Publisher:

Romanian Society for Quality Assurance PDG:Dan Grigore Stoichiţoiu

Editorial Board:

Editor-in-Chief:Tudor-George Mărunţelu Senior editors:

Florin Gheorghe Filip(Romanian Academy),

Grigore Belostecinic(Academy of Science of Moldova), Ioan C. Bacivarov(„Politehnica“ University, Bucharest, Romania) Editor:Anca Perşoiu

Editorial Advisory Board:

Marin Andreica(Trade Academy Satu Mare, Romania),Liana Anica-Popa(ASE Bucharest, Romania),Gabriel Băbuţ(University of Petroşani, Romania), Dumitru-Alexandru Bodislav(ASE Bucharest, Romania),Elena Bogan(University of Bucharest, Romania), Stelian Brad(Technical University of Cluj-Napoca, Romania),Florina Bran(ASE Bucharest, Romania),Giuseppe Calabro(Universita degli Studi di Messina, Italy),Grazia Calabro(Universita degli Studi di Messina, Italy),Gian Paolo Cesaretti(Parthenope University of Naples, Italy),Lucian-Ionel Cioca(Lucian Blaga University of Sibiu, Romania),Andrzej Chochól(Cracow University of Economics, Poland), Pietro Columba (University of Palermo, Italy), Sorin Cruceru (DeVry College of New York, USA), Vasile Deac (ASE Bucharest, Romania),Cosmin Dobrin(ASE Bucharest, Romania),Enrica Donia(University of Palermo, Italy),Nicolae Drăgulănescu („Politehnica“ University, Bucharest, Romania),Dalina Dumitrescu(ASEBUSS Bucharest, Romania),Numan Muhammet Durakbasa (Vienna University of Technology, Austria),Carlo Giannetto(University of Messina, Italy),Bogdan Ionescu(ASE Bucharest, Romania), Florin Ionescu (Steinbeis University Berlin, Germany), Maurizio Lanfranchi (Universita Degli Studi di Messina, Italy), Lolita Liberatore(University "G. d’Annunzio" of Chieti-Pescara, Italy),Bernard Morard(University of Geneva, Switzerland),Lidia Niculiţă (UTCB, Bucharest, Romania), Max M. North (Coles College of Business, Kennesaw State University, USA), Marieta Olaru(ASE Bucharest, Romania), Bogdan Onete (ASE Bucharest, Romania), Rodica Pamfilie (ASE Bucharest, Romania), Sabka Pashova (University of Economics – Varna, Bulgaria),Iuri Peri (University of Catania, Italy),Ion Popa(ASE Bucharest, Romania),Doina I. Popescu (ASE Bucharest, Romania),Sorin Popescu(Technical University of Cluj-Napoca, Romania),Elena Popkova (Volgograd State Technical University, Russian Federation), Carmen Valentina Rădulescu (ASE Bucharest, Romania), Juozas Ruzevicius (Vilnius University, Lithuania),Filippo Sgroi(University of Palermo, Italy),Roberta Sisto(Unversity of Foggia, Italy),Angela Tarabella (University of Pisa, Italy), Mihail Aurel Ţîţu(Lucian Blaga University of Sibiu, Romania),Ion Verboncu(ASE Bucharest, Romania), Albert Weckenmann (Friedrich-Alexander University of Erlangen-Nuremberg, Germany), Dominik Zimon (Rzeszow University of Technology, Poland)

Indexed in:WEB OF SCIENCE – ESCI, SCOPUS, EBSCO, PROQUESTand listed inCABELL’S Whitelist Journal address:

Str. Theodor Burada, No. 6, Sector 1, 010215 - Bucharest, Romania Information:

Tel: 021.313.63.35; 0731.300.120 Fax: 021.313.23.80

E-mail:[email protected] Website:www.calitatea.srac.ro Pre-press & Print:

S.C. Interbrand Impex S.R.L.

The opinions presented in this publication represent only the opinions of the authors.

Any form of reproduction of any part of this journal, without the written permission of the author or publisher is forbidden.

ISSN 1582-2559

Vol. 20, No. 168/ February 2019

QUALITY

Access to Success

Vol. 20, No. 168 - February 2019

Petr REHACEK,

Risk Management as an Instrument

of the Effectiveness of Quality Management System 93 MASKUDI, Christantius DWIATMADJA,

Ahyar YUNIAWAN,

The Mediating Effect of Commitment Team Goals and Team Solidarity Capital in the Team Cohesiveness toward Team Performance: At Book Publishing Company in Central Java and Special Region of

Yogyakarta, Indonesia 97 Naqib DANESHJO, Erika DUDÁŠ PAJERSKÁ,

Mirwajs DANISHJOO,

Energy Industry and Risk Management 103

ENVIRONMENTAL MANAGEMENT

ENVIRONMENTAL MANAGEMENT

Daniela IVANOVA, Anelia HARADINOVA, Elka VASILEVA,

Eco-Innovations in Bulgarian Companies

with Pro-Environmental Policy 107 Iskandar MUDA, Elisa WAHYUNI,

An Analysis on the Effect of Environmental

Performance and the Implementation of Environmental Management System (ISO 14001) on the Issuer

Financial Performance 113 Amie KUSUMAWARDHANI, Kardison Lumban BATU,

Diana AQMALA, ANDRIYANSAH,

How Green should Trust, Norm

and Attitude be Colored? An Empirical Research

in Asian Market Consumers 118 Leila BAKTASH, Muzalwana Abdul TALIB,

Enrica Donia, Selenia Piampiano,

Green Marketing Strategies: Exploring Intrinsic and

Extrinsic Factors towards Green Customers’ Loyalty 127 Doina I. POPESCU,

Social Responsibility and Business Ethics.

IX. Green Management and Sustainable Development of the Firm 135

FOOD SAFETY MANAGEMENT

FOOD SAFETY MANAGEMENT

Erica VARESE, Alessandro BONADONNA,

Food Wastage Management: The “Una Buona

Occasione - A Good Opportunity” Contribution 139 Maurizio LANFRANCHI, Agata ZIRILLI, Salvatore

ALFANO, Francesco SARDINA SPIRIDIONE, Angela ALIBRANDI, Carlo GIANNETTO,

The Carob as a Substitute for Cocoa in the Production of Chocolate: Sensory Analysis with Bivariate

Association 148

OCCUPATIONAL HEALTH AND SAFETY

OCCUPATIONAL HEALTH AND SAFETY

MANAGEMENT

MANAGEMENT

Zahra POURSAFAR, Sriram K.V.,

Lewlyn L.R. RODRIGUES, Nandineni Rama DEVI

Evaluation of Psychological Influences of Colour, Lighting and Form in Office Buildings for Enhancing

Productivity 154

QUALITY MANAGEMENT

QUALITY MANAGEMENT

Peter MADZÍK, Ľudmila LYSÁ, Pavol BUDAJ,

Determining the Importance of Customer Requirements in QFD – A New Approach based on Kano Model

and its Comparison with other Methods 3 Alexandr GUGELEV, Anastasia GRISHNEVA,

Anzhelika SEMCHENKO, Margarita LUKYANENKO,

Modern Methods of Quality Control in Educational

Services based on ТQM 16 Tatyana ODINTSOVA, Nataliya KOCHERJAGINA,

Olga GORDASHNIKOVA, Olga RYZHOVA,

Formation of Logistics Services Quality Management

Model 21

Miriam ANDREJIOVA, Anna GRINCOVA, Zuzana KIMAKOVA,

Quality Assessment of the Rubber-Textile

Conveyor Belts at the Dynamic Impact Loading 28 Kirill Igorevich PORSEV, Marat Fatyhovich BULATOV,

Method to improve Information Assurance Quality for Research and Development at Knowledge-based Enterprises 33 Gabriela PASCU (POPESCU),

Lavinia COSTAN (POPA),

Preventive Financial Control in Public Entities 38 Shrikant Krupasindhu PANIGRAHI,

Hatem Mahmoud AL-NASHASH,

Quality Work Ethics and Job Satisfaction:

An Empirical Analysis 41 Komal MALIK, Harsh VARDHAN, Vinitendra P. SINGH

Evaluating the Affect of Harmony between Consumer Psyche and Brand on Customer Loyalty

in the Insurance Sector 48 Nila TRISTIARINI, St. Dwiarso UTOMO,

Yulita SETIAWANTA,

The Capability of Risk as a Corporate Reputation

Driver to increase Market Value 54 Egwu U. EGWU, Ama A. UDU, Livinus Okpara ONU,

Effects of Entrepreneurial Innovativeness on Firm

Performance 62 Irina PCHELINTSEVA, Olga GORDASHNIKOVA,

Anastasia VASINA,

Methodologies and Tools of a Two-Phase Rating

System for Innovation Project Value Assessment 69 Jaahnavi KOLA, Praseeda CHALLAPALLI,

A Study on Relationship between Emotional Intelligence, Ethical Ideology, Job Performance and Employee Engagement in Telangana Autonomous Engineering

Colleges 73

Isfenti SADALIA, Ira Erminda DAULAY, Lisa MARLINA, Iskandar MUDA,

The Influence of Intellectual Capital towards Financial Performance with Brand Value as an Intervening

Variable 79

Ika Nurul QAMARI, Julitta DEWAYANI, Augusty FERDINAND,

Strategic Human Resources Roles and Knowledge

ENVIRONMENTAL MANAGEMENT

113

1. Introduction

In September 2015, the United Nations officially introduced the SDG (Sustainable Development Goals), after a grand meeting in the United Nations headquarters in New York, USA, attended by the representatives of 193 countries. Sustainable Development Goals (SDG) is a continuation of the Millennium Development Goals (MDG) project that has been conducted since 2005 until the end of 2015. SDG has 5 (five) main foundations: human, planet, welfare, peace and partnership, to achieve three main objectives including ending poverty, achieving equality, and addressing climate change, which is expected to be realized in 2030 (Demirel et al., 2018; Castika and Balzarova, 2018 and Wiengartenet al., 2018). Currently, the leaders of the nation are encouraging their society to care and contribute to the implementation of SDG, especially in de-veloped countries. They continuously develop the latest innovations for a better world realization by 2030. In July 2016, the United Nations announced 3 (three) countries with the best index of SDG realization. They are Sweden, Denmark and Norway. Not only the governments and communities, but also the companies, especially the multinational companies, are required to participate in the realization of SDG. The World Bank states that at least nearly 50% of the world’s waste is produced by corporations, not including the amount of pollution, and other destructive factors. It is only natural for the corporation to participate in the handling. Environmental performance is the companies’ activity which is directly related to the natural environment (Albertiniet al., 2001; Huiet al., 2001; Watsonet al., 2004; Zutshi and Sohal, 2004; Watsonet al., 2004; Darnall and Edwards, 2006; Eng and Wahid, 2006; Lozano and Valles

et al., 2007; Gonzales and Diaz, 2009; Iraldoet al., 2009; and San et al., 2016). One of the environmental performance

measuring instruments in Indonesia is PROPER. The Pollution Control Evaluation and Rating or PROPER is one of the alternative means of compliance instruments employed by the government since 1995. In this case, the Ministry of Environ-ment encourages the compliance and concern of the companies for environmental management through the performance level information of corporate compliance dissemination to the public and stakeholders. Thus, it is expected that the community and stakeholders can respond to the environmental management performance of the companies which are participants of PROPER in accordance with its capacity. The company per-formance assessment is derived from the serial monitoring data analysis that is required in the regulation of environmental pollution control. To facilitate the communication with the stake-holders in addressing the performance results of each company’s structuring, the company’s performance rating is grouped into five colors: gold, green, blue, red, and black.

The ISO 14001 Environmental Management System (ISO 14001 EMS) was published by the International Organization for Standardization (ISO) in 1996 in Geneva, Switzerland. This system is believed to help create an integrated mechanism for continuous improvement of environmental performance that is applied to everyday production activities (Kumaret al., 2017 and Thayeret al., 2017). The problem is that not all companies are willing and able to implement the ISO 14001 EMS. In addition to being voluntary, some studies reveal that the certification of ISO 14001 EMS requires a large cost depending on the characteristics and facilities of each company that includes investment costs and routine audit fees (Ionașcu et al., 2017; Testa and D’Amato, 2017; Qianet al., 2018 and Wiengarten,et al., 2018). In 2015, more than 300.000 companies worldwide were certified ISO 14001 EMS. The high participation in the implementation of ISO 14001 EMS is because the ISO 14001

Q U A LI T Y

Access to Success

Vol. 20, No. 168/ February 2019

An Analysis on the Effect of Environmental Performance and the

Implementation of Environmental Management System (ISO 14001)

on the Issuer Financial Performance

Iskandar MUDA

1*, Elisa WAHYUNI

21,2Universitas Sumatera Utara, Jl. Prof. TM Hanafiah No.12 USU Campus, Medan, 20155, North Sumatera, Indonesia

*Corresponding author: Iskandar Muda; E-mail: [email protected]

Abstract

This study aims to examine and analyze the impact of Environmental Performance as measured by the result of PROPER (Pollution Control Evaluation and Rating) assessment and the implementation of ISO 14001 environmental management system (EMS) to the financial performance, based on the value of Earning Per Share in manufacturing companies which are listed in Indonesia Stock Exchange and being PROPER participants from 2012 to 2016. The results of this study indicated that simultaneously environmental performance and the Implementation of Environmental Management System (ISO 14001) has no significant effect on the financial performance. The Environment Performance partially has significant effect on the financial performance while the Implementation of Environmental Management System (ISO 14001) partially has no significant effect on the financial performance.

EMS provides benefits such as: providing cost and resource efficiency, expanding market opportunities, increasing reputation and profitability, reducing the government’s coercive, avoiding conflict and increasing stakeholder satisfaction. Company performance is often associated with the financial condition of the company. Financial performance is a general measure of a company’s overall financial health at a given time or subjective measurement of how well a company can use or manage its assets from the main operational activities of its business in accordance with the policies made by the management to be the income of the company itself at a certain time. The company financial performance can be measured by evaluating and analyzing the financial statements. Company financial performance can be measured by analyzing and eva-luating the financial statements. There are several categories of company financial performance measurement according to Lu,

et al., (2018); Fingeret al., (2018); Wonget al., (2018) and Blasi

et al., (2018) they are:

1. Earnings Measures: earning per share (EPS), return on assets (ROA), return on net assets, return on capital employment and return on equity,

2. Cash flow Measures: free cash flow, cash flow return on gross investment, cash flow return on investment, total shareholder return and business return,

3. Value Measures (economic value added (EVA), market value added (MVA), cash value added (CVA) and shareholder value (SHV).

In this study, financial performance is measured using Earning Per Share (EPS), in which EPS shows the amount of money to be earned on every common share outstanding in the period. EPS or earnings per share is calculated by dividing the net income available to ordinary shareholders (residual net income) by the weighted average number of ordinary shares outstanding during the period (Muda, 2017 & Leyvaet al., 2018). EPS is only shown for the calculation of common stock. The greater the net income of a company, the greater the EPS will be. As the EPS of a company increases, the greater the net income will be distributed in the form of cash dividend to the common shareholders.

2. Research Methods

This study was conducted in 2012-2016. The samples were obtained from the PROPER database from Indonesian Ministry of Environment and Forestry and Indonesia Stock Exchange. There were as many as 20 companies with a total of 100 observations with criteria that the company experienced fluctuations in PROPER ratings and did not get black rating on PROPER during the study period. The method employed was Regression Generalized Least Square using E-Views Software.

3. Results and Discussion

3.1. Result

3.1.1. Goodness of Fit (Hausmann Test)

Hausmann test was performed to decide the best regression model used in this study. The model is selected based on:

1. If the p-value of Hausmann Test is less than 0.05, thus the approach model to be used is the Fixed Effect Model. 2. If the p-value of Hausmann Test is more than 0.05, thus the approach model to be used is the Random Effect Model.

The estimation result shows that p-value is 0.4222 or more than 0.05 which means the approach to be used is Random Effect Model (REM).

3.1.2. Hypothesis testing

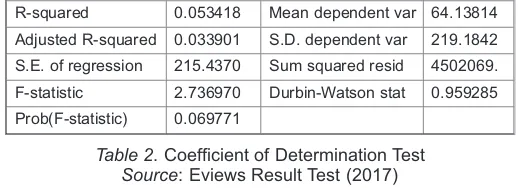

3.1.2.1. Coefficient of Determination Test (R2)

Coefficient of determination test was done to see the proportion of Y dependent variable total variances which are explained by X independent variable.

The regression result using Random Effect Model (REM) shows that the coefficient of determination (R2) is equal to

0.053418, or in other words, 5.34%. Variations or changes in Earning Per Share (EPS) can be explained by both variables namely environmental performance and ISO 14001 Environ-mental Management Implementation. Meanwhile, the rest of 94.6% is explained by other variables and factors not included in this study model.

3.1.3. Simultaneous Significance Test (F-Test)

F-test is performed to evaluate the effect of independent variable to the dependent variable individually. Based on F-test results it can be seen that p-value is 0.069771. The hypothesis for the F-test is as follows:

H0: There is no influence of environmental performance and environmental disclosures variables simultaneously on the financial performance

Ha: There is an influence of environmental performance and environmental disclosure variables simultaneously on the financial performance

Based on the F-test criteria, it is concluded that:

If Prob (F-Statistics) < 0.05 thus H0is rejected (Muda et al., 2018), and

If Prob (F-Statistics) > 0.05 thus H0is accepted.

The result of Prob (F-Statistics) is 0.069771 > 0.05. Therefore, it can be concluded that H0is accepted. It shows that simultaneously both independent variables, namely environmen-tal performance and ISO 14001 Environmenenvironmen-tal Management System Implementation, have no influence on the dependent variable, namely financial performance (EPS).

3.1.4. Partial Significance Test (T-Test)

The t-test was performed to evaluate the effect of the two independent variables on the dependent variable separately.

The t-test result shows that the environmental performance variable has a t-statistic value of 2.162842 and p-value of 0.0330. This probability result is smaller than the level of α = 5% or in other words partially independent variable of environmental performance has a significant impact on the financial per-R-squared 0.053418 Mean dependent var 64.13814 Adjusted R-squared 0.033901 S.D. dependent var 219.1842 S.E. of regression 215.4370 Sum squared resid 4502069. F-statistic 2.736970 Durbin-Watson stat 0.959285 Prob(F-statistic) 0.069771

Correlated Random Effects – Hausman Test Equation: Untitled

Test cross-section random effects

Test Summary Chi-Sq. Statistic Chi-Sq. d.f. Prob.

Cross-section random 0.644138 1 0.4222

Table 1. Hausmann Test

Source: Eviews Result Test (2017)

Table 2. Coefficient of Determination Test

ENVIRONMENTAL MANAGEMENT

115

formance and has a positive relationship. The t-test result alsoshows that the t-statistic value of Environmental Management System Implementation variable is -1.059012 and the p-value is 0.2922. The result of this probability is greater than the level of α = 5% or in other words partially ISO 14001 Environmental Management Implementation independent variable does not significantly affect the financial performance.

3.2. Discussion

Increased competition increasingly awaken the company for quality. The more critical the customer in responding to the quality of the product increasing the company need to improve the quality. ISO 14001 has become one of the requirements in world trade as one form of guarantee on the quality of products that consider the environmental aspects (McMillanet al., 2017; Tuczeket al., 2018; Albertini, 2018 and Salimet al., 2018). This requirement becomes an absolute requirement from customers of developed countries especially America, Europe and Japan. This is a challenge for companies in increasing customer sa-tisfaction. The market demand for the application of international standards is intended to provide good and safe goods or services to the wearer and to meet the requirements of security, safety and environmental sustainability as well as competitive prices to consumers of the goods or services purchased. Thus, the development and application of environmental manage-ment, occupational safety and health systems need to be given attention. The development of companies and industries today has caused an environmental and energy crisis. Impact of industrial development, organizations and industries are re-quired to increase accountability to the environment. Under these conditions, the demands of the world's rules on the accountability of organizations and industries in environmental management are increasing. Environmental conservation has become the demand of developed country customers who consciously see the importance of protecting the environment early on to minimize future environmental damage, according to international agreements in 1996 The International Organization for Standardization launched a standard for managing the envi-ronment professionally within the organization and industry, the standard is called the ISO 14001 Environmental Management System (Graafland, 2018; Albertini, 2018; Wiengarten et al., 2018; Murmura et al., 2018; Heras et al., 2018; Castka and Balzarova, 2018 and Salim et al., 2018). The business trans-formation process undertaken by the company has the potential to have an impact on the environment, both positive and ne-gative impacts. Environmental management system standards are not actually an international standard for environmental management systems as termed. This ISO in no way regulates the absolute requirements of environmental performance that an Organization must satisfy. This ISO Standard is more appro-priate if it is considered as a framework to assist the Organization in developing its own environmental management system, managing environmental aspects and improving its

environmental performance. Organizations can integrate ISO 14001 standards with other management functions to achieve environmental goals or economic goals. The impacts that arise can be grouped into two parts, namely physical impact and social impact (Fura and Wang., 2017; Peršič et al., 2018; Weidemaet al., 2018; Greenlandet al., 2018 and Gauthier and Wooldridge, 2018). When the company implements ISO 14001, the company has committed to continually improve its environmental performance. ISO 14001 is a standard that com-bines and balances business interests with the environment. Efforts to improve performance are tailored to the resources in the form of human, technical, or financial resources. Financial factors in the form of return on Earning Per Share is a reflection of management's success in managing the value of the company as reflected in the share price of the company concerned and after being divided from the company's net profit in Capital Market and Financial Market. Improvement of environmental performance takes a short time due to limited capital and financial. Liquid waste that pollutes the environment around the company can be reduced if it already implements ISO 14001. Financial Internal factor is the determining factor in managing its waste so as to reach the specified threshold. Sufficient sewage treatment facilities can be built within certain periods of time. If before the period is achieved then the company will never meet the environmental quality standards. However, if the company develops an environmental manage-ment system that meets the requiremanage-ments of ISO, the company may obtain the ISO 14001 certificate. Another company, whose environmental performance meets the quality of raw materials but does not meet the requirements will not obtain ISO 14001 certificate. ISO 14001 is developed from the concept of Total Quality Management (TQM) based on Plan-Do-Check and Action activities (Macenoet al., 2018; Muñozet al., 2018; Ayuso

et al., 2018 and Zhou et al., 2018). The environmental policy should be documented and communicated to all employees and made available to the community, and includes a commitment to continuous improvement, pollution prevention, and compliance with regulations and a framework for goal setting and objectives (Demirelet al., 2018; Tuczeket al., 2018; Yurievet al., 2018 & Latanet al., 2018). environmental aspects of the organization's activities, identification and access to regulatory requirements, the existence of objectives and targets that are documented and consistent with the policy, and the existence of programs to achieve the planned goals and objectives. In the documentation and communication phases of roles and responsibilities, adequate training, the assurance of internal and external co-mmunications, written documentation of the environmental ma-nagement system and good document control procedures, documented operational control procedures and documented procedures of emergency action are essential to the achieve-ment of the Environachieve-mental policy in the form of developachieve-ment of environmental commitment of an organization. This policy will be used as a framework for the preparation of environmental plans.

4. Conclusions and Suggestions

4.1. Conclusions

1. Environmental Performance and Environmental Mana-gement System Implementation (ISO 14001) do not simultaneously affect the Earning Per Share.

2. Company Environmental Performance measured from PROPER of Indonesian Ministry of Environment and Forestry rating partially has significant effect on the Earning Per Share.

3. Environmental Management System Implementation as measured by ISO 14001 certification ownership partially has no significant effect on the Earning Per Share.

Q U A LI T Y

Access to Success

Vol. 20, No. 168/ February 2019

Dependent Variable: EPS

Method: Panel EGLS (Cross-section random effects) Sample: 2012 2016

Periods included: 5 Cross-sections included: 20

Total panel (balanced) observations: 100

Swamy and Arora estimator of component variances

Variable Coefficient Std. Error t-Statistic Prob.

C 353.4890 290.2348 1.217941 0.2262

PROPER 96.65838 44.69045 2.162842 0.0330 ISO14001 -333.5370 314.9511 -1.059012 0.2922

Table 3. T-Test

4.2. Suggestions

1. Companies are suggested to increase the environment awareness inside and outside the company so that it will give a positive impact for the surrounding that will affect the investor in investing.

2. It is suggested for further researches to add other variables especially related to the environment that has influence on financial performance, either EPS or other variables such as ROA and ROI.

3. This research only employed manufacturing sector com-panies as the samples, it is suggested for the future researchers to expand the scope of study.

References

[1] Alberti, M., Caini, L., Calabrese, A., & Rossi, D. (2000). Evaluation of the costs and benefits of an environmental management system. International Journal of Production Research, 38(17). 4455-4466.

[2] Albertini, E. (2018). The Contribution of Management Control Systems to Environmental Capabilities. Journal of Business Ethics, 1-18.

[3] Ayuso, S., & Navarrete‐Báez, F.E. (2018). How Does Entrepreneurial and International Orientation Influence SMEs' Commitment to Sustainable Development? Empirical Evidence from Spain and Mexico. Corporate Social Responsibility and Environmental Management, 25(1), 80-94.

[4] Blasi, S., Caporin, M., & Fontini, F. (2018). A Multidimensional Analysis of the Relationship between Corporate Social Responsibility and Firms' Economic Performance. Ecological Economics, 147, 218-229.

[5] Castka, P., & Balzarova, M. A. (2018). An exploration of interventions in ISO 9001 and ISO 14001 certification context – A multiple case study approach.Journal of Cleaner Production, 174, 1642-1652.

[6] Darnall, N., & Edwards, D. (2006). Predicting the cost of environmental management system adoption: the role of capabilities, resources and ownership structure. Strategic management journal, 27(4), 301-320.

[7] Demirel, P., Iatridis, K., & Kesidou, E. (2018). The impact of regulatory complexity upon self-regulation: Evidence from the adoption and certification of environmental management systems. Journal of environmental management, 207, 80-91.

[8] Eng Ann, G., Zailani, S., & Abd Wahid, N. (2006). A study on the impact of environmental management system (EMS) certification towards firms' performance in Malaysia. Management of Environmental Quality: An International Journal, 17(1), 73-93. [9] Finger, M., Gavious, I., & Manos, R. (2018). Environmental risk

management and financial performance in the banking industry: A cross-country comparison. Journal of International Financial Markets, Institutions and Money, 52. 240-261.

[10] Fura, B., & Wang, Q. (2017). The level of socioeconomic development of EU countries and the state of ISO 14001 certification.Quality & Quantity, 51(1), 103-119.

[11] Gonzalez, P., Sarkis, J., & Adenso-Diaz, B. (2008). Environmental management system certification and its influence on corporate practices: Evidence from the automotive industry. International Journal of Operations & Production Management, 28(11), 1021-1041.

[12] Graafland, J.J. (2018). Ecological impacts of the ISO14001 certification of small and medium sized enterprises in Europe and the mediating role of networks. Journal of Cleaner Production, 174, 273-282.

[13] Greenland, S. J., Dalrymple, J., Levin, E., & O’Mahony, B. (2018). Improving Agricultural Water Sustainability: Strategies for Effective Farm Water Management and Encouraging the Uptake of Drip Irrigation. InThe Goals of Sustainable Development(pp. 111-123). Springer, Singapore.

[14] Heras-Saizarbitoria, I., Boiral, O., & Allur, E. (2018). Three Decades of Dissemination of ISO 9001 and Two of ISO 14001:

Looking Back and Ahead. In ISO 9001, ISO 14001, and New Management Standards(pp. 1-15). Springer, Cham.

[15] Hui, I.K., Chan, A. H., & Pun, K.F. (2001). A study of the environmental management system implementation practices. Journal of Cleaner Production, 9(3), 269-276.

[16] Ionascu, M., Ionascu, I., Sacarin, M., & Minu, M. (2017). Exploring the Impact of ISO 9001, ISO 14001 and OHSAS 18001 Certification on Financial Performance: The Case of Companies listed on the Bucharest Stock Exchange. Amfiteatru Economic Journal, 19(44), 166-180.

[17] Iraldo, F., Testa, F., & Frey, M. (2009). Is an environmental management system able to influence environmental and competitive performance? The case of the eco-management and audit scheme (EMAS) in the European Union.Journal of Cleaner Production, 17(16), 1444-1452.

[18] Kumar, A., Cantor, D.E., Grimm, C.M., & Hofer, C. (2017). Environmental management rivalry and firm performance.Journal of Strategy and Management, 10(2), 227-247.

[19] Latan, H., Jabbour, C.J.C., de Sousa Jabbour, A.B.L., Wamba, S.F., & Shahbaz, M. (2018). Effects of environmental strategy, environmental uncertainty and top management's commitment on corporate environmental performance: The role of environmental management accounting.Journal of Cleaner Production, 180, 297-306.

[20] Leyva-de la Hiz, D.I., Ferron-Vilchez, V., & Aragon-Correa, J. A. (2018). Do Firms’ Slack Resources Influence the Relationship Between Focused Environmental Innovations and Financial Performance? More is Not Always Better. Journal of Business Ethics, 1-13.

[21] Lozano, M., & Vallés, J. (2007). An analysis of the implementation of an environmental management system in a local public administration.Journal of environmental management, 82(4), 495-511.

[22] Lu, L.W., & Taylor, M.E. (2018). A study of the relationships among environmental performance, environmental disclosure, and financial performance. Asian Review of Accounting, 26(1), 107-130.

[23] Maceno, M.M.C., Pawlowsky, U., Machado, K.S., & Seleme, R. (2018). Environmental performance evaluation – A proposed analytical tool for an industrial process application. Journal of Cleaner Production, 172, 1452-1464.

[24] McMillan, A., Dunne, T.C., Aaron, J.R., & Cline, B.N. (2017). Environmental Management’s Impact on Market Value: Rewards and Punishments.Corporate Reputation Review, 20(1), 105-122. [25] Muda, I, F. Roosmawati, H.S. Siregar, Ramli, H Manurung and T

Banuas. 2018. Performance Measurement Analysis of Palm Cooperative Cooperation with Using Balanced Scorecard. IOP Conference Series: Materials Science and Engineering 2017. 288. 012081 doi: 012081 doi:10.1088/1757-899X/288/1/012081 [26] Muda, I., H.S. Siregar, S.A. Sembiring, Ramli, H. Manurung and Z.

Zein (2018). Economic Value of Palm Plantation in North Sumatera and Contribution to Product Domestic Regional Bruto. IOP Conference Series : Materials Science and Engineering 2017. 288. 012080 doi: 10.1088/1757-899X/288/1/012080.

[27] Muda, Iskandar (2018). The Effect of Allocation of Dividend of the Regional Government-Owned Enterprises and the Empowerment Efforts on the Revenue of Regional Government: The Case of Indonesia.European Research Studies Journal. XX(4B). 244-259. [28] Muñoz-Villamizar, A., Santos, J., Viles, E., & Ormazábal, M. (2018). Manufacturing and environmental practices in the Spanish context.Journal of Cleaner Production, 178, 268-275.

[29] Murmura, F., Liberatore, L., Bravi, L., & Casolani, N. (2018). Evaluation of Italian Companies' Perception About ISO 14001 and Eco Management and Audit Scheme III: Motivations, Benefits and Barriers.Journal of Cleaner Production, 174, 691-700.

[30] Peršič, A., Markič, M., & Peršič, M. (2018). The impact of socially responsible management standards on the business success of an organisation.Total Quality Management & Business Excellence, 29(1-2), 225-237.

ENVIRONMENTAL MANAGEMENT

117

[32] Salim, H.K., Padfield, R., Hansen, S.B., Mohamad, S.E., Yuzir, A., Syayuti, K. & Papargyropoulou, E. (2018). Global trends in environmentalmanagement system and ISO14001 research.Journal of Cleaner Production, 170, 645-653.

[33] San Ong, T., Teh, B.H., Ng, S.H., & Soh, W.N. (2016). Environmental management system and financial performance.Institutions and Economies, 27-53.

[34] Testa, M., & D’Amato, A. (2017). Corporate environmental responsibility and financial performance: Does bidirectional causality work? Empirical evidence from the manufacturing industry.Social Responsibility Journal, 13(2), 221-234.

[35] Thayer, M.L. (2017).Holistic Risk-Based Approach to Identify Significant Environmental Aspects within an Environmental Management System (Doctoral dissertation, Oklahoma State University).

[36] Tuczek, F., Castka, P., & Wakolbinger, T. (2018). A review of management theories in the context of quality, environmental and social responsibility voluntary standards.Journal of Cleaner Production, 176, 399-416.

[37] Watson, K., Klingenberg, B., Polito, T., & Geurts, T. G. (2004). Impact of environmental management system implementation on financial performance: A comparison of two corporate strategies.Management of Environmental Quality: An International Journal, 15(6), 622-628. [38] Weidema, B.P., Pizzol, M., Schmidt, J., & Thoma, G. (2018). Attributional or consequential Life Cycle Assessment: A matter of social

responsibility.Journal of Cleaner Production, 174, 305-314.

[39] Wiengarten, F., Onofrei, G., Humphreys, P., & Fynes, B. (2018). A Supply Chain View on Certification Standards: Does Supply Chain Certification Improve Performance Outcomes? InISO 9001, ISO 14001, and New Management Standards(pp. 193-214). Springer, Cham. [40] Wong, K.L., Chong, K.E., Chew, B.C., Tay, C.C., & Mohamed, S.B. (2018). Key Performance Indicators for Measuring Sustainability in Health

Care Industry in Malaysia.Journal of Fundamental and Applied Sciences, 10(1S), 646-657.

[41] Yuriev, A., & Boiral, O. (2018). Implementing the ISO 50001 System: A Critical Review. InISO 9001, ISO 14001, and New Management Standards(pp. 145-175). Springer, Cham.

[42] Zhou, X., Xu, Z., Yao, L., Tu, Y., Lev, B., & Pedrycz, W. (2018). A novel Data Envelopment Analysis model for evaluating industrial production and environmental management system.Journal of Cleaner Production, 170, 773-788.

[43] Zutshi, A., & Sohal, A. (2004). Environmental management system adoption by Australasian organisations: part 1: reasons, benefits and impediments.Technovation, 24(4). 335-357.