THE AWARENESS OF SOCIETY TO FINANCIAL LITERACY

IN THE REMOTE AREA

(Case Study: Tanjung Putri Village, Arut Selatan District, West

Kotawaringin Regency, Central Kalimantan)

KESADARAN MASYARAKAT TERHADAP MELEK

KEUANGAN DI DAERAH TERPENCIL

(Studi Kasus: Desa Tanjung Putri, Kecamatan Arut Selatan,

Kabupaten Kotawaringin Barat, Kalimantan Tengah)

Written by:

Alfina Rahmatia

20130430031

FACULTY OF ECONOMICS AND BUSINESS

UNIVERSITAS MUHAMMADIYAH YOGYAKARTA

i

THE AWARENESS OF SOCIETY TO FINANCIAL LITERACY

IN THE REMOTE AREA

(Case Study: Tanjung Putri Village, District South Arut, West

Kotawaringin Regency, Central Kalimantan)

KESADARAN MASYARAKAT TERHADAP MELEK

KEUANGAN DI DAERAH TERPENCIL

(Studi Kasus: Desa Tanjung Putri, Kecamatan Arut Selatan,

Kabupaten Kotawaringin Barat, Kalimantan Tengah)

UNDEGRADUATE THESIS

In partial fulfillment for the requirement for the degree of Bachelor of

Economics (Sarjana Ekonomi) at International Program for Islamic

Economics and Finance (IPIEF), Economics and Business Department

Written by:

Alfina Rahmatia

20130430031

FACULTY OF ECONOMICS

ii

THE AWARENESS OF SOCIETY TO FINANCIAL LITERACY

IN THE REMOTE AREA

(Case Study: Tanjung Putri Village, District South Arut, West

Kotawaringin Regency, Central Kalimantan)

KESADARAN MASYARAKAT TERHADAP MELEK

KEUANGAN DI DAERAH TERPENCIL

(Studi Kasus: Desa Tanjung Putri, Kecamatan Arut Selatan,

Kabupaten Kotawaringin Barat, Kalimantan Tengah)

UNDEGRADUATE THESIS

In partial fulfillment for the requirement for the degree of Bachelor of

Economics (Sarjana Ekonomi) at International Program for Islamic

Economics and Finance (IPIEF), Economics and Business Department

Written by:

Alfina Rahmatia

20130430031

FACULTY OF ECONOMICS

iv

THE AWARENESS OF SOCIETY TO FINANCIAL LITERACY IN THE REMOTE AREA

(Case Study: Tanjung Putri Village, Arut Selatan District, West Kotawaringin Regency, Central Kalimantan)

KESADARAN MASYARAKAT TERHADAP MELEK KEUANGAN DI DAERAH TERPENCIL

(Studi Kasus: Desa Tanjung Putri, Kecamatan Arut Selatan, Kabupaten Kotawaringin Barat, Kalimantan Tengah)

Written by: Alfina Rahmatia

20130430031

This thesis has been reviewed and validated before the Examination comitte of International Program for Islamic Economic and Finance (IPIEF) Economic Faculty Muhammadiyah University of Yogyakarta

Date: April, 22nd 2017 The Examination Comittee

Agus Tri Basuki, S.E., M.Si. Chief Examiner

Ayif Fathurrahman, S.E., M.Si. Co-Examiner

Dyah Titis Kusuma Wardani, S.E., MIDEc. Co-Examiner

Approved by

Dean of Economics and Business Faculty Universitas Muhammadiyah Yogyakarta

v

DECLARATION

Name : Alfina Rahmatia

Student Number : 20130430031

I declare that this thesis entitled “THE AWARENESS OF SOCIETY TO

FINANCIAL LITERACY IN THE REMOTE AREA (Case Study: Tanjung

Putri Village, District South Arut, West Kotawaringin Regency, Central

Kalimantan)” is consideration of the award of a bachelor degree is my own

personal effort. Where any of content presented is the result of input input or data

from a related collaborative research program this is duly acknowledged in the

text such that it is possible to ascertain how much of the work is my own.

Furthermore, I took reasonable care to ensure that the work is original, and to the

best of my knowledge, does not breach copyright law, and has not been taken

from other sources except where such work has been cited and acknowledged

within the text.

Yogyakarta, 28 February 2017

vi

MOTTO

“Don’

t cry because of what you lost, smile

because of what you learned

.”

“Every soul is held in pledge for what it earns.”

vii

ABSTRAK

Tujuan dari penelitian ini adalah untuk mengetahui tingkat kesadaran masyarakat

terhadap melek keuangan di daerah terpencil, dengan studi kasus di Desa Tanjung

Putri. Data yang digunakan adalah data primer. Data diperoleh dari penyebaran

kuesioner dan wawancara. Analisis data yang digunakan adalah Regresi Logistik

Biner dengan menggunakan aplikasi SPSS, sedangkan pada analisis data

wawancara adalah menggunakan analisis deskripsi. Hasil penelitian menunjukkan

bahwa jenis kelamin, pendapatan perbulan, dan latar belakang pendidikan tidak

berpengaruh positif secara signifikan terhadap tingkat kesadaran masyarakat

terhadap melek keuangan di Desa Tanjung Putri. Hal tersebut terjadi karena faktor

pengalaman penduduk pada masa lalu tentang melek keuangan.

viii ABSTRACT

The main objective of this study is to identify and analyze the awareness level to

financial literacy in the remote area, with a case study in Tanjung Putri Village.

Primary datas used in this study are collected from questionare and interview. The

study uses binary logistic regression using SPSS aplication, whereas the interview

datas use descriptive analysis. The result shows that gender, income per-month

and education backgroud has no positive significant effect to the awareness level

of financial literacy in Tanjung Putri Village society. These are happens because

of the past experience about financial literacy.

.

ix PREFACE

Bismillahirrahmanirrahim

Assalamu’alaikum wa rahmatullahi wa barakatuh.

Alhamdulillah, praise and thanks to Allah Subhanahu wa ta’ala for

blessing the writer with health and joy for finally finishing this minor thesis.

Shalawat and Salam to Muhammad Rasulullah Shallallahu Alaihi wa Salam,

hopefully His syafa’at will be abundant in days later. This minor thesis entitled

“The Awareness Of Society To Financial Literacy In The Remote Area (Case

Study: Tanjung Putri Village, District South Arut, West Kotawaringin Regency,

Central Kalimantan)” has made to submitted as partial fulfillment to achieve

bachelor degree of economics, focusing on Islamic economics and finance. The

writing process of this undergraduate thesis has involved directly and indirectly

many people and parties that the author would like to express gratitude to all

people and parties below:

1. My family, especially for my parents; Arliansyah and Muslimah, and

my beloved little brother who have educated me and give motivation,

pray for me and love me.

2. Bapak Agus Tri Basuki and Ibu Yuli Utami as my undergraduate

thesis advisor who has provided guidance and suggestions to author

since the beginning of the study until the completion of this thesis

x

3. Bapak Masyhudi Muqorobin (Alm) as a lecture as well as father while

I am become an econimics student and Head of International Program

for Islamic Economics and Finance who has give me many

motivations and suggestions to be a great student.

4. The entire Lecturer and Staff in International Program for Islamic

Economics and Finance for all of knowledge given to the author in

which these knowledge really help the author in doing the research.

Hopefully this knowledge may be beneficial for human being.

5. My friends in college, especially entire friend in IPIEF. Thank you for

the togetherness we have been through. Especially by beloved best

friends: Fuzna Raisa Maharani and Sindi Siti Fatimah Z.

6. My Proyek Ekspedisi Nusantara friends, in particulary Biting girls;

Anisa Putri Nabila, Woro Endah Palupi and Amira Daneswari. Thank

you for all the lol. Thank you for all the laughter we shared. And thank

you for everythings.

In addition to people above, there are other people and parties, which gave

much supports and helps during the making of this undergraduate thesis, but the

author could not mention one by one. However, the author, by this chance would

like to say thank you and send best regards to all unstated parties for the hopes

that God will bless all the mentioned and unmentioned parties of their kindness.

Finally, the author believes that this undergraduate thesis is not perfect yet, hence,

xi

and lead this undergraduate thesis into a better one. Hopefully, this undergraduate

thesis would be useful in enriching the knowledge of all reader. Amin.

Wassalamu’alaikum

Yogyakarta, 24 Februari 2017

xii

TABLE OF CONTENTS

TITLE PAGE... ii

PAGE OF RATIFICATION ... iii

PAGE OF RATIFICATION ... iv

PAGE OF DECLARATION... v

MOTTO... vi

ABSTRAK ...vii

ABSTRACT...viii

PREFACE ...xi

TABLE OF CONTENT ...xiii

LIST OF TABLE ... xiv

LIST OF FIGURE AND PICTURE... xv

CHAPTER I. INTRODUCTION A. Background...1

B. Research Questions...5

C. Research Objectives ...6

D. Research Benefits ...6

E. Problem Limitation...7

CHAPTER II. LITERATURE REVIEW A. Theoretical Framework...8

1. Society Awareness...8

2. Financial Knowledge ...10

3. Financial Literacy...13

4. Remote Areas...18

B. Previous Research...18

C. Hypotheses...22

D. Research Framework ...23

CHAPTER III. DATA AND RESEARCH METHODOLOGY A. Source and Method...24

B. Data Collection Techniques...24

C. Operational Definition of Research Variable...29

D. Instrument Research Test ...30

E. Data Analysis ...31

F. Classic Assumption Test...37

CHAPTER IV. OVERVIEW A. South Arut Subdistrict Overview...39

B. Tanjung Putri Village Overview ...42

C. Respondent Characteristic ...44

CHAPTER V. RESULT AND ANALYSIS A. Instrument Research Test ...47

B. Regression Analysis ...48

C. Classic Assumption Test Result ...52

D. Index Formula Percent...53

xiii

CHAPTER VI. CONCLUSION AND RECOMMENDATION

A. Conclusion...67 B. Suggestion ...68 B. Research Limitation...70 BIBLIOGRAPHY

xiv

LIST OF TABLE

2.1. Financial Literacy: A Country-by-Country Breakdown...16

3.1. Criteria of Reliablity Coefficient Based on Guilford...31

3.2. Weight Value Table...33

3.3. Percentage Value Table...33

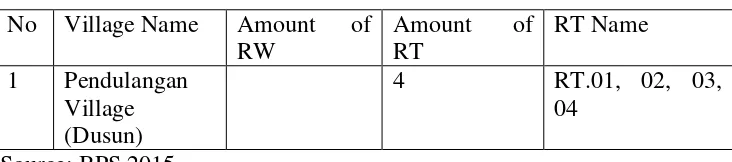

4.1. List of Village and RT in Tanjung Putri Village...42

4.2. Respondent Based on Age and Gender...45

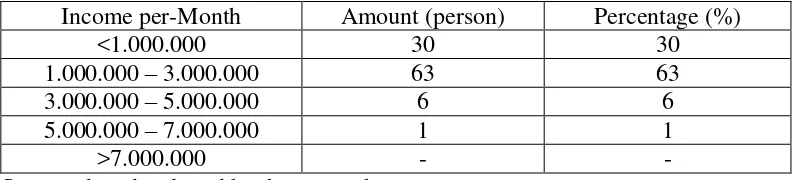

4.3. Respondent Based on Income per-Month...45

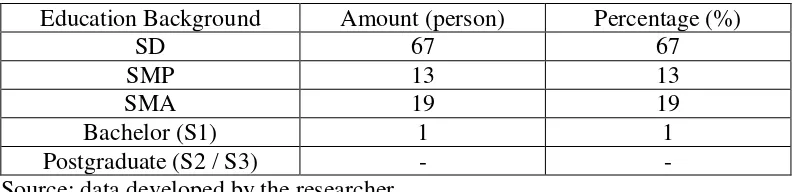

4.4. Respondent Based on Education Background...46

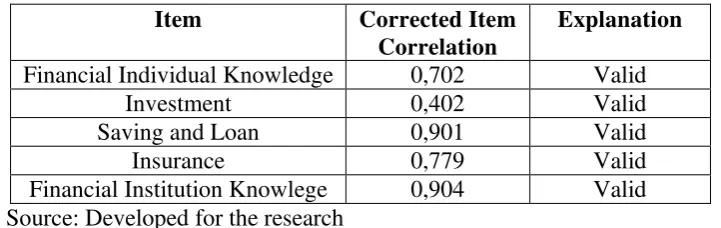

5.1. Validity Test Result...46

5.2. Reliability Test Result...48

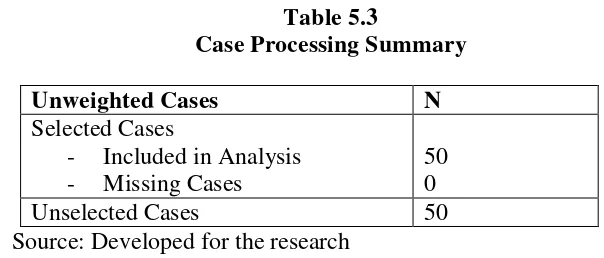

5.3. Case Processing Summary...48

5.4. Dependent Variable Encoding...49

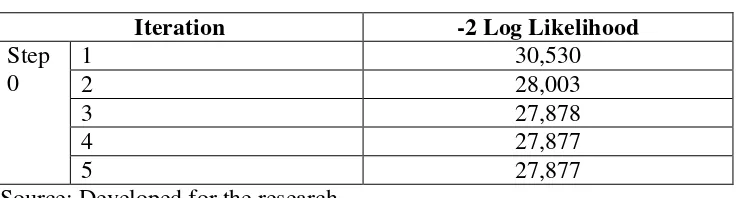

5.5. Iteration History...49

5.6. Omnibus Test of Model Coefficients...50

5.7. Classification Table...50

5.8. Model Summary Result...50

5.9. Hosmer and Lemeshow Test Result...51

5.10. Variable in The Equation...51

5.11. Heterokedastisity Test Result...51

xv

LIST OF FIGURE AND PICTURE

ABSTRAK

Tujuan dari penelitian ini adalah untuk mengetahui tingkat kesadaran masyarakat

terhadap melek keuangan di daerah terpencil, dengan studi kasus di Desa Tanjung

Putri. Data yang digunakan adalah data primer. Data diperoleh dari penyebaran

kuesioner dan wawancara. Analisis data yang digunakan adalah Regresi Logistik

Biner dengan menggunakan aplikasi SPSS, sedangkan pada analisis data

wawancara adalah menggunakan analisis deskripsi. Hasil penelitian menunjukkan

bahwa jenis kelamin, pendapatan perbulan, dan latar belakang pendidikan tidak

berpengaruh positif secara signifikan terhadap tingkat kesadaran masyarakat

terhadap melek keuangan di Desa Tanjung Putri. Hal tersebut terjadi karena faktor

pengalaman penduduk pada masa lalu tentang melek keuangan.

ABSTRACT

The main objective of this study is to identify and analyze the awareness level to

financial literacy in the remote area, with a case study in Tanjung Putri Village.

Primary datas used in this study are collected from questionare and interview. The

study uses binary logistic regression using SPSS aplication, whereas the interview

datas use descriptive analysis. The result shows that gender, income per-month

and education backgroud has no positive significant effect to the awareness level

of financial literacy in Tanjung Putri Village society. These are happens because

of the past experience about financial literacy.

.

1 CHAPTER I

INTRODUCTION

A. Background

Financial inclusive terms has been discussed in Indonesia since 2008 after

the economic crisis that occurred in Indonesia. The definition of financial

inclusive itself does not exist yet, though various institutions try to define it. One

of them is from the Reserve Bank of India (RBI) which propose the definition for

it is the process of ensuring access to appropriate financial products and services

needed by all sections of the society in general and vulnerable groups such as

weaker sections and low income groups in particular at an affordable cost in a fair

and transparent manner by regulated mainstream institutional players.

In Indonesia, an the financial inclusive policies have been drafted in the

2016 Regulation Financial Services Authority in 2016 on the chapter improving

literacy and financial inclusion in the financial services sector to consumers and or

community. In Chapter one, article 1, on seventh paragraph, says that financial

inclusive is the availability of access for the public to take advantage of the

products and or financial services in the financial services institutions according

to the needs and capabilities in order to realize prosperity.

According to the data obtained from the World Bank in 2012, financial

inclusives today grow rapidly, for it has a link to the poverty and social

phenomena in the financial sector. Fifty two percent of the entire population has

2

percent are underserved poor. There are about one third of population completely

have no savings, and bank credit financed seventeen percent of the population,

while the Micro Finance Institutions only reach them for ten percent.

In developing financial inclusive, Financial Services Authority and Bank

Indonesia have an important role inside. That is why the national strategy for the

development of financial inclusive is held. It aims to encourage better

coordination, to continue and expand existing initiatives, identify the obstacles,

commit and encourage breakthroughs (DPAK, 2014). Similarly, the Bank

Indonesia socializes financial inclusive program, establishes cooperation with

relevant stakeholders outside Bank Indonesia, implements financial inclusive

activities, and evaluates program of financial inclusive activities (Ibid, 2014).

Based on the strategies described above which knowledge of financial

inclusive is still very low in the communit and it needs to be improved. By doing

so, the conducted training assistance to the output quality can be maintained.

Besides holding training program, which is socialization, local governments also

need to cooperate with the banks and the Financial Services Authority to expand

the access of society financial services (Ma'ruf & Desiyana, 2015).

In the development of financial inclusive solutions proposed on the study

above, besides holding socialization and ongoing training programs, there is more

concrete solution that is to expand the access of society financial services. To

expand the access of society financial services, it is necessary to build a financial

3

bank itself have two types, that are conventional and Islamic. The difference of

these two types is each of them has its own foundation and procedur.

The presence of Islamic system in the financial institution gives a new

color and new shades. Islamic economic system is present at a crossroads, and

shows its existence among the secular former economic systems (Muqorobin,

2008). The economic crisis in Indonesia on 1998 can be an evidence, when all the

conventional banks were bankrupt and even suffered from economic downturn,

banks with the Islamic system stayed firm without being effected by the crisis.

This incident drew public attention, even until now. FSA head of department of

Islamic Banking, Ahmad Buchori, said that the development of Islamic banking in

2016 increased better than 2015. Besides the historical factors, another thing that

makes islamic economic system became the center of attention at this time is a

characteristic that is offered in the Islamic economic system itself, such as the

sharing system that removes interest. Interest often becomes fear for lenders of

capital since those who are rich get richer and the poor get poorer.

In this globalization era, which is full of development, of course, many

systems are in growth, where the old systems will be replaced by the new systems.

Since there are many products are offered, the human desire are increased as well.

For this reason, mostly human buy something regardless the necessity but desire.

This will have an impact on the financial system on the individual. Such as

financial management in the form of income and expenditure, the amount of

savings and consumption, investments and accounts receivable, and others. The

4

Talking about financial inclusive, it is closely related to financial literacy.

Financial literacy does not exist in any subjects within all levels of education in

Indonesia, whereas it is considered important. Therefore, a person's education

does not guarantee the persons skill in planning and managing his finances.

According to Robert T. Kiyosaki, financial literacy is a basic ability to read and

understand financial statements and to control cash flow (cash flow). Each person

should know how the financial planning of the income he has. One of the part is

to know the income and outcome, as well as to avoid unexpected things in the

future. These unexpected things, such as early retirement or bad debt. Many

people have to realized the importance of financial literacy, but still lack of

knowledge and understanding of how to plan and manage both personal and

household finances.

In this study, the researcher will conduct case study in the Tanjung Putri

village, Arut Selatan District, West Kotawaringin regency, Central Kalimantan.

Tanjung Putri is one of the remote areas decided by the government of West

Kotawaringin regency. Tanjung Putri is far away from the central government, it

has lack of existing financial institutions. As it was broadcasted in Borneo-News,

there are eight villages that are still left behind in all aspects, such as

infrastructure, education and healthcare, including financial aspect were many

moneylenders are still in high number, which cause the society prefere to get loan

from moneylenders rather that corporation. Such event shows that financial

literacy level in Tanjung Putri is still low. In this case, the Islamic financial

5

applied in Islamic economic make a person wiser in selecting a financial products

(Ahmad, 2010).

Indonesia with an area of 1,905 km2 certainly has numerous obstacles in

spreading welfare, in terms of facilities, education, hospitals, financial institutions,

and so on. Therefore, it is undeniable that this becomes our duty to make a change

and progress for our country. Likewise what the researcher will do, that is to

conduct a research in one of the remote areas in Indonesia.

Based on the elaboration above, as an effort to introduce Islamic financial

institutions to support financial literacy in Indonesia, of course, it is not

immediately socialized or established, such as BMT (Baitul Maal wa Tamwil).

However, the researcher will examine the level of financial literacy; low, medium,

or high. For this reason, in this study, the researcher chooses the title “The

Awareness of Society on Financial Literacy in The Remote Area, with a case

study in Tanjung Putri Village, Arut Selatan District, West Kotawaringin

Regency, Central Kalimantan”.

B. Research Questions

1. How is the influence of gender to the awareness level of society in

Tanjung Putri village on financial literacy?

2. How is the influence of education background to the awareness level of

society in Tanjung Putri village on financial literacy?

3. How is the influence of income to the awareness level of society in

6

C. Research Objectives

Based on the problems above, the purpose of this study is to determine:

1. The effect of gender to the awareness level of society in Tanjung Putri

village on financial literacy.

2. The effect of education background to the awareness level of society in

Tanjung Putri village on financial literacy.

3. The effect of income to the awareness level of society in Tanjung Putri

village on financial literacy.

D. Research Benefits

This study is expected to be beneficial for:

1. For other researchers or scientists, since this study can be served as a

reference to determine the economic development in Indonesia,

particularly in the financial areas, which is financial literacy. In

addition, this study can be used as a comparison for similar studies

under the same title.

2. For the community, for this research can be a source of reading

material for society and are able to increase knowledge and awareness

to financial literacy.

3. For the government and relevant institutions, due this study may be a

become a source of information, particularly the institutions that

7

consideration in determining the policy and strategy for the economic

progress in Indonesia.

E. Problem Limitation

Talking about financial inclusive, it is closely related to financial literacy.

This study only focuses on society awareness to financial literacy. The scope of

this study is limited by taking case study in remote areas, which is in the Tanjung

Putri village, Arut Selatan District, West Kotawaringin Regency, Central

1 CHAPTER II

LITERATURE REVIEW

A.Theoretical Framework

1. Society Awareness

Society awareness is related to the field of sociology. According to

Indonesian Big Dictionary (KBBI, 2016). Consciousness is a feeling; to

know and understand, while awareness is the conviction; understand the

circumstances. In elaboration, environmental awareness is a deep

understanding of a person or group in ideas, attitudes, and behaviors that

support the evironmental development. Social awareness is the awareness of

person’s rights and obligations as a complete member of society.

Many experts present a theory of awareness, including the Carl G Jung

and Freud Sigmund. According to Carl Gustav Jung (Ismail, 2009),

awareness consists of three interconnected systems, there are consciousness

or ego, personal unconsciousness and collective unconsciousness.

Meanwhile, according to Freud (Clancy, 2008), awareness is composed of

conscious mind and unconscious mind, both of these are driven by the

motivation and encouragement from inside or outside of the individual.

Including the theories about society, many experts from the field of

sociology describe the theory of society. One of them is Soerjono Soekanto.

According to Soerjono Soekanto (Soekanto, 2003), in general, society has

2

People who live together; consisting of at least two people.

Mingling or commune in the long period of time.

By gathering, human will generate new human being, as a result of

living together, arising communications systems and regulating a

relationship among humans.

Being aware of their entity and unity.

It is a system of living together. The system of living together raises a

cultural because they feel they have a relation to each another.

Meanwhile, according to Paul B. Horton (Muin, 2013), definition of

society is a collection of relatively independent human by living together in

quite long time, inhabiting in certain area with a same culture, activities of

the group are similar.

From several theories described by some experts above, it can be

concluded that community is a group of individuals which are living in a

same place with the culture of their own, and they have interconnection to

each others. It also can be concluded that society awareness is an

understanding of condition of the group of individuals who have

interconnection and the same culture, and it is manifested in a form of

3

2. Financial Knowledge

According to Pudjawidjana (2015), knowledge as a humans reaction with

all the stimuli that happen to sense a particular object. Knowledge is a

process that occurs after stimulation of curiosity from the human senses,

such as sight and hearing. The level of knowledge is divided into five;

know, comprehension, application, analysis and evaluation (Notoatmodjo,

2013).

a. Know

Know is interpreted as consideration of a material that is studied

previously, including knowledge. This level is the recall to something

specific of all the materials studied or stimulated that have been received.

Know is the lowest level of knowledge. The verb to measure are

mentioning, describing, identifying, expressing and so on.

b. Comprehension

Understanding is defined as an ability to explain properly about the

object known and can correctly interpreted. A person who has

comprehended to the object or material must be able to explaining, citing

examples, predicting, and so on.

c. Application

The application is defined as an ability to use material that has been

4

d. Analysis

Analysis is the ability to describe the material or an object into

components, but still within an organizational structure, and are still

related to each others.

e. Evaluation

Evaluation relates to the ability on conducting the justification or a

material or an object. This assessment is based on existing criteria.

Every person has a different knowledge, knowledge is not innate, but

getting after a journey of age. Knowledge is related to education.

According to Indonesian Big Dictionary (Department, 2016), word

education or “pendidikan” comes from the word "didik" (educate) to get

the suffix "pe" and the suffix "an", which means the way, the process or

the act of educating.

According to Prof. H. Mahmud Yunus (Yunus, 1990), referred

education is an effort that is deliberately chosen to influence and help

children aimed to improving science, physical and morals, so they could

deliver the children to reach their dreams in order to get a happiness in

life and make a good impact to ourselves, society, state and religion.

According to Indonesian Big Dictionary (Department, 2016),

education is a learning process for each individual to achieve knowledge

and a higher understanding of the particular and specific objects. The

5

to have the mindset, behavior, and morals in accordance with the

education obtained.

Meanwhile, according to Ki Hajar Dewantara (Pamungkas, 2012). He

said education is a growing demand in the lives of children. It means that

education leads all forces of nature that exist in human beings and society

can reach salvation and high joy of life.

From the description above, it can be concluded by the researcher that

knowledge is a stage and process for every person, starting from know until

evaluation where in the process of knowledge that can be assisted and

accompanied by education. Education will increase knowledge of every

person to achieve happiness in life and a better future.

Financial knowledge can improve the ability to manage and organize

individual finances for well-being at that time and the future. Money is used

mostly to solve the problems in which it is associated with primitive barter

items, namely the aforementioned double coincidence of wants,

indivisibility of goods and services and the lack of a unit of account.

Accordingly, the most important functions of money are to serve as a unit of

account and medium of exchange. However, Depending on what is being

used as money, it could serve as a store of value and standard of deferred

payment (ISRA, 2012).

Muhammad Syafi’i Antonio as an Islamic Economist said that money

has close connection with the bank. In the financial knowledge, people can

6

understands about financial instruments in a bank. Bank is an essential

intermediary institutions between savers and investors. Savings will only be

useful if it is invested, while savers can not be expected to do it by

themselves with their skill. Customers want to save their money in the bank

because they believed that the bank may choose an attractive alternative

investment (Antonio, 2001).

From the description above about knowledge and finance, someone can

be said has financial knowledge when he has the knowledge and confidence

in financial services institutions and financial service products, including

features, benefits and risks, rights and obligations related to financial

products and services, and has skills in using financial products and

services.

3. Financial Literacy

Financial literacy means being able to read and understand financial

products. Financial literacy is characterized by the ability to distinguish the

financial statements that are owned by rich people and owned by poor and

middle class. People who understand financial literacy should understand at

least two forms of financial statements, cash flow and assets (property)

(Wiharto, 2010).

Cash flow consists of income and expenditure, whereas wealth consist

of assets and liabilities. Income includes salary, royalties, interest and any

incomes. Expenditure covers all living expenses and family expenses, and

7

lead to income of cash flow. These assets include people nearby who share

the burden of the family, home/car rent, royalties from invention, stock

dividends, bank interest, and so on. Liability is all obligations that still

burden and cause a cash flow expenditure. Treasure liabilities include

mortgages, car payments, payment of dues, the annual retirement fund,

liability of family living expenses, and so on (Wiharto, 2010).

The implementation of education in order to improve the society

financial literacy is necessary because according to a survey conducted by

the FSA in 2013, that the level of financial literacy of Indonesia population

is divided into four parts, namely:

1. Well literate (21,84%), who have the knowledge and confidence in

financial services institutions and financial services products, including

features, benefits and risks, rights and obligations which are related to

financial products and services, and have skills in using financial

products and services.

2. Sufficient literate (75,69%), have the knowledge and confidence in

financial services institutions and financial products and services,

including features, benefits and risks, rights and obligations which are

related to financial products and services.

3. Less literate (2,06%), only have a knowledge about financial services

8

4. Not literate (0.41%), do not have a knowledge and confidence in the

financial services institutions and financial products and services, and do

not have skills in using financial products and services.

The financial inclusive goals have been drafted in the 2016 Regulation

Financial Services Authority in 2016 on the chapter improving literacy and

financial inclusion in the financial services sector to consumers and or

community that created and published by Financial Authority Service.

Chapter eleventh contains as follows: (1) Increasing public access to the

institutions, products and services of formal financial services; (2)

Increasing the supply of products and/or financial services in the formal

financial institutions; and; (3) Increasing utilization of the product and or

financial services according to the needs and capabilities.

Financial literacy has a long-term goal for all segments of society:

Improving someone’s literacy who is in previously less literate or not

literate become well literate;

Increase the number of users in products and financial services.

In order society are able to determine which products and financial services

in accordance with the needs, the society should understand the benefits and

risks, understand their rights and obligations and believes that the products

and financial services are able to improve the society welfare. For the

seciety, financial literacy provides great benefits, such as:

Ability to select and utilize the products and financial services as

9

Protected from investing activities in financial instruments that are not

clear.

An understanding of the benefits and risks of financial products and

services, financial literacy also provides great benefits for the financial

services sector. Financial institutions and society need each other because

the higher level of financial literacy is, the more people take advantage of

the products and financial services (FSA, 2014).

As the McGraw Hill Financial report shows, teaching financial literacy

in schools encourages students to think critically about financial needs

versus wants, smart ways to save their money, and how to take charge of

their future by becoming financially independent. While financial literacy is

seen as a developed world problem, urbanization, the growing middle class,

and expanding financial access means that individuals are more empowered

to make financial choices and need to be better prepared for the

consequences of those choices. (Runde, 2015)

Without an understanding of basic financial concepts, people are not

well equipped to make decisions that related to financial management.

People who are financially literate have the ability to make informed

financial choices regarding saving, investing, borrowing, and more

10

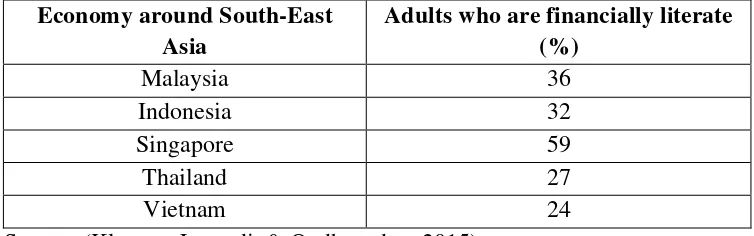

Table 2.1

Financial Literacy: A Country-by-Country Breakdown

Economy around South-East Asia

Adults who are financially literate (%)

Malaysia 36

Indonesia 32

Singapore 59

Thailand 27

Vietnam 24

Source: (Klapper, Lusardi, & Oudheusden, 2015)

From the data above, we can draw the conclusion that financial literacy

in Indonesia is still very low compared to developed countries, even in

Malaysia. Though Indonesia and Malaysia are nearby neighbor

geographically, but, Malaysia leads in financial literacy.

4. Remote Areas

The definition of what is "remote" varies substantially between regions

of the world. A remote area is one that either is a long distance from highly

populated settlements or lacks transportation links that are typical in more

populated areas (Denkenberger, Way, & Pearce, 2015). Defining and

identifying remote area is often done by governments in every countries so

that special considerations can be made to provide services to these

difficult-to-reach places.

Based on regulation of the Minister of Education and Culture of the

Republic of Indonesia number 34 of 2012 on the criteria for remote areas,

and allowance for teachers, Article two, paragraph one, states that "the

criteria for remote or underdeveloped areas as referred to in Article 1 letter a

11

a) transportation access is difficult to reach and expensive due to the

unavailability of the highway, depending on a specific schedule,

depending on the weather, the only accessible is by foot, and it has

great nature challenges;

b) not available and or very limited services, public facilities,

educational facilities, health facilities, electricity, information and

communication facilities, and clean water; and

c) higher prices and or the difficulty of the availability of foodstuffs

clothing, and shelter or housing to meet the needs of life."

Based on the criteria already set by the government in the legislation

about the criteria for remote areas above, we can conclude that remote area

is an area with facilities are still limited and prices are high. It is caused by

the location of remote area is far from big cities and the center of

government.

B.Previous Research

The research conducted by Deerajen Ramasawm, Savila Thapermall, S.

Anoop Dowlut and Mootooganaen Ramen (2013) entitled “A Study of the

Level of Awareness of Financial Literacy among Management” indicates that

most students have a medium level of knowledge and skills in financial literacy

and in savings and borrowings. Based on the study, it was found that age,

gender, language, race and income level do not have an impact on the level of

12

The research conducted by Noor Azizah Shaari, Nurfadhilah Abu Hasan,

Ramesh Kumar Moona Haji Mohamed, Mior Ahmad Jafri Md Sabri (2013)

entitled “Financial Literacy: A Study Among The University” indicates that the

spending habit and year of study have a positive relationship with the financial

literacy, whereby the age and gender are negatively associated with the

financial literacy.

The research conducted by Bharat Singh Thapa and Raj Surendra Nepal

(2015) entitled “Financial Literacy in Nepal: A Survey Analysis from College”

indicates that most of the students have a basic level of financial knowledge

but they lack in understanding of credit, taxes, share market, financial

statement and insurance.

The research conducted by Hani and Velumani (2014) entitled “A Study

on Financial Literacy Among Rural Women in Tamilnadu” indicates that

financial literacy of marginalized rural women is very low. Development of

financial literacy would help the women for better financial decision making

and proper utilization of financial services and products. It would help them for

wealth accumulation and financial well-being. It will lead to their personal

development as well as social development. Their financial participation would

help our country’s economic development.

The research conducted by Lusardi (2015) entitled “Financial Literacy

Skills for the 21st Century: Evidence from PISA” indicates that large

proportions of students in countries and economies at all levels of economic

13

More than 15% of students in the participating OECD countries and economies

perform below the baseline level of profiiency. These students can complete

only the simplest fiancial tasks, such as recognizing the difference between

needs and wants or comparing the value of goods based on a comparison of

their price per unit. An improvement in fiancial literacy for these

low-performing students is necessary to ensure their full participation in

economic life.

The research conducted by Sekar M. and Gowri M. (2015) entitled “A

Study on Financial Literacy and Its Determinants among Gen Y Employees in

Coimbatore City” indicates that that level of fiancial literacy varies

signifiantly among respondents based on various demographic and

socioeconomic factors. It can be concluded that fiancial literacy level gets

affected by gender, education, income, marital status and number of dependent

whereas it does not get affected by age. Overall it can be concluded that

fiancial literacy level is low among Gen Y employees in our Coimbatore city

and necessary measures should be taken by government to increase awareness

about fiancial related matters.

The research conducted by Huston (2010) entitled “Measuring Financial

Literacy” indicates that that a successful measure of financial literacy will

improve a researcher’s ability to distinguish when a deficiency in financial

literacy may be responsible for welfare-reducing financial choices and will

allow educators to identify education to achieve a desired outcome. Another

14

literacy is that researchers are better able to identify what outcomes are most

impacted by a lack of financial knowledge and skill. It is increasingly apparent

that financial mistakes can impact individual welfare as well as create negative

externalities that affect all economic participants. Tracking variation and

change in financial literacy rates is of interest to educators, policymakers,

employers and researchers. A more standard approach to measure financial

literacy is needed to identify barriers to financial well-being and assist in

solutions that enable effective financial choice.

The research conducted by Annamaria Lusardi and Olivia S. Mitchell

(2013) entitled “The Economic Importance of Financial Literacy: Theory and

Evidence” indicates that: first, theoretical models of saving and financial

decision-making can be further enriched to incorporate the fact that financial

knowledge is a form of human capital. Second, efforts to better measure

financial education are likely to pay off, including gathering information on

teachers, training programs, and material covered. Third, outcomes beyond

what have been studied to date are likely to be of interest, including, for

instance, borrowing for student loans, investment in health, reverse mortgage

patterns, and when to claim social security benefits, decisions that all have far

reaching economic consequences. Additional conclusion is also needed to learn

more about the directions of causality between financial knowledge and

economic wellbeing, though the early results offered here are promising. It also

appears that more and careful field experiments and cross-national research

15

the causal links between financial knowledge, costs, and benefits. While the

costs of raising financial literacy are likely to be substantial, so too are the

costs of being liquidity-constrained, over-indebted, and poor, in retirement.

The research conducted by Setyawati and Suroso (2016) entitled “Sharia

Financial Literacy And Effect On Social Economic Factors (Survey On

Lecturer In Indonesia)” indicates that socio-economic characteristics influence

on financial knowledge, financial behaviors and financial attitudes. The level

of financial knowledge, financial behaviors and attitudes of financial

Indonesian lecturers determined by the interaction of socio-economic

characteristics possessed lecturer, which consists of the interaction between the

characteristics of age, gender, level of education, domicile, expenditure per

month and marital status. Age, level of education, expenditure per month and

marital status of lecturers in Indonesia are variables that affect the level of

financial knowledge, financial behaviors and financial attitudes. The higher the

person's level of education, the higher the person's level of knowledge about

finances.

C.Hypothesis

Based on the theory and the previous studies that have been outlined

above, we can take the temporary hypothesis below:

1. Assumed gender has a significant influence to the awareness level of

16

2. Assumed education background has a significant influence to the

awareness level of society in Tanjung Putri village on financial literacy.

3. Assumed income has a significant influence to the awareness level of

society in Tanjung Putri village on financial literacy.

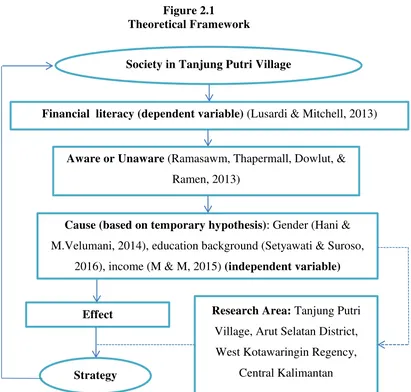

[image:42.595.130.541.290.682.2]D.Research Framework

Figure 2.1

Theoretical Framework

Source: Developed by the researcher (2017).

Society in Tanjung Putri Village

Financial literacy (dependent variable) (Lusardi & Mitchell, 2013)

Aware or Unaware (Ramasawm, Thapermall, Dowlut, &

Ramen, 2013)

Cause (based on temporary hypothesis): Gender (Hani &

M.Velumani, 2014), education background (Setyawati & Suroso,

2016), income (M & M, 2015) (independent variable)

Effect

Strategy

Research Area: Tanjung Putri

Village, Arut Selatan District,

West Kotawaringin Regency,

1

CHAPTER III

DATA AND RESEARCH METHODOLOGY

A. Research Source and Method

The data used in this study is primary data taken directly from the

location to be examined. This study uses mixed method, means that the

research is mixed between quantitative and qualitative method. There are

three basic mixed method design; convergent parallel mixed method,

explanatory sequential mixed method, and exploratory sequential mixed

method.

Convergent parallel mixed method is a method that is used in this study.

Convergent parallel mixed method is a mixed method where a resercher

collects a qualitative and quantitative data, analyses it separately, and

compares the result to determine: are there any findings that confirm each

others (Creswell, 2016).

B. Data Collection Technique

1. Population and Sample

The population is a collection of data sources, which have the same

properties (Sukandarrumidi & Haryanto, 2008). The population in this

study is the number of people in the Tanjung Putri village.

Sampling is the process of selecting a number of objects of research

2

Sampling is to obtain information from the population which is the

location of the study. Based on the formula Baiky (1982), so that research

can be analyzed with a statistical minimum number of samples taken 30,

although there are others suggested minimal sample size is 100 samples

(Sukandarrumidi & Haryanto, 2008). This research uses Slovin’s Formula

to determine the sample size from the given population size.

Where:

= sample size

= pupulation size

= marginal of error

To take sample for questionare, the researcher will use random

sampling methods. Random sampling method is the sampling process that

everyone in the population has an opportunity and same freedom to be

selected as a sample (Sumanto, 2014). However, in taking sample for

indepth-interview, the researcher will use purposive sampling. Purposive

sampling method is a sample that is choosen based on the criteria or

purpose of the study. In this study, the criteria for indepth-interview

respondents are; one from local decision policy and one from a teacher.

2. In-Depth Interview

Data collection by interview is often conducted in the qualitative

3

information exchange for sustainability research. According to Steward &

Cash (2008),

"An interview is interactional Because there is an exchanging, or sharing of roles, responsibilities, feelings, beliefs, motives, and information. If one person does all of the talking and the other all of the listening, a speech to an audience of one, not an interview, is taking place."

In-depth interviewing is a qualitative research technique that involves

conducting intensive individual interviews with a small number of

respondents to explore their perspectives on a particular idea, program, or

situation. For example, we might ask participants, staff, and others

associated with a program about their experiences and expectations related

to the program, the thoughts they have concerning program operations,

processes, and outcomes, and about any changes they perceive in

themselves as a result of their involvement in the program. The primary

advantage of in-depth interviews is that they provide much more detailed

information than what is available through other data collection methods,

such as surveys. They also may provide a more relaxed atmosphere in

which to collect information people may feel more comfortable having a

conversation with you about their program as opposed to filling out a

survey (Boyce & Neale, 2006).

In this study, interview techniques used is in-depth interviews. In-dept

interview is an intensive individual interview with a small number of

4

3. Questionnaire

The questionnaire consists of a variety of questions related to the

research. Data revealed by the questionnaire is the factual data or data that

is reputed truth known by the author. Questions on the questionnaire in the

form of direct questions directed to the information about the data.

Questionnaire respondents know exactly what is being asked in the

questionnaire and what information is required by related questions. The

answers are in the questionnaire will not be given as a score, but given

numbers as identification or classification coding answers (Azwar, 1999).

Based on the webside that talking about questionnaire in research (The

advantages and disadvantages of questionnaires). There are seven

advantages of using questionnaires for research:

1. Practical.

2. Large amounts of information can be collected from a large number of

people in a short period of time and in a relatively cost effective way.

3. Can be carried out by the researcher or by any number of people with

limited affect to its validity and reliability.

4. The results of the questionnaires can usually be quickly and easily

quantified by either a researcher or through the use of a software

package.

5. Can be analysed more 'scientifically' and objectively than other forms

5

6. When data has been quantified, it can be used to compare and contrast

other research and may be used to measure change.

7. Positivists believe that quantitative data can be used to create new

theories and / or test existing hypotheses

The disadvantages of questionnaires:

1. Is argued to be inadequate to understand some forms of information ,

such as: changes of emotions, behaviour, feelings etc.

2. Phenomenologists state that quantitative research is simply an artificial

creation by the researcher, as it is asking only a limited amount of

information without explanation.

3. Lacks validity.

4. There is no way to tell how truthful a respondent is being.

5. There is no way of telling how much thought a respondent has put in.

6. The respondent may be forgetful or not thinking within the full context

of the situation.

7. People may read differently into each question and therefore reply

based on their own interpretation of the question.

8. There is a level of researcher imposition, meaning that when developing

the questionnaire, the researcher is making their own decisions and

assumptions as to what is and is not important, therefore they may be

missing something that is of importance.

The process of coding in the case of open ended questions opens a great

6

In this study, there are 50 questions in the questionnaire. There are

five specific question that talking about financial literacy; financial

individual knowledge, investment, insurance, saving and loan, and

financial institution knowledge.

C. Operational Definition of Research Variable

1. Dependent Variable

In this study, the dependent variable used is a financial literacy, which

is a person's ability to process and financial planning, not only for himself

but also his family. To measure the level of financial literacy

questionnaires will be distributed to the community that has defined his

sample. Questions from questionnaires distributed are questions about

financial literacy.

2. Independent Variable

There are three independent variables used in this study. The first one

(1) is gender, this variable explain the gender, i.e. male and female.

Second (2) is the educational background, in this variable is determined by

the last study respondents were then classified into; SD, SMP, SMA,

Diploma, S1, S2 and S3. Variable three (3) or the last one is the revenue,

variable describes the amount of a person's income in each month are

clarified in the form of average; < 1.000.000, 1.000.000 – 3.000.000,

7

D. Instrument Research Test

1. Validity Test

The data has been obtained from the questionnaire, before processing

should be performed validity test first to test how valid questions are asked

in the questionnaire with the variables studied (Algifari, 2015).

This study using SPSS version 15.0 in determining construct validity.

Construct validity is to demonstrate that the measuring instrument in

measuring valid questionnaires indicated by a strong correlation with

existing variables in research (Abdillah & Hartono, 2015). Validity test of

this research using the technique of corrected item correlation, in taking

the decision is if rcount > rtable, it can be said valid, but on the contrary if the

rcount < rtable then said invalid. Once it is found valid or not, the researcher

do significant testing using r table, it can be said significant at the 0.05

8

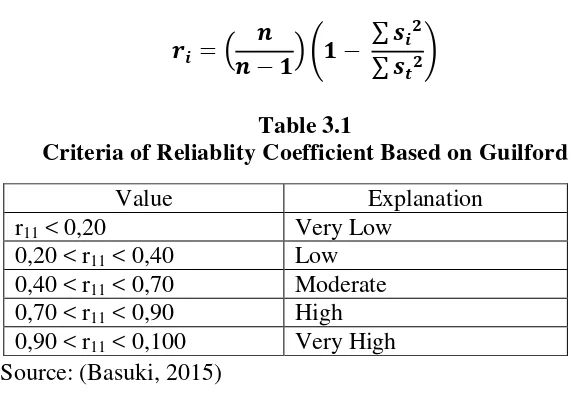

2. Reliability Test

If the validity test is already done, the next step is doing reliability

test. Reliability tests are used to test how consistent the answers given by

respondents in the questionnaires given (Algifari, 2015).

Reliability test conducted with Cronbach Alpha formula:

[image:50.595.177.466.243.440.2]∑ ∑

Table 3.1

Criteria of Reliablity Coefficient Based on Guilford

Source: (Basuki, 2015)

Data can be said reliable if the Cronbach Alpha (r11) at least at 0.8.

But there also are found Croanbach Alpha at 0.6 can be said reliably

(Algifari, 2015).

E. Data Analysis

1. Descriptive Analysis for Interview

Descriptive research can be either quantitative or qualitative. It can

involve collections of quantitative information that can be tabulated along

a continuum in numerical form, such as scores on a test or the number of

times a person chooses to use a-certain feature of a multimedia program,

or it can describe categories of information such as gender or patterns of

Value Explanation

r11 < 0,20 Very Low

0,20 < r11 < 0,40 Low

0,40 < r11 < 0,70 Moderate

0,70 < r11 < 0,90 High

9

interaction when using technology in a group situation. Descriptive

research involves gathering data that describe events and then organizes,

tabulates, depicts, and describes the data collection. It often uses visual

aids such as graphs and charts to aid the reader in understanding the data

distribution. Because the human mind cannot extract the full import of a

large mass of raw data, descriptive statistics are very important in reducing

the data to manageable form. When in-depth, narrative descriptions of

small numbers of cases are involved, the research uses description as a tool

to organize data into patterns that emerge during analysis. Those patterns

aid the mind in comprehending a qualitative study and its implications.

Data analysis techniques in qualitative research through a procedure

that has been done by many experts qualitatively. The procedure is

undergoing data collection, data input, data analysis, conclusion and

verification, and ending with the form of the findings in narrative form

(Herdiansyah, 2010).

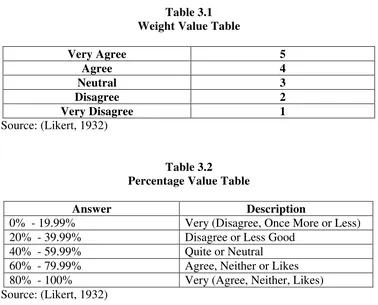

2. Likert scale

This study use likert skale as the data analysis in quantitative

method. In response to the difficulty of measuring character and

personality traits, developed a procedure for measuring attitudinal scales

(Likert, 1932). The original Likert scale used a series of questions with

five response alternatives: strongly approve (1), approve (2), undecided

10

Respondents will choose one of five options given to answer

questions. Questions contained in the questionnaire are questions that are

approved and in accordance with what is being used as research material.

In this study, the question on the questionnaire are questions about

financial literacy, such as savings, investment, insurance, and others.

In analyzing Likert scale, researchers will create weight value table

[image:52.595.141.519.302.607.2]and percentage value table, then uses an index formula percent.

Table 3.1 Weight Value Table

Very Agree 5

Agree 4

Neutral 3

Disagree 2

Very Disagree 1

Source: (Likert, 1932)

Table 3.2

Percentage Value Table

Answer Description

0% - 19.99% Very (Disagree, Once More or Less)

20% - 39.99% Disagree or Less Good

40% - 59.99% Quite or Neutral

60% - 79.99% Agree, Neither or Likes

80% - 100% Very (Agree, Neither, Likes)

Source: (Likert, 1932)

Index % Formula = Total Score / Y x 100

After calculating the percent of the index is complete, it will be

found the percentage of people who agree or disagree on the results of a

11

3. Descriptive Statistics

Descriptive statistics are used to describe the data or make a summary

of the data in the first phase of data analysis (Sumanto, 2014). Descriptive

statistics are not concluded directly, but only provides information to use

data that has been processed before, usually it is displayed in the form of

tables, graphs and diagrams.

Descriptive statistics are typically distinguished from inferential

statistics. With descriptive statistics the researchers are simply describing

what is or what the data shows. With inferential statistics, the researchers

are trying to reach conclusions that extend beyond the immediate data

alone. Thus, the researchers use inferential statistics to make inferences

from our data to more general conditions; we use descriptive statistics

simply to describe what's going on in the data.

Descriptive Statistics are used to present quantitative descriptions in a

manageable form. In a research study we may have lots of measures. Or

we may measure a large number of people on any measure. Descriptive

statistics help us to simplify large amounts of data in a sensible way. Each

descriptive statistic reduces lots of data into a simpler summary.

4. SWOT Analysis

Usually, SWOT analysis used in the management and business

research. SWOT itself is the abbreviation from Strength, Weakness,

Opportunity, and Treat. Strength and weakness used for internal analysis,

12

SWOT analysis because it will be useful to get the conclusion and

recommendation (FME, 2013).

5. Binary Logistic Regression Analysis

Regression analysis is one of statistical data analysis techniques that

often used to examine the relationship between several variables and

predict a variable (Kutner, Nachtsheim, Neter, & Li, 2004). There are two

types of regression analysis; simple regression and multiple regression.

Generally, logistic regression is well suited for describing and testing

hypotheses about relationships between a categorical outcome variable and

one or more categorical or continuous predictor variables. Logistic

regression is an approach to make a prediction model, such as in linear

regression. The difference is in dependent variable; dichotomy scale.

Dichotomy scale is a nominal data scale with two categories, for example:

yes and no, good and bad, or high and low.

There are two main uses of logistic regression: The first is the

prediction of group membership. Since logistic regression calculates the

probability of success over the probability of failure, the results of the

analysis are in the form of an odds ratio. Logistic regression also provides

knowledge of the relationships and strengths among the variables.

This study will uses binary logistic regression. Binary logistic

regression is used when there are only two possibility of respond variable

(Y). The equation is:

13 Where:

Ln : Logaritma natural

: OLS equation

Based on the equation above, it will be difficult to interprate the

regression coefficient. So, this research will use Odds Ratio or Exp(B) or

OR. Exp(B) is a component from regression coefficient. This

interpretation means the category code in every variables:

1. Independent variable is financial literacy: 0 code is for the

awareness of financial literacy is low, and code 1 is for the

awareness of financial literacy is high.

2. Dependent variable is gender: 0 code is for man, and 1 code is for

woman.

3. Dependent variable is indome: 0 code is for income a month <

1.000.000, 1 code is for income a month 1.000.000 – 3.000.00, 2

code is for income a month 3.000.000 – 5.000.000, 3 code is for

income a month 5.000.000 – 7.000.000, and 4 is for income a

month > 7.000.000.

4. Dependent variable is education background: 0 code is for SD, 1

code is for SMP, 2 code is for SMA, 3 code is for S1, and 4 code

is for S2.

Another difference in logistic regression is there is no “R Square” to

14

dependent variable. In logistic regression called it Pseudo R Square, R

Square similar with R Square in OLS.

If in OLS uses F Anova test to measure significant level and a

goodness of equation model. In logistic regression uses Chi Square value

based on Likelihood maximum measurement (Basuki, 2015).

Assumptions of Logistic Regression:

1. Logistic regression does not assume a linear relationship between the

dependent and independent variables.

2. The dependent variable must be a dichotomy (2 categories).

3. The independent variables need not be interval, nor normally

distributed, nor linearly related, nor of equal variance within each

group.

4. The categories (groups) must be mutually exclusive and exhaustive;

a case can only be in one group and every case must be a member of

one of the groups.

5. Larger samples are needed than for linear regression because

maximum likelihood coefficients are large sample estimates. A

minimum of 50 cases per predictor is recommended.

F. Classic Assumption Test

1. Heterokedastisitas Test

Heterokedastisitas test is to see whether there is variance’s

dissimilaritis from one residual observation to another one.

15

method by ploting the value of ZPRED (prediction value) with SRESID

(residual value). Statistic test which is used in this study is Glejser test.

Another alternative is if the heterokedastisitas assumption is not

appoviate, then it should be transformed into logaritma form if all the data

is positive measurement (Basuki, 2015).

2. Normality Test

Normality test is condacted to see whether the value of residual is

normally distributed or not. Normality test is done to residual value, not to

each variable. Some statistic experts argued that the data whose number is

higher than 30, than it can be said that it is normality distributed. In this

study it will use Kolmogorov Smirnov as the statistic test (Basuki, 2015).

3. Multikolinearity Test

Multikolinearity test is to see whether there is high correlation

between independent variables in multiple regression model. If

independent variables show high correlation, that dependent variable will

be distrubed. In this study it will use variance inflation vactor (VIF). If

VIF value < 10 then there is no mult