Analysis of Tax Aggressiveness and Financial Reporting Aggressiveness

on Public Companies in Indonesia 2010-2014

Rina Indah Sari Ginting [email protected] and Dwi Martani [email protected]

Universitas Indonesia, Depok 16424, Indonesia

ABSTRACT

In this paper, we investigate the relationship between tax aggressiveness and financial reporting aggressiveness in Indonesia-listed companies. The sample used in this study were 157 manufacturing and non manufacturing company during 2010-2014 period. Using discretionary permanent differences (DTAX) and abnormal book tax differences (ABTD) as proxies, we find that there is strong positive correlation between tax aggressiveness and financial reporting aggressiveness. This shows that there is no trade off in decisions related to earnings management and tax management. The results also show that ABTD able to measure tax aggressiveness and showed consistent results with DTAX proxy.

Keywords: tax aggressiveness, financial reporting aggressiveness, financial reporting, permanent differences, abnormal book tax differences.

1. Introduction

financial reporting aggressiveness. Although it can provide benefits to the company, but financial reporting aggressiveness actions can have negative impacts for the company through the payment of taxes. Wherein, the higher the profits of the company, the higher the tax expense of the company to be paid. Frank et al (2009) states that the tax planning by lowering the value of the taxable income, either through tax evasion or not, is referred to tax aggressiveness. Tax aggressiveness can be done in various ways, including finding a gap (loopholes) contained in the tax laws so often referred to as tax avoidance, tax sheltering and tax management (Hanlon and Heitzman, 2010).

Frank et al (2009) conducted a research on the relationship of tax and financial reporting aggressiveness in America using permanent differences as the measurement. Frank et al (2009) found that there is a strong positive relation between these two constructs. It means that the company able to increase the level of corporate profits but reported a low tax payment. Furthermore, Hanlon and Heitzman (2010) states that the tax evasion, in this study referred as tax aggressiveness, showed a significant result by measuring the content of permanent differences therein. In addition to discretionary permanent differences (DTAX) which has been used Frank et al (2009), there is another way to measures tax aggressiveness, the proxy abnormal book tax differences (ABTD) developed by Tanya and Fifth (2012).

2. Literature Review

2.1 Quality of Financial Reporting

The financial statements of a company contains a lot of information that can be used by stakeholders to assist the decision making process. That requires that the financial statements have a good quality information that can be used to make the right decision. The quality of a company's financial reporting depends on how much information is presented can be useful and is based on the conceptual framework, the basic principles and accounting purposes. In practice, the preparation of the financial statements cannot be separated from the pressure for management to meet the expectations of users of financial statements. Then the management used to do the earning management to maximize profits and increase the value of the company's market value. This earnings management activities will impact the difference in taxable income and hide the actual condition of the company. At which time the company reported accounting profit is higher than the burden of the tax to be paid will be higher also. Such conditions indicate a tradeoff between earnings management activities and management of corporate taxes.

2.2 Financial Reporting Aggressiveness

Frank et al (2009) states that the activities aimed at increasing the company's profit with earnings management, whether appropriate or not in accordance with generally accepted accounting principles known as the financial reporting aggressiveness. Therefore, in this study, financial reporting aggressiveness have the same context with earnings management. Financial reporting aggressiveness or earnings management in general do some specific techniques. Some earnings management techniques are taking a bath, income minimization, income maximization and income smoothing. (Scott, 2009)

aggressive financial are Model Jones (1991), Dechow et al (1995), Kasznik (1999) and Kothari (2005).

2.3 Tax Aggressiveness

Broadly, tax avoidance is define as the reduction of explicit taxes ( Hanlon and Heitzman, 2010 ;Dyreng et al., 2008). But tax avoidance is influenced by the attitudes and opinions of individuals, therefore the tax aggressiveness represents a continuum of tax planning strategies of the company. Different people will have different opinions about the degree of aggressiveness of a transaction. So those tax planning behavior of the company and can be discuss in various terms such as tax aggressiveness, tax sheltering, tax evasion or non-compliance. However, Hanlon and Heitzman (2010) emphasizes that the definition of tax aggressiveness are not limited to specific measurement methods. Commonly tax avoidance measure by several methods such as effective tax rate, long run effective tax rate, book tax differences, discretionary or abnormal measure of tax avoidance, unrecognized tax benefits and tax shelter firms.

2.4 Prior Research

Frank et al (2009) is the first literature conducted research about the relationship of tax and financial reporting aggressiveness. Using their own of proxy of discretionary permanent differences (DTAX), Frank et al (2009) include that tax and financial reporting aggressiveness are significantly and positively related. It indicates that there is nonconformity between financial accounting standards and tax law allows firm to manage book income upward and taxable income downward. Similar studies have also been carried out in Indonesia by Kamila (2014) and Ridha (2014). The results show that there is no tradeoff between tax and financial reporting aggressiveness in Indonesia’s manufacturing company.

book-tax differences (ABTD) sourced from earnings management and tax evasion. Tang research results and Firth (2012) showed that NBTD positive effect on earnings of the relevance and relevance ABTD negatively affects earnings. The research results proved that ABTD negative effect on earnings because it contains information of relevance earnings management and tax management.

2.5 Hypothesis Development

Prior results of studies in the United States show that from 1990 to 2000 there was an increase in book tax difference, and consistently with the increase in book tax gap, there is evidence that the accounting rules provide an opportunity for management to adjust the gain of the company without affecting taxable income. This is prove that firm able to manage book income upward without affecting higher taxable income (Philips et al., 2003; Hanlon, 2005) and suggest that firm have the opportunity to engage in tax and financial reporting aggressiveness in the same reporting period (Frank et al, 2009).

H1. Tax aggressiveness measured by discretionary permanent differences (DTAX) positively related to financial reporting aggressiveness.

H2. Financial reporting aggressiveness positively related with tax aggressiveness measured by discretionary permanent differences (DTAX).

Hanlon and Heitzman (2010) states that there are various methods that can be used to measure tax aggressiveness. One of them is to use the content of the company's permanent differences. In addition to the measurement method DTAX conducted by Frank et al (2009), Tang and Fifth (2012) develop another measurement using company's permanent differences called abnormal book tax differences (ABTD). So it can be said that ABTD can be used as another method to measure tax aggressiveness and find the relationship of tax and financial reporting aggressiveness as prior research of Frank et al (2009).

H3. Tax aggressiveness measured by abnormal book tax differences (ABTD) positively related to financial reporting aggressiveness.

3. Research design

This study uses tax aggressiveness measurement adaptation by Frank et al (2009) and Kamila (2014). However, in this study there is the addition of ABTD develop by Tang and Fifth (201) as independent variable.

3.1 The effect of tax aggressivenss on financial reporting aggressiveness

The research model to measure the relationship of tax on financial reporting aggressiveness use two models of discretionary permanent differences (3.1) and abnormal book tax differences (3.2). The research model used in this study are as follows :

DAC Cit=α0+α1DTA Xit+α2PTRO Ait+α3≤Vit+α4LC FDit+α5FO RDit+α6SIZ Eit+εit

(3.1)

DAC Cit=α0+α1ABT Dit+α2PTRO Ait+α3≤Vit+α4LC FDit+α5FO RDit+α6SIZ Eit+εit

(3.2)

where :

DACCit dicretionary accrual

DTAXit dicretionary permanent differences

ABTDit abnormal book tax differences

PTROAit pretax income diveide by total asset at year t-1

LEVit sum of long term debt divided by total asset

LCF_Dit dummy variable that equals 1 when an entity reported loss carryforwads

FOR_Dit dummy variable that equals 1 when the value of foreign income > 0

SIZEit natural log of total assets

Models 3.1 and 3.2 are used to test hypotheses 1 and 3. Hypothesis 1 and 3 are acceptable if there is significantly positive correlation between tax and financial reporting aggressiveness.

3.2 The effect of financial reporting aggressiveness on tax aggressiveness

The research model to measure the relationship of financial reporting aggressiveness on tax aggresivenss use two models of discretionary permanent differences (3.3) and abnormal book tax differences (3.4). The research model used in this study are as follows :

DTA Xit=α0+α1DAC Cit+α2PTRO Ait+α3≤Vit+α4LC FDit+α5FO RDit+α6SIZ Eit+εit

ABT Dit=α0+α1DAC Cit+α2PTRO Ait+α3≤Vit+α4LC FDit+α5FO RDit+α6SIZ Eit+εit

(3.4)

Models 3.3 and 3.4 are used to test hypotheses 2 and 4. The hypothesis are acceptable if there is significantly positive correlation between financial reporting and tax aggressiveness.

3.3 Variable Operationalization 3.3.1 Dependent Variables

The dependent variable in this study is the value of the financial reporting aggressiveness for models 3.1 and 3.2 and tax aggressiveness for models 3.3 and 3.4 . The research model used in this study are as follows :

Measuring Financial Reporting Aggressiveness

To measure financial reporting aggressiveness in this study, we use the Modified - Jones model ( Dechow et al . 1995) as our proxy according to prior research of Frank et al (2009 ). The research model are as follows :

T AC Cit=α0+α1

(

∆ℜVit−∆ A Rit)

+α2PP Eit+εit (3.5) where :TACCit total accruals = ((EBEIit +TTEit) – (CFOit+ITPit))

EBEIit earning before extraorndinary item

TTEit total tax expense

CFOit cash flow from operating activities

ITPit income tax paid

∆REVit change in sales from year t-1 to year t

∆ARit change in account receivables from year t-1 to year t

PPEit gross property, plant and equipment

ԑit discretionary accruals

Measuring Tax Aggressiveness

The proxy used in this study are DTAX adopted by Frank et al (2009) and Kamila (2014) and ABTD developed by Tang and Fifth (2012). The research model are as follows :

PERMDIFFit =

α

0 +α

1INTANGit +α

2UNCONit +α

3MIit +α

4CSTEit +α

5∆NOLit +where :

PERMDIFFit permanent differences divided by total aset at t-1

INTANGit goodwill and other intangibles divided by total aset at t-1

UNCONit consolidated net income (loss) divided by total aset at t-1

MIit Minority net income or loss divided by total aset at t-1

CSTEit current state tax expense divided by total aset at t-1

∆NOLit changes in net operating loss carryforward divided by total aset at t-1

LAGPERMit permanent differences in year t-1 divided by total aset at t-1

εit discretionary permanent differences

PERMDIFF equation is processed by regression of data into two industrial grups, manufactur and non manufactur company. The discretionary permanent differences is the residual value of PERMDIFF’s equation regression.

BTD it = β0 + β1 ∆INVit + β2 ∆REV it + β3 NOL it + β4 TLU it + β5 BTD it-1 + ԑ it ( 3.7)

BTDit book tax differences

∆INVit changes in gross fixed asset from year t-1 to year t

∆REVitt change in sales from year t-1 to year t TLUit the value of tax losses utilized

BTDit-1 book tax differences from year t-1

ԑit error term

BTD equation is processed by regression of data inti two industrial grups, manufactur and non manufactur company. The discretionary permanent differences is the residual value of BTD’s equation regression.

3.3.2 Indipendent variabel.

4. Empirical results

4.1 Research samples

The population of this research is companies listed on the Stock Exchange during the period 2010-2014. Selection of the sample using purposive judgment sampling. The clasification of the industries are based on JASICA Index in IDX Fact Book Companies in the industrial sector of agriculture, mining , property , real estate , construction , and finance are excluded from the study because it is governed by special tax regulations. Data and information obtained from DataStream , Eikkon and the company's financial statements.

4.2 Econometrics Test

Model Test Panel is used to determine statistical panel models that are considered in accordance with the characteristics of the research model. The results for Chow Test show that the four main models have a value of F-stat 0.000 or less than alpha. Therefore, the regression model that should be used is the model FE (Fixed Effect). Further LM Test showed that the study results should use the model RE (Random Effect) for F stat has a value below alpha. Hausman Tests showed that the 1,2 and 4 have the following results alpha or 0,05 and show that the model should be used in the equation is the FE models. Meanwhile model 3 shows the results of 0.1290 which means a better model used is the model RE. Econometrics test results show that the model is free from multikolinearitas research, but has a problem of heteroskedasticity and autocorrelation. Therefore, to solve this problem, it is used commands Generalized Least Square (GLS) in STATA to be used as a data analysis of the research results.

4.3 Regression Test

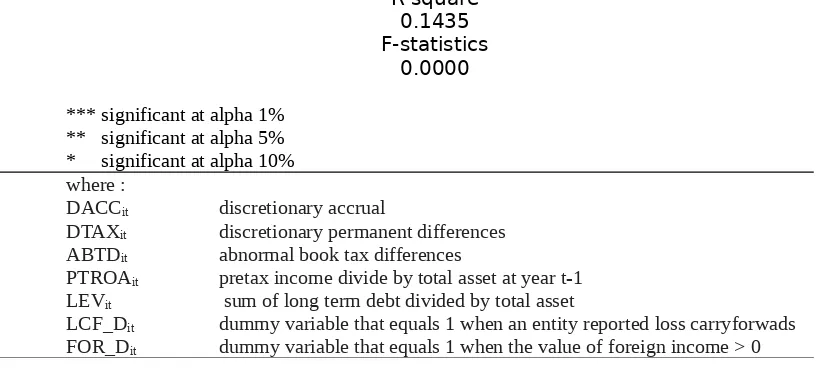

4.3.1 The effect of tax aggressiveness on financial reporting aggressiveness

the relationship between variables included in the research model . With a value of 0.000 indicates that the first hypothesis is accepted or earnings management activities of companies affected by corporate tax management activities.

Table 4.1

R-square

PTROAit pretax income divide by total asset at year t-1

LEVit sum of long term debt divided by total asset

LCF_Dit dummy variable that equals 1 when an entity reported loss carryforwads

FOR_Dit dummy variable that equals 1 when the value of foreign income > 0

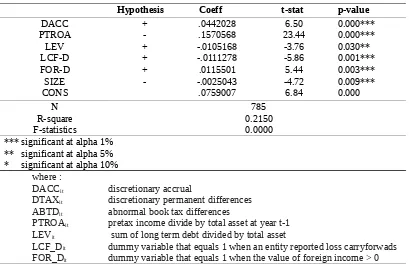

Regression results of models 3.2 are shown in Table 4.2. The results shows the value of F stat on showed similar results with model 3.1, that is 0.0000 or smaller than α. This is means that H0 is rejected. The coefficient of determination, or r2 worth 0.1445 % or 14:45 on ABTD measurements means that ABTD can be explained by the major independent variables and control variables in research methods around 14.45%. The p-value stat with a value of 0.000 indicates that the second hypothesis is accepted or tax aggressiveness measured by abnormal book tax differences (ABTD) positively related to financial reporting aggressiveness.

Table 4.2

The effect of tax aggressiveness with ABTD proxy on financial reporting aggressiveness

LEVit sum of long term debt divided by total asset

LCF_Dit dummy variable that equals 1 when an entity reported loss carryforwads

FOR_Dit dummy variable that equals 1 when the value of foreign income > 0

4.3.2 The effect of financial reporting aggressiveness on tax aggressiveness

Models 3.3 and 3.4 show the results of financial reporting aggressiveness effect’s on tax aggressiveness. Results of regression presented in Table 4.3 and Table 4.4. Results of regression model 3.3 and 3.4 4 show that the value of F stat is 0.000 or less than α ( 0.05 ) . This suggests that the main independent variable and the independent variables significantly influencing the value DPERM and ABTD. The r2 value in model 3.3 is 0.2150 , or 21.5 % . This value indicates

that the level of discretion permanent differences can be explained by 21.5 % . through the independent variables of the company. While the value of the coefficient of determination r2 for

model 3.4 indicate that abnormal levels of book tax differences can be explained by 14,50 % through independent variables .

Table 4.3

The effect of financial reporting aggressiveness on tax aggressiveness with DTAX proxy

DTAX it = α0 + α1DACCit + α2PTROAit + α3LEVit + α4LCF_Dit + α5FOR_Dit + α6SIZEit + εit

PTROAit pretax income divide by total asset at year t-1

LEVit sum of long term debt divided by total asset

LCF_Dit dummy variable that equals 1 when an entity reported loss carryforwads

FOR_Dit dummy variable that equals 1 when the value of foreign income > 0

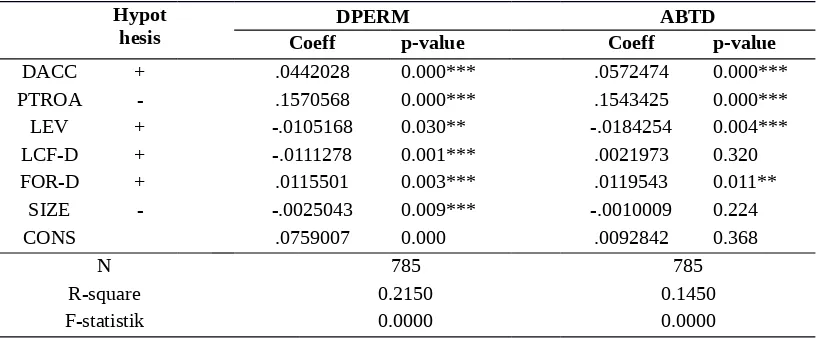

measurement. Similar results are also shown in Table 4.4 which shows the value of 0.01 which means there is positive corelation with a 99% confidence level that the discretionary accruals influence the aggressiveness of tax with DTAX measurement. This results dismissed the assumption that there is a trade off between tax and financial reporting aggressiveness in the company. This means that company can increase profits without increasing tax paid or company using the opportunity to do tax and earning management in the sama reporting period ( Frank et al, 2009).

Table 4.4

The effect of financial reporting aggressiveness on tax aggressiveness with ABTD proxy

PTROAit pretax income divide by total asset at year t-1

LEVit sum of long term debt divided by total asset

LCF_Dit dummy variable that equals 1 when an entity reported loss carryforwads

FOR_Dit dummy variable that equals 1 when the value of foreign income > 0

4.2.3 Consistency of Measuring Tax Aggressiveness

reporting aggressiveness on both proxy. Research results shows that both proxies have the same F stat value for all the equations. The positive coefficient and the same value of significancy (0,001) showed that consistently DPERM and ABTD show that tax aggressiveness influence the financial reporting aggressiveness and vice versa. Control variables effect on the research results also show a similar value between DPERM and ABTD proxy.

Table 4.5

Comparison Measurement of Tax Aggressiveness on Financial Reporting Aggressiveness

Hypot

Comparison Measurement of Financial Reporting Aggressiveness on Tax Aggressiveness

Hypot

hesis CoeffDPERMp-value CoeffABTDp-value

DACC + .0442028 0.000*** .0572474 0.000***

permanent differences content show consistent results. But in this study ABTD can not be said to be better in measuring the tax aggressiveness compared with DPERM proxy because we need to do further research.

5. Conclusions and recommendation

5.1Conclusion

The purpose of this study is to investigate the relationship between tax and financial reporting aggressiveness on public companies in Indonesia. The results show that there is a positive and significant relation between tax and financial reporting aggressiveness. This indicates that in accordance with the study of Frank et al (2009), a public company in Indonesia does not face the problem of trade-offs in decision making related to the value of net income and tax payment. This may be an indication that the accounting rules and taxation Indonesia has loopholes that can be exploited by companies to manage their book tax income.

The results also showed that aggressiveness measurement using a permanent tax differences (DPERM) or abnormal book tax differences (ABTD) showed consistent results. This proves that the content of permanent differences in both proxies are able to be used as a method of measuring tax aggressiveness in accordance with the research done by Hanlon and Heitzman (2010).

5.2 Research implications

increasingly difficult to detect. Furthermore, for academics , through the study found that ABTD measurement showed consistent results with DPERM . Thus, ABTD can be used as an alternative method of measuring the tax aggressiveness or tax avoidance . This research can also be used as a reference for future research.

5.3 Limitations and Suggestions

Reference

Dechow, P., Soan, R. & Sweeney, A. (1995). Detecting earning management. The Accounting Review, 70, 193-225.

Desai M. A. & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79, 145-179.

Dyreng, S. , Hanlon M. , Maydew E., (2008). Long-run corporate tax avoidance. The Accounting Review , 83 (1) , 61-82.

Exchange, I. S. (2011). IDX Fact Book. Jakarta: Indonesian Stock Exchange

Frank, M., Lynch, L., Rego, S., (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The International Journal of Accounting, Vol 46, 175-204.

Hanlon, M. (2005). The persistence and pricing of earnings, accruals, and cash flows when firms have large book-tax differences. The Accounting Review, 80, 137-166.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50, 127-178.

Kamila, P. A., dan D. Martani, (2014), Analisis Hubungan Agresivitas Pelaporan Keuangan dan Agresivitas Pajak. Jurnal Keuangan dan Perbankan, Vol 16 (2), 228-245

Kothari, S. P., Leone A. & Wasley C., (2005). Performance matched discretionary accrual measures, Journal of Accounting and Economics, 39(1), 163-197

Phillips, J., Pincus, M., & Rego, S. O. (2002). Earnings management: new evidence based on firms’ tax footnote disclosures. University of Iowa Working Paper.

Ridha, M. dan D. Martani, (2014), Analisis Terhadap Agresivitas Pajak, Agresivitas Pelaporan Keuangan, Kepemilikan Keluarga dan Tata Kelola Perusahaan di Indonesia. Skripsi Fakultas Ekonomi Universitas Indonesia. Depok

Scott, W. R. (2015). Financial Accounting Theory. Toronto: Pearson Canada.

Sekaran, U., Bougie, R., (2013). Research Methods for Business-Sixth Edition. United Kingdom: John Wiley & Sons Ltd.

Tang, T. Y., & Fifth, M. (2012). Earnings Persistence and Stock Market Reactions to the Different Information in Book-Tax Differences: Evidence from China. The International Journal of Accounting, 47, 369-397.

Undang-Undang Republik Indonesia Nomor 36 Tahun 2008 tentang Tentang Pajak Penghasilan