he Committees

Honorary Committee:

Rector of Universitas Atma Jaya Yogyakarta

Director of Graduate Program of Univrsitas Atma Jaya Yogyakarta Dean of Faculty of Law Universitas Atma Jaya Yogyakarta

Chair Persons of the Conference Dr. E. Sundari, S.H, M.Hum.

Mahestu Noviandra Krisjanti, S.E, M.Sc.IB, Ph.D

Members of the Committee: Maria Hutapea, S.H, M.Hum. Yustina Niken Sharaningtyas, S.H, M.Hum.

TH. Agung M Harsiwi, SE., MSi Puspaningtyas Panglipurjati, S.H, M.Hum.

Dita Septiari, SE., MSc Dewi Krisna Hardjanti, S.H, M.Hum. Bibianus Hengky Widhi Antoro, S.H, M.Hum.

Scientiic Committee: Prof. Dr. MF Shellyana Junaedi, MSi Mahestu Noviandra Krisjanti, S.E, M.Sc.IB, Ph.D.

PREFACE ... V

LAW: 1

... 1ASEAN ECONOMIC AND TRADE LIBERALIZATION AGREEMENT Competition or Cooperation ?

Triyana Yohanes ... 3

FOREST FIRE’S PHENOMENON:

AEC REIFICATION PITFALL VERSUS DEEP ECOLOGY

Bambang Santoso, Muhammad Rustamaji* ... 13

THE RECONSTRUCTION OF ISLAMIC BANKING DISPUTE

RESOLUTION THROUGH MEDIATION IN THE POST THE SUPREME COURT REGULATION NUMBER 1 OF 2016

Dewi Nurul Musjtari, et al ... 27

PROTECTION FOR INDONESIAN MIGRANT WORKERS IN ASEAN COUNTRIES

Jupita Jevanska Atuna ... 45

BUSINESS: 1

... 53GROWTH STRATEGY FOR E-COMMERCE USING DIGITAL MARKETING: A Case Study of Brodo

Evo Sampetua Hariandja ,Meirna Utami Afsari ... 55

MEANING OF CORPORATE SOCIAL RESPONSIBILITY FOR PUBLIC RELATIONS PRACTITIONERS IN BANDUNG

Yanti Setianti dan Lukiati Komala ... 73

THE INFLUENCE OF OIL PRICE, GOLD PRICE, US BOND INTEREST, AND JSX INDEX TO RUPIAH – US DOLLAR RATE MOVEMENT

Benny Budiawan Tjandrasa ... 81 ACHIEVING SERVICE EXCELLENCE THROUGH DYNAMIC MARKETING

VIII

CAPABILITY MODERATED BY MARKETING COMMUNICATION IN HOSPITALITY INDUSTRIES-A CONCEPTUAL MODEL

Evo Sampetua Hariandja ... 91

LAW-SOCIAL JUSTICE: 1

... 101ELECTION NOKENS SYSTEM BASED ON LOCAL DEMOCRACY IN THE CENTRAL MOUNTAINS OF PAPUAPROVINCE

Methodius Kosay, ... 103

ASEAN’s CHALLANGES IN ADDRESING REFUGEE AND HUMAN TRAFFICKING ISSUES OF ROHINGYA

Aryuni Yuliantiningsih ... 105

OWNERSHIP OF THE APARTMENT UNIT AS COLLATERAL IN THE BANK LOAN AGREEMENT

Henny Saida Flora ... 121

LAW: 2

... 135OPTIMIZING CONFISCATION OF ASSETS IN ACCELERATING THE ERADICATION OF CORRUPTION

Shinta Agustina ... 137

THE APPLICATION OF THE REGIMES ON LIABILITY AND COMPENSATION FOR OIL POLLUTION

DAMAGE BY TANKERS IN INDONESIA

Elly Kristiani Purwendah ... 149

“DILEMMA IN IMPLEMENTING SANCTION FOR COMPANIES WHO ARE NOT REGISTERED IN EMPLOYMENT BPJS PROGRAM

Tutut Indargo, S.H ... 151

ENHANCING THE ROLE OF MUTUAL LEGAL ASSISTANCE IN COMBATING TRANSNATIONAL ECONOMIC CRIME WITHIN THE ASEAN ECONOMIC COMMUNITY

BUSINESS: 2

... 165MODERATING EFFECT OF MARKETING COMMUNICATION ON THE RELATIONSHIP BETWEEN SERVICE INNOVATION CAPABILITY AND SERVICE EXCELLENCE IN HOSPITALITY INDUSTRY-A CONCEPTUAL FRAMEWORK

Evo Sampetua Hariandja ... 167

HUMAN RESOURCES EMPOWERMENT STRATEGY IN LOCAL TELEVISION IN WEST JAVA

Feliza Zubair, Evi Novianti, and Aat Ruchiat Nugraha ... 179

TYPOLOGIES AND DIMENSIONS OF ORGANIZATIONAL CULTURE: CORRELATIONS TO STRATEGY IMPLEMENTATION

Lorenzo Vicario Esquivelda Fellycyano, Teddy Mulyawan,

Eupsychius Kusumadmo, Ph.D., ... 191

NEW PRODUCT DEVELOPMENT STRATEGY OF CREATIVE INDUSTRIES: A CASE STUDY OF DKI JAYA AND WEST JAVA PROVINCE

Evo Sampetua Hariandja ... 193

STUDENTS’ ATTITUDES TOWARDS BUSINESS ETHICS: ACOMPARISON BETWEEN INDONESIA AND LESOTHO

Mpholle Clement Pae-pae Lesotho ... 209

LAW-SOCIAL JUSTICE: 2

... 229LEGAL PROTECTION TO INDIGENOUS PEOPLE IN THE LAW ON VILLAGE

Mulyanto, Mohammad Adnan ... 231

“LEGAL ASSISTANCE TO THE WITNESS BY THE ADVOCATE IN THE LEGAL PROCESS”

Martin Fernando Lubis, S.H ... 241

THE DIFFERENCE BETWEEN KOREAN LAW AND INDONESIAN LAW: Study of Inheritance Law

X

LAW: 3

... 251THE EFFECTIVENESS OF CRIMINAL SANCTION OF ACT NO.16 OF 1997 ON STATISTICS

Bayu Sulistomo,S.H ... 253

THE RELEVANCE OF EXHAUST EMISSION REGULATION STANDARDS IN INDONESIA WITH THE CURRENT ENVIRONMENTAL CONDITIONS Kanugrahan Rahayu ... 255

THE DEVELOPMENT

OF A GOOD COOPERATIVE GOVERNANCE MODEL

Dr. Tri Budiyono, SH.M.Hum and Dr. Christina Maya Indah S., S.H., M.Hum ... 257

BUSINESS: 3

... 273A DESCRIPTIVE STUDY ON THE RELATIONSHIPS BETWEEN WORKING CONDITION, AND JOB SATISFACTION OF MYANMAR CIVILIAN

SEAFARERS: WORK MOTIVATION AS A MODERATOR

EI EI MYO, M. PARNAWA PUTRANTA ... 275

LAW-SOCIAL JUSTICE: 3

... 277THE RECOGNITION OF CUSTOMARY COURTS BY THE VILLAGE GOVERNMENT IN INDONESIA: Study on Liliama Village, Seram Regency

Novita Golda Ameyer Rehiara... 279

THE ELIMINATION OF MEDIATION PROCESS IN BUSINESS DISPUTE RESOLUTION THROUGH COMMERCIAL COURT

Opniel Harsana BP,S.H ... 281

APPROVAL REQUIREMENT TO CALL AND INVESTIGATE AGAINTS MEMBER OF PARLIEMENT IN CRIMINAL PROCESS AND THE INDEPENDENCE OF YUDICATURE POWER

BUSINESS, LAW-SOCIAL JUSTICE: 4

... 285PARTICIPATORY COMMUNICATION SYSTEM IN THE MOVEMENT OF ASEAN TO MAKE A BETTER ASEAN COMMUNITY RELATIONSHIP

Pentarina Intan Laksmitawati, ... 287

THE CONSTRAINT OF THE EXECUTION OF ADMINISTRATIVE COURT DECISION IN INDONESIA

Francisca Romana Harjiyatni ... 293

THE CHALLENGES ON UPHOLDING HUMAN RIGHTS TO ACHIEVE THE SOCIAL JUSTICE IN INDONESIA

FadillahAgus ... 309

THE POLICY OF WATER RESOURCES MANAGEMENT BASED ON SYNCHRONIZATION OF AUTHORITY OF WATER RESOURCES MANAGEMENT IN ORDER TO ACHIEVE SOVEREIGNTY OF WATER RESOURCES

Indrawati, SH., LL.M, Dr. Sri Winarsi, SH., MH ... 313

FINANCIAL MANAGEMENT OF THE VILLAGE FROM THE PERSPECTIVE OF STATE FINANCIAL MANAGEMENT AFTER PROMULGATION OF LAW NUMBER 6 TAHUN 2014 REGARDING VILLAGE

Dr. SRI WINARSI, SH., MH, INDRAWATI ... 315

RESPONSIBILITY OF ENVIRONMENTAL IMPACT ASSESSMENT ASSESSOR IN THE ACTIVITIES OF MINING

Lilik Pudjiastuti* and Franky Butar Butar ** ... 331

CORPORATE INTEGRATED RESPONSIBILITY ON MINING MANAGEMENT IN INDONESIA

Franky Butar Butar* ... 353

DILEMMA’S OF USE OF LEASING AGREEMENT OBJECT AS FIDUCIARY GUARANTEE OBJECT

Siti Malikhatun Badriyah ... 355

PRISON SANCTIONS INCONSISTENCIES BETWEEN ACT NO. 28 OF 2014 ON COPYRIGHT AND PENAL CODE

Charlyna S. Purba, S.H., M.H ... 367

DEMOGRAPHIC FACTORS IN HEDONIC CONSUMPTION. A STUDY ON THREE DIFFERENT INDONESIA ETHNICITIES.

LEGAL ASPECTS OF PROPERTY OWNERSHIP BY FOREIGNERS

Sri Wahyu Handayani. ... 381

THE IMPACT OF SALES DISCOUNT AND CREDIT SALES

THE RECONSTRUCTION OF ISLAMIC BANKING DISPUTE RESOLUTION THROUGH MEDIATION IN THE POST THE SUPREME

COURT REGULATION NUMBER 1 OF 2016

Dewi Nurul Musjtari, Benny Riyanto (Supervisor) and Ro’fah Setyowati (Co-Supervisor) Lecturer in Faculty of Law, University Muhammadiyah Yogyakarta

Email: dewinm@yahoo.com and dewinurulmusjtari@umy.ac.id Ph.D Student Doctoral Program, Faculty of Law, Universitas Diponegoro

Jalan Imam Bardjo No. 1, Semarang, Middle Java,. Indonesia

AbStrACt

Mediation as an alternative dispute resolution people’s choice in the resolution of civil disputes that arise in the practice of Islamic banking outside the court, or better known as non-litigation dispute resolution. Dispute resolution through mediation become the people’s choice in the hope that the dispute settlement process can provide impartial settlement for both the Customer of Islamic Banking and Islamic Banking is a “win-win solution”. Goals to be achieved through this research was to determine the reconstruction of Islamic banking dispute resolution through mediation post the enactment of Supreme Court Regulation No. 1 of 2016 and know the model of the judicial procedure for dispute resolution through mediation Islamic banking in religious courts, with the target of the research is composed amends Law No. 30 h. 1999 on Alternative Dispute Resolution (ADR), composed of academic texts as well as the bill on Sharia ADR derivative of the Supreme Court Regulation No. 1 of 2016.

Urgency of this study was to determine the reconstruction of Islamic banking dispute resolution through mediation post the enactment of Supreme Court Regulation No. 1 Year 2016 on Procedures for Mediation in the Court. For researchers, the importance of this study is to realize the competence of researchers in developing a program of legal studies and the development of sharia-minded Judiciary Religion in dispute resolution of Islamic Financial Institutions in Indonesia, particularly Islamic Banking.

28

the legal system, the judicial system, mediation, the agreement (contract), Islamic banking, political law, legal theory, legal research methodology, journals. he primary data obtained through research in the ield (Field Research) with observations, interviews and Focus Group Discussion (FGD) / Workshop which include: 1) Law sanction institution: Judge at the Religious Courts, Legal Section staf at Bank Syariah; 2) Role Occupant: Management Islamic Banking, Islamic Banking Customers, who performed with hermeneutics, sociology of law and phenomenology. he analysis data using qualitative descriptive analysis that describes the reconstruction of Islamic banking dispute settlement through mediation.

he results obtained from this study is the reconstruction of Islamic banking dispute resolution through mediation in religious courts based on Article 2 (1) PERMA No. 1 h. In 2016, with this provision of human resource issues, especially the limitations and skills of judges who understand Islamic banking dispute can be resolved by allowing the mediator other than judges based on Article 1 point (1) PERMA No. 1 h. 2016. he presence of this mediation will be able to increase public conidence in the Religious Court in carrying out the mandate in the resolution of disputes of Islamic banking. Model judicial procedure for dispute resolution through mediation of Islamic banking in the Religious Courts applied with efectiveness and eisiens. hat could be done with the implementation of the principle of good faith in the sense of subjective meaning in the sense of honesty and objective meaning both parties in the mediation process should be based on decency and justice. If both parties apply the good faith both subjective and objective in the sense that the mediation process will work efectively and eiciently.

Keywords: Reconstruction, Dispute Resolution, Islamic Banking, Mediation.

A. INtrODUCtION

he existence of Islamic banking as one of the Islamic inancial institutions strongly support the fulillment of human needs in the ield of economics. In fulillment of human needs in the economic ield must be accompanied by legal certainty in order to create efective and eicient. herefore, the relationship between the economy and the legal certainty of the apparent existence of a close relationship between law and economics. Based on this relation appears that the legal system as an embodiment of the economic system, and vice versa, the economic system of a nation will be relected in the legal system. Islamic banking industry is growing since the issuance of Law No. 3 of 2006 on the Amendment of Act No. 7 of 1989 on Religious Courts.

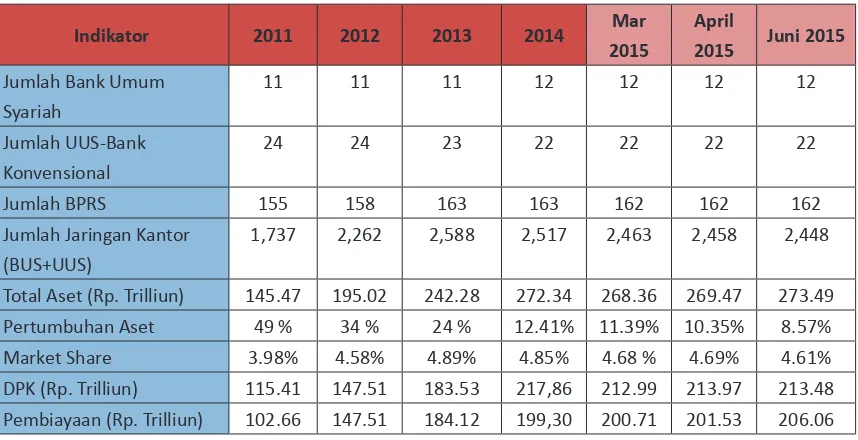

mentioned above, namely the existence of a slowdown in the growth of the Islamic banking in Indonesia. his can be seen in the following data.

Internationally, Indonesia is seen as strength and has great potential in the development of global Islamic inance. Indonesia ranks 9th out of 10 countries that develop Islamic inance. he sequence in question can be seen in the following table:

Tabel 1.

Top 10 Islamic Finance Asset ($ Million)

No. Nama Negara Jumlah Asset

Sources: OJK: Islamic Banking Road Map 2015-2019

Internationally, Indonesia is seen as strength and has great potential in the development of global Islamic inance. Indonesia ranks 9th out of 10 countries that develop Islamic inance. he sequence in question can be seen in the following table: Nationally, the development of Islamic banking industry is still growing, but growth is slowing down. he data development nationally Islamic Bank can be seen in the table below:

Tabel 2.

Perkembangan Perbankan Syariah

Indikator 2011 2012 2013 2014 Mar 2015

Jumlah BPRS 155 158 163 163 162 162 162 Jumlah Jaringan Kantor

(BUS+UUS)

1,737 2,262 2,588 2,517 2,463 2,458 2,448

30

NPF (gross) 2.52% 2.22% 2.62% 4.33% 4.81% 4.62% 4.73% CAR 16.63% 14.13% 14.44% 16.10% 13.85% 14.06% 14.09% FDR 88.94% 100.0% 100.32% 91.50% 94.24% 94.18% 96.52%

Sources: OJK: Islamic Banking Road Map 2015-2019

Legal certainty is important to maintain the sustainability of the growth of Islamic banking industry as well as for the development, product, risk management and eiciency of the bank. One thing that is important (urgent) currently requires concentration and thinking for the management of Islamic banking associated with the judicial system and dispute settlement mechanism in an efective, eicient and equitable. Urgency requires attention especially ater the Court Decision Konstutusi No. 93 / PUU-X / 2012, dated August 29, 2013, related to the testing of Article 55 paragraph (2) and (3) of Law Number 21 of 2008 concerning Sharia Banking (hereinater Islamic Banking Act was written). Based on the ruling, the Constitutional Court to restore the competency of Islamic banking dispute settlement to the Religious Courts. his gives a positive correlation that the absolute competence dispute settlement Islamic banking is in the Religious Courts.

Following the Ruling of the Constitutional Court No. 93 / PUU-X / 2012 consequence will be the revision of Law No. 21 h. 2008 concerning Sharia Banking (hereinater written Islamic Banking Act) and its implementing regulations as well as the adjustment of the dispute settlement process. Another consequence is the need for the judiciary religious readiness to implement the Constitutional Court ruling and the readiness of human resources (HR) Judges and law clerks who understand the material and formal Islamic inancial institutions. Besides, the ability to understand the legal and judicial system in resolving cases arising. In the Constitutional Court ruling that gives concequences that in addition to the settlement of disputes through the Religious Courts, possible settlement through Alternative Dispute Resolution (ADR). Among the alternative dispute resolution is regulated in Law Number 30 of 1999 on Alternative Dispute Resolution (ADR), based on the results of previous research interesting to do further research is about Mediation.

he provisions on mediation in court referring to the rule of the Supreme Court (PERMA) No. 1 of 2008 as amended by PERMA No. 1 h. In 2016 on Mediation Procedure in the courts. he integration of mediation in court proceedings can be one efective instrument to overcome the possibility of a court buildup. In addition to the institutionalization of the mediation process in the judicial system can strengthen and maximize the functions of the judiciary in resolving disputes in addition to litigation that is disconnected (adjudicative).

mediation referred to in Article 130 HIR and 154 Rbg, or SEMA No. 1 of 2002 has not been implemented and there is a problematic start.

he use of mediation in the peaceful institutes It began with the issuance of the Supreme Court Circular (SEMA) No. 1 of 2002 (ex Article 130 HIR / 154 Rbg) about empowering the court of irst instance to apply the peace institute. SEMA was issued to address one of the problems faced by the judiciary in Indonesia in terms of pending lawsuits in the Supreme Court (MA) and dissatisfaction with those seeking justice against the decision of the judiciary who are considered not solve the problem.

he existence of the SEMA is a real step in optimizing the peace eforts so that the implementation is not just a formality. However, because some of the basic things that have not been explicitly stipulated in the SEMA, the Supreme Court issued PERMA No. 2 h. 2003, which contains general provisions, the stages, the place and the cost of mediation in court and then the latter enhanced by the release of PERMA No. 1 of 2008 on Mediation Procedure in the court as amended by PERMA No. 1 h. 2016 on Mediation Procedure in court. In addition to mediation through the courts, it is also possible mediation by the Financial Services Authority (FSA) and the National Sharia Arbitration Board (BASYARNAS). However, in practice the Islamic banking operations and the settlement of the problem has not been well documented.

Based on the above, the researchers are interested in doing research on the reconstruction of Islamic banking dispute settlement through mediation ater the entry into force of PERMA No. 1 h. 2106. he formulation of the problem is:

1. How is the reconstruction of Islamic banking dispute resolution through mediation ater the entry into force of PERMA No. 1 h. 2016?

2. How to model the judicial procedure for dispute resolution through mediation of Islamic banking in the Religious Courts.

Goals to be achieved through this research are:

1. Knowing the reconstruction of Islamic banking dispute settlement through mediation. 2. Knowing the model of the judicial procedure for dispute resolution through mediation of

Islamic banking in the Religious Courts.

he target of the research, among others, composed of:

a. Guidelines for the hearing as the technical guidelines of the Supreme Court Regulation No. 1 Year 2016 on Mediation Procedure Court in structuring the mediation process in Peradulan Religion and the stages and steps.

b. Model judicial procedure for dispute resolution through mediation of Islamic banking in the Religious and patterns of communication and dissemination to stakeholders of Islamic banking.

32

banking in religious courts. For researchers, the importance of this study is to realize the competence of researchers in developing the legal studies program sound sharia.

b. MEtHODS

b.1. Point of View / Stand Point

In this study used a qualitative tradition, operasionalization done according construktivisme paradigm. Constructivism paradigm is a set of beliefs on a legal reality (Islamic banking) as a result of the construction of the relative / relative, and contextually speciic. he relative position (stand point), the author of the problem in this study at the level epiteme not as a participant but rather as an observer. As an observer, the writer will seek answers to any formulation of the problem posed by studying the reality of Islamic banking dispute settlement through mediation (constructed) which share in legislation or related policies and their implementation in the religious court. Understanding plenary obtained a product of the interaction between researchers with products observed object. here is a relatively subjective transactional relationship between researcher and research subjects. he researcher is the instrument, and thus at the level of axiology notch researchers is to facilitate the bridging diversity of existing data and subjects.

b.2. Strategy research

he study was conducted with two strategies, namely research library (Library Research) and case studies (Case Study). Literature study conducted on all documents or literature about Islamic banking dispute settlement through mediation. Documents then grouped according to the dimension of time or the period. he case studies in this research is the case nationwide, particularly the case of Islamic banking disputes. Research with this case study, carried out to record the social facts that accompany the development of society in supporting and sustaining human needs in the ield of economics in society.

his study uses the codes of socio-legal studies, ie understanding the law not as a normative normologik entities and esoteric merely the law of Islamic banking in this study is understood as an entity which is heavily inluenced by non-legal factors. Formulation of the substance or content, choice of goals and the means used to achieve the objectives of Islamic banking or dispute settlement is believed to be interaction with non-legal factors.

b.3. teknik Data Collection

a. Secondary data was obtained through the Research Library (Library Research) and Legal Document, which includes:

1) Material Primary Law, include:

a) Law No. 21 h, 2008 and its implementing regulations, Article 39 of Law No. 30 h, 1999, Law No. 50 h. 2009, PERMA No. 1 h. 2016.

2) Secondary Legal Materials, consisting of books about the legal system, the principles of law, the agreement (contract), Islamic banking, political law, legal theory, legal research methodology, journals.

b. Primary data obtained through research in the ield (Field Research) with observations, interviews and Focus Group Discussion (FGD) / workshop, which includes: 1) Law sanction institution: Judges Religion, Staf Legal Department at Bank Syariah, Notary, Advocate , the Registrar. 2) Role Occupant: Management Islamic Bank, Islamic Bank Customer-do with hermeneutics, sociology of law and phenomenology.

b.4. Data Analysis

Data were obtained either from the research literature and ield research is processed by qualitative descriptive analysis. As is the descriptive is clearly describe actual circumstances and qualitative analysis of the data revealed by informants and sources later elaborated in order to obtain an understanding. So it is a qualitative descriptive analysis that describes the reconstruction of Islamic banking and dispute resolution model of the judicial procedure for dispute resolution through mediation of Islamic banking in the Religious Courts.

C. ANALYSIS

C.1. reconstruction of Islamic banking dispute resolution through

mediation ater the entry into force of PErMA No. 1 h. 2016?

Islamic banking is a part of a inancial institution regulated by the Minister of Finance Decree No. 792 of 1990. Under these provisions, Financial Institutions are all entities whose activities in the ields of inance, conduct the collection and distribution of funds to the public especially to inance inancial institutions preferred to support inance investment companies, but by no means limiting the inancing activities of inancial institutions. he legal relationship between the Islamic inancial institutions and customers is part of the muamalah. Muamalah in Islamic law in the broadest sense are the rules (laws) of Allah to organize man in relation to worldly afairs in social intercourse.

Islamic Banking is an institution that operates in accordance with the principles of Islamic law, namely inancial institutions refer to the procedures for the operation of the provisions of the Qur’an and Hadith. he meaning is that in the operation of inancial institutions to follow the provisions of Islamic law, especially concerning the procedures of muamalah in Islam. In the procedure of muamalah shunned practices that feared contain elements of usury to be illed with activities on the basis of proit sharing investment and trade inancing.

34

he main legal basis in operationalization if LKS, especially Islamic banking is the Qur’an and Hadith. he following will take the several verses in the Qur’an, among others:

a. Al-Baqarah: 275, which means: “people who eat (take) usury can not stand but as stands one whom possessed devil because of the (pressure) insanity”.

b. Al-Imran: 130, which means: “O ye who believe, do not take usury doubled and fear Allah and that ye may prosper.”

c. An-Nisa ‘: 29, which means: “O ye who believe, do not eat each other neighbor’s property with a false way, except by way of commerce that applies to consensual among you”.

In addition to some verses of the Quran and based on positive law, a cornerstone in operasionalization especially for Islamic banking is Law No. 21 of 2008 concerning Sharia Banking (Islamic Banking Act). Government Regulation No. 72 of 1992 concerning Bank Based on Principles of Sharing, in which among other things regulates the provisions on the establishment of a Commercial Bank Nirbunga. Pursuant to Article 28 and 29 of the Decree of Directors of Bank Indonesia Number 32/34 / KEP / DIR dated May 12, 1999 of the Bank based on the Principle Sharing, set about some business activities that can be done by Bank Syariah, PBI 10/32 / PBI / 2008 dated 20 November 2008 on the establishment of Sharia Banking Committee

Other rules speciically governing the contract in a business based on sharia principles is Bank Indonesia Regulation Number 10/16 / PBI / 2008 on Amendment to Bank Indonesia Regulation No. 9/19 / PBI / 2007 regarding the implementation of Sharia in the Activity Fund Raising and Disbursement as well as Islamic Banking Services. Other regulations that provide the basis for Islamic Banking operasionalization is Law No. 50 of 2009 on the second amendment of Law No. 7 of 1989 on Religious Courts. In the law on Religious Courts are syariah economic sense and their absolute competence of the Religious Court in resolving disputes sharia economy. his is airmed in Article 49 of Law No. 1 letter 3 h. 2006 on the Religious Courts.

Islamic banking activity, since the enactment of the Law on Islamic Banking to date have shown very postitif prospects for economic progress and in practice showed a very good development. Internationally, Indonesia is seen as strength and has great potential global Islamic inance. As has been described above that Indonesia ranks 9th out of 10 largest countries in the ield of inance. Nationally, the development of Islamic banking industry is still growing, but growth is slowing according to the data in Table 2 above on the development of Islamic banking. herefore, in order to accelerate the growth of Islamic banking is getting stronger then some persilan is a constraint in practice need to be addressed.

Tasharruf divided into two, namely tasharruf i’li and tasharruf qauli. Tasharruf i’li is the work done by the power of man and his body apart from the tongue, such as utilizing the land barren, received the goods in the sale, damaging somebody else’s property. Tasharruf qauli is tasharruf that comes out of the human tongue is divided into two, namely aqdi and not aqdi. Tasharruf qauli aqdi is something that is formed from the words of both parties are interrelated, such as the sale, lease and joint venture. Tasharruf qauli not aqdi there are two kinds, namely: (a) Represents the procurement of two rights statement or revoke a right, like Wakas, thalak and liberating; (B) not declare a will, but he is making these demands rights, such as a lawsuit, iqrar, vow to reject the lawsuit.

In implementing muamalah there are general principles of law (rechts beginselen) or also called psinsip law, not the law of the concrete, but the mind of a common base nature. he principle of the law is the background in the formation of positive law that is not eternal / ixed. According Sudikno Mertokusumo is the legal principle is: “Fundamentals or directions in the formation of positive law”. he principles can be used in the manufacture of the agreement (contract sharia), among others: konsensualisme principle, the principle of freedom of contract and the principle of good faith in the subjective sense. While the principles used in the implementation of the treaty is pacta sunt servanda principle and the principle of good faith in the objective sense.

In Islamic law are the principles of the treaty. his principle afect the status of the contract. When this principle is not met, it will lead to void or the validity of the engagement / agreements made. he principles are as follows: Al-Hurriyah (Freedom), Al-Musawah (Equality or Equality), Al-’is (Justice), Al-Rida (willingness), Ash-Shidq (Honesty and Truth), Al -Kitabah (Written).

In the application in practice of Islamic banking muamalah relected in the legal relationship between the Customer and Bank Syariah Bank Syariah as outlined in the Agreement. he type of contract that is of concern in this paper is the Islamic Financing Agreement. Device contract in Islamic sharia law is the fulillment of the pillars and the terms of a contract. Rukun element is an absolute must (inherent) in things, events and actions. While the terms are elements that must exist for a certain thing, event, and the action, but not the essence of the contract.

he scholars difered in deining pillars of this contract. Diferences emerged in terms of the essence of the contract itself. Here there will be discussed the divergent views. In the opinion of jumhur especially those written by Wahbah Zuhaili. Wahbah states that consent and granted is one important element in an agreement, other than that there are other elements. he elements are as follows: sighat al-aqad (statements to bind themselves), Al-ma’qud alaih / considering al-’aqd (contract object), Al-muta’aqidain / al-’aqidain (parties which berakad), Maudhu’al-aqd (contract purposes).

36

by people who have the right to do so, although he was not aqid who has the goods, do not contract the contract prohibited by Personality ‘, such as trade mulasamah, the contract may provide faidah, it is not valid if rahn regarded as a counterweight to the trust, consent that goes on, not revoked prior to kabul, then when people berijab retract ijabnya before kabul, then batallah ijabnya, qabul consent and must be continued, so if someone berijab already separated before their kabul, then that consent is void.

In the inancing agreement implementing the Islamic banking practices necessary legal certainty for the parties so that there is justice and expediency. According Sudikno Mertokusumo, legal certainty is a guarantee that the law is executed, that are entitled by law can gain their rights, and that the decision can be implemented. Although closely related to the legal certainty of justice, but the law is not synonymous with justice. General law, binds everyone, is a leveler, while justice is subjective, individualistic, and not generalize.

Meanwhile, according to M. Fernando E. Manullang, legal certainty is an implementation of the law in accordance with sound so that people can make sure that the law is implemented. In understanding the value of legal certainty should be noted is that the value of it is related closely with the legal instruments and the positive role of the state in the actualization of positive law.

Legal certainty is a question that can only be answered normatively, not sociological. Normative legal certainty is when a rule is made and enacted exactly as set out clear and logical. Obviously in the sense not to cause hesitations (multi-interpretation) and logical in the sense that it becomes a system of norms with other norms so as not to clash or conlict norms. Conlict norms arising from the uncertainty of rules can be shaped contestation of norms, reduction or distortion norm norm.

So legal certainty is the certainty of the rule of law, not a certainty action against or act in accordance with the rule of law. Because the phrase of legal certainty is not able to describe the behavior of legal certainty completely. Likewise with Newtonian mechanics. Even Newtonian mechanics was already twice against in the development of natural science itself, that of Einstein’s heory of Relativity and Quantum Physics.

In the legal relationship between the Islamic Bank and the customer begins with the signing of the contract which apply to them. Implementation of the agreement was originally intended for the objectives of the parties can be realized, but in practice not all contract goes well. Implementation of the agreement began plagued with problems. According Mahmoeddin, the problem is the existence of a diiculty that needs solving, or an obstacle that interfere with the achievement of goals or optimal performance. he problem may also be a deviation or inconsistency between necessity and reality. he core of the problem formulation should get an answer is correct the error if it encountered an error and remove obstacles if any problems were found.

doubtful and loss (non performing loans). In the event of any inancing problems, the bank seeks to maintain liquidity with the completion of the problems it faces. Based on the principles in the contract then applied principle of Pacta sunt servanda, which means that the agreement of the parties made legally binding on the parties as the law. In the dispute resolution clause of the contract through Islamic banking there is a stage of completion include:

1. Resolution by consensus;

2. Settlement through Alternative Dispute Resolution, among others: Mediation, Basyarnas and Conciliation;

3. Settlement through the Religious Courts.

Basyarnas dispute resolution have not been regulated in separate legislation. During this time the parties may agree with reference of the Indonesian Ulema Council Decision No. Kep-09 / MUI / XII / 2003 dated December 24, 2003 set including a name change Bamui be Basyarnas and changing the shape of its legal entity which was originally a foundation to “entity” under the MUI and a device MUI organization.

Basyarnas dispute resolution based on Law Number 30 Year 1999 on Alternative Dispute Resolution, known as Alternative Dispute Resolution (ADR). Model solution through: arbitration, mediation, negotiation and reconciliation. Problems in the legal system is required ater the enactment of Law No. 3 h. 2006 relating to the content of Article 3 and Article 11 of Law No. 30 h. 1999.

Article 3 of Law No. 30 h. 1999 provides: “he Court has the authority to adjudicate disputes that have bound the parties in the arbitration agreement”. Article 11 (1) and (2) of Law No. 30 h. 1999 provides:

Paragraph (1): “he existence of an arbitration agreement in writing to eliminate the right of the parties to submit the dispute or diference of opinion contained in the agreement to the Court”.

Paragraph (2): “District Court must reject and will not intervene in a dispute that has been established through arbitration, except in certain matters set forth in this law”.

Given the rules governing the arbitration sharia yet then settling disputes Islamic banking can refer to the dispute resolution guidelines that have been made by Basyarnas using Ekstensif Interpretation Method with Argumentum Peranalogia of Law No. 30 h 1999. Deinition of the District Court within the meaning of the Act No. 30 h. 1999 can analog to the Religious Court ater the enactment of Law No. 50 h. 2009.

38

Deinition Mediation is a dispute resolution process through a process of negotiation or consensus of the parties, assisted by a mediator who has no authority to decide or impose a settlement. he main characteristic of the mediation process is essentially the same negotiations with the process of consultation or consensus. In accordance with the nature of negotiation or consultation or consensus, then there should be no compulsion to accept or reject the idea or settlement during the mediation process underway. Everything must obtain the consent of the parties.

he legal basis for the implementation of Mediation in the Court is the Supreme Court Regulation No. 1 Year 2008 on Procedures for Mediation in the Court that a revision of the Supreme Court Regulation No. 2 of 2003 (PERMA No. 2 h. 2003), where the PERMA No. 2 of 2003, there are still many weaknesses that make PERMA normative does not reach the desired maximum target, and also a wide range of input from the judiciary on the issue of problems in the PERMA.

Background on why the Supreme Court (MA-RI) requires the parties to take a mediation before the case decided by the judge described below. MA-RI policies impose mediation proceedings in the Court was based on the following reasons:

1. he mediation process is expected to overcome the problem of accumulation of cases. If the parties can resolve their own disputes without the need to be tried by a judge, the number of cases to be examined by the judge will decline. If the dispute can be resolved through peace, the parties will not take legal action appeal for peace is the result of a common will of the parties, so that they will not propose a remedy. Conversely, if the case decided by the judge, the decision is a result of the views and the judge’s assessment of the facts and the legal position of the parties. he view and the judge’s assessment is not necessarily in line with the views of the parties, especially the losing party, so that the losing party to forge an appeal and cassation. In the end it all boils down to the Supreme Court case that resulted in the accumulation of cases.

2. he mediation process is viewed as a means of dispute resolution that is faster and cheaper than the litigation process. In Indonesia there has been no research to prove the assumption that mediation is a process that is faster and cheaper than litigation. However, if it is based on logic as described in the irst reason that if the case is terminated, the loser oten iled legal actions, appeals and cassation, thereby making the settlement of the case in question could take many years, from the examination in court he irst level up to the Supreme Court level examination. Conversely, if the case can be solved by peace, the parties themselves can accept the outcome because it is their work that relects the common will of the parties. In addition to logic as previously described, the literature it is oten stated that the use of mediation or other forms of settlement were included in the deinition of alternative dispute resolution (ADR) is a dispute resolution process that is faster and cheaper than litigation.

through the process of deliberation by the parties. With the enactment of mediation into the formal justice system, people seeking justice in general and the disputing parties in particular can irst try to resolve their disputes through consensus approach aided by a mediator called mediators. Even if in fact they have been through the process of deliberation before either party to bring the dispute to the Court, the Supreme Court still considers it necessary to oblige the parties to take the peace eforts were aided by the mediator, not only because the provisions of the procedural law, namely HIR and Rbg, require judges to irst reconcile the parties before deciding process begins, but also because of the view, that the better solution and satisfactory settlement is a process that provides an opportunity for the parties to jointly seek and ind the inal result.

4. he institutionalization of mediation into the judicial system can strengthen and maximize the functions of the judiciary in resolving disputes. If in the old days judicial institutions function more prominent ones is the function of deciding, with the enactment of PERMA Mediation reconcile or mediate the expected functionality can go hand in hand and balanced with functionality disconnected. PERMA Mediation is expected to drive change in the way the actors in civil judicial proceedings, the judges and lawyers, that the courts are not only cut of, but also to reconcile. PERMA Mediation provides guidance for achieving peace. Inspiration Mediation Procedure In order to follow the decision MARI revise PERMA No. 2 of 2003, has formed a working group to assess the weaknesses in PERMA PERMA and prepare a revised drat, the result is PERMA No. 1 h. 2008. he Working Group is chaired by Dr. Hariin A. Tumpa, SH.MH., followed by Atja Sondjaja, SH.

In performing its duties, the Working Group has conducted activities to complete the process of drating the revision PERMA. he work of the Working Group was then submitted to the Steering Group (Steering Committee), which consists of Vice Chairman MARI judicial ield, and all the presidents of the Young MARI and expert consultants. Steering Group determines the inal word on every formulation of clauses in PERMA revised. Results brieing include:

(1) In Act No. 30 of 1999 mediation is deined as a written agreement of the parties, disputes or diferences of opinion resolved through the help of “one or more expert advisor” or through a mediator.

(2) he Agreement reached in a mediation process to be made in writing, shall be inal and binding on the parties. And also must be registered in the District Court within a period of 30 (thirty) days from signing. he resulting agreement in writing, shall be inal and binding on the parties. And also must be registered in the District Court within a period of 30 (thirty) days from signing. he agreement shall be implemented within a period of 30 (thirty) days from registration.

40

judges well in the Yogyakarta District Court or Judge in Pengadulan Religion in DIY obtained diference between PERMA No. 1 h. 2008 and PERMA No. 1 h. 2016 as follows.

1. Related to the mediation deadline shorter than 40 days to 30 days since the establishment of the command did Mediation;

2. he requirement for the parties (inpersoon) to attend a mediation meeting directly with or without accompanied by an attorney, unless there are legitimate reasons such as health conditions that do not allow attendance at the meeting Mediation by a doctor’s certiicate, under guardianship, homeless , residence or position in foreign or state business, profession or job demands that can not be abandoned.

3. here are rules of good faith in the mediation process and the legal consequences for the parties who are not of good will in the mediation process. his is the most recent regulations.

Based on the above discussion, the reconstruction of Islamic banking dispute settlement through mediation in religious courts based on Article 2 (1) PERMA No. 1 h. 2016 states that the provisions of the Mediation Procedure in the Supreme Court Regulation is applicable in the process of litigating in court, either in general courts and religious courts. Under these provisions the issue of human resources, especially the limitations and skills of judges who understand Islamic banking dispute can be resolved by allowing the mediator other than the judge. It is based on Article 1 point (1) PERMA No. 1 h. 2016 mentions the mediator is a judge or other parties who have a Certiicate Mediator sebagau neutral third party who helps the parties in the negotiation process for a wide range of possibilities for the settlement of disputes without using a way of breaking or impose a settlement.

he presence of mediation by PERMA No. 1 h. 2016 is expected to increase public conidence in the religious courts in carrying out the mandate in the resolution of disputes of Islamic banking. he results achieved through the mediation of religious courts will also give the process of peaceful settlement of disputes between the two sides and will manifest a common understanding in resolving sengkta happened. In terms of legal certainty is obtained then should be justice and beneit will also be realized. If all of the components in the development of Islamic banking has had the understanding and behavior of the money at the growth of Islamic banking will continue to rise.

C.2. Model judicial procedure for dispute resolution through mediation of

Islamic banking in the religious Courts.

In determining the model of mediation in resolving disputes Islamic banking must consider the content PERMA No. 1 h. 2016. Pursuant to Article 7 PERMA No. 1 h. 2016, stated that:

1. he Parties and / or their attorneys shall take the mediation in good faith;

a. Not present properly called two (2) times in a row in Mediation meetings without a valid reason;

b. Attend the irst mediation meeting, but was never present at the next meeting has been properly called, although two (2) times in a row without a valid reason;

c. Absence annoying repetitive schedule Mediation meetings without a valid reason; d. Mediation attend the meeting, but did not ile and / or do not respond to other parties

Case Resume; and / or;

e. Did not sign the concept of “Peace Agreement” has been agreed without a valid reason.

In the event that the plaintif declared no good intention in the Mediation process referred to in Article 7 (2), based on Article 23, the lawsuit can not be accepted by the Examining Judge Case. his is conirmed in Article 22 PERMA 1 h. 2016. Plaintif declared good will are not referred to in paragraph (1) shall be subjected Mediation fee payment obligation. For the next Mediator plaintif did not submit a report to the judge of good will Examining the Case with recommendations Mediation fee imposition and calculation of the amount in the report unsuccessful or can not be implemented Mediation.

Based Mediator report referred to in paragraph (3), Case Examiner Judge issued a decision which is inal and that the lawsuit is unacceptable accompanied condemnation Mediation fee payments and court fees. Mediation costs as a punishment to the claimant can be taken from the down payment fee or a separate payment by the claimant and submitted to the defendant through the court clerkships. If the Defendant declared good will are not referred to in Article 7 (2), subject to liability for payment of fees Mediation. Mediator to submit a report to the defendant is not a good faith belief the Examining Judge Case with recommendations Mediation fee imposition and calculation of the amount in the report unsuccessful or can not be implemented Mediation.

Based Mediator report referred to in paragraph (2), before resuming the examination, the Examining Judge Case in the trial are set next states must issue a determination that the defendant is not of good will and punish the defendant to pay a mediation fee. Mediation costs referred to in paragraph (3) is part of the mandatory court fees mentioned in the inal verdict. In the event that the defendant referred to in subsection (1) is won in the verdict, the verdict stated Mediation fee charged to the defendant, while the ixed court fee is charged to the plaintif as the losing party.

In civil cases and economic disputes Islamic religious courts, the defendant referred to in paragraph (1) was sentenced to pay a mediation fee, while the court fees charged to the claimant. Payment of Fees Mediation by the defendant to be handed over to the plaintif by the Court clerkships to follow the implementation of decisions that have been legally binding. In the event that the Parties jointly declared no good intention by the Mediator, the lawsuit can not be accepted by the Examining Judge Mediation Costs Case unpunished.

42

it can also be shown the essential spirit and an indication of the efectiveness of the process of mediation in resolving the case. With the good i’tikad this that the mediation process will be carried out efectively and eiciently, “If studied more thoroughly PERMA 1 h. 2016 reairmed the role of independent mediator to play a more active role in resolving disputes in court or out of court, which then results agreed mediation may be iled stipulation to the Court through the mechanism of a lawsuit.

Based on the previous description, the efectiveness and eiciency of the mediation process can be accomplished with implemented of the principle of good faith. Pursuant to Article 1338 paragraph (3) of the Civil Code which said that the agreement be implemented in good faith. Good faith has two meanings. he irst in a subjective sense, in the sense of subjective good faith means honesty. In this case, the parties to make an agreement or contract and the mediation process should be with honesty. Secondly, good faith in the sense of objective meaning both parties in the mediation process should be contained decency and justice. If both parties apply the good faith both in the sense of subjective and this obyective the mediation process will work efectively and eiciently. herefore, it is highly expected that the win-win solution will materialize and both sides will get justice with peace and mutually support each other.

D. Conclusions and suggestions

D.1. Conclusions

Based on the description in the discussion, the conclusion is:

1. Reconstruction of Islamic banking dispute resolution through mediation in religious courts based on Article 2 (1) PERMA No. 1 h. In 2016, with this provision of human resource issues, especially the limitations and skills of judges who understand Islamic banking dispute can be resolved by allowing the mediator other than the judge. It is based on Article 1 point (1) PERMA No. 1 h. 2016. he presence of the mediation is expected to increase public conidence in the religious courts in carrying out the mandate in the resolution of disputes of Islamic banking. he results achieved through the mediation of religious courts will also give the process of peaceful settlement of disputes between the two sides and will manifest a common understanding in resolving the dispute.

D.2. Suggestion

In terms of legal certainty has materialized with the PERMA No. 1 h. In 2016 it should be justice and beneits will also be realized. his will be achieved by cooperation, interconnection and integration and communication of all components in the development of Islamic banking. he component in question is the Supreme Court (MA), the National Sharia Council (DSN), the Financial Services Authority (FSA), the Association of Islamic Banking Indonesia (Asbisindo), Notary, Customers Bank Syariah Judge, Registrar, Advocate and society observers and users of Islamic banking has had the same understanding and behavior of the growth of islamic banking will continue to rise.

rEFErENCES

Andri Soemitro, 2010, he Bank and the Islamic Financial Institutions, Jakarta, Kencana. E. Fernando M. Manullang, 2007, Reaching Law Review Fair Value of Natural Law and

Antinomy, Jakarta, Kompas Book Publishers

Hendi Suhendi 2002, Fiqh Muamalah, Jakarta, King Graindo Persada.

Noeng Muhajir has four elements, namely: a. Determination of a purposive sample; b. Inductive analysis; c. Grounded heory; d. While the design will depend on the context. Noeng Muhadjir 2002, Qualitative Methodology Research, Yogyakarta, Publisher Rakesarasin.

Rikardo Simarmata, Socio-Legal Studies and Renewable Movement Law in Law Digest, Society and Development, Volume 1 December 2006-March 2007.

Ro’fah Setyowati, 2013, he Constitutional Court Decision No. 93 / PUU-X / 2012 Related Law Enforcement of Islamic Banking Perspective Progressive Law, Call for Papers on Consortium Progressive Law Indonesia: deconstruction and hought Movement Progressive Law, Satjipto Raharjo Institute in cooperation with the Association of Sociology of Law Indonesia (ASHI) etc, Semarang, 29 -30 November.

Satjipto Rahardjo, 2009, Build and Remodel Law of Indonesia (An Interdisciplinary Approach), Yogyakarta, Genta Publishing.

Sudikno Mertokusumo, Know Law An Introduction., Yogyakarta, Liberty.

Yance Arizona, http://tbn0.google.com/images?q=tbn:xJyx45A4gtYNM: http: // www. communitymx.com/content/source/1D850/L 0 logo.jpg.