75

PT Bank Mizuho Indonesia, 2010 Annual Report71

PT Bank Mizuho Indonesia,

2012 Annual Report

75

PT Bank Mizuho Indonesia,

2013 Annual Report

TABEL MANAJEMEN RISIKO

|

Risk Management Table

Tabel Manajemen Risiko

Risk Management Table

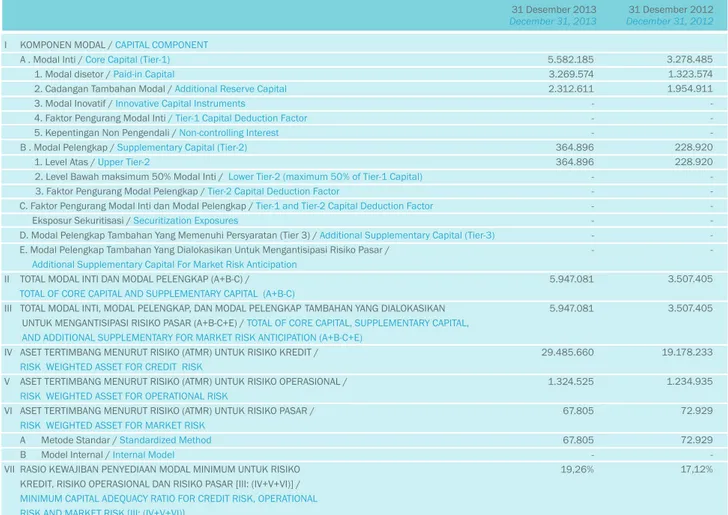

I KOMPONEN MODAL / CAPITAL COMPONENT A . Modal Inti / Core Capital (Tier-1)

1. Modal disetor / Paid-in Capital 2. Cadangan Tambahan Modal / Additional Reserve Capital 3. Modal Inovatif / Innovative Capital Instruments

4. Faktor Pengurang Modal Inti / Tier-1 Capital Deduction Factor 5. Kepentingan Non Pengendali / Non-controlling Interest B . Modal Pelengkap / Supplementary Capital (Tier-2)

1. Level Atas / Upper Tier-2

2. Level Bawah maksimum 50% Modal Inti / Lower Tier-2 (maximum 50% of Tier-1 Capital) 3. Faktor Pengurang Modal Pelengkap / Tier-2 Capital Deduction Factor

C. Faktor Pengurang Modal Inti dan Modal Pelengkap / Tier-1 and Tier-2 Capital Deduction Factor Eksposur Sekuritisasi / Securitization Exposures

D. Modal Pelengkap Tambahan Yang Memenuhi Persyaratan (Tier 3) / Additional Supplementary Capital (Tier-3) E. Modal Pelengkap Tambahan Yang Dialokasikan Untuk Mengantisipasi Risiko Pasar /

Additional Supplementary Capital For Market Risk Anticipation II TOTAL MODAL INTI DAN MODAL PELENGKAP (A+B-C) /

TOTAL OF CORE CAPITAL AND SUPPLEMENTARY CAPITAL (A+B-C)

III TOTAL MODAL INTI, MODAL PELENGKAP, DAN MODAL PELENGKAP TAMBAHAN YANG DIALOKASIKAN UNTUK MENGANTISIPASI RISIKO PASAR (A+B-C+E) / TOTAL OF CORE CAPITAL, SUPPLEMENTARY CAPITAL, AND ADDITIONAL SUPPLEMENTARY FOR MARKET RISK ANTICIPATION (A+B-C+E)

IV ASET TERTIMBANG MENURUT RISIKO (ATMR) UNTUK RISIKO KREDIT / RISK WEIGHTED ASSET FOR CREDIT RISK

V ASET TERTIMBANG MENURUT RISIKO (ATMR) UNTUK RISIKO OPERASIONAL / RISK WEIGHTED ASSET FOR OPERATIONAL RISK

VI ASET TERTIMBANG MENURUT RISIKO (ATMR) UNTUK RISIKO PASAR /

RISK WEIGHTED ASSET FOR MARKET RISK

A Metode Standar / Standardized Method B Model Internal / Internal Model

VII RASIO KEWAJIBAN PENYEDIAAN MODAL MINIMUM UNTUK RISIKO KREDIT, RISIKO OPERASIONAL DAN RISIKO PASAR [III: (IV+V+VI)] / 0,1,080&$3,7$/$'(48$&<5$7,2)25&5(',75,6.23(5$7,21$/

RISK AND MARKET RISK [III: (IV+V+VI)]

3.278.485 1.323.574 1.954.911 - -228.920 228.920 -3.507.405 3.507.405 19.178.233 1.234.935 72.929 72.929 -17,12% 31 Desember 2012

December 31, 2012

Tabel 1 Pengungkapan Struktur Permodalan - Bank secara Individual /

Table 1 Disclosure of Capital Structure – Bank Only

5.582.185 3.269.574 2.312.611 -364.896 364.896 -5.947.081 5.947.081 29.485.660 1.324.525 67.805 67.805 -19,26%

31 Desember 2013

December 31, 2013

Saldo awal CKPN / Beginning Balance - Allowance for Impairment Losses Pembentukan (pemulihan) CKPN pada periode berjalan (Bersih) / Additional (reversal) allowance for impairment losses during the year (Net) 2.a Pembentukan CKPN pada periode berjalan /

Additional allowance for impairment losses during the year 2.b Pemulihan CKPN pada periode berjalan / Reversal allowance for impairment losses during the year

CKPN yang digunakan untuk melakukan hapus buku atas tagihan pada peride berjalan / Allowance for impairment losses used for written off receivables during the year

Pembentukan (pemulihan) lainnya pada periode berjalan / Other additional (reversal) of allowance during the year Saldo akhir CKPN / Ending Balance

175.662 (14.716) 121.110 (135.826) -6.907 167.853

(Jutaan Rupiah / Million Rupiah)

Tabel 2.1 Pengungkapan Rincian Mutasi Cadangan Kerugian Penurunan Nilai - Bank Individual

Table 2.1 Movements of Allowance for Impairment Losses Disclosure - Bank Only

100.000 77.412 127.412 (50.000) -177.412 CKPN Individual / Allowance for Impairment Losses - Individual CKPN Kolektif / Allowance for Impairment Losses - Collective 31 Desember 2012 /

December 31, 2012 Keterangan / Description 167.853 104.297 183.110 (78.813) -45.327 317.477 177.412 328 133.728 (133.400) -33.599 211.339 CKPN Individual / Allowance for Impairment Losses - Individual CKPN Kolektif / Allowance for Impairment Losses - Collective 31 Desember 2013 /

December 31, 2013 (Jutaan Rupiah / Million Rupiah)

76

76

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

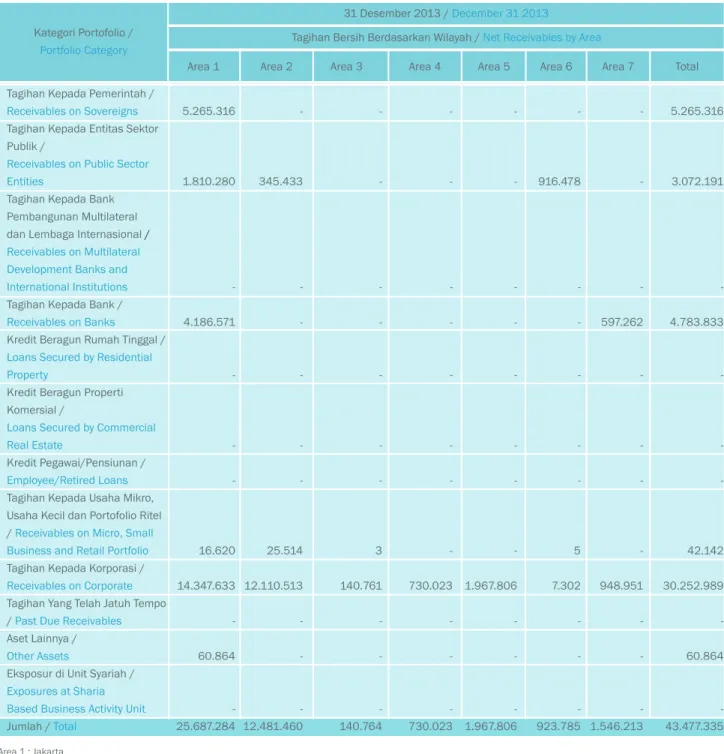

Tagihan Kepada Pemerintah /Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik /

Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks

Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property

Kredit Beragun Properti Komersial /

Loans Secured by Commercial Real Estate

Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel /Receivables on Micro, Small Business and Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

Eksposur di Unit Syariah / Exposures at Sharia Based Business Activity Unit Jumlah /Total -3 140.761 -140.764 -730.023 -730.023 -1.967.806 -1.967.806 -916.478 -5 7.302 -923.785 -597.262 -948.951 -1.546.213 5.265.316 3.072.191 -4.783.833 -42.142 30.252.989 -60.864 -43.477.335

Area 3 Area 4 Area 5 Area 6 Area 7 Total

Tabel 2.2 Pengungkapan Tagihan Bersih berdasarkan Wilayah - Bank secara Individual

Table 2.2 Disclosure of Net Receivables by Area - Bank Only

31 Desember 2013 / December 31 2013

Tagihan Bersih Berdasarkan Wilayah / Net Receivables by Area Area 2 Area 1 Kategori Portofolio / Portfolio Category 5.265.316 1.810.280 -4.186.571 -16.620 14.347.633 -60.864 -25.687.284 -345.433 -25.514 12.110.513 -12.481.460 Area 1 : Jakarta

Area 2 : Jawa Barat - West Java Area 3 : Jawa Tengah - Central Java Area 4 : Jawa Timur - East Java Area 5 : Sumatera & Kalimantan

Area 6 : Indonesia Timur (Bali, Sulawesi, Nusa Tenggara, Maluku & Papua) - Eastern Indonesia (Bali, Sulawesi, Nusa Tenggara, Maluku & Papua) Area 7 : Di luar Indonesia - Overseas

77

PT Bank Mizuho Indonesia, 2010 Annual Report77

PT Bank Mizuho Indonesia,

2013 Annual Report

-119.810 -119.810 -531.615 -531.615 -10 1.163.593 -1.163.603 -12 4.821 -4.833 -582.672 -1.014.724 -1.597.396 2.954.643 2.102.691 -3.017.464 -36.447 20.877.703 -57.125 -29.046.073 (Jutaan Rupiah / Millions Rupiah)

Area 3 Area 4 Area 5 Area 6 Area 7 Total

31 Desember 2012 / December 31 2012

Tagihan Bersih Berdasarkan Wilayah / Net Receivables by Area Area 2 Area 1 2.954.643 1.792.603 -2.434.792 -14.413 11.652.555 -57.125 -18.906.131 -310.088 -22.012 6.390.585 -6.722.685

78

78

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

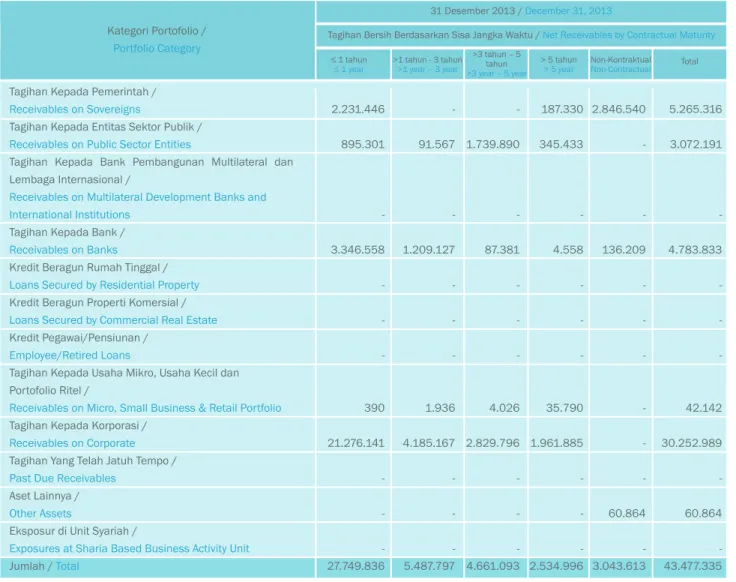

Tagihan Kepada Pemerintah /Receivables on Sovereigns

Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional /

Receivables on Multilateral Development Banks and International Institutions

Tagihan Kepada Bank / Receivables on Banks

Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate Kredit Pegawai/Pensiunan /

Employee/Retired Loans

Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel /

Receivables on Micro, Small Business & Retail Portfolio Tagihan Kepada Korporasi /

Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables

Aset Lainnya / Other Assets

Eksposur di Unit Syariah /

Exposures at Sharia Based Business Activity Unit Jumlah /Total 2.231.446 895.301 -3.346.558 -390 21.276.141 -27.749.836 -91.567 -1.209.127 -1.936 4.185.167 -5.487.797 -1.739.890 -87.381 -4.026 2.829.796 -4.661.093 187.330 345.433 -4.558 -35.790 1.961.885 -2.534.996 2.846.540 -136.209 -60.864 -3.043.613 5.265.316 3.072.191 -4.783.833 -42.142 30.252.989 -60.864 -43.477.335 WDKXQ

\HDU >1 tahun - 3 tahun>1 year – 3 year

>3 tahun – 5 tahun >3 year – 5 year > 5 tahun > 5 year Non-Kontraktual Non-Contractual Total

Tabel 2.3 Pengungkapan Tagihan Bersih berdasarkan Sisa Jangka Waktu Kontrak - Bank secara Individual

Table 2.3 Disclosure of Net Receivables by Contractual Maturity – Bank Only

31 Desember 2013 / December 31, 2013

Tagihan Bersih Berdasarkan Sisa Jangka Waktu / Net Receivables by Contractual Maturity

Kategori Portofolio / Portfolio Category

79

PT Bank Mizuho Indonesia, 2010 Annual Report79

PT Bank Mizuho Indonesia,

2013 Annual Report

966.938 958.423 -1.589.526 -322 15.359.665 -18.874.874 -871.631 -2.278 2.741.308 -3.615.217 -834.180 -25.470 -2.367 1.009.678 -1.871.695 192.775 310.088 -14.241 -31.480 1,767.052 -2.315.636 1.794.930 -516.596 -57.125 -2.368.651 2.954.643 2.102.691 -3.017.464 -36.447 20.877.703 -57.125 -29.046.073

(Jutaan Rupiah / Millions Rupiah)

WDKXQ

\HDU >1 tahun - 3 tahun>1 year – 3 year

>3 tahun – 5 tahun >3 year – 5 year > 5 tahun > 5 year Non-Kontraktual Non-Contractual Total 31 Desember 2012 / December 31, 2012

80

02

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

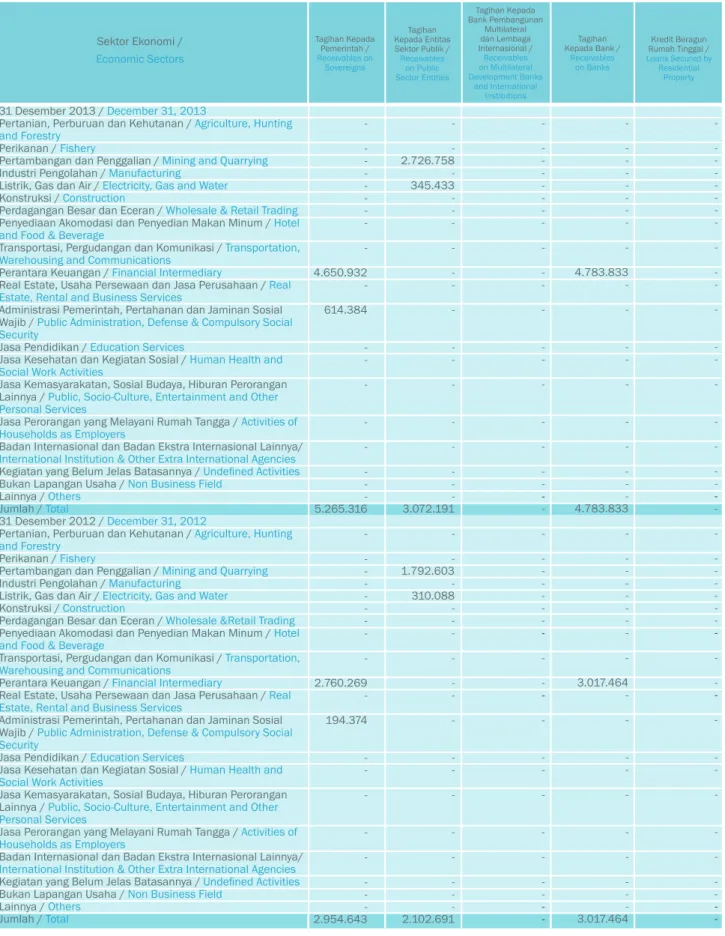

-4.650.932 -614.384 -5.265.316 -2.760.269 -194.374 -2.954.643 -2.726.758 -345.433 -3.072.191 -1.792.603 -310.088 -2.102.691 -4.783.833 -4.783.833 -3.017.464 -3.017.464 -Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal / Loans Secured by Residential PropertyTabel 2.4 Pengungkapan Tagihan Bersih berdasarkan Sektor Ekonomi - Bank secara Individual

Table 2.4 Disclosure of Net Receivables by Economic Sectors - Bank Only

Sektor Ekonomi / Economic Sectors

80

PT Bank Mizuho Indonesia,

2013 Annual Report

31 Desember 2013 /December 31, 2013

Pertanian, Perburuan dan Kehutanan / Agriculture, Hunting and Forestry

Perikanan / Fishery

Pertambangan dan Penggalian / 0LQLQJDQG4XDUU\LQJ Industri Pengolahan / Manufacturing

Listrik, Gas dan Air / Electricity, Gas and Water Konstruksi / Construction

Perdagangan Besar dan Eceran / Wholesale & Retail Trading Penyediaan Akomodasi dan Penyedian Makan Minum / Hotel and Food & Beverage

Transportasi, Pergudangan dan Komunikasi / Transportation, Warehousing and Communications

Perantara Keuangan / Financial Intermediary

Real Estate, Usaha Persewaan dan Jasa Perusahaan / Real Estate, Rental and Business Services

Administrasi Pemerintah, Pertahanan dan Jaminan Sosial Wajib / Public Administration, Defense & Compulsory Social Security

Jasa Pendidikan / Education Services

Jasa Kesehatan dan Kegiatan Sosial / Human Health and Social Work Activities

Jasa Kemasyarakatan, Sosial Budaya, Hiburan Perorangan Lainnya / Public, Socio-Culture, Entertainment and Other Personal Services

Jasa Perorangan yang Melayani Rumah Tangga / Activities of Households as Employers

Badan Internasional dan Badan Ekstra Internasional Lainnya/ International Institution & Other Extra International Agencies Kegiatan yang Belum Jelas Batasannya / 8QGHÀQHG$FWLYLWLHV Bukan Lapangan Usaha / Non Business Field

Lainnya / Others Jumlah / Total

31 Desember 2012 / December 31, 2012

Pertanian, Perburuan dan Kehutanan / Agriculture, Hunting and Forestry

Perikanan / Fishery

Pertambangan dan Penggalian /0LQLQJDQG4XDUU\LQJ Industri Pengolahan / Manufacturing

Listrik, Gas dan Air / Electricity, Gas and Water Konstruksi / Construction

Perdagangan Besar dan Eceran / Wholesale &Retail Trading Penyediaan Akomodasi dan Penyedian Makan Minum / Hotel and Food & Beverage

Transportasi, Pergudangan dan Komunikasi / Transportation, Warehousing and Communications

Perantara Keuangan / Financial Intermediary

Real Estate, Usaha Persewaan dan Jasa Perusahaan / Real Estate, Rental and Business Services

Administrasi Pemerintah, Pertahanan dan Jaminan Sosial Wajib / Public Administration, Defense & Compulsory Social Security

Jasa Pendidikan / Education Services

Jasa Kesehatan dan Kegiatan Sosial / Human Health and Social Work Activities

Jasa Kemasyarakatan, Sosial Budaya, Hiburan Perorangan Lainnya / Public, Socio-Culture, Entertainment and Other Personal Services

Jasa Perorangan yang Melayani Rumah Tangga / Activities of Households as Employers

Badan Internasional dan Badan Ekstra Internasional Lainnya/ International Institution & Other Extra International Agencies Kegiatan yang Belum Jelas Batasannya / 8QGHÀQHG$FWLYLWLHV Bukan Lapangan Usaha / Non Business Field

Lainnya / Others Jumlah / Total

81

PT Bank Mizuho Indonesia, 2010 Annual Report03

PT Bank Mizuho Indonesia,

2013 Annual Report

-41.163 979 42.142 -35.248 1.199 36.447 1.093.426 -256.379 16.869.372 -533.615 2.542.984 -716.877 6.735.468 1.504.868 -30.252.989 693.460 14 82.787 10.113.490 -418.925 2.539.035 -808.779 5.095.553 1.125.660 -20.877.703 -60.864 60.864 -57.125 57.125 -(Jutaan Rupiah / Millions Rupiah)

Tagihan Kepada Usaha Mikro, Usaha

Kecil dan Portofolio Ritel /

Receivables on Micro, Small Business &

Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo /

Past Due Receivables

Aset Lainnya / Other Assets Eksposur di Unit Syariah / Exposures at Sharia Based Business Activity

Unit -Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai/ Pensiunan /

Employee / Retired Loans

81

PT Bank Mizuho Indonesia,

2013 Annual Report

82

82

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

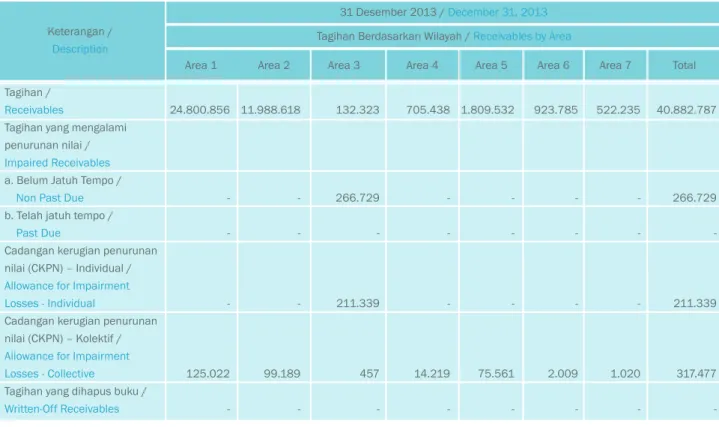

Tagihan /Receivables

Tagihan yang mengalami penurunan nilai / Impaired Receivables a. Belum Jatuh Tempo / Non Past Due b. Telah jatuh tempo / Past Due

Cadangan kerugian penurunan nilai (CKPN) – Individual / Allowance for Impairment Losses - Individual

Cadangan kerugian penurunan nilai (CKPN) – Kolektif / Allowance for Impairment Losses - Collective

Tagihan yang dihapus buku / Written-Off Receivables 132.323 266.729 -211.339 457 -705.438 -14.219 -1.809.532 -75.561 -923.785 -2.009 -522.235 -1.020 -40.882.787 266.729 -211.339 317.477

-Area 3 Area 4 Area 5 Area 6 Area 7 Total

Tabel 2.5 Pengungkapan Tagihan dan Pencadangan berdasarkan Wilayah - Bank secara Individual

Table 2.5 Disclosure of Receivables and Provisioning based on Area - Bank Only

31 Desember 2013 / December 31, 2013 Tagihan Berdasarkan Wilayah / Receivables by Area Area 2 Area 1 Keterangan / Description 24.800.856 -125.022 -11.988.618 -99.189 -Area 1 : Jakarta

Area 2 : Jawa Barat - West Java Area 3 : Jawa Tengah - Central Java Area 4 : Jawa Timur - East Java Area 5 : Sumatera & Kalimantan

Area 6 : Indonesia Timur (Bali, Sulawesi, Nusa Tenggara, Maluku & Papua) - Eastern Indonesia (Bali, Sulawesi, Nusa Tenggara, Maluku & Papua) Area 7 : Di luar Indonesia - Overseas

83

PT Bank Mizuho Indonesia, 2010 Annual Report83

PT Bank Mizuho Indonesia,

2013 Annual Report

113.262 227.412 -177.412 222 -519.590 -15.850 -1.041.708 -22.716 -4.832 -42 -523.382 -551 -26.820.029 227.412 -177.412 167.853 -(Jutaan Rupiah / Millions Rupiah)

Area 3 Area 4 Area 5 Area 6 Area 7 Total

31 Desember 2012 / December 31, 2012 Tagihan Berdasarkan Wilayah / Receivables by Area Area 2 Area 1 18.341.910 -89.460 -6.275.345 -39.012

-84

84

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

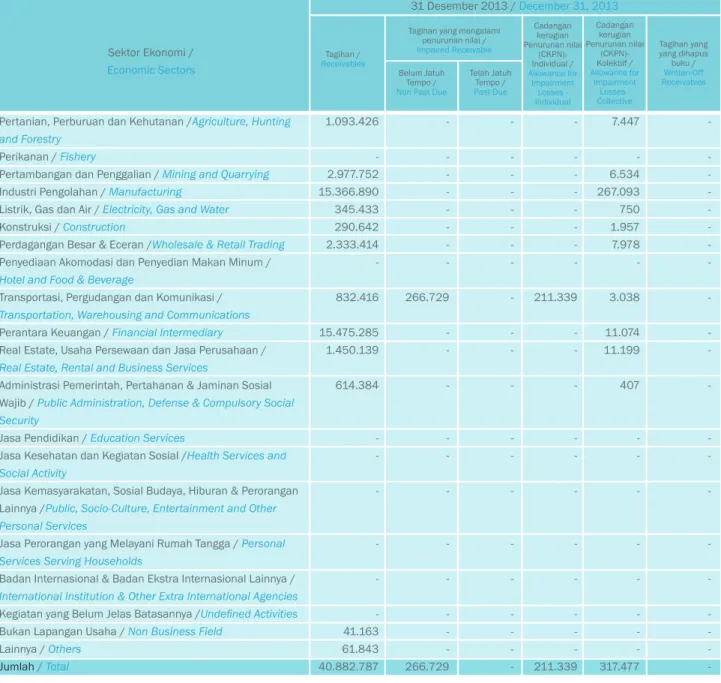

Pertanian, Perburuan dan Kehutanan /Agriculture, Hunting and ForestryPerikanan / Fishery

Pertambangan dan Penggalian / Mining and Quarrying Industri Pengolahan / Manufacturing

Listrik, Gas dan Air / Electricity, Gas and Water Konstruksi / Construction

Perdagangan Besar & Eceran /Wholesale & Retail Trading Penyediaan Akomodasi dan Penyedian Makan Minum / Hotel and Food & Beverage

Transportasi, Pergudangan dan Komunikasi / Transportation, Warehousing and Communications Perantara Keuangan / Financial Intermediary Real Estate, Usaha Persewaan dan Jasa Perusahaan / Real Estate, Rental and Business Services

Administrasi Pemerintah, Pertahanan & Jaminan Sosial Wajib / Public Administration, Defense & Compulsory Social Security

Jasa Pendidikan / Education Services

Jasa Kesehatan dan Kegiatan Sosial /Health Services and Social Activity

Jasa Kemasyarakatan, Sosial Budaya, Hiburan & Perorangan Lainnya /Public, Socio-Culture, Entertainment and Other Personal Services

Jasa Perorangan yang Melayani Rumah Tangga / Personal Services Serving Households

Badan Internasional & Badan Ekstra Internasional Lainnya / International Institution & Other Extra International Agencies Kegiatan yang Belum Jelas Batasannya /8QGHÀQHG$FWLYLWLHV

Bukan Lapangan Usaha / Non Business Field Lainnya / Others Jumlah / Total 1.093.426 -2.977.752 15.366.890 345.433 290.642 2.333.414 -832.416 15.475.285 1.450.139 614.384 -41.163 61.843 40.882.787 -266.729 -266.729 -211.339 -211.339 7.447 -6.534 267.093 750 1.957 7.978 -3.038 11.074 11.199 407 -317.477 -Tagihan / Receivables Belum Jatuh Tempo /

Non Past Due

Telah Jatuh Tempo / Past Due Cadangan kerugian Penurunan nilai (CKPN)- Individual / Allowance for Impairment Losses - Individual Cadangan kerugian Penurunan nilai (CKPN)-Kolektiif / Allowance for Impairment Losses - Collective Tagihan yang yang dihapus buku / Written-Off Receivables

Tabel 2.6 Pengungkapan Tagihan dan Pencadangan berdasarkan Sektor Ekonomi - Bank secara Individual

Table 2.6 Disclosure of Receivables and Provisioning based on Economic Sectors - Bank Only

Sektor Ekonomi / Economic Sectors

Tagihan yang mengalami penurunan nilai /

Impaired Receivable

85

PT Bank Mizuho Indonesia, 2010 Annual Report85

PT Bank Mizuho Indonesia,

2013 Annual Report

687.222 -1.866.211 8.849.891 310.088 197.242 2.241.360 -914.392 10.404.867 1.060.810 194.374 -35.248 58.324 26.820.029 -227.412 -227.412 -177.412 -177.412 2.970 -2.326 140.926 379 615 7.082 -927 8.700 3.692 236 -167.853

-(Jutaan Rupiah / Millions Rupiah)

Tagihan /

Receivables

Belum Jatuh Tempo /

Non Past Due

Telah Jatuh Tempo / Past Due Cadangan kerugian Penurunan nilai (CKPN)- Individual / Allowance for Impairment Losses - Individual Cadangan kerugian Penurunan nilai (CKPN)-Kolektiif / Allowance for Impairment Losses - Collective Tagihan yang yang dihapus buku / Written-Off Receivables

Tagihan yang mengalami penurunan nilai /

Impaired Receivable

86

86

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

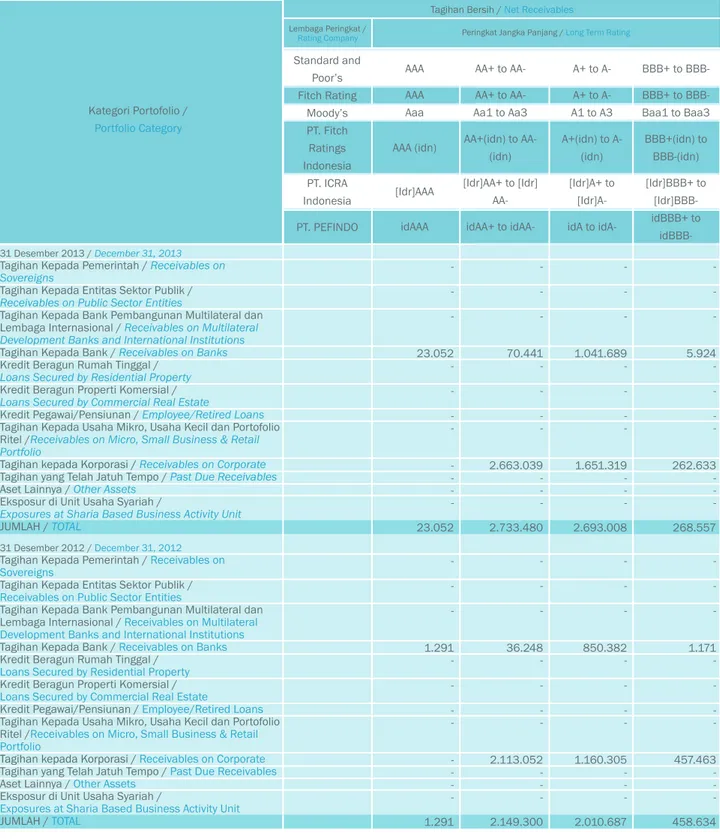

31 Desember 2013 / December 31, 2013Tagihan Kepada Pemerintah / Receivables on Sovereigns

Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal /

Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel /Receivables on Micro, Small Business & Retail Portfolio

Tagihan kepada Korporasi / Receivables on Corporate Tagihan yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

Eksposur di Unit Usaha Syariah /

Exposures at Sharia Based Business Activity Unit JUMLAH / TOTAL Standard and Poor’s Fitch Rating Moody’s PT. Fitch Ratings Indonesia PT. ICRA Indonesia PT. PEFINDO AAA AAA Aaa AAA (idn) [Idr]AAA idAAA AA+ to AA+ to AA-Aa1 to Aa3 AA+(idn) to AA-(idn) [Idr]AA+ to [Idr] AA-idAA+ to idAA-Lembaga Peringkat /

Rating Company Peringkat Jangka Panjang / Long Term Rating

Tabel 3.1 Pengungkapan Tagihan Bersih berdasarkan Kategori Porfolio dan Skala Peringkat - Bank secara Individual

Table 3.1 Disclosure of Net Receivables by Portfolio and Rating Category - Bank Only

Kategori Portofolio / Portfolio Category

Tagihan Bersih / Net Receivables

-1.041.689 -1.651.319 -2.693.008 -5.924 -262.633 -268.557 -23.052 -23.052 -70.441 -2.663.039 -2.733.480 A+ to A+ to A-A1 to A3 A+(idn) to A- (idn) [Idr]A+ to [Idr]A-idA to [Idr]A- idA-BBB+ to BBB+ to BBB-Baa1 to Baa3 BBB+(idn) to BBB-(idn) [Idr]BBB+ to [Idr]BBB-idBBB+ to idBBB-31 Desember 2012 / December idBBB-31, 2012

Tagihan Kepada Pemerintah / Receivables on Sovereigns

Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal /

Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel /Receivables on Micro, Small Business & Retail Portfolio

Tagihan kepada Korporasi / Receivables on Corporate Tagihan yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

Eksposur di Unit Usaha Syariah /

Exposures at Sharia Based Business Activity Unit JUMLAH / TOTAL -850.382 -1.160.305 -2.010.687 -1.171 -457.463 -458.634 -1.291 -1.291 -36.248 -2.113.052 -2.149.300

87

PT Bank Mizuho Indonesia, 2010 Annual Report87

PT Bank Mizuho Indonesia,

2013 Annual Report

(Jutaan Rupiah / Millions Rupiah)

-2.288.805 -42.142 24.465.064 -60.864 -26.856.875 5.265.316 3.072.191 -4.783.833 -42.142 30.252.989 -60.864 -43.477.335 Tanpa Peringkat Unrated Total 5.265.316 2.155.713 -1.353.922 -1.155.544 -9.930.495 -916.478 -916.478 -55.390 -55.390 -A-2 F2 P-2 F2(idn) [Idr]A2+ to [Idr]A2 idA2 A-3. F3 P-3 F3(idn) [Idr]A3+ to [Idr] A3 idA3 to idA4 BB+ to BB+ to BB-Ba1 to Ba3 BB+(idn) to BB-(idn) [Idr]BB+ to [Idr]BB-idBB to [Idr]BB- idBB+ to B+ to B-B1 to B3 B+(idn) to B-(idn) [Idr]B+ to [Idr]idB+ to Kurang dari Lower than Kurang dari Lower than B-Kurang dari B3 Lower than B3

Kurang dari B-(idn) Lower than B-(idn) Kurang dari [Idr]B- Lower than

[Idr]Kurang dari id B-Lower than

idB-A-1 F1+ to F1 P-1 F1+(idn) to F1(idn) [Idr]A1+ to [Idr]A1 idA1

Kurang dari A-3 Lower than A-3 Kurang dari F3 Lower than F3 Kurang dari P-3 Lower than P-3

Kurang dari F3(idn) Lower than F3(idn) Kurang dari [Idr]A3 Lower than [Idr]A3

Kurang dari id A4 Lower than id A4 -1.298.420 -36.447 16.183.092 -57.125 -17.575.084 2.954.643 2.102.691 -3.017.464 -36.447 20.877.703 -57.125 -29.046.073 2.954.643 2.102.691 -829.952 -913.791 -6.801.077 -50.000 -50.000

-Peringkat Jangka Pendek / Short Term Rating

Peringkat Jangka Panjang / Long Term Rating

88

88

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

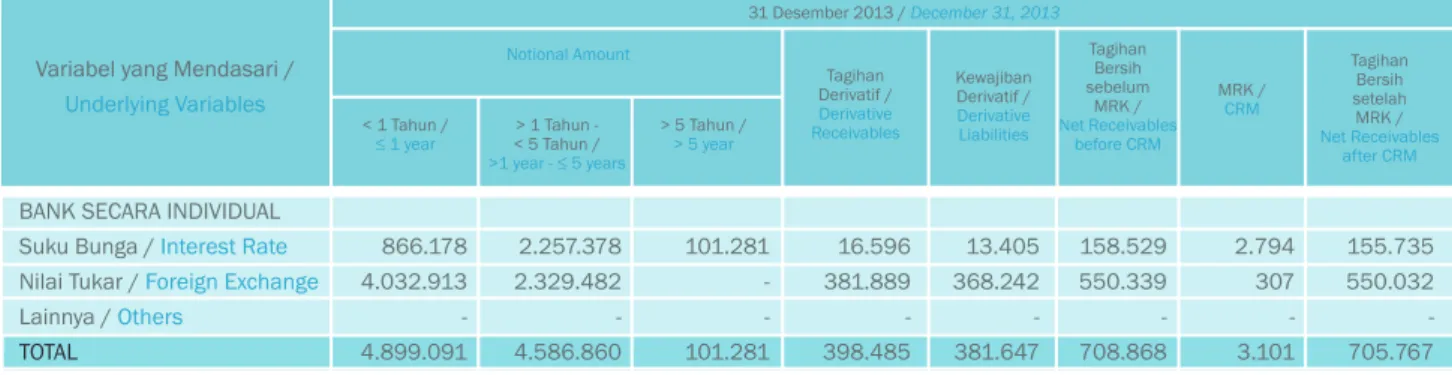

BANK SECARA INDIVIDUALSuku Bunga / Interest Rate Nilai Tukar / Foreign Exchange Lainnya / Others TOTAL 101.281 -101.281 16.596 381.889 -398.485 13.405 368.242 -381.647 158.529 550.339 -708.868 2.794 307 -3.101 155.735 550.032 -705.767 2.257.378 2.329.482 -4.586.860 866.178 4.032.913 -4.899.091 > 5 Tahun / > 5 year Tagihan Derivatif / Derivative Receivables Kewajiban Derivatif / Derivative Liabilities Tagihan Bersih sebelum MRK / Net Receivables before CRM MRK / CRM Tagihan Bersih setelah MRK / Net Receivables after CRM

Tabel 3.2 Pengungkapan Risiko Kredit Pihak Lawan: Transaksi Derivatif

Table 3.2 Disclosure of Counterparty Credit Risk : Derivative Transaction

Variabel yang Mendasari / Underlying Variables

< 1 Tahun /

\HDU < 5 Tahun /> 1 Tahun - !\HDU\HDUV

Notional Amount

89

PT Bank Mizuho Indonesia, 2010 Annual Report89

PT Bank Mizuho Indonesia,

2013 Annual Report

BANK SECARA INDIVIDUAL Suku Bunga / Interest Rate Nilai Tukar / Foreign Exchange Lainnya / Others TOTAL 315.834 -315.834 21.366 175.651 -197.017 14.478 164.865 -179.343 133.430 356.417 -489.847 1.613 3.758 -5.371 131.817 352.659 -484.476 (Jutaan Rupiah / Millions Rupiah)

> 5 Tahun / > 5 year Tagihan Derivatif / Derivative Receivables Kewajiban Derivatif / Derivative Liabilities Tagihan Bersih sebelum MRK / Net Receivables before CRM MRK / CRM Tagihan Bersih setelah MRK / Net Receivables after CRM

Variabel yang Mendasari / Underlying Variables 1.510.557 2.201.499 -3.712.056 55.782 5.968.488 -6.024.270 < 1 Tahun /

\HDU < 5 Tahun /> 1 Tahun - !\HDU\HDUV

Notional Amount

90

90

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

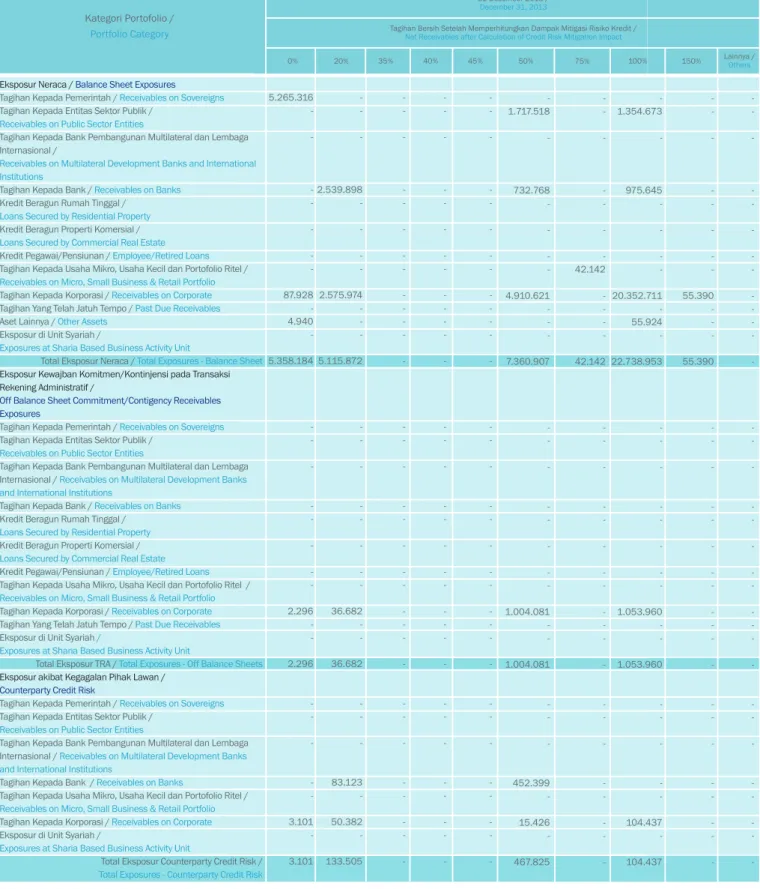

Eksposur Neraca / Balance Sheet Exposures Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik /

Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional /

Receivables on Multilateral Development Banks and International Institutions

Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal /

Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

Eksposur di Unit Syariah /

Exposures at Sharia Based Business Activity Unit

Total Eksposur Neraca / Total Exposures - Balance Sheet

Eksposur Kewajban Komitmen/Kontinjensi pada Transaksi Rekening Administratif /

Off Balance Sheet Commitment/Contigency Receivables Exposures

Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik /

Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions

Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal /

Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Eksposur di Unit Syariah /

Exposures at Sharia Based Business Activity Unit

Total Eksposur TRA / Total Exposures - Off Balance Sheets

Eksposur akibat Kegagalan Pihak Lawan /

Counterparty Credit Risk

Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik /

Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions

Tagihan Kepada Bank / Receivables on Banks

Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Eksposur di Unit Syariah /

Exposures at Sharia Based Business Activity Unit

Total Eksposur Counterparty Credit Risk / Total Exposures - Counterparty Credit Risk

5.265.316 -87.928 -4.940 -5.358.184 -2.296 -2.296 -3.101 -3.101 -2.539.898 -2.575.974 -5.115.872 -36.682 -36.682 -83.123 -50.382 -133.505 -0% 20% 35% 40% 45%

Tabel 4.1 Pengungkapan Tagihan Bersih berdasarkan Bobot Risiko Setelah Memperhitungankan Dampak Mitigasi Risiko Kredit - Bank secara Individual

Table 4.1 Disclosure of Net Receivables by Risk Weight after Credit Risk Mitigation - Bank Only

Kategori Portofolio / Portfolio Category -1.354.673 -975.645 -20.352.711 -55.924 -22.738.953 -1.053.960 -1.053.960 -104.437 -104.437 -55.390 -55.390 -100% 150% Lainnya /Others -1.717.518 -732.768 -4.910.621 -7.360.907 -1.004.081 -1.004.081 -452.399 -15.426 -467.825 -42.142 -42.142 -50% 75%

Tagihan Bersih Setelah Memperhitungkan Dampak Mitigasi Risiko Kredit / Net Receivables after Calculation of Credit Risk Mitigation Impact

31 Desember 2013 / December 31, 2013

91

PT Bank Mizuho Indonesia, 2010 Annual Report91

PT Bank Mizuho Indonesia,

2013 Annual Report

-2.213.432 -1.850.009 -31.607 23.406.301 -55.924 -27.557.273 -1.563.337 -1.563.337 -242.824 -122.226 -365.050 -177.075 -148.001 -2.529 1.872.504 -4.474 -2.204.582 -125.067 -125.067 -19.426 -9.778 -29.204

(Jutaan Rupiah / Millions Rupiah)

ATMR / RWA Beban Modal / Capital Charge 2.952.715 -15.950 -4.156 2.972.821 -2.367 -2.367 1.928 -5.372 -7.300 -1.302.996 -2.007.073 -3.310.069 -25.243 -25.243 -45.409 -80.736 -126.145 -0% 20% 35% 40% 45% -900.444 -483.576 -11.864.146 -52.969 -13.301.135 -825.450 -825.450 -289 -124.657 -124.946 -50.000 -50.000 -1.501.568 -1.224.995 -27.335 14.744.690 -52.969 -17.551.557 -1.360.773 -1.360.773 -121.148 -144.756 -265.904 -120.125 -98.000 -2.187 1.179.575 -4.238 -1.404.125 -108.862 -108.862 -9.692 -11.580 -21.272 100% 150% Lainnya /Others ATMR / RWA Beban Modal / Capital Charge -1.202.247 -961.640 -4.808.258 -6.972.145 -1.060.548 -1.060.548 -223.554 -7.903 -231.457 -36.447 -36.447 -50% 75%

Tagihan Bersih Setelah Memperhitungkan Dampak Mitigasi Risiko Kredit / Net Receivables after Calculation of Credit Risk Mitigation Impact

31 Desember 2012 / December 31, 2012

92

92

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

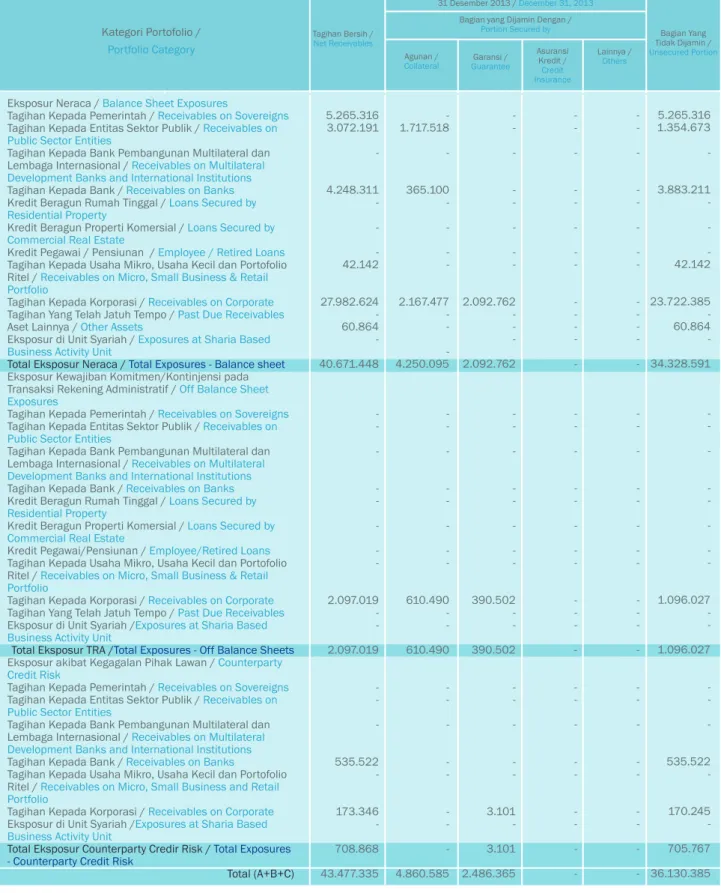

Eksposur Neraca / Balance Sheet ExposuresTagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property

Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai / Pensiunan / Employee / Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio

Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

Eksposur di Unit Syariah / Exposures at Sharia Based Business Activity Unit

Total Eksposur Neraca / Total Exposures - Balance sheet Eksposur Kewajiban Komitmen/Kontinjensi pada Transaksi Rekening Administratif / Off Balance Sheet Exposures

Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property

Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio

Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Eksposur di Unit Syariah /Exposures at Sharia Based Business Activity Unit

Total Eksposur TRA /Total Exposures - Off Balance Sheets Eksposur akibat Kegagalan Pihak Lawan / Counterparty Credit Risk

Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks

Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business and Retail Portfolio

Tagihan Kepada Korporasi / Receivables on Corporate Eksposur di Unit Syariah /Exposures at Sharia Based Business Activity Unit

Total Eksposur Counterparty Credir Risk / Total Exposures - Counterparty Credit Risk

Total (A+B+C) 5.265.316 3.072.191 -4.248.311 -42.142 27.982.624 -60.864 -40.671.448 -2.097.019 -2.097.019 -535.522 -173.346 -708.868 43.477.335 -1.717.518 -365.100 -2.167.477 -4.250.095 -610.490 -610.490 -4.860.585 -2.092.762 -2.092.762 -390.502 -390.502 -3.101 -3.101 2.486.365 -5.265.316 1.354.673 -3.883.211 -42.142 23.722.385 -60.864 -34.328.591 -1.096.027 -1.096.027 -535.522 -170.245 -705.767 36.130.385 Tagihan Bersih / Net Receivables Agunan / Collateral Garansi / Guarantee Asuransi Kredit / Credit Insurance Lainnya / Others Bagian Yang Tidak Dijamin / Unsecured Portion

Tabel 4.2 Pengungkapan Tagihan Bersih dan Teknik Mitigasi Risiko Kredit - Bank secara Individual

Table 4.2 Disclosure of Net Receivables and Credit Risk Mitigation Techniques - Bank Only

Kategori Portofolio / Portfolio Category

Bagian yang Dijamin Dengan /

Portion Secured by

93

PT Bank Mizuho Indonesia, 2010 Annual Report93

PT Bank Mizuho Indonesia,

2013 Annual Report

2.952.715 2.102.691 -2.748.212 -36.447 18.745.427 -57.125 -26.642.617 -1.913.608 -1.913.608 1.928 -269.252 -218.668 -489.848 29.046.073 -1.202.247 -289.125 -2.975.549 -4.466.921 -804.177 -804.177 -5.271.098 -1.675.592 -1.675.592 -249.450 -249.450 -10.744 -10.744 1.935.786 -2.952.715 900.444 -2.459.087 -36.447 14.094.286 -57.125 -20.500.104 -859.981 -859.981 1.928 -269.252 -207.924 -479.104 21.839.189

(Jutaan Rupiah / Millions Rupiah)

Tagihan Bersih / Net Receivables Agunan / Collateral Garansi / Guarantee Asuransi Kredit / Credit Insurance Lainnya / Others Bagian Yang Tidak Dijamin / Unsecured Portion

Bagian yang Dijamin Dengan /

Portion Secured by

94

94

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

Tagihan Kepada Pemerintah / Receivables on SovereignsTagihan Kepada Entitas Sektor Publik / Receivables on Public Sector Entities Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional / Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks

Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate Kredit Pegawai/Pensiunan / Employee/Retired Loans

Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business and Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables Aset Lainnya / Other Assets

TOTAL -1.501.568 -1.224.995 -27.335 14.744.689 -52.969 17.551.556

(Jutaan rupiah / Million Rupiah)

Tabel 5.1 Perhitungan ATMR Risiko Kredit Pendekatan Standar: Eksposur Aset di Neraca

Table 5.1. Calculation of Risk Weighted Assets for Credit Risk under Standardized Method

-2.102.691 -1.369.558 -27.335 16.863.138 -52.969 20.415.691 ATMR Sebelum MRK / RWA before CRM ATMR Setelah MRK /RWA after CRM 31 Desember 2012

/

December 31, 2012 Kategori Portofolio / Portfolio Category 2.952.715 2.102.691 -2.748.212 -36.447 18.745.427 -57.125 26.642.617 Tagihan Bersih /Net Receivables -2.213.432 -1.850.009 -31.607 23.406.301 -55.924 27.557.273 -3.072.191 -2.032.559 -31.607 25.368.175 -30.504.532 ATMR Sebelum MRK / RWA before CRM ATMR Setelah MRK /RWA after CRM 5.265.316 3.072.191 -4.248.311 -42.142 27.982.624 -60.864 40.671.448 Tagihan Bersih /Net Receivables 31 Desember 2013/

December 31, 201395

PT Bank Mizuho Indonesia, 2010 Annual Report95

PT Bank Mizuho Indonesia,

2013 Annual Report

Tagihan Kepada Pemerintah / Receivables onSovereigns

Tagihan Kepada Entitas Sektor Publik /Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional /Receivables on Multilateral Development Banks and International Institutions Tagihan Kepada Bank / Receivables on Banks Kredit Beragun Rumah Tinggal / Loans Secured by Residential Property

Kredit Beragun Properti Komersial / Loans Secured by Commercial Real Estate

Kredit Pegawai/Pensiunan / Employee/Retired Loans Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio

Tagihan Kepada Korporasi / Receivables on Corporate Tagihan Yang Telah Jatuh Tempo / Past Due Receivables TOTAL -1.360.773 -1.360.773

(Jutaan rupiah / Million Rupiah)

Tabel 5.2 Perhitungan ATMR Risiko Kredit Pendekatan Standar: Eksposur Kewajiban Komitmen/Kontinjensi pada Transaksi

Rekening Administratif

Table 5.2. Calculation of RWA for Credit Risk under Standardized Approach: Off Balance Sheet Commitment/Contingency

Exposures

-1.618.844 -1.618.844 ATMR Sebelum MRK / RWA before CRM ATMR Setelah MRK / RWA after CRM 31 Desember 2012/

December 31, 2012 Kategori Portofolio / Portfolio Category -1.913.608 -1.913.608 Tagihan Bersih / Net Receivables -1.563.337 -1.563.337 -1.831.092 -1.831.092 ATMR Sebelum MRK / RWA before CRM ATMR Setelah MRK / RWA after CRM -2.097.019 -2.097.019 Tagihan Bersih / Net Receivables 31 Desember 2013/

December 31, 201396

96

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

Tagihan Kepada Pemerintah / Receivables on Sovereigns Tagihan Kepada Entitas Sektor Publik /Receivables on Public Sector Entities

Tagihan Kepada Bank Pembangunan Multilateral dan Lembaga Internasional /

Receivables on Multilateral Development Banks and International Institutions

Tagihan Kepada Bank / Receivables on Banks

Tagihan Kepada Usaha Mikro, Usaha Kecil dan Portofolio Ritel / Receivables on Micro, Small Business & Retail Portfolio Tagihan Kepada Korporasi / Receivables on Corporate TOTAL -242.824 -122.226 365.050 (Jutaan rupiah / Million Rupiah)

Tabel 5.3 Perhitungan ATMR Risiko Kredit Pendekatan Standar: Eksposur yang Menimbulkan Risiko Kredit akibat Kegagalan Pihak

Lawan (Counterparty Credit Risk)

Table 5.3. Calculation of Risk Weighted Assets for Credit Risk under Standardized Method: Counterparty Credit Risk Exposure

-242.824 -125.327 368.151 ATMR Sebelum MRK /RWA before CRM ATMR Setelah MRK /RWA after CRM 31 Desember 2013

/

December 31, 2013 Kategori Portofolio / Portfolio Category -535.522 -173.346 708.868 Tagihan Bersih / Net ReceivablesTagihan Kepada Entitas Sektor Publik /

Receivables on Public Sector Entities

-Tagihan Kepada Bank / Receivables on Banks 535.522 242.824 242.824

TOTAL ATMR RISIKO KREDIT / TOTAL RWA FOR CREDIT RISK TOTAL FAKTOR PENGURANG MODAL / TOTAL CAPITAL DEDUCTION FACTOR

19.178.233

31 Desember 2012 /

December 31, 2012

Tabel 5.4 Pengungkapan Total Pengukuran Risiko Kredit - Bank secara Individual

Table 5.4. Disclosure of Total Credit Risk Measurement - Bank Only

29.485.660

31 Desember 2013 /

December 31, 2013 -121.148 -144.756 265.904 -121.148 -150.128 271.276 ATMR Sebelum MRK / RWA before CRM ATMR Setelah MRK /RWA after CRM 1.928 -269.252 -218.668 489.848 Tagihan Bersih / Net Receivables 31 Desember 2012

/

December 31, 2012 (Jutaan rupiah / Million Rupiah)97

PT Bank Mizuho Indonesia, 2010 Annual Report97

PT Bank Mizuho Indonesia,

2013 Annual Report

31 Desember 2013/

December 31, 2013Pendekatan Indikator Dasar / Basic Indicator Approach Total

31 Desember 2012

/

December 31, 2012 Pendekatan Indikator Dasar / Basic Indicator Approach Total1.324.525 1.324.525

1.234.935 1.234.935

Tabel 7 Pengungkapan Kuantitatif Risiko Operasional - Bank secara Individual

7DEOH4XDQWLWDWLYH'LVFORVXUHRI2SHUDWLRQDO5LVN%DQN2QO\

105.962 105.962 98.795 98.795 Beban Modal / Capital Charge ATMR / RWA (jutaan rupiah / million Rupiah)Pendekatan Yang Digunakan /

Indicator Approach tahun terakhir) / Average Gross Pendapatan Bruto (Rata-rata 3

Income in the past 3 years Risiko Suku Bunga / Interest Rate Risk

D5LVLNR6SHVLÀN6SHFLÀF5LVN b. Risiko Umum / General Risk Risiko Nilai Tukar / Foreign Exchange Risk Risiko Ekuitas / Equity Risk

Risiko Komoditas / Commodity Risk Risiko Option / Option Risk Total -45.758 27.171 -72.929

(Jutaan Rupiah / Million Rupiah)

Tabel 6 Pengungkapan Risiko Pasar dengan Menggunakan Metode Standar - Bank secara Individual

Table 6 Disclosure of Market Risk Using Standardized Method - Bank Only

ATMR / RWA 31 Desember 2012

/

December 31, 2012 Jenis Risiko / Type of Risk -3.661 2.174 -5.835 Beban Modal / Capital Charge Bank-36.525 31.275 -67.800 ATMR / RWA -2.922 2.502 -5.424 Beban Modal / Capital Charge 31 Desember 2013

/

December 31, 2013 706.415 706.415 658.632 658.63298

98

PT Bank Mizuho Indonesia,

PT Bank Mizuho Indonesia, 2010 Annual Report2013 Annual Report

Neraca / Balance SheetA. Aset / Assets

1. Kas / Cash

2. Penempatan pada Bank Indonesia / Placement with Bank Indonesia 3. Penempatan pada bank lain / Placement with other Bank

4. Surat Berharga / Marketable Securities 5. Kredit yang diberikan / Loans 6. Tagihan Lainnya / Other Receivables 7. Lain-lain / Others

Total Aset / Total Assets

B. Liabilitas / Liabilities

1. Dana Pihak Ketiga / Deposits from Customer 2. Liabilitas kepada Bank Indonesia / Liabilities with Bank Indonesia 3. Liabilitas kepada bank lain / Liabilities with other bank 4. Surat Berharga yang Diterbitkan / Securities Issued

5. Pinjaman yang Diterima / Borrowings 6. Liabilitas Lainnya / Other Liabilities 7. Lain-lain / Others

Total Liabilitas / Total Liabilities

Selisih Aset dengan Liabilitas dalam Neraca /

On Balance Sheet Asset and Liabilities Differences

Rekening Administratif / Off Balance Sheet

A. Tagihan Rekening Administratif / Off Balance Sheet Receivables

1. Komitmen / Commitment 2. Kontinjensi / Contingency

Total Tagihan Rekening Administratif /

Total Off Balance Sheet Receivables

A. Liabilitas Rekening Administratif / Off Balance Sheet Liabilities

1. Komitmen / Commitment 2. Kontinjensi / Contingency

Total Liabilitas Rekening Administratif /

Total Off Balance Sheet Liabilities

Selisih Tagihan dan Liabilitas Rekening Administratif /

Off Balance Sheet Assets and Liabilities Differences

Selisih [(IA-IB) + (IIA-IIB)] / Differences

Selisih Kumulatif / Cummulative Differences

2.216 2.384.452 483.415 427.054 9.095.880 745.928 107.466 13.246.411 5.828.469 -5.133 -2.374 714.680 157.667 6.708.323 6.538.088 3.179.106 11.503 3.190.609 3.665.455 3.665.455 (474.846) 6.063.242 6.063.242 2.216 2.185.804 483.415 78.565 4.745.867 491.437 107.466 8.094.770 5.746.994 -5.133 -462.812 157.667 6.372.606 1.722.164 476.341 476.341 358.590 358.590 117.751 1.839.915 1.839.915 -198.648 1.105.931 13.115 1.317.694 77.475 17 10.721 88.213 1.229.481 281.542 281.542 377.429 377.429 (95.887) 1.133.594 2.973.509 -12.044 350.775 241.376 604.195 4.000 -241.147 245.147 359.048 151.537 151.537 155.516 155.516 (3.979) 355.069 3.328.578 -336.445 893.133 1.229.578 374 -374 1.229.204 415.292 415.292 532.485 532.485 (117.193) 1.112.011 4.440.589 -2.000.174 2.000.174 1.983 -1.983 1.998.191 1.854.394 11.503 1.865.897 2.241.435 2.241.435 (375.538) 1.622.653 6.063.242 Saldo /

Balance < 1 bulan /< 1 month

>1 bln - 3 bln / >1 3 months >3 bln - 6 bln / >3 months 6 months >6 bln - 12 bln / >6 months 12 months >12 bulan / > 12 months

7DEHO3HQJXQJNDSDQ3URÀO0DWXULWDV5XSLDK%DQNVHFDUD,QGLYLGXDO

7DEHO'LVFORVXUHRI5XSLDK0DWXULW\3URÀOH

Pos-pos / Account 31 Desember 2013/ December 31, 2013 I II No99

PT Bank Mizuho Indonesia, 2010 Annual Report99

PT Bank Mizuho Indonesia,

2013 Annual Report

1.470 1.361.578 149.240 1.828 6.899.030 273.015 62.053 8.748.214 3.869.802 1.463 4.496 - - 256.494 157.460 4.289.715 4.458.499 3.862.053 20.072 3.882.125 4.388.693 - 4.388.693 (506.568) 3.951.931 3.951.931 1.470 753.040 149.240 - 4.096.892 184.919 62.053 5.247.614 3.812.157 531 4.496 - - 168.709 157.460 4.143.353 1.104.261 654.662 - 654.662 1.313.974 - 1.313.974 (659.312) 444.949 444.949 - 74.585 - 229 923.600 88.096 - 1.086.510 57.645 277 - - - 87.785 - 145.707 940.803 569.549 - 569.549 372.681 - 372.681 196.868 1.137.671 1.582.620 - 313.996 - - 476.580 - - 790.576 - 655 - - - - - 655 789.921 285.259 - 285.259 249.300 - 249.300 35.959 825.880 2.408.500 - 219.957 - 1.599 388.257 - - 609.813 - - - - - - - - -609.813 1.303.029 - 1.303.029 1.023.795 - 1.023.795 279.234 889.047 3.297.547 - - - -1.013.701 - - 1.013.701 - - - - - - - - 1.013.701 1.049.554 20.072 1.069.626 1.428.943 - 1.428.943 (359.317) 654.384 3.951.931 Saldo /

Balance < 1 bulan /< 1 month

>1 bln - 3 bln / >1 3 months >3 bln - 6 bln / >3 months 6 months >6 bln - 12 bln / >6 months 12 months >12 bulan / > 12 months 31 Desember 2012 / December 31, 2012 (Jutaan Rupiah / Million Rupiah)

100

PT Bank Mizuho Indonesia, 2010 Annual Report Neraca / Balance SheetA. Aset / Assets

1. Kas / Cash

2. Penempatan pada Bank Indonesia / Placement with Bank Indonesia

3. Penempatan pada bank lain / Placement with other Bank

4. Surat Berharga / Marketable Securities

5. Kredit yang diberikan / Loans

6. Tagihan Lainnya / Other Receivables

7. Lain-lain / Others

Total Aset / Total Assets

B. Liabilitas / Liabilities

1. Dana Pihak Ketiga / Deposits from Customer

2. Liabilitas kepada Bank Indonesia / Liabilities with Bank Indonesia

3. Liabilitas kepada bank lain / Liabilities with other bank 4. Surat Berharga yang Diterbitkan / Securities Issued

5. Pinjaman yang Diterima / Borrowings

6. Liabilitas Lainnya / Other Liabilities

7. Lain-lain / Others

Total Liabilitas / Total Liabilities

Selisih Aset dengan Liabilitas dalam Neraca /

On Balance Sheet Asset and Liabilities Differences

Rekening Administratif / Off Balance Sheet

A. Tagihan Rekening Administratif / Off Balance Sheet Receivables

1. Komitmen / Commitment

2. Kontinjensi / Contingency

Total Tagihan Rekening Administratif /

Total Off Balance Sheet Receivables

A. Liabilitas Rekening Administratif / Off Balance Sheet Liabilities

1. Komitmen / Commitment

2. Kontinjensi / Contingency

Total Liabilitas Rekening Administratif /

Total Off Balance Sheet Liabilities

Selisih Tagihan danLiabilitas Rekening Administratif /

Off Balance Sheet Assets and Liabilities Differences

Selisih [(IA-IB) + (IIA-IIB)] / Differences

Selisih Kumulatif / Cummulative Differences

224 186.235 18.912 179.412 1.783.709 127.355 4.638 2.300.485 589.552 -139.326 -1.475.667 62.535 28.532 2.295.612 4.873 542.785 1.060 543.845 713.355 -713.355 (169.510) (164.637) (164.637) 224 186.235 18.912 144.294 562.074 42.031 4.638 958.408 568.192 -139.326 -95.000 22.055 28.532 853.105 105.303 104.267 -104.267 133.102 -133.102 (28.835) 76.468 76.468 -12.496 221.238 65.806 -299.540 8.384 -31.674 -40.058 259.482 36.997 -36.997 137.205 -137.205 (100.208) 159.274 235.742 -22.622 67.111 19.518 -109.251 12.476 -225.000 8.806 -246.282 (137.031) 15.968 -15.968 21.555 -21.555 (5.587) (142.618) 93.124 -206.007 -206.007 500 -596.156 -596.656 (390.649) 70.315 -70.315 79.147 -79.147 (8.832) (399.481) (306.357) -727.279 -727.279 -559.511 -559.511 167.768 315.238 1.060 316.298 342.346 -342.346 (26.048) 141.720 (164.637) Saldo / Balance < 1 bulan / < 1 month >1 bln s.d. 3 bln / >1 month 3 months >3 bln s.d. 6 bln / >3 months 6 months >6 bln s.d. 12 bln / >6 months 12 months >12 bulan / > 12 months

7DEHO3HQJXQJNDSDQ3URÀO0DWXULWDV9DODV%DQNVHFDUD,QGLYLGXDO

7DEHO'LVFORVXUHRI)RUHLJQ([FKDQJH0DWXULW\3URÀOH

Pos-pos / Account 31 Desember 2013 / December 31, 2013 I II No101

PT Bank Mizuho Indonesia, 2010 Annual Report2.689 1.396.763 512.356 1.317.438 13.782.074 1.178.628 45.177 18.235.125 5.366.644 - 1.264.659 - 11.426.133 614.273 31.168 18.702.877 (467.752) 6.401.280 - 6.401.280 7.651.297 - 7.651.297 (1.250.017) (1.717.769) (1.717.769) 2.689 1.396.763 512.356 727.690 6.637.664 400.072 43.693 9.720.927 5.285.640 - 1.264.659 - 289.125 246.420 31.168 7.117.012 2.603.915 1.759.714 - 1.759.714 1.376.543 - 1.376.543 383.171 2.987.086 2.987.086 - - - 351.065 1.527.043 520.435 1.484 2.400.027 36.507 - - - 481.875 267.874 - 786.256 1.613.771 747.003 - 747.003 1.495.335 - 1.495.335 (748.332) 865.439 3.852.525 - - - 234.847 437.485 258.121 - 930.453 15.584 - - - 2.625.216 99.979 - 2.740.779 (1.810.326) 248.937 - 248.937 343.712 - 343.712 (94.775) (1.905.101) 1.947.424 - - - 3.836 1.048.507 - - 1.052.343 28.913 - - - 7.114.354 - - 7.143.267 (6.090.924) 1.163.025 - 1.163.025 1.664.367 - 1.664.367 (501.342) (6.592.266) (4.644.842) - - - - 4.131.375 - - 4.131.375 - - - - 915.563 - - 915.563 3.215.812 2.482.601 - 2.482.601 2.771.340 - 2.771.340 (288.739) 2.927.073 (1.717.769) Saldo / Balance < 1 bulan / < 1 month >1 bln s.d. 3 bln / >1 month 3 months >3 bln s.d. 6 bln / >3 months 6 months >6 bln s.d. 12 bln / >6 months 12 months >12 bulan / > 12 months 31 Desember 2012 / December 31, 2012

101

PT Bank Mizuho Indonesia,

2013 Annual Report

(Jutaan Rupiah / Million Rupiah)