1

Lampiran 1

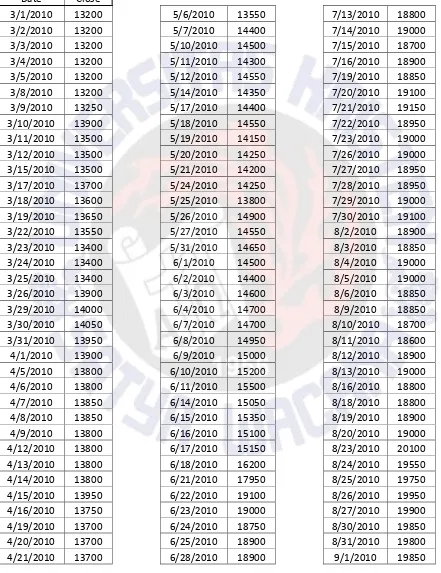

Tabel 1. data harga saham penutupan harian dari PT. HM. Sampoerna Tbk. tanggal 1 Maret 2010 sampai 29 Februari 2012

Date Close

3/1/2010 13200 5/6/2010 13550 7/13/2010 18800

3/2/2010 13200 5/7/2010 14400 7/14/2010 19000

3/3/2010 13200 5/10/2010 14500 7/15/2010 18700

3/4/2010 13200 5/11/2010 14300 7/16/2010 18900

3/5/2010 13200 5/12/2010 14550 7/19/2010 18850

3/8/2010 13200 5/14/2010 14350 7/20/2010 19100

3/9/2010 13250 5/17/2010 14400 7/21/2010 19150

3/10/2010 13900 5/18/2010 14550 7/22/2010 18950

3/11/2010 13500 5/19/2010 14150 7/23/2010 19000

3/12/2010 13500 5/20/2010 14250 7/26/2010 19000

3/15/2010 13500 5/21/2010 14200 7/27/2010 18950

3/17/2010 13700 5/24/2010 14250 7/28/2010 18950

3/18/2010 13600 5/25/2010 13800 7/29/2010 19000

3/19/2010 13650 5/26/2010 14900 7/30/2010 19100

3/22/2010 13550 5/27/2010 14550 8/2/2010 18900

3/23/2010 13400 5/31/2010 14650 8/3/2010 18850

3/24/2010 13400 6/1/2010 14500 8/4/2010 19000

3/25/2010 13400 6/2/2010 14400 8/5/2010 19000

3/26/2010 13900 6/3/2010 14600 8/6/2010 18850

3/29/2010 14000 6/4/2010 14700 8/9/2010 18850

3/30/2010 14050 6/7/2010 14700 8/10/2010 18700

3/31/2010 13950 6/8/2010 14950 8/11/2010 18600

4/1/2010 13900 6/9/2010 15000 8/12/2010 18900

4/5/2010 13800 6/10/2010 15200 8/13/2010 19000

4/6/2010 13800 6/11/2010 15500 8/16/2010 18800

4/7/2010 13850 6/14/2010 15050 8/18/2010 18800

4/8/2010 13850 6/15/2010 15350 8/19/2010 18900

4/9/2010 13800 6/16/2010 15100 8/20/2010 19000

4/12/2010 13800 6/17/2010 15150 8/23/2010 20100

4/13/2010 13800 6/18/2010 16200 8/24/2010 19550

4/14/2010 13800 6/21/2010 17950 8/25/2010 19750

4/15/2010 13950 6/22/2010 19100 8/26/2010 19950

4/16/2010 13750 6/23/2010 19000 8/27/2010 19900

4/19/2010 13700 6/24/2010 18750 8/30/2010 19850

4/20/2010 13700 6/25/2010 18900 8/31/2010 19800

2

4/22/2010 13700 6/29/2010 18500 9/2/2010 20450

4/23/2010 13700 6/30/2010 18650 9/3/2010 21250

4/26/2010 13850 7/1/2010 18400 9/6/2010 21800

4/27/2010 13850 7/2/2010 18400 9/7/2010 21550

4/28/2010 13750 7/5/2010 18500 9/15/2010 20900

4/29/2010 13850 7/6/2010 19100 9/16/2010 20850

4/30/2010 14000 7/7/2010 18800 9/17/2010 20550

5/3/2010 13950 7/8/2010 18950 9/20/2010 20350

5/4/2010 14100 7/9/2010 19350 9/21/2010 20300

5/5/2010 13000 7/12/2010 18800 9/22/2010 20250

9/23/2010 20250 11/30/2010 27500 2/9/2011 25500

9/24/2010 20900 12/1/2010 27500 2/10/2011 25350

9/27/2010 21750 12/2/2010 27750 2/11/2011 25250

9/28/2010 21950 12/3/2010 27800 2/14/2011 25700

9/29/2010 21850 12/6/2010 28000 2/16/2011 25300

9/30/2010 22000 12/8/2010 27950 2/17/2011 25250

10/1/2010 21750 12/9/2010 28450 2/18/2011 25450

10/4/2010 21700 12/10/2010 29050 2/21/2011 25800

10/5/2010 21700 12/13/2010 29100 2/22/2011 25700

10/6/2010 21500 12/14/2010 28850 2/23/2011 25750

10/7/2010 21500 12/15/2010 28550 2/24/2011 25400

10/8/2010 21350 12/16/2010 29050 2/25/2011 25750

10/11/2010 21800 12/17/2010 29000 2/28/2011 25700

10/12/2010 21550 12/20/2010 28500 3/1/2011 25400

10/13/2010 21650 12/21/2010 28500 3/2/2011 25400

10/14/2010 21450 12/22/2010 28300 3/3/2011 25350

10/15/2010 21350 12/23/2010 28200 3/4/2011 25400

10/18/2010 21450 12/27/2010 28400 3/7/2011 25450

10/19/2010 21300 12/28/2010 28600 3/8/2011 25400

10/20/2010 21350 12/29/2010 28900 3/9/2011 25400

10/21/2010 21400 12/30/2010 28150 3/10/2011 25350

10/22/2010 21300 1/3/2011 28000 3/11/2011 25100

10/25/2010 21350 1/4/2011 27800 3/14/2011 25350

10/26/2010 21250 1/5/2011 27700 3/15/2011 25350

10/27/2010 21200 1/6/2011 27600 3/16/2011 25500

10/28/2010 21400 1/7/2011 27500 3/17/2011 25400

10/29/2010 21450 1/10/2011 26850 3/18/2011 25950

11/1/2010 21300 1/11/2011 26700 3/21/2011 25950

11/2/2010 24150 1/12/2011 26900 3/22/2011 25950

11/3/2010 28400 1/13/2011 26700 3/23/2011 26500

3

11/5/2010 26150 1/17/2011 26500 3/25/2011 26400

11/8/2010 26150 1/18/2011 26500 3/28/2011 26100

11/9/2010 27000 1/19/2011 26200 3/29/2011 25900

11/10/2010 26900 1/20/2011 26000 3/30/2011 26100

11/11/2010 27800 1/21/2011 26000 3/31/2011 26200

11/12/2010 28000 1/24/2011 25900 4/1/2011 26500

11/15/2010 27950 1/25/2011 25900 4/4/2011 30750

11/16/2010 27650 1/26/2011 25400 4/5/2011 28550

11/18/2010 27600 1/27/2011 25450 4/6/2011 28600

11/19/2010 27800 1/28/2011 25600 4/7/2011 28300

11/22/2010 28150 1/31/2011 25500 4/8/2011 28250

11/23/2010 28000 2/1/2011 25350 4/11/2011 28350

11/24/2010 27550 2/2/2011 25650 4/12/2011 28400

11/25/2010 28050 2/4/2011 25600 4/13/2011 28150

11/26/2010 28000 2/7/2011 25550 4/14/2011 28350

11/29/2010 27600 2/8/2011 25500 4/15/2011 28350

4/18/2011 28000 6/27/2011 28000 9/9/2011 32850

4/19/2011 28000 6/28/2011 28300 9/12/2011 32250

4/20/2011 28000 6/30/2011 28600 9/13/2011 32250

4/21/2011 28000 7/1/2011 29000 9/14/2011 32000

4/25/2011 28000 7/4/2011 28700 9/15/2011 31700

4/26/2011 28000 7/5/2011 28800 9/16/2011 31900

4/27/2011 28000 7/6/2011 28700 9/19/2011 31700

4/28/2011 28000 7/7/2011 28750 9/20/2011 31500

4/29/2011 28000 7/8/2011 29100 9/21/2011 31700

5/2/2011 28000 7/11/2011 29200 9/22/2011 28500

5/3/2011 27950 7/12/2011 29000 9/23/2011 29750

5/4/2011 27900 7/13/2011 29300 9/26/2011 28950

5/5/2011 27800 7/14/2011 29400 9/27/2011 30100

5/6/2011 27800 7/15/2011 30150 9/28/2011 29900

5/9/2011 27750 7/18/2011 30000 9/29/2011 30000

5/10/2011 27850 7/19/2011 30050 9/30/2011 30100

5/11/2011 27900 7/20/2011 30100 10/3/2011 29550

5/12/2011 27900 7/21/2011 30300 10/4/2011 29200

5/13/2011 28000 7/22/2011 31000 10/5/2011 29400

5/16/2011 27950 7/25/2011 31000 10/6/2011 30000

5/18/2011 28000 7/26/2011 30900 10/7/2011 30100

5/19/2011 28700 7/27/2011 31200 10/10/2011 29550

5/20/2011 28800 7/28/2011 31250 10/11/2011 30650

5/23/2011 28500 7/29/2011 32000 10/12/2011 30700

4

5/25/2011 28600 8/2/2011 32100 10/14/2011 30750

5/26/2011 28800 8/3/2011 31950 10/17/2011 31000

5/27/2011 29000 8/4/2011 32550 10/18/2011 30900

5/30/2011 28900 8/5/2011 31500 10/19/2011 31150

5/31/2011 28950 8/8/2011 31100 10/20/2011 31000

6/1/2011 29150 8/9/2011 30950 10/21/2011 31300

6/3/2011 29000 8/10/2011 31500 10/24/2011 31500

6/6/2011 29000 8/11/2011 31500 10/25/2011 31500

6/7/2011 29100 8/12/2011 31300 10/26/2011 31500

6/8/2011 29400 8/15/2011 31400 10/27/2011 31950

6/9/2011 29100 8/16/2011 31400 10/28/2011 31800

6/10/2011 29200 8/18/2011 31400 10/31/2011 31650

6/13/2011 28250 8/19/2011 31100 11/1/2011 31550

6/14/2011 28250 8/22/2011 31100 11/2/2011 31900

6/15/2011 28100 8/23/2011 30900 11/3/2011 31850

6/16/2011 28050 8/24/2011 30950 11/4/2011 32250

6/17/2011 27950 8/25/2011 30950 11/7/2011 32300

6/20/2011 28000 8/26/2011 31000 11/8/2011 32200

6/21/2011 28000 9/5/2011 31500 11/9/2011 32550

6/22/2011 28050 9/6/2011 31600 11/10/2011 32200

6/23/2011 28150 9/7/2011 32000 11/11/2011 32200

6/24/2011 28200 9/8/2011 32800 11/14/2011 32750

11/15/2011 34050 1/20/2012 42100 3/29/2012 52900

11/16/2011 33700 1/24/2012 42500 3/30/2012 53200

11/17/2011 34900 1/25/2012 42500 4/2/2012 53500

11/18/2011 35700 1/26/2012 43000 4/3/2012 54050

11/21/2011 37000 1/27/2012 42950 4/4/2012 54200

11/22/2011 38400 1/30/2012 42400 4/5/2012 54300

11/23/2011 37500 1/31/2012 42500 4/9/2012 54200

11/24/2011 37100 2/1/2012 42800 4/10/2012 54300

11/25/2011 37450 2/2/2012 44000 4/11/2012 53900

11/28/2011 37500 2/3/2012 45000 4/12/2012 54000

11/29/2011 39100 2/6/2012 46500 4/13/2012 54150

11/30/2011 39000 2/7/2012 46750 4/16/2012 54200

12/1/2011 39200 2/8/2012 46750 4/17/2012 54000

12/2/2011 39300 2/9/2012 46600 4/18/2012 54350

12/5/2011 39000 2/10/2012 46500 4/19/2012 54350

12/6/2011 38800 2/13/2012 47500 4/20/2012 54400

12/7/2011 38850 2/14/2012 47300 4/23/2012 54300

12/8/2011 38750 2/15/2012 47900 4/24/2012 54350

5

12/12/2011 38700 2/17/2012 47700 4/26/2012 54350

12/13/2011 38950 2/20/2012 47700 4/27/2012 54350

12/14/2011 38850 2/21/2012 47700 4/30/2012 54200

12/15/2011 38700 2/22/2012 48800 5/1/2012 54250

12/16/2011 38550 2/23/2012 53000 5/2/2012 54600

12/19/2011 38600 2/24/2012 53000 5/3/2012 54800

12/20/2011 38500 2/27/2012 52050 5/4/2012 55700

12/21/2011 38500 2/28/2012 52850 5/7/2012 55700

12/22/2011 38500 2/29/2012 53000 5/8/2012 55500

12/23/2011 38500 3/1/2012 52500 5/9/2012 55500

12/27/2011 38500 3/2/2012 53000 5/10/2012 55700

12/28/2011 38500 3/5/2012 52800 5/11/2012 55750

12/29/2011 38650 3/6/2012 52850 5/14/2012 55000

12/30/2011 39000 3/7/2012 52950 5/16/2012 54000

1/2/2012 39000 3/8/2012 53500 5/21/2012 54000

1/3/2012 39000 3/9/2012 53100 5/22/2012 53750

1/4/2012 39800 3/12/2012 52900 5/23/2012 52700

1/5/2012 40000 3/13/2012 52800 5/24/2012 53100

1/6/2012 39550 3/14/2012 52850 5/25/2012 53000

1/9/2012 39950 3/15/2012 52850 5/28/2012 53100

1/10/2012 40250 3/16/2012 52650 5/29/2012 53100

1/11/2012 41800 3/19/2012 53000 5/30/2012 53000

1/12/2012 42200 3/20/2012 52950 5/31/2012 52800

1/13/2012 42350 3/21/2012 52800 1/16/2012 42000 3/22/2012 52750 1/17/2012 42000 3/26/2012 52650 1/18/2012 42000 3/27/2012 52650 1/19/2012 42250 3/28/2012 52750

Lampiran 2

Algoritma Matlab untuk menampilkan data dan

return

dari harga saham penutupan PT.

HM. Sampoerna. Tbk adalah sebagai berikut :

Saham=csvread('HMSP.csv');

n=length(Saham);

figure(1)

plot(1:n,Saham)

title('Harga Saham Penutupan Harian PT. HM Sampoerna')

xlabel('waktu (t)'), ylabel('Harga Saham')

6

figure(2)

plot(1:n_Ret,Ret)

title('Nilai Return dari Harga Saham')

ylabel('Return Harga Saham')

Algritma Matlab untuk estimasi parameter adalah sebagai berikut :

Saham=csvread('HMSP.csv');

ndat=length(Saham);

Ret=diff(log(Saham));

n_Ret=length(Ret);

myu_MLE=sum(Ret)/(ndat-1);

sigma_MLE=sqrt((sum((Ret-myu_MLE).^2))/(ndat-1));

Algoritma Matlab untuk simulasi harga saham untuk satu tahun kedepan adalah sebagai

berikut:

clc

clear all

%---Parameter-parameter metode.

S0=53000; r=0.0575; T=1; n=269; M=100;

%---Inisialisasi.

estimasi;

S=zeros(M,n);

S(:,1)=S0;

dt=T/n; % time-step

t=(0:dt:n*dt); % vektor titik waktu

%---Harga-harga aset pada setiap simulasi.

randn('state',100);

for m=1:M

for i=1:n

S(m,i+1)=S(m,i)*exp((r-0.5*sigma_MLE^2)*dt+(sigma_MLE*sqrt(dt))*randn);

end

figure(1)

plot(t,S(m,:),'-'), hold on

end

hold off

xlabel('waktu'), ylabel('Harga Saham')

title('Simulasi Pergerakan Harga Saham')

figure(2)

plot(1:M,S(:,n+1),'-')

xlabel('simulasi'), ylabel('Harga Saham')

7

Algoritma Matlab untuk menentukan harga opsi adalah sebagai berikut:

St=S(:,n+1);

%Nilai Opsi Call Eropa

K = [50000 53000 56000];

for i = 1:3

C(i)=(sum(exp(-r*T)*max(0,St-K(i))))./M;

end

%Nilai Opsi Call Eropa

for i = 1:3

P(i)=(sum(exp(-r*T)*max(0,K(i)-St)))./M;

end

[K' C' P']

Algoritma Matlab untuk simulasi pergerakan harga saham tiga bulan kedepan serta

mendapatkan nilai prosentase nilai error yang maksimum adalah sebagai berikut:

clc

clear all

%---Parameter-parameter metode.

S0=53000; T=1/4; n=61; M=100;

%---Inisialisasi.

estimasi;

S=zeros(M,n);

galat=zeros(1,n);

S(:,1)=S0;

dt=T/n; % time-step

t=(0:dt:n*dt); % vektor titik waktu

%---Harga-harga aset pada setiap simulasi.

randn('state',100);

for m=1:M

for i=1:n

S(m,i+1)=S(m,i)*exp((myu_MLE-0.5*sigma_MLE^2)*dt+(sigma_MLE*sqrt(dt))*randn);

end

figure(1)

plot(t,S(m,:),'-'), hold on

end

hold off

xlabel('waktu(Tahun)'), ylabel('Harga Saham(Rupiah)')

title('Simulasi Pergerakan Harga Saham')

%studi error dari simulasi

data2=csvread('HMSP2.csv')';

8

figure(2)

plot(data2)

xlabel('waktu(Hari)'), ylabel('Harga Saham')

title('Harga Saham PT. HM Sampoerna Tbk. tanggal 29 Februari sampai 31 Mei 2012')

figure(3)

plot(galat)