Siloam Hospitals

Company Focus

Patricia GabrielaInitiate coverage on SILO with BUY

We initiate SILO with a Buy rating as company has been able to deliver a strong double-digit top line growth. Supported with its network across Indonesia (20 hospitals and 17 clinics in total), we believe SILO will have more upside in terms of patient volume that translates to a prom-ising top line growth. The industry is still underpenetrated; and with MIKA already priced in, we think that SILO might catch up the laggard.

Aggressive hospital development: 4 hospitals per year

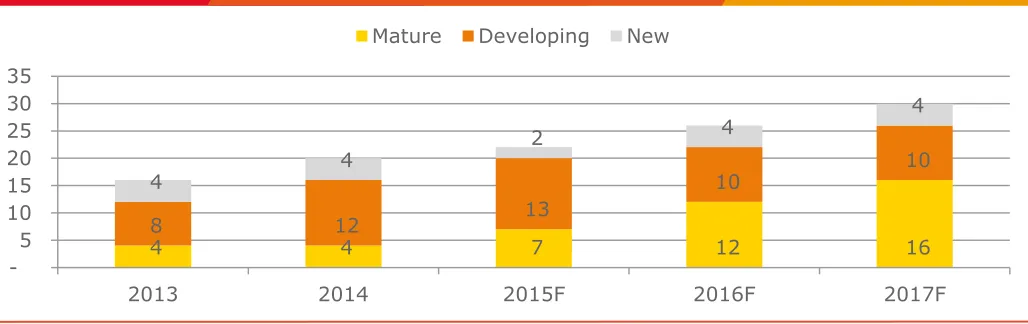

SILO managed to add 4-5 hospitals per year in last four years to its hospital group through greenfield and acquisition. We forecast SILO to add another 4 hospitals/year (lower than company’s guidance of 8-10 hospitals), but only 1 hospital for 2015F due to delay in permit. We view that our hospital expansion forecast is still realistic considering the his-torical data and construction progress of some hospitals.

Positive growth from BPJS program

SILO has recorded robust patient volume growth with 18% CAGR 2012-14. In 2014, patient from BPJS program contributes 6% to total patient volume albeit only 7 hospitals registered. Given hospital business’ high operating leverage and SILO’s currently low occupancy rate, enrolling in BPJS program makes sense as it should improve asset turnover and therefore ROE (ROE to rise from 7% in 2015 to 11% in 2017).

Asset-light business model

In order to be able to ramp up its expansion plan, SILO uses light-asset business model for its greenfield expansion. SILO does not own majority of land and building of its hospitals. Of 20 hospitals, 12 is rented, 4 is owned, and 4 is rented from 3rd parties. SILO’s rental expense is ~3% of net revenue.

Valuation: BUY with TP of Rp 15,500

We recommend SILO at Rp 15,500 using DCF method (WACC of 10%, LTG of 3%). Our TP implies 2016-17F EV/EBITDA of 28.1x and 23.8x respectively.

Siloam Hospital Group is the leader of in-tegrated healthcare services in Indone-sia. It operates 20 hospitals in total with more than 3,900 bed capacity.

Share Price Rp 12,300

Reuters Code SILO.JK

Bloomberg Code SILO.IJ

Issued Shares 1,156

Mkt Cap. (Rpbn) 14,220

Avg. Value Daily 6

Month (Rpbn) 49.1

52-Wk range 17100 / 11275

PT Megapratama Karya Persada 60.5%

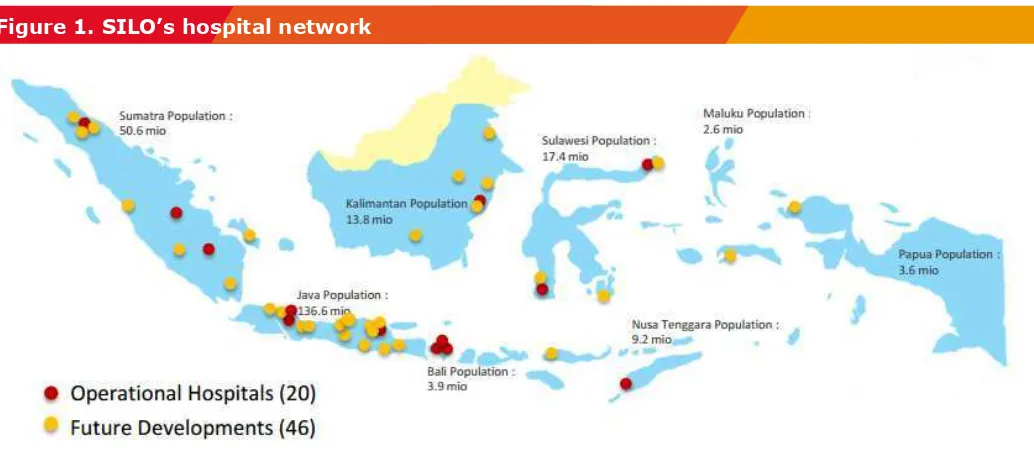

Hospital network across Indonesia

In 1H15, SILO operates 20 hospitals across Indonesia. Management targets to have more than 50 hospitals by 2017F with 8-10 hospital expansion per year. However, we are being realistic as we forecast company to add 4 hospitals per year. In 2015F, we assume SILO to add only 1 hospitals as management confirmed that they’re lagging in hospital development due to problem in license. Once license has released, company is ready to open its hospital in Yogyakarta. Aside from hospitals, SILO also operates 17 clinics that serves as a feeder for BPJS patients.

Figure 2. SILO’s operational beds Figure 1. SILO’s hospital network

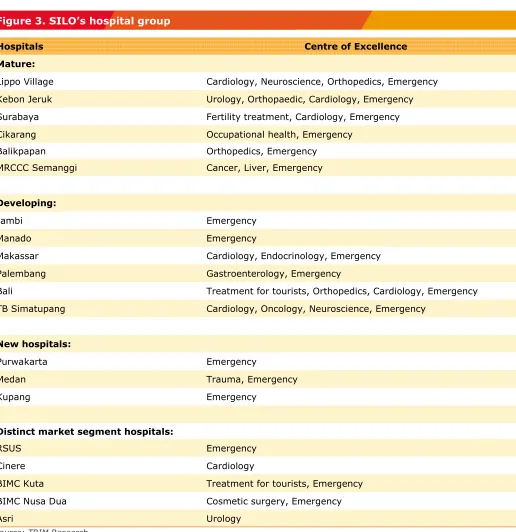

In order to differentiate its hospital from others, SILO established center of excellence in each of its hospitals. Moreover, SILO acquired BIMC Kuta and BIMC Nusa Dua in 2013 to achieve medical tourism. These hospitals are well known with Australian tourists, thus can support SILO’s vision. In 1H15, distinct market segment (incl. BIMC Kuta and BIMC Nusa Dua) contributes 14% to SILO’s total patient volume.

As of now, SILO has the biggest number of operational bed in Indonesia with 29% CAGR 2011-14.

Source: TRIM Research

Figure 3. SILO’s hospital group

Source: TRIM Research

Hospitals Centre of Excellence

Mature:

Lippo Village Cardiology, Neuroscience, Orthopedics, Emergency

Kebon Jeruk Urology, Orthopaedic, Cardiology, Emergency

Surabaya Fertility treatment, Cardiology, Emergency

Cikarang Occupational health, Emergency

Balikpapan Orthopedics, Emergency

MRCCC Semanggi Cancer, Liver, Emergency

Developing:

Jambi Emergency

Manado Emergency

Makassar Cardiology, Endocrinology, Emergency

Palembang Gastroenterology, Emergency

Bali Treatment for tourists, Orthopedics, Cardiology, Emergency

TB Simatupang Cardiology, Oncology, Neuroscience, Emergency

New hospitals:

Purwakarta Emergency

Medan Trauma, Emergency

Kupang Emergency

Distinct market segment hospitals:

RSUS Emergency

Cinere Cardiology

BIMC Kuta Treatment for tourists, Emergency

BIMC Nusa Dua Cosmetic surgery, Emergency

One stop care for primary, secondary, tertiary, and quaternary levels

By primary, means SILO provides clinics for corporate clients and gateway to Indonesia’s “Universal Healthcare Coverage” as well as Government Health Insurance Program. As in 1H15, 11 of SILO’s hospitals participates in BPJS program. SILO eagers to be best in class through rapid expansion of hospital network, attracting and re-taining best doctors, and equip hospitals with latest technology. On top of that, SILO also develops integrated centers of excellence and Digital Tele-Medicine.

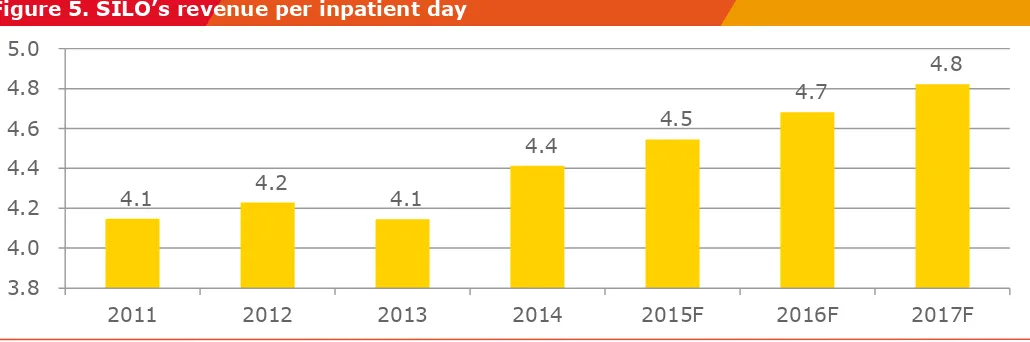

As SILO serves all class levels, SILO has a higher revenue per patient compared to MIKA. We expect SILO to hike its price by 2% CAGR 2015-20F (vs historical 2-6% CAGR 2012-14). The price increase is expected from a more complex services. In 2011-12, SILO opened comprehensive cancer center and Indonesia’s first Gamma Knife.

Regarding BPJS program, management stated that there is no problem in terms of payment. Once BPJS patient has checked out from hospital, the documents related are collected and checked by verifiers. Management con-firmed that the money can be received ~15 days after the document is verified.

Figure 4. Number of operational beds comparison

Source: TRIM Research

Figure 5. SILO’s revenue per inpatient day

- 500 1,000 1,500 2,000 2,500 3,000 SILO

MIKA Awal Bros Group Sari Asih Group Ramsay Sime Darby Health Care

4.4

4.5

4.7

4.8

Lower occupancy rate due to new and developing hospitals

SILO has a slight lower occupancy rate at 53.9%, compared to MIKA at 63.6% in FY14. Need to remind that SI-LO has 4 mature hospitals, 12 developing, and 4 new; while majority of MIKA’s hospitals are considered as ma-ture hospitals. (We base our mama-ture assumption with >3 years of commencing).

A mature hospital tends to have higher occupancy rate; hence, better efficiency. We expect SILO to be able to raise its occupancy rate overtime and a robust patient volume growth of 22% CAGR 2015-20F on the back of more mature hospitals.

Figure 6. SILO’s revenue per outpatient

Source: TRIM Research

Figure 7. SILO’s hospital breakdown

Source: TRIM Research

2011 2012 2013 2014 2015F 2016F 2017F

4 4 7 12 16

2013 2014 2015F 2016F 2017F

Financials

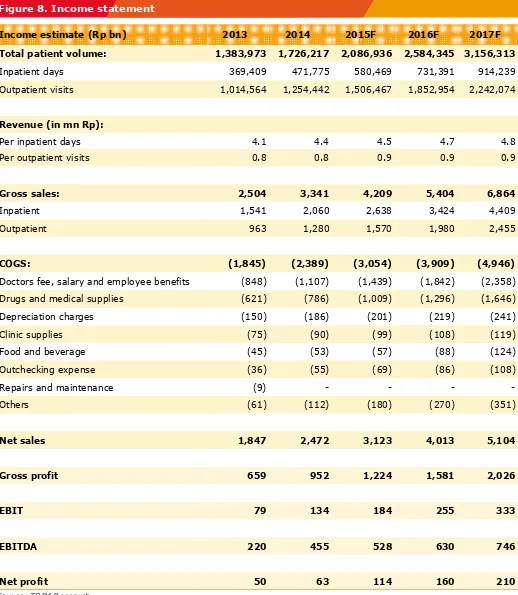

Figure 8. Income statement

Income estimate (Rp bn) 2013 2014 2015F 2016F 2017F

Total patient volume: 1,383,973 1,726,217 2,086,936 2,584,345 3,156,313

Inpatient days 369,409 471,775 580,469 731,391 914,239

Outpatient visits 1,014,564 1,254,442 1,506,467 1,852,954 2,242,074

Revenue (in mn Rp):

Per inpatient days 4.1 4.4 4.5 4.7 4.8

Per outpatient visits 0.8 0.8 0.9 0.9 0.9

Gross sales: 2,504 3,341 4,209 5,404 6,864

Inpatient 1,541 2,060 2,638 3,424 4,409

Outpatient 963 1,280 1,570 1,980 2,455

COGS: (1,845) (2,389) (3,054) (3,909) (4,946)

Doctors fee, salary and employee benefits (848) (1,107) (1,439) (1,842) (2,358)

Drugs and medical supplies (621) (786) (1,009) (1,296) (1,646)

Depreciation charges (150) (186) (201) (219) (241)

Clinic supplies (75) (90) (99) (108) (119)

Food and beverage (45) (53) (57) (88) (124)

Outchecking expense (36) (55) (69) (86) (108)

Repairs and maintenance (9) - - - -

Gross profit 659 952 1,224 1,581 2,026

Others (61) (112) (180) (270) (351)

We forecast SILO to post 25% net profit CAGR in 2015-18F as the group’s hospitals maturing. Note that we as-sume BPJS business will not hurt SILO’s margin (BPJS business is 8% of revenue). Company has assigned a case manager to keep track of BPJS patient in order to manage their ALoS (Average Length of Stay) low. Management stated that they will suffer no loss as long as ALoS for BPJS patient under 4 days.

Source: TRIM Research

Figure 9. Margin outlook (%)

2013 2014 2015F 2016F 2017F

Gross profit 35.7% 38.5% 39.2% 39.4% 39.7%

Operating profit 4.1% 6.8% 7.0% 7.2% 7.2%

EBITDA 11.9% 18.4% 16.9% 15.7% 14.6%

Pretax profit 3.9% 3.8% 5.6% 6.1% 6.4%

Net profit 2.7% 2.5% 3.7% 4.0% 4.1%

Figure 10. Balance sheet

Source: TRIM Research

Rp bn 2013 2014 2015F 2016F 2017F

Cash 515 280 243 256 248

Receivables 271 393 419 539 685

Inventories 95 106 125 161 203

Fixed assets 1,402 1,589 1,717 1,960 2,290

Others 317 476 467 467 467

Total assets 2,601 2,844 2,971 3,382 3,893

Loan 447 462 462 662 912

Payables 164 193 221 283 359

Others 351 535 535 535 535

Total liability 962 1,190 1,219 1,481 1,806

Valuation

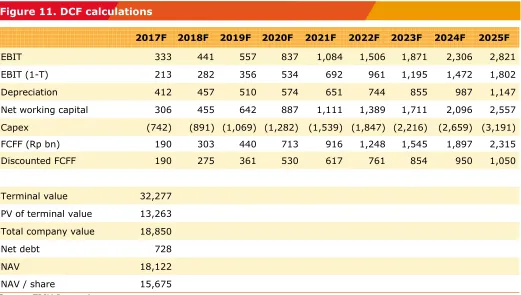

We initiate SILO with a BUY rating at target price of Rp 15,500, +26% upside from current price. We like SILO as company managed to deliver double digit top line growth and continue to serve a strong growth on the back of its aggressive hospital development and participation in BPJS program. We derive our target price using DCF method assuming a WACC of 10% and LT growth rate of 3%.

Our TP implies 2016-17F EV/EBITDA of 28.1x and 23.8x. This is a 38% discount to MIKA (SILO’s only actively traded peer in JCI), respectively. We view the discount should narrow as SILO delivers on its growth promise.

Figure 11. DCF calculations

Source: TRIM Research

2017F 2018F 2019F 2020F 2021F 2022F 2023F 2024F 2025F

EBIT 333 441 557 837 1,084 1,506 1,871 2,306 2,821

EBIT (1-T) 213 282 356 534 692 961 1,195 1,472 1,802

Depreciation 412 457 510 574 651 744 855 987 1,147

Net working capital 306 455 642 887 1,111 1,389 1,711 2,096 2,557

Capex (742) (891) (1,069) (1,282) (1,539) (1,847) (2,216) (2,659) (3,191)

FCFF (Rp bn) 190 303 440 713 916 1,248 1,545 1,897 2,315

Discounted FCFF 190 275 361 530 617 761 854 950 1,050

Terminal value 32,277

PV of terminal value 13,263

Total company value 18,850

Net debt 728

NAV 18,122