AUDITOR PERCEPTIONS ABOUT THE USEFULNESS OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

IMPLEMENTATION IN THE COMPANIES

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

Training in partial fulfilment of the requirements for the Degree of Strata 1

ANDIKA (103082029447)

AUDITOR PERCEPTIONS ABOUT THE USEFULNES OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

Training in partial fulfilment of the requirements for the Degree of Strata 1

Made By:

Andika NIM: 103082029447

Under Supervision of:

Supervisor I Supervisor II

Dr. Khomsiyah, Ak. MM Drs. Abdul Hamid Cebba, Ak. MBA NIP: 132 055 044

AUDITOR PERCEPTIONS ABOUT THE USEFULNES OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

IMPLEMENTATION IN THE COMPANIES

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

Andika NIM: 103082029447

Research Test Team

Dr. Khomsiyah, Ak. MM Drs. Abdul Hamid Cebba, Ak. MBA NIP: 132.055.044

Drs. Rahmawati, SE., MM

NIP: 150.377.441

Today, Thursday, July 19th, 2008, has been done final test on behalf of Andika NIM: 103082029447, with research title "AUDITOR PERCEPTIONS ABOUT THE USEFULNESS OF CONTROL SELF-ASSESSMENT TO AUDIT AND IT'S IMPLEMENTATION IN THE COMPANIES". Pays attention to the student during test takes place, hence this research paper have been acceptable as one of condition to obtain college degree of Economic for Accounting program at Faculty of Economic and Social Science State Islamic University (UIN) Syarif Hidayatullah Jakarta.

Jakarta, July 19th, 2008

Drs. Yessi Fitri, Ak, M.Si Drs. Rahmawati, M.Si

Leader Secretary

Dr. Abdul Hamid, MS

Expert Examiner

AUDITOR PERCEPTIONS ABOUT THE USEFULNESS OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

IMPLEMENTATION IN THE COMPANIES

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

ANDIKA (103082029447)

AUDITOR PERCEPTIONS ABOUT THE USEFULNES OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

IMPLEMENTATION IN THE COMPANIES

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

Training in partial fulfilment of the requirements for the Degree of Strata 1

Made By:

Andika NIM: 103082029447

Under Supervision of:

Supervisor I Supervisor II

AUDITOR PERCEPTIONS ABOUT THE USEFULNES OF

CONTROL SELF-ASSESSMENT TO AUDIT AND IT’S

IMPLEMENTATION IN THE COMPANIES

RESEARCH PAPER

Presented to the Faculty of Economic and Social Science

Training in partial fulfilment of the requirements for the Degree of Strata 1

Andika NIM: 103082029447

Research Test Team

Dr. Khomsiyah, Ak. MM Drs. Abdul Hamid Cebba, Ak. MBA NIP: 132.055.044

Drs. Rahmawati, SE., MM

Today, Thursday, July 19th, 2008, has been done final test on behalf of Andika NIM: 103082029447, with research title "AUDITOR PERCEPTIONS ABOUT THE USEFULNESS OF CONTROL SELF-ASSESSMENT TO AUDIT AND IT'S IMPLEMENTATION IN THE COMPANIES". Pays attention to the student during test takes place, hence this research paper have been acceptable as one of condition to obtain college degree of Economic for Accounting program at Faculty of Economic and Social Science State Islamic University (UIN) Syarif Hidayatullah Jakarta.

Jakarta, July 19th, 2008

Comprehensive Test Team

Drs. Yessi Fitri, Ak, M.Si Drs. Rahmawati, M.Si

Leader Secretary

Dr. Abdul Hamid, MS

Expert Examiner

TABLE OF CONTENTS

COVER………...

LEGALIZATION LETTER………...………..

ABSTRACT…..……….……… ii

ACKNOWLEDGEMENT……… iii

TABLE OF CONTENTS……….…..….………. v

LIST OF TABLES AND CHARTS ……….. vii

CHAPTER 1 INTRODUCTION……….. 1

A. Background………. 1

B. Research Question………... 4

C. Purpose and Contribution of the Study………... 5

CHAPTER 2 LITERATURE REVIEW………... 6

C. Theoretical Framework and Hypothesis………. 16

CHAPTER 3 RESEARCH DESIGN…...……… 17

A. Scope of the study and Sampling Method……….. 17

B. Variables……….. 18

C. Data Collection Method………... 19

D. Analyze Method……….. 19

CHAPTER 4 RESEARCH FINDINGS AND ANALYSIS A. Descriptive of Data………. 22

1. Descriptive Statistics…………..……… 22

2. Data Quality and Normality Test...……… 24

B. Analysis of Data….………. 25

1. Difference Test Analysis with Paired Samples Test………... 25

C. Discussion of Study………. 27

RECOMMENDATIONS ………. 30

A. Conclusion…………..……… 30

B. Limitations………..……… 31

C. Recommendations……….………. 31

BIBLIOGRAPHY………..………….….…….………… 33

APPENDICES………... x

1. SP SS Output………... x

2. Qu estionnaires Tabulation……….. x

3. Res pondent Data………. x

4. Res earch Questionnaires………. x

5. Int ernal Control Self-assessment Form (FTA Grantees)……… x

LIST OF TABLES AND CHARTS

Tables No Tables Title Pages

1.1 Accounting Crime in the US 2 1.2 Financial Case in Indonesia 2 4.1 Respondents of the Study 22 4.2 Auditor Experience 23 4.3 Descriptive Variables 23 4.4 Difference Test 26 4.5 Respondent Answer in Percentage Value 27

Charts No Charts Title Pages

CHAPTER 1 INTRODUCTION

A. Background

In the year of 1990, began to see another forcing power and much greater that insist auditor to develop their approaches and their skill. This is the time where companies begin move backwardly in the extent capacity, downsizing of the company program to stated total quality management, re-engineering, big investment in technological solution, and in many case, happen a disappearing of timely based control process.

Era after the Watergate scandal at 1970 in US, many big multinational companies been examined, to decide whether they had illegally transferring fund to many political parties (Sawyer’s, 2003). In that case revealed, many of the companies had a secret bank account, used for transferring fund illegally to political parties and governmental employees. This scandal opened a black side of the big business world.

After the Watergate era, in 1987, Gulf Canada designing new process what they called, Control self-assessment (CSA) process. Team consists of employees and manager, gathered in one day meeting. Senior staff of internal auditor facilitates this meeting. In 1992, when COSO was found, Gulf Canada Control self-assessment (CSA) process routinely revealing problems in full scope and its declare in a new model. Business paradigm of the companies is showing a new era. After having a down sizing and re-organized, take over and comprehensively re-engineering (Sawyer’s, 2003).

One of the first lessons we learned at Gulf Canada in the 1980s speaks to this point. We decided that the mission of an audit department was not to perform audits. Our job was to provide assurance to management, staff, the board, and others on a wide variety of end-result business objectives, including - but in no way limited to - compliance with policies, reliable financial information, and economy and efficiency (Mc Cuaig, 1998).

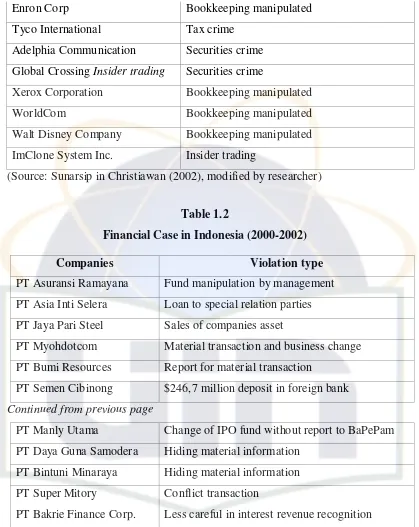

The table 1.1 and 1.2 is describing some of accounting crime that ever happened in world-class companies and in Indonesia, most of them cause by the weaknesses of companies’ internal control.

Table 1.1

Accounting Crime in the US

Enron Corp Bookkeeping manipulated Tyco International Tax crime

Adelphia Communication Securities crime Global Crossing Insider trading Securities crime

Xerox Corporation Bookkeeping manipulated WorldCom Bookkeeping manipulated Walt Disney Company Bookkeeping manipulated ImClone System Inc. Insider trading

(Source: Sunarsip in Christiawan (2002), modified by researcher)

Table 1.2

Financial Case in Indonesia (2000-2002)

Companies Violation type

PT Asuransi Ramayana Fund manipulation by management PT Asia Inti Selera Loan to special relation parties PT Jaya Pari Steel Sales of companies asset

PT Myohdotcom Material transaction and business change PT Bumi Resources Report for material transaction

PT Semen Cibinong $246,7 million deposit in foreign bank

Continued from previous page

PT Manly Utama Change of IPO fund without report to BaPePam PT Daya Guna Samodera Hiding material information

PT Bintuni Minaraya Hiding material information PT Super Mitory Conflict transaction

PT Bakrie Finance Corp. Less careful in interest revenue recognition (Source: INVESTOR (8-2002) in Christiawan, 2002)

Self-Assessment (CSA).

Although in the beginning Control Self-Assessment (CSA) is more focusing for the development of audit method by internal auditor, that doesn’t mean that external auditor can’t involved or using Control Self-Assessment (CSA) as a tools to developed the quality and the competence of the auditor and their audit services.

Based on the report of many journals, Control Self-Assessment (CSA) still becomes a private tool for the internal auditor. Researcher want to know how far is the implementation of Control Self-Assessment (CSA) by the internal auditor.

The lack of information about the CSA use in Indonesia during the audits motivated this research. Especially researcher intent to know, are the internal auditor who works in the companies using Control Self-Assessment (CSA) process have or giving a significant impact for the assessment and implementation of audit plan by external auditor or to the companies it self.

Others motivation is wanted to know what is the major functions of Control Self-Assessment (CSA) that are very useful for external auditor in their audit works, in this case their audit plan.

B. Research Question

Before defining problem of this research, first we identified the problem from past research and surveys.

Joseph and Engle investigate the use of Control Self-Assessment (CSA) by external auditor, the result, auditors is less using CSA during the audits process, and this research they also survey about auditor perceptions about their level of involvement in CSA process activity, the result, is same, less involvement in CSA process (Joseph and Engle, 2005).

audits, the results show that some of CSA product is useful in assessing risk, evaluating internal control (soft control), and Asses fraud (still low utilization) (Joseph and Engle, 2001).

Kizirian investigate the impact of management integrity on audit planning and evidence. The results show that, there is a significant influence of management integrity on audit planning and risk material misstatement (RMM). The results also suggest that clients with higher assessed levels of integrity have lower preliminary risk assessment. Management integrity exhibits incremental explanatory power beyond the risk material misstatement for the persuasiveness of audit evidence collected (Kizirian, 2005).

Ernst & Young studied about factors that will impact audit fees and related to the scope of audit. The result is, there are three major factors that will impact audit fees in 2005 and 2006: 1). Regulatory changes to accounting and auditing standards, (80%), 2). Prior year under recoveries on the engagement, (10%), 3). Inflationary increases (CPIX and professional inflation), (10%).

Ernst & Young also relate the impact of additional hours on audit to the scope of audit. The result, companies who prepare or supplies external auditor with Client Assistant Schedule approximately 3-4 weeks prior to the audit fieldwork commences will impact the scope of audit and also impact the audit fee (Ernst & Young, 2005).

Components of the Client Assistant Schedule is similar to work of internal auditor in Control Self-Assessment (CSA) or it can be said part of it, that’s why researcher use the study made by Ernst & Young.

Based on problem identification above, researcher is willing to make a research about “Auditor perception about the usefulness of Control Self-Assessment

(CSA) in audit plan and its implementation in the companies”.

journal and then researcher limiting the research by only surveys about the usefulness of Control Self-assessment in audit planning.

After the problem identification and limitation above, researcher pointing the problem definition of this research, that is:

“Is there a significant difference between auditor perceptions about the usefulness of Control Self-Assessment (CSA) in audit plan with its implementation in the company?”

C. Purpose and Contribution of the Study 1. Purpose of the study

Purpose of this study is, to know how far the usefulness Control Self-Assessment (CSA) during the financial statements audits performs by external auditor, and also to know how far the impact of CSA in audit planning.

2. Contributions of the study

CHAPTER 2 enhanced by its own ways. Many companies in Indonesia has begin to use Control Self-Assessment to help them become more efficient and effectively. Many internal audits have developed this method into various ways and approaches, but still in line with the basic standards. The definition of CSA it self is various between many user.

Control self-assessment (CSA) is a methodology used to review key business objectives, risks involved in achieving the objectives, and internal controls designed to manage those risks. Some CSA proponents expand this description to encompass opportunity as well as risk, strength as well as weakness, and the overall effectiveness of the system in ensuring that the organization’s objectives are met. CSA is a process through which internal control effectiveness is examined and assessed. The objective is to provide reasonable assurance that all business objectives will be met. The responsibility for the process is shared among all employees in an organization. CSA is conducted within a structured environment in which the process is thoroughly documented and the process is repetitive as an incentive for continuous improvement (IIA, pp: 98-2, 1998).

According IIA pp: 98-2, 1998, The CSA process allows management and/or work teams directly responsible for a business function to:

a. Participate in the assessment of internal control. b. Evaluate risk.

c. Develop action plans to address identified weakness. d. Assess the likelihood of achieving business objectives.

things that differs it from other approaches is risk assessment and evaluation of internal control done by operational employees and lower-level managers, works together in evaluated area , 2001).

Control Self-Assessment (CSA) is a process where teams consist of employees and manager, in local and executive area, continuously keep their awareness of all material factors, that can influence companies goal congruence, so they can made the right adjustment. To enhance independence, objectivity, and quality in CSA process, and also to make a good and effective bookkeeping, that’s why auditor involvement is necessary in Control Self-Assessment (CSA) process and independently reports the result to senior management and commissioner board (Sawyer’s, 2003).

Control Self-Assessment (CSA) is an alternative to the typical internal audit, where instead of conducting tests and observations. The auditor facilitates a process whereby the managers and employees of an entity perform an examination of the entity’s business processes. The primary focus of a CSA is to review and assess an entity’s system of internal control (Davis, 2004).

Control Self-Assessment operations oriented any activity where the people responsible for a business area, task, or objective using some demonstrable approach analyze the status of control and risk to provide additional assurance related to the achievement of one or more business objectives (Crawford, 2005).

Self-Assessment provides auditors with:

Control Self-Assessment (CSA) also supplement traditional audit with several things that can be used is audit process (Crawford, 2005), the supplement are:

c. Better operational findings.

d. Better buy-in to planned corrective action. e. More efficient audit process.

f. Risk assessment documentation of each department.

With or without Control Self-Assessment (CSA), external auditor had a very close relation with internal auditor during the audit process. Management can ask external auditor to review internal auditor work that had been planned for prior year and report their work quality. Through the Control Self-Assessment (CSA) these relation should be more tight and cooperative for the successful of general audit or financial statement audit in the client companies.

To decide the influence of internal auditor works to audit process, external auditor should Considering competence and objectivity of internal auditor, and Evaluate the quality of internal auditor works (Sawyer’s, 2003).

2. CSA Approaches

The three primary CSA approaches are facilitated team meetings (also known as workshops), questionnaires, and management-produced analysis. Organizations often combine more than one approach to accommodate their own self-assessment.

Facilitated team meeting gathers internal control information from work teams that may represent multiple levels of employee within the companies or organization. The facilitator is trained and had knowledge about internal control system design.

Management-produced analysis is any approach that does not use a facilitated meeting or survey. Through this approach, management produces a staff study of the business process. The CSA specialist (who may be an internal auditor) combines the results of the study with information gathered from sources such as other managers and key personnel. By synthesizing this material, the CSA specialist develops an analysis that process owners can use in their CSA efforts.

Research commissioned by The IIA Research Foundation shows that most organizations have selected the CSA workshop approach. The IIA recommends performing an analysis of the organization to determine how effectively it can accept and support candid participant response. If the culture is supportive, The IIA recommends facilitated team meetings. In the event a corporate culture does not support a participative CSA approach, questionnaire responses and internal control analysis can enhance the control environment. Internal auditing should be prepared to validate any internal control representations received.

3. CSA reporting

CSA is a method, develop to gain more deeper information of the companies. It can be done by internal auditor or/and external auditor, but in this research more focussing in CSA done by internal audit. Based on the theory and literature review, there are two element included in the scope of CSA method that is hard control and soft control, both element of control can be found in all five components of COSO, for example see ”Internal Control Self-Assessment Form For FTA Grantees“ (FTA, 2003), in appendice 5, that is related one and another. Those five components are

b. Risk assessment, identification or analysis of entity risk that are relevan to companies goal congruence, and form a basic about how risk should be handle

c. Control activities, assisting policy and procedures assures that management command has been done

d. Information and communication, identification, understanding, and transfer of inside information in aform and time framework making people can execute its responsibility

e. Monitoring, process that assessing the quality of internal control performance at one time

Auditors can effectively evaluate hard controls (e.g., bank reconciliations, credit approvals) by traditional auditing procedures such as reperformance, confirmations, inspections, and physical observation. These procedures are far less effective in evaluating critical soft controls such as management’s integrity and ethical values, management’s commitment to competence, or management’s philosophy and operating style

Based on joseph and Engle statement, researcher concluded that hard control is the element that is influenced by actual and physical evidence, such as review of cash and bank, expense, credit approval, etc. Soft control is the element that is not depend on actual and physical evidence, but its more likely an environment quality that will effect to companies components performance, such as management integrity, conflict between employees or/and management, management philosophy of operating style, communication between management and middle level employees, and many others.

criteria that should be comply, for example see “CSA Workshop #2“ (Mayer, 2003) for internal audit report form of CSA in appendice 6.

4. Audit plan

General audits are commonly stated as financial statements audit. This kind of audits is audit to business assertion. Purpose of the general audit is to give opinion, and this may influence the continuously of national securities market healthy competition. Significantly general audits can minimize the investor risk in decision made, this because auditor serve the investors with high quality information. To do that auditor must have professionalism in their job, one of it by giving the best plan for the best result.

Financial statements audit is related to action of collecting and evaluate the evidence about the entity financial report, with purposes to give opinion, whether the financial report is followed the Generally Accepted Accounting Principles (Boynton, 2000).

Audit planning is a process that involves strategy development and innovation that run widely for implementation and deciding scope of audit. Auditors must plan the audit with a professional skepticism about things like, management integrity, misstatement, and also client litigation act. There are few steps or factors in audit planning (Boynton, 2000). That is:

(Source: Boynton, 2000)

If we look at chart 2.1, when compiles an audit plan auditors must passing few steps and internal auditor can serve those steps with a process called Control Self-assessment (CSA). The field standards for plan enshrined in the INTOSAI Auditing Standards, it stated the auditor should plan the audit in a manner which ensures that an audit of high quality is carried out in an economic, efficient and effective way and in a timely manner (INTOSAI Auditing Standards, p.51 & 52). To describe the use of Control Self-assessment (CSA) by external auditor in audit plan process researcher combine between the output of Control Self-assessment (CSA) and audit plan steps. Researcher saw a link between audit plan and Control Self-assessment (CSA) that can be implemented and can be an efficient ways to increase audit quality.

Audit plan is meant to help the auditor in developing audit plan and audit program to run efficient and effective. Audit program including list of all audit procedure, used to collect competent material of evidence.

According to Intosai Auditing Standards, in planning an audit, the auditor should (Intosai, par: 4.4, 2005):

a. Identify important aspects of the environment in which the audited entity operates;

b. Develop an understanding of the accountability relationships;

c. Consider the form, content and users of audit opinions, conclusions or reports; d. Specify the audit objectives and the tests necessary to meet them;

e. Identify key management systems and controls and carry out a preliminary assessment to identify both their strengths and weaknesses;

f. Determine the materiality of matters;

g. Review the internal audit of the auditee and its work program;

h. Assess the extent of reliance that might be placed on other auditors i.e. internal auditors;

i. Determine the most efficient and effective audit approach; and

j. Provide for appropriate documentation of the audit plan and for the proposed fieldwork. SAI may revise the plan during the audit when necessary.

Audit plan are influencing several things and been influenced by several things too like risk assessment and management integrity, assess in early audit process. When plan an audit, auditor should make four important decisions about audit scope and audit implementation that will be modified accordingly to what companies they work on, that is Audit nature, Timing on audit test, Extent of audit test and Staffing decision.

Scope is the boundary of the audit and should be directly tied to the audit objectives. For example, the scope defines parameters of the audit such as the period of time reviewed, the availability of necessary documentation or records, and the locations at which field work will be performed (GAO, par: 7.05, 2003).

audit test that willing to make. Timing is, related to auditor decision about when is the audit should be start to and to work on, these also referring to when is the test of audit have to be started. Extent of audit is about auditor decision for the extent of audit evidence, how many of it or should be taken. Staffing is about auditor decision for audit employment and personnel supervise during the audit process. Those four things are important in audit process, so auditors have a view about what auditor must do and test, to give a reliable opinion at the end of audit process.

Extent of audit directly influence by the level of control risk planned by auditor. More extensive testing is needed for low level of control risk, more than moderate level of control risk. The extent of additional testing also influence by the purpose of evidence usefulness about the affectivity of last year audit or past audit (Jusup, 2001).

The auditor gathers planning information through different methods (observation, interviews, reading policy and procedure manuals, etc.) and from a variety of sources, including; Top-level entity management, entity management responsible for significant programs, Office of Inspector General (IG) and internal audit management (including any internal control officer), Others in the audit organization concerning other completed, planned or in-progress assignments, Personnel in OGC, Personnel in the Special Investigator Unit, and Entity legal representatives (GAO, par: 220.08, 2003).

The level of auditor risk assessment is influence by the evaluation of management integrity, and it’s inversely relating, the relation become a parallel relation because the risk assessment planned by auditor is inversely relate to the extent of audit.

B. Basic Assumption

self. When internal auditor of the company start using CSA effectively, the company weaknesses and strengths is known because the auditor is participate with local manager of department. This will provide much information about companies in each department, for this study researcher take three major factors of Control Self-assessment from the study of Joseph and Engle, that going to use to measures implementation of CSA in the companies, that is:

1. Specific use of Control Self-Assessment (CSA),

2. Communication between organizations with their external auditor about CSA, 3. External auditor involvement in Control Self-Assessment (CSA) process.

Then in audit plan researcher take three major factors from Joseph and Engle also, which is:

1. Understanding client business and core cycle of the company.

The understanding about client is the first thing auditor must known, these will gave auditor basic plan, what auditor must have and to do. CSA product support auditor with much documentation about the companies or client, this information is made by someone who knows best about the company it self, the internal auditor.

2. Risk Assessments.

3. Others audit objectives.

CSA also provide and process others audit relevant such as detecting and evaluating soft controls, such as controls over the effectiveness of communications, attitudes toward control (e.g., tone at the top and bottom), the ethics and integrity of management, and controls designed to enhance customer satisfaction, and many others things that will be so useful for audit. This information about other audit relevant is also can be effective information when CSA is fully implemented.

C. Theoretical Framework and Hypothesis

Chart 2.2

Theoretical Framework

HA = “There is a significant difference between auditor perceptions about the

usefulness of CSA in audit plan with its implementation in the companies”

Expected usefulness of CSA in Audit Plan Actual implementation

of Control Self-assessment

Dimensions 1. Specific use of CSA in

the companies. 2. The value of external

auditor involvement 3. Communication between

external auditor and companies about CSA.

Dimensions 1. Understanding about

CHAPTER 3 RESEARCH DESIGN

A. Scope of the study and Sampling Method

This research is studied Auditor Perception About The Usefulness Of Control Self-Assessment In Audit Plan, primarly this will explain further about the usefulness of CSA in audit plan and its implementation in the companies according to external auditor opinion. According to simple definition of the problem and because of the researcher limitation, researcher take three major factors of Control Self-assessment that strongly related, that is: Specific use of Control Self-Assessment (CSA), communication between organizations with their external auditor about Control Self-Assessment (CSA), external auditor involvement in Control Self-Self-Assessment (CSA) process. Then in audit plan researcher limiting the study by only taken three major factors, which is: understanding of client business and internal control, risk assessment, and others audit relevant.

Sample to this research is External Auditor. Population of External Auditor is taken from a list of C.P.A in IAI 2006 directory book. Judgement Sampling is used to decide the sample. This method is giving same probability to all sample, sample is decided using method made by Slovin in Tugiyo et. al, 2002:

n = Sample e = Critical Value/Tolerable Error (15%)

N = Population

B. Variables

According to scope of the study, variables in this study are: 1. Implementation of Control Self-Assessment (CSA)

Control Self-Assessment (CSA) is a process provide by companies internal auditor, where team consist of employees and manager, in local and executive area, continuously keep their awareness of all material factors, that can influence companies goal congruence, so they can made the right adjustment.

To measure these operational, researcher use instrument from Joseph and Engle (2005):

a. Specific use of Control Self-Assessment (CSA),

b. Communication between organizations with their external auditor about Control Self-Assessment (CSA),

c. External auditor involvement in Control Self-Assessment (CSA) process.

To measure the variable, researcher use likert scale for the questionnaires. The scale, 1-2 is very low, 3-4-5 is medium, and 6-7 is high.

2 Usefulness of CSA in Audit Plan

Audit planning is a process that involves strategy development and innovation that run widely for implementation and deciding scope of audit. The major research is about the impact of Control Self-Assessment (CSA) on audit planning. To measure the variable, researcher use likert scale for the questionnaires. The scale, 1-2 is very low, 3-4-5 is medium, and 6-7 is high.

The measurement of how Control Self-Assessment (CSA) impact audit plan is perform by measuring several factors used for deciding audit plan by external auditor combine with the main output of Control Self-Assessment (CSA), the factors are:

a. Understanding of business and companies internal control b. Risk Assessment

C. Data Collection Method

Method use to collect data in this study is Field Research. Field research is a method to collect primary data. Primary data is a source of data that directly collect from original source. Primary data is collected from mail-questionnaires, the questionnaires are given to competence parties, and in this case is external auditor. Those parties or respondent is the most related parties to this study.

Researcher also studied and examined the theory that build the variable and theory that follow it. These can be done by reading and summarizing books, journal, article, and many others references.

D. Analyze Method

1. Descriptive Statistic

This research is made by a descriptive statistic approaches. Descriptive statistic is a statistic use to describe or analyze statistical evidence of the study by describing the data, but is not intent to make a larger assumption or generalized. (Sugiyono, 2005). Descriptive statistic is use to collect, process and analyze data, and also to explain the fact of audit plan that been studied, and being influenced by the use of Control Self-assessment.

2. Data Quality And Normality Test

One of the weakness of mail survey is, respondent who willing to responses is they who had purpose to this study. Generally, there is a possibility that the characteristic of the respondent may be different. This problem will be seriously if the response rate is very low. Researcher also tests the questionnaires, using reliability and validity test.

Reliability test actually is a device to measure questionnaires, as indicator from variable or construct. Questionnaires called reliable if the answer of the respondent is consistent or stable from time to time. Reliability measurement can be done in One Shot Measurement. In these measurement we can use statistical test like Cronbach Alpha Test. Construct or variable is called reliable if giving Cronbach Alpha value >0.60 (Nunnally in Ghozali, 2005).

b. Validity test

Validity test is used to test or measured validity of a questionnaires. Questionnaires called valid if the question can reveal what we want to measures in the study. So validity test is intent to measures the question we made, are they really can measure what we want to measures.

c. Normality test

Kurtosis is a measure of the extent to which observations cluster around a central point, for a normal distribution, the value of the kurtosis statistic is 0. Positive kurtosis indicates that the observations cluster more and have longer tails than those in the normal distribution and negative kurtosis indicates the observations cluster less and have shorter tails.

3.Hypothesis Test

The Paired-Samples Test procedure compares the means of two variables for a single group. It computes the differences between values of the two variables for each case and tests whether the average differs or not. To perform t-test the step are:

a. Determines level of significance which will be applied in this research, the

level is 5%, or (α) = 0.05.

• Ho = Ha, (Not Significant). Average value of both variables is identical

and no difference which is significant among both.

• Ha Ho, (Significant). Average value of both variables is not identical

CHAPTER 4

RESEARCH FINDINGS AND ANALYSIS

A. Descriptive of Data

1. Descriptive Statistics

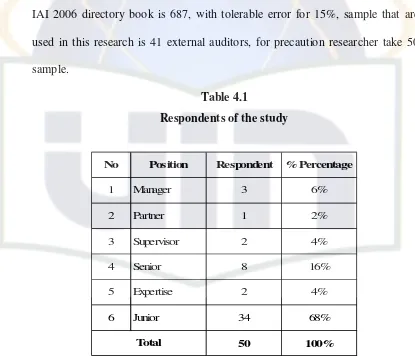

Before entering data analysis, first we have to know the object and sample of the study, the object of the study is Control Self-Assessment, being related to the audit plan of external auditor, that’s why researcher decided to have external auditor as a research sample. The amount of external auditor in Jakarta based on IAI 2006 directory book is 687, with tolerable error for 15%, sample that are used in this research is 41 external auditors, for precaution researcher take 50 sample.

Table 4.1

Respondents of the study

No Position Respondent % Percentage

1 Manager 3 6%

2 Partner 1 2%

3 Supervisor 2 4%

4 Senior 8 16%

5 Expertise 2 4%

6 Junior 34 68%

50 100%

Total

up position, from total of fifty respondents, junior auditors is the most commonly to response, these kind of respondent is still relevant considering that junior auditor often sent to do the field work in client to collect audit data, thereby junior interactively communicate with internal auditor, with a strict supervision.

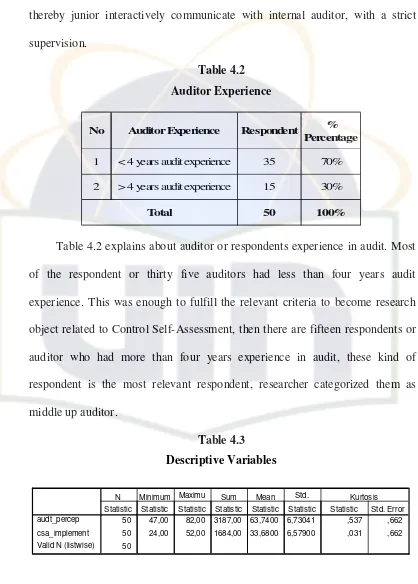

Table 4.2 Auditor Experience

No Auditor Experience Respondent % Percentage

1 < 4 years audit experience 35 70%

2 > 4 years audit experience 15 30%

50 100%

Total

Table 4.2 explains about auditor or respondents experience in audit. Most of the respondent or thirty five auditors had less than four years audit experience. This was enough to fulfill the relevant criteria to become research object related to Control Self-Assessment, then there are fifteen respondents or auditor who had more than four years experience in audit, these kind of respondent is the most relevant respondent, researcher categorized them as middle up auditor.

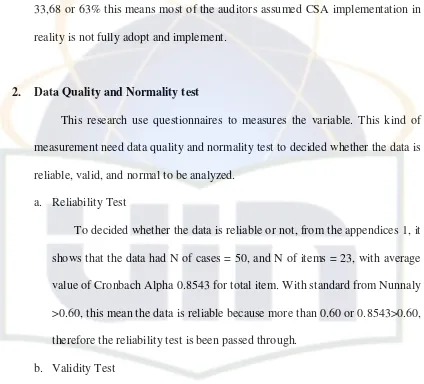

Table 4.3 Descriptive Variables

50 47,00 82,00 3187,00 63,7400 6,73041 ,537 ,662

50 24,00 52,00 1684,00 33,6800 6,57900 ,031 ,662

50 audt_percep

csa_implement

Valid N (listwise)

Statistic Statistic Statistic Statistic Statistic Statistic Statistic Std. Error

N Minimum Maximu Sum Mean Std. Kurtosis

value of audit plan and CSA is 47, and 24. The maximum value of audit plan and CSA is 82 and 52. Sum of audit plan and CSA is 3187 and 1684. Average value or mean of auditor perception is 63,74 or 77%, this means most of the auditors assumed CSA is useful for audit primarly in audit planning, then for the implementation of CSA in companies, respondent gave an average value for 33,68 or 63% this means most of the auditors assumed CSA implementation in reality is not fully adopt and implement.

2. Data Quality and Normality test

This research use questionnaires to measures the variable. This kind of measurement need data quality and normality test to decided whether the data is reliable, valid, and normal to be analyzed.

a. Reliability Test

To decided whether the data is reliable or not, from the appendices 1, it shows that the data had N of cases = 50, and N of items = 23, with average value of Cronbach Alpha 0.8543 for total item. With standard from Nunnaly >0.60, this mean the data is reliable because more than 0.60 or 0.8543>0.60, therefore the reliability test is been passed through.

b. Validity Test

Reliability Test in section Corrected Item-Total Statistics, we can see that not all the item of questionnaires is valid there is several items that didn’t through the validity test. There are 16 items that are valid and bigger than r-table, which is y1, y2, y3, y4, y6, y7, y8, y9, y10, y11, y12, x3, x4, x5, x6, x7, x8, x9, and x10. Then beside the valid there also 7 items that are invalid, the items is y5, x1, and x2. The invalid items will be excluded from the study. The invalid item is removed because they can’t explain or measures the variable, that’s why they’re being discarded so there is no bias when analyzing the data.

c. Normality Test

Table 4.3 above also describes about kurtosis. From table we can see that auditor perception and CSA had positive value for 0,537 and 0,031. Data is called normally distributed if the value is 0, from the descriptive table the value of auditor perception and CSA implementation is still normally distributed , if we see auditor perception is a bit oblique and for CSA is normally distributed, but researcher still consider auditor perception is normally distributed, with this interpretation the data still can be called normally distributed.

B. Analysis of Data

1. Difference Test Analysis (t-test) with Paired Samples Test

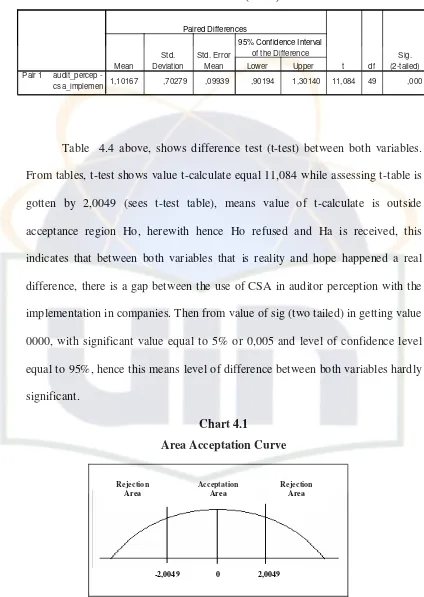

Table 4.4 Difference test (t-test)

1,10167 ,70279 ,09939 ,90194 1,30140 11,084 49 ,000

audit_percep -From tables, t-test shows value t-calculate equal 11,084 while assessing t-table is gotten by 2,0049 (sees t-test table), means value of t-calculate is outside acceptance region Ho, herewith hence Ho refused and Ha is received, this indicates that between both variables that is reality and hope happened a real difference, there is a gap between the use of CSA in auditor perception with the implementation in companies. Then from value of sig (two tailed) in getting value 0000, with significant value equal to 5% or 0,005 and level of confidence level equal to 95%, hence this means level of difference between both variables hardly significant.

Chart 4.1

Area Acceptation Curve

Chart 4.1 shows the t-test in curve model, to test the hypothesis (Ho 0 and

whether the hypothesis is accepted or rejected. The t- calculate value is 11,084, then the t-table value is 2,0049, which means the t- calculate value is out of the acceptation area, in this condition Ho is rejected and there is a significant

differences between reality and hope for the usefulness of CSA and its implementation.

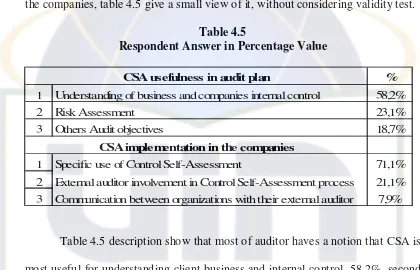

To describe about the respondent answer, and in what section does CSA very useful for audit plan and in what section does CSA really implemented by the companies, table 4.5 give a small view of it, without considering validity test.

Table 4.5

Respondent Answer in Percentage Value

%

1 Understanding of business and companies internal control 58,2%

2 Risk Assessment 23,1%

3 Others Audit objectives 18,7%

1 Specific use of Control Self-Assessment 71,1%

2 External auditor involvement in Control Self-Assessment process 21,1%

3 Communication between organizations with their external auditor 7,9%

CSA implementation in the companies CSA usefulness in audit plan

Table 4.5 description show that most of auditor haves a notion that CSA is most useful for understanding client business and internal control, 58,2%, second is for risk assessment 23,1%, as for the implementation, most of the companies adopt CSA for Specific use, 71,1%, this section include internal control review, risk assessment, policy and procedure review, and training media for the employee. External auditor involvement and communication between them about CSA is still low for about 21,1% and 7,9%.

C. Discussion

gives in audit, especially in audit planning, this because auditors realized and aware with the benefits of CSA in many audit works, few are describe as follows:

1. Preliminary Surveys, in this area, external auditor can minimized their time, cost, and make preliminary risk assessment. This is served by the CSA report of internal auditor. In this research the part of this audit is placed and described in “understanding of business and main cycle of the companies” questionnaires, and in this part also auditor feeling the most of CSA benefits to audit works or General Audit.

2. Audit Planning, in this part CSA took part in the advanced risk assessment and also deciding what part of the business that supposed to make external auditors put more attention, we can also assumed that companies with CSA already had a good bookkeeping, flowchart, and maximized Internal Control, even though we still have to make an assessment to all by internal control questionnaires, but with a good internal audit it can be a plus score to the companies. In this research the part of this audit is placed and described in “Risk Assessment and Others Audit objectives” questionnaires.

Although with the many advantages CSA can gives, the use of CSA in General Audit is still low for some reason, this because the benefits is still in auditors minds and thoughts not in the real implementation even if they do it only took part in minimal percentage and not fully as a CSA Reports, it became more clearly when we see the result of difference test (t-test) that is explain, there is a hardly significant gap or differences between the hope and reality of the CSA advantages.

companies for real only done for 63%, this mean there is a gap between both variables and still low utilization of CSA and it support previous research made by Joseph and Engle. In today research, writer assumed based on the experience in the field, specifically in Certified Public Accountant Office, there is few things what made CSA still in low utilization, describe as follows:

1. CSA utilization still low because the resources to developed this method is still in small area, we know that not all the companies in Indonesia had an internal auditor, even if they had their still use traditional method to do their job. This maybe caused by the experience of internal auditor position in Indonesia still a new stuff and not fully grows in the past few years, it only become and seen as a complementary position in the companies and theyre also still focus in financial matters not others like soft control and business environment.

2. The standard, knowledge, and information of CSA among the internal auditor in Indonesia still in small area and only become a theme, not a real method that already used or going too used. Based on this reason, it is understandable why external auditor can’t fully absorb much valuable information about their client.

CHAPTER 5

CONCLUSIONS, LIMITATIONS, AND RECOMMENDATIONS

A. Conclusion

According to data analysis in previous chapter, it can be concluded that between auditor perceptions about the usefulness of CSA (hope) and the implementation of CSA in companies (reality) had a significant differences. Auditor assumed that CSA is useful for 77%, but in reality implementation of CSA in companies only 63%, therefore lies a gap among both. The gap among them might not too large, this because CSA actually already implemented it just still focus in financial matters, thats why there is still utilization on CSA by external auditor, when perform field work auditor need a lot of information, especially about companies management (soft control) to assess audit risk and better audit planning, if being correlate with the research or survey made by Joseph and Engle about The Usefulness of CSA by

Independent Auditors, it support the survey, the results of survey made by Joseph and Engle show there is still low utilization on CSA products during the audits, according to auditor opinion on previous research, the level of CSA usefulness during the audits is only 21.6%.

The most applicable things from Control Self-Assessment to audit plan is come from the information about companies and the internal control system, this result also support previous research made by Joseph and Engle that most of auditors use CSA to understand companies business, and companies internal control. The products of Control Self-Assessments also gave high information about the companies when they have to perform or decided the level of materiality and risk assessment.

Results of this study have several limitations; first, there is still low implementation of CSA in Indonesia, therefore many another dominant factors that can influence audit planning. Second, CSA is a new method, even in international world only few country that implemented CSA, in Indonesia it self it only become a theme not a standard, that why many internal auditor in Indonesia still using traditional ways to fulfill their works. Third, sample and data of this research is decided by using judgmental method and consideration of researcher. Sample of the study is middle low CPA office (Certified Public Accountant), this sample is decided because it is hard to get response from the top 10 CPA. Most of the respondent is junior auditor with less than 2 years experience. Fourth, similarity between common internal audit method and CSA can make a doubtful response for respondent who did not have a proper knowledge about CSA.

C. Recommendations

BIBLIOGRAPHY

Boynton, William C. 2000. Modern Auditing. Erlangga: Jakarta

Crawford, David B. Chaffin, Charles G. 2005. COSO and Risk/Control Self-Assessment. The University of Texas System Audit Office.www.utsystem.edu/aud/resources

Crawford, David B. 2005.COSO & Self Assessment. The University of Texas System Audit Office. www.utsystem.edu/aud/resources

Christiawan, Yulius Jogi. 2002. Kompetensi dan Independensi Akuntan Publik : Refleksi Hasil Penelitian Empiris. http://puslit.petra.ac.id/journals/accounting/

Dajan, Anto. 2000. Pengantar Statistika. LP3ES: Jakarta

Davis, Beryl H. et al. 2004. Internal Controls OverCash Collections.

http://www.cityoforlando.net/executive/audit/PDFReports/05-07%20Control%20Self%20Assessment%20Recreation%20Division.pdf.

FTA. 2003. Internal control self assessment form (for FTA grantees).

http://66.218.69.11/search/cache?ei=UTF- 8&p=CONTROL+SELF+ASSESSMENT+REPORT+FORM&fr=yfp-t- 203&fp_ip=ID&u=www.fta.dot.gov/documents/FTA_Internal_Control_Self-Assessment_Tool.pdf&w=control+self+assessment+report+reporting+form+forms &d=R3wNvPReRXtj&icp=1&.intl=us

Joseph, Gilbert W Engle, Terry J. 2001. Use of Control Self-Assessment in Audits. CPA Journal. http://www.nysscpa.org/cpajournal/2001/0800/dept/d084601.htm

Intosai. 2005. Auditing Standards: Audit Planning Procedures.

http://www.asosai.org/R_P_auditquality/chapter4.htm

IIA. 1998. Professional Practices Pamphlet 98-2: A Perspective on Control Self Assessment. www.ucop.edu/ctlacct/csa/prof-pract/csa-1.pdf

IAI. 2006. Kantor Akuntan Publik dan Akuntan Publik DIRECTORY 2006. Bagian penerbitan IAI: Jakarta.

Joseph, Gilbert W Engle, Terry J. 2005.

. CPA Journal.

http://www.nysscpa.org/cpajournal/2005/1205/essentials/p38.htm

Jusup, AI Haryono. 2001. Auditing (Pengauditan). Bagian penerbitan STIE YKPN: Yogyakarta.

Ernst & Young. 2005. Fair Fees: Regulatory Impact on Audit Fees.

http://www.ey.com/za

GAO. 2003. Audit Planning Field Work Standards.

GAO. 2003. Audit Planning Standards; Understanding Entity’s Operations: 220. http://www.gao.gov/atext/d01765_200.txt

Ghozali, Imam. 2005. Aplikasi Analisis Multivariate dengan Program SPSS. Badan Penerbit UnDip: Semarang.

Kizirian, Timothy G. et.al. 2005. The Impact of Management Integrity on Audit

planning and Evidence. AUDITING: A JOURNAL OF PRACTICE & THEORY, Vol.24. No.2.

Mayer, John A. 2003.Control Self-Assessment Workshop - Session #2.

www.utsystem.edu/aud/Services/Control%20Self-assessment/Session2.doc -.

Mc Cuaig, Bruce. 1998. Auditing, assurance, & CSA - control self-assessment -

includes related articles on CSA approaches, assurance strategies and definition of controls. http://findarticles.com/p/articles/mi_m4153/is_n3_v55/ai_20860224

Sawyer, Lawrence. B. et al. 2005. Internal Auditing Sawyer. Salemba Empat: Jakarta Sugiyono. 2005. metodologi Penelitian Bisnis. CV. Alfabeta: Bandung

Tugiyo et. al. 2002. Analisis Segmentasi Dan Penentuan Posisi Perguruan Tinggi Swasta Di Jogjakarta.

http://images.soemarno.multiply.com/attachment/0/RgB1VgoKCpkAAGhXbJA1/se