157

DOES UNCERTAINTY IN MONETARY GROWTH AFFECT THE

EQUITY MARKET: THE CASE OF THAILAND

1

Bany Ariffin,

2Wahyu Ario Pratomo,

3Agus Harjito

1

Lecturer at Universiti Malaya, Malaysia 2

Lecturer at Faculty of Economics, Universitas Sumatera Utara 3

Lecturer at Faculty of Economics, Universitas Islam Indonesia, Yogyakarta

Abstract: Banyak kajian tentang hubungan pertumbuhan jumlah uang beredar dan harga surat berharga, namun hanya sedikit yang memperhatikan dampak dari ketidakpastian pada pertumbuhan uang terhadap harga surat berharga. Elemen dari tidakpastian pada pertumbuhan uang menurut para pakar adalah meningkatnya kehati-hatian dari asset finansial yang beresiko dan ini berdampak kepada harga surat berharga. Dengan menggunakan teknik ekonometrik, kajian ini dibuat untuk mengetahui hubungan antara kedua variable di negara yang memiliki pasar modal yang sedang berkembang, yaitu Thailand. Berbeda dengan hipotesis, adanya ketidakpastian pada pertumbuhan uang tidak memberikan dampak terhadap harga surat berharga. Namun ketidakpastian tersebut memberikan dampak hubungan dinamis yang signifikan dalam jangka panjang.

Keywords : Ketidakpastian dalam pertumbuhan moneter dan ekuitas

INTRODUCTION

Over the years empirical studies that examine the relationship between money supply and stock prices are abundant and with particular references to advanced market. As a matter of fact, documented evidence suggests that the issue has been investigated as early as the sixties (Brunner 1961, Friedman 1961, Friedman and Schwartz 1963 and Sprinkel 1964). From seventies era through out the nineties, the studies continue to be expanded in the covering various markets worldwidei

Based on the existing theoretical frameworks, the propose relationship between the two variables is a uni-directionally causation relationship running from money supply to stock prices (Rozeff 1974). However despite the extensiveness of the studies on these two variables, empirical findings fail to reach a conclusive agreement

.

ii

Theoretically, the value of a common stock is determined by the present value of the discounted expected cash inflows to be received by investors who owned the stock -in this case from dividend payments

. Hence, the issue continues to receive attention from both finance scholars and researchers.

iii

Monetary economics framework has provided an argument that links money supply with stock prices

. Therefore we may suggest that the ability of a company to pay dividends will influence

the price of its stock.

iv

The focus of this study is not on the impact of money supply on stock prices per say, but instead the impact of money supply uncertainty on stock prices, which in our opinion is still unclear. According to Friedman (1983 & 1984) because money supply has a real effect on the economy, therefore monetary growth variability should increases the degree of perceived uncertainty in the market. Given this argument and the fact that financial asset ( i.e. common stock) prices are dependence on investor expectations (Rozeff 1974), an argument was put forward by Boyle (1990) who argues that changes in uncertainty regarding money

Bany Ariffin, Wahyu Ario Pratomo, Agus Harjito: Does Uncertainty in Monetary Growth Affect

158

stock will affect prices of common stock. Theoretically, he claims that monetary uncertainty alter the equity risk premium to reflect the additional expected return investors require for bearing the risk of holding stocks during period economy uncertainty.v

Since we believe this proposition has never been tested in developing market, this paper intends to ascertain the relationship between monetary uncertainty and stock prices, with a special reference to the Thai stock market. Hence, the objectives of this paper are twofold - first to test for the existence of a relationship between the uncertainty associated with the past variability (uncertainty) of the money growth and the stock prices. Secondly, to determine if there presence a long-run dynamics relationship between uncertainty in monetary aggregate and stock prices.

Given the stock valuation model presented in (see note 3), increase in risk premium will result in decline in stock price. Thus, monetary uncertainty is implied to have an adverse relationship with stock prices.

The next section of the paper will discuss the background of the study followed by the presentation of data, methodology and findings. A brief discussion of the findings and its conclusion will end the paper.

Motive of the Study

In the context of Thai financial market, Rungsun (1997) has performed one of the comprehensive studies to determine the relationship between money supply and stock prices. They employ the Vector Autoregression (VAR) methodology in order to identify the relationship between money supply and stock prices while controlling for two others variables namely income and interest rate. The result of the Granger causality test shows the presence of a significant uni-directionaI relationship running from money supply to stock prices. Using the impulse response function (IRF) it was shown that stock prices response positively following monetary expansion and the impact peaks after seven month from the initial shock. Motivated with the belief that stock prices reflect real economic performance (Roseff 1974), the authors conclude that their finding is consistent with

the long-run effect of money on the real sector.

Kessara (2001) conducts similar study for the Thai market and found an almost identical result. Using the co-integration and error-correction model (ECM), He discovers that the two variables - stock prices and money, are nonstationary in their level form but are co-integrated in the long-run with the presence of error correction representation. More significantly, he finds from the error -correction model that money supply, represented by M3, Granger cause stock prices but not otherwise. He concludes that his finding is inconsistent with the efficient market hypothesis (EMH) since market participants will be able to predict stock prices in the market using information on broad money supply, M3, as a trading rule to earn excess returns.

The empirical results that suggest the importance of monetary policy in influencing stock prices in Thailand is not surprising since the government has long been known to pursue monetary policy in attaining economic goals, one of which is price stability in the country. The Thai central bank is entrusted with the responsibility of formulating and implementing the country's monetary policy. One of the earlier strategies has been targeting the monetary aggregate, which saw the emphasis given on Ml and eventually M3 to ensure sufficient liquidity in the system to meet the demand of the economyvi

However, the large capital influx into the country since early 1990's has caused considerable instability in the relationship between monetary aggregates and nominal GDP (Central Bank of Thai 2001). Output growth is seen to cause monetary growth and not vice versa, forcing the central bank- to shift its strategy from monetary aggregate targeting to interest rate targeting. Nevertheless, the central bank still monitors the monetary aggregates very closely despite suggestions that they become unreliable indicators of economic activity. During this period, monetary velocities - the ratios of nominal GDP to various monetary

159

aggregates, are reported to frequently-depart from the historical patters. This departure from the historical pattern implies variation in money growth (Central Bank of Thai 2001).

Following the Thorbecke (1995) argument of monetary policy real and quantitative effect on the economy, we suspect that this phenomena -instability of monetary aggregates over those periods should have an affect on the level of economic activity. In addition, since stock prices reflect real economic performance, the impact of the monetary uncertainty should transpire in the common stock prices. Considering this development, it is deemed appropriate to pursue empirical evidence to establish the relationship between monetary uncertainty and stock price behaviors.

With this in mind, this paper is designed to test two hypotheses, namely (i) monetary uncertainty is negatively related to stock pricesvii, and (ii) stock price uncertainty uncertainty to monetary uncertainty. The major contribution of this paper is in its attempt to clarify the issue of monetary uncertainty and its effect on the Thai stock market. The findings will be of use for market participants and regulators alike.

METHODOLOGY AND FINDINGS This study employs monthly data running from 1989:01 to 2001:03. Using M1viii to represent monetary aggregate and SET index ixas a proxy of stock prices, the month to month (i.e. January-to January ) rate of change is computed to generate new series that represent changes in M1 and SET index. The monetary variability is measured by calculating the standard deviation of changes in the M1 series over one year periodx

To measure the past history of monetary instability, following Boyle (1990) a series of one-year moving average of the standard deviation is constructed. Similar process is also performed on the SET index series to accomplish the second objective of the study. Overall, three series are generated – namely moving average of standard deviation of monetary growth, stock price growth and moving average of standard deviation for stock price growth.

.

In order to examine whether there is a long run equilibrium relationship among

the variables, we employ the method of co-integration developed by Johansen (1991). Prior to testing for co-integration, the time series properties of the variable should be investigated. If the variables are stationery, conventional regression procedures are appropriate. However, if the variables are stationary, with time- dependent means and variances, then test of co-integration are necessary to establish long run relationship. The test for unit roots employed is Augmented Dickey-Fuller, suggested by Dickey and Fuller (1979) and Phillip and Peror (1988) respectivelyxi

If both variable are non-stationery and integrated of the same order, then the relationship of these variables is estimated by employing the co-integration methodology suggested by Johansen (1991). The co-integration (see Engle and Granger, 1987) is a long run relationship and it implies that deviations from equilibrium are stationery, with finite variance, even though the series themselves are non-stationery and have infinite variance.

.

If a common trend among a set of variables that move together in the long run equilibrium exists, the granger causality tests should be constructed within a vector error-correction model (VECM) to avoid misspecification. The granger causality test is implemented by calculating the F-statistic based on the null hypothesis that the set of coefficient on the lagged values of independent variables are not statistically different from zero. If the null hypothesis is not rejected, then it can be concluded that the independent variable does not cause dependent variable. If the coefficient of error correction term from the co-integrating regression is significant based on the t-statistic, then both independent and dependent variables have a stable relationship in the long-run.

Bany Ariffin, Wahyu Ario Pratomo, Agus Harjito: Does Uncertainty in Monetary Growth Affect

160

the Granger- causal chain or degree of exogenity amongst the variable beyond the sample period ( Masih and Masih 1995). VDCs which may be termed as out-of-sample causality test, by partitioning the variance of the forecast error of a certain variable (say, money supply) into proportions attributable to the innovations ( or shocks) in each variable in the system including its own, can provide an indication of these relativities. A variable that is optimally forecast from its own lagged values will have all its forecast error variance accounted for by its own disturbances (Sims 1982).

RESULTS

The result from the ADF tests is presented in Table 1. They indicate that only two series are nonstationery at level form but integrated of first order, I(1). The two series are moving average of standard deviation for monetary growth (MADVM1) and moving average of standard deviation for stock price growth (MADVSTK). Since these two series are integrated of the same level, it suggests the presence of co-integration relationships and that validates the use of co-integration analysis to ascertain the long-run dynamic between the two series.

Table 1. ADF tests for the presence of unit root Variable Statistic for level Statistic for first

difference

MADVM1 -2.236148 -3.51462***

MADVSTK -2.051253 -5.539158*** MAGSTK -5.316498*** -6.772527 Note:

MADVM1= moving average std dev. of money growth MADVSTK= moving average std. dev of stock price growth

MAGSTK = stock price growth * significant at 10%

** significant at 5% *** significant at 1%

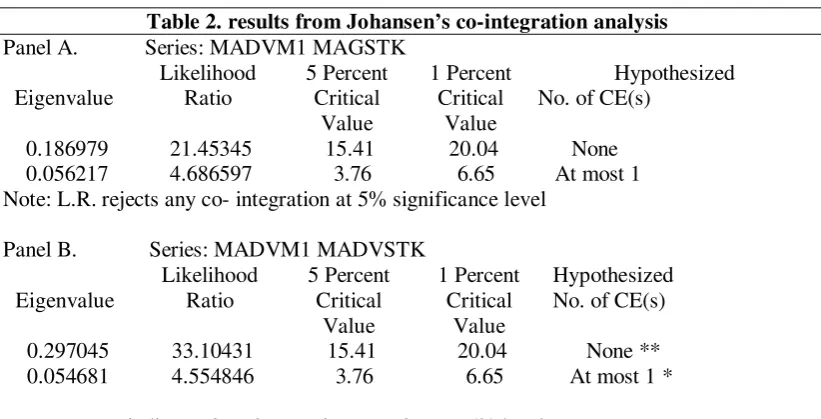

[image:4.595.89.500.472.681.2]The results from co-integration analysis are presented in table 2. Based on the results presented in panel A of table 2, it is found that the two series – moving average of standard deviation for monetary growth (MADVM1) and stock price growth (MAGSTK) are not co-integrated in the long-run. This is consistent with the ADF test, which shows that these two series reach their stationery at different level. However panel B shows that the series of moving average of standard deviation for monetary growth (MADVM1) and moving average of standard deviation for stock price growth (MADVSTK) do indeed possess a long-run equilibrium between them.

Table 2. results from Johansen’s co-integration analysis Panel A. Series: MADVM1 MAGSTK

Likelihood 5 Percent 1 Percent Hypothesized Eigenvalue Ratio Critical

Value

Critical Value

No. of CE(s)

0.186979 21.45345 15.41 20.04 None 0.056217 4.686597 3.76 6.65 At most 1 Note: L.R. rejects any co- integration at 5% significance level

Panel B. Series: MADVM1 MADVSTK

Likelihood 5 Percent 1 Percent Hypothesized Eigenvalue Ratio Critical

Value

Critical Value

No. of CE(s)

0.297045 33.10431 15.41 20.04 None ** 0.054681 4.554846 3.76 6.65 At most 1 *

161

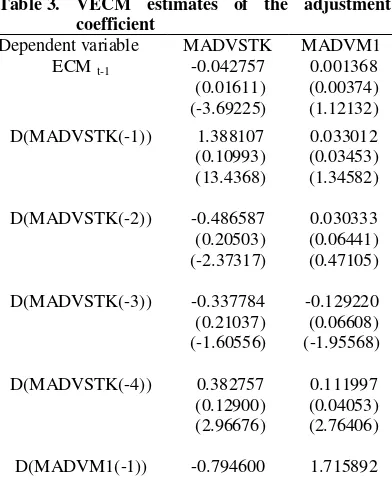

Table 3 presents the results of VECM. The coefficients for the error correction terms (ECM) which represent the speed of adjustment are found to be significantly different from zero. This indicates the two series ( MADVM1 and MADVSTK) simultaneously correcting for the disequilibria resulting from momentary deviation from their long-run equilibrium path, thus explaining the cointegration relationship between the series. The fact that the two series are adjusting at different rates and different significant level, that gives raise to the matter of which series is the leader and which variable is the follower. Thus establishing the causal relationship between the series. Because MADVSTK adjusting more significantly in comparison to MADVM1 based on the coefficient of the ECM term and its significant level, this may indicate that MADVSTK is the follower while MADVM1 is the leader. In other words, changes MADVM1 may lead to changes in MADVSTK. Additional evidence that provide support for this causation relationship lies in their lagged coefficient. The lagged coefficients for MADVM1 are found to be significant from lagged 1 all the way to lagged 3. On the hand the only significant coefficient for MADVSTK are in lagged 4. With evidence from the ECM coefficient and the lagged coefficient, this may indicate that the uncertainty in money growth has more relevant effect on the uncertainty in stock prices than vice versa.

Table 3. VECM estimates of the adjustment coefficient

Dependent variable MADVSTK MADVM1

ECM t-1 -0.042757

(0.01611) (-3.69225)

0.001368 (0.00374) (1.12132) D(MADVSTK(-1)) 1.388107 0.033012 (0.10993) (0.03453) (13.4368) (1.34582)

D(MADVSTK(-2)) -0.486587 0.030333 (0.20503) (0.06441) (-2.37317) (0.47105)

D(MADVSTK(-3)) -0.337784 -0.129220 (0.21037) (0.06608) (-1.60556) (-1.95568)

D(MADVSTK(-4)) 0.382757 0.111997 (0.12900) (0.04053) (2.96676) (2.76406)

D(MADVM1(-1)) -0.794600 1.715892

(0.35437) (0.11130) (-2.24227) (15.4172)

D(MADVM1(-2)) 1.079885 -1.138641 (0.72587) (0.22797) (1.48770) (-4.99463)

D(MADVM1(-3)) -0.671035 0.258231 (0.73300) (0.23021) (-0.91547) (1.12172)

D(MADVM1(-4)) -0.254664 -0.014365 (0.35990) (0.11303) (-0.70760) (-0.12709) Note: Standard errors & t-statistics in parentheses

The results for the variance decomposition are found to be consistent with that of the VECM causality test. For example, in terms of own shock, MADVM1 shows its relative exogeneity with 83.649 percent of its own innovations in 20-quarter. This result tends to confirm our initial findings from the VECM formulation that the MADVM1 is more exogenous of the two series in the system developed. In 20- quarter about 73.046 percent of the MADVSTK shock is explained by innovation in MADVM1 variable. This result is consistent with the earlier results provided by our VECM model, where MADVSTK may be affected by MADVM1 and not the other way around. Again these findings tend to highlight the roles played by monetary uncertainty in influencing the variability in the stock market.

[image:5.595.86.282.530.773.2]Bany Ariffin, Wahyu Ario Pratomo, Agus Harjito: Does Uncertainty in Monetary Growth Affect

162

information does not seem to influence the contemporary stock prices. As such, it suggests that market has already considered past information of market uncertainty in determining stock prices.

Secondly, the study intends to detect for the presence of long-run dynamics between uncertainty in monetary aggregate and stock prices. Using Johansen (1991) co-integration analysis, the long-run relationship between the uncertainties of the two variables is detected. This finding conforms to the suggestion that monetary policy has real and quantitatively important effects on the economy since uncertainty in the monetary aggregate, is reflected in the uncertainty in stock prices which is a proxy of economic prosperity. The extent of the relationship is further substantiated from the VECM testing. It was shown in the testing that monetary uncertainty indeed granger cause stock prices variability. In addition our variance decomposition procedure are also pointed in the same direction.

This paper provides evidence that (i) monetary uncertainty has no significant relationship with the contemporaneous stock prices, and (ii) the uncertainty in monetary policy is co-integrated in the long run with the uncertainty in stock prices, at least within the context of Thailand. Given the importance of the issue of uncertainty in financial markets, this paper virtually contributes to beef up the literature on the subject particularly with reference to emerging markets like Thailand. It is hope that this effort will instigate further investigations on the topic in view of its great importance to market

REFERENCES

Bank Negara Malaysia. 1999, “The Central Bank and the Financial System in Malaysia: A Decade of Change 1989-1999,” Kuala Lumpur.

Boyle, G.W. 1990, “Money Demand and the Stock Market in a General Equilibrium Model with Variable Velocity,”

Journal of Political Economy 98, pp.

1039-1053.

Brunner, K. 1961, “Some Major Problems in Monetary Theory,” American

Economic Review Proceedings, May.

47-56.

Eviews 3: User’s Guide 2nd Edition 1994-1998. Quantitative Micro Software, Irvine, CA.

Friedman, M. 1961, “The Lag in Effect of Monetary Policy,” Journal of Political

Economy, pp.447-66.

Friedman, M. & Schwartz, A. 1963, “Money and Business Cycle,” Review of

Economics and Statistics Supplement,

pp.32-64.

Friedman, M. 1983, Monetary Variability: United States and Japan,” Journal of

Money,Credit and Banking 15 (3). pp.

339-343.

Friedman, M. 1984, “Lessons from the 1979-82 Monetary Policy Experiment,” AEA

Papers and Proceedings, May 1984.

pp. 397-400.

Friedman, M. 1988, “Money and the Stock Market,” Journal of Political Economy

96, pp. 221-45.

Ghazali, N. A. & Yakob, N. A. 1997, “Money Supply and Stock Prices: The Case of Malaysia,” Proceeding Seminar Antar Bangsa Managing

Growth and Changes,Bengkulu,

Indonesia, pp. 605-617.

Granger, C. W. J. 1969, “Investigating Causal Relations by Econometric Models and Cross Spectral Methods,”

Econometrica 37, pp. 424-38.

Granger, C. W. J. 1988, “Some Recent Developments in the Concept of Causality,” Journal of Econometrics 36 , pp. 199-211.

Habibullah, M.S. 1998, “The Relationship between Broad Money and Stock Prices in Malaysia: An Error Correction Approach,” Jurnal Ekonomi

Malaysia 32, pp. 51- 73.

Hashemzadeh, N. & Taylor, P. 1988, “Stock Prices, Money Supply, and Interest Rates: The Question of Causality,”

Applied Economics 20, pp. 1603-1611.

Johansen, S. 1991, “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector

Autoregressive Models,”

Econometrica 59, pp. 1551-1580.

Mak, B. S. C. & Cheung, D. W. W. 1991, Causality Tests of the United States Weekly Money Supply and Asian-Pacific Stock Markets. Asia Pacific

Journal of Management 9 (2), pp.

163

Masih, Abul MM & Rumi Masih 1995, “On the temporal causal relationship between energy consumption, real income, and prices: Some new evidence from Asian-energy dependent NICs Based on a multivariate cointegration/vector error-correction approach”, Journal of Policy

Modelling 19, pp 417 – 440.

Rogalski, R.J. & Vinso, J.D. 1977, “Stock Returns, Money Supply and the Direction of Causality,” The Journal of

Finance 32, pp. 1017-1030.

Ross, S. A., Westerfield, R. W. & Jordan, B. D. 1995, “Fundamentals of Corporate Finance, Third Edition. (Chicago, Illinois: Richard Irwin, Inc).

Rozeff, M.S. 1974, “Money and Stock Prices: Market Efficiency and the Lagged Effect of Monetary Policy,”

Journal of Financial Economics 1, pp.

245-302.

Rungsun, Hataiseree 1997, “Modelling Exchange Rate Policy Reaction Function: Evidence from Thailand Under the Basket Pegging Regime”,

Sasin Journal of Management 3

Sims, C.A. 1982, `Policy Analysis with

Econometric Models', Brookings

Papers on Economic Activity, Vol. 1, 107-152.

Sprinkel, B.W. 1964, “Money and Stock Prices”. (Homewood, Illinois: Richard Irwin, Inc).

Thorbecke, W. 1995, “On Stock Market Returns and Monetary Policy,” Working

Paper No. 139, April 1995. The Jerome

Pedoman Penulisan

Petunjuk Penulisan bagi Penulis

Jurnal EKONOM

ISSN 0853-2435

1. Artikel yang ditulis adalah merupakan hasil penelitian dan pemikiran analitisdi bidang ekonomi. Naskah diketik dengan huruf times new roman, font 12, satu spasi, kertas A4, maksimal 15 halaman, rangkap 3 eksemplar beserta disket dan file diketik dengan Micrisoft Word.

2. Nama penulis artikel ditulis tanpa gelar akademik dan ditempatkan di bawah judul artikel. Apabila artikel ditulis oleh lebih dari satu orang, maka penulis berikutnya diurutkan di bawah penulis utama. Alamat dan institusi penulis serta e-mail harus dicantumkam untuk mempermudah komunikasi.

3. Artikel ditulis dalam bahasa Indonesia yang bernar atau bahasa Inggeris dengan format essai. Judul bagian dicetak dengan huruf besar, bagian berikutnnya dengan huruf besar kecil dan bagian lain dengan huruf besar kecil miring.

4. Format penulisan untuk hasil penelitian adalah : judul, nama penulis; abstrak (maks. 100 kata berisikan tujuan, metode dan hasil penelitian); kata kunci, pendahuluan (latar belakang, tinjauan pustaka dan tujuan penelitian; metode ; hasil ; pembahasan ; kesimpulan dan saran ; daftar rujukan

5. Format penulisan untuk non penelitian (hasil pemikiran) adalah : judul, nama penulis; abstrak (maks. 100 kata berisikan tujuan, dan hasil penelitian); kata kunci, pendahuluan (latar belakang, tinjauan pustaka dan tujuan penelitian) ; pembahasan ; kesimpulan dan saran ; daftar rujukan.

6. Daftar Rujukan memuat pustaka terbitan 10 tahun terakhir, bersumber dari buku-buku, jurnal dan laporan penelitian lain (skripsi, tesis dan disertasi). Setiap pengutipan rujukan dicantumkan nama dan tahun contoh (Samuelson, 2005: 202).

7. Daftar Rujukan ditulis dengan ketentuan sebagai berikut : Buku :

Hill, H. 2000. Unity and diversity Regional Economic Development : In Indonesia Since 1970, University Press, Oxford.

Jurnal :

Miraza, 2002. Pengembangan Kawasan Perkotaan dan Dampaknya tehadap Lingkungan,

Jurnal Ekonom, Vol. 6 /No.3,Fakultas Ekonomi USU, Medan.

Koran (Surat Khabar) :

Waspada. 29 Juli, 2006. Reformasi Ekonomi Dewasa Ini. Hal. 5.

Skripsi, Tesis, Disertasi dan laporan Penelitian :

Rahmansyah, A. 2004. Analisis Pengaruh Pengeluaran Pemerintah Daerah Terhadap

Pertumbuhan Ekonomi Propinsi-propinsi di Indonesia. Tesis tidak diterbitkan.

Medan.SPs Universitas Sumatera Utara.

Internet :

Hitchkock, S. 1996. A Survey of STM Online Journals 1990-1995 : The Calm Before the

8. Semua artikel ditelaah oleh secara anonym oleh penyunting ahli yang ditunjuk berdasarkan kepakaran dan kompetensinya. Perbaikan dimungkinkan setelah artikel tersebut disunting dan pemberitahuan pemuatan tulisan atau ditolak akan diberitahukan kepada penulis.

9. Proses penyuntingan terhadap draft tulisan dilakukan oleh penyunting dan atau melibatkan penulis.

Jurnal Ekonom, Vol. 13 No.1 Januari 2010 : 1-44

Author Indeks

F

Friska S, ” Value Chain Analysis (Analisis Rantai Nilai) untuk Keunggulan Kompetitif

Melalui Keunggulan Biaya,

13 (1): 36-44

G

Ginting Monalisa Br , Arifin Akhmad, ” Pengaruh Karakteristik Perusahaan terhadap

Kelengkapan Pegungkapan Laporan Keuangan pada Perusahaan Barang Konsumsi yang

Terdaftar di Bursa Efek Indonesia”,

13 (1): 18 - 26

H

Hidayat Paidi, ” Analisis Kausalitas dan Kointegrasi Antara Jumlah Uang Beredar,

Inflasi, dan Pertumbuhan Ekonomi di Indonesia”,

13 (1): 27 - 35

J

Jafar Hotmal, Iskandar Muda, Andri Zainal, Wahidin Yasin, ”Pengaruh Penerapan Total

Quality Management (TQM) terhadap Fungsi Audit Internal (Studi pada Perusahaan

Bersertifikasi ISO 9000 di Propinsi Sumatera Utara), ”

13 (1): 9 - 17

S

Simorangkir Indra Gabe , Isfenti Sadalia, ”Analisis Pengaruh Rasio Keuangan dan

Potensi Pertumbuhan serta Ukuran Perusahaan terhadap Kebijakan Dividen (Studi

Kasus di Bursa Efek Indonesia)”,

13 (1): 1 – 8

Jurnal Ekonom, Vol. 13 No.2 April 2010 : 45 - 87

Author Indeks

I

Irawati Nisrul, “ Analisis Hubungan Earning Per Share dengan Profitabilitas pada

Perusahaan Food and Beverages yang Go Public di Indonesia”,

13 (2): 56 - 64

L

Lubis Tapi Anda Sari, “ Persepsi Auditor dan User tentang Independensi Akuntan dan

Pengaruhnya terhadap Opini Audit”,

13 (2): 80 - 87

N

Nasution Budi Anshari, Arifin Akhmad, “ Pengaruh Struktur Modal, Biaya Ekuitas

(Cost of Equity) dan Pertumbuhan Perusahaan terhadap Nilai Perusahaan yang

Terdaftar di BEI”,

13 (2): 45 - 55

S

Sadalia Isfenti, Octavianus Pandiangan, “ Analisis Anomali Pasar Perdagangan pada

Return Saham di Bursa Efek Indonesia”,

13 (2): 71 - 79

S

Jurnal Ekonom, Vol. 13 No.3 Juli 2010 : 88 - 118

Author Indeks

B

Bahri Syamsul. “ Mencari Metode Penyusutan Aktiva Tetap yang Sesuai Bagi Industri

Kelapa Sawit”,

13 (3): 112 - 118

R

Ritonga Haroni Doli H, “ Pola Konsumsi Dalam Perspektif Ekonomi Islam”,

13 (3):

88-91

R

Rosanna Ruth, “ Analisis Faktor-Faktor yang Mempengaruhi Pertumbuhan Modal

Sendiri Perusahaan Property, Real Estate & Building Construction di Bursa Efek

Indonesia”,

13 (3): 99 - 106

S

Santoso Imam,” Pengembangan Model Pemberdayaan Ekonomi Masyarakat Petani

Tepian Hutan Berbasis Perilaku Adaptif: Analisis Sosio Kultural”,

13 (3): 92 - 98

S

Jurnal Ekonom, Vol. 13 No.4 Oktober 2010 : 119 - 163

Author Indeks

A

Abdullah Tengku Mohammad Chairal, “ Profit Maximiziation Theory, Survival-Based

Theory and Contingency Theory: A Review on Several Underlying Research Theories

of Corporate Turnaround”,

13 (4):136-143

A

Arifin Bany, Wahyu Ario Pratomo, Agus Harjito, “ Does Uncertainty in Monetary

Growth Affect The Equity Market: The Case of Thailand”,

13 (4):157-163

S

Sirojuzilam. “Disparitas Ekonomi Wilayah Pantai Barat dan Pantai Timur Provinsi

Sumatera Utara”,

13 (4):144-156

W

Warokka Ari, Haim Hilman “ The Effects of Entrepreneurship, Competitiveness, and

Technology Innovation on Growth : A Case of Asean Economic Development”.

13

(4):

119-127

W

JURNAL EKONOM

INFORMASI BERLANGGANAN

(Biaya Berlangganan: Kota di Sumatera Rp 100.000/tahun dan Kota di

luar Sumatera Rp 150.000/tahun)

LEMBAR PEMESANAN

Nama

:_____________________________________Alamat

:_____________________________________

Kota

:_____________________________________

Telepon

:__________Fax.__________e-mail________

Lembaga

:_____________________________________

_____________________________________

Pemesanan Tahun Terbitan :____________________________

Pembayaran Tunai Transfer

Sekretariat :

1.

Walad Altsani

2.

Ahmad Rafiqi

Bank Mandiri : 106 – 00 – 0440321 - 1

A.n. Sirojuzilum

Alamat Redaksi