Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

73

THE IMPACT OF POLITICAL EVENT ON EXCHANGE RATE VOLATILITY

(Study at Bloomberg on January-December 2016)

Ratna Sari Supriyanti Siti Ragil Handayani Faculty of Administrative Science

Brawijaya University Malang

Email: sari.supriyanti@gmail.com

ABSTRAK

Penelitian ini bertujuan untuk menganalisis dampak kejadian politik terhadap volatilitas nilai tukar. Penelitian ini menggunakan pendekatan kuantitatif dan metodologi event study untuk menganalisis efek dari British Exit terhadap nilai tukar Poundsterling (GBP) terhadap US Dollar dan US Dollar terhadap Rupiah. ARCH-GARCH model digunakan dalam penelitian ini untuk mengeksplor volatilitas nilai tukar. Sampel yang digunakan dalam penelitian ini adalah harga penutupan nilai tukar dan berjumlah 101 data. Hasil penelitian ini menjelaskan bahwa: 1) Uji Wilcoxon pada Poundsterling (GBP) terhadap US Dollar menujukkan adanya perbedaan sebelum dan sesudah kejadian British Exit; 2) Uji Wilcoxon pada US Dollar terhadap Rupiah menunjukkan bahwa ada perbedaan yang terjadi sebelum dan sesudah kejadian British Exit; 3) Analisis pada nilai tukar Poundsterling (GBP) terhadap US Dollar menggunakan ARCH-GARCH model menunjukkan adanya volatilitas yang terjadi di sekitar waktu observasi, begitu juga dengan Analisis pada nilai tukar US Dollar terhadap Rupiah menunjukkan adanya volatilitas yang terjadi di sekitar waktu observasi; 4) Hasil dari evaluasi ARCH-GARCH model menggunakan ARCH-LM pada Poundsterling (GBP) terhadap US Dollar dan US Dollar terhadap Rupiah menunjukkan bahwa ARCH-GARCH model dapat mengatasi unsur heteroskedastisity pada sampel yang diteliti. Hasil penelitian menunjukkan bahwa efek volatilitas dapat terjadi dikarenakan faktor non ekonomi yang mempengaruhi, terutama faktor politik.

Kata Kunci: Kejadian Politik, Nilai Tukar, Event Study, ARCH-GARCH Model

ABSTRACT

The purpose of this study is to analyze the effect of political event on exchange rate volatility. This study uses quantitative approach and event study methodology to analyze the effect of British Exit on PoundSterling (GBP) against US Dollar and US Dollar against Rupiah. ARCH-GARCH model is also used in this research to explore the volatility of exchange rate. Sample in this study are 101 data from exchange rate closing price. The results as follows: 1) Wilcoxon test in PoundSterling (GBP) against US Dollar shows the difference before and after British Exit event; 2) Wilcoxon test on US Dollar against Rupiah shows that there is a difference before and after British Exit event; 3) Analysis of PoundSterling (GBP) against US Dollar using ARCH-GARCH model indicates volatility occurs around the observation time, so are Analysis on US Dollar against Rupiah using ARCH-GARCH model shows volatility around the observation time; 4) Results from ARCH-GARCH evaluation model using ARCH-LM in PoundSterling (GBP) against US Dollar and US Dollar against Rupiah indicates that ARCH-GARCH the model could overcome the element of heteroscedastisity in the data studied. The results show that effects of volatility that could be happened due to non-economic factors especially political factors.

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

74

INTRODUCTION

The investor and also firms who need to exchange their currency with other currencies could do the activity in foreign exchange market. Foreign exchange market is global decentralized market for the trading of currencies against one other currency and it is the largest financial market in the world in terms of both geographical dispersion and daily turnover, which is in excess of $5 trillion (Bank for International Settlements, 2013). More than trillion dollars of currency is traded each day in the foreign exchange market, primarily through a network of the largest international banks.

Exchange rate is also one of macroeconomic indicators that sensitive on external turmoil condition. In this case, exchange rate reflects the economic power as a result of economic global condition. Among the instruments that are crucial in economic management and stability of basic prices is the exchange rate (Were, Geda, Karingi & Ndung’u, 2001). The more stable exchange rate value, the more it shows that fundamental strength of countrie’s economic. The movement of exchange rate is depends on purchasing power of exchange rate under the influences of demand and supply of market. The supply and demand is affected by several factors. The factors affecting exchange rate and its volatility are divided into two groups that are economic and non-economic factors.

Based on Twarowska and Kąkol (2014), economic factor consist of rate of economic growth, inflation rate, interest rate in the country and abroad, and etc. Non-economic factors consist of political risk (e.g. risk of armed conflict), natural disasters, policy approaches and psychological factors. During the last decades, a range of studies has emphasized the way in which the economic and political news and event that tend to be a political risk affecting the currency market. There are many studies that examine the way in which the elective systems, the elections, the political alliance and the political incertitude affect both the evolution and the volatility of capital market and of exchange rate market. The political events influence the assets price in different ways. In some cases, these significantly influence the financial markets, and on the other hand, the markets sometimes react calmly to political changes.

In this research is focusing on variable of political risk and its relation with the exchange rate movement. The political risk is an important factor, especially in emergent economies and in

the developing ones. Howell and Chaddick (1994) define the political risk as being “the possibility of the political decisions and political events from a country, including the social ones, to affect the business environment, so that the investors recall the investments or the profit leeway reduces”.

Several previous researches did a research in exchange rate volatility caused by political news and also events. According to Schwidht (2014) a coup or riot would give depreciate effect on Bolivar currencies because the event is resulting on political instability would create a climate of fear that would push domestic investors to unload Bolívares and hold onto Dollars which are more secure, and would lessen foreign demand for the Bolívar.

In this research, British Exit event was used as variable that affect exchange rate. British Exit event is recent event that happened as a result of United Kingdom society who wants to exit from European Union. This event not only shocked at the level of Europe, but also the worldwide. On 23th June 2016 British was exit from European

Union (EU).

The consequences of British Exit occurs in many areas like Economic and also political and social. The Economic consequences for United Kingdom happened in several areas like Trade, United Kingdom GDP growth, Inflation, and also Exchange Rate. The volatility of exchange rate also reported in Euro Exchange Rate News: “British Exit has already made a clear impact upon PoundSterling, with the GBP/EUR exchange rate falling -6% in the first eight weeks of 2016, while GBP/USD has dropped -4.5% over the same period. There is still a long way to fall, according to Bank of America Merrill Lynch (BaML), which believes Pound Sterling is still overvalued by around 3%. ‘Our valuation suggests that Sterling is overvalued and, in an extreme scenario where capital inflows temporarily slow in the run-up to the referendum, it could face large declines.”

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

75 condition of Indonesia. Governor of Bank

Indonesia, Agus Maragainstojo said that it was normal for the exchange rate volatility happened and it was temporary. Although Rupiah is not liquid as US Dollar, but the effect of US Dollar appreciate against Poundsterling (GBP) give impact on Rupiah because the investor tend to choose US Dollar as safest asset besides gold and yen, moreover in unstable economic and political situation

Within this research, the relationship between effects of political event towards exchange rate volatility is measured. This research using two research instruments that are autoregressive conditional heteroskedasticity (ARCH)/general autoregressive conditional heteroskedasticity (GARCH) models to explore the volatility effect of the British exit event and the paired test to study the level impact of British Exit. The observation period of this research is fifty days before and after British Exit which is 5 workdays start from April 14th until September 1th 2016. Based on background above, the title of this research is “The Effect of Political Event on Exchange Rate Volatility (Study at Bloomberg January-December 2016)”.

LITERATURE REVIEW Exchange Rate

a. Foreign Exchange Rate

Exchange rate indicates the price of currency when exchanged with other currencies. Foreign exchange rate is to measure the value a currency from the perspective of other currencies (Madura, 2000: 86).

b. Volatility of Exchange Rate

Volatility is a statistic measurement to measure the price movement at certain period. The measurement shows decreasing and increasing prices in short period but do not shows the level of prices except the variance level form one period to another period. High volatility reflects the uncommon demand and supply. In general, volatility measures the fluctuation average from time series data. However, the further research develops by emphasizing the variance value of the data. So it means that volatility variance as value of fluctuation data (Sunaryo: 2007 as citied at Hermayani et al.: 2014).

Time series data, especially in financial sector data are face the high volatility. High volatility is indicated by a phase where

fluctuations are relatively high and then followed by low fluctuation and then move into high fluctuation again. In other words, this data has an average and variance that are not constant (Widarjono, 2009).

c. Factors Affecting Exchange Rate

Movement

Exchange rate deviates from the valuation basis purchasing power of currencies under the influences of demand and supply of currency. The correlation of supply and demand depends on several factors. Usually the factors affecting exchange rate and its volatility are divided into two groups that are economic and non-economic factors. Economic factors are distinguished into long term and short term. Based on Twarowska and Kąkol (2014), factors that influence the demand and supply of exchange rate and result on exchange rate fluctuation are:

1. Economic Factors a. Short-Term

1) rate of economic growth 2) inflation rate

3) interest rate in the country and abroad

4) current account balance 5) capital account balance 6) currency speculation b. Long-Term

1) level of economic development of the country

2) competitiveness of the economy

3) technical and technological development

4) size of the foreign debt 5) budget deficit

6) relative domestic and foreign prices

7) capital flows 2. Non- Economic Factors

a. political risk (e.g. risk of armed conflict)

b. natural disasters c. policy approaches d. psychological factors

d. Exchange Rate Determinant

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

76 EUR/USD 1.2500 means that 1 Euro is

exchanged for 1.2500 US Dollar.

e. Political Event

Political event is event that occurs in a certain palace during a particular interval of time in term of politic decision that lead on political event. Every country faces certain political event which is gives the positive and negative impact on country condition whether in economic, politic and social area. Some of political event can caused the effect which can be interpreted as risk. Broadly, political risk refers to the complications businesses and governments may face as a result of what are commonly referred to as political decisions or any political change that alters the expected outcome and value of a given economic action by changing the probability of achieving business objectives.

Conceptual Model and Hypotheses a. Conceptual Model

Conceptual Model is a model that used to describe how the theory has the logical relationship and connect the identified problems. Conceptual model is also explains each variables in the research.

Figure 1 Conceptual Model

Source: Theoretical review, June 2017

b. Hypotheses

Based on background and theoretical review mentioned in this research, the researcher constructs four hypotheses related with the problem. There are four hypotheses, those are:

1) Hypotheses I

H0 : There is no difference on

Poundsterling (GBP) against US Dollar exchange rate before and after British Exit H1 : There is difference on

Poundsterling (GBP) against US Dollar exchange rate before and after British Exit

2) Hypotheses II

H0 : There is no difference on US

Dollar against Rupiah exchange rate before and after British Exit

H2 : There is difference on US Dollar

against Rupiah exchange rate before and after British Exit

3) Hypotheses III

H0 : There is no volatility on

Poundsterling (GBP) against US Dollar exchange rate around British Exit event H3 : There is volatility on

Poundsterling (GBP) against US Dollar exchange rate around British Exit event

4) Hypotheses IV

H0 : There is no volatility on US

Dollar against Rupiah exchange rate around British Exit event

H4 : There is volatility on US Dollar

against Rupiah exchange rate around British Exit event

RESEARCH METHOD Type of Research

The type of research used in this research is quantitative approach using event study. Event study refers to measure the impact of economic and political event (Baldas, Oran: 2014). Besides the event study methodology used, researcher will explore the volatility of exchange rate around the observation period by using ARCH-GARCH model. By using two instruments research, researcher will find the effect of political event on Poundsterling (GBP) against US Dollar, US Dollar against Rupiah and also explore the exchange rate volatility.

Location of Research

Research was done by documenting the data sample from websites those are http://www.bloomberg.com/ and another website that gives the daily, weekly, monthly data about rate, where these websites as the world trusted currency authority. This website is chosen because it provides the complete historical data and diagram about exchange rate movement.

Research Population and Sample Population

Research population in this research is the closing price data of daily foreign exchange rate movements from January to December 2016.

Sample

Samples of this research are daily exchange rate of Poundsterling (GBP) against US Dollar and US Dollar against Rupiah from 5 work days (Monday to Friday). Purposive sampling was used to determine the sample. The criteria that can be used in the determination of the sampling are as follows: 1. US Dollar in the most liquid currencies in the

world (Bank of International settlement, 2013) Political

event

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

77 and also number one in most used currencies

in international trade (Liputan6.com news, 2015).

2. United State is country which most aimed for goods export of United Kingdom, and it is means that the exchange of currency with another currency is more often.

3. Rupiah is chosen because the appreciation of US Dollar Value will give impacts on Rupiah currencies, because US Dollar is one of safe asset intended by investor and also trader especially in unstable condition.

Data Analysis Technique

This research uses two instrument researches in order to explore the change of Poundsterling (GBP) exchange rate movement against US Dollar and US Dollar against Rupiah. The first instrument is differences test, where the instrument used is paired sample test to describe the exchange rate differences before and after British exit. The second instrument is ARCH-GARCH model analysis to explore the volatility as instrument research in around the observation time.

a. Event Study to Measures the Level of Political Event Effect

1) Normality Test

The basic concept of Kolmogorov- Smirnov normality test is comparing the distribution of the data (which will be tested the normality level) with a standard normal distribution. The criteria in determine the data have normal distribution or not are as follows:

a) If the significant number of Kolmogorov Smirnov test Sig. < 0.05 so the data have not normal distribution

b) If the significant number of Kolmogorov Smirnov test Sig. > 0.05 so the data have normal distribution

2) Paired Test

The purpose of paired test is to compare the average of two groups whether having the same significant average or not. This research uses t-test for measure the average of closing price of US Dollar against Poundsterling and US Dollar against Rupiah as samples during research period. If the data is normally distributed, the difference test for the research would be done by paired sample T-test. However, if the data is not normally

distributed, the difference test for the research would be done by wilcoxon signed rank test.

b. ARCH-GARCH Model Analysis to

Explore the Exchange Rate Volatility

Researcher uses Eviews 8 program as analysis tool. Steps in Analyzing ARCH-GARCH model in this research as follows: 1) Plot of Time Series Data

2) Stationary Test a. Stationary Test

b. Differentiation level test

3) Identify ARMA-ARIMA model by Using Correlogram

a. Model Identification by using Correlogram

b. Selecting the Best of ARIMA Model 4) Detecting the Heteroskedasticity element

by using ARCH-LM Test

5) ARCH-GARCH Mode Estimation by using Maximum Likelihood

6) Model Evaluation Test

RESULT AND DISCUSSION A. Descriptive Statistical Analysis

1. Descriptive Statistical Analysis of Poundsterling (GBP) against US Dollar

Table 1 Descriptive statistical analysis of GBP on US Dollar

Source: Data processed by researcher, August 2017

Table 1 Shown that the maximum value is 1.487700 and it shown the highest exchange rate happened in around the observation period. The minimum value is about 1.229800 and it is means the lowest value of GBP on US Dollar exchange rate in observation period. According to average value on the table above shows that average of Poundsterling (GBP) against US Dollar exchange rate is about 1.381913 with the amount of total observation sample are 101.

2. Descriptive Statistical Analysis of US Dollar against IDR (Rupiah)

Poundsterling (GBP) against USD

Mean 1.381913

Median 1.41140

Maximum 1.48770

Minimum 1.229800

Std. Deviation 0.068962

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

78 Table 2 Descriptive statistical analysis of US

Dollar against IDR (Rupiah)

Source: Data processed by researcher, August 2017

Table 2 Shown that the mean value of the US Dollar against Rupiah exchange rate is 13261.17 with the amount of observation sample are 101. This number means that average to get 1 dollar, people have to change with 13261.17 in fifty days before and after British Exit event. The maximum value that happened in time of observation is about 13705.65 with the minimum value of US Dollar against Rupiah exchange rate is about 13056.90.

B. Event Study Method to Measures the Level of Political Event Effect

1. Normality Test

Table 3 Result of Normality test of GBP against USD and USD against IDR

Source: Data processed by researcher, August 2017

The result show that the data of GBP against US Dollar abnormal because the significance value is less than α = 5% (0.000 < 0.05) and the data of US Dollar against Rupiah also has abnormal distribution with the significance value is less than α = 5% (0.035 < 0.05).

2. Wilcoxon Signed Rank Test

Table 4 Result of Wilcoxon Signed Rank Test of GBP against USD and USD against IDR

GBP against USD

Before_ after

Z calc Asymp. Sig.

(2-tailed)

-5.251 0.000

USD against IDR

Before_ after -5.237 0.000 Source: Data Processed by researcher, August

2017

1) The result of Poundsterling (GBP) against US Dollar (USD) shown that the value of symp.sig. (2-tailed) is 0.000 less than 0.05 and it is means that H0 accepted and H1

rejected. H0 accepted means that there is

difference on GBP against US Dollar before and after British exit.

2) The result of US Dollar (USD) against Rupiah (IDR) showed that asymp.sig. (2-tailed) is 0.000 that is less than 0.05 and it is means that H0 accepted and H1 rejected.

H0 accepted means that there is difference

on US Dollar against Rupiah before and after British exit.

C. ARCH-GARCH Model Analysis to Explore

the Exchange Rate Volatility

1. Plot of Time Series Data

a. According to plot of time series of Poundstreling (GBP) against US Dollar (Figure 1), it can be conclude that the movement of exchange rate of Poundsterling (GBP) against US Dollar has fluctuates plot and it has decrease trend.

1.20 1.25 1.30 1.35 1.40 1.45 1.50

1825 2 9 16 2330 6 132027 4 11 1825 1 8 1522 29

M4 M5 M6 M7 M8

GBP/USD

Figure 2 Plot of time series GBP against US Dollar data

Source: Data Processed by researcher, August 2017

b. The pattern of time series data on US Dollar against Rupiah showed the significant increasing movement is happened in 4th May, 2016 and the lowest point in 4th July, 2016. Generally, the plot of US Dollar against Rupiah exchange rate shows the volatility movement. The data is fluctuates which the pattern shown the up movement and down movement continually.

Poundsterling (GBP) against USD

Mean 1.381913

Median 1.41140

Maximum 1.48770

Minimum 1.229800

Std. Deviation 0.068962

N 101

Variable P-Value Meaning

GBP_USD 0.0000 Abnormal

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

79

Source: Data Processed by Researcher, August 2017

2. Stasionary Test

a. According to unit root test level test of Poundstreling (GBP) against US Dollar , the value of augmented Dickey-Fuller test statistic is -1.537607 is less than test critical values which the values are -3.497029, -2.890623, -2.582353, so it is mean that the data is not stationer. Because the data is not stationer, so the data will be tested with unit root test in first difference level. Based on unit root test in first difference level, the value of augmented Dickey-Fuller test statistic is -12.10668 which more than test critical values which are in level 1% is -3.497727, level 5% is -2.890926 and in the level of 10% is -2.582514. It is means the data is stationer. b. Based on unit root test level test of US

Dollar against Rupiah, the value of augmented DickeyFuller test statistic is -2.973526 is less than test critical values which the values are -3.497029,-2.890623, -2.582353. It is mean that the data is not stationer. Because the data is not stationer yet, so the differences unit root test has to be done. Based on unit root test in first difference level, The value of augmented Dickey-Fuller test statistic is -10.01595 which more than test critical values which are in level 1% is -3.498439, level 5% is -2.891234 and in the level of 10% is -2.582678. So it is mean that the data is

stationer in first difference level.

3. Identify ARMA-ARIMA model by

Using Correlogram

A. Model Identification by using Correlogram

1) Poundsterling (GBP) against US Dollar

The result of the correlogram test of Poundstreling (GBP) against US Dollar shows that the maximum value of AR order (p) is

obtained at lag 1, lag 12 where this lag is cut off the line and the lag which is used by researcher is 24. MA order (q) is also obtained at lag 1 and lag 12 where this lag is cut off the square estimation. The results of regression are describes below:

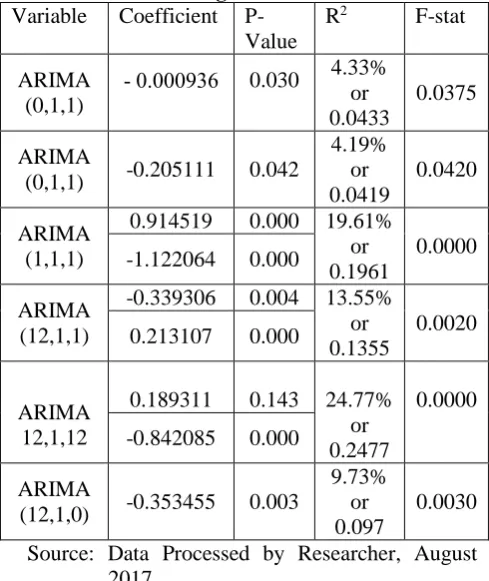

Table 5 Result of ARIMA tentative model estimation of GBP against USD

Variable Coefficient P-Value

Source: Data Processed by Researcher, August 2017

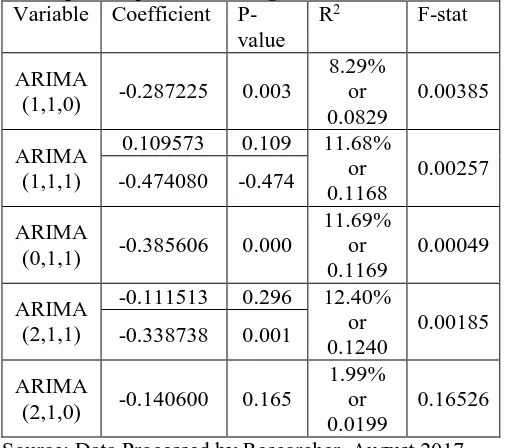

2) US Dollar against Rupiah (IDR)

The result of the correlogram test shows that the maximum value of AR order (p) is model is ARIMA (2,1,0), ARIMA (2,1,1).

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

80 Table 6 Result of ARIMA tentative model by using

least square equation USD against IDR Variable Coefficient

P-value

Source: Data Processed by Researcher, August 2017

B. Selecting the Best of ARIMA Model Before determine the ARCH-GARCH model, the several tentative models is prepared. The steps of choosing the best model are same with GBP against USD. The selected model is determined by using some of criteria. The First criteria is the biggest R2 value, and then the smallest AIC and SC.

1) Poundsterling (GBP) against US Dollar

Table 7 Result of ARIMA tentative model by using least square equation GBP against USD

Model R2 AIC SC

(12,1,12) 0.247728 -4.89935 -4.81490

ARIMA

(12,1,0) 0.097326 -4.73982 -4.68352

Source: Data Processed by Researcher, August 2017

Based on table above, the biggest R squared are showed at ARIMA (1,1,1) and ARIMA (12,1,12). But, at ARIMA (12,1,12) there p-value which is not significance with the p-value of variable AR (12) is 0.143 and it is more than 0.05. The smallest AIC and SC

2) US Dollar against Rupiah (IDR)

Table 7 Result of ARIMA tentative model by using least square equation USD against IDR

Model R2 AIC SC

ARIMA

(0,1,1) 0.116986 11.84183 11.89394

ARIMA

(1,1,0) 0.082913 11.88501 11.93743

ARIMA

(1,1,1) 0.116803 11.86755 11.94619

ARIMA

(2,1,1) 0.124052 11.86546 11.94459

ARIMA

(2,1,0) 0.019959 11.95734 12.01009

Source: Data Processed by Researcher, August 2017

ARIMA (12,1,12) there is p-value which is not significance with the p-value of AR (12) is 0.2964 and it is more than 0.05. So the chosen model is ARIMA (0,1,1).

4. Detecting the Heteroskedasticity element by using ARCH-LM Test

1) Poundsterling (GBP) against US Dollar

Based on ARCH-Lagrange Multiplier test shows that obs*R2 calculation value is 23.2346, with the probability value is 0.0258. The probability value of chi square is less than 0.05. It is means that the value is significance and the data contains of Heteroskedasticity element. The existence of Heteroskedasticity element means that residua variance is not constant and model used contains of ARCH element. So the model should be estimated by using ARCH-GARCH model to overcome the Heteroskedasticity problem.

2) US Dollar against Rupiah (IDR)

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

81 is significance and the data contains of

Heteroskedasticity element. It is means that residual variance is not constant and model used contains of ARCH element.

5. ARCH-GARCH Mode Estimation by

using Maximum Likelihood

1) Poundsterling (GBP) against US Dollar

The ARIMA (1,1,1) model that is used contains of Heteroskedasticity element. So Maximum Likelihood model estimation was needed. The output which is showed at Maximum Likelihood model estimation consists of two parts that are conditional mean calculation and conditional variance calculation

.

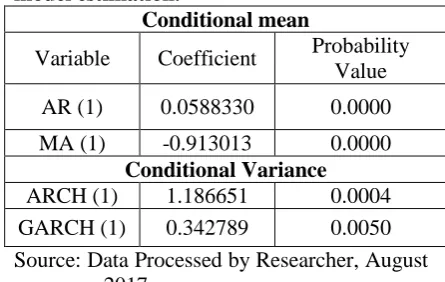

Table 8 Result of ARCH (1) and GARCH(1) model estimation.

Conditional mean

Variable Coefficient Probability

Value

AR (1) 0.0588330 0.0000

MA (1) -0.913013 0.0000

Conditional Variance

ARCH (1) 1.186651 0.0004

GARCH (1) 0.342789 0.0050

Source: Data Processed by Researcher, August 2017

The result of Maximum Likelihood regression estimation shows that the probability value at ARCH (1) and GARCH (1) are significance. They are significance whether in conditional mean and also conditional variance. The probability value of conditional variance is significance and it is means that there is volatility at exchange rate value in observation period within 50 days before British Exit event and 50 days after British Exit event.

The heteroskedasticity element that was detected in exchange rate value of Poundsterling (GBP) against Dollar means that the residual variance of the data is not constant and fluctuates from one period to another period. At conditional mean equation, the probability value for AR (1) is 0.0000 and MA (1) is 0.0000 and it less than 0.05, so the value is significance. The significance of AR (1) and MA(1) means that the exchange rate value of Poundsterling (GBP) against US Dollar is

affected by exchange rate value the period before at lag 1.

2) US Dollar against Rupiah (IDR)

Table 9 Result of ARCH (1) and GARCH (1) model estimation

Conditional mean

Variable Coefficient Probability

Value

MA (1) -0.326290 0.0219

Conditional Variance

ARCH (1) 1.338500 0.0000

GARCH (1) 0.260482 0.0057

Source: Data Processed by Researcher, August 2017

The result of Maximum Likelihood regression shows that the probability value at ARCH (1) and GARCH (1) are significance. They are significance whether in conditional mean and also conditional variance. The probability value of conditional variance is significance and it is means that there is volatility at exchange rate value in observation period within 50 days before British Exit event and 50 days after British Exit event. The residual variance of exchange rate value (ARCH) is affected by residual at the period before and lag of residual variance at the period before (GARCH).

6. Model Evaluation Test

The diagnostic model test should be done to analyze whether the data formed is good enough to modeling the data. To analyze if the data still contains of heteroskedasticity element or not, ARCH-LM test is used. The result of GBP against US Dollar shown that the value of X2 (Obs*R-squared) is 4.524610 with the probability value is 0.9720 or 97.2% and it is more than 0.05. The result of ARCH-LM test of US Dollar against IDR revealed the value of X2 (Obs*R-squared) is 0.291058 with the probability value is 0.5895 or 58.95% and it is more than 0.05. So it is means that both of sample have not contain of ARCH element and the model could overcome Heteroskedasticity .

Jurnal Administrasi Bisnis (JAB)|Vol. 55 No. 3 Februari 2018| administrasibisnis.studentjournal.ub.ac.id

82

CONCLUSION AND SUGGESTION Conclusion

1. The result of Wilcoxon signed rank test on daily closing price of Poundsterling against US Dollar shows that there is difference at observation period which are 50 days before and 50 days after British Exit.

2. The result of daily closing price of US Dollar against Rupiah 50 days before and 50 days after British Exit event shows that there is difference on the exchange rate.

3. The result of ARCH-GARCH model shows that there is heteroskedasticity element on Poundsterling against US Dollar and also US Dollar against Rupiah. It is means that residual variance is not constant and change over especially in observation period. Applying the GARCH model at closing price of Poundsterling (GBP) against US Dollar shows that the data have time varying volatility problem.

4. Model evaluation test for poundsterling (GBP) against US Dollar and also US Dollar against Rupiah show that the ARCH-GARCH could overcome the heteroskedasticity problem. The residual variance of the data is constant or the data has not contains of ARCH element.

Suggestion

1. For Further researcher

a. Researcher should find out and improve other information that can affect exchange rate market. The short period can be used in the future research in order to minimize the bias result so it will be better to use long term period in future research.

b. For Rupiah, the perceived effect is not felt directly, like has been mentioned in background in chapter 1.

2. For Company

Company should anticipate about the event that can be viral in media. It is worth mentioning that in the long run the exchange rate evolution will always reflect the level of competitiveness, the level of productivity from countries and the investor sentiment against a country. And it will affect the productivity of the company.

REFERENCES

Adiwijaya, Setiawan. 2016. Dampak Brexit, BI: Ekonomi Indonesia Baik, Bisnis Tempo Article, accessed at May 17, 2017 from

https://bisnis.tempo.co/read/782799/dampa k-brexit-bi-kondisi-ekonomi-indonesia-baik.

Baldas Ulkem, Oran Adil. 2014. Event Studies in Turkey. Accessed at February 3, From http://www.sciencedirect.com/science/artic le/pii/S221445014000271

.

Bank of International Settlements. 2013. Triennial Central BankSurvey. Foreign Exchange Turnover in April 2013: preliminary

global results Monetary and Economic

Department, accessed at February 2, 2017

http://www.bis.org/publ/rpfx13fx.pdf.

Fruen, L. 2016. What is Brexit? Everything you need to know about the UK leaving the EU. The sun Article, November 22, 2016 from https://www.thesun.co.uk./.

Hermayani et al. 2014. Mengatasi Heteroskedastisitas pada Model ARIMA dengan Menggunakan ARCH-GARCH (Studi Kasus: Indeks Harga Konsumen Provinsi Kalimantan Timur Tahun 2005-2012), Jurnal Eksponensial Volume 5, Nomor 1, accessed at May 22, 2017 from https://fmipa.unmul.ac.id/files/docs/[9]%2 0jURNAL%20hERMAYANI%20ok.doc. Howell, L. & Chaddick, B. 1994. Models of

Political Risk for Foreign Investment and Trade: An Assessment of Three.

Madura, Jeff. 1995. Manajemen Keuangan Internasional. Alih Bahasa oleh Emil Salim. 2000. Edisi Keempat. Jilid 1. Jakarta: Erlangga.

Madura, jeff. 2008. International finance management. Ninth edition. South western: Thomson.

Twarowska, Katarzyna & Kakol, Magdalena. 2014. Analysis of Factors Affecting Fluctuation the Exchange Rate of Polish Zloty against Euro. International Conference: Slovenia, accessed from, http://www.toknowpress.net/ISBN/978-961-6914-09-3/papers/ML14-652.pdf. Were, M., Geda, A., Karingi, S. & Ndung’u, N.