Refer to Important disclosures on the last of this report

Stock DataTarget price (Rp) Rp700

Prior TP (Rp) Rp700

Shareprice (Rp) Rp655

Upside/downside (%) +6.9

Sharesoutstanding (m) 14,426

Marketcap. (US$ m) 633

Semarop Agung 33.5%

Sinarmegah Jayasentosa 6.6%

Public 24.9%

Estimate Change; Vs. Consensus 2018 2019 PT Indo Premier Sekuritas [email protected] +62 21 5793 1168

Good 2Q, but below expectation

Earnings of Rp78bn in 1H18 (+61% yoy), below market expectation

Relatively slow marketing sales of Rp1.9tn in 8M18 (+2% yoy)

Possible earnings growth from debt refinancing of Rp23bn in 2019.

Maintain Hold with unchanged TP of Rp700.

Earnings of Rp78bn in 1H18 (+61% yoy), forming 19% of our forecast.

SMRA

reported earnings of Rp78bn in 1H18 (+61% yoy), which came below

market expectation, forming 19% of our/consensus FY18F forecast. Revenue was

flat -1% yoy, but grew 23% qoq, with margin improvement due to limited

launching, where COGS declined by 7% yoy. In addition, SMRA booked positive

cash flow of Rp184bn in 1H18, which is company’s best performance since 2016.

In quarterly basis, SMRA booked relatively strong earnings of Rp36bn in 2Q18

(-13% qoq), much stronger that 2Q17 and 2Q16 where company booked losses of

Rp23bn and Rp4bn, respectively.

8M18 marketing sales forming only 47% of FY18F guidance.

Due to limited

launching ytd (3 projects), SMRA only booked total marketing sales of Rp1.9tn in

1H18 (+2% yoy), forming only 47% of company’s FY18 guidance of Rp4tn (Ours:

Rp3.8tn). Summarecon Serpong is still the main contributor to the marketing

sales with Rp890bn, followed by Bekasi and Bandung with Rp581bn and Rp167bn,

respectively. Going forward, SMRA will launch four new projects in the remaining

2018 with one major launching of its sixth township, Summarecon Mutiara

Makassar (326ha). In the first phase of development, SMRA targets marketing

sales of Rp240bn from the launching of 200-300 unit houses with ticket price

around Rp1bn. The remaining project launching will be located in SMRA existing

township in Karawang, Bekasi and Serpong.

Potential interest expense savings in 2019 due to debt refinancing.

With

total bonds of Rp2tn due in 2018 and 2019, SMRA plans to issue continuous

bonds to refinancing the bonds with lower interest. Assuming lower blending

interest rate of 10-10.5% (Bond ratings: idA) from current of 11%, the company

would save around Rp13-23bn of interest expense in 2019, which represents

around 3-5% of our FY19F earnings forecast of Rp461bn.

Maintain Hold with TP of Rp700.

Despite relatively weak 1H18 earnings and

slow marketing sales, we still maintain our FY18F/19F earnings forecast, given

potential sizeable land plot sales in 4Q18 and interest expense savings in 2019.

We maintain our Hold rating on SMRA with TP of Rp700, representing FY18F P/E

target of 25.4x. Upside potential to our call might come from huge land plot sales

in last quarter to provide immediate boost to FY18F marketing sales and earnings.

Summarecon Agung

(

SMRA IJ

)

28 September 2018

Source: SMRA, IndoPremier Share Price Closing as of : 28-Sept-2018

SMRA IJ Results Note

2

Refer to Important disclosures on the last of this report

Fig. 1: Earnings to grow by 3% CAGR FY14-FY20F Fig. 2: Recurring and development proportion to revenue

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: 8M18 marketing sales only achieved 47% of guidance Fig. 4: Serpong and Bekasi remains the main contributors

Source: Company, IndoPremier Source: Company, IndoPremier

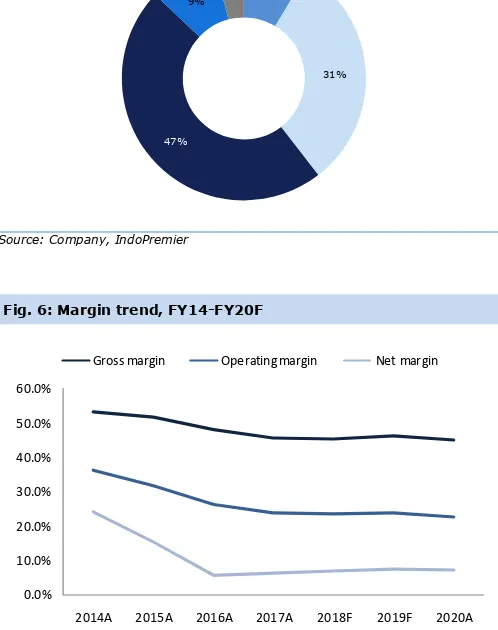

Fig. 5: Payment profile as of 8M18 Fig. 6: Margin trend, FY14-FY20F

Source: Company, IndoPremier Source: Company, IndoPremier

25.7%

2014A 2015A 2016A 2017A 2018F 2019F 2020F

Net profit Growth

(Rp bn)

2014A 2015A 2016A 2017A 2018F 2019F 2020F

Recurring income Development properties

(Rp bn)

8M18 8M17 8M16 8M15 8M14

(Rp Bn)

8M18 Marketing Sales % of FY

9%

31%

47%

9% 4%

Kelapa Gading Bekasi Serpong Bandung Karawang

25%

47% 27%

Cash Cash Installment Mortgage

0.0%

2014A 2015A 2016A 2017A 2018F 2019F 2020A

3

Refer to Important disclosures on the last of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 5,398 5,641 5,846 6,119 6,554

Cost of Sales (2,801) (3,074) (3,189) (3,282) (3,604)

Gross Profit 2,597 2,567 2,657 2,836 2,950

SG&A Expenses (1,192) (1,229) (1,298) (1,381) (1,477)

Operating Profit 1,406 1,339 1,358 1,455 1,473

Net Interest (532) (542) (489) (484) (473)

Forex Gain (Loss) 0 0 0 0 0

Others-Net 1 2 3 5 8

Pre-Tax Income 874 799 873 976 1,007

Income Tax (272) (267) (280) (297) (319)

Minorities (293) (170) (190) (217) (220)

Net Income 308 362 403 462 468

Balance Sheet

Cash & Equivalent 2,039 1,482 1,426 1,577 1,884

Receivable 548 661 685 720 816

Inventory 5,531 6,498 7,748 8,748 10,248

Other Current Assets 546 517 577 585 643

Total Current Assets 8,664 9,158 10,437 11,631 13,591

Fixed Assets - Net 11,096 11,179 10,505 9,091 7,896

Goodwill 0 0 0 0 0

Non Current Assets 1,001 1,315 1,560 1,850 2,196

Total Assets 20,771 21,663 22,513 22,583 23,696

ST Loans 1,041 906 1,406 2,406 3,406

Payable 369 423 0 405 444

Other Payables 2,446 3,458 3,600 3,757 4,090

Current Portion of LT Loans 362 1,489 1,841 1,200 700

Total Current Liab. 4,217 6,276 7,240 7,767 8,640

Long Term Loans 6,028 5,598 5,162 4,212 4,012

Other LT Liab. 2,399 1,436 1,505 1,696 1,840

Total Liabilities 12,645 13,309 13,908 13,675 14,491

Equity 1,467 1,467 1,467 1,467 1,467

Retained Earnings 4,776 5,043 5,373 5,754 6,130

Minority Interest 1,923 1,844 1,765 1,686 1,608

Total SHE + Minority Int. 8,166 8,354 8,606 8,908 9,205

Total Liabilities & Equity 20,810 21,663 22,513 22,583 23,696

SMRA IJ Results Note

4

Refer to Important disclosures on the last of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 602 532 593 679 688

Depr. & Amortization 266 323 337 351 365

Changes in Working Capital (728) (1,297) (1,300) (972) (1,442)

Others (803) (223) 1,571 346 338

Cash Flow From Operating (663) (664) 1,200 404 (51)

Capital Expenditure (910) (720) 92 773 484

Others 101 91 132 132 132

Cash Flow From Investing (808) (630) 224 905 616

Loans 954 562 417 (591) 300

Equity 0 0 0 0 0

Dividends (72) (72) (72) (81) (92)

Others 699 (1,676) (630) (505) (541)

Cash Flow From Financing 1,581 (1,186) (286) (1,177) (333)

Changes in Cash 109 (2,481) 1,139 132 232

Financial Ratios

Gross Margin (%) 48.1 45.5 45.4 46.4 45.0

Operating Margin (%) 26.0 23.7 23.2 23.8 22.5

Pre-Tax Margin (%) 16.2 14.2 14.9 15.9 15.4

Net Margin (%) 5.7 6.4 6.9 7.5 7.1

ROA (%) 1.6 1.7 1.8 2.0 2.0

ROE (%) 3.9 4.4 4.8 5.3 5.2

ROIC (%) 3.1 3.2 3.6 3.9 3.9

Acct. Receivables TO (days) 23.2 38.3 41.2 41.2 41.4

Acct. Receivables - Other TO (days) 0.5 0.8 0.8 0.7 1.4

Inventory TO (days) 0.5 0.5 0.4 0.4 0.4

Payable TO (days) 28.1 47.0 46.7 44.4 43.0

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 91.0 95.7 97.7 87.8 88.2

Interest Coverage Ratio (x) 0.5 0.5 0.5 0.4 0.4

Net Gearing (%) 66.0 77.9 81.1 70.1 67.7

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS