The Analysis of Influence between Service Quality and Satisfaction towards Customer Loyalty

Case Study at PT. Bank Negara Indonesia (PERSERO), Tbk

Submitted By: Erika Nur Octariani Student ID: 604082000006

INTERNATIONAL PROGRAM ACCOUNTING DEPARTMENT

FACULTY OF ECONOMICS AND SOCIAL SCIENCES UNIVERSITAS ISLAM NEGERI SYARIF HIDAYATULLAH

ABSTRACT

Erika Nur Octariani. Thesis Title “The Analysis of Influence between Services Quality, Satisfaction and Customer Loyalty, Case Study at PT. Bank Negara Indonesia (persero), tbk”. Graduate program (S1). Major in management concentration in marketing. Economics faculty and Social Sciences of State Islamic University Syarif Hidayatullah, Jakarta.

The main purpose of this research is to analyze and know about the influence of service quality, customer satisfaction influence to customer loyalty at PT. Bank Negara Indonesia (persero), tbk. The indicators for this research Such as: Services Quality (X1), Satisfaction (X2), and Customer Loyalty (Y) as dependent variable.

In getting data and information, the researcher took 50 respondents as a sample. The researcher got the primary data from a field research in Jakarta that is supported by secondary data, and then using double to account of the statistics methods from linier regression and correlation for analysis and the hypothesis.

The result of research has been shows; there is a correlation about 0.647 means there is a positive influence between services quality and satisfaction towards customer loyalty. From the multiple linier regressions similarity have influence to customer loyalty is the customer satisfaction variable around 0.459 from the services quality significance is 0.027.

ACKNOWLEDGEMENT

Bismillahirrohmanirrohim

Alhamdulillahi rabbil ‘alamin, I would like to say thanks and being grateful to Allah SWT that already gives His gift, bless, and consecrate to me and also regard to nabi Muhammad SAW, so that this thesis could be finished in fulfilling one of the requirements to get my Bachelor Economics Degree in the State Islamic University, Syarif Hidayatullah, Jakarta.

The writer realizes that this thesis is too far from the perfection, realizing that the limitation of the knowledge as well as experiences that the writer has, but because of many parties support, finally the writer could finish this thesis by hoping that it could be worthwhile for every reader. The writer also expects for any suggestions to improve the content of this thesis.

In making this thesis, the writer was not alone but I was supported and taught by many parties. In this opportunity, the writer would like to say my huge thankful to:

1. My lovely parents Mr. Ir. H. John Hendry, MEng. and Mrs. Desrina Nasmudin, SMHk, for their effort to help and support. I realize that I could be nothing without their prayer to Allah SWT, especially to my father for his time every midnight, doing prayer to his children and my family in general.

The most important is for understanding in helping me giving a joke and entertaining when I became stress and frustrated when finish my thesis. I wish we all will be a successful people together, we can reach our dream and show to the world, make our parents happy and proud to us, okey guys... I love you so much

3. My aunts, Mrs. Hj. Tuti Sundari SE. MM, that are works in the right place and suitable to spread out my questioners in their workplace as my data in helping finish my thesis. Also to Mrs. Marliza Sulaeman SE, and Mrs. Mira Sulaeman SE, all of you have given me great experience and knowledge that I haven’t reward back yet with what they have given to me.

4. To all of my family that I could not tell one by one, I would like to present my thesis to both of my lovely grand mom, such as: Almarhumah H. Hilma, I love you oma, unfortunately you can not see my graduation but I believe if you are here with me you will be proud of me as your lovely grand child, and also ibu H. Asmaniar, that always pray in the middle of night for me and all of family generally. 5. Mr. Prof. Abdul Hamid as a Dean of Faculty of Economics and Social

6. Mrs. Dr. Rofikoh Rokhim as supervision 1 and Mr. Sisdjiatmo K.Widhaningrat as supervision 2. Thanks have given the times to guide, motivate as well as the supports accompanied by the knowledge and unforgettable great experiences from them.

7. For all of my friends at campus, we have a great time in last 5 years, especially for Iyah and Bono that already help and support me in finishing process the thesis, hopefully we all as the first batch will always be communication, keep contact and have good relationship after graduation while we will be rather meet each other.

8. To PT. Bank Negara Indonesia (persero), Tbk. That have gives me an opportunity did an internship also held the research and gives me the data or information that I needs in process to finishing my thesis. 9. For all the lecturers in UIN Jakarta, staff, and the other parties in the

international program secretariat. Hope Allah could reward back your nice helps.

At the end, the writer expects for any critics as well as suggestions that could improve the content of this thesis. Hopefully this thesis could be worthwhile for all of us. Amien. Thank you.

Wassalamualaikum warahmatullahi wabarakatuh.

Jakarta, February 2009

TABLE OF CONTENTS

Acceptance Letter

... ii

Auto Biography

... iv

Abstract

... v

Acknowledgement

... vi

Contents

... ix

Contents of Table

... xiii

Contents of Picture

Contents of Appendices

... xvi

Chapter I INTRODUCTION

Page

A. Background 1

B. Problem Formulation

... 4

C. Research Objective and Purpose

... 5

D. Population and Research Sample

... 6

Chapter II LITERATURE REVIEW A. General figure of company

1. Background of BNI

2. Vision and Mission of BNI

... 10

3. Philosophy of New Logo

... 10

B. Definition of Marketing

... 11

C. Definition of Bank

... 13

D. Definition of Services

... 14

E. Definition of Marketing in Services

... 15

F. Definition of Customer Value

G. Definition of Service Quality

... 18

H. Definition of Customer Satisfaction

... 21

I. Definition of Customer Loyalty

... 25

J. Relationship between Customer Satisfaction and Customer Loyalty

... 27

K. Consideration Framework

... 32

L. Hypothesis

... 34

A. Research Scope

... 35

B. Sampling Methods

... 36

C. Population and Research Sample

... 36

D..Data Collection Methods

... 37

E. Analysis Methods

... 38

1. Validity Test

... 39

2. Reliability Test

3. Multiple Linier Regression

... 40

4. Classic Assumption Test

... 40

5. Hypothesis Test

... 43

F. Operational Variable Research

... 45

Chapter IV ANALYSIS

A. General Description of Research Object

... 51

1. Location and Time of Research

... 51

2. Characteristics of Respondent

B. Analysis and Discussion

... 51

1. Validity and Reliability Test

... 51

C. Questioner Result of Services Quality

... 54

D. Questioner Result of Satisfaction

... 69

E. Questioner Result of Customer Loyalty

... 72

F. Multiple Classic Regression Assumption Test

... 75

1. Multicolinearity Test

2. Heterokedasity Test

... 76

3. Normality Data Test

... 77

G. Multiple Linier Regression

... 78

1. Determination Coefficient (R2)

... 78

2. Similarity of Multiple Linier Regression

... 78

3. F Test

... 80

4. T Test

... 81

A. Conclusion

... 82

B. Implication

... 83

C. Recommendation

... 85

REFERENCES

... 86

APPENDICES

CONTENT OF TABLES

No Details

Page

3.1 Likert Scale 38

4.1 Try Out Questioner Result 53

4.2 BNI has capability in fulfill services 54

4.3 Employee has knowledge about BNI products 55

4.4 Employee has knowledge and skill in handle customer problem 55

4.5 BNI has good reputation on customer perspective 56

4.6 BNI follows banking regulation 57

4.7 BNI guarantee the clandestine of customer 57

4.8 BNI guarantee security feeling of customer 58

4.9 Employee have concern to customer 58

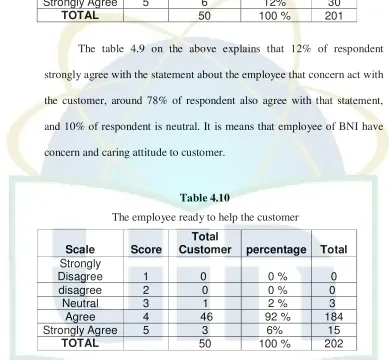

4.10 Employee ready to help customer 59

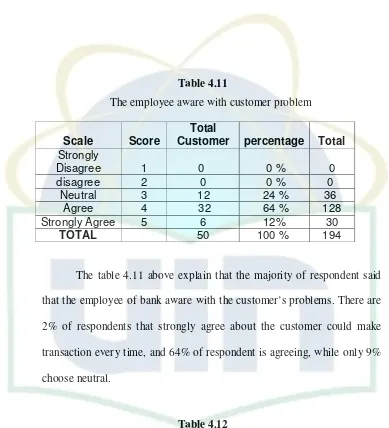

4.12 BNI give easiness transaction to customer every time 60

4.13 BNI give the easy thing to electric and telephone payment 61

4.14 BNI could give quick and short transaction of services 62

4.15 BNI has good performance in ATM facilities, complete and Spread in much area

62

4.16 BNI provide the services suitable with the promise 63

4.17 BNI could save the customer data very well and keep the secret 64

4.18 The employees have good performance in handle the problem 64

4.19 The employee could finish the fault happen 65

4.20 The employee can give solution if there is a fault 65

4.21 The employee can handle the situation if there is a fault 66

4.22 The physically appearance and good interior 66

4.23 The employee always fresh look and polite 67

4.25 BNI give the services according with the customer needs 68

4.26 The performance of BNI based on expectation of customer 69

4.27 The physically appearance and good interior 70

4.28 The customer will recommend BNI to another people in using banking services

70

4.29 The customer will repeat the transaction 71

4.30 The customer will reject another bank 72

4.31 The customer will always use banking services of BNI in the future 73

4.32 The customer will give reference BNI to other people 74

4.33 Multicolinearity Test 75

4.36 Determination Test 78

CONTENT OF PICTURES

No Details

Page

2.1 Concept of Customer Satisfaction 23

2.2 Consideration Framework 33

4.34 Heterokedasity Test 76

CONTENT OF APPENDICES

No Details

Page

1. Questioner of customer BNI 88

2. Questioner Result of 50 Respondents 91

CHAPTER I INTRODUCTION

A. Background

The competition among the corporation in the globalization era more hard and tight, the be concerned to satisfaction and unsatisfied of the customer that more huge, a lot of people that be concerned of this thing, because the company or service industry such as a bank or other financial institution have to put the orientation of customer satisfaction as the main purpose.

The main key to win the competition is give the value and satisfaction to the customer by deliver the product or services that have the best quality. The company has to thinking how could make the customer feel satisfied and customer never leave the company or organization to another company, and will be the competitor customer that make the effect of the less of profit in the company.

Service industry has dominated in economic concentration almost in all of industry country. Especially in banking, development in service sectors has the impact to create work field and increase the income for industry country. Many deregulations in development in service sector especially in era high technology and digital era give the intensive challenges in service sector.

but in marketing MuhtosimArief (2006) think need to add ‘3P’ more to service marketing, are people, physical evidence and process because more of services that given by people is like selection, training, and motivation to employee.

Generally, the level of service quality influence by some factor which is reliability, assurance, tangible, empathy and responsiveness. The fifth dimension factor of service quality could be influence by the employee according Gonroos (2000) theory.

That case will be makes differentiation, means in customer satisfaction. The bank also need demonstrate the service quality by physical evidence. Next, bank can choose the differentiation in process that bank give to customer. The service delivery influence by some element, for example consumer come to the bank to get the bond or debt, the customer will be know that other customer waiting the service and other services. Customer also can see physical environment such as building, interior, equipment, and furniture. The customer also can see the employee of bank or contact personnel and connect with bond staff.

In banking also can leave with the service and service quality because in banking activity the main point is service that give to customer directly. Because of that all of the bank or other financial institution makes the competition and effort to give the best services that will be effect the satisfaction of the customer.

strategic location, the services with the expert human resource that could represent the high quality value that had of the bank to give to customer.

Many effort that always keep and running by the bank or finance institution to show off the credibility that had by the bank professionally, so that the bank or finance institution has to give the trust, secure, convenience and comfortable feeling to customer that want to invest the money. Because the customer satisfaction is will be represent the successful the bank services that could give the services suitable with the customer needs and willingness.

M. Arief (2006) explain that not visible to customer is production process in behind and organization system that support visible to customer. So, the result of services is the customer will be loyal to the bank that influenced by all of the system services business.

Tjiptono (2000) explains that in service quality, the definition of process is almost same, except the activity process can do as combination from structure, process and result. Focus in services process in bank is to give and fulfill the benefit or give more outside from the customer expectation.

The research is predominantly consumer orientated rather than taking place in business to business settings. The research covers both goods and services with a variety of sample sizes reported.

While how much the influence of service quality and customer satisfaction to customer loyalty, not really know well so I as the writer would try to analyze the research for my thesis with the title:

“The Analysis of Influence between Service Quality and Satisfaction towards Customer Loyalty” (Case Study at BNI)

Three key issues emerged from the literature regarding the relationship between satisfaction and loyalty:

(1) Satisfaction and loyalty are related constructs; (2) There are moderating factors for the relationship, and (3) The methodology influences the outcome of the research. These will now be discussed.

B. Problem Formulation

Business competition is much stretched force all bank or service company to have business strategy in running business. Related in these things, so the problem will be researches are:

1. How the service quality can be influence to loyalty of customer in BNI? 2. How the customer satisfaction has influence to customer loyalties in BNI? 3. How the service quality and customer satisfaction has influence toward

C. Research Objective and Purpose 1. Objective

The objectives of this research are:

a. To analyze the influence of service quality to loyalty of customer in BNI.

b. To analyze the influence of customer satisfaction to loyalty of customer in BNI.

c. To analyze the influence of both, services quality and customer satisfaction towards customer loyalty in BNI.

2. Usefulness of Research The uses of this research are:

a. As a regulation to achieve undergraduate in international program, management, faculty economic and social science, state Islamic University Syarif Hidayatullah Jakarta.

b. As an application and applying knowledge that already get from management merger. And give the writer understanding and perspective about value, customer satisfaction towards customer loyalty perspective.

c. Give the input to the company as an alternative solution in arrange the company policy in services business strategy to reach sustainable competitive advantage.

that can be use as a reference to next research in management and marketing.

D. Population and Research Sample 1. Research Population

Research population in this case is the customer of BNI. Due to a lot of number of population customer at BNI, so the representative sample collection is needed to give a correct picture of the population.

2. Research Sample

The size of variable is determined by:

a. The sizes of total sample minimum are 50 respondents. Actually before the researcher was using 100 respondents with 15 of questions, but the result was not valid then, the researcher was tried to use 50 respondents with 31 of questions and the outcome is valid, so the researcher could continue the research.

b. The research held in PT. Bank Negara Indonesia 46, kantor besar, Sudirman, Jakarta.

c. The respondent chooser by this research, following the order; active customer, means come to BNI minimum once a month, have fix income, the respondent is chooser with simple random sampling methods.

CHAPTER II LITERATURE REVIEW

A. General figure of company

1. Background of PT. Bank Negara Indonesia (BNI)

Established in 1946 as the first bank formed and owned by the Indonesian government, BNI used to call by its unabbreviated name of Bank Negara Indonesia.

Historical records show that on the eve of the 30th of October 1946, only a few months after its formal establishment, the bank distributed the first currency bills ever issued by the Indonesian government, known as ORI, or oeang republic Indonesia. This day is commemorated annually as the national finance day, while the date of the bank’s establishment, the 5th of July was assigned as national bank day.

Following the appointment of the Dutch inherited de javasche bank as Indonesia’s central bank in 1949, Bank Negara Indonesia’s role as the circulation and central bank was terminated. The bank was instead designated as a development bank, and was later given the right to provide foreign reserve services, thus allowing direct foreign transactions.

By the last quarter of 1968, the bank decided to attach its year of established to its name s a part of its corporate identity, officially changing the corporate name into Bank Negara Indonesia. The bank was then widely referred to as ‘BNI 46’ for several decades. The simpler name of ‘Bank BNI’ was adopted in 1998 along with the change of the corporate identity.

BNI legal status was upgrade in 1992 into a state owned limited corporation with the name of PT. Bank Negara Indonesia (PERSERO), while the bank decision to become a public company was manifested through an initial public offering of its shares in 1996.

BNI ability to adapt to environmental, socio-cultural and technological advances is reflected through the continuous refinement of its corporate identity over time, which signifies the bank dedication and commitment to continuous improvement of performance.

A refine corporate identity was introduces in 2004, reflecting positive future prospects after a year of struggle through a period of hardship. A shorter name of ‘BNI’ replaced the former ‘BANK BNI’, while the year of establishment ‘46’ was exposed through the logo mark, as a reinforcement of the pride of being the country first national bank.

Maintaining the spirit of the heroic national struggle that is rooted in its history, BNI strives to provide the best services for the country, to become the pride of nations, today and always.

Vision of BNI

To be a national bank that can be proud of leading in services and performance in Indonesia. To be proud of national bank that offers the best service with the competitive price to corporation market segmentation, commercial and consumer.

Mission of BNI

Maximize stakeholders’ value by providing financial solutions that are focused on selected corporate, commercial and consumer market segments.

3. The philosophy of new logo Character of BNI

The character of BNI is made in new turquoise color, to represent the strength, authority, uniqueness, and modern image in the performance. The characteristic is made special to show off the original and unique structure in BNI performance.

The symbol of ‘46’

The number of ‘46’ is symbolization in BNI birthday; also represent an inheritance as the first bank in Indonesia. In this logo, the number of ‘46’ position is diagonally that pierce the peach box to represent the new and modern of BNI 46.

Color pallet

new logo is more dark, strength, and represents the stabilization and survive image. The new orange in the symbol made bright and strong in the performance, and also represent the confidential and fresh image.

The logo of ‘46’ and BNI represent the modern and dynamic appearance. While by using the new corporate color represent more perform the BNI identity. That kind of things will facilitate the BNI to do differentiation in banking industry and market by illustrate the unique, fresh, and modern image.

Start from the fighting spirit that already grown up based on the history, BNI has vision and mission to give the best services to Indonesia, also to be the pride bank in our country.

B. Definition of Marketing

Marketing is the one of the main activity that doing by the business people in surviving in life, in develop and get the profit. The marketing is development from the market word that have means the place or facility where the people meet and make the transaction, in the abstract perspective marketing could say that the activity or process of the all of the system.

On the below will see from the marketing expert about the meaning of marketing.

Marketing is “an organizational function and a set of processes for creating, communicating, and delivering value to customers and managing

customer relationships in ways that benefit the organization and its

stakeholders”, Drucker (2002). Means that marketing as a tools or process communication in introduce the service and products for the people to get the beneficial for the marketer and customer.

While, Sofyan Assauri (2004) has perspective marketing is the human activity that have purpose to fulfill the necessary and people willingness by the changes process. AndWilliam J. Stanton (1998) marketing is the system of all of the business activity that has point to planning, price decision, promotion, and distribution of goods and services in fulfill the potential buyer needs.

Beside that Kotler (2001) said that marketing is the human activity that have purposes to make satisfaction of people needed and people willingness by the changes process.

That understanding could give the figure that marketing by the meet process among individual or group where they are want to get what they need and what they want by creating, offering and changes process. Beside that the marketing is the activities systems that have relationship between one to another that will be continue in planning, pricing decision, promoting and distribution of goods and services to customer by individually or grouping.

efficient. The coordination that could be creates the synergy with good management, which called by marketing management.

C. Definition of Bank

The bank is the familiar word for the people, especially for urban people and even in the town; bank is not the strength thing anymore. Kasmir (2004) perspective bank is the finance institution that has that main activity collect the money from the people and distribute back to the people also give another services of bank.

Meanwhile the finance institution is the company or organization that has the task in finance subject that the activities only collect the money, or only distribute the people or can be both of them, which are collect and distribute the money.

From the explanation on the above we could take the summary that the bank is the company that have specialization on financial focus, means the

banking system always have connection in financial issue, so the conclusion is the bank industry have three main activity are collect the money, distribute the money and give another bank services.

The third activity is giving another service of bank. The purposes in giving another services of bank is to support the both activity before is collect the money and distribute the money. Another services that given by the bank to the customer such as: transfer, clearing, collection, bank card, distribute the fee and payment.

Service is present in work or act that can see or invisible from one side to another side. In generally services that produced and consumed at one time, where interaction among the person that give services and the person that received the services is influence the result of services. Kotler (2003)said” a service can be defined as any activity or benefit that one party can offer another that is essential

intangible and that does not result in the ownership anything. Its production may

or may not tie to a physical product”.

Definition from Zeithaml and Bitner (1996) that “services are deeds, process, and performance”. In these statement service as process and screen, service not only resulted from service company, but is including integral thing that offered by manufacture company. Based on definition above, service means as invisible thing that involve act or work performance by process and work result offered by one party to another party. In production service is have related in physical product, but could not excessively.

on the whole, service is including all economic activity that makes result not in physical product or construction, commonly it’s consumed at one time when the product resulted and give the addition value, such as convenience, entertainment, happiness and healthy or solution of the problem that faced by the customer.

among consumer and the party that give the service, meanwhile both of party that involve not always recognize.

Means Service Company or bank attract and concern the customer with contract system, beside that the member will get the facility and easy thing from company, with the purpose of company will get the profit.

E. Definition of Marketing In Services

Marketing that developed by McCarthy (1981), that popular with marketing mix 4P is: “product, price, promotion, and place”. The 4P already accepted the benefit and affectivity by the marketer. In service industry, products are not real so that only can see by the process not the result, because of these characteristic so that the quality is the point in service industry. Because the characteristics of services not real so the price can be the indicator that representative the service quality.

The purposes of promotion in marketing is to make the services more real for the customer, in services communication promoting by “word of mouth” is very effective in influence the customer. The right place can be makes easy in distribution the services for the customer to get the products. People in Service Company or bank are vital elements in do the marketing.

Rambat (2001) explain that “marketing merupakan tool atau alat bagi marketer yang terdiri atas berbagai elemen suatu program pemasaran yang perlu

dipertimbangkan agar implementasi strategi pemasaran dan positioning yang

ditetapkan dapat berjalan sukses”.

F. Definition of Customer Value

Gale (1994) state that, consumer perception to value of the quality offered by the bank, have more relative highly from the competitor and will be influence to customer loyalty level, more high value perception that feels by the customer, so more high the possibility the transaction happen. And the expectation of relationship that expect is the long term relationship, because the effort and cost that spend out by the bank is certain more high than have to attract a new customer or the customer that already leave the bank, from the maintaining relationship.

For the customer, the product mechanism that feels by customer is same or higher than the expectation, which give value thinking and also the satisfaction, Kotler (2000). The attribute value is characteristics product in mind and explained by the customer. The value consequence is subjective customer estimate as the consequence from products consumer.

The concept attribute value customer services that using in this research is: 1. Price

2. Products (services):

a. Function deposit of transaction tools b. Function financial movements c. Deposits multifunction 3. Services:

a. Easy location b. Speed c. Convenience d. Information e. People f. Image

g. Professionalism staff (people) and gift (promotion).

G. Definition of Services Quality

While Chandra (2005) said that the quality as the dynamic condition that has relationship with the product, services, human resource, process and the environment that could fulfill or can passing the expectation.

The customer perception to services quality is the hall thinking by the services authority, but also because the services performance most of all the time not consistent, so the customer often using the sign of intrinsic and extrinsic as the evidence in intrinsic sign in valuing, that has connected with the output and the delivering technique, while the extrinsic sign is the support of services.

Kotler and Amstrong (1996) have statement that services have four characteristics, such as:

1. Intangibility 2. Inseparability 3. Variability 4. Perish ability

The management of Bank has to arrange the strategy in facing the service characteristics that perish ability. Bank need to make adaptation in order to make it equilibrium among the total of request with the available of personal that ready in give the services to customer, that kind of things can be anticipated with the ATM machine and on line system that have to available on 24 hours in services optimally.

every market organization, for manufacture company or even the distributor of services.

The quality has relation with the customer satisfaction. The quality gives the special support for the customer to make relationship and link that make the profitable for both of side for the long term. The emotional bond it can make it possible for company to make understanding what the specific customer needs and expectation of customer.

In the company revolve, company will increase the customer experience that amazing and minimize or make a zero the sad experience. Next the customer satisfaction will gives contribution in create the switching barriers, switching the cost, and customer loyalty.

The factors that used in evaluating the services quality is that have intangible characteristic, the customer in general using some of attribute such as: tangibility, reliability, responsiveness, assurance, and empathy.

There is three of services quality dimension such as: outcome related or technical quality, process related or functional quality, and image related dimensions. The third of dimension then explain in seven criteria of service quality, which are:

1. Professionalism and Skills

The customer believe that the business of services distributor can trusted, and give the value for money that suitable and represent the performance and positive value.

3. Attitude and Behavior

The customer feels that the employee of bank has concern to the customer and try to help in solving the problem with happiness.

4. Accessibility and Flexibility

The customer feels the services distributor, location, operational hours, employee, and the operational system is arranged and operated well so makes the customer can easy in access the finance activity. Beside that also arranged with the purposes in make flexible in fulfill the customer request and customer willingness.

5. Reliability and Trustworthiness

The customer believe that anything that could happen or that already ahs agreement, the customer could trust to services distributor, employee, or the system in fulfill the promises and do the best for customer.

6. Services Recovery

The customer believes that if there is a fault, the services distributor will active to take the situation and found the best solution.

H. Definition of Customer Satisfaction

In reality customer satisfaction concept is still abstract, achieving of satisfaction can articulate a simple process or complicated, every people have a part in give services, it’s very important and influence in build satisfaction, but in this era customer have to facing variance of products, brand, price, and supplies.

Kotler (1997) said “customer satisfaction is a person’s feeling of pleasure or disappointment resulting from comparing a product’s received performance

(or outcome) in relations to the person’s expectation”. Means that satisfaction or dissatisfaction is comparing from expectation of consumer to real service encounter perception, from the opinion of expert on the above, so can construct conclusion in generally meaning of satisfied or dissatisfied of customer can see from suitable among expectation customer with perception.

Meanwhile Tjiptono (2005) have statement that the satisfaction of customer is the transaction of selling and buying evaluation, where the alternative that could be choose at least give same result or pass from the customer expectation, while the unsatisfied it show up if there is no get the outcome at all. From that definition we can make the formula is:

Customer satisfaction = f (expectation, perceive performance)

Basically, the customer satisfaction concept is including the differentiation between level of necessary and performance or the outcome that could be feeling by customer. That concept could be apply in satisfaction measurement or unsatisfied to current company quality, because both of the concept is has relation.

Picture 2.1

Source: Rangkuti (2003), Measuring Customer Satisfaction, PT. Gramedia Pustaka Utama.

The customer that feel satisfied of the company will attract to buy products of this company all over again, it’s happen because customer felt their willingness already fill, commonly, expected of customer is estimation or conviction customer about what customer will get if they buy or consume a products or services.

The Objective of Company

Customer Expectation of the

Product PRODUCT

Customer Needs and Willingness

The Product Value for Customer

One factor that identify customer satisfaction is customer perception about service quality that have focus in five service dimensions, customer satisfaction , besides influenced by services perception also by quality products, price, and other private factors also situation at that time, customer perception about quality services should not makes customer use services to give value.

Definition customer satisfaction by Mowen (1990:511) is “customer satisfaction is defined as overall attitude regarding a good or service after its

acquisition and use it is a post choice evaluative judgment resulting from a

specific purchase selection”. Means that customer satisfaction is all of attitude to products or service after acquisition and use it.

Interestingly, satisfaction is used as a common marketing benchmark of an organization’s performance, almost to the exclusion of other issues. The banking sector is a classic example of an industry where customer satisfaction and repeat purchase are not positively related, although the PR hype from the banks would have you believe otherwise.

Definition acquisition in here by Mowen (1990:504) is “the consumption, disposition, and post choice evaluation of goods, services, and idea. Means that

acquisition are consumption, using, and evaluation from products, services and

idea that choused”. That’s statement supported by Mowen (1990:622) is “satisfaction refers to an emotional response to evaluation of product or service

consumption”.

these thing suitable with statement by Mowen (1990:523) “the factor most important to satisfaction is the level of performance of the product or service. If

the level of product or service quality is high, customer tends to satisfied, even if

they expected such levels of performance”.

I. Definition of Customer Loyalty

Service capability that have by company in giving excellent services to customer, it is will be effect satisfaction of customer. With satisfaction that felt by customer it will be achieve loyalty to company.

Customer loyalty is affect of the satisfaction of customer, when customer felt that the expected and willingness of customer fill up, more customer feel satisfied more increase the loyal of customer to the company it self, behavioral loyalty is the purchase behavior actually displayed by customer, cognitive loyalty relates to the intentions of future behavior expressed by the customer. Finally, affective loyalty defines the attitude of the customer to the company.

Attitudinal loyalty represents the individual’s feeling towards the company, which may or may not be translated into purchase behavior, depending on factors such as cost, alternatives, and convenience. However, attitudinal loyalty is an important construct as customer with more favorable attitudes are more likely to stay loyal in the long term.

The increased profit from loyalty comes from reduces marketing costs, increased sales and reduces operational costs. “Loyal customers are less likely to switch because of price and they make more purchases than similar non loyal

Loyal customer will also help promote the Service Company or bank. The customer will provide strong word-of-mouth. Rambat (2001) states, “loyal customers serve as a ‘fantastic marketing force’ by providing recommendations

and spreading positive word-of-mouth”. Loyal customers are customers who hold favorable attitudes toward the Service Company or bank, commit to repurchase the services, and recommend to others.

The customer loyalty, in general, there are three distinctive approaches to measure loyalty:

1. The behavioral measurement 2. Attitudinal measurement 3. composite measurement

The behavioral measure considers consistent, repetitious purchase behavior as an indicator of loyalty. Thus, repeat purchase does not always mean commitment. Attitudinal measurements use attitudinal data to reflect the emotional and psychological attachment inherent in loyalty. The third approach, composite measurements of loyalty, combines the first two dimensions and measurement of loyalty.

According Tjiptono (2000) customer loyalty is commitment created by customer to brand, shop, or distributor based on positive attitude that representative in consistent transaction or buying by customer.

switching barrier (SWA sembada “saatnya mencermati loyalitas pelanggan”, 2005: 27).

Thus method could be concluding is condition of customer will evaluate services attribute that could buy and customer will be satisfied. Next satisfaction could decide loyalty or customer desire to do transaction continually, (www.Suaramerdeka.com).

The loyal customer don’t need to think more in save money in BNI, because by learning process and experience, the customer found that fulfill customer willingness. And loyalty is commitment of customer for the BNI, and the customer will consistent with these commitments.

J. Relationship between Customer Satisfaction and Customer Loyalty Customer satisfaction is an important issue for marketing managers, particularly those in services industries. However, it appears that achieving customer satisfaction is often the end goal, as evidenced by the emphasis on customer satisfaction surveys. This paper proposes that this focus is due to the assumption that satisfied customers are loyal customers and thus high levels of satisfaction will lead to increased sales.

It appears that customer satisfaction is not necessary for repeat loyalty. In fact, 70 percent of the customers of these banks are attitudinally loyal: they intend to repurchase from their current bank despite being dissatisfied. These examples suggest the nature of the relationship between satisfaction and loyalty is complex. Yet marketing literature suggests that it is quite simple: satisfaction leads to attitudinal loyalty Lovelock et al. (2001).

As a result of this assumption, customer satisfaction is often used as a proxy for loyalty and other outcomes. The authors empirically demonstrate that satisfaction is not the same as attitudinal loyalty and that there are instances where satisfaction does not result in loyalty. A business sample was selected due to the relevance of satisfaction and attitudes in settings of high risk where a high level of decision making is involved. A sample of 267 businesses was surveyed on their satisfaction and attitudinal loyalty levels towards an advertising service.

The results indicate that satisfaction and loyalty in a business services setting are different constructs, and that, while the relationship is positive, high levels of satisfaction do not always yield high levels of loyalty.

The objective of customer satisfaction measurements should be customer loyalty, high customer satisfaction will result in increasing loyalty for the firm and that the customers will be less prone to overtures from competition, however the ability of customer satisfaction scores to predict such loyalty has not been adequately demonstrated.

important marketing concept. Marketing leads to outcomes other than satisfaction, including awareness, image perceptions and loyalty. There are also other factors that influence purchasing where satisfaction does not always play a role, lack of perceived differentiated competitors, such as in the banking industry. Thus, satisfaction should not be the only goal for marketing practitioners.

Customer loyalty is determined to a large extent by customer satisfaction, Customer satisfaction index study find a positive connection between customer satisfactions and stock market return also offer some evidence of the linkage between customer satisfaction and loyalty.

True loyalty requires commitment to brands, holding a favorable relative attitude towards brands is indicative of manifest satisfaction and commitment towards brands, this commitment will interpret into a desire to buy brands, recommending the brands to others, and loyalty.

Customer loyalty is happen by learning process, where the customer realize, choose, and evaluate the service company and bank that can fulfill the expectation and give the satisfaction of customer. Coyne (1989) states,” there are two critical thresholds affecting the connection between satisfaction and loyalty,

on high side, when satisfaction reaches a certain level, loyalty increases

dramatically”.

which will deliver the greatest competitive advantage in terms of customer satisfaction, ensuring the company makes best use of scarce resource.

Customer satisfaction and customer loyalty surveys are important in ensuring that the voice of the customer is heard at the highest level within an organization and that business plans are prepared with the customer’s needs in mind.

While satisfaction itself is an emotional construct, its antecedents or drivers can be either emotional or cognitive, depending on the situation. Oliver (1989) proposed five models of satisfaction and its antecedents, three of which result from disconfirmation of expectations and can be labeled evaluative-based satisfaction.

The remaining two depict satisfaction as an outcome of non-rational processes that can be labeled Emotion-driven. Patterson et al (1997) summarized previous research and indicated that satisfaction does not always have disconfirmation antecedents. It is the purpose of this paper to demonstrate that satisfaction is not a proxy for loyalty.

needed to investigate the other two issues, and this is detailed in the final section of this paper.

These issues lead to the identification of three key gaps, which this research aims at filling. First, there is a lack of empirical evidence for discriminate validity for satisfaction and attitudinal loyalty. Second, few studies on satisfaction and loyalty have been conducted in a business-to-business services setting. Finally, insufficient attention is paid to reporting measurement or constructs validity when examining the relationship between satisfaction and loyalty.

Dick and Basu (1994) suggest that “low relative attitude with low repeat purchase connotes absence of loyalty, while low relative attitude with high repeat

purchase indicates spurious loyalty. Satisfaction is thus viewed as an antecedent

of relative attitude”. “However, the ability of customer satisfaction scores to

predict such loyalty has not been adequately demonstrated” Higgins (1997).

K. Consideration framework

Tjiptono (2000) said that the quality of services or goods is the effort to fulfill the necessary and willingness of the customer also the exactly in delivery to fill the customer expectation.

The factors that used in evaluate the services by Gonroos (2000)explain in seven criteria in valuation of services, are professionalism and skill, reputation and credibility, accessibility and flexibility, reliability and trustworthiness, services recovery and service cape.

The satisfaction is the buyer evaluation where the alternative is chosen by give the outcome that same or pass the customer expectation, while unsatisfied is the effect if the outcome could not fulfill the customer expectation.

Picture 2.2

Consideration Framework

L. Hypothesis

Value (X1)

Satisfaction (X2)

Customer Loyalty (Y)

Multiple Linier Regressions

According Mowen (1995:531) statement that “the loyalty in organization influences directly by satisfied or unsatisfied of customer by accumulation, when

customers have low satisfaction to an organization”. So the customers also have low loyalty. These statement supported by Hawkins (1986:699) explain that “the customer that loyal with an organization show the satisfaction level that higher

than the customer that not loyal or the customer that have low loyalty to an

organization”.

The hypothesis formula that can be approved that has relation between Services Quality-Satisfaction-Customer Loyalty is:

1. Ho1: there is no significant direct influence between services quality of banking services variable to customer loyalty in BNI.

Ha1: there is significant direct influence between services quality of banking services variable to customer loyalty in BNI.

2. Ho2: ρ=0: There is no significant influence between customer satisfaction of

banking services variable to customer loyalty in BNI.

Ha2: ρ≠0: There is significant influence between customer satisfactions of banking services variable to customer loyalty in BNI.

3. Ho3: There is no significant direct influence between services quality of banking services with customer satisfaction towards customer loyalties in BNI.

CHAPTER III RESEARCH METHOD

The research design that will be use in this research is causal research, which explains about the causal relationship between research variables, the purposes to make a decision of relationship methods cause and effect from independent variables to dependent variables. On problem that discussed on chapter 1 about is there any influence between value, customer satisfaction and customer loyalty in BNI? The answer according Mowen (1995:531) statement that explains about customer loyalty is having relationship with satisfied or unsatisfied of customer to organization. Because of that research method is needed to answer those problem formulation based on the hypothesis that already discussed on chapter 2.

B. The Research Scope

The scope of this research is descriptive research and conclusive, where the definitions of descriptive are:

a. To describe the characteristics from the relevant group b. To show the variables that have correlation or relationship c. To make the specifics prediction

The research is a cause and effect relationship to see the influence between values, customer satisfaction variable, towards customer loyalty in BNI.

B. Sampling Methods

The sample fill the characteristics of population, so that, the answer of questioner from the population is representative the people opinion. These methods in taking sample using non probability sampling, means the methods taken by subjective and researcher could to choose the respondent.

In this research use the scale that have the purpose to analysis the respondent opinion about the influence between value, satisfaction of customer and customer loyalty in BNI Jakarta. The customer of BNI is the object of this research. The respondent will be asking to answer the questioner to participate in giving the assessment of services in BNI.

C. Population and Research Sample 1. Research Population

Research population in this case is the customer of BNI. Due to a lot of number of population customer at BNI, so the representative sample collection is needed to give a correct picture of the population.

2. Research Sample

The size of variable is determined by:

respondents with 31 of questions and the outcome is valid, so the researcher could continue the research.

b. The research held in BNI, kantor besar, Sudirman, Jakarta.

c. The respondent chooser by this research, following the order; active customer, means come to BNI minimum once a month, have fix income, the respondent is chooser with simple random sampling methods.

D. Data Collection Methods

These research methods did on October 2008 used collection and observation data, data is collected from BNI Jakarta, there are:

1. Primary Data: data is getting from the survey result with giving questioner to the respondent that suitable with the population characteristics of customer BNI Sudirman, kantor besar, Jakarta. 2. Secondary Data: the general data is getting from the last research and

literature about relationship between customer loyalty and customer satisfaction.

E. Analysis Methods

This research method using the analysis methods is the descriptive methods. The purpose is to get some figure of descriptive or systematic outline, actual, accurate about the fact, also the phenomenon relationship that will be researched and explore.

The level of essential of customer value factor and customer satisfaction towards customer loyalty will do by Likert method. The instrument of the question will end result the total score for every member of sample that represent by every score that already write down, on the below:

Table 3. 1 Likert Scale

Likert Scale Score

Strongly disagree Disagree

Neutral Agree

Strongly agree

1 2 3 4 5 Source: Freddy Rangkuti (2003)

Validity is an indicator that shows the level of validity or legitimacy of an instrument. An instrument is valid if could measurement what do we need. Valid means that instrument could be use to measure what we want to calculate. Validity that used in this research is construction validity is the framework from one concept; with calculate among correlation with moment product correlation formula. With r = 0, 01 if less from that so the statement is not valid.

2. Reliability Test

The instrument that used for many times to measure the same object will make a same data of the result. To measure the reliability coefficient could use with alpha cronbach formula.

Where:

R 11 = Instrument Reliability k = sum of Question

σ2 = Total Variance

σ2 b = Sum of Variance

In this research using model is multiple linier regression analysis. This model used because wants to looking for the influence value (X1) and satisfaction (X2) to customer loyalty (Y) in BNI.

Multiple linier regressions the formula is:

Y = α + b1 X1+ b2 X2+ ε

Where:

Y = Dependent Variable

a = constantan (price Y if X = 0) b = Coefficient Regression

X1 = Independent Variable (Customer Value) X2 = Independent Variable (Customer Satisfaction)

ε = Standard Error

4. Classic Assuming Test a. Autocorrelation

Where:

Ho: there is no correlation

Ha: there is positive/negative correlation if Durbin Watson < -2 so there is positive autocorrelation, and if DW >2 so it is negative correlation.

b. Multikolinearity

Multikolinearity used to prove there is correlation linier between independent variable in regression model. If independent variable creates the perfect correlation it could be perfect multikolinearity.

To analyze is there any multikolinearity or not in regression model with do the observation the tolerance value and variance inflation factor (VIF). Independent regression model multikolinearity have VIF value approximately on 1 until 10 and have tolerance number close to the fault in estimation independent variable capacity as a dependent variable predictor.

The multikolinearity test do by consider VIF value regression if VIF value of independent variable bigger than 10 so, the conclusion that a variable have strong linier relation with another independent variable. To decrease the multikolinearity is disappear the independent that variable from the similarity regression.

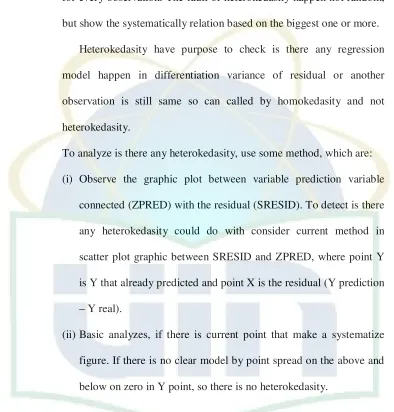

Heterokedasity show that the variance of variable there is no same for every observation. The fault of heterokedasity happen not random, but show the systematically relation based on the biggest one or more.

Heterokedasity have purpose to check is there any regression model happen in differentiation variance of residual or another observation is still same so can called by homokedasity and not heterokedasity.

To analyze is there any heterokedasity, use some method, which are: (i) Observe the graphic plot between variable prediction variable

connected (ZPRED) with the residual (SRESID). To detect is there any heterokedasity could do with consider current method in scatter plot graphic between SRESID and ZPRED, where point Y is Y that already predicted and point X is the residual (Y prediction – Y real).

(ii) Basic analyzes, if there is current point that make a systematize figure. If there is no clear model by point spread on the above and below on zero in Y point, so there is no heterokedasity.

The objective to make a conclusion regarding the influence of independent variable (X) to dependent variable.

So, the formula such as:

Sb

b = Coefficient correlation N = Total sample

Sb = Error Coefficient Correlation Se = Estimation Error

If T test > T table so Ho rejected and Ha accepted, means independent variable by partial have significant influence to dependent variable .

If T test < T table so Ho accepted and Ha rejected, means independent variable by partial don’t have significant influence to variable dependent.

To do hypothesis analysis, so there is role that needs to be concerned is the formulation zero hypotheses (ho) and we also need to put the alternative hypothesis (ha), such as:

1. Ho : ρ = 0 there is no significant influence between variable X1 and X2 to variable Y.

2. Ha : ρ≠ 0 there is significant influence between variable X1 and X2 to variable Y.

This analyzes to analyze all the independent variable together can influence to dependent variable. So the formulate to F test is:

(

1)

/(

1)

variable together have significant influence to dependent variable.If F test < F table so Ho accepted and Ha rejected, means independent variable together don’t have significant influence to dependent variable.

F. Research operational variable

1. Independent variable

This variable called by stimulus variable, predictor, antecedent. Or in bahasa can call with variable bebas. Independent variable is the variable that gives influence or the causal of the changes happen or the effect from dependent variable. In this research that being the independent variable is service quality (Professional and Skill, Reputation and Credibility, Attitude and Behavior, Accessibility and Flexibility, Reliability and Trustworthiness, Services Recovery, and Service Cape) (X1) and satisfaction (X2).

2. Variable dependent

This variable always calls by output variable, criteria, consequence. In bahasa called by variable terikat. Dependent variable is the variable that influence or that to be the effect, because of the independent variable. The variable dependent in this research is the customer loyalty (Y).

the easy things that given by the bank for the customer of the services that resulted in getting the product of services by the bank.

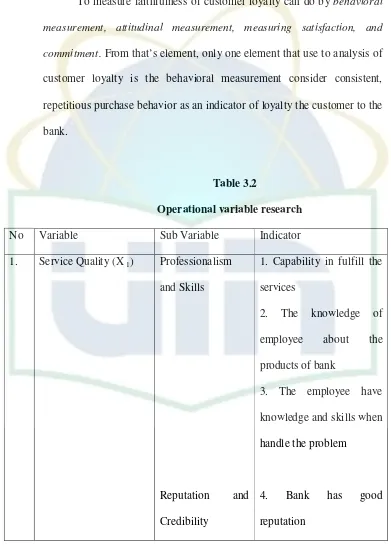

To measure faithfulness of customer loyalty can do by behavioral measurement, attitudinal measurement, measuring satisfaction, and

commitment. From that’s element, only one element that use to analysis of customer loyalty is the behavioral measurement consider consistent, repetitious purchase behavior as an indicator of loyalty the customer to the bank.

Table 3.2

Operational variable research

No Variable Sub Variable Indicator

1. Service Quality (X 1) Professionalism and Skills

Reputation and Credibility

1. Capability in fulfill the services

2. The knowledge of employee about the products of bank

3. The employee have knowledge and skills when handle the problem

Attitudes and Behavior

Accessibility and Flexibility

5. Follow the rules and regulation of banking system

6. The clandestine / secret of the customer cover by bank

7. Give the guarantee of security to customer

8. The employee concerned to customer of bank.

9. The employee always ready to help customer. 10. The employee aware with the problem that faced by Customer.

11. The customer feels easy doing transaction all the time.

Reliability and Trustworthiness

Services Recovery

Service Cape

13. The transaction process is fast and quick 14. The machine ATM facility is complete and spread.

15. Provide the services suitable with the promises 16. keep notes and document without a mistake

17. Can trusted in solve the problem

18. Can finish the trouble if there is a mistake.

19. Can give solution when the fault happens. 20. The employee could handle the situation if fault happens.

2.

performance of building and good interior.

CHAPTER IV ANALYSIS

A. General Description of Research Object 1. Location and Time of Research

This research is held in PT. Bank Negara Indonesia (persero), Tbk. Kantor Besar, Sudirman, Jakarta. Research data is found through distributing questionnaires and collecting the information directly. The distribution of questionnaires started on October 2008.

2. Characteristics of Respondent

The questionnaires has been distributed to 50 respondents of customers at PT. Bank Negara Indonesia (persero), Tbk. It is a representative sample that is needed to give a correct picture of the whole population.

B. Analysis and discussion

1. Valid and Reliability Test

Before the questioner was spread to the 50 respondents, the researcher tried out or survey to 10 respondents with 31 questions to test the validity also reliability from the entire questionnaire.

variable, customer satisfaction variable and customer loyalty. The service quality variable divided to be 7 sub variables, which are: Professional and Skills, Reputation and Credibility, Attitudes and Behavior, Accessibility and Flexibility, Reliability and Trustworthiness, Services Recovery, and Service Capability, that have 24 indicator and sub indicator.

Table 4.1

The Result of Analysis of Influence between Service Quality and Customer Satisfaction towards Customer Loyalty in PT. BNI 46

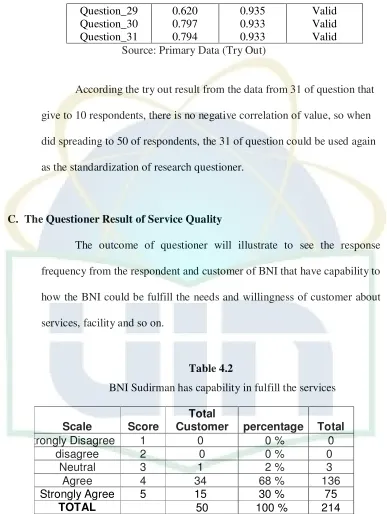

Question_29 Source: Primary Data (Try Out)

According the try out result from the data from 31 of question that give to 10 respondents, there is no negative correlation of value, so when did spreading to 50 of respondents, the 31 of question could be used again as the standardization of research questioner.

C. The Questioner Result of Service Quality

The outcome of questioner will illustrate to see the response frequency from the respondent and customer of BNI that have capability to how the BNI could be fulfill the needs and willingness of customer about services, facility and so on.

Table 4.2

BNI Sudirman has capability in fulfill the services

Scale Score

Total

Customer percentage Total

Strongly Disagree 1 0 0 % 0

ability in accomplish the services that needs by customer and 68% respondent have statement agree of capability that had by BNI in fulfill to customer, while only 2% is neutral. This means Customer believe BNI have capability of BNI in giving the best services.

Table 4.3

The employees have knowledge about the products of BNI

Scale Score

Total

Customer percentage Total

Strongly knowledge about the product of bank. This is proven by the 50 respondent, approximately 8% of respondent is agree with the statement that said the employee have knowledge about the banks products. Around 66% is strongly agreed, while about 26% of respondent is neutral. And there is no respondent disagree with the statement.

Table 4.4

The employee of bank has knowledge and skill in handle the problem of customer

Scale Score

Total

Customer percentage Total

Disagree strongly agree, 86% of respondent have statement agree with the statement and 4% of respondent is neutral. It is prove that the employee of bank has knowledge and skill in handle the problem of customer.

Table 4.5

BNI has good reputation on customer perspective

Scale Score

Total

Customer percentage Total

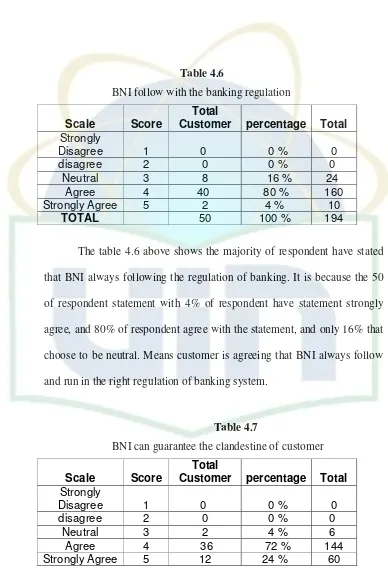

Table 4.6

BNI follow with the banking regulation

Scale Score

Total

Customer percentage Total

Strongly

The table 4.6 above shows the majority of respondent have stated that BNI always following the regulation of banking. It is because the 50 of respondent statement with 4% of respondent have statement strongly agree, and 80% of respondent agree with the statement, and only 16% that choose to be neutral. Means customer is agreeing that BNI always follow and run in the right regulation of banking system.

Table 4.7

BNI can guarantee the clandestine of customer

Scale Score

Total

Customer percentage Total