IMPROVING THE CAPABILITY FOR INNOVATION IN THE

INDONESIAN SEAWEED INDUSTRY: AN EXPLORATORY

RESEARCH

ADITYA ANDIKA WICAKSONO

GRADUATE SCHOOL

BOGOR AGRICULTURAL UNIVERSITY BOGOR

DECLARATION*

I certify that the thesis entitled “Improving the Capability for Innovation in the Indonesian Seaweed Industry: an Exploratory Research” is my original work and has been fully acknowledged by academic advisors. In addition, I certify that this copy of thesis has been approved for being available in both University of Adelaide and Bogor Agricultural University.

I give consent to this copy of my thesis when deposited in the Bogor Agricultural University library, subject to the provisions of the copyright act. The author acknowledges that copyright of published works contained within this thesis resides with the copyright holder(s) of those works.

Jakarta, July 2015

Aditya Andika Wicaksono

SUMMARY

ADITYA ANDIKA WICAKSONO. Improving the Capability for Innovation in the Indonesian Seaweed Industry: An Exploratory Research. Supervised by AJI HERMAWAN and TITI CANDRA SUNARTI.

The Indonesian government perceives technology issue playing an important role in improving industrial performance. The government then believes that technological intervention through particular government programs will help securing a commodity price. A machinery grant, for instances, has been chosen as a solution to overcome seaweed problem in many Indonesian regions. However, the program has showed different result in every place.

All companies under the program tend to perform differently despite being equipped by same technology. It, however, indicates that technology alone is not necessarily granting a success. Instead, it indicates another distinctive elements that company should posses in order to succeed

This research aims to identify key factors that would lead the company to be successful. It is conducted by comparing two distinctive company performances, which are successful and less successful state-owned carrageenan (ATC) Industry in Indonesia. All Data collection is conducted through semi-structured interview.

The research took place both in the company A and B. both companies are geographically separated. The company A represents a success ATC Company, which is located in East Sumba. Meanwhile, the company B represents underperforming company, which is located in East Lombok. All samples taken are officially under government machinery grant program. This research used preselected framework in order to generalize the findings.

The researcher views that both of technological and transactional capability have influenced a company to be innovative (Gamarra & Zawislak, 2013). Gamarra and Zawislak (2013) says technological capability is an ability to use technology in order to gain advantage over competitor while the transactional capability aims the same goals by managing a company expenses. Hence, both factors are taken into account as a research framework.

The research finds that managerial skills plays important factors in a success company. It becomes a distinctive factor that distinguish the company A to the company B. Unlike the company B, the company A is chaired by experienced manager. It allows the manager showing good managerial skills in the company. Meanwhile, the manager in company B is inexperienced manager. It allows the manager showing poor managerial skill in the company. The managerial skill has actually been a distinctive role in two companies.

RINGKASAN

ADITYA ANDIKA WICAKSONO. Meningkatkan Kemampuan untuk Inovasi dalam Industri Rumput Laut Indonesia: Sebuah Penelitian Eksploratif. Dibimbing oleh AJI HERMAWAN dan TITI CANDRA SUNARTI.

Pemerintah Indonesia menganggap teknologi berperan penting dalam meningkatkan kinerja suatu industri. Oleh karena itu, pemerintah percaya bahwa intervensi suatu teknologi dapat memperbaiki harga komoditas. Program pemberian bantuan alat telah didaulat menjadi salah satu kunci untuk menanggulangi permasalahan tersebut yang terjadi pada industri rumput laut di beberapa bagian Indonesia. Namun, pada kenyataanya program tersebut menunjukkan perbedaan tingkat keberhasilan.

Semua perusahaan yang menerima bantuan tersebut cenderung menampilkan perbedaan kinerja meski memiliki teknologi yang sama. Hal tersebut mengindikasikan bahwa teknologi tidak mutlak memberikan kesuksesan yang sama. Sebaliknya, hal tersebut mengindikasikan adanya kontribusi krusial dari elemen yang lain terhadap kinerja suatu perusahaan.

Penelitian ini bertujuan untuk mengidentifikasi faktor kunci yang menyebabkan kesuksesan perusahaan yang menerima bantuan teknologi yang sama. Pengambilan data dilakukan dengan cara membandingkan performa dari dua perusahaan Alkali-treated Carageenan (ATC) yang memiliki perbedaan performa.

Data dikumpulkan melalui wawancara semi terstruktur pada perusahaan sampel di Waingapu dan Lombok timur. Penelitian ini menggunakan suatu framework untuk menggeneralisir temuan.

Penelitian ini menunjukkan bahwa kemampuan teknologi dan kemampuan transaksi erat kaitannya dengan tingkat keinovativan suatu perusahaan. Selain peran teknologi, penelitian ini menemukan bahwa kemampuan manajerial sangat berperan dalam kesuksesan suatu perusahaan. Kemampuan seorang manajer perusahaan sangat berperan dalam memajukan industri yang dipimpinnya. Pengalaman manajerial yang dimiliki seorang manajer merupakan keuntungan yang dimiliki oleh perusahaan A dan tidak dimiliki oleh perusahaan B.

Copyright ©2015, by Bogor Agricultural University

All Right Reserved

1. No part of all of this thesis excerpted without inclusion or mentioning the sources

a. Excerption only for research and education use, writing for scientific papers, reporting, critical writing or reviewing of a problem

b. Excerption does not inflict a financial loss in the proper interest of Bogor Agricultural University

Thesis

Submitted to the Graduate School in partial fulfillment of Master of Science Degree in

Agro-industrial Technology

IMPROVING THE CAPABILITY FOR INNOVATION IN THE

INDONESIAN SEAWEED INDUSTRY: AN EXPLORATORY

RESEARCH

GRADUATE SCHOOL

BOGOR AGRICULTURAL UNIVERSITY BOGOR

2015

PREFACE

Firstly, I would like to thank Allah SWT for the guidance, which assists me in accomplishing this research. The paper, however, is deliberately written in accordance to double degree program between Institut Pertanian Bogor in Indonesia and University of Adelaide in Australia. Given the reason, it is then inevitable that there are two exact copies of thesis submitted to each institution.

The author would also like to thank Dr. Aji Hermawan, Dr. Titi Candra, and Dr. Ron Grill, respectively. Their presence has made writing process easier through valuable feedback and expertise. Then, it helps the author to finish the project effortlessly.

At last, the author would abundantly thank family for relentless supports and patience to get through the time with effortless grace. It is definitely an honor completing this research. Hopefully, academic society would be a beneficiary of this research.

Jakarta, July 2015

TABLE OF CONTENTS

LIST OF TABLES vi!

LIST OF APPENDIXES vi!

1! INTRODUCTION 7!

Background 7!

Problem Statement 8!

Research Objectives 8!

Significance to the field 8!

Limitation 9!

2! LITERATURE REVIEW 10!

Introduction 10!

Definition of company’s internal capabilities 10!

Innovation capability 10!

Transaction Capability 12!

Technological Capability 13!

3! RESEARCH METHOD 16!

Introduction 16!

Setting 16!

Participants 16!

Research Procedure 17!

Data Analysis 18!

4! FINDING AND DISCUSSION 19!

Performance Capability of Seaweed Industry 19!

Influence of Technological Capability on Firm Performance 20! Influence of Transactional Capability on Firm Performance 24!

5! CONCLUSION AND RECOMMENDATION 28!

Conclusion 28!

Recommendation 29!

REFERENCES 30!

APPENDIXES 32!

LIST OF TABLES

Table 1 The typology of transactional capability (Gamarra & Zawislak, 2013) 12 Table 2 The typology of technological capability (Lall, 1992) 14

Table 3 List of Respondents 17

LIST OF APPENDIXES

7

1

INTRODUCTION

The Indonesian government perceives technology issues playing an important role toward industrial performance. A company would show positive performance once technology was included into company routine. For this reason, the government then involves technology in seaweed business through processed seaweed.

This research aims to identify key factors that would lead the company to succeed. The research compared two distinctive company performances. One company represents a success company while the remainder represents a poor-performer in producing Alkali-treated carrageenan (ATC). All samples taken are government-owned and are grantee for machinery grant program. Such circumstance has enabled the company to have same machinery as well as the same training materials. Given same level of technology, there are nonetheless noticeable differences in terms of company performances.

There is still an underperforming company despite being supplied with same technology and training material. It automatically ignores a technology role as the only one distinctive element in a success company. Instead, the evidence indicated another element as determinative factors.

Background

Price fluctuation is problematic in a seaweed industry. It has been occurring over years and thus gives seaweed farmers great losses. It has been disadvantages seaweed farmers as it keep fluctuating in seaweed growing season, particularly during 30 to 45 days growing period. As a result, it has eventually give major impact to the farmer’s income, and regional economic growth in general.

Mutual collaboration then formed between local government and central government in order to support industrialization through Alkali-Treated Carrageenan (ATC) production. ATC is famed as the simplest form of processed seaweed. It has four times higher in term of selling prices compared to raw seaweed. In addition to value added content, ATC is also less susceptible towards price fluctuation than raw seaweed and thus would benefit seaweed farmers. Therefore, the government provided assistance by giving ATC machinery as well as capacity building to local region.

The machinery program has been lasting for years. Providing a full set of ATC machinery, such as washer, boiler and chopping machine. To some extent, the program mostly conducted in a great seaweed producer region due to stable supply of raw material.

8

new jobs as well as promoting new business. The technology nevertheless has shown different results in term of company performance amongst grant recipients.

Problem Statement

The machinery grant program has shown low impact towards company performance. Despite having same specification of machinery, the company varied in term of company productivity.

The presence of technology has shown low success rate amongst recipients. It automatically rejects government hypothesis regarding technology’s great contribution toward a success company. It indicates instead the role of another distinctive capability in a company. Therefore, there is a need to identify another important capabilities in the company. The findings of the research will be useful to modify current program operationalization as well as strengthening all related regulation.

There are actually several studies regarding company internal capabilities, such as technological capabilities (Lall, 1992), innovation capability (Janaratne, 2014; Zawislak, Cherubini Alves, Tello-Gamarra, Barbieux, & Reichert, 2012) and transactional capability (Gamarra & Zawislak, 2013). These notions accordingly are useful framework to approach the problems in machinery grant program.

Research Objectives

The purpose of this research is to identify key factors that lead to the successfulness of companies receiving technology grant. The study aims to contribute in policy-making on managing technology grant in Indonesia.

Significance to the field

In connection with the research, the definition of innovation capability has been disputed with many scholars. This research views innovation capability as a driver that is able to influence a company to innovate (Zawislak et al., 2012). Saunila and Ukko (2012) confirm that there is significance between innovation capability and firm performance.

9

This research confirms the importance of transaction capability elements in the company. It views transactional capability as a technological perfect match in a company. The company needs both capabilities in order to keep innovating. In the real world, the innovation is the ultimate weapon to outperform the competitors (Janaratne, 2014). The transaction capability benefit the company through reducing transactional cost and thus is regarded as a innovation. Many scholars studied its definition and the benefit. However, there are still few empirical studies as to transactional contribution to the company.

Current literature have studied innovation capability in private-owned Small Medium Enterprise (SME), ranging from the assessment of innovation capability in Finnish SME (Saunila & Ukko, 2014), until improving innovation capability in Australian SME (Janaratne 2014). However, there is still limited study conducted in state-owned SME, which may differs in term of capital structure, SME’s definition as well as the company mission.

In term of capital structure, the private company mostly source from bank loan for its capital. Meanwhile, the Indonesian state-owned company uses annual government budget. Therefore, the state-owned company has never been affected by interest rate.

With respect to SME’s definition, there is a substantial difference among countries. Saunila and Ukko (2012), for instances, uses SME definition based on EU Recommendation (2003/362). It basically varies in term of amount of employees and revenue compared to Indonesian SMEs.

At last, Indonesian state-owned SMEs is also designed for certain objectives, ranging from promoting industrialization in remote area until commodity price stabilization. As a result, these factors may distinguish from SME in current literature review. Hence, it is important to examine both technological and transactional capability in Indonesian state-owned company, including in ATC Industry.

Limitation

This research is conducted in a government pilot-project. It employs two companies as research samples, which differ in term of its time establishment. It therefore may interfere both company performances.

The limited number of respondents occurred due to technical other research in different commodity.

10

2

LITERATURE REVIEW

Introduction

Nowadays, innovation is perceived as the solution to sustain the business since restructuring or lowering cost is no longer able to stand the pace of today’s competition. Therefore, it is important for a company to develop their innovation capability so as to be competitive (Janaratne, 2014).

However, there is still no fixed definition regarding innovation capability. In addition, innovation capability has been recognized as an intangible asset. It is therefore difficult to measure and thus makes the researcher need to find specific tools to approach it (Janaratne, 2014).

Nevertheless, innovation capability is able to explain current firm performance (Saunila & Ukko, 2012). For instances, Janaratne (2014) studied the firm performance measurement by using innovation capability as a tool for improving Australian Small Medium Enterprises (SME) performances. Having this in mind, it is important to demonstrate good knowledge of innovation capability prior to the company examination.

According to Saunila and Ukko (2012), they have specified innovation capability through defining its closely related aspects. It is therefore important to comprehend firm internal capabilities, which mainly constitute the innovation capability framework.

Definition of company’s internal capabilities

Studies on capabilities have been conducted by many researchers, such as core competence (Prahalad & Hamel, 1990), transactional capabilities, innovative capabilities (Zawislak et al., 2012) and technological capabilities (Patel & Pavitt, 1997). A capability is one of determinant factors that company use to create differentiated products and services.

According to Zawislak et al. (2012), It is a four set of internal capabilities, namely technological; operational; management; and transactional capabilities. Amongst capabilities, technological capability has emerged as the most popular concept to determine a level of company innovativeness (Patel and Pavitt, 1997) although not all technology companies become an innovative company. The remainders are then grouped and labeled as complementary capabilities.

Transactional capability, however, has been studied as a technological capability perfect match. According to Gamarra and Zawislak (2013), a collaboration between technological and transactional capability has resulted superior firm performance. It confirms that technology is not sufficient so that a company requires complementary capabilities, such as transactional capabilities.

Innovation capability

11

produce innovative outputs (Janaratne, 2014; Neely, Filippini, Forza, Vinelli, & Hii, 2001). Saunila and Ukko (2012) confirm that innovation capability referring to all elements that influence an organization’s capability to manage its innovation. As a result, innovation capability is a concept coming from internal knowledge conversion, which is commonly extracted from daily routine operation.

Alternatively, Branzei and Vertinsky (2006) emphasizes that innovation capability is the company’s ability to transform external knowledge into a new product. It, however, also covers the ability to commercialize the product. It rather focuses on external than internal knowledge transformation. The external knowledge means useful information coming from outside the company.

Meanwhile, Zawislak et al. (2012) find that innovation capability primarily consists of four elements of organization’s capabilities that working together in order to promoting innovation and thus would improve the company competitiveness. These four sets of capabilities are namely technological capability, transactional capability, operational capability and management capability.

Gamarra and Zawislak (2013) only focus on two out of four set essential capabilities in the company, such as technological and transactional capability. The author perceives that innovation capability is the ability both in translating the company knowledge and marketing the innovation result.

On one hand, the company is able to crystallize its learning process into mature technology development. On the other hand, the company is also able to market the product. According to Zawislak et al. (2012), Innovation capability is achieved when a company has equally accomplished both task. The scholar then claims both capabilities are essential due to its ability to achieve innovation goals

The concept basically confirms innovation capability model introduced by Zawislak et al. (2012). Innovation capabilities comprises Technology Capabilities (Lall, 1992), Operational Capabilities; Management Capabilities; and Transactional Capabilities (Zawislak et al., 2012).

However, it is still possible to distill the concept into a compact concept. Operational capabilities, for instance, is solely represented by technology capability. Both elements indicate a company’s good proficiency in transforming company’s internal knowledge, such as product formula, chemical mix, etc.

12

Transaction Capability

Studies on transaction cost led by Coase (1937) becomes a base line for the emergence of transaction capability. Traditionally, Coase emphasizes that market mechanism is not free but involves transaction cost. In short, it refers to time and money to search sellers and buyer. Transaction capability is defined as a firm’s ability, skill, knowledge or useful experience that firm use in reducing transaction costs, such as marketing cost, delivery cost, etc.

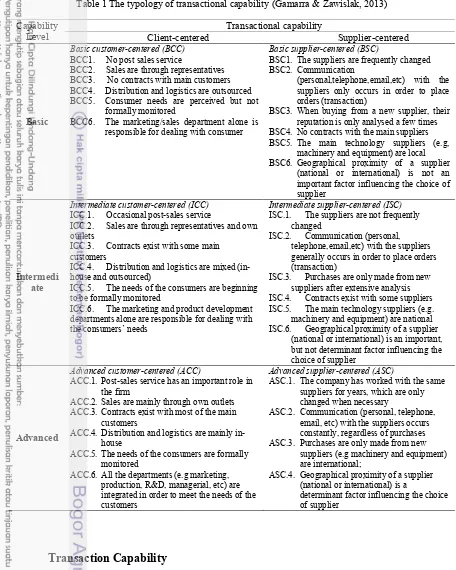

Table 1 The typology of transactional capability (Gamarra & Zawislak, 2013)

Capability BCC3. No contracts with main customers BCC4. Distribution and logistics are outsourced BCC5. Consumer needs are perceived but not

formally monitored

BCC6. The marketing/sales department alone is responsible for dealing with consumer

Basic supplier-centered (BSC)

BSC1. The suppliers are frequently changed BSC2. Communication

(personal,telephone,email,etc) with the suppliers only occurs in order to place orders (transaction)

BSC3. When buying from a new supplier, their reputation is only analysed a few times BSC4. No contracts with the main suppliers BSC5. The main technology suppliers (e.g,

machinery and equipment) are local BSC6. Geographical proximity of a supplier

(national or international) is not an important factor influencing the choice of supplier

Intermedi ate

Intermediate customer-centered (ICC) ICC.1. Occasional post-sales service

ICC.2. Sales are through representatives and own outlets

ICC.3. Contracts exist with some main customers

ICC.4. Distribution and logistics are mixed (in-house and outsourced)

ICC.5. The needs of the consumers are beginning to be formally monitored

ICC.6. The marketing and product development departments alone are responsible for dealing with the consumers’ needs

Intermediate supplier-centered (ISC) ISC.1. The suppliers are not frequently

changed

ISC.2. Communication (personal, telephone,email,etc) with the suppliers generally occurs in order to place orders (transaction)

ISC.3. Purchases are only made from new suppliers after extensive analysis ISC.4. Contracts exist with some suppliers ISC.5. The main technology suppliers (e.g.

machinery and equipment) are national ISC.6. Geographical proximity of a supplier

(national or international) is an important, but not determinant factor influencing the choice of supplier

Advanced

Advanced customer-centered (ACC)

ACC.1. Post-sales service has an important role in the firm

ACC.2. Sales are mainly through own outlets ACC.3. Contracts exist with most of the main

customers

ACC.4.Distribution and logistics are mainly in-house

ACC.5.The needs of the consumers are formally monitored

ACC.6.All the departments (e.g marketing, production, R&D, managerial, etc) are integrated in order to meet the needs of the customers

Advanced supplier-centered (ASC)

ASC.1. The company has worked with the same suppliers for years, which are only changed when necessary

ASC.2. Communication (personal, telephone, email, etc) with the suppliers occurs constantly, regardless of purchases ASC.3. Purchases are only made from new

suppliers (e.g machinery and equipment) are international;

ASC.4. Geographical proximity of a supplier (national or international) is a

13

Accordingly, the firm will outperform another firm as they can reduce the emerging cost from finding suppliers and customers. Similar with technological capability typology (Lall, 1992), Figure 1 illustrates the firm’s current level of transactional capability. It consists of two dimensions (Client-centered and Supplier-centered) and each of which has three groups of level, namely basic, intermediate and advanced.

Gamarra and Zawislak (2013) research preposition was that each group represents the level of transaction capability. Advanced level of transactional capability requires more complex qualifications. This typology could be useful in indicating current state of firm’s transactional capability and thus would represent the level of a firm’s performance.

Technological Capability

The Neo-Schumpeterian tradition focused on the technological capabilities as main determinant factor to achieve Schumpeterian profits. In addition to technological factor, neo-Schumpeterian also concern on “input” of resources (e.g technology) analysis instead of “output” of resource (product) in firms. It then may suggest proper technology firms should acquire.

Similar research has conducted by Lall (1992), whose studies examining technology capabilities difference between developed and developing countries, as well as the way they transfer the technology. Like transactional capability typology (Gamarra & Zawislak, 2013), the researchers design a typology of technology capabilities, consisting three level of complexity (basic, intermediate and advanced). Figure 2 clearly showed all qualifications that should be met before classified either as basic, intermediate or advanced technological capability.

Traditionally, technological capability constitutes the most influential variable of innovation performance of the firms. Nevertheless, the firms should take into account three another major factors, such as operations, management and transaction capabilities so as to capture the innovative performance of the firms (Gamarra & Zawislak, 2013)

This research perceives innovation capability as two essential elements, namely technological and transactional capability. Based on literature review, those two elements have become the firm’s essentials because it meets innovation goals.

Technological capability is perceived as the result of company knowledge internalization. It enables the company to produce either new product or process by possessing the ability to use technology, such as skills, methods and techniques. The position becomes even important due to its role in business initiation, (Zawislak et al., 2012). Nevertheless, it also needs another capabilities in order to overcome a company’s failure in improving its performances (Gamarra & Zawislak, 2013)

14

Nowadays, innovation is the ultimate weapon to surpass competitors (Janaratne, 2014). The transaction capability benefits the company through reducing transactional cost. Moreover, it helps the company to transact the product to the market. Transactional capability is then classified as innovation as it helps the company to be competitive.

Many studies research transactional capability definition and benefit. Yet, there are few empirical studies with regard to its presence in the company, particularly in state-owned company. This study, however, aims to use two dimensions of innovation capability into empirical study. Each typology as shown both in figure 1 and 2 are useful in determining interview questions.

The research took place in state-owned ATC Industry located in Indonesia. Current literature have studied innovation capability in private-owned Small Medium Enterprise, ranging from the assessment of innovation capability in Finnish SME (Saunila & Ukko, 2014), to improving innovation capability in Australian SME (Janaratne, 2014). A state-owned company may differ in term of capital structure, SME’s definition as well as the company objectives.

Table 2 The typology of technological capability (Lall, 1992)

15

With respect to capital structure, the state-owned company has been fully funded under a government budget whereas private company funds its company from bank loan. Therefore, it showed significant difference, as the state-owned company has never been affected by loan interest rate.

With respect to SME’s definition, there is substantial difference among countries. For instances, Saunila and Ukko (2012) defined SME based on EU Recommendation (2003/362) that shows different specification with the other SME in some developing countries , Indonesia in particular. Total employees, total revenue would differentiate the company definition to the others and thus need further adjustment.

16

3

RESEARCH METHOD

Introduction

In this research, the author deliberately views that innovation capability becoming integral factors of company success story. It is inseparable and mainly consisted of four company’s internal capabilities, such as technological capabilities, management capabilities, operational capabilities and transactional capabilities. The research is conducted through in-depth interview with two CEOs coming from two different company backgrounds. One company has successfully operated its business; meanwhile the other showed the otherwise. Sample selection is purposive sampling. It is because the research coverage is only in all state-owned ATC industry, which is still regarded as government pilot project.

With respect to the research objectives, the author has been prepared three main research questions, which is then altered as interview field questions. There are three questions as follow:

1. What kind of capabilities distinguishes one firm from another in the performance of seaweed industry?

2. How much difference does technology make to firm performance? 3. How much difference does transactional capability make to firm

performance?

Setting

The research took place in two different state-owned ATC companies. All companies are under machinery grant program and therefore are entitled for same machine specification as well as receiving same training materials. Company B is located in Eastern Lombok, West Nusa tenggara and Company A is in Waingapu, East Nusa Tenggara.

Participants

17

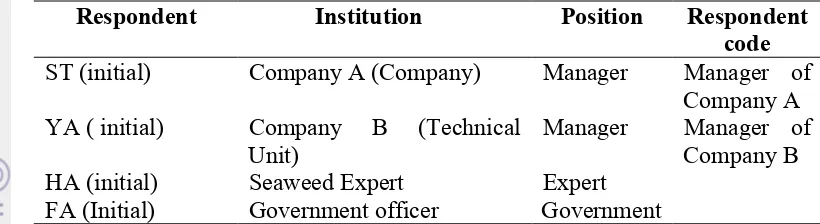

Table 3 List of Respondents

Respondent Institution Position Respondent code ST (initial) Company A (Company) Manager Manager of

Company A selected because its vital role in operating the company. The interviews are conducted to get their perspective regarding company’s internal capabilities as well as ATC business. The author and interviewee have set certain date and time for interview. Interview took place in company site and local government building. Each interview has been tape-recorded for accuracy and lasted for 1 hour. The identification has three stages as follows:

1. Identification of companies profile and the progress of machinery programs.

The research collected data regarding company’ general information such as number of employees, the production capacity, the organization, the company eligibility of the program, the progress of machinery grant program.

The data collection employed semi-structure interview and field observation. There were two companies interviewed in this research, namely company A and company B. The details of respondents can be seen in Table 1. Moreover, the list of questions during interview session is in Appendix 1.

2. Identification of internal capabilities of companies

This stage is to identify the current internal capabilities (transactional and technological capability) in two companies. The research covers both processing technology being used by companies and transactional capability.

Data collection method employed semi-structured interview and field observation in companies, respectively. The research interviewed manager of company who plays central role in company as to technological and managerial issues in company.

18

To confirm the findings gathered from interview session and field observations, the research interviewed a seaweed expert and government officer. Both respondents are having good knowledge of ATC business as well as machinery grant program in Indonesia.

Data Analysis

19

4

FINDING AND DISCUSSION

This chapter will describe interview results. This research successfully gathered information form two respondents, comprising of two managers from the local companies. All interview results have been transcribed and coded prior grouping it for a major theme.

All interview questions have successfully drawn major themes that are determinative for a successful company, such as human resources or personnel expertise in particular. All findings will be thoroughly discussed based on its relevancy to research questions.

Performance Capability of Seaweed Industry

The research question 1 asked what capabilities that distinguish one company to another. The data revealed there are majorly five issues, which successfully distinct two companies, such as form of organization, the level of government assistance; potential buyer; and raw material supplier. The following discussion will cover all of such factors in respective company. The discussion firstly started in accordance to the company A experience, representing a successful company. The company B then followed by showing opposites facts despite sharing similarities in particular issues.

First, both companies have differed in term of organization form. The company A has been firstly projected as a full state-owned company, which consists of shareholders, CEO, and employees. Meanwhile, the company B has smaller form of company than company A. Adding to that; the company is hierarchically under government body, which is not a full part of business entity. The government claimed that the company would compete for the market once it shows robust productivity.

As a functional company, The CEO of company A holds frequent meeting with shareholders, including house of representative, to report a factory progress. They discussed intensively as to problem encountered in the factory, such as cash capital and general problems. The meeting covers both technical issues as well as corresponding policy in the company business, such as raw material availability. Given such discrepancies, it is then possible for both companies having different level of support from each government.

The company A, for instances, has strong support from local government in securing its business. The local government supports by issuing protective policy for raw material while the company B has endured unsupportive force from local regulation.

20

which has impacted raw material supply. The policy has forced all raw material suppliers taking factory into account as a potential buyer. Theoretically, it advises certain amount of raw material, which all suppliers should have fulfilled prior selling it outside Waingapu. Having done this method, the company A has never found difficulties to meet the company A demand of raw material.

Third, both companies have differed in term of buyers. As a leading company in process seaweed, the company A has good sales network. They have successfully sold the product to several companies, such as PT. Galic Artha Bahari; PT. Phoenix Mas; PT. Giwang Citra Laut; PT. Gumindo; PT. Giwang and PT. Indo Seaweed. All buyers, typically come from a big company, are selling an advanced product of carrageenan.

The data then revealed that the company A has better sales pitch than company B. it works by way of using manager’s previous connection to reach the potential buyer. Mutual trust and product’s quality has successfully tied a long-term business partnership between the company and buyers. The evidence indicates that manager role is still irreplaceable. The role is even obviously seen when exploring a company potential.

Residing in a fully remote area, the company A has been successfully surviving for six years. The company, nevertheless, has built its business realm from scratch and was begun with limited number of employees. A leader’s prowess in maximizing company potential is very bold in such circumstance. In this case, the company A has officially benefited from manager’s expertise. Through her expertise, she could manage any limitation human resources in the area.

Influence of Technological Capability on Firm Performance

Research question 2 asked how much difference technology makes to firm performance. The data revealed that both company have basically had benefit due to technology intervention. In this case, the benefits are ranging from a stable price, scheduled sales and job creation. In term of price, a technological intervention has successfully transform raw material into process ATC.

Technological capability concept emerges due to the gap, which usually present in learning progress, among countries. It, nevertheless, appears indicative. Furthermore,(Lall, 1998) explains that there are important determinants of technological capabilities, such as human capital base and R&D (Research and Development) activity. The human capital base is then measured through enrolment levels. his thesis, however, emphasizes the correspondence between education and technology levels of a country.

21

place. Formal education, besides specific experience, has considerably given employees access to gain technology know how (Lall, 1998).

The research then uses Lall’s approach, which uses formal education serving as a proxy to technology capability. It practically seeks enrolment level in each region so as to compare it thoroughly. Then, the research also compares R&D activity on each region for differences. The research, however, not only does compare the differences but it also seeks some similarities, which reside in both companies.

Based on National Bureau of Statistic, the data revealed that both companies share similar condition of educational background in its employment. There is 69,71 precents of total local workforce graduated from primary school (Wahyudin, 2015). On the other hand, East Nusa Tenggara has better quality of workforce. The data showed that there is 61,39 precents of total workforce have graduated with the same level (Wea & Nggili, 2014). Such data has also been supported by another findings, DAI (2013) found that vast majority of labour force in NTB are unskilled level. Three main categories has been occupied to describe the current situation, namely unskilled (elementary or lower, semi-skilled (junior secondary) and skilled (senior secondary and above).

The research then found problem that occurred to get a good employment. The company A, for instances, has various underlying reasons that impede them having better hiring, such as tertiary-graduated employee (e.g. Bachelor degree or Master degree). First, the research found that a their favorite job. Such orientation has automatically rejected any other prospective jobs, like ATC business. Having tough impediment, the company then human resources development between them give different.

The company A, for instances, has successfully sent its best employees having their scholarship. The company values the role of human resources towards company. Even though, the scholarship endowment merely devoted for administration requirement. The national regulation has set minimum education enrolment for particular position in company.

By contrast, the company B resides near to the city and therefore has better accessibility than company A. it is nevertheless unable to make the company B performing. However, the company has found difficulties in better hiring due to lack of competent people. The enrolment level in NTB statistically shows poor condition and therefore successfully influences another dimension, such as R&D activity in the company.

22

found that technological capability role is rather functional in adapting a new technology than to innovate (Lall, 1998).

According to the manager in Waingapu, the machinery technology has firstly introduced by Chinese companies in 1980’s. It emerges firstly as a small-scale business, which are eventually adopted by many ATC companies throughout the country. The technology gained its popularity quickly and therefore was taken into account by the Indonesian government. Indonesia has been adopted the technology since 1990’s. The Indonesian government tried to adopt the technology locally and tested it in form of small-scale business. Such evidence, however, prove the existence of technological capability in the Indonesian seaweed industry. It affects the overall of company performance and therefore is responsible for performance gap among the companies. Lall (1992) defines that a competitive company should be able to show its basic core of functions. Investment, production, and linkage capabilities would serve as a suitable proxy to explain firm-level technological capabilities (FTC).

Investment capabilities mostly play in planning domain. It refers to skills of a firm to identify, prepare and procure a suitable technology for the firm to operate. Subsequently, production capabilities refer to required skills, which is involved in quality control, maintenance, and operation of a firm. Specifically, it also includes the adaptation of new technology that company acquire or equipment stretching (Lall, 1992). Meanwhile, linkage capabilities are the skills required to convey information, skills and technology between firm and external parties, such as raw-material supplier, subcontractor and another institutions. Such factors are then considered as variables in reviewing two research samples.

In term of investment capabilities, the manager of company A showed distinctive prowess in determining suitable technology and equipment for the company. Meanwhile, the manager of company B showed the otherwise. The manager could not predict and overly put reliance to external party, which is its consultant, when procuring the machinery.

In term of production capabilities, there is significant difference in term of technology utilization between two companies. In this case, one company uses the technology more efficiently than its counterpart despite having same technology (Lall, 1992). The research then located notable gap in cost improvement and equipment stretching between companies. Company A, for instances, is beneficiaries of manager’s past experience in ATC industry. It then strongly influences manager mindset, which is now keeping efficiency as company’s top priority. Theoretically, cost improvement is one of hallmark of technologically mature company, and is indicating a further step taken after assimilating a new technology (Lall, 1992). In addition to cost improvement, the company also undertook machinery modification for better productivity. The company successfully internalized the technology that matches its need.

23

successfully upscale the industry, extending the equipment, and has shown strong communication toward external party. The judgment of company function is still indicative. Yet, a guidance written by Lall has considerably helped the measurement. it indicates advanced level of two functions, particularly in process; and industrial engineering. It is also noteworthy that the company need at least one function in FTC typology (Lall, 1992). The company complies to three major elements that construct FTC, namely investment; production; and linkage capabilities.

Meanwhile, the company B showed lack of efforts in internalizing a new technology. The research took some evidences to prove its ability deficiency. According to FTC’s typology, the company B has matches one or more company function and thus deserve for correspond degree of complexity, which is set out by row in the table (see Figure 2.). In this case, the company B strongly indicates both function of product and process engineering as appeared in Figure 2. Currently, the company still struggles in discovering the best practice of ATC production. All production process still limited to operating a company with by-default configuration, which is also obtained from consultant—and is not extracted from knowledge accumulation within the company—. There are only minor modifications with respect to process engineering, and most configurations have been left as it is. They are, however, merely undertaken as a part of technology assimilation. Therefore, the company B deserve for basic level of technological capability, which only involved simple technology in daily basis.

In investment perspective, the company B undertook company erection and was responsible for commissioning the factory while all equipment procurement were left to grant donpor. Having all machineries in place, all manufacturing process then follows default guidance provided by a consultant. Major change eventually comes from the simple modification on machine setup. The idea emerged as an accumulation of company experience over the time, which would also take place in constructing production capability.

As mentioned earlier, production capabilities are skills required to undertake operation and maintenance within a company. Furthermore, the production capabilities also cover adaptation of technology. In this case, the company B showed limited options to operate the company. Its limitation has been formed since the company has none of relevant knowledge prior commencing the company. Such condition urges it to use service provided by external party such as consultant. of machine configuration, being over-reliance would be disastrous as it confines the company flexibility in discovering company’s best practice. Thus, it eventually yields insignificant productivity using current production setup. It is then evident that company B has been troubled in adapting technology. It also indicated that there are gaps between company A and B in term of technology adaption.

24

its fellow as the company has been struggling to avoid raw material scarcity, which is now prompting production termination.

The evidences showed that technology intervention has successfully benefited the company through a stable ATC price. Nevertheless, the company B would gain more benefit by collaborating technological intervention with good managerial practices. It allows the company to double its current productivity, create more jobs and give significant impact toward regional economic growth.

Influence of Transactional Capability on Firm Performance Research questions 3 asked how much difference transactional capability make to firm performance. The data revealed that transactional capability has been resulting three outputs, namely steady raw material supply, cost efficiency and sustainable sales.

With regard to raw material availability, the manager in company A has demonstrated more reliable scheme compared to the company B. the company A has outsourced its seaweed supplier both from local and outside the region. As a result, the company A has a steady supply of raw material whereas the company B showed the otherwise.

The company B manager has shown lack of managerial practices that risk the company to raw material scarcity. For instance, the company B only source from local producer in east Lombok. However, the company has been encountering a problem since there are a mutual agreement between local supplier and the other company. It impedes the company to have steady supply of raw material.

With respect to cost efficiency, the manager in company A focused on cost efficiency in every production line, particularly on less energy efficient machinery. Both chopping and washing division has been asked to do energy savings continuously. Likewise, the manager also put the program on the top list so as to keep the company competitive.

The manager personally trained every employee about the program. The manager also seduces the employees with higher salary if the program runs flawlessly. Having done this, the manager expected that it would help giving the company profit aside product sales.

In term of sustainable sales, the manager in company A has mostly benefited from its previous market network. Meanwhile, the company B only relies on both government intervention and the seaweed’s tutor connection.

25

relatively stable price for raw material buying. It has great influence in maintaining the company-supplier relationship.

As a state-owned company, the company A behaves differently compared to a private company. The company, however, not only competes for profit but also needs to give social implication. Therefore, it is common for a state-owned company becoming a pilot project in remote location, which is commonly associated as poor region in Indonesia.

The establishment of company A aims regional economical growth in East Sumba. On the one hand, the company is mandated to make good profit so as to keep them sustain. On the other hands, the company is also asked to give social benefit by creating jobs and inducing regional economic growth.

In essence, the presence of company A in east Sumba has levered regional economic level. Given great production of raw seaweed in east Sumba, the company establishment has been benefiting all growers with stable and reasonable seaweed price.

A mutual partnership between local growers and the company has been lasting for six years long. Despite encountering some impediment, the partnership has shown the result in internal organization. The company employees, for instances, has indicated significant improvement. At the first stage of company establishment, the company hired only seven employees and is now able to hire around 70 employees. Such numbers indicated that the company gives significant contribution in term of social implication. The company has successfully created jobs for local people.

Not only benefitting the company’s internal organization, the company also successfully helps its external network, such as seaweed supplier and seaweed growers. The company helps them to get a stable seaweed price. The company technically helps them through profit margin reduction. Alternatively, the company keeps the raw seaweed’s buying price so that both local grower and supplier would get a stable price.

Instead, The Company B behaves differently compared to company A. company A is more stable and is becoming profitable company whereas the company B still struggles to revive from production termination. The company B has been encountering a problem in its local supplier. Nevertheless, both companies are still mandated with social missions. Such obligatory would then determine the company style in transacting its product.

As explained, Gamarra and Zawislak (2013) has divided transactional capabilities into two dimensions, namely client-centric and supplier-centric. Figure 1 fully illustrated transactional capability. The columns set out the capabilities by its dimensions—client- or supplier-centric—, while the row set it by the level of complexity. Such typology also included some indicator, which may relevant and could help to determine company tendency, either supplier or buyer.

26

customer analysis (Gamarra & Zawislak, 2013). It therefore could be served as a proxy.

This research found company A demonstrating contract-less business. There is nothing such a legal contract between the company and external parties despite having recurring transaction. The company A, for instances, has been benefiting from past of manager’s experience. The data subsequently showed that the company reaches the market using manager popularity in producing quality product.

On the other side, there is none of contract between the company A and raw material supplier. Regional house of representative currently avoid the company from raw material monopoly and encouraging business competition.

As a result, the company A has different seaweed suppliers across Indonesia. The manager of company A then described that she travelled to outside of the island for the best raw seaweed. The manager of company A mostly uses telephone to make a deal in case she could not make it in person. Meanwhile, the company B currently struggles with multi-supplier of raw material, yet it is still locally.

However, both companies share similarities in company orientation. It is, however, not merely a profit and thus unlikely to be a client- centric company. Being state-owned company, the company A is mandated by government—which fully own the biggest company’ shares—to undertake great social responsibility. It makes sense since the company residing mostly in a remote area throughout country. Accordingly, the company presence would be a giant lever for local economy, giving positive contribution through people empowerment in particular.

The presence of company A has contributed in levering regional economy. The company A has been empowering local people residing around company location. The company has successfully induces job creation through ATC business. The company now successfully hired up to 70 persons, or is ten times more than its first commencement. Moreover, the company also uses local supplier for its raw material.

Hence, this research found that the company A is rather supplier- than client-centric company. This tendency is boldly shown from company decision. The company A, for instances, has never offered low price for raw material. Instead, they tend to cut the profit for keeping raw material price stable.

The company B, basically, has the same orientation with the company A. it would rather be supplier oriented than buyer oriented. In essence, a state-owned company establishment expects economic growth in a correspond location. The manager acknowledges that a raw material price hike reflects an improvement. On one hand, it indicates an increasing grower’s income and thus affects their social welfare. In the other hand, price increasing also expects higher purchasing power, which is troublesome for a state-owned company.

27

may also affect the budget approval since the company uses government money.

Unlike the company A, the company B is still aiming a stable performance before giving social benefit to surrounding. The company would undertake social responsibility once it completely reviving and has strong business base.

According to typology of transactional capability, both company therefore have demonstrated a basic level of transactional capability. All companies currently are contract-less and are not limited by supplier proximity.

To sum up, the evidences confirmed (Gamarra & Zawislak, 2013) notion as to transactional capabilities being as supportive elements for technological capability. The notion claims that technological intervention should be followed by good managerial skills.

Based on company A case, this research also confirms that transactional capability is a solution to cope performance stagnancy (Gamarra & Zawislak, 2013). The data revealed that transactional capability has allowed the manager to chase higher Cash Conversion Cycle. it means that the manager will try to higher efficiency, which eventually comes to capacity expansion once there is no another room for improvement. Upgrading capacity requires more resources, such as workforce and raw material. As a result, it will eventually give many social benefits to surrounding through job creation.

This research potentially becomes a foundation for further research in improving the performance of the Indonesian state-owned company. There are prior research regarding innovation capability, ranging from creating a framework for innovation capability measurement (Haldma, Näsi, Grossi, Saunila, & Ukko, 2012; Janaratne, 2014; Saunila & Ukko, 2012) and identifying a prominent capability to innovate (Gamarra & Zawislak, 2013; Zawislak et al., 2012).

However, this research aims to examine a distinctive factor in a state-owned company and thus has benefited future research by providing a building block regarding determinative factors that influence a state-owned company to succeed.

28

5

CONCLUSION AND RECOMMENDATION

Conclusion

Managerial capabilities influence the successfulness of companies receiving technology grants. The company A has demonstrated good managerial skills in its daily basis compared to the company B. The evidences showed that the manager has strong proficiency in managing a seaweed company. It is reflected from how the manager plans, acts and decides.

Generally, this research found distinctive factors after contrasting two companies. It comprises of people, research and development activity and investment.

In term of people factor, managerial experience is distinctive factor in this research. An experienced manager has better capability than new manager to use company’s resources efficiently.

Accordingly, the human capital is responsible for performance discrepancy between two companies. In this research, companies showed different managerial experiences. It, however, influences the company decision when resolving many issues ranging from company employment to company operationalization.

Subsequently, companies have shown different research and development activity. There are notable gap between two examples. Still, the managerial experience is distinctive. It positively contributes to manager’s intuition in finding ATC formulation as well as company’s operationalization. In addition to technical issue, such factor also influences activity within planning domain like investment.

Two companies responded differently with respect to investment. The managerial skill has made substantial different as to investment in both companies. The managerial skill let the manager finding suitable technology efficiently.

Lack of managerial practice showed significant results to raw material procurement, cost improvement and company sales. The company with managerial skill is successfully undertaking cost efficiency over times. In addition, the managerial practice also affects sales sustainability. This research found that the company with managerial capability could afford sustainable sales through project order scheme. Eventually, the managerial skill could allow company to secure its raw material through multi-supplier scheme, hiring more than one of raw seaweed supplier.

29

Recommendation

30

REFERENCES

Branzei O, Vertinsky, I. 2006. Strategic pathways to product innovation capabilities in SMEs. J Bus Ventur. 21(1):75-105. doi:10.1016/j.jbusvent.2004.10.002

Coase RH. 1937. The nature of the firm. economica. 4(16): 386-405.

DAI. 2013. Nusa Tenggara Barat Economic Growth and Inclusiveness Diagnostic. Nusa Tenggara Barat: AUSAID.

Haldma T, Näsi S, Grossi G, Saunila M, Ukko J. 2012. A conceptual framework for the measurement of innovation capability and its effects. Baltic J Manage. 7(4):355-375. doi:10.1108/ 17465261211272139

Janaratne N. 2014. a Framework for improving innovation capability of SMEs to enhance competitiveness in the digital economy. at: 27th Annual SEAANZ Conference; Sydney, 16-18 Jul 2014. Australia. Sydney (AU).

Lall S.1992. Technological capabilities and industrialization. World Dev. 20(2): 165-186.

Lall S. 1998. Technological capabilities in emerging Asia. Oxford Dev Stud, 26(2): 213-243. doi: 10.1080/13600819808424154

Neely A, Filippini R, Forza C, Vinelli A, Hii J. 2001. A framework for analysing business performance, firm innovation and related contextual factors: perceptions of managers and policy makers in two European regions. Integr Manuf Syst. 12(2): 114-124.doi: 10.1108/09576060110384307

Patel P, Pavitt K. 1997. The technological competencies of the world's largest firms: complex and path-dependent, but not much variety.

Res policy. 26(2): 141-156.

Prahalad C, Hamel G. 1990. The core competence of the corporation.

Boston (Ma). 1990, 235-256.

Saunila M, Ukko J. 2012. A conceptual framework for the measurement of innovation capability and its effects. Baltic J Manage. 7(4): 355-375. doi:10.1108/17465261211272139

Saunila M, Ukko J. 2014. Intangible aspects of innovation capability in SMEs: Impacts of size and industry. J Eng Technol Manage. 33, 32-46.

Gamarra JT, Zawislak PA. 2013. Transactional capability: Innovation's missing link. J Econ Finan Adm Sci. 18(34):2-8.

Wahyudin, editor. 2015. Keadaan Angkatan Kerja Provinsi Nusa Tenggara Barat Tahun 2014. Mataram (ID): Badan Pusat Statistik Provinsi Nusa Tenggara Barat.

31

32

APPENDIXES

APPENDIXES 1. LIST OF INTERVIEW QUESTIONS

Research Question

1. What kind of capabilities distinguishes one firm from another in the performance of seaweed industry?

2. How much difference does technology make to firm performance? 3. How much difference does transactional capability make to firm

performance? Interview Question

1. Aside of raw material, what factors do influence a firm productivity? 2. What role does the technology play in firm activities?

3. What is the main reason that prompted company to involve a technology?

4. What kind of capability should a firm consider prior to receive new technology?

5. What is the biggest obstacle to a firm operation after using a technology?

6. What kind of factors do company need to stimulate interest in seaweed downstream product?

7. At the initial stage of new technology introduction, what factor does really make such technology works properly?

8. Is government assistance has met industry expectation? If not, what kind of assistance does company need?

9. In your opinion, why is current government assistance not effectively working?

33

AUTOBIOGRAPHY

Aditya Andika Wicaksono, the author, was born on 20th August 1986 in Jakarta, Indonesia. He completed his elementary school in 1998 and joined SMP Negeri 1 Tangerang. Graduating in 2001, he later joined SMU Negeri 1 Tangerang for senior high school and graduated in 2003. In 2004, he was qualified to enter Universitas Gadjah Mada in Yogyakarta majoring Fishery and graduated in 2010.

He is now working in Ministry of Industry the Republic of Indonesia. He has been working since 2010 and is assigned as a staff on Department of Food and Fishery Industry, which allows him to examine the problem on food and fishery product for years.