THE INFLUENCE OF AUDIT COMMITTEE

CHARACTERISTIC TO AUDIT LAG ON FINANCIAL

REPORTING

(Empirical study on Company Listed on The Indonesia Stock

Exchange Year 2013)

By:

Saifan Atsauri Hidayatullah ID: 109082100015

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESSES STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

i

THE INFLUENCE OF AUDIT COMMITTEE

CHARACTERISTIC TO AUDIT LAG ON FINANCIAL

REPORTING

(Empirical study on Company Listed on The Indonesia Stock

Exchange Year 2013)

By:

Saifan Atsauri Hidayatullah ID: 109082100015

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESSES STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

ii

THE INFLUENCE OF AUDIT COMMITTEE

CHARACTERISTIC TO AUDIT LAG ON FINANCIAL

REPORTING

(Empirical study on Company Listed on The Indonesia Stock

Exchange Year 2013)

Undergraduate Thesis

Submitted to The Faculty of Economics and Business In Partial Fulfillment of the Requirement For Acquiring Bachelor Degree of Economics

By:

Saifan Atsauri Hidayatullah 109082100015

Under Supervision of

Supervisor I Supervisor II

Prof. Dr. Abdul Hamid, MS Atiqah, SE, M. Si

ID. 19570617 198503 1 002 ID. 19820120 200912 2 004

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESSES STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

iii

ENDORSEMENT SHEET COMPREHENSIVE EXAMINATION

On this day, Tuesday, July 30th, 2013, we have administered a comprehensive test

examination to:

1. Name : Saifan Atsauri H 2. Student Number : 109082100015

3. Department : Accounting (International Program)

4. Thesis Title : The Influence of Audit Committee Characteristic to Audit Lag on Financial Reporting

After carefully observation and attention to appearance and capabilities relevant for the comprehensive exam process, it was decided that the above student passed and given the opportunity to thesis as one of the requirement to obtain a Bachelor of Economics in The Faculty of Economics and Business Syarif Hidayatullah State University Jakarta.

Jakarta, July 30th, 2013

1. Zuhairan Yunmi Yunan, M.Sc ( )

ID. 19800416 200912 1 002 EXAMINER I

2. Yulianti, M.Si ( )

ID. 19820318 201101 2 011 EXAMINER II

3. Abdul Hamid Cebba, MBA, CPA ( )

iv

CERTIFICATION OF THESIS EXAM SHEET

On this day, Tuesday, November 24th, 2015, we have administered a comprehensive test examination to:

1. Name : Saifan Atsauri H 2. Student Number : 109082100015

3. Department : Accounting (International Program)

4. Thesis Title : The Influence of Audit Committee Characteristic to Audit Lag on Financial Reporting

After carefully observation and attention to appearance and capabilities relevant for thesis examination process, it was decided that the above student has passed and the thesis was accepted as one of the requirement to obtain a Bachelor of Economics in The Faculty of Economics and Business Syarif Hidayatullah State University Jakarta.

Jakarta, November 24th, 2015

1. Dr. Amilin., SE., Ak., M.Si., CA., QiA., BKP ( ) ID. 19730615 200501 1 009 Head of Examiner

2. Hepi Prayudiawan,SE.,MM.,Ak.,CA ( )

ID. 19760924 200604 2 002 Secretary

3. Prof. Dr. Abdul Hamid, MS ( )

ID. 19730615 200501 1 009 Supervisor I

4. Atiqah, SE, M. Si ( )

ID. 19820120 200912 2 004 Supervisor II

5. Yulianti, SE, M.Si , CPA ( )

v

SHEET STATEMENT

AUTHENTICITY SCIENTIFIC WORKS

Signature Below

Name : Saifan Atsauri H

Student Number : 109082100015

Department : Accounting (International Program) Faculty : Economics and Business

Hereby declare that in writing this thesis, I:

1. Do not use other people’s ideas without being able to develop and accountable.

2. Do not plagiarism of other people’s working manuscript.

3. Do not use other people’s work without mentioning the original source or without the owner’s permission.

4. Do not manipulate and falsify the data.

5. Own work and able to work for responsible for this work.

If in the future there is a demand from the other side of my work, and have been accountably proved, was indeed found evidence than I have violated the above statement, then I am ready to be sanctioned according t rules applicable in the Faculty of Economics and Business Syarif Hidayatullah State Islamic University Jakarta.

Thus statement truly made with sincerely.

Jakarta, 1st October 2015

vi

CURRICULUM VITAE

Personal Data

Full Name : Saifan Atsauri H Nick Name : Saifan

Address : GRB. Cluster Fedora Blok J16/ 19 Tangerang Selatan, Banten

Mobile Phone : 081310962244

E-mail : [email protected] Place, Date of Birth : Denpasar, April 18, 1992

Gender : Man

Religion : Islam

Nationality : Indonesia

Education

Elementary SDIT TAWAKKAL Denpasar 1997-2003

Junior High School MTS ASSALAAM Solo 2003-2006

Senior High School MA ASSALAAM Solo 2006-2009

University UIN Syarif Hidayatullah Jakarta 2009-now Major: Accounting international class program

Informal Education

o PPA FEUI, Akuntansi Keuangan dan Komputer Akuntansi (2012) o Goethe Institute, Level A1 (2013)

Work Experience

o Internship at Bata Dollar at Bogor (2012)

Organization Experience

vii Seminar

o Summer School “Renewable Energy-Leadership and Enterpreneurship” in Weiden, Germany, sponsored by DAAD ( September 10-18, 2011)

Activity of Co-curricular

viii

THE INFLUENCE OF AUDIT COMMITTEE CHARACTERISTIC TO AUDIT LAG ON FINANCIAL REPORTING

(Empirical study on Company Listed on The Indonesia Stock Exchange Year 2013)

ABSTRACT

The purpose of this research is to analyze factors that influences timeliness submission of the Indonesian public company’s financial report. The examined factors of this research are audit committee characteristic, which are audit committee independence, audit committee expertise, audit committee size, and audit committee meeting as independence variable while timeliness as dependent variable.

The data that used in this research was the secondary data and selected by using purposive sampling method. The sample consist of 288 companies listed in Indonesia Stock Exchange (IDX) and sent the financial report to BAPEPAM in 2013. The analysis to test the hypothesis is using logistic regression at level significant 5%.

The result of this research shows that audit committee size and audit committee meeting have significant influence to reduce audit report lag, while the audit committee independence and audit committee expertise do not have significant influence on the timeliness submission on financial reporting.

ix

PENGARUH KARAKTERISTIK KOMITE AUDIT TERHADAP AUDIT LAG PADA PENGUMPULAN LAPORAN KEUANGAN

(Studi empiris pada perusahaan Go Public yang terdaftar di BEI pada tahun 2013)

ABSTRAK

Tujuan dari penelitian ini adalah untuk menganalisa faktor faktor yang menyebapkan audit lag dalam pengumpulan laporan keuangan. Faktor- faktor yang dianalisa dalam penelitian ini adalah komite audit karakteristik yang terdiri dari independensi komite audit, keahlian komite audit, ukuran komite audit, dan rapat komite audit yang berfungsi sebagai variable independen sedangkan keterlambatan dalam pengumpulan laporan keuangan menjadi variable dependen.

Data yang digunakan dalam penelitian ini merupakan data turunan yang didapat menggunakan metode purposive sampling. Data terdiri dari 288 perusahaan yang terdaftar dalam Bursa Efek Indonesia (BEI) dan melaporkan keuangannya pada BAPEPAM pada tahun 2013. Analisa pada penelitian ini menggunakan regresi logistic pada signifikansi 5%.

Hasil penelitian ini menunjukan bahwa ukuran komite audit dan rapat komite audit memiliki pengaruh yang signifikan terhadap keterlambatan pengumpulan laporan keuangan, sedangkan independen komite audit dan keahlian komite audit tidak memiliki pengaruh yang signifikan terhadap keterlambatan pengumpulan laporan keuangan.

x FOREWORD

Assalammu'alaikum Wr.Wb

All Praise to Allah SWT as the Hearer, the Seer and above all an abundance of grace, Taufiq, as well as his guidance. So, because Allah SWT I can finish this research on time.

Shalawat always gives to the Prophet of Muhammad SAW and all his family and friends who always helped him in establishing Dinullah in this earth. With the strength, intelligence, patience, and strong desire from Allah SWT, I am able to finish this mini thesis as graduation pre requirement for bachelor degree. I believe there is an invisible hand that has helped me going through this process.

My special thank for my parents, Puji Suhartono and Iftitah who alway support my studying and teach me your best experience. Although I were seldom in home during my studies this years, but you give me love and care. Making you proud of me is always becoming my priority. I do not want to be regret for the second time. Thanks for the hard work that had you done for the family. Thanks a lot for being great father and mother ever for me.

I believe I am nothing without each one of you who has helped me in finishing this mini thesis. Thus, in this very special moment, let me say many thanks to all of them who have been helping me the process of this thesis, including:

xi

2. Prof. Dr. H. Abdul Hamid, MS as my thesis supervisor I. You are my mentor who has provided direction and guided me, shared your knowledge to me, and thank you for your time that you gave .So, I able to finish this mini thesis.

3. Atiqah, SE, M.Si as my thesis supervisor II who has provided direction, guidance, and thank you for your time and your patience that you gave to me, so I can finish this mini thesis. So sorry for my bad attitude during the consultation.

4. My brother and sister, who has always helped and supported me for my best, whatever I do and whenever it is.

5. Bekasi Family, Ilham and Zulia, thanks for supporting me, and thanks also for the convenience, love, care, support and helps.

6. All Lecturers who have taught patiently, may what they have given are recorded in Allah SWT almighty and all staff UIN Jakarta.

7. All my friends in accounting international 2009, Angga, Arini, Aulia, Bimo, Cici, somal friends (Adnanv & Usman), Diah, Evi, Gamal, Galer, Merdiansyah, Nanda, Jihan, Luthfi, Pipit, Putri, Septian, Tami, and Yusuf. Thanks for the remarkable moments that we had been through together and special thanks for some of you that already shared and taught me your valuable experiences, especially in doing thesis. Thanks also for my friends in management international 2009.

xii

I realize this minithesis is still far from perfection, thus suggestions and constructive criticism from all parties are welcome, in order to improve my thesis. Finally, only Allah SWT will return all and I hope this thesis will be useful to all parties, especially for writers and readers in general, may Allah bless us and recorded as the worship of Allah’s hand. Amin.

Wassalammualaikum Wr.Wb

Tangerang, 1st October 2015

xiii

CONTENT OF TABLE

INFORMATION PAGE

Cover ... i

Certification from Supervisor ... ii

Certification of Comprehensive Exam Sheet ... iii

Certification of Thesis Exam Sheet ... iv

Authenticity Statement Sheet Scientific Work ... v

Curriculum Vitae ... vi

Abstract ... viii

Abstract ... ix

Foreword ... x

Content of Table ... xiii

List of Table ... xvi

List of Figure ... xvii

CHAPTER I INTRODUCTION A. Background ... 1

B. Problem Formulation ... 8

C. Purpose of Research ... 8

D. Benefit of Research ... 8

CHAPTER II LITERATURE REVIEW A. Theory Framework ... 10

1. Agency Theory ... 10

2. Compliance Theory ... 11

3. Corporate Governance ... 13

4. Audit ... 16

a. Audit Committee ... 17

1. Audit Committee in Indonesia ... 18

5. Financial Report ... 21

6. Timeliness ... 22

xiv

1. Descriptive Statistic... 32

2. Classical Test Assumption ... 32

3. Multiple Regression Analysis ... 36

4. Coefficient Determination Test ... 38

E. Variable Operation ... 38

CHAPTER IV RESULT AND DISCUSSION A. Overview of Research Object... 45

1. Description of Research Object ... 45

2. Description of Selected Companies’ Sample ... 46

B. Analysis and Discussion ... 54

1. Descriptive Statistic Analysis ... 54

xv

3. Multiple Regression Analysis ... 62

4. Coefficient Determination Test ... 70

5. Interpretation ... 70

CHAPTER V CONCLUSION AND RECOMMENDATION A. Conclusion ... 78

B. Recommendation ... 79

REFERENCES ... 81

xvi

LIST OF TABLE

NO INFORMATION PAGE

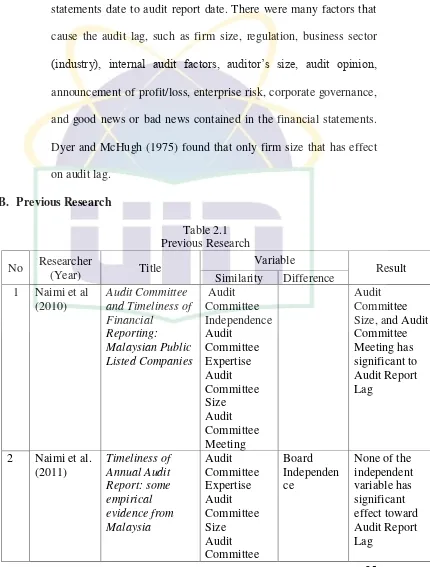

2.1 Previous Research ... 25

3.1 DW Test ... 35

3.2 Research Operational Variable ... 44

4.1 Sample Selection ... 46

4.2 Companies Distribution which is On Time and Delay ... 47

4.3 Distribution ACI to the Timeliness Submission Financial Report ... 48

4.4 Distribution ACE to the Timeliness Submission Financial Report ... 49

4.5 Distribution ACS to the Timeliness Submission Financial Report ... 50

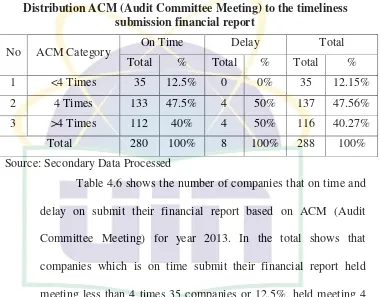

4.6 Distribution ACM to the Timeliness Submission Financial Report... 51

4.7 Distribution CS to the Timeliness Submission Financial Report ... 52

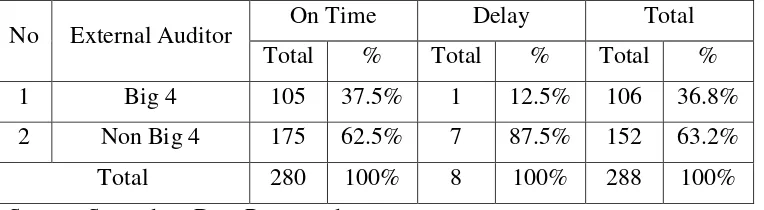

4.8 Distribution EA to the Timeliness Submission Financial Report ... 52

4.9 Distribution ROA to the Timeliness Submission Financial Report ... 53

4.10 Descriptive Statistic ... 54

4.11 Kolmogorov-Smirnov Test ... 58

4.12 Multicolinearity Test Result ... 59

4.13 Autocorrelation Test Result ... 61

4.14 Result of Multiple Regression ... 62

4.15 Result of F-Test ... 67

4.16 Result of t-Test ... 67

xvii

LIST OF FIGURE

NO INFORMATION PAGE

2.1 Logical Framework ... 27

4.1 Histogram Graph ... 57

4.2 Normal P-P Plot Graph ... 57

1 CHAPTER I INTRODUCTION A.Background

The decrease in investor confidence in financial statement information resulting from corporate scandals involving once well-respected companies such as Enron and WorldCom served as a catalyst for the Sarbanes-Oxley Act of 2002 (SOX). In Indonesia, there is case which drag state enterprise (PT KAI). Problem come when commissioner as a principal fraud management performance which result untrusted financial report (www.dokumen.tips). The intent of SOX is to protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws. The financial information should be of higher quality before it is being delivered to outside stakeholders because the users of financial information demand for complete, transparent and timely information. Singhvi and Desai (1971) in Shukeri and Nelson (2011) suggest that quality of reporting, is reporting which complete, accurate, reliable and prepared in a timely manner that leads to quality decision making. Thus, timely financial reporting is considered as one of financial reporting quality that leads to quality decision-making.

2 loses its capacity to influence business decisions. Greater benefits will be derived from the timely reporting of financial statements, and specifically timely reporting refers to the shorter time between the date of accounting financial year-end and the date an independent auditor issues an audited annual report. The delay in releasing the financial statement is most likely to boost uncertainty associated with the decisions made based on the information contained in the financial statements Ashton et al (1987). Therefore, time precision in reporting will enhance decision-making and reduce information asymmetry in the capital market Stephen Owusu-Ansah and Stergios Leventis (2006). The issue of timeliness of reporting also affects regulators and policy makers since they need to play a role in ensuring the shorter gap of financial report delay. Hence, exploring the determinants of timeliness of reporting would enhance the regulators of emerging capital market in formulating new policies to improve the allocation efficiency of their markets. Giving the importance of financial reporting timeliness to investors, and identifying the determinants of financial reporting delay has become a significant move to improve the financial reporting quality and also continue to examine the factors that may influence the timeliness of financial reporting.

3 companies periodically. It stated that all public companies listed on the Indonesia stock exchange obligated to submit annual financial statements and issue the opinion made by the certified public accountant. The regulation makes enterprise companies listed in Indonesia Stock Exchange became motivated to report their financial statements in a timely manner, in accordance with applicable regulations.

Professionals and government agencies take action to identify the factors that caused company in presenting its financial statements in a timely manner. Bursa Malaysia highlights that one of the corporate governance mechanism; audit committees, will play significant role in a company to ensure the accuracy in the delivery the financial statements will be achieved based Bursa Malaysia’s regulators Hashim and Rahman (2011).

4 by Jakarta Stock Exchange (now Indonesia Stock Exchange). The rule obligates the companies to establish an audit committee in order to actualize good corporate governance (GCG) in Indonesia Darmawati et al. (2005).

The effectiveness of audit committees in monitoring corporate financial reporting is great concern to regulators, especially in light of recent accounting scandals. The audit committee serves as a liaison between the external auditor and the board of directors, and facilitates the monitoring process by reducing information asymmetry between the external auditor and the board Klein (1998). In addition, Lennox and Park (2007) suggest that the audit committee is the most important governance mechanism with respect to audit firm appointments because it is responsible for hiring the external auditor and for overseeing audit quality. Therefore, a properly functioning audit committee is critical in ensuring the independence of auditors and high quality financial reporting Wild (1996) in Husam et al. (2012).

5 Afify (2009) in Hashim and Rahman (2011) tried to analyze the relationship between the audit committee and the timeliness of financial report, which says that the establishment of audit committees in Egypt voluntarily reduces instances of audit report lag. Bedard and Gendron (2010) in Naimi et al (2010) indicate that the relationship between the audit committee and the timeliness of financial reporting is rarely investigated.

Hashim and Rahman (2011) in previous studies analyzed the effect of audit committee characteristics on audit report lag in Malaysia. This study used the audit committee independency, the number of audit committee meetings and audit committee expertise as independent variables to analyze their effects on audit report lag. This study found that audit committee independence and audit committee expertise have a significant relationship to company's audit report lag. Wijaya and Rahardja (2012) show that audit committee size and audit committee expertise has significant influence to reduce audit report lag, while the others audit committee characteristic has not.

6 exchange, but also the compliance of the firm towards regulations, and reliability of the reporting including the good corporate governance regulation, by put right composition of audit committee in the firm and also the time of submission of financial reporting. Therefore, the researcher takes the title of thesis “The Influence of Audit Committee

Characteristics towards Timeliness Submission on Financial Reporting (Empirical study on Company Listed on The Indonesia Stock Exchanges Year 2013)”.

This research have been done by Wijaya and Rahadja (2012) with the title “Pengaruh Karakteristik Komite Audit Terhadap Audit Report Lag, Puasa et al (2014) with title “Audit Committee and Timeliness of Financial Reporting: Malaysian Public Listed Companies”, and Vuko and Cular (2014) with title “Finding determinants of audit delay by pooled

OLS regression analysis”. With the differences as follow:

1. Wijaya and Rahadja (2012)

a. Variable: The previous research used same variable as this research.

b. Period: The previous research was done in 2011. While this research is done in 2013.

c. Population: The previous research used same variable as this research.

2. Puasa et al (2014)

7 Independence, AC Non Independence, AC Size, AC Expertise, AC Activity, Profitability, Company Size, Leverage, Managerial Ownership, Type of External Auditor, Audit Opinion, and Company financial year-end.

b. Period: The previous research was done within 2004-2006, and 2009-2011, while this research is done in 2013.

c. Population: The previous research used stock listed on Bursa Malaysia, while this research uses stock listed in Indonesia Stock Exchange as population.

3. Vuko and Cular (2014)

a. Variable: The previous research used Audit Firm Type, Audit Opinion, Profitability, Leverage, Audit effort, and Absolute level of total accrual, Company Size, and Audit Committee.

b. Period: The previous research was done within 2008-2011, while this research is done in 2013.

8 B.Problem Formulation

1. Does audit committee independent have influence to audit lag? 2. Does audit committee expertise have influence to audit lag? 3. Does audit committee size have influence to audit lag? 4. Does audit committee meeting have influence to audit lag? 5. Does company size have influence to audit lag?

6. Does big 4 auditor have influence to audit lag? 7. Does profitability have influence to audit lag? C.Purpose of Research

The purpose of this study was to obtain empirical evidence regarding the following matters:

1. Audit committee independent has influence to audit lag. 2. Audit committee expertise has influence to audit lag. 3. Audit committee size has influence to audit lag. 4. Audit committee meeting has influence to audit lag. 5. Company size significant has influence to audit lag. 6. Big 4 auditor significant has influence to audit lag. 7. Profitability has significant influence to audit lag. D.Benefit of Research

9 This study is expected to provide the information in drafting the law of timeliness submission of financial report for public companies in Indonesia.

b. For Practitioners and Auditors

This study is expected to be useful and helpful in identifying factors that affect the time delay submission of financial statements and to provide an overview of the importance of timeliness in delivering the company's financial position to the public.

c. For Audit Services User

The study is expected to improve the efficiency and effectiveness of the audit process by controlling the factor that cause delays in submission of financial report.

d. For Future Research

The results of this research can give contribution and information regarding the factors that influence the delay of the submission of financial report, as well as a basis or reference for future studies. e. For Researcher

10 CHAPTER II LITERATURE REVIEW A. Theoretical Framework

1. Agency Theory

An agency relationship is one, which the principals engage to another person (the agent) performing some service on their behalf, which involves delegating some decision-making authority to the agent Delves and Patrick (2008). Mitnick (1973) highlighted that the most recognizable form of agency relationship is that of employer and employee. Other examples include state (principal) and ambassador (agent); constituents (principal) and elected representative (agent); organization (principal) and lobbyist (agent); or shareholders (principal) and CEO. They give further explanation that agency theory is the study of the agency relationship.

decision-11 making.

The separation of ownership and control has led to notorious agency problem. The agency problem was first explored in Ross (1973), with the first detail theoretical exposition of agency theory presented in Jensen and Meckling (1976).

Delves and Patrick (2008) argued that the issue arises from particularly dilemma when the principal and agent while nominally working toward the same goal may not always share the same interests. While Brennan (1995) explained that the agency problems happen due to the impossibility of perfectly contracting for every possible action of an agent whose decisions can affect both his own welfare and the principal welfare. The problem is arising, how to induce the agent to act for the best interests of the principal. Managers bear the entire cost of failing to pursue their own goals, but capture only a fraction of the benefits. Jensen and Meckling (1976) argue that this inefficiency is reduced as managerial incentives to take value-maximizing decisions are increased.

2. Compliance Theory

According to the General Dictionary Indonesian compliance comes from the word obey. Obey means love, obedience to orders or rules and discipline. Compliance means to be submissive, obedient, and obedient to the teachings or rules.

12 especially in psychology and sociology with emphasis on the importance of the socialization process in influencing the compliance behavior of an individual Sulistyo (2010). According to Saleh and Susilowati (2004) in Sulistyo (2010) there are two basic perspectives on law compliance in the instrumental and normative. Instrumental perspective assumes the individual as a whole is driven by self-interest and responses to changing incentives, and penalties associated with the behavior. Normative Perspectives in touch with what people consider being moral and contrary to their personal interests.

An individual tends to obey the laws that they deem appropriate and consistent with the internal norms. Normative commitment through morality means obeying law because the law is regarded as a necessity, whereas normative commitment legitimacy through means comply with the authorities making up the law has the right to dictate behavior Sudaryanti (2008) in Sulistyo (2010).

Compliance theory can lead people better to comply with current regulations, as well as companies are trying to submit financial report on time because in addition to being a company's obligation to submit financial report on time, will also be very beneficial for the users of financial report.

13 134/BL/2006 head of Bapepam and LK concerning Obligation to Submit Periodic Financial Report. Such regulations are legally indicate the existence of any compliance behavior of individuals and organizations involved in the Indonesian capital market to submit the company's annual financial report on time to Bapepam.

3. Corporate Governance

Corporate governance is a term that over the last two decades has become popular literature. The term governance derives from the Latin gubernare, meaning to steer, usually applying to the steering of a ship, which implies that corporate governance involves the function of direction rather than control Cadbury Report (1992). Talamo (2011) explains that the corporate governance in the traditional definition is considered as a cornerstone of ethical conduct within accounting practices such as the integrity and objectivity of accountants and auditors.

Shleifer and Vishny (1989) propose a broad definition of corporate governance: corporate governance concerns the ways in which suppliers of funds and the corporations themselves ensure returns on investment. Using a similar approach, Picou and Rubach (2006) define corporate governance as the construction of rules, practices, and incentives to align effectively the interests of the agents (boards and managers) with those of the principals (capital suppliers).

14 concerned with managing the relationship among various corporate stakeholders. Corporate governance is a concept to increase company performance through supervising or monitoring management performance and guarantee management accountability to stakeholder based on rule’s framework.

The main objective of corporate governance is to achieve a company management transparency for the users of financial statement Yonnedi and Sari (2009). If the company could implement this concept so the economics growth could keep on going well together with company management transparency that is also going well and give benefit for many sides.

In formulating corporate governance, there are many countries, including Indonesia, that refer to OECD (Organization for Economic Co-operation and Development). OECD reveals a corporate governance structure and its relation of accountability among the involved parties consisting of shareholders, board members, commissioners, and managers. It designed to encourage the creation of a competitive performance and to reach the main objectives of the company.

15 crisis and credit crunch, which have engulfed financial markets and economics around the world, have further catapulted corporate governance onto center stage Solomon (2010).

Generally, Indonesia’s corporations are family businesses,

which mean that family members hold key managerial positions, and control the corporation Sang-Woo Nam and Il Chong Nam (2004). This situation emerges the agency problem between the management (the controlling family) and minority shareholders. The agency problem does not appear commonly between the management and owners. The existence of large shareholders may by itself not be a matter of concern, or may even be a blessing but the beneficial effect of large shareholders should be expected only when management is separated from ownership or when proper corporate governance mechanisms are in place so that outside shareholders can effectively check misbehavior by controlling owners. Due to those reasons, Indonesia needs more attention in relations to the corporate governance problem arising from the separation of control from ownership.

Good corporate governance (GCG) is an important pillar of market economy as it relates to the investors’ confidence both in the

16 In addition, good corporate governance is needed to prevent the expropriation of shareholders by managers and to ensure the efficient management of a company that has multiple owners. It is also needed to attract the capital needed to pursue large and worthwhile projects Sang-Woo Nam and Il Chong Nam (2004).

4. Audit

Generally audit is a systematic process of (1) objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between those assertions and established criteria and (2) communicating the results to interested users (www.accountingconcern.com).

An auditor's job is to ensure the integrity of financial data. When performing an audit, an auditor will request access to the business' financial records. This includes the ledgers, lists of receipts and expenditures, bank balances, records of physical assets owned or leased and many other records. The auditor will also interview personnel and review the business' accounting system and its internal controls. In essence, the auditor will review any activity that affects the business' finances (www.fasb.org).

17 public exchange might engage a firm to audit its financial statements in order to obtain more desirable loan terms from a financial institution. Without the audit, the lending party would not have assurance as to whether or not the company's financial position is accurate. In turn, the lender could price protect (raise their price) against this information asymmetry.

An auditor working for a private business may review a client's banking and other financial statements, to verify that they have been correctly prepared and appropriately reported as required by the law. Auditors must keep themselves educated of any changes in law that will affect how their clients must report financial information. It is important that the auditor be able to give an unbiased evaluation of a client's records.

Auditors are not expected to guarantee that 100 percent of the transactions are recorded correctly. They are only required to express an opinion as to whether the financial statements, taken as a whole, give a fair representation of the organization's financial picture. In addition, audits are not intended to discover embezzlements or other illegal acts. Therefore, a "clean" or unqualified opinion should not be interpreted as an assurance that such problems do not exist.

a. Audit Committee

non-18 executive directors. The audit committee is increasingly seen as one of the cornerstones of corporate governance. Many argue that the success of an organization’s corporate governance arrangements relies in part on the success of the established audit committee.

Under Sarbanes-Oxley Act in 2002, audit committees are ultimately responsible for the appointment of external auditors, although in practice, managers may also play a significant role. To emphasize the importance of audit committees, there are several sections of the SOX (i.e., Sections 204, 301, and 407) dedicated to the responsibilities and composition of audit committees Lisic and Zhou (2013).

DeZoort et al. (2002) in Ika and Ghazali (2011) explained that an effective audit committee has qualified members with the authority and resources to protect stakeholder interests by ensuring reliable financial reporting, internal controls, and risk management through diligent oversight efforts. It asserts that the ultimate goal of audit committee service is to protect shareholders’ interests, and the way audit

committee can achieve this goal is through the use of qualified members with adequate authority and resources to provide diligent oversight.

1. Audit Committee in Indonesia

19 financial crisis Ika and Ghazali (2011). Initially, audit committee formation was voluntary BAPEPAM (2000). It was made mandatory to all listed companies after the issuance of BAPEPAM (2004) concerning Guidelines on Establishment and Working Implementation of audit committee.

According to BAPEPAM rule (2004), audit committee membership must comprise of at least three members, one of whom shall be an independent commissioner and concurrently the chairman of the audit committee, while the others shall be external independent parties. Additionally, at least one of the audit committee shall have accounting and/or finance expertise. The responsibility of the audit committee is to provide independent professional advice to the board of commissioners (BOC) and identifying matters that require the attention of the Board of Commissioner.

Regarding National Committee on Governance (2006), the function of the Audit Committee is to assist the Board of Commissioners to ensure that:

1) Financial reports are presented appropriately in accordance with the generally accepted accounting principles.

2) Internal control structure is adequate and effective.

20 applicable audit standards.

4) Audit findings are followed up by the management.

The Audit Committee shall review candidates for external auditors including their remuneration, and submits its recommendation to the Board of Commissioners. Audit committee also has the responsibility to review the independence and objectivity of a public accountant, and to review the audit adequacy conducted by public accountant IDX (2004a, b).

BAPEPAM (2004) rule also provides guidelines on some aspects such as the definition of independent for audit committee members, the authority of audit committee, and audit committee meetings. In terms of audit committee meetings this rules stipulates that the number of audit committee meetings held during a year should be at least the same with the minimum requirement of BOC meetings as stated in company’s article of association.

In terms of Audit Committee reporting, IDX (2004a, b) rule stipulates that audit committee must submit a report on its activity to the BOC periodically at least once in three months. Audit committee reports must be disclosed in the annual reports as part of company’s corporate governance

21 least provide information on:

1. Name, position, and short biography of audit committee member.

2. Job description and responsibility of audit committee. 3. Number of meetings held during the financial year and

detail attendance of each audit committee member. Summary of the activities of audit committee in discharging its duties during a financial year.

5. Financial Report

The financial report have an important role because financial reports intended to provide information regarding the financial position, performance and changes in financial position of an enterprise that benefits a large number of users in making economic decisions.

22 making decisions about providing resources to the entity. Those decisions involve buying, selling, or holding equity and debt instruments and providing or settling loans and other forms of credit Decisions by existing and potential investors about buying, selling, or holding equity and debt instruments depend on the returns that they expect from an investment in those instruments; for example, dividends, principal and interest payments, or market price increases. Similarly, decisions by existing and potential lenders and other creditors about providing or settling loans and other forms of credit depend on the principal and interest payments or other returns that they expect. Investors, lenders, and other creditors expectations about returns depend on their assessment of the amount, timing, and uncertainty of (the prospects for) future net cash inflows to the entity. Consequently, existing and potential investors, lenders, and other creditors need information to help them assess the prospects for future net cash inflows to an entity.

6. Timeliness

23 Prickett (2002), and Kulzick (2004), transparency from the perspective of financial statements users includes eight aspects as follows, accuracy, consistency, appropriateness, completeness, clarity, timeliness, convenience, and governance and enforcement.

Timely release of corporate financial report has long been recognized as one of the qualitative attributes of financial reporting (Accounting Principle Board, 1970; Financial Accounting Standards Board, 1980). In the capital market where corporate financial information is a primary source of information to shareholders, timely publication of the information is crucial Ika and Ghazali (2011). For investors, timely reporting reduces the uncertainty related to investment decision Ashton et al. (1989) and asymmetric dissemination of financial information among stakeholders in the capital market Jaggi and Tsui (1999).

Timeliness of financial reporting has allowed the information to be available for decision-makers before it loses its capacity to influence decisions. Greater benefit will be derived from the timely reporting of financial statement, and specifically timely reporting refers to the shorter time between the date of accounting financial year-end and the date of independent auditor issuing an audited annual report (Shukeri and Nelson).

24 shareholders and potential investors rely on the audited financial reports before deciding whether to retain as shareholders or to become investors of a company. Reliability of the reports would increase when external auditor audits it. In Exposure Draft of an Improved Conceptual Framework for Financial Reporting (2008), which is issued by International Accounting Standard Board, also includes that reliability as an essential qualitative characteristic of decision-useful financial reporting information Hasyim and Rahman (2011).

25 In this research, audit lag is used to assess the timeliness.

a. Audit Lag

Audit lag were measured by number of day between financial statements date to audit report date. There were many factors that cause the audit lag, such as firm size, regulation, business sector (industry), internal audit factors, auditor’s size, audit opinion,

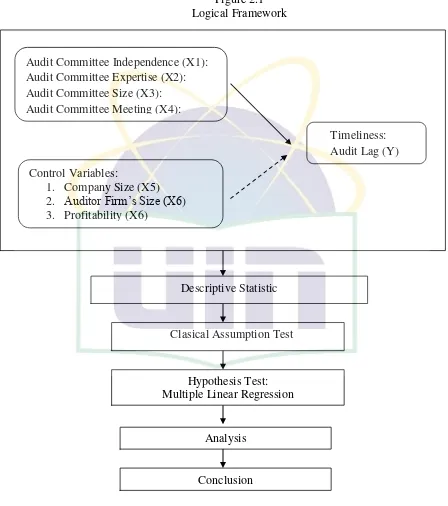

27 C. Logical Framework

Figure 2.1 Logical Framework

Audit Committee Independence (X1): Audit Committee Expertise (X2): Audit Committee Size (X3): Audit Committee Meeting (X4):

Control Variables:

1. Company Size (X5) 2. Auditor Firm’s Size (X6) 3. Profitability (X6)

Timeliness: Audit Lag (Y)

Descriptive Statistic

Clasical Assumption Test

Hypothesis Test: Multiple Linear Regression

Analysis

28 D. Hypothesis

Hypothesis is considered as a tentative statement that proposes a possible explanation to some phenomenon or event. Based on the literature review previously, the hypothesis development can be describe as:

1. Audit Committee Independence

BAPEPAM (2004) regulated at least 3 members of audit committee consist of 2 members from outside parties and lead by an independent commissioner. If there are 2 independents commissioners, one of them should be a leader. Nor et al (2010) and Hasyim and Rahma (2011) in Wijaya and Rahardja (2012) stated that audit committee independence has negative influence to the audit lag.

H1: Audit Committee Independence has influence to audit lag 2. Audit Committee Expertise

BAPEPAM (2004) regulated at least 1 of audit committee member has background in and experience in accounting or finance. The expertise of audit member could increase the quality of financial report related with timely manner. Purwati (2006), and Hasyim and Rahma (2011) in Wijaya and Rahardja (2012) stated that audit committee expertise has negative influence to audit lag.

H2: Audit Committee Expertise has influence to audit lag 3. Audit Committee Size

29 independent commissioner. If there are 2 independents commissioners, one of them should be a leader. With the varieties of public company raise a statement bigger audit committee increase the quality of financial report and reduce audit lag. Purwati (2006), and Nor et al (2010) in Wijaya and Rahardja (21012) stated there are negative influence between audit committee size and audit lag.

H3: Audit Committee Size has influence to audit lag 4. Audit Committee Meeting

FCGI in Wijaya and Rahardja (21012) stated at least 3 or 4 meeting held in a year to fulfill the obligation and responsibility. Nor et al (2010) in Wijaya and Rahardja (21012) stated that audit committee meeting has negative influence to the audit lag.

30 CHAPTER III

RESEARCH METHODOLOGY A. Scope of Research

This research uses quantitative method. The research design or relationship between variables uses causality. Causality is a type of relationship, which can be seen from the characteristics of the relationship between independent and dependent variables. When the dependent variable explained or influenced by independent variables, it can be stated that variable X cause variable Y.

The aim of this study is to examine the influence of audit committee effectiveness to the timeliness submission of financial reports. In this research, audit committee is the independent variable proxies by audit committee independence, audit committee expertise, audit committee size, audit committee meeting, company size, external auditor, and profitability. Meanwhile, the dependent variable is timeliness proxy by audit lag. The population in this study is companies listed on the Indonesia Stock Exchange (BEI) for the period 2013, which fulfill the selected criteria for this research. B. Sampling Method

31 uses non-probability sampling, which means that the elements of the population do not have the same chance to select as a sample.

This research will conduct purposive sampling. Purposive sampling is divided into two types, quota sampling and judgmental sampling. In this research, researcher will use judgmental sampling as sampling method. In judgmental sampling, subjects selected on the basis of their expertise in the subject investigated.

The population used in this research is companies listed on the Indonesia Stock Exchange in 2013. The choice of choose all listed companies in 2013 because more companies have more complex diversity which great way to examine the effect the timeliness of the financial report. The sample selection criteria in this in this research are as follow:

1. Companies listed in IDX period of 2013.

2. Companies have published its annual report publicly period 2013. 3. Companies have the data of audit committee independence, audit

committee expertise, audit committee size, audit committee meeting, company size, external auditor, profitability that will be tested in its annual report.

C. Data Collection Method

32 Secondary data used in this study are the financial report of companies listed on the Indonesia Stock Exchange in 2013. The data obtained in this study are gathered from the Indonesian Capital Market Directory (ICMD), www.idx.co.id, through Corner, Capital Market Reference Center (CMRC) at the Indonesia Stock Exchange (IDX).

D. Data Analysis Method

The method of analysis data in this research is using statistical calculations; the name of application is SPSS (Statistical Product and Service Solutions). Once the necessary data have been collected in this study, the data analysis can be performed by descriptive statistics and hypothesis test. The descriptions of the data analysis method are as follows:

1. Descriptive Statistics

The data in this study were analyzed with descriptive statistics. The descriptive statistical testing is a transformation process of research data by using tabulation in order to make the data understandable and easily being interpreted. Generally, tabulation is used by researcher to obtain information about characteristics of primary variable in research. The measurement applied in this descriptive statistical testing depends on the type of scale of measurement. The descriptive statistical testing obtains a picture or describes data that can be seen from median, mean, mode, standard deviation, variance, maximum and minimum.

33 According to Hair et al. (2006) cited in Adinugraha et al (2007), the purpose of the normality test is to determine whether the regression model variables are normally distributed or not. The normality test conducted to determine whether the inferential statistics to be used is a parametric or non-parametric statistics. There are two ways to test, i.e. the graph analysis and statistical tests Ghozali (2011). Researcher chooses two tools to test whether the data is normally distributed or not.

1) Graph Analysis

When using graph analysis, normality test can be done by looking at the spread of the data (dots) on the diagonal axis of the graph or by looking at the histogram from the residual.

a) If the dots spread around the diagonal line and follow the direction of the diagonal line, the regression model meets the normality assumption.

b) If the dots spread away from diagonal lines and / or do not follow the direction of the diagonal line, the regression model does not meet the normality assumption.

2) Statistical Test

Kolmogorov-Smirnov Z (1 - Sample KS) uses for making decision regarding the normality test.

34 (b) If the value Asymp. Sig. (2-tailed) of more than 0.05, it

means that the data are normally distributed. b. Multicollinearity Test

Multicollinearity test aims to test whether the regression model found a correlation between the independent variables Ghozali (2011). A good regression model should not happen correlation between the independent variables. To detect the presence or absence of multicollinearity in the regression model can be seen from the value of tolerance and the variance inflation factor opponent (VIF). Multicollinearity views of the tolerance value <0.10 or VIF> 10. Both of these measurements indicate each independent variable, which is explained by the other independent variables.

c. Heteroscedasticity Test

Heteroscedasticity test aims to test if there is variance difference from residual of one observation to (an) other observation(s) occurred Santoso (2010). Furthermore, if the variance remains constant, it is called homoscedasticity and if it is changing or different, it is called heteroscedasticity Santoso (2010). A good regression model is homoscedasticity or there is no heteroscedasticity.

35 that has been predicted and the X-axis is the residual (Y predicted-Y actual). Decision-making can be made by this consideration:

1) If there is a specific pattern, like dots, which form well-ordered pattern (waving, spreading then narrowing), it indicates that heteroscedasticity occurs.

2)If there are no well-ordered pattern and the dots spread above and below 0 in Y-axis, heteroscedasticity does not prevail.

d. Autocorrelation Test

Autocorrelation test aims to find if there is correlation in linear regression model between disturbances in t period with previous period (t-1) Santoso (2010). A good regression model is a regression that is free from autocorrelation.

Autocorrelation can be determined using DW (Durbin- Watson) Test and Breusch-Godfrey Test.

Table 3.1

DW (Durbin- Watson) Test

Formula Decision

DW < -2 Positive Autocorrelation -2 < DW < +2 No Decision

36 3. Multiple Regression Analysis

Multiple regression analysis used to test the effect of two or more independent variables toward the dependent variable Ghozali (2011). Regression analysis divided into two kinds, simple regression analysis (if there is only one independent variable) and multiple regression analysis (if there is more than one independent variables). Multiple regression analysis can be measured partially (indicated by coefficient of partial regression) jointly indicated by coefficient of multiple determination or R2.

Independent variable in this research is audit committee effectiveness, dependent variable is timeliness, which is separated into audit lag and report lag, and control variables are financial condition, company size, and audit firm’s size. Structural equation model that proposed as an empirical model is as follows:

Y1 = β0 + β1X1 + β2X2 + β3X3 + β4X4 + β5X5 + β6X6 + β7X7 + ε

Where:

Y1 = Audit Lag

X1 = Audit Committee Independence

X2 = Audit Committee Expertise

X3 = Audit Committee Size

X4 = Audit Committee Meeting

X5 = Company Size

37 X7 = Profitability

β1 =Regression Variable Audit Committee Independence

β2 = Regression Variable Audit Committee Expertise

β3 = Regression Variable Audit Committee Size

β4 = Regression Variable Audit Committee Meeting

β5 = Regression Variable Company Size

β6 = Regression Variable Auditor Firm’s Size

β6 = Regression Variable Profitability

ε = Error

a. Simultaneous Regression Analysis (Test - F)

Essentially, F- test has purpose to know whether among independent variables simultaneously have significant influence toward dependent variable. Independent variables in this research are good corporate governance and ownership structure whereas dependent variable is firm value. So, F- test has a function to know the influence among good corporate governance and ownership structure towards firm value. α used for this research is 0.05 (5%) with assumption:

1) α > 5%, Ho is accepted. 2) α < 5%, Ho is rejected.

b. Partial Regression Testing (T-test)

38 The level of significance used in this test is 5% or (α) 0.05. The

decision-making is based on probability values:

1) If the value Significance is < error rate (α = 0.05), then Ho1 and Ho2 are rejected

2) If the value Significance is > error rate (α = 0.05), then Ho1 and Ho2 are accepted.

4. Coefficient Determination Test (R2)

Coefficient determination (R2) is a statistical measurement of how well the regression line approximates the real data point. By knowing the value of R2, it can determine the magnitude contribution of independent variables toward the dependent variable. R2 expresses a value between zero and one.

If R2 is near to 0, the regression model cannot explain most of data variations. In this case, the regression model fits the data poorly. On the other hand, if R2 is near to 1, the regression model can explain most of the variation in the dependent variable. In other words, the regression model fits the data well Sekaran and Bougie (2010).

E. Variable Operation 1. Independent Variable

39 are Audit Committee Independence, Audit Committee Expertise, Audit Committee Size, and Audit Committee Meeting.

a. Audit Committee Independence

Audit committee independence described as a situation where the members of the audit committee should be recognized as an independent party. Audit committee members also must be free from any liability to the company. In addition, the audit committee members also do not have a particular interest to company and must be free from circumstances that cause others to doubt the nature of its independence. The variable measured by the number of members of the Audit Committee. The data is obtained from the annual report as well as the Indonesian Capital Market Directory.

b. Audit Committee Expertise

40 the proportion of members of the Audit committee were competent with the number of the Audit committee member. The data is obtained from the annual report as well as the Indonesian Capital Market Directory.

c. Audit Committee Size

Based on the Circular of directors PT.Bursa Efek Indonesia No.SE-008 / BEJ / 12-2001 December 7, 2001 and Guidelines for the Establishment of Audit Committee regarding the membership of the audit committee, stated that the audit committee member at least three (3) members, including the chairman of the audit committee. This variable is measured from the number of members of the Audit Committee. The data is obtained from the annual report as well as the Indonesian Capital Market Directory.

d. Audit Committee Meeting

Based on guidelines, Bapepam mention that the audit committee shall hold a meeting of at least 4 (four) times a year to discuss the financial reporting with external auditors. This variable is measured on how many times the audit committee to conduct meetings in a year.

2. Dependent Variable

41 Therefore, the dependent variable is timeliness of reporting. In this research, timeliness of reporting is defined as the number of days that elapses between a company’s financial year-end and measured into one, namely:

a. Audit Lag

Audit lag is measured by number of days between financial statements date until the date of the audit report Dyer and McHugh (1975), McGee (2009), Khasharmeh and Aljifri (2010), Rachmawati (2008) Al-Ajmi (2008); and Perdhana, (2009). According to Elder et al. (2008), the date of the audit report is the date when audit fieldwork has been completed. If there are events after the signing of the audit report, which significantly affects the financial statements, it will be possible for dual-dated audit report. Dual-dated audit report is an audit report that takes two dates, which is the date of audit fieldwork completion and the date of incident investigation completion (Elder et al., 2008). This study will use the most recent date for dual-dated audit report.

3. Control Variable

Consistent with Wijaya and Rahardja (2012), three corporate characteristics namely company size, auditor firm size, and profitability are included as control variables.

42 Company Size is measured by a natural logarithm of the companies’ total assets. This control variable is used in order to

control the variable of audit committee effectiveness to timeliness because large companies are often followed by a large number of investment and media analysts who demand for timely reporting in order to review their performance for investment decision-making Stephen Owusu-Ansah and Stergios Leventis (2006) and the large companies have higher resources, which enable them to pay the auditor a higher audit fees to get the audit done in a shorter period of time Al-Ajmi, (2008). b. External Auditor

External Auditor is represented by dummy variable by classifying the Big Four public accounting firm and non-Big Four public accounting firm. The Big Four refers to Klynveld Peat Marwick Goerdeler (KPMG), Ernst & Young, PricewaterhouseCoopers and Deloitte Touche Tohmatsu. Companies that are audited by public accounting firm associated with the Big Four was given the value ‘1’ while companies

audited by non-Big Four public accounting firm was given the value ‘0’.

43 technology Newton and Ashton (1989) in Ika and Ghazali (2011). In addition, the international audit firms (Big 4 auditors) have a tendency to finish audit faster to preserve their reputation Afify (2009) in Ika and Ghazali (2011).

c. Profitability

Profitability is an indicator of success in the company (management activities) to getting profit. More higher the company’s ability to getting profit, indicate the higher level of effectiveness in the company’s management. Profitability can be

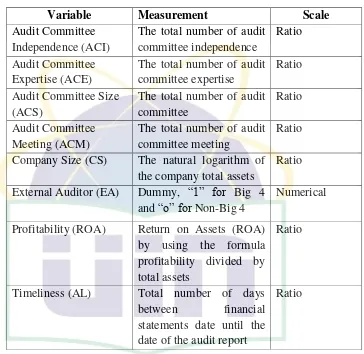

44 Table 3.2

Research Operational Variable

Variable Measurement Scale

Audit Committee

Profitability (ROA) Return on Assets (ROA) by using the formula profitability divided by total assets

Ratio

Timeliness (AL) Total number of days between financial statements date until the date of the audit report

45 CHAPTER IV

RESULT AND ANALYSIS

A. Overview Research Object

1. Description Research Object

This chapter presents the findings of the research. The populations in this study are all companies that go public and listed on the Indonesian Stock Exchange (IDX) in 2013. The selection of sample is chosen by criteria of population that have explained in research methodology in previous chapter that is taken as annually in 2013. The focus of this research is to look at the effect of audit committee independent, audit committee expertise, audit committee size and audit committee meeting, company size, big 4 auditor, and profitability to the timeliness of company in submitted their financial report.

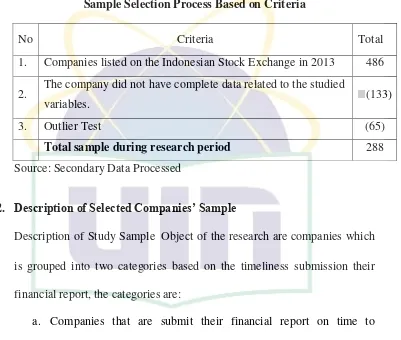

46 Table 4.1 below presents the sample selection process based on established criteria.

Table 4.1

Sample Selection Process Based on Criteria

No Criteria Total

1. Companies listed on the Indonesian Stock Exchange in 2013 486 2. The company did not have complete data related to the studied

variables. (133)

3. Outlier Test (65)

Total sample during research period 288

Source: Secondary Data Processed

2. Description of Selected Companies’ Sample

Description of Study Sample Object of the research are companies which is grouped into two categories based on the timeliness submission their financial report, the categories are:

a. Companies that are submit their financial report on time to BAPEPAM.

47 Table 4.2

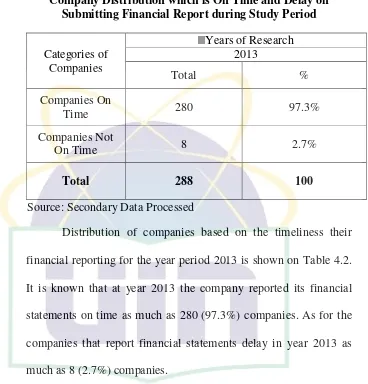

Company Distribution which is On Time and Delay on Submitting Financial Report during Study Period

Categories of Companies

Years of Research 2013

Total %

Companies On

Time 280 97.3%

Companies Not

On Time 8 2.7%

Total 288 100

Source: Secondary Data Processed

Distribution of companies based on the timeliness their financial reporting for the year period 2013 is shown on Table 4.2. It is known that at year 2013 the company reported its financial statements on time as much as 280 (97.3%) companies. As for the companies that report financial statements delay in year 2013 as much as 8 (2.7%) companies.

Companies that delay in submitting financial report according to a report from BAPEPAM and LK caused by several things, such caused by technical problems the parent’s company consolidated with subsidiaries. An increasing number of companies who are delay in submitting financial statements according to a report from Bapepam-LK because of several things, as a follows:

48 systems, and the willingness of the company in submitting their financial report.

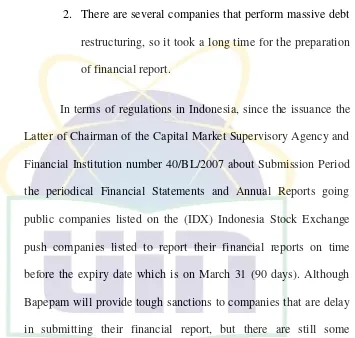

2. There are several companies that perform massive debt restructuring, so it took a long time for the preparation of financial report.

In terms of regulations in Indonesia, since the issuance the Latter of Chairman of the Capital Market Supervisory Agency and Financial Institution number 40/BL/2007 about Submission Period the periodical Financial Statements and Annual Reports going public companies listed on the (IDX) Indonesia Stock Exchange push companies listed to report their financial reports on time before the expiry date which is on March 31 (90 days). Although Bapepam will provide tough sanctions to companies that are delay in submitting their financial report, but there are still some companies that do not submit financial reports on time. It is seen 97.3% of companies that on time in submit their financial report while the remaining 2.7% of companies has been late.

Table 4.3

Distribution ACI (Audit Committee Independence) to the timeliness submission financial report

No ACI Category On Time Delay Total

Total % Total % Total %

1 <3 Person 7 2.5% 0 0% 7 2.43%

49

3 >3 Person 28 10% 1 12.5% 29 10.07%

Total 280 100% 8 100% 288 100%

Source: Secondary Data Processed

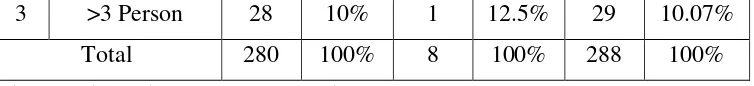

Table 4.3 shows the number of companies that on time and delay on submit their financial report based on ACI (Audit Committee Independence) for year 2013. In the total shows that companies which is on time submit their financial report have independence member less than 3 persons 7 companies or 2.3%, have member 3 persons 245 companies or 87.5%, and have more than 3 persons 28 companies or 10%. At the other side, companies that have delay in submit their financial report have member less than 3 persons 0 companies, and companies have member 3 person 7 companies or 87.5%, meanwhile companies that have more than 3 persons 3 companies or 12.5%.

Table 4.4

Distribution ACE (Audit Committee Expertise) to the timeliness submission financial report

No ACE Category On Time Delay Total

Total % Total % Total %

1 <2 Person 49 17.5% 0 0% 49 17.01%

2 2 Person 144 51.4% 7 87.5% 151 52.44%

3 >2 Person 87 31.1% 1 12.5% 88 30.55%

Total 280 100% 8 100% 288 100%

Source: Secondary Data Processed

50 companies which is on time submit their financial report have independence member less than 2 persons 49 companies or 17.5%, have member 2 persons 144 companies or 51.4%, and have more than 2 persons 87 companies or 31.1%. At the other side, there are no companies that have delay in submit their financial report have member less than 2 persons and companies have member 2 person 7 companies or 87.5%, meanwhile companies that have more than 2 persons 1 companies or 12.5%.

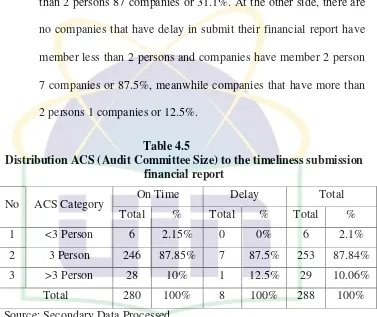

Table 4.5

Distribution ACS (Audit Committee Size) to the timeliness submission financial report

No ACS Category On Time Delay Total

Total % Total % Total %

1 <3 Person 6 2.15% 0 0% 6 2.1%

2 3 Person 246 87.85% 7 87.5% 253 87.84%

3 >3 Person 28 10% 1 12.5% 29 10.06%

Total 280 100% 8 100% 288 100%

Source: Secondary Data Processed