and drive away to eatc. Casual Restaurant

[image:43.595.92.457.174.664.2]d. Fast Casual-Dining Restaurants

A fast casual restaurant is similar to a fast-food restaurant in

that it does not offer full table service, but promises a somewhat

higher quality of food and atmosphere. Av€irage prices charged are

higher than fast-food prices and non-disposable plates and cutlery

are usually offered. This category is a growing concept that fills the

space between fast food and casual dining.

e. Other Restaurants

Most of these establishments can be considered subtypes of fast

casual-dining restaurants or casual-dining restaurants.

1) Cafe

Cafes and coffee shops are informal restauran1s offering a range of

hot meals and made-to-order sandwiches. Caftis offer table service.

Many cafes are open for breakfast and serve full hot breakfasts. In

some areas, cafes offer outdoor seating.

2) Coffeehouse

Coffeehouses are casual restaurants without table service that

emphasize coffee and other beverages; typically a limited selectioo

of cold foods such as pastries and perhaps sandwiches are offered

as well. Their distinguishing feature is that they allow patrons to

relax and socialize on their premises for long periods of

time

3) Pub

A pub (short for public house) is a bar

that

serves simple food fare.Traditionally, pubs were primarily drinking establislnnents with

food in a decidedly secondary position, whereas the modem pub

business relies on food as wen, fo. the point where gastropubs are known for their high-quality pub food. A typical pub has a large

selection of beers and ales on tap.

4) Bistrooand Brasserie

A brasserie is a cafe doubling as a restaurant and serving single

dishes and other meals in a relaxed setting. A bistro is a familiar

name for a cafe serving moderately priced simple meals in an

unpretentious setting. Especially in Paris, bistros have become

increasingly popular with tourists. When used in English, the term

bistro- usually indicates either a fast casuahlinmg restaurant with a

European-influence-0 menu of a cafe with a larger menu of food.

5) Family Style

"Family style restaurants'' are restaurants that have a fixed menu

and fixed price, usually with diners seated at a communal table

such as on bench seats. More common in the 19th and early 20th

century, they can still be found in rural communities, or as theme

restaurants, or in vacation lodges. There is ino menu to choose

crabhouses, German-style beer halls, BBQ restaurants, hunting

lodge&, e te.

Some

normal restaurantswm

miK element& of familystyle, such as a table salad or bread bowl that is included as part of

the meal.

6) BYO Restaurant

BYO Restaurant are restaurants and bistros which do not have a

liquor license.

7} Delieateooen& Restaurant

Restaurants offering foods intended for immediate consumption.

The main product line is normally luncheon meats and cheeses.

They may offer sandwiches, soup&, and salad& a& wen. Most food&

are precooked prior to delivery. Preparation of food products is

generally simple and only involves one or two steps.

S} Ethnie Restaurants

They range from quick-service to upscale. Their menus usually

include ethnic dishes and I or authentic ・エィョゥQセ@ foods. Known in a

particular multicultural cuisine

not

specifically accommodatedby

any other listed categories. Example: Asian Cuisine, Chinese

cuisine, Indian Cuisine, American Cuisine etc.

9} Destination Restaurants

A destination restaurant is one that has a strong enough appeal to

Guide 3-star restaurant in Europe, which according to the restaurant

guides is "worthy of a j-Oumey".

(www.b-u.ac.inlsde_book!bsc_beverage.pdf)

In Depok city, restaurant tax is collected from restaurants, cafe, and bistro

(rurnah

makan}. Those re9'taurant9' are classified based on the place,the

price offoods and beverages, and the size of restaurants. the bigest re:venues of restaurant

tax come from the restaurants compared with cafe and bistros.

2. The Restaurant tax Object and Subject

a. Restaurant tax object

Restaurant tax is based on the service provision of a restaurant against

payment.

The catering business service or cate1ring services are ootobject of the restaurant tax.

b. Taxpayers as subject of the Tax Restaurants

Interpretation of tax subjects are not given in Article I of Law no. 6 of

198>,

as

amended 1Jy Act no. 17 of 2000. The su1Jject of mxes. is. a

person or an entity which meets the requirements of the subject, that is

residing or domiciled in Indonesia. (Asaz dan Dasar Peqiajakan 1,

2004) .

Taxpayers according to Article I letter a General Provisions Taxation

is a person or

body

ooder fue provisions of the Act in question isIn the book Taxation: Theory and Case (2009), defines a tax.payer is

an individual or entity, including taxpayers, and tax colketors, who.

have rights and tax obligations in accordance with :the provisions of tax

legislation.

The subject o-f restaurants tax hf an individual or an entity that made payments to the restaurant and the owner of restaurant is the

intennediate between the customers (individual or entity and the tax

office).

J. &sk

of me iniposioon,

rate,

andoow to

ca!Cilliite

tne rax for restaurant

a. Basic of Restaurant Tax

Restaurant tax base is the total payments made by the customer to the

restaurant.

b. Restaurant Tax Rates

Restaurant tax rate is set 10% (Ten Percent).

c. How to calculate the tax for restaurant

The

baseamount

ofresmu.tant rax payable

iscakulated by multiplying

the tax rate restaurants (ten percent) and tax bases (the amount of

payments made

to

the restlurant).4. Collection procedures

a. Taxes levied on the basis of determining their own mayors or paid

by the taxpayer.

b. Taxpayers comply with tax obligations are imposed by using

SKPD (in Bahasa) or Local Tax Assessment Letter, or other

equivalen*

document.

c. Taxpayers meet their own taxes using SPTPD (in Bahasa) or Local

Tax Notice, SKPDKB (in Bahasa) or Local Tax Assessment Letter

of Pay Less, and or SKPDKBT (in Bahasa} or Local Tax

Assessment Letter that of Additional Pay Less.

E. Effectiveness Teory

Effectiveness is one of the achievements to be achieved by an

organization.

To obtain the theoreti<::iil

・ヲヲセカ・ョ・ウウ@ ofresearcheu

Ciifiuse

the.concepts in management theory and organizational theory, especially that

related to effectiveness. Effectiveness can

oot

be equated ·with efficiency. Sinceboth have different meanings, although in different word usage efficiency

closely with effectiveness. Efficiency implies a comparison between costs and

outcomes, while effectiveness is directly linked to the a£hievement of goals.

Aunosooprapto (2002:B9} srates Effectiveness is doing

the·riglit

lliilig,

while the efficiency is doing things right, or effectiveness is the extent to which

Sondang P. Siagian (2001: 24) pprovides definition as follows:

"Effectiveness is the utilization of resowrces, facilities and infrastructure within a certain amount of conscious pre-determined

to proouce some go.Ods for services activities mat

iilii. Tue effectiveness demonstrates success in terms of targets whether achieved or not. If the activity closer to the 1target, means higher effectiveness."Hidayat (1986) defines the effectiveness as:

"a measure that states how far targets (quantity, quality, and time}

is achieved. The greater percentage of targets achieved, the higher

its effectiveness."

F. Previous Research

The author conducts this research with the 」ッュー。イゥウッョZセ@ of previous. studies

such as:

l. Restaurant Tax Contribution Towards The Original of Revenue in the

Semarang City year 2004-2007

The problem in this thesis is the contributions of the Restaurant tax

to the revenues of the city of Semarang in 2004 to 2007. The purpose of

this study was to find out how much the restaurant tax contributes to the

overall revenues of the household budget of the city of Semarang. In fact

the Restaurant Tax Contribution to Revenue in Semarang year 2004-2007

was in 2004 of 13.05%, in 2005 increased by 0.02% to 13.07% in 2005,

high and low amount of Restaurants tax contribution are affected by the

condition economic community and the factors of meals or snacks; types in

the city of Semarang.

2. Contribution Analysis of Hotel and Restaurant Tax to the Original Area

Revenue ofPurworej{}District Year 1989-2003-(lndra, 2005}

The purpose of this study was to analyze the factors that affected the

contribution of the hotel and restaurant taxes as Revernues in the District of

Pmworej{}.

The

data used are secondary data that consisted of tw&dependent variables and independent variables. Dept:ndent variable used

was the realization of the hotel and restaurant tax, while the independent

variables used were the number of hotels and restaurants, the Inflation

Rate, the Number of tourists Archipelago. The data was processed using

EV.IBWS program. The conclusion of that research was the number of

hotels and restaurants has significant positive effects, to the realization of

hotel and restaurant tax. The positive effect of inflation rate was not

considered as significant. The same was due for the number of tourists.

While the number of tourist does not have significant affetc, because the

amount of ups and downs of Tourists visiting tlm attraction does not

support an increase in hotel and restaurants セ@ revenues. This may imply

that increased domestic tourists are not necessarily increase the hotel and

restaurants tax revenues because tourists do not stay at the hotel.

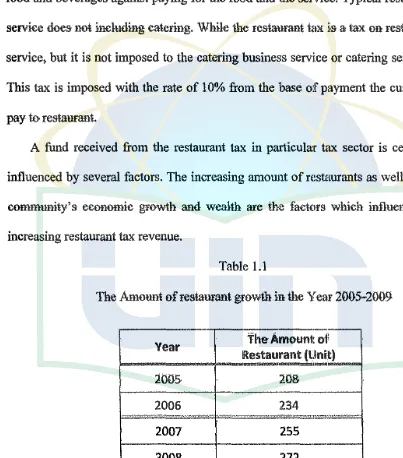

G. Logical Framework

"

The contribution of Restaurant Tax

•

Contribution Analysis

/

Sx_lQO o/n

[image:52.595.41.507.99.541.2]y

Figure 1.

The Contribution Analysis of Restaurant Trot towards Local Tax Revenues in Depok City

-

-'

The effectiveness of restaurant tax

collection

Effectiveness Analysis

Realtzatton of RT .rtOO%

Target of LTR

,

-[The impact of Restaurant tax to Local tax revenues

(

Simple Linear · Regression

ᄋセMNMMMMMMMMM

A. Scope of Research

CHAPTER III

RESEARCH METHODOLOGY

This- study discuss-es- about the contribution and the development of

restaurant tax in Depok city towards Local tax イ・カ・ョオゥセL@ then analyze the

influence of that contribution to the overall local

tax

revenues. The data is-obtained from the Local Government (DISPENDA) ofDepok City.B. Sampling Method

Tue author refers. to secondary data such as the dala •i>f the restaurant tax

target, the restaurant tax realization, and the overall of local tax revenues of

Depok City. Besides the contribution and the development •i>f restaurant tax, the

author will examine the effectiveness of restaurant tax revenues, the author will

analyze whether the enrollment of restaurant tax has been collected effectively or

not from year to year. Tue data consists- of data in

5

years which is in 20.'}5-2009C. Data Collection Methods

Methods of data collection ha& been conducted in two way:;.: 1. Method of literature

Literature method is a method of collecting data from

books,

articles, and journals associated with this research. Moreover, the authors also addinformation from the Internet to find the data that support this research.

2. Interview Method

One metnoo of dam collecoon

iS byinterviews to get infomwioo

byasking questions directly to respondents. The interviews are one of the

most important part!! of each survey, with no inte1•vfows, researchers will

lose information that can only be obtained by asking directly to the

respondent. (Masri Sand Sofian Effendi, 1995: 192).

The interview is a conversation with a purpose. The conversation was

condiiCted

bytwo parties,

iiiimelytlie

interviewer

wno

aoo.

questM>ns. and

interviewee that provide answers to these questions. (Lexy J, 2006: 186).

This method is conducted to obtain the primary data which is the data

D. Data Analysis Method

1. Descriptive Analysis

Descriptive analysis is used to provide a general overview of the data, so it

can be seen the maximum, minimum, mean, and standard deviation of

restaurant tax and local tax revenues ofDepok City.

2. Contribution Analysis.

restaurant tax contributes to Local Tax revenues of Depok City. The

formula of calculating the eontribution of restaurants 1:ax and the Local tax

revenue is as follows:

x

Contrtbutton

= -

x

100 %y

Syafri Daud (Abdul Halim, 2005: 163)

Description:

x = the realization ofrestauranti; tax revenue y = the realization of local tax revenues

With this analysis we will know how much the restaurants tax

contributes to the overall of local tax 1·evenues in Depok

city.

Byconducting this analysis in a monthy basis during the period of five years,

.,

3. Effectiveness Analysis

The

effectiveness analysis is used

to. obtain the output of the

effectiveness of restaurant

tax

collection in Depok City. The formulaof effectiveness is as follows: (Nick Devas, 1989 : 146)

ff

realization of restaurants t·ax revenue

E

ectiveness

=

x

100 %target of restaurant tax revenue

Effectiveness criteria:

--No '·

Percentaire Interval ·Criteria1

00,00% - 20,00% Very Low--.2 ____

.21,0..0.% -

4.Q,00% .L.9WMセBM , .. c =

3

41,00%- 60,00% Sufficient4

61,00%-80% Good5 80%above High

Source: Arv1an Triantoro (2003: 48)

If the result is between 00.00% and 20.00%,, it means that the

effectivenes1:1 is veny

low.Where the result is between 21.00o/., and 40'%·,

itmeans that the effectiveness is low. The effectiveness is called worth or

good enough if the result is between 41.00% and 60%. If the result is

between 6l.OO-% and 80-.00%, it means

thatthe effectiveness is good. The

effectiveness is called high if the result is 80% above.

4. Simple Linear Regression Analysis

.,

between a dependent variable and one or more independent variables. More specifically, regression analysis helps-

one

understand how the typical value of the dependent variable changes when any one of the independent variables is varied, while the other independent variables are held fixed. In this study the author uses the simple linear regression in which the equation is:Description

Y = Local tax revenues X = Restaurant tax a = intercept

b = regression coefficient

Y=a+bX.

In this study the author uses a simple linear regression in order to determine the effect or the impact of restaurant tax (X) to the local tax revenue (Y) in the Depok city.

E. Operational Variable

This research consists o.f two variabcls: 1. The contribution of restaurant tax revenue

.,

show the contribution of restaurant tax to local tax revenues within the

respective iline ftame of 60 months-(12 months x

5

years-).2. The effectiveness ofrestaurant tax collection

This variable will measure the effectiveness of the restaurant tax

collection, which is calculated by dividing

the

realizajioo of restaurant taxrevenues and the target (badget) oflocal tax revenues.

3. Restaurant Tax

This variable is an independent variables which

the

60 months-data

will be regressed to local tax revenues to analyze how big the influence ofthix

taxlocal tax revenues.

4. Local Tax Revenue

This- variable is a dependent vruiable which wiiU be analyzed by

independent variable and to analyze how big this variable influenced by

CHAPTER IV

ANALYSIS AND DISCUSSION

A. General Description of Research Object l. The overview of Depok City

lllN SVARIF HlDAYATUU.llH

Depok City, is a city in West Java province, Indonesia. The city is located in

south

ofJakarla,

namelybetween Jakaria-'Bogor.

The Depokword itself comes from the word in Sundanese means hermitage or pla