ROLE OF WOMEN IN CREDIT DECISION MAKING PROCESS (CASE OF WOMEN TRADER IN TRADITIONAL MARKET IN DENPASAR CITY)

Putu Desy Apriliani, I Wayan Sukadana, Luh Gede Meydianawathi Udayana University

Abstract

This paper outlines and tests a model of decision-making process for women within a patriarchal social system related to the access to financial resources using case of women trader in Kreneng Traditional Market in Denpasar Bali, Indonesia. Financially, women trader contributes to their family from their daily revenue, which in larger scope means involving in the progression of region economic development. It finds that women trader extrinsically face inequality right to access financial sources (read: productive credit from bank/non-formal financial institutions) as compared to men, yet this condition is not fully considered by women since they realize well their position as “ a second-line” in the family and prefer men to lead them in many ways including assets ownership and access to financial sources. This evidence is supported by analysis output using The Relative Risk Ratio (RRR) from the Multinomial Logit Model, which found that men have a higher probability to access credit from banks than women although they have been mostly exposed by financial services from various providers. Women will have a higher probability to use credit from moneylenders as compared to men. The women personal ownership of collateral, as mostly required by the formal banking, is the cause of the low credit disbursement level. Furthermore, by using The Conditional Logit model found that women prefer to get loans from sources that don’t force upon the availability of collateral, for instances the moneylenders, the community owned MFI (Lembaga Perkreditan Desa), and The Regional Development Banks. Thus, it’s important to recommend government or stakeholders to focus on creating credit-alignment program that allow Balinese women act under their own financial legality yet consider a sustainable and prudential financial institution performance.

INTRODUCTION

Since the last decade, Indonesian economic has shown a consistency of growth together with

countries in Asian and Asia Pacific. The region grew at 7 percent of average between 2000 and

2008, the structure of the region’s economics has shifted away from agriculture toward

manufacturing and services, and extreme poverty has fallen dramatically. Indeed, the share of the

region’s population living on less than US$1.25 a day has declined by more than 50 percent

since 1990. (World Bank, 2012). Elaborate that macro condition to the regional level, Bali as the

economic growth shows that Bali economic has increased significantly in 2nd quarter of 2012 to the level of 6.76% (yoy). The realization is much higher compare to the previous quarter at level

6.09% (yoy). The growth is affected by the fast recovery of agriculture sector and construction,

which grow along the realization of investment in Bali. Some major investments in infrastructure

are designed and build in Bali nowadays to welcome the APEC Conference in 2013.

Furthermore, growth of private investment is also in form of hotel and condominium hotel,

which majorly situated in Southern part of Bali as the heart of tourism industry of this Island.

Regional inflation level has a tendency to decrease because of the soft pressure from food and

house construction commodity. Otherwise, certain commodities like rice, vegetable and red chili

are the biggest inflation contributor since the increase in people consumption behavior that

pursues demand. Disparity of income explained by the Gini Index in 2012 shows that Bali is

categorized as low-income disparity at 0.32 (Regional Statistic Institution, 2012).

Moreover, the rise of local economy has also been pursued by the positive performance of

banking industry in Bali including from rural banks. Banking industry expands noticeably on the

2nd qt of 2012 through saving and credit allocation. Banking asset has reached 22.20% (yoy) which is supported by high level of third party fund at 23.43% (yoy), and at the end boost the

credit allocation to the higher level at 27.29% (yoy). Remarkable banking performance has

driven the intermediation function that stated by a relatively high level of LDR (Loan to Deposit

Ratio) at 70.59%.

Yet, despite considerable progress in macro economic indicator, gender disparities persist in

attain gender equality in many dimensions accompanies the phenomena. Bali, as one of the

region that applies the patriarchal social system has limited women in some areas where men are

dominant for instance in the asset ownership, decision making of important issues in family, role

in politic and education. As mentioned in the World Bank Report (2012), Women still have less

access than men to a range of productive assets and services, including land, financial capital,

agricultural extension services, and new information technologies. Women in East Asian and

Pacific countries still have a weaker voice and less influence than men, whether in household

decision-making, in the private sector, in civil society, or in politics.

Weak access of Balinese women toward the ownership of asset is due to the unfair system of

legacy between men and women in a family. Men, hold dominant power to be inherited assets

(land, house, money) by the previous generation while women has no right at all to have even to

use unless they are ever-single. Thus, women are mostly rely themselves to men they will

married to. Nevertheless, this unfair condition has been combated from time to time in order to

give an equal treatment for women. It is simply because the role of Balinese women is generally

shifting from doing domestic tasks to the professional duty. The release of Bali Customary

Village Main Assembly Decision Number 01/KEP/PSM-3 MDP Bali/X/2010 which mentions

that Balinese women have ½ of their men sibling’s right after they get married will hopefully

accelerate the effort of pursuing gender equality in Bali.

The purpose of this paper is to investigate several issues related to role of women in credit

decision making process which are elaborated by whether gender characteristic bring impact

institution that is chosen (by rank) by women to finance their business, what kind of financial

institution that fit with purpose empowering women in traditional market.

SURVEY METHODOLOGY

Reliable data is important to define the impact of gender on credit source. To meet the demand

of the reliable data, first we select the population of sample from many economic activity points

that mostly involved women. The activity point that we choose is the traditional market. This

research chooses Kreneng traditional market as the locations of the research, which comprise

almost 90 percent women, and has large of product differentiation. The respondent for this

research is 115 women trader out of 322 women trader in this market.

The main variables for this research are “status” and “collateral”, variable “status” explains about

the marital status of the respondent, the value is 0 for those who married and 1 for others. The

variable “status” has main idea to reveal the role of man on the decision of credit. Based on the

patriarchal social system, asset for collateral mostly own by man, hence man has more ability to

access the bank. The second variable is “collateral” which reveal the collateral conditions of the

credit, which must meet by the borrowers. This variable also reveals the intangible collateral,

such as credibility of the person, size of the business, and the existence of the business, which

influence the repeated access to the lenders.

SURVEY RESULTS

Respondent based on marital status, chosen financial institution, and amount of credit

About 53.91 percent of 115 respondents in Kreneng Traditional Market in Denpasar are married.

survey result shows that a relation between marital status to the accessibility toward financial

institution no matter the type of institution, collateral size, and the amount of loan especially for

the initial time for credit application.

About 76.00 percent respondents who access credit for the first time from banks are married. As

the alternative, respondents choose cooperation (70.83 percent), followed by LPD and

moneylenders (56.52 percent and 30.23 percent respectively).

Table 1.

Proportion of Financial Institution Based on Respondent Marital Status

Financial Int

Marital Status

BU LPD Kop ML Total

N % N % N % N % N %

married 19 76.00 13 56.52 17 70.83 13 30.23 62 53.91

widow 6 24.00 10 43.48 7 29.17 30 69.77 53 46.09

Total 25 100.00 23 100.00 24 100.00 43 100.00 115 100.00

Source : Primary Data, 2012

Note : BU = Bank Umum (banks); LPD = Lembaga Perkreditan Desa (the community owned MFI); Kop = Koperasi (cooperation); ML = rentenir (moneylenders)

Among the formal financial institutions (BU, LPD, Kop), the most preferred institution to be

accessed for the first time by married respondent is bank. To apply for credit in banks, customers

are obligated to fulfill the physical ownership of collateral. The unavailability of collateral is

predicted become a reason for the low level of women participation in accessing credit from

banks especially for the productive credit purposes (Morrison, et al, 2007). In Bali, this

condition is unfavorable due to the ownership status of land and other important asset, which

belongs to men (patriarchal right). It means, for the married respondent will be avoided from the

On the opposite, the widow respondent has more probability to use services from non-formal

financial institution, which can disburse free-collateral credit represented by 69.77 percent of

widow respondent. Another reasons why respondent choose moneylenders are because of short

in process, simple term and condition, 24-hour accessibility even large amount of loan up to IDR

25 million. Meanwhile, about 24.00 percent bank borrowers are widow and they are repeater.

They potentially face collateral condition from banks, but they can still have access to assets that

belong to their male relatives. Even though women trader generates daily income for the family

from the business, they still face discriminative treat on accessing financial support (debt) from

financial intermediaries surround the market (Suryani, 2003). Thus, it makes sense for women to

use moneylenders frequently when they think hard to find loans from formal bank (including

rural bank).

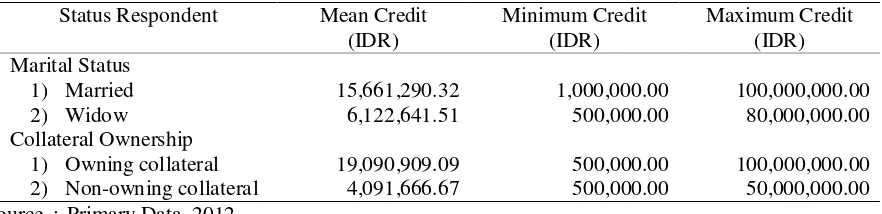

The range of credit amount applied from the banks is varying from IDR 10 to 100 million; while

moneylender is varying from IDR 500 thousand to IDR 3 million. It shows that the complexity

of the procedure and condition affecting the amount of credit accessed by respondents.

Table 2

Amount of Credit based on Marital Status and Collateral Ownership

Status Respondent Mean Credit (IDR)

Minimum Credit (IDR)

Maximum Credit (IDR) Marital Status

1) Married 15,661,290.32 1,000,000.00 100,000,000.00

2) Widow 6,122,641.51 500,000.00 80,000,000.00

Collateral Ownership

1) Owning collateral 19,090,909.09 500,000.00 100,000,000.00

A MODEL OF DECISION MAKING PROCESS

In many cases of credit application through financial intermediaries (formal and or informal),

commonly found that men play more roles than women. Men, a breadwinner of a family, have

more power instead of privilege to make a decision toward things that related to the asset and

debt family management. For almost all regions in Indonesia, which follow the patriarchal

system, this condition felt to be undeniable. In fact, women as a housewife with flexibility in

time to work can be potentially exposed by banking loan disbursement procedure but they are

not. In practice, women who lived in patriarchal culture system mostly stand on position that

weakening their bargain power toward men especially for issues related to financial inclusion. At

the end, women become more dependent to men – wife to her husband – especially when women

need to have a financial support from bank or any other financial intermediaries. It contradicts

the effort to empower women through self-managing business to support family financial

condition.

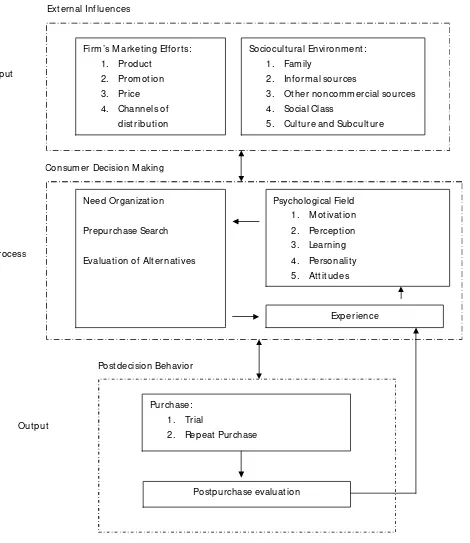

A model as shown in Figure 3 can be viewed as a three distinct but interlocking stages: the input

stage, the process stage, and the output stage. The input stage influences the consumer’s

recognition of a product need and consist of two major sources of information: the firm’s

marketing effort (the product itself, its price, its promotion, and where it is sold) and the external

sociological influences on consumer (family, friends, neighbors, other informal, and

noncommercial sources, social class, and cultural and sub cultural memberships). The process

stage of the model focuses on how consumers make decision. The psychological factors inherent

in each individual (motivation, perception, learning, personality, and attitudes) affect how the

external inputs from the input stage influence the consumer’s recognition of a need, prepurchase

decision-making model consists of two-closely related postdecision activities: purchase behavior

and postpurchase evaluation (Schiffman, Leon G and Kanuk, Kelslie Lazar, 2007)

In order to explain how women trader decide their preference and decision toward source of

credit for their own business, the figure of simple decision making process is applicable. Firstly,

input of information is usually gathered from brochure and frequent sales call from the sales

person of the bank/financial institution and also the moneylenders. Sales person usually explains

the detail of the product they offered for example product identity, interest rate, period of

payment, rewards/bonus. Together with the firm’s marketing effort, the sociocultural

environment likes family, informal sources; women also deliberate culture and subculture. At

this stage, the culture of patriarchal mostly occurs in form of the ownership of the assets (land

and or other important assets that valuable as a collateral), that finally constraint women to make

a further action as regard to finance. Secondly, on the process stage, women trader will combine

the need organization including purpose of credit, amount, length of payment, payment

mechanism and reward, type of financial institution with the former understanding they have as a

Balinese woman. These variable are mostly affected by psychological field that including

motivation to apply the credit and expand the business, perception that they are a women with

limited ownership toward collateral, learning from the past concept inherited by previous

generation, personality of risk averse and risk lover, and attitudes to fulfill the obligation. In

addition, experience is also considered as a lesson learns in making decision. Thirdly, on the last

stage, women trader will decide to select the financial institution as a result of the process of

consumer decision making which mostly affected by the “the word of mouth”. Thus, the model

Firm ’s M arket ing Efforts: 1. Product

2. Prom ot ion 3. Price 4. Channels of

dist ribution

Sociocultural Environm ent : 1. Fam ily

2. Informal sources

3. Ot her noncom m ercial sources 4. Social Class

5. Culture and Subcult ure

Need Organizat ion

Prepurchase Search

Evaluat ion of Alternat ives

Psychological Field 1. M ot ivat ion 2. Perception 3. Learning 4. Personalit y 5. At tit udes

Purchase: 1. Trial

2. Repeat Purchase

Postpurchase evaluation

Experience External Influences

Postdecision Behavior Consum er Decision M aking Input

Process

Output

Figure 1. A Sim ple M odel of Consum er Decision M aking

ECONOMETRIC APPROACH AND RESULTS

Probability of Women in Accessing Credit

In order to investigate the probability of women to access credit from various credit sources we

employ the multinomial logit model. The regressors that we use in this model are “status” and

“collateral”. These two variables are not vary over alternatives hence the Multinomial Logit

Model can be use (Cameron and Trivedi, 2005). The base outcome variable in this model is

“moneylender”, which denote the variable for respondent who choose credit from moneylender.

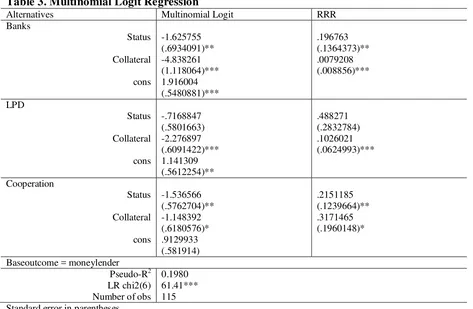

The Multinomial Logit Regression result is as follows.

Table 3. Multinomial Logit Regression

Alternatives Multinomial Logit RRR

Banks

Status -1.625755 .196763

(.6934091)** (.1364373)** Collateral -4.838261 .0079208

(1.118064)*** (.008856)*** cons 1.916004

(.5480881)*** LPD

Status -.7168847 .488271

(.5801663) (.2832784)

Collateral -2.276897 .1026021 (.6091422)*** (.0624993)*** cons 1.141309

(.5612254)** Cooperation

Status -1.536566 .2151185

(.5762704)** (.1239664)** Collateral -1.148392 .3171465

(.6180576)* (.1960148)*

cons .9129933 (.581914) Baseoutcome = moneylender

Pseudo-R2 0.1980 LR chi2(6) 61.41*** Number of obs 115 Standard error in parentheses

)*** significant at 1 percent, )** significant at 5 percent, )* significant at 10 percent

The variable “status” and “collateral” are mostly significant except for variable “status” in LPD.

mostly preferred is Bank) than the moneylenders. It will helpful if we transform the coefficient

of the multinomial logit regression to the odds ratio or Relative-Risk Ratios (RRR) that will

show how men have more ability to access more than women. Here, men are defined as person

who married with women respondent and play a pivotal role against his wife. For instance, men

(represent married women respondents) have relative odds 0.196763 to choose bank rather than

women (widow). For the collateral variables, have a negative slope, which means that respondent

who own the collateral and repeated borrower would prefer bank the most. The relative odds for

this group of respondent are 0,0079208 to choose bank rather than the respondent with no

collateral.

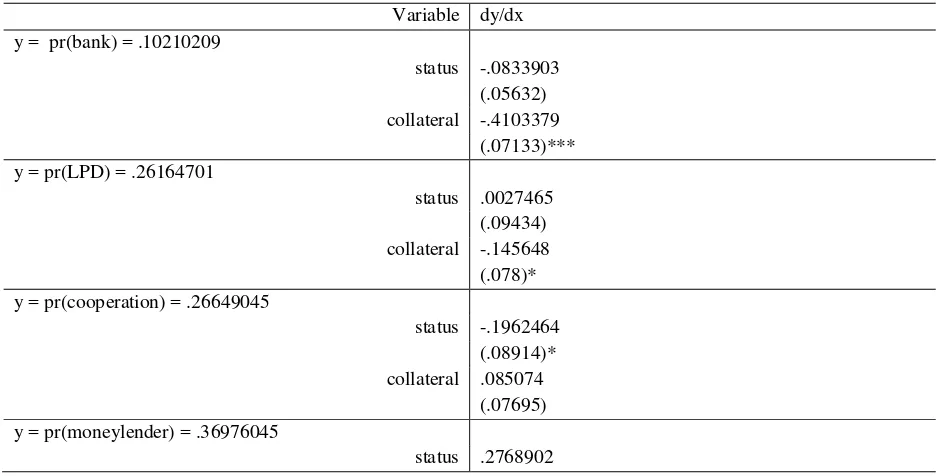

The probability of respondent to choose credit from i-alternative rather then j-alternatives can be

showed through the marginal effect. The marginal effect at mean of status and collateral

variables for bank, LPD, cooperation and moneylender choices are as follows.

Table 4. Marginal Effect of The Multinomial Logit Regression

Variable dy/dx y = pr(bank) = .10210209

status -.0833903 (.05632) collateral -.4103379

(.07133)*** y = pr(LPD) = .26164701

status .0027465 (.09434) collateral -.145648 (.078)* y = pr(cooperation) = .26649045

status -.1962464 (.08914)* collateral .085074

(.10411)** collateral .4709118

(.08069)*** Standard error in parentheses

)*** significant at 1 percent, )** significant at 5 percent, )* significant at 10 percent

The table explains that married respondents have probability 0.27 lower than the unmarried

respondents to choose moneylenders. This apply also for the collateral variables, that

respondents with collateral have probability 0.47 lower to choose moneylender than those who

does not have collateral. It means that marital status and collateral ownership for banking

administration need are more pro-men.

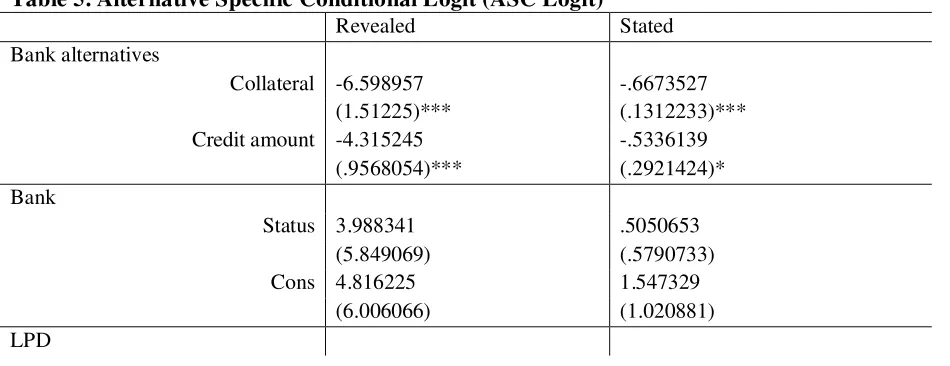

Women Preference Toward the Financial Institution

To investigate the preference of the respondent toward credit source given the “status” and

“collateral”, we use the Alternative Specific Conditional Logit (ASC Logit). We compare the

revealed model where the financial institution chosen are come up originally from the respondent

decision making process, with the stated model where the financial institution chosen are come

up after the respondent being introduced to the alternative type of institution which differ from

the previous institution they mention. The result is as follows.

Table 5. Alternative Specific Conditional Logit (ASC Logit)

Revealed Stated

Bank alternatives

Collateral -6.598957 -.6673527

(1.51225)*** (.1312233)***

Credit amount -4.315245 -.5336139

(.9568054)*** (.2921424)*

Bank

Status 3.988341 .5050653

(5.849069) (.5790733)

Cons 4.816225 1.547329

Status .5125301 .5125301

(.751992) (.751992)

Cons -.0056839 -.0056839

(.7781836) (.7781836)

Cooperation

Status -3.592871 .5607536

(1.720388)** (.5503331)

Cons 7.037415 1.13266

(1.854077)*** (.4990582)**

Baseautcome = moneylender

Log likelihood -134.08917 -134.08917

Wald chi2(5) 33.16*** 33.16***

Number of obs 460 460

Number of cases 115 115

Standard error in parentheses

)*** significant at 1 percent, )** significant at 5 percent, )* significant at 10 percent

The table illustrates that the collateral and credit amount for both revealed and stated model are

significant and have negative sign. It means that an increase in the collateral value stated by the

institution administration will reduce the probability of borrowers to take loan from the

respective institution.

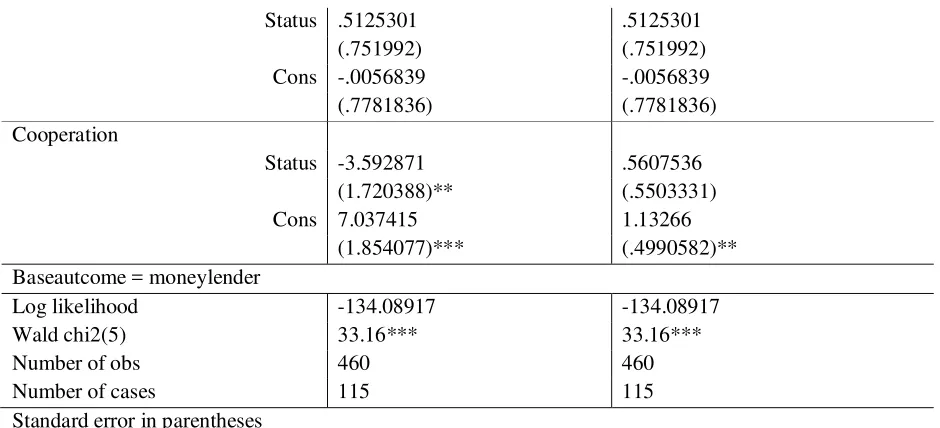

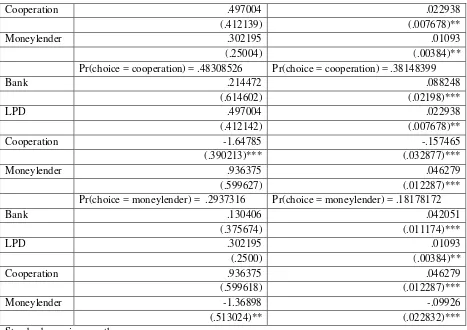

Table 6. Marginal effect for Regressor Collateral

Revealed Stated

Variable dy/dx dy/dx

Pr(choice = Bank) = .06727788 Pr(choice = Bank) = .34663552

Bank -.414095 -.151142

(1.17986) (.031931)***

LPD .069216 .020842

(.204801) (.006956)**

Cooperation .214472 .088248

(.614598) (.02198)***

Moneylender .130406 .042051

(.375674) (.011174)***

Pr(choice = LPD) = .15590526 Pr(choice = LPD) = .09009876

Bank .069216 .020842

(.204798) (.006956)**

Cooperation .497004 .022938

(.412139) (.007678)**

Moneylender .302195 .01093

(.25004) (.00384)**

Pr(choice = cooperation) = .48308526 Pr(choice = cooperation) = .38148399

Bank .214472 .088248

(.614602) (.02198)***

LPD .497004 .022938

(.412142) (.007678)**

Cooperation -1.64785 -.157465

(.390213)*** (.032877)***

Moneylender .936375 .046279

(.599627) (.012287)***

Pr(choice = moneylender) = .2937316 Pr(choice = moneylender) = .18178172

Bank .130406 .042051

(.375674) (.011174)***

LPD .302195 .01093

(.2500) (.00384)**

Cooperation .936375 .046279

(.599618) (.012287)***

Moneylender -1.36898 -.09926

(.513024)** (.022832)***

Standard error in parentheses

)*** significant at 1 percent, )** significant at 5 percent, )* significant at 10 percent

Table 6 shows that almost all the marginal effect of the collateral regressor for the revealed

model are insignificant while all are significant for the stated model. It means that respondents

prefer more to financial institution that apply fewer collateral condition. For example, if Banks

raise the collateral criteria (in value), thus the probability will decrease by 0.15 and rise to LPD

by 0.02, cooperation by 0.02, and moneylenders by 0.04.

CONCLUTION AND POLICY IMPLICATIONS

We have tried in this paper to shed some light on the nature of gender constraint toward credit

disbursement especially on the Balinese patriarchal society. We develop a simple model in which

burden them to access financial source as free as men. Without a formal property rights to own

valuable assets women become less bankable than men even though they actively gain income

from their own business. Thus, it delivers not only the obstacles toward the expansion of

business scale itself but also far more it will limit the process of economic growth.

The econometric results found that men have a higher probability to access credit from banks

than women although they have been mostly exposed by financial services from various

providers. Women will have a higher probability to use credit from moneylenders as compared

to men. The women personal ownership of collateral, as mostly required by the formal banking,

is the cause of the low credit disbursement level. For a certain extent, model found that women

prefer to get loans from sources that don’t force upon the availability of collateral, for instances

the moneylenders, the community owned MFI (Lembaga Perkreditan Desa), and The Regional

Development Banks. Thus, it’s important to recommend government or stakeholders to focus on

creating credit-alignment program that allow Balinese women act under their own financial

legality yet consider a sustainable and prudential financial institution performance. As a result,

this paper suggests that the better financial scheme for them is reduce the collateral condition. In

determining what financial institution that fit women trader in the middle of patriarchal

circumstances, we found that the characteristic of financial institution that close to the

moneylender mechanism is more preferred by respondents.

Reference

Cameron, A. Colin., Trivedi, Pravin K. 2005. Microecenometrics Methods and Applications.

Cambridge University Press: New York.

Central Bank of Indonesia. 2012. Kondisi Ekonomi Regional Bali Kuartal II Tahun 2012.

(http://bi.go.id)

Morrison, Andrew,. Raju, Dhushyanth. and

Sinha, Nistha. 2007. Gender Eguality, Poverty and Economic Growth. Policy Research

Working Paper No. 4349. The World Bank: New York.

(papers.ssrn.com/sol3/papers.cfm?abstract_id=1014233)

Regional Center of Statistic Institution (http://bali.bps.go.id/series_data/tampil_data_series.php)

Schiffman, Leon G and Kanuk, Kelslie Lazar. 2007. Consumer Behaviour. Pearson Prentice Hall: New Jersey.

Suryani, Luh Ketut. 2003, Perempuan Bali Kini, Bali Post: Denpasar.

World Bank. 2012. Toward Gender Equality in East Asia and the Pacific: A Companion to the World Development Report—Conference Edition. Washington, DC: World Bank. License: Creative Commons Attribution CC BY 3.0

(