New asset accounting features

Fixed asset accounting based on universal journal

After new asset accounting migration, previous year reporting is

possible due to compatibility views.

We have an option of assigning the depreciation is to accounting

principle.

Here we can segregate the accumulated depreciation and depreciation

asset wise, but it is not happening now in classic asset accounting.

Simplified chart of depreciation, only one depreciation area per

valuation is necessary, no delta depreciation areas required for parallel

valuation, but which is happening now in classic asset accounting.

Flexible account determination and no more FI-AA reconciliation is

required.

Posting to different periods possible, but beginning /end of the FY need

to be equal.

New transactions for accounting principle, depreciation area specific

documents.

The beauty of new asset accounting is always systems will posts the

separate documents per each accounting principle, like ledger specific

document in new GL.

Depreciation postings will happen each asset wise.

The traditional asset tables like ANEK, ANEP, ANEA, ANLP & ANLC

now replaced with ACDOCA and ANEK table data will be replaced with BKPF;

we will call ACDOCA as a universal journal table.

In new asset accounting technical clearing account acts as a zero

balance clearing account in new GL and it is a offsetting account.

In new asset accounting after posting the document, the display

document in FB03 contains the special tab of Asset accounting display, once

you click on this document it will give you the accounting principle wise posted

accounting document, here the technical clearing account will acts as a

offsetting account in both the accounting principles.

In AW01N transaction you have hierarchical views for both

accounting principles and we can differentiate the same.

The AFAB depreciation screen modified completely and you

can give the company code range in AFAB screen, accounting

principle specific we can run the depreciation.

In the classic asset account, system won’t allow you to post

any depreciation if you have errors in depreciation run, but now in

new asset accounting, you can exclude the errors and can execute

the depreciation for other assets, like cost estimate for materials in

CK40N.

Former IMG activity reset posted depreciation is obsolete

due to redesign of depreciation run.

AT THE TIME OF POSTING SIMULATE ASSET

ACCOUNTING WILL APPEAR

WE CAN SEE THE DOCUMENT POSTED WITH LEDGER

GROUPWISE

AT DEPRECIATION RUN-WE GET ACCOUNTING

PRINCIPLE-RUN DEPRECIATION ACCOUNTING

PRINCIPLEWISE

NOT GIVEN REPEAT/RESTART/UNPLANNED POSTING

RUN

AT THE TIME OF ASSET TRANSFER WE CAN GIVE

ACCOUNTING PRINCIPLE AND DEPRECIATION AREA. IF

WE DO NOT GIVE SEPARATELY IT TAKES ALL LEDGERS

i.e., LEADING AND NON-LEADING LEDGERS.

AT THE TIME OF ASSET SCRAPPING WE CAN GIVE

ACCOUNTING PRINCIPLE AND DEPRECIATION AREA. IF

WE DO NOT GIVE SEPARATELY IT TAKES ALL LEDGERS

i.e., LEADING AND NON-LEADING LEDGERS.

CAPITAL WORK IN PROGRESS-LINE ITEM

SETTLEMENT-WE HAVE TO SELECT ASSET LINE ITEMS AND

TECHNICAL CLEARING ACCOUNT LINE ITEMS

Financial Accounting (New) -> Asset Accounting (New) ->

General Valuation -> Depreciation Areas -> Define Depreciation

Area for Quantity Update

Quantity updates in real time is possible for depreciation areas

other than 01. This function is especially relevant in case of

collective low-Value assets. Currently the system uses

depreciation area 01 for updating quantities unless we have

configured different depreciation area for the same.

Smoothing is no more relevant (and available) any more

For representing parallel accounting in New asset

accounting, you have two scenario’s as mentioned below.

Using Parallel ledgers: The Ledger approach

Using Additional accounts: The Accounts approach

Ledger approach:

2.

The depreciation areas have equal status. Separate

documents are posted for each accounting principle or

valuation.

3.

For each accounting principle or valuation, the system

posts the correct values in real time. The values that are

posted are full values and not delta values.

4.

For each valuation, there is always just one

depreciation area that posts to the general ledger in real

time and manages APC. For this leading depreciation area,

choose the posting option

Area Posts in Realtime

. This

applies both for the leading valuation and for all parallel

valuations. You can choose which of these depreciation

areas, which post to the general ledger, posts to the leading

ledger.

5.

One or more depreciation areas represent a valuation.

You must assign an accounting principle uniquely to all

depreciation of a valuation. For each valuation, the

accounting principle has to be assigned to a separate ledger

group. The ledgers of these ledger groups are

not

allowed to

overlap.

6.

Differences in values in each accounting principle: You

can enter documents that are valid only for a certain

accounting principle or valuation. To do so, when entering

the business transaction, you can restrict the posting to the

accounting principle or to one or more depreciation areas.

start dates and end dates of the fiscal year variants must be

the same.) If the dates of FY are different then AA MCT need

to be enhanced accordingly.

8.

Within an asset class, it is possible to make a simple

assignment of different G/L accounts (such as, reconciliation

accounts for APC and value adjustments) for each valuation.

9.

If you have defined parallel currencies in new General

Ledger Accounting, and you want to use these currencies in

new Asset Accounting, you are required to create – for the

leading valuation and the parallel valuations – the necessary

depreciation areas for each currency.

10.

Managing quantities: In the standard system,

depreciation area 01 is intended for the quantity update. If

needed, you can specify a different depreciation area for the

quantity update. However, this has to be a depreciation area

that posts to the general ledger. The quantity – if it is to be

managed on the asset – is updated in the asset master

record only when a posting is made to this different

depreciation area.

Different Fiscal Year Variants:

variant is assigned. The system then derives the period from

the posting date. The depreciation, however, is determined

as before using the fiscal year variant of the depreciation

area of the posting.

Accounts Approach:

1.

You represent different valuations on different accounts

within the same general ledger. This means that you have to

create the same set of accounts again for each parallel

valuation.

2.

Separate documents are posted for each accounting

principle or valuation.

3.

For each accounting principle or valuation, the system

posts the correct values in real time. The values that are

posted are always full values and

not

delta values.

4.

For each valuation, there is always just one

depreciation area that posts to the general ledger in real

time and manages APC. The following applies for these

posting depreciation areas:

1.

For the leading valuation, choose the posting

For the parallel valuations, choose the posting option

Area

Prerequisites for new asset accounting:

1.Enterprise Business function activation

EA-FIN is required for FI-AA (new) and

FIN_AA_parallel_val under Enterprise

Business functions.

2.For every additional currency type

defined on the company code a

corresponding depreciation area need to

be set up.

SAVE

5.ASSIGN ACCOUNTING PRINCIPLE TO LEDGER GROUPS

7.copy/delete depreciation areas

Select area 15-select details button

save

8. Assignment of chart of depreciation to company code –error

Transfer apc values-by default for deprn area 35-01 will appear.

Remove 01-then enter

NOTE: THE SAME WAY WE HAVE TO DO FOR TRANSFER

DEPRECIATION VALUES

code-10.specify account determination

12.Define number range interval

14.Define screen layout for asset master data

IN SCREEN LAYOUT WE SPECIFY COST CENTER REQUIRED FOR

ASSET MASTER CREATION.

14.Determine Depreciation areas in the asset class (oayz)

16.CREATION OF GL MASTERS

350001-ASSET SALE ACCOUNT-NON-OPERATING INCOME

350002-PROFIT ON ASSET SALE-NONOPERATING INCOME

450001-LOSS ON ASSET SALE-NONOPERATING EXPENSES

450002-LOSS DUE TO SCRAPPING-NONOPERATING

EXPENSES

400500-DEPRECIATION-OPERATING EXPENSES-COST

ELEMENT CATEGORY 1

17.CREATION OF TECHNICAL CLEARING ACCOUNT

FS00

CREATE 200010-TECHNICAL CLEARING-RECONCILIATION ACCOUNT

FOR ACCOUNT TYPE-ASSETS

COPY A/C 200000 AND CREATE TECHNICAL CLEARING ACCOUNT

–AO90

POSTING OF

TRANSACTION-ASSET 1-0 DR

1000000 TECHNICAL CLEARING A/C-200010

TO VENDOR

SAP NOTE:TO ENABLE PARALLEL POSTINGS TO DIFFERENT LEDGERS

SYSTEM USES A TECHNICAL CLEARING ACCOUNT FOR ASSET

ACQUISITIONS. THIS IS REQUIRED FOR A TECHNICAL PURPOSE AND

THE BALANCE OF THIS ACCOUNT IS ALWAYS ZERO AFTER EACH

POSTING. THE TECHNICAL CLEARING ACCOUNT MUST BE A

RECONCILIATION ACCOUNT FOR ASSETS AND IT CAN NOT BE USED

IN ACCOUNT DETERMINATION FOR ASSET ACCOUNTING.

20.specify document type for posting of depreciation

21

.specify intervals and posting rules

22.SPECIFY ACCOUNT ASSIGNMENT TYPES FOR ACCOUNT

ASSIGNMENT OBJECTS

23.SPECIFY ROUNDING OF NET BOOK VALUE AND/OR DEPRECIATION

24.DEPRECIATION KEYS CREATION

25.TO MAKE COST CENTER FIELD OPTIONAL ENTRY FIELD FOR

FIELD STATUS GROUP G067

OBC4

ERROR MESSAGE WHILE POSTING:

RUN PARALLEL

VALUATION-SOLUTION:

26.Migrate Chart of depreciation

SPRO->FINANCIAL >ASSET

ACCOUNTING->MIGRATION ASSET ACCOUNTING (NEW) -> MIGRATION

(CLASSIC) TO NEW ASSET ACCOUNTING-> MIGRATION FOR

NEW ASSET ACCOUNTING-> MIGRATE CHART OF

SELECT UPDATE RUN AND EXECUTE

27.WHEN NEW PACKAGE IS GIVEN IT GIVES AN ERRO

MESSAGE –CHART OF DEPRECIATION 0DE NOT ASSIGNED

TO COMPANY CODE 003.

GO TO ASSIGN CHART OF DEPRECIATION TO COMPANY

CODE

28. ACTIVATE ASSET ACCOUNTING NEW

By default in preparation radio button will be selected.

INDIAN INCOME TAX DEPRECIATION IN SIMPLE

FINANCE-1.ACTIVATE BUSINESS FUNCTION

2.CHECK COUNTRY SPECIFIC SETTINGS

3.COPY REFERENCE CHART OF DEPRECIAN/DEPRECIATION AREAS

EC08

ALREADY COMPLETED

4.ASSIGN CHART OF DEPRECIATION TO COMPANY CODE

OAOB

ALREADY COMPLETED

5.SPECIFY ACCOUNT DETERMINATION

6.CREATE SCREEN LAYOUT RULES

7.DEFINE NUMBER RANGE INTERVAL

8.DEFINE SCREEN LAYOUT FOR ASSET MASTER DATA

ALREADY COMPLETED

9.DEFINE SCREEN LAYOUT FOR ASSET DEPRECIATION AREAS

ALREADY COMPLETED

10.DEFINE ASSET CLASSES

11.SPECIFYING TAB LAYOUT FOR ASSET MASTER RECORD

12.ASSIGN TAB LAYOUTS TO ASSET CLASSES

13.DEFINING DEPRECIATION AREAS

3.INCOME TAX DEPRECIATION CALCULATION REPORT

END USER AREA:

1.MAIN ASSET MASTER CREATION

AS01

1-0

2.MAIN ASSET PURCHASE POSTING

F-90

3.TO VIEW EACH SUB-ASSETWISE YEARWISE VALUES

4.DEPRECIATION RUN

CHANGES

EHP6

SIMPLE FINANCE

ACCOUNTING PRINCIPLE

NOT AVAILABLE

AVAILABLE

REPEAT/RESTART/

UNPLANNED POSTING RUN

AVAILABLE

NOT AVAILABLE

DETAIL LOG/TOTAL LOG

NOT AVAILABLE

AVAILABLE

5.ASSET TRANSFER

ACCOUNTING PRINCIPLE LEVEL

ASSET TRANSFER IN ONE STEP

METHOD-i) DEFINE SCREEN LAYOUT FOR ASSET DEPRECIATION AREAS

AO21

ii)DETERMINE DEPRECIATION AREAS IN THE ASSET CLASS

OAYZ

iii)CREATION OF PROFIT CENTER STEEL1 FOR BANGALORE

SEGMENT

KE51

iv)CREATION OF COST CENTER FOR BANGALORE

KS01

v)ASSET TRANSFER IN ONE STEP METHOD

ABUMN

OTHER CHANGES IN ASSET

ACCOUNTING-OLD CODES

NEW CODES

AB01

AB01L

ABAK

ABAKL

ABST

ABSTL

Different fiscal year variants for leading ledger and

non-leading ledger:

1.Define accounting principle

2.Define non-leading ledger 1 and 2

Leading ledger-apr to march

Non-leading ledger 1-jan to dec

Non-leading ledger 2-apr to march

3) Create a ledger group containing of both non-leading

ledgers: different FY and the one from the step before

marking this as representative

4) Assign this ledger group to the parallel valuated

depreciation area

We are already using new G/L and are on EhP7. Now we

want to activate new asset accounting. Some company

codes use a different fiscal year defined in a non-leading

ledger. To handle this there's a workaround described in

SAP note 2220152:

a) Assign company code to an additional

non-leading-ledger assigned to the same fiscal year variant as the

leading ledger

b) Create a ledger group containing of both non-leading

ledgers: different FY and the one from the step before

marking this as representative

STEPS REQUIRED: sap note no. 2220152

1.Define Accounting principle

X1-indian accounting standards

X2-IFRS

2.Define settings for ledgers and currency types

0L-leading ledger-fiscal year variant v3

X1-non-leading ledger1-fiscal year variant k4-accounting

Principle-x2

X2-non-leading ledger1-fiscal year variant v3-accounting

Principle-x2

3.Define ledger group

For ledger group

x3-Assign

ledgers-X2-select representative ledger check box

X1-deselect non-representative ledger check box

4.Assign accounting principle to ledger groups

Accounting principle ledger group

X1 0L

X2 X3

SAP S/4HANA Finance

Fiscal Year variant in Company

Code have different end

oadb-settings.png

Hi All,

We are in the process of migrating to S/4HANA and got an error while running the

pre-migration check program RASFIN_MIGR_PRECHECK. The error is "Fiscal

Year variant in Company Code XXXX have different end dates". We are using

New GL and have created non-leading ledgers are per local requirements.

The Fiscal year variant (FYV) of the leading ledger does differ from the fiscal year

variant of the non-leading ledgers. Hence we are getting the issue during the

migration check.

We found SAP notes "2220152 - Ledger approach and Asset Accounting (new):

Non-calendar fiscal year variant for parallel valuation" and "844029 - Inconsistent

fiscal year variant with ledgers in the NewGL" which talks about creation of

additional ledgers and ledger groups to resolve the issue.

Our queries are as follows:

1. Is the solution specified under notes 844029 and 2220152 are the only

solutions available or are there are any solution which can be evaluated?

2. Suppose the solution available under the above notes is the only solution, and

we have the current setup

Main ledger: 0L (FYV X1)

Non leading ledger: L1 (FYV Z6)

Ledger Group Z1: L1 and L2 and make L2 as the representative ledger

We assign the new ledger group Z1 under parallel valuation in OADB to the local

depreciation area. Our question is, prior to the change the local depreciation

postings were happening as per the local FYV Z6, since ledger L1 was assigned

to it. After the configuration change the local depreciation postings will happen as

per

which FYV,

since it has now been assigned to the ledger group Z1, where

the representative ledger is L2?

Additional ledger constrain in

New asset accounting for S4

HANA

Hi Friend,

My company is in Hana on cloud and we are planning to go for S/4 HANA Finance ( Simple finance) next year July. For S/4 Hana Finance we have to move to new asset accounting from classic asset accounting. According we have decided to move with the ledger approach with new asset accounting.

My client is a UK based company with legal entities spread across the countries. For legal reporting we follow the April to March reporting period for all company codes but for local reporting we have to abide by country specific tax requirement. For example countries Russia and Mexico the leading ledger(0L) is maintained in April to March fiscal year but for local report Jan to December fiscal year is maintained.

Hence at the time of migration of Chart of depreciation ( one of the step post installation of Simple finance alias SFin 1503 alias S/4 Hana Finance) , system gives a error message start and end end of the leading and non leading ledger is not same. As with new asset accounting there will be real time posting in both the books (i.e leading and non leading ledger) . SAP has recently introduced a note with more clarity on the topic. The SLO service mentioned in the note is a work around to abide by the issue of asset accounting rather can completely solving.

SAP note 2220152 - Ledger approach and Asset Accounting (new): Non-calendar fiscal year variant for parallel valuation

Good to have your view on the same as we are stuck. Regards

Shikha

Tags:

2 replies

Vikash Kumar Tulsyan replied December 01, 2015 at 19:20 PM Hi Shikha,

You can perform the steps outlined in the note 2220152 and issue will be resolved. Unless you have different start and end date between 0L and Non leading ledger you need not have to go with SLO service.

Defined a ledger group and assign a ledger (create a dummy one) which has the same fiscal year variant as leading ledger and add the non leading ledger and assign this ledger group to your parallel depreciation area and issue will be resolved.

Shikha Gupta replied

December 02, 2015 at 11:45 AM Hi Vikash,

The reason we are stopping is because for Russia legal entity we have a different fiscal year in leading and non leading ledger.

Current scenario

To fix we need to create additional ledger Z1 with fiscal year as April to Mar (same as

per leading) and make that as representative ledger and assign in the ledger group

with the old non - leading Ledger

Ledger

This entire configuration needs to be done before the simple finance installation as SAP suggest to populate values in the new Z1 Ledgers before the table structure changes in S/4 Hana Finance.

But the bottleneck is SAP suggests an SLO service which in simple term is Table update is not sure to resolve this. This is a work around for asset accounting to work.

Also the source ledger for Z1 to copy values cannot be Z2 ledger as the fiscal year variant for them is not same neither it cant be 0L Ledger due to local statutory reporting posting made only in non leading ledger. This becomes a stop stopper for S4 Hana Finance.

Regards Shikha

SAP note 2220152 – Ledger approach and Asset Accounting (new): Non-calendar fiscal year variant for parallel valuation

Regards Eugene

like

(0)1.

Abhay ParekhSeptember 19, 2016 at 10:51 am

Thanks for sharing the document… It will help a lot in HANA implementation but one thing i would like that why SAP has not allowed to get LSMW,BDC for ABLDT.. Don’t you think it wierd thing?? D

like

(0)Thanks for encouraging words.

Yes there is no LSMW or BDC for ABLDT which is bit weird. Regards

Eugene

like

(0)Subsequent implementation of an additional ledger

Hello,

We are already using new G/L and are on EhP7. Now we

want to activate new asset accounting. Some company

codes use a different fiscal year defined in a non-leading

ledger. To handle this there's a workaround described in

SAP note 2220152:

a) Assign company code to an additional

non-leading-ledger assigned to the same fiscal year variant as the

leading ledger

b) Create a ledger group containing of both non-leading

ledgers: different FY and the one from the step before

marking this as representative

c) Assign this ledger group to the parallel valuated

depreciation area

STEPS REQUIRED:

The current version of note 2220152 dated Dec 2015

states the following:

"Existing customers must ensure that correct values exist

in the new

representative ledger L2 . In addition, a migration of the

data (with

migration and the absolutely necessary SLO migration

service, see

www.service.sap.com/glmig

."

If we follow this recommendation we face tremendous

challenges for our new asset accounting implementation.

Furthermore we plan at a later point to switch to S/4HANA

which is baed on new asset accounting.

Now, knowing that this ledger assignment (step A above)

is only a techical prerequisite done to enable the config of

New Asset Accounting the data in the additional ledger is

irrelevant and will never be analyzed or used.

Could anybody share some experiences or insights if we

really need to go that route and perform a new G/L

migration with the connected effort, time and cost? What

would happen if we don't do that? I have worked on New

asset accounting last year, implemented this in a sandbox

w/o any migration. The handful asset tests we performed

were alright.

Thanks,

JoachimJoachim Nerreter

January 28, 2016 at 11:35 AM

0 Likes Helpful Answer

by

Sanil Bhandari

Sanil Bhandari

Ajay Maheshwari SAP Trainer

Ajay Maheshwari SAP Trainer

Ajay Maheshwari SAP Trainer

13 replies

Helpful Answer

Sanil Bhandari replied

January 12, 2016 at 17:06 PM

We are in the process of migration to S/4 HANA Finance

1503 edition. We had a similar situation where our leading

ledger had fiscal year from April to March and non leading

ledger had a fiscal year from Jan to Dec or June to July

depending on the geography. We have used a technical

ledger with the same fiscal year as leading ledger to allow

the transactions to go through.

However, local GAAP reporting still remains a challenge

for non leading ledger since the above solution only allows

the transactions to be posted for assets, but if i want to

look at a block of assets for local GAAP the reports do not

work. We are developing a custom report to tide over that.

SAP also has an additional tool, where a dummy company

code is created and data migrated to the dummy company

code for reporting. But you will have to check with the SLO

or LT team within SAP for the same as there is additional

license fee involved.

New Asset Accounting in itself is mandatory for S/4 HANA

Finance and you will have to activate the same during

migration. Given my exp, it is easier to develop based on

ACDOCA rather than Suite on HANA. So unless there is

pressing business requirement for new asset accounting

functionality, you may want to do this as a part of your S/4

HANA Finance Journey.

Thanks & Regards

Sanil Bhandari 0 likes

Joachim Nerreter replied

January 12, 2016 at 18:24 PM

Hello Sanil,

you don't face any issues with that "technical" ledger which you have only to allow postings to go through?

Because this was exactly my question.

However, you recommend not to implement New Asset Accounting at this point of time but rather at the same time the migration to S/4HANA takes place. I would have expected that the S/4HANA Finance (formerly known as Simple Finance) would be easier if New Asset accounting is already in place. Initially we planned to go-live with S/4HANA Finance in one step: SoH, new asset accounting and activation of Simple Finance. We found that transfer prices are not supported as of now and reduced the scope to SoH. The idea would be to further minimize the risk and effort by decoupling New Asset accounting activation and the Simple Finance add-on activation. Any comments on that? You wrote: "However, local GAAP reporting still remains a challenge for non leading ledger since the above solution only allows the transactions to be posted for assets, but if i want to look at a block of assets for local GAAP the reports do not work. We are

developing a custom report to tide over that."

Can you explain that and let me know what you mean? I don't fully understand. Thank you,

Joachim 0 likes

Helpful Answer

Sanil Bhandari replied

January 13, 2016 at 10:13 AM

Hi

We have 240+ Company Codes with almost 100+ Company codes having this issue. We have not faced any technical issues yet and we are in Integration testing 3 phase of the S/4 HANA Finance Project.

I believe the New Asset Accounting should be activated with S/4 HANA Finance transformation since there are fundamental changes on the accounting itself for assets and it is easier to go in for this kind of changes in terms of user adoption and changes. Secondly, my suggested change of a technical ledger works in New GL, however, standard Asset Reports still report based on the fiscal year of leading ledger. In our case the leading ledger is from April to March and multiple markets have fiscal years from June -July or Jan -Dec. So in such a case, we are developing a custom report and such a report works much more easily on ACDOCA rather than on the new GL Tables. So unless it is a very pressing business requirement which is addressed by New Asset Accounting, I would rather prefer to go as a one step for New Asset Accounting plus S/4 HANA Finance.

Hope that answers your questions. Regards

Joachim Nerreter replied

January 13, 2016 at 11:51 AM

Hello Sanil,

Wow, a huge number of company codes, is this in a single instance? We have > 150 company codes within one instance/SAP system. A few of them need this "technical" ledger because they are using different FY. Some already use different FY. I can cinform what you are saying as this is not new to us: the asset reports are always based on the FY of the company, no matter what depreciation area you use - with same of different FY. I take it that's no issue for accountants since they live with that w/o complaining. I understand that you are still implementing S/4 HANA Finance so you haven't seen the "technical" ledger in a live system - and can tell if that's an issue or not. Correct? I opened a message to SAP to ask if the migration scenarion is really necessary... Thanks,

Joachim 0 likes

Joachim Nerreter replied

January 19, 2016 at 09:06 AM

Hello Sanil,

I'm coming back to the question if an additional ledger causes issues when not migrated properly with General Ledger migration scenario 7.

I opened an incident to SAP raising this questions. The answer that I received said that SAP itself can't give an comprehensive answer. Issues would arise after the assignment of additional ledgers: while reversing or clearing documents that have been posted before the assignment. In addition currency calculation could be an issue. We're free to test this and maybe we can live with that.

However, I tested this: assigned an additional ledger, reversed and cleared documents w/o any issue.

Additionally I've seen that in the config where you add additional ledgers a pop-up appears asking whether the company is productive and telling that you then need to use General Ledger migration Services.

Ajay Maheshwari SAP Trainer replied

January 19, 2016 at 10:28 AM

Hi Joachim

I know this approach works, but cant recommend that..

With our limited knowledge about the system design, we can foresee upto some extent. If something goes adverse, SAP wont support you. So, that's the only flip side

If you wanna go ahead, I would suggest also do YE Close activities, GL Balance C/F on Ledgers, etc. test everything that you would do in the live system

I align with Sanil that it is better to activate New AA in Simple Finance.. Because AA in SFIN has further changed over and above EhP7... So, no point in doing it twice

Regards Ajay M

0 likes

Joachim Nerreter replied

January 19, 2016 at 12:21 PM

Hi Ajay,

So you are saying adding the subsequent ledger w/o G/L migration works. The down side is that if an issue arises SAP wouldn't be forthcoming in the support. That makes sense seeing the hint in the note and in the config. So either test it soundly and take the risk or use the SAP G/L migration scenario 7. The latter would be the safest I take it. I haven't done a G/L migration service project yet. Do you have any idea what the cost might be (100$, 1000$ or 10000$, or more). The impact of adding a subsequent ledger isn't that high, it's not a complete new G/L implementation.

Any experience with G/L migration service?

Ok, I understand Sanil's and your point regarding the timing with S/4HANA being on the horizon.

Ajay Maheshwari SAP Trainer replied

January 19, 2016 at 12:26 PM

Hi Joachim

No idea about the cost involved.. But this scenario should be an easier one

Fyi.. I read one SAP note long back, which offers a correction program.. That program basically populates a ledger with the historical data, by deleting the present transaction data

Though SAP says it must be used only for correction purpose, am not sure if it can work for you.. Again it is a Q of taking risk

Regards Ajay M 0 likes

Joachim Nerreter replied

January 19, 2016 at 12:45 PM

Thank you Ajay for your help. You don't happen to know the number of this note? 0 likes

Helpful Answer

Ajay Maheshwari SAP Trainer replied

January 19, 2016 at 12:58 PM

Hi Joachim

Am a lazy guy, but you made me search finally Program: FAGL_DELETE_RELOAD_LEDGERS

However, note 1340411 - EURO: FAGL_DELETE_RELOAD_LEDGERS, says this must be used only for Currency Conversion cases and not as a utility to correct corrupt docs Rgds

Ajay M 0 likes

Joachim Nerreter replied

January 21, 2016 at 09:26 AM

Thanks, Ajay.

Regarding my original question I got a reply from NewGLMigration@sap.com.

They told me at length that SAP strongly recommends to use the G/L migration service to add the and populate consistently the additional ledger. Also in order not to jeopardize the support and warranty. Costs are from 10,000 to 30,000 Euro based on the migration scenario used. Scenario 7 would be in the lower region. The migration date would be the start of our next fiscal year (July 1).

Any thoughts? Thanks, Joachim

0 likes

Ajay Maheshwari SAP Trainer replied

January 21, 2016 at 09:43 AM

Hi Joachim

I think you can club both. They are not mutually exclusive

but since you have access to SAP New GL Migration team, better to ask them Br, Ajay M

0 likes

Aleksey Tkachenko replied

January 28, 2016 at 11:35 AM

Hi,

I wouldn't recommend to perform 2 these project in parallel. 0 likes

S4HANA Finance: New Asset Accounting – Simplified.

S/4 HANA- New Asset Accounting – Considering Key Aspects

This blog is focused on New Asset accounting for ledger approach in

multiple currency environment. New Asset Accounting is the only

Asset Accounting solution available in S/4 HANA, classic Asset

Accounting is not available any more.

I have covered following key topics within S/4 HANA New Asset

Accounting keeping in view various questions coming in from

different customers/partners on this key innovation step taken

within Finance as part of S/4 HANA simplification and we need to

be very clear on this new requirement before starting the new or

conversion S/4 HANA project.

1. Pre-requisite Business Functions

2. Data Structure Changes in Asset Accounting

3. New FI-AA-Integration with the Universal Journal Entry

4. Asset Accounting Parallel Valuation

5. Key Configuration Consideration in Ledger Approach

6. Why will use a technical clearing GL account

7. New Asset Accounting Posting Logic

8. FI-AA Legacy Data Transfer

9. Adjusting chart of Depreciation Prior to Conversion

10. Installing SFIN in Conversion/Migration Scenario

1. Pre-requisite Business Functions

Activate the following Business Functions

ENTERPRISE_EXTENSIONS – EA-FIN

ENTERPRISE_BUSINESS_FUNCTIONS – FIN_AA_PARALLEL_VAL

2. Data Structure Changes in Asset Accounting

Actual data of ANEK, ANEP, ANEA, ANLP, ANLC is now stored in table

ACDOCA. ANEK data is stored in BKPF.

Compatibility views FAAV_<TABLENAME> (for example, FAAV_ANEK)

are provided in order to reproduce the old structures.

Statistical data (for example, for tax purposes) previously stored in

ANEP, ANEA, ANLP, ANLC is now stored in table FAAT_DOC_IT

Plan data previously stored in ANLP and ANLC is now stored in

FAAT_PLAN_VALUES

Classic Asset Accounting is mostly transformed automatically into the

New Asset Accounting by executing mandatory migration steps related

to Asset Accounting.

Posting to different periods possible (restriction: beginning/end of FY

needs to be equal) refer OSS note 1951069/ 2220152

3. New FI-AA-Integration with the Universal Journal Entry

Asset Accounting is based on the universal journal entry. This means there is no longer any redundant data store, General Ledger Accounting and Asset Accounting are reconciled Key changes are listed below: –

There is no separate balance carry forward needed in asset

accounting, the general balance carry forward transaction of FI

(FAGLGVTR) transfers asset accounting balances by default.

The program Fixed Assets-Fiscal Year Change (RAJAWE00)

transaction AJRW is no longer has to be performed at fiscal year

change

Planned values are available in real time. Changes to master data and

transaction data are constantly included

The most current planned depreciation values will be calculated

automatically for the new year after performing the balance carry

forward. The depreciation run posts the pre-calculated planned values.

The Selection screen is simplified as the “reasons for posting run”

(planned depreciation run, repeat, restart, unplanned posting run) are

no longer relevant.

Errors with individual assets do not necessarily need to be corrected

before period-end closing; period-end closing can still be performed.

You have to make sure that all assets are corrected by the end of the

year only so that depreciation can be posted completely.

All APC changes in Asset Accounting are posted to the general ledger

in real time. Periodical APC postings are therefore no longer supported.

Transaction types with restriction to depreciation areas are removed in

new Asset Accounting and you can set the obsolete indicator in the

definition of the transaction that were restricted to depreciation areas in

the classic asset accounting.

4. Asset Accounting Parallel Valuation

Very Important part of new Asset accounting is parallel valuation in

multicurrency environment.

The leading valuation can be recorded in any depreciation area. It is no

longer necessary to use depreciation area 01 for this. The system now

posts both the actual values of the leading valuation and the values of

parallel valuation in real time. This means the posting of delta values

has been replaced; as a result, the delta depreciation areas are no

longer required.

5. Key Configuration Consideration in Ledger Approach

We need to answer some basic question before configuring new asset accounting in S4 Hana environment as this would determine the required minimum depreciation areas to align the FI with Asset Accounting. i.e.

Required Valuation Approach

How Many Ledgers (Leading + Non Leading) exists or to be

configured.

What all currencies are used in each of the ledgers.

For

Example:-In this Example we have one com code which has 2 ledgers 0L & N1 & these 2 ledgers having 3 currencies i.e 10,30 & 40 as shown below.

Above mapping is to ensure and establish link between depreciation area/accounting principal and Currency

Explaining with ledger approach example. From release 1503 i.e initial version of SAP Finance add on version in S4 Hana a new table ACDOCA is introduced which stores the asset values also per ledger /per currency on real time basis & no need to have any reconciliation between Finance and Asset accounting and to do so it is must to follow the guidelines while setting up depreciation areas & respective currencies, which I have tried to explain with an example as given below: –

Ledger & currency setting has to be done in New GL in the following

SPRO node.

Financial Accounting (New)–> Financial Accounting Global Settings (New)–> Ledgers–> Ledger –> Define Settings for Ledgers and Currency Types

Define Depreciation Areas

Specify Depreciation Area Type

Specify Transfer of APC Values

Specify Transfer of Depreciation Terms

In this activity, you specify how the depreciation terms for a depreciation area are adopted from another depreciation area. You can specify if the adoption of values is optional or mandatory. If you specify an optional transfer, then you can change the proposed depreciation terms in the dependent areas in the asset master record. In the case of a mandatory transfer, you cannot maintain any depreciation terms in the asset master record. In this way, you can ensure that depreciation is uniform in certain depreciation areas.

Define Depreciation Areas for Foreign Currencies

For every additional currency type defined on the company code a corresponding depreciation area needs to be set up.

depreciation area ( Here leading valuation depreciation area will derive currency from com code currency)

Specify the Use of Parallel Currencies

Here we need to specify the Currency type for each for the Depreciation area which will align FI Currency type with Asset Depreciation areas & accordingly will be updated in ACDOCA.

With this setting its ensured that all currency types are aligned with respective

depreciation area and asset values are getting updated parallel to Financial accounting per currency.

6. Why will use a technical clearing GL account

Architecture has been changed in the way that we now post in asset accounting for each valuation a separate document. So we perform on the asset part accounting principle specific postings. Technically we perform ledger-groups specific postings.

On the operational part (accounts receivable, accounts payable) the value is always the same for each accounting principle. So for the operational part we have to perform postings which are valid for all accounting principles. Technically we perform postings without specifying the ledger-group.

To split the business process in an operational and a valuating document there was a need to establish the “technical clearing account” for integrated asset acquisition.

For each valuating part (asset posting with capitalization of the asset), the system generates a separate document that is valid only for the given accounting

principle. This document is also posted against the technical clearing account for integrated asset acquisitions. From a technical perspective, the system generates ledger-group-specific documents.

Define account “Technical clearing account” for integrated asset

acquisition.

Specify Alternative Document Type for Accounting Principle-Specific

Documents

Here Operational document type will have original document used during entry & while generating accounting principal wise separate document it would be document type AA.

7. New Asset Accounting Posting Logic

The Operational Entry Document posts to a technical clearing account. The Operational Entry Document does not update the asset values; the asset data is only used to perform checks.

Asset Acquisitions Operational Document

Asset Acquisitions Accounting Principal (LOCA) specific Document

Universal Table updated with respective ledger (0L & N1) and

currencies.

Correction Asset Acquisition value in specific GAAP

Use Transaction code AB01L

8. FI-AA Legacy Data Transfer

You post the transfer values using transaction ABLDT; in doing so, a

universal journal entry is posted for the fixed asset.

If wrong transfer values were posted, you must reverse the journal

entry and then recreate it.

You can use transaction AS92 to change master data; transaction

AS93 to display master data; and transaction AS94 to create sub

numbers for the Asset master record.

Time of Legacy Asset Transfer

The transfer date is the cut-off date for the transfer of legacy data. The transfer will only include data up to this point in time. There are two possible scenarios.

The transfer date can be the end of the last closed fiscal year.

The transfer date can be in the fiscal year. This is called

“transfer during the fiscal year.

Scenario 1: Transfer Date is the End of the Last Closed Fiscal Year:

In this case, you do not need to include any posted depreciation or transactions in the transfer of legacy data. You only need to transfer master data and the cumulative values as of the end of the last closed fiscal year.

Scenario 2: Transfer During the Fiscal Year

Along with the general master data, and the cumulative values from the start of the fiscal year (time period A), you must also transfer the following values.

Depreciation during the transfer year and Transactions during the

transfer year

Include the depreciation posted in the legacy system since the end of

the last closed fiscal year up to the date of transfer (time period B).

Any asset transactions in your legacy system that have a value date

after the transfer date, but before the date of the physical transfer of

data (time period C), need to be posted separately in the Asset

Accounting component in any case.

year:-Case: Legacy asset is acquired in previous year 01.01.2015 and taken over into simple finance system in mid-year of current year (30.04.2017)

Specify Transfer Date/Last Closed Fiscal Year (V_T093C_08)

Specify Last Period Posted in Prv. System (Transf. During FY)

(OAYC)

Step 2:- ABLDT to update Legacy Original Acquisition Value/

Accumulated Depreciation and current year Depreciation

Posted.

Step 4: Verify Legacy posted Value

9. Adjusting Chart of Depreciation prior to Conversion

For the leading valuation of the ledger approach and accounts

approach and for parallel valuations of the ledger approach its must

that the parallel currencies in the leading ledger in General Ledger

Accounting and in the depreciation areas in Asset Accounting must be

the same as explained one example above with ledger approach

scenario.

Using the migration program available under Migration Tools, you can

automatically adjust the parameters in your charts of depreciation. If

error messages appear stating that automatic adjustment is not

possible, you have to adjust the charts of depreciation manually.

If until now you have been using parallel currencies in General Ledger

Accounting, but you have not implemented the corresponding parallel

currency areas in Asset Accounting for all depreciation areas, you must

implement these areas in a separate project before you install SAP

Simple Finance. In such a project, you must first perform the

preparatory steps for creating depreciation areas in Customizing; you

must then determine the new values for each fixed asset for a newly

created depreciation area.

For company codes that are assigned to the same chart of

depreciation, these company codes are not allowed to differ in number

and type from the parallel currencies used in General Ledger

Accounting.

Even if you migrate to SAP Accounting powered by SAP HANA from a

system (e.g. EHP7) having FI-AA (new) already active, you still must

migrate every active chart of depreciation.

10. Installing SFIN in Conversion/Migration Scenario

complete period-end closing directly before you install SAP Simple Finance and some of the important point you must consider w.r.t New Asset Accounting. (for detail you may refer conversion guide)

To check if the prerequisites outlined are met, you have to check using

the program for preliminary checks RASFIN_MIGR_PRECHECK. You

import the current version of this program using SAP Note 1939592,

before you install SAP Simple Finance in your system. Perform this

check in all of your systems – in the Customizing system as well as in

the downstream systems (test system and production system).

If until now you updated transactions in parallel valuations with different

fiscal year variants and want to continue using this update, then you

must implement a new representative ledger using the SAP General

Ledger Migration Service before you install SAP Simple Finance. For

more information about alternative fiscal year variants with parallel

valuation, see SAP Note 2220152 Information published on SAP site.

You must have performed periodic APC posting (RAPERB2000)

completely; the timestamp must be current.

Execute the periodic depreciation posting run (RAPOST2000).

Run the program for recalculating depreciation (transaction AFAR).

Reconcile your general ledger with the Asset Accounting subsidiary

ledger, both for your leading valuation and for parallel valuations.

The migration must take place at a time when only one fiscal year is

open in Asset Accounting.

You can check which fiscal year is closed in your company code in

Customizing for Asset Accounting (New) under Preparations for Going

Live à Tools à Reset Year-End Closing.

Ensure that no further postings are made in your system after running

period end transactions before installing S4 Hana Simple Finance

hence lock the users.

Perform a backup before installing SFIN

As soon as you have installed SAP Simple Finance, you can no longer

post in Asset Accounting. To ensure that migration is successful, it is

essential that you make sure that the prerequisites are met and a

complete period-end closing was performed before you install SAP

Simple Finance. Posting for new Asset Accounting is only possible

again after you have completed the migration fully and successfully.

After completing the migration, make sure that no fiscal year that is

before the migration is reopened in Asset Accounting.

Thanks a lot

Ajeet Agarwal

venkatakasi Reddy Polu Aug 24, 2016 9:36 AM

Hello Ravi,

Regards Kasi Reddy

Like (0)

o

Ravi Chirivella Aug 24, 2016 9:58 AM (in response to venkatakasi Reddy Polu)

Hi kasi,

As per the current system settings

once you select the check box

Smoothing, In one financial year

system will distributes the delta

depreciation value to other open

periods equally, other wise, the

whole delta value will post in the

immediate period, but in New asset

accounting this change is

incorporated in the coding level so

that, the setting is obsolete.

Regards,

RaviLike (1)

venkatakasi Reddy Polu Aug 25, 2016 6:19 PM

Hello Ravi,

In Simple Finance Can we use different

Fiscal Year Variants for Different

Accounting Principles and Ledgers?

Regards Kasi Reddy Like (0)

o

Hello,

find some hint in SAP help

I have marked relevant text, see screenshot.

br erwin

Link SAP Help: FI-AA

New Asset Accounting: Ledger Approach and Accounts Approach - SAP Simple Finance Add-On for SAP Business Suite powered b…

Like (1)

venkatakasi Reddy Polu Aug 26, 2016 12:00 PM (in response to Erwin Leitner)

thank u Erwin for ur information. Like (0)

o

venkatakasi Reddy Polu Aug 26, 2016 12:01 PM (in response to venkatakasi Reddy Polu)

ACCOUNTS APPROACH VS LEDGER APPROACH:

Difference between Ledger and Accounts Approach in

SFIN

I would like to understand the difference between Ledger

Approach and Accounts Approach in SFIN. where i can

see which approach they are using in our current system

.is there any configuration steps are involved.

if possible could you brief us with certain examples or

Business scenarios where we can use different

approaches.

Aleksey Tkachenko

Aug 8, 2016 4:29 PM

(in response to

Lal Maheswararao Dara)

Hi, first of all you can check in IMG Financial Accounting

Financial Accounting Global Settings

(New)-Ledger-Define Settings for Journal Entry Ledger. you can

choose/assign which approach do you use wise

combination Ledger/Company code... But this config more

'informal' then required.

How posting flow to FI you need to check automatic

postings config, e.g. in FI-AA AO90, config for FAGL_FCV

and so on.

Accounting Global Settings (New)-Ledgers-Parallel

Accounting

o

Al

How to Set Up Parallel Asset

Accounting in SAP S/4HANA

Finance with Differing Fiscal Year

Variants

Posted on10/07/2017

by Ajay Maheshwari,

SAP FI/CO and SAP S/4HANA Solution Architect Kavita Agarwal,

SAP FI/CO and SAP S/4HANA Solution Architect

February 02, 2017

Learn how to set up the new Asset Accounting

functionality (FI-AA) in SAP S/4HANA Finance in a

parallel reporting scenario with differing fiscal year

variants.

Learning Objectives

Reading this article, you will learn:

How the real-time integration between General

Ledger Accounting (FI-GL) and Asset Accounting

(FI-AA) in SAP S/4HANA forces a different kind of

setup for the ledgers

Key Concept

The unified data model and real-time

integration between General Ledger Accounting (FI-GL)

and Asset Accounting (FI-AA) force the fiscal year variants

from the leading and non-leading ledgers onto the

depreciation areas.

Accounting (FI-AA). It offers many benefits to users,

especially the real-time reconciled ledgers (the

main ledger and asset sub-ledger).

However, the new features of SAP S/4HANA

Finance also significantly change how the new

FI-AA module must be set up in a parallel reporting

scenario (for example, local reporting and group

reporting, where the local company and parent

companies follow different reporting periods).

Consider a scenario that represents a practical

real-life scenario for many organizations. ABC Inc.

USA follows International Financial Reporting

Standards (IFRS) reporting standards and Jan-Dec

as the fiscal reporting period. It has a subsidiary

company in India (represented by company code

9999 in our example) that has to follow Apr-Mar as

the fiscal reporting period to comply with local

laws. As such, company code 9999 follows parallel

accounting in SAP S/4HANA Finance, using a ledger

approach.

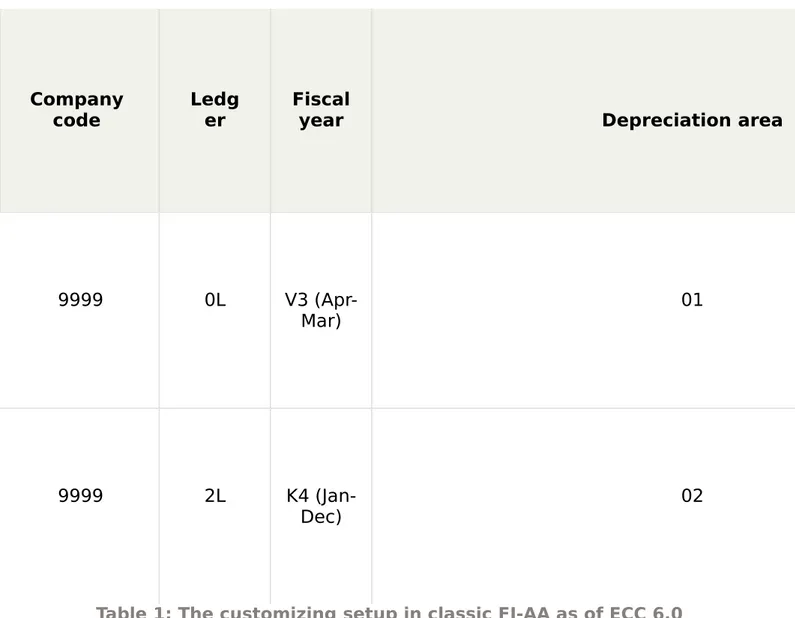

Setting Up the Scenario in Classic FI-AA as of ECC

6.0

Company

code

Ledg

er

Fiscal

year

Depreciation area

9999

0L

V3

(Apr-Mar)

01

9999

2L

K4

(Jan-Dec)

02

Table 1: The customizing setup in classic FI-AA as of ECC 6.0

In our scenario, you would assign the leading ledger (0L)

and a non-leading ledger (2L), with fiscal year variants as

V3 and K4, respectively, to the company code 9999. (The

steps for this configuration in ECC are not part of the

scope of this article). Using the ledger 0L, company code

9999 would be reporting as per local laws (i.e., Apr-Mar)

and with the ledger 2L, it would report as per the group

reporting norms (i.e., Jan-Dec).

The leading ledger 0L is assigned to the Depreciation Area

01 and the non-leading ledger 2L is assigned to the

start and end date must be same for all depreciation areas

in asset accounting.

Asset Accounting (New) in S4 HANA

Finance

New Asset accounting is available in ECC6.0 EHP7 (optional)

and S4 HANA Finance (Mandatory)

In New asset accounting, you can handle parallel accounting

using depreciation areas.

For representing parallel accounting in New asset

accounting, you have two scenario’s as mentioned below.

Using Parallel ledgers: The Ledger approach

Using Additional accounts: The Accounts approach

Ledger approach:

11.

Different accounting principles or valuation are mapped

in separate ledgers, as in new General ledger accounting. In

general, the same accounts are used in the ledgers.

13.

For each accounting principle or valuation, the system

posts the correct values in real time. The values that are

posted are full values and not delta values.

14.

For each valuation, there is always just one

depreciation area that posts to the general ledger in real

time and manages APC. For this leading depreciation area,

choose the posting option

Area Posts in Realtime

. This

applies both for the leading valuation and for all parallel

valuations. You can choose which of these depreciation

areas, which post to the general ledger, posts to the leading

ledger.

15.

One or more depreciation areas represent a valuation.

You must assign an accounting principle uniquely to all

depreciation of a valuation. For each valuation, the

accounting principle has to be assigned to a separate ledger

group. The ledgers of these ledger groups are

not

allowed to

overlap.

16.

Differences in values in each accounting principle: You

can enter documents that are valid only for a certain

accounting principle or valuation. To do so, when entering

the business transaction, you can restrict the posting to the

accounting principle or to one or more depreciation areas.

18.

Within an asset class, it is possible to make a simple

assignment of different G/L accounts (such as, reconciliation

accounts for APC and value adjustments) for each valuation.

19.

If you have defined parallel currencies in new General

Ledger Accounting, and you want to use these currencies in

new Asset Accounting, you are required to create – for the

leading valuation and the parallel valuations – the necessary

depreciation areas for each currency.

20.

Managing quantities: In the standard system,

depreciation area 01 is intended for the quantity update. If

needed, you can specify a different depreciation area for the

quantity update. However, this has to be a depreciation area

that posts to the general ledger. The quantity – if it is to be

managed on the asset – is updated in the asset master

record only when a posting is made to this different

depreciation area.

Different Fiscal Year Variants:

as before using the fiscal year variant of the depreciation

area of the posting.

Accounts Approach:

5.

You represent different valuations on different accounts

within the same general ledger. This means that you have to

create the same set of accounts again for each parallel

valuation.

6.

Separate documents are posted for each accounting

principle or valuation.

7.

For each accounting principle or valuation, the system

posts the correct values in real time. The values that are

posted are always full values and

not

delta values.

8.

For each valuation, there is always just one

depreciation area that posts to the general ledger in real

time and manages APC. The following applies for these

posting depreciation areas:

1.

For the leading valuation, choose the posting

option

Area Posts in Realtime

.

2.

For the parallel valuations, choose the posting

option

Area Posts APC Immediately, Depreciation

Periodically

.

You can choose which of these depreciation areas that post

to the general ledger represent the leading valuation.

receive the posting option

Area Posts in Realtime

for the

leading valuation or

Area Posts APC Immediately,

Depreciation

Per

iodically

for parallel valuations.

2.

One or more depreciation areas represent a valuation.

You must assign an accounting principle uniquely to all

depreciation areas of a valuation. For each valuation, the

accounting principle has to be assigned to a separate ledger

group. These ledger groups must

always

contain the leading

ledger as the representative ledger.

3.

If you have defined parallel currencies in new General

Ledger Accounting, and you want to use these currencies in

new Asset Accounting, you are required to create a

depreciation area for each currency for the leading

valuation. However, this is not mandatory for the parallel

valuations.

4.

Differences in values in each accounting principle: You

can enter documents that are valid only for a certain

In New asset accounting, you can handle parallel

accounting using depreciation areas.

For representing parallel accounting in New asset

accounting, you have two scenario’s as mentioned below.

Using Parallel ledgers: The Ledger approach