ffi$""m

VohrrtreVnHumber

*laixg;h,?,9^l2

I

CAPITAL STRUCTURE ON MANUFACTURING GOiIPANIES IN

lNDoNEslA

STocK

EXGHANGE FOR PERIOD2ool

'2009*l

.

/

Hendra Nursalim - AgusZainulArifin

V

EMOTIONAL LOYALTY TO RING BACK TONES PURCHASE INTENTIONDimas K. Aditiawan - Sukaris

SME's FINANCIAL STATEMENT : A GOLLAIERALI\LTERNATIVE Golrida l(aryawati. P

REVIEW OF CULTURE, STYLE LEI\DERSHIP AFFECT JOB SATISFACTION ON EMPLOYEE PERFORMANGE BA$ED APPROACH

SPSS VS LISREL Haryadi Sarjono - Lim Sanny - Sheftian Pancha Gahyo

O RGAN EATIONAL LEARN I N G AN D TRANSFORiIATIONAL

LEADERSHIP IN HIGHER EDUCAT|oN lna ChrisYanti Dewi

AGENCY COST AND GOMPANY LIFE CYCLE TO DIVIDEND COMPI\NIES IN THE LISTED COiIPANIES NadiaAsandimitra Haryono - Farah DeviArdhiani P.S

SERVIGE QUALITY TOWARDS HOTEL CUSTOMER LOYALTY Retno Dewanti - Citra Prameshwari - Aryanti Puspokusumo

EFFEGTIVENESS INTERNET BLOG AS

I\

MI\RKETING PRACTICE BASEP ON E-MARKENNG CONCEPT Heru WiiayantoENTREPRENEURIAL COMPETENCIES AND THE COMPETITIVENESS OF AN AGRIBUSINESS IN EAST JAVA, INDONESIA Y.Lilik Rudianto

THE EFFECT OF AUDITOR

TENURE,

SPECII\LIZATION' INDEFENDENCE AND REPUTATION TO AUDITQUALIW

Sesar Sehat Santoso

-,-rr*=tR{}

dffiffi

'"::\h#""

Published

in

cooperation

beetwen

the

STIEIEU Surabaya

and

KADII\| Surabaya---r

"l

f

aL:il-*;il

jfffl'l'fujil'{

ll,iiill l.\it'l l,l ;l,l'iil,l,1,;'l i:i l'il'liX', 't,i l.t'1{,11,!i,.1 I i,l"("{I l,!ll l'

The GLOBAL NETWORK Journal

is

a

refereed

journal

that

is

jointly

published

by

the

STIE

IEU

Surabaya

and

IADIN

Surabaya.

The

journal

endeavors

to provide forums

for

academicians andpractitioners who

are interestedin

the

discussion

of

current and

future

issues

and

challenges

impacting

theBusiness and Management as

well

as

promoting

and disseminating relevant

tohigh

quality

,r."urih.

fht

1'orl*al has

an

established

and

long

history

of

poitirtting

quality

researchfindings

from

researchersnot

only in

theAsianregion

but

alsoglobally.

The

GLOBAL

NETWORK Journal

is

published

eachMarch

andAugust

(two

times

a year).

We

welcome

papersfrom both

academicians andpractitioners

on theories,borio"r,

models,

conceptualparadigms,

academic research, consultancy projects, aswell

asorganizational

practices.CHIEF

EDITOR

EDITORS

Irra

Chrisyanti Dewi

Heru Wijayanto

Haryati

Setyorini

Haryo

SantosoIndra

SantosaSesar Sehat Santoso

Djamhadi

STIE

IEU

Surab ayaSTIE

IEU

Surab ayaSTIE

IEU

Surab ayaSTIE

IEU

Surab ayaSTIE

IEU

Surab ayaSTIE,

IEU

Surab ayaKADIN

Surab aya(

I

I

!

(

h S R E B H E] A]Y

TI

n

SerIEU

PressJl. Raya

Dukuh

Kupang

L57B Surab aya 60255Telp.

(6231)

5665654 Fax . (6231)

5665933#,fte#ffi3*

i:$ffi5:$#ffi

tlti $ { it 3 ;1 i i ;1

;ili', i illlffi , il il jil fi

ffi

il lj T;t l fiffi

l"lf:ili1j{,ffi

:iiTABLE

OF

CONTENTS

CAPITAL

STR.UCTURE ON

MANUEACTT]RING COMPAIIIES

IN

rNDoNEsrA

srocK

ExcHANGE FoR pERroD

2007_2009*)

\y'

HendraNursalim

-Agus

ZainulArifin

I

_lg

EMOTIONAT LOYALTY

TCIRII{G BACK

TONES

PURCIIASE INTENTTON

Dimas K.

Aditiawan -

Sukaris

0

- 26SME,s

FINANCIAL STATEMENT

:A

COLLATERALALTERNATIVE

Golrida Karyawati.

P

27 _ 35

RBVIEW

OF

CULTUR.E,STYLE LEADERSI{IPAFFECT

JOB

SATISFACTION

ON

EMPLOYEE PERFORMANCE

BASED

APPROACH

SPSS VS

LISREL

Haryadi Sarjono -

Lim

Sanny-

Sheftian panchaCahyo

36 _ 57ORGANIZATIONAL LEARNING AND TRANSFORMATIONAL

LEADERSIIIP IN HIGHER EDUCATION

Irra

ChrisyantiDe,rvi

5g _ g1

AGENCY COSTAND

COMPAIIYLIFE

CYCLE

TO

DIVIDEND

COMPANIES IN TI{E LISTED COMPANIES

Nadia Asandimitra Haryono - Farah DeviArdhiani

p.SSERVICE QUALITY

TOWARDS

HOTEL

CUSTOMER

LOYALTY

Retno

f)ewanti

-citra

prameshwari -Aryanti

puspokusumoEFFTICTIVENFSS

INTERNET BLOG

AS AMARKETING PRACTICE

BAS ED OTq N.NAARKETING: @ONCEPT

Heru Wijayanto

82

-

104105

-

ttg

r20

-

144ENTREPRENEURIAL COMPETENCIES AND

TI{E

COMPETITTVENSSS OF

ANAGRIBUSINESS IN

EAST

JA\A,

INDOI\ESIA

Y.

Lilik

RudiantotA5

-

169Sesar Sehat Santoso i,:,r

t,l;: iriiil: 194fii ,l:r:::i irtrl: tji.iri iiillj Iil; t.:l ,t;,.. :'ir': ,,;l;l

,i it

':ii:i,

Qto\atNetwordlournaf-,/o[. ,/ No,

1

gVLarcfr 2012CAPITAL

STRUCTURE

ON

MANUTACTURING

COMPANIES

IN INDONESIA

STOCK

EXCHANGE FOR

PERTOD

2007-2009*)

Hendra Nursaliml)

hendraJr@hotmail.com

Agus

Zarnul Arifin2)Agu s_ za@fe. t aruma nagffi a. ae . tdl g gus z a 1 8 0 8 @gmail. c o m

Faculty

of

Economics, Tarumanagara lJniversity JakartaABSTRACT:

The

objective

of

this

researchis to

identifu

thefactors

influencing the capital

structure of manufacturedJirms in Indonesian Stock Exchange

period

2007-2009.This

research

using multiple

regresstonto

test

whether

capital structure

is impactedby various

variables, namelyfixed

assetratio, growth,

size, netprofit

margin, and dividend payout

ratio.

Basedon

statistical

t

test,growth of

sales andNPM

hassignificant

influence of DER. Based onstatistical

F

test indicatesthat

variables FAR,growth of

sales,firm

size,NPM,

and DPR simultantly affectDER on

manufacturing

companieslisted

in

Indonesian Stock Exchangepertod

2007-2009.

Key

wordsz

Fixed

AssetRatio

(FAR),

growth

of

sales,firm

size,Net

profit

Margin

(NPM), and Dividend Payout Ratio (DPR).*)

This

paper had

presentedon

International Accounting

Concerence(IAC),

Surabaya State

University

(IINESA)

Z4-ZS November 2011INTRODUCTION

The national economic performance is a

reflection

of the performanceof

all

business entities that operate

within it.

The main purposeof

business entities is to create valuefor

shareholders, or in other words, maximizing shareholder wealth asCapitaf Structure on fuIanufacturing Comp anie s in Intonesia Sto c frlL4c frang e

for

Seriod

2 00 7- 2 009

-

tten[ra 9{ursa[im, Agus ZainatArfi.n

measured

by

stock price maxirnrzation. Theway

to

increasethe

shareprice

of

afnm

is

conductedthrough

threemain activities,

namelyplanning

andfinancial

analysis, make investment decisions, and make firnding decisions

(Gitmarl

2004).Important decision faced

by

financial managersin

relationto

thf,continuity

of the company's operations arethe

capitalstructureor

financing decisions,which

is

related

with

the

composition

of

debt, preferred

stock and

common

stock.Managers must be able

to

raise funds,both from

inside and outside the companywith

efficiently,

so the funding decisions are ableto minimize

capitafcosts of the company.When

managers usedebt, capital

eostsare incu:red

for

the

cost

of

interest charged by the lender,

while

if

managers use rnternal funds orthe

capitalitself,

therewill

be opportunity costof

funds used.If

wenot carefully

in

makingthe funding

decisions,it

will

lead

to

high

capital

costs,which

impact

to

the cornpany'sprofitability. The

capital

structure decisionstaken

by

manager also affect the financial risks of the company. Financial risks include thepossibility

the company could not pay its obligations, and also thepossibility of

not reaching the cornpany's targetedprofits.

Capital structure shown theproportion

of

debtwhich

use

to

financingthe

investment.By

knowing the

capital structure, investors canfind

a balance betweenrisk

andreturn on

investment. Basedon

the explanation above, we can conclude that the capital structure decision is very importantfor

thecompany's

future.

Many

factors influence

the

decisions

of

managers in

determining the cornpany's capital structure. According Prabansari (2005), capital

structure

is

influenced

by

firm

size,

asset

growth, profitability,

risk,

andownership

/

systemaffiliation.

Furthermore, basedon

reseaxch conductedby

Januarino

Aditya

(2006),

asset structure, operating leverage,the level

of

sales growth andprofitability

significantly

influence the capital structure.This

study aimsto

analyzrngthe

factors that affect the capital structureof

manufacturing

enterprisesin

the

IndonesiaStock

Exchange. Basedon

several previous,studies, some factors that influence capital structure thatwill

reviewedin

the present study is: the structgre of assets, growthof

sales,profrtability,

firm

size, and dividend policy.Qtofiat Networ(-lournaf -

,/o[

,/ gVo.1

fularcfi 2012GRAND THEORY

Capital

describesthe owner's

right of

the

company incurred as a resultof

investing decisions. Accordingto

the Brigham and Houston (2001) andMunawir

(2001), capital structure is a

mix of

debt, preferred stock and common stock. The company's capital structure is closely related to the investment so that in this case regardingthe

sourceof

the

fundswill

be

usedto

finance investment projects. Sourcesof

funds are basically consists of the issuanceof

stock (equity financing),the

issuanceof

bonds (debt financing), and retained earnings. Issuanceof

sharesand bonds are often referred to as the source

of

funds from outside the companyor

external financing, while retained earnings is often referred to as a source

of

fundsfrom

inside the company or intemal financing.Asymmetric

information or information inequality by Brigham and Houston (2001) and Brealy dan Myers (2003) is a situation where managers have differentinformation about

the

company's prospectsthan

investors.

This

information

asymmetry occurs because the management has more information than investors.

According

Murhadi

(2008),

"as5mmetricinformation theory

is a

condition

that one side hasmore information

than others."In a firm,

company managerswill

havemore

andbetter information than

investors.The

calculationsby

corporate managerswould be more

accuratewhen

calculating whether

the

share price overvalued or under value.The

theory

saidthat financial

structureis'influenced

by

the

incentives and behaviorof

decision makers (management). Jensen andMeckling

(1996) suggestthe

existenceof two

potentialconflicts. First, the

conflict

between shareholders and creditors. Creditors receive the moneyin

a fixed number from firms (interest),while

the revenue depends on the amountscf

firm

profits.In

this situation, lenderspay

more attentionto

the company'sability to

repay debt, and shareholders payCapitaf Structure onful.anufactuing Companies in IndonaiastocfrEapfrangeforeeriof

2 0 0 7 - 2 0 0 9

-

I{enfra g{urs a frm, Ag tt s Z ainaf

Arifr.nproject fails, creditors rnay suffer losses as a result of the

inability of

shareholdersto

pay its debt. To anticipate thepossibility

of

loss, the lender charges the agency debt (debt agency cost)with

restrictions on debt's using by the manager. Second,the

conflict

between shareholderswith

management.The

nranagement does not always actfor

shareholders wants, but rather leadsto

self-interest.For

anticipatethis

things,

shareholdersbear

agency costs

to

monitor the activities

of

the management.Brigham

&

Daves (2002) saidtrade-offmodel trying to

explain that there is a bankruptcyrisk of

a companythat

will

raisethe

costof

financial

distress. The costof

suchfinancial

difficulties

could be a

costto

sell the

company assets at below-market prices, costof

liquidation

of

the company,or

the management feeas a precaution

to

avoid bankruptcy. Tradeofftheory

states that the greater useof

debt

will

further

increasethe value

of

the

company,but

on the

other

hand, increasedthe

debt

to

finance

the

cornpanywill

further

increasethe

financial distress and agency cost. The increaseof

financial distress and agency costwill

be greater thanthe

benefitsfrom

the useof

debt.

It's

meanthat

the useof

debt is good and can increasethe

valueof

the

company,but

to

some case increase the debtwill

actually decreasefirm

value.QtofiatMetwqrdlournaf-,/ot, ,r/

gp,

I

foIarcfr z01zTHE

FACTORS

INFLUENCING

ITYPHOT'ESISCAPITAL

STRUCTURE

AND

Based

on the

theory and

sorne research study takes several, factors that affect the capital1.

Assets Structureof

the previous

researchers, this structure, namely:Asset structure describes the amounts

of

assets that can be used as collateralfor firm

debt (collateral valueof

assets). Brigham and Gapenski (1996) statedthat the

companywhich

hasa

guaranteeof

debtwill

be easierto

get

loansthan

companiesthat

do

not

havea

guarantee. Basedon

the

perspectiveof

trade-off theory and

agencytheory,

firms

that

havea

fxed

assetin

large numberswill

have more debt thanfirms

that have a small numbersof

fixed

assets (Smart, Megginson

&

Gitman,

2004).Hidayat

(2001) saidthat

assetsstructure have a

positive

effect on capital structure. The studyof

Sari (2001) and Bhaduri (2002) also supports the Hidayat's research, where the structureof

assets have apositive effect

of

capital

structure becausethe

more assets you have, the easier companies to get loans to improve capital structure.Hypothesis 1: Assets structure affect positively on capital structure.

2.

Growth RateGrowth is an indicator

for

the

successof

companies. Companieswith

high

growth

should use large

amountsof

debt,

becausethe

costsof

the

shareissuance shares are higher than the bond issuance. Company's growth rate is also a factor affecting the capital structure. Companies

with

high salesgrowth

and high

profits

usually use more debt as external funding than the company that has alow

growth rate (Weston and Copeland, 2000). Therefore, there is apositive

relationship

betweengrowths and capital structure

(Rakhmawati, 2008).Capiutstructure on fulanufacturing Companies in Intonesia StocfrEacfrangeforAeriof

2007-2009

- ltmtm

tVursafhn" ngus ZainafAriftn3.

Firm

SizeFirm

size indicatesthat the

largera

company,the

greaterthe level

of

debt (Smart, Megginson&

Gitman, 2004). Large firms are generally better knownby

outsiders such as investors and analysts, so that theinformatim

received outside parties symmetricalwith

company managers.A

positive relationship betweenfirm

size and

leverageis

becauselarge

companies havea

higherlevel

of

credibility'than small firms so that

large

companieshave

easieraccess

to

loans (Prabansari, 200 5 ; Werdiniarti,

2007 ;Nuraini,

20 I 0).lllpothesis

3:Firm

size

affect positively on capital strugture.4.

Profitability

Brigham

and Houston

(2001)

said

that the

companywith

high retum

of

investments

will

use smaller debt. This return (profrt)will

use to financing the companies needs.In

otherwords, the

companywith

high

profit

will

use alower debt. There

is a

negative correlation between

profit

and

capital structure (Nurrohim, 2008; Prabansari, 2005 ; Werdiniarti,

2007 ; Rina (2003).Hlpothesis: Profitability

affect negatively on capital structure.5.

DividendPolicy

Dividend

policy

essentially determineshow

much the

profit

distributed to

shareholders, and how many

will

keep. Accordingto

Home andMachowietz

(1998),'

dividend

policy

is

an

integrated

part

of

the

company's

funding decisions. The higher dividend payoutratio

will

profitable

for

investors, butwill

weaken the internal frnancial bbcauseit

will

decrgase retained earnings.Meanwhile,

the

smaller dividend

payout ratio

iis'

not

profitable

for

shareholders,

but will

strong

the

internal

financial

of

companies (Gitosudann-ot, 1992).There

is a

negative relationship

betweenDividend

Payout Ratio by

DE&

whichif

high levelsof

debt, payrnentof

dividendswill

be

low

because mostof

the

company'sprofits

are usedto

paythe

debt and interest (Rina, 2008;Yuhasril,

2006).Qtofiaf $fetwor(-lourruaf*,/o[ ,/

I[o.

I

fuIarcfrz\Lz

Hlpothesis:

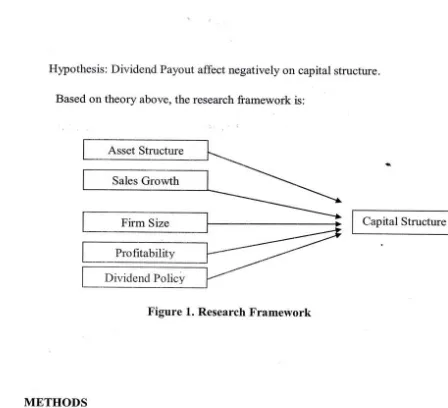

Dividend Payout affect negatively on cap rtaI structure.Based on theory above, the research framework is:

Capital Structure

Figure

1. ResearchFramework

METIIODS

Subject

of

this

studyit

tlut

issuers listed on the Indonesia Stock Exchange years 2047'2009. The sample is a manufacturing cornpany listed on the Indonesia Stock Exchange.The

sampling method is purposive sampling,with

criteria

that the financialreport is

availablefrom2007-2009,

the companies paydividend for

period

2007-2009,

didn't

have

a

negative

capital structure,

and

not

doing corporate action during the research period.This

study usessix

variables, consisting one dependent variableand five

independent variables. Independent variable used is

the

structureof

assets, sales growth,firm

size,profitability,

and dividendpolicy.

The dependent variable is the capital structure. The formula of research variables are:Asset Structure

Sales Growth

Profitability

2.

Capitatstructure on flLanufacnning Companizs in Intonesia StocLfXcfiangefor Aeriof

2 00 7 - 200 9

-

!{en[ra gthtrsafrrn, -Agus ZainafArfin

l.

Capital structureBased on

Nuraini

(2010), capital structure is measuredby

comparing thetotal

debt to total equity:

DER

:

Tsta$S*bt

To;*eu'I" Sqfff;f-S

Assets Structure

The

assets structureis the ratio

betweentotal

Assets (Copeland, 2000)

FAI.

_

iVet Fi.#,sd .Sesg.fFn,fia-! fic,,grgi

fixed

assets to-total

assets.the

change (increaseor

decrease)jlfffi Ss*Ibsc

-

Sil** S#Ibs,?'-sJ[rsf, ,Ss[exr,-,!,

of

cornpany's sales(Van

4.

Firm

Sizeis a company's

ability to

generate revenues from the sales (Christianti, 2006).Firm

Size:

ln Sales5.

DividendPolicy

It

is

measured using the dividend payoutratio @PR). How

to

calculateit

is(Atmaja,

1999):fas&8{sJdgld

DPR: s

itf,et f,'rt*ws'cqsIn

this researclq the data analysis method ismultiple

linear regressionswith

using

SPSS

software (Statistical Product

and

Service Solution). Thus

the statistical equations can be elpressed asfollows:

3. Sales growth

Sales

$owth

is Horne, 2000)Sales Growth

-I

t-Stoilaf 7r{etwor$oumrtf -

'/o[

'/

9,{o.1

1ilarcfr 2012DER*

Bo+

pl

FAR+

FIGS+

93 SIZE+

p4NPM +

B5DPR+

eiNotes:

DER

po

81, p2, p3, F4, p5

pfft

GS

SIZE

NPM

DPR

ei

:

Debt toEquityRatio

:

intercept valueq

:

coefficient

of

regressionfor

FAR,

NPM,

GS,SIZE'

and DPR*

Fixed Asset Ratio=

Growth Sales*

ln

Sales:

NetProfit Margin

:

Dividend Payout Ratio:

residual valueBefore testing the hlpothesis,

first

we performed a classical assumption testto

testthe feasibitity

of

using regression models and independent variables. Thisclassical

assumption

test

in

this

study

consisted

of

tests oT

normality,

multicollinearity,

heteroscedasticitynand

autocorrelation. Hypothesistesting

of

CapitafStructure on foLanufacturing Companies in Infonesia Stocfrn4cfiangefor

eerio[

2007-2009

-

j{en"fra Nursafrrry Agw ZainatArifinRESULTS

AND

DISCUSSION

1.

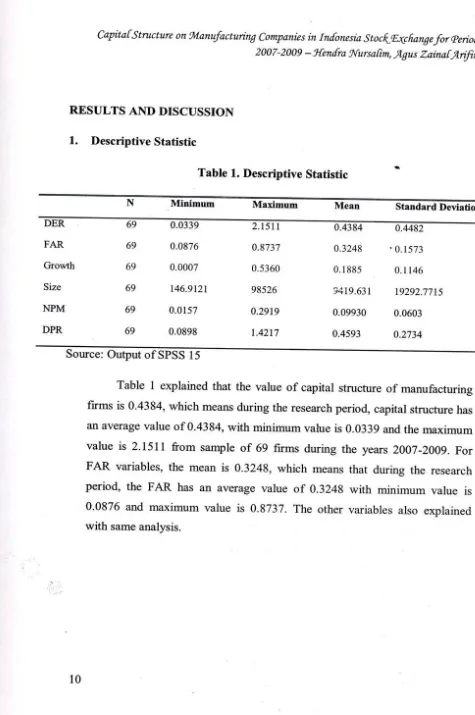

Descriptive Statistic

Table

L.Descriptive Statistic

Minimum Maximum Mean Standard Deviation

DER FAR Growth Size NPM DPR 69 69 69 69 69 69 0.0339 0.0876 0.0007 146.gI2l 0.0157 0.0ggg

2.l5ll

0.8737 0.5360 98526 0.2glg 1.42L7 0.4384 0.32490.1 885

9119.631

0.09930

0.4593

0.4482

" 0.1 573

O,IT46

19292.7715

0.0603

0.2734

Source: Output

of

SPSS 15Table

I

explainedthat

the valueof

capital

structureof

manufacturingfirms

is 0.4384, which means during the research period, capital structure has an average valueof

0.4384,with

minimum value is 0.0339 and the maximumvalue

is

2.l5ll

from

sarnpleof

69 firms

during

the

years2007-2009.For

FAR

variables,the

meanis

0.3248,which

meansthat

during

the

researchperiod,

the FAR

hasan

averagevalue

of

0.324g

with

minimum value

isStofiat$fetwordlowmaf- Vo[. ,{/ !{o,

1

tuIarcfr z01z2.

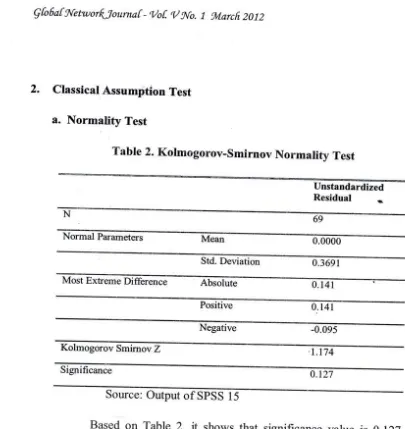

ClassicalAssumption

TestNormalify

Testt.

Table

2.Kolmogotrov-srnirnov

Normality

TestUnstandardized

Residual

a69

Normal Parameters Mean 0.0000

Std. Deviation 0.3691

Most Extreme Difference Absolute 0. 141

Positive 0.141

Negative -0.095

Kolmogorov Smirnov Z ,1.17 4

Significance 0.t27

Source: Output

of

SPSS 15Based

on

Table

z,

it

showsthat

significance value is gre atw than 0.05 so that thenull

hypothesis means that the residual data isnofinally

distributed.b.

Multicollinearity

TestingTable 3.

Multicottinearity

TestingVariabel Bebas Tolerance

value

is

0. 127.

This is not rejected, whichFAR

GROWTH

SIZE

NPM

DPR

0.911

0.990

0.854

0.746

0.83 I

1.099

t.021

l.l7l

1.341

1.203

11

':. "

Capitaf Structure on foIanufactuing Qompanies in Infonesia

Stockqcfr4ngeforeeiod

2007-2009

- ltmfra

tVitrsa[im, Agus Zainaf Arifi.nBased

on

nrulticollinearity

test

in

Table

3,Tolerance value

of

each variable is more than 0,10 variableis

below

10.It

can be concludedthat

no independent varrables in the regression model.Autocorrelation

TestTable 4.

Autocorrelation

Testit

was found

that

the andVIF

valueof

eachmulticollinearity on all

C.

ModeI R Square Durbin-Watson

0.s67 0.322 2.028

Source: Output

of

SPSS 15From

the test is

known

that

the

DW

value (Table

4)

is

equal to 2.028. From TableDW

for

n:69,

k:

5, and the significance levelof

5yo,dL

:

1.4588 anddu

:1.7680.

Because theDW

value is

between the du(1.7680) and

4-du

(2.2320)

so

it

can

be

concluded

that

there are

no autocorrelation problem in the regression model.d.

Heteroscedasticity

TestTable 5. Heteroscedasticity Test

Variabel Significance FAR

GROWTH

SIZE,

NPM

DPR

0.07 5

0.353

0.166

0.065

0.826

Source: Output

of

SPSS 15From

the

Table

5,

it

is known

that

the

significancevalue

for

all

independent variables

is

greater than 0.05.This

result shows that there is no heteroscedasticity problem on residual variance.Qtofiat lrfetworSJournaf -

'l/o[

'/

$[o.1

fuIarcfr 2012After

all

variables pass

the

classical

assumptions,we

can

conductmultiple

regression analysisto

determine the effect of each variable on capital structure. Here is the result of data analysiswith

SPSS 15:Table

6.Multipte

RegressionAnalysis

Variabel Koefisien Regresi Signlncance

Konstanta

FAR

GROWTH

SIZE

NPM

DPR

1.513

0.302

a.973

-0.039

-3.627

0.270

0.088

0.332

0.021

0.220

0.000

0.1s2

R2

:

A322; F sig:0.000Source: Output

of

SPSS 15From table 6, we can determine the

multiple

linear equations asfollows:

DER

:

1,513+

0,302FAR

+

0,973GROWTH

-

0,039 SIZE

-

3,627NPM

+

0,270 DPR

3.

Discussion (Hypothesistesting)

Based on

t

testin

Table 5, thevalue

for

the regressioncoefficient

for

FAR is

0.302with

a

significance valueof

0.332.This

significancevalue

is greater than0.05 so

it

canbe

concluded thereis

no

significant effect from

FAR

to

DER

Thus,

the

research hypothesiswhich

statesthat there

is

apositive influence of FAR to DER is rejected.

From Table 5, the regression

coefficient for

thegrowth

is 0.973with

a significance valueof

0.021. This valueis

smaller than 0.05 so thatit

can be concluded that there w:Na significant

influencegrowth

to DER

Regression coefficient valueof

0.973 meansif

the growth variable increases oneunit,

it

will

increaseDER by

0.973units.

It

means thereis a positive

influenceof

capiufstracture on g4anufacturing companies in rnfonesia stocfrn4cfrangeforeeriof

2002_2009_t{enfra$rursafrm,AgusZainatArifin

grouryh

to

variableDER

and hlpothesis effect growth to DER is accepted.significance value

for

the variable thatit

can be concluded that there was nothe

DbIt.

Thus,the

research hlpothesis effectsfirm

size to DER is rejected.which

states that thereis

a positivesize

is

0.220 (greater than0.05)

sosignificant effect

of

variabte size towhich

statesthat

thereis

positiveBased

on

the

resurts

of

t

test

for

NpM

variables,

thd

regressioncoefficient

valuesis

-3.627with

a

significance valueof

0.000. Significancevalue

is

smaller than

0.05 so that

it

can

be

conciudedthat

there

was

asignificant

effect

NpM

to

DER.

Regressioncoefficient value

with

minus signs indicate that there are negative effects onvariables

NpM to

DER.

The increaseof

one

unit

NpM

will

decreaseDER

by

3.627

units.

Thus,

the hlpothesiswhich

states that there is negative effectNpM

to DER isaccepted. Based on the results

of

thet

testfor

vaiiablesDp&

the significance value is0'152' This significance value is greater than 0.05 so that

it

can be concludedthat there was

no

significant effect DPR

to

DER.

Thus,

the

researchhypothesis

which

statesthat

there

is a

negativeinfluence dividend

policy

variable (DPR) to the DER is rejecred.From Table

6 is

known

that

the

significance

value

is

0.000. significance value is smaller than 0.05 so that thenull

hypothesis is rejected.It

can be concluded that thefixed

assetratio,

growth,size, net

profit

margin, and dividend payout ratio is simultantly affect thevariable debt to equity ratio (DER).

Based on test results

in

Table 6, the valueof R

Squareof

32.2%owhich means that 32.zyoof

the variationof

the variable debtto

equityratio

(DER) canbe

explainedby

the

variabrefixed

assetratio

(FAR), growth,

size, netprofit

margin(NPM),

and dividend payout ratio@pR),

andthe

restof

67.gyo

explained by other factors thht are not included in this nrodel.

t4

[-I

$to6at lV'etworfrlournaf -

,/o[

,l/I[o,

1

foIarcfr 2012CONCLUSIONS

Assets Structure

is

not

affect

to

Capital

Structure

on

Manufacturing Companiesin

IndonesiaStock

Exchangefor

Period

2007-2009.Growth

atrectpositively

to

Capital Structureon

Manufacturing Companiesin

Indonesia Stock Exchangefor

Period

2007-2009.Firm

Sizeis

not

affectto

Capital

Structure on Manufacturing Companiesin

Indonesia Stock Exchangefor Period

frOl-ZOOg oo Mantrfacturing Companiesin

IndonesiaStock

Exchangefor

Period

2007-2009.Profitability

is affect negativelyto

Capital Structure on Manufacturing Companiesin

Indonesia Stock Exchangefor

Period 2007-2009. DividendPolicy

isnot

affectto

Capital Structureon Manufacturing

Companiesin

Indonesia Stock Exchange for Period 2007-2009.REFERENCES

Assets Structure, Growth,

Firm

Size,Profitability,

andDividend

policy

af,lect assimultanly on

Capital Structureon

Manufacturing Companiesin

Indonesia Stock Exchange for Period 2007 -2009Brighanr" Eugene, F., dan Houston, Joel,

F.

(2001). Manajemen Keuangan,Edisi

8. Jakarta: Erlangga.

Chandra, Teddy. (2006). Pendekatan-pendekatan dalam Penelitian Struktur

Modal

Perusahaan. Jumal Eksekutifl Volume 3, Nomor 2, Agustus 2006.Coheru R.,

D.

(2004).An Implication

of theModigliani-Miller

Capital StructuringTheorems

on

the

Relation

between

Equity and Debt.

Retrieved from

http://rdcohen. S0megs.com/JvlMabstr aa.htm/ December Z, 2010.

Frydenberg,

stein.

(2004). Theory

of

capital

structure

-

A

Review.

Retrieved from www.ssrn.com/ December 20, 2010.Capitaf Structure onfuLanufacturing Companies in Indonesiastoc&WfrangeforAeriof

2 00 Z- 2 0A9

-

t[en[ra ttfursatim, Agus Zaitwtjrfin

Ghozali,

Imam.

(2005).

Aplikasi Analisis Multivariate

denganprogym

spss,

Hadianto,

Bram. (2007).

Pengaruhstruktur Aktiva, ukuran

perusahaan, danProfitabilitas

Terhadap

Struktur

Modal Emiten Sektor

Telekomunikasi'

Periode 2000

-

2006: Sebuah Pengujian Hipotesis Pecking Order. Bandung: Fakultas Ekonomi Manajemen Universitas Kristen Maranatha.Harjanti

T., T,,

danTandelilin, E.

(2007). PengaruhFirm

size,

Tangible Assets,Growth

Opporfirnity,Profitability,

dan BusinessRisk

pada StrukturModal

Perusahaan

Manufaktur

di

Indonesia: Studi Kasusdi

BEJ. Jurnal Ekonomi dan Bisnis,Vol.

l,

No,

1, Maret 2007, hal.l-10.

Haryono,

Slamet. (2005). StrukturKepemilikan

dalarnBingkai Teori

Keagenan. Jurnal Akuntansi dan Bisnis,Vol.

5,No.

l,

Februari 2005,hal.

53-7t.

Husnan,

S.

(2001).

Dasar-dasarTeori Portfolio

dan

Analisis

Sekuritas, Edisi Ketiga. Yogyakarta: UPPAI4P YKPN.

Isteitieb A.,

and Rodriguez, J.,M,

(2003).Finn's capital

structure

andFactor-Prsduet Markets:

A

Theoritical Ovorview, University

of

Valladolid.

Retrieved: www.ssrn.gony' Dssemb

vr

14, 20 I 0.Jensen,

M,,

andw.,lvleskling.

(1976). Theoryof

TheFirm:

Managerial Behavior,Agency Cost,

and Ownerehip

Struoturo,Journal

of

Finance

Economics (Deoembor) 3, page 305-360,Kotruma,

Ali'

(2009), AnalisioFaktor

yang Mernppnganrhi StrukturModal

serta Ponganrhnya terhadap Harga Saham Ponrsahaan Roal Estate yang Go Publiodi

BrunaBfek

Indonesia. Jurnal Manajemen dan Kewirausahaan,Vol.

ll,

No.

l,

Marst

2009, hal, 38-45.Qtofiat I{etworfrlourrtaf -

'/o[

q/Nu

I

foIarcft 2012Kurshev,

A.,

and

StrebulaevoI., A.

(2006).

Firm

Size

and Capital

Structure. Retrieved from www,ssrn.com/ Decernber 23 2010,Munawir,

S. (2001). Analisa Laporan Keuangan. Yogyakarta:Liberty.

Murhadi, Werner,

R.

(2008). HubunganCapital

Expenditure,Risiko

Sistematis,Stnrktur Modal, Tingkat

Kemampulabaan,terhadap

Nilai

Ptrusahaan. Jumal Manaje{nen dan Bisnis,Volume

7,Nomor

1, Maret 2008.Murray,

Z.n Frank, andVidhan,

IC,

Goyal.

(2007).Capital

Structure Decisions:Which

Factors

are Reliably

Important? Retrieved

from

www.ssrn.com/ December 26 2010.Nnrani,

Lila,

Esty.

(2004).Analisis

Faktor-Faktor yang MempengaruhiStrukhr

Modal

Perusahaan.

Semarang:

Magister

Manaiemen

Universitas Diponegoro (Thesis, unpublish).Nuraini,

Yustiana, Ratna. (2010). Analisis Pengaruh Return on Investment, Fixed Assets Ratio,Firm

Size, dan Rateof Growth

Terhadap Debt to Equity Ratio Pada Perusahaan Manufbktur yang Tercatat di Bursa Efek Indonesia Periode2003-2007.

Semarang:

Magister

Manajemen

Universitas

(Thesis, Unpublish).Nurohirrq

Hasa.

(2008).

PengaruhProfitabilitas,

Fixed Asset Ratio,

Kontrol

Kepemilikano dan Struktur

Aktiva

terhadap Strukhu Modal pada PerusahaanManufaktur

di

Indonesia.Sinergi.

Kajian Bisnis

dan Manajemen,Vol.

10,No.

l,

Januari 2008,hal.

Il-18.

Paramu,

H.

(2006). Determinan StrukturModal:

StudiEmpiris

pada PerusahaanPublik

di Indonesia. Manajemen Usahawan Indonesia,XXXV

(11): 48-54.Prabansari,

Yuke,

dan Kusuma,Hadri.

(2005). Faktor-faktor yang MempengaruhiStruktur Modal

PerusahaanManufaktur Go Public

di

BursaEfek

Jakarta. Kajian Bisnis dan Manajemen, p.1-15.Capiut s tructure ofl g4.andacturing C omgtanic s in Intonzsia S toc &lE Xc frnng e

for

eeriof,2007-2009

-

tfendra tVursafrm, AgusZairufArifin

Putra,

Buyo,

Septadona. (2006).Analisis

Pengaruhstruktur

Kepemilikan,

RasioPertumbuhan,

dan

Return

on

Asset

terhadap'Kebijakan

pendanaan.S emarang : Universitas Diponegoro. (Thesis, Unpublish).

Ross, S.,

A.,

Westerfield, R.,W.,

and Jaffe, J. (2001). Corporate Fin4grce,7th

ed.,New

York, USA: McGraw-Hill.

Ramlall,

Indranarain. (2009).

Determinantsof

Capital

StructureAmong

Non-Quoted

Mawitian Firms

under

specificity

of

Leverage:Looking

for

aModified

Pecking

Order Theory

Retrieved

ftom

www.eurojournals.com/finance.htnr/ November 28 2010.Rao, S.,

Narayan, andP., J.,

Jijo,

Lukose.

(2010).An

Empirical Study

on

the Determinantsof

the

Capital

Structureof

Listed Indian

Firms.

Retrieved from www.ssrn.com/ December 13, 2010.Rina, Walmiaty.

(2008). Pengaruh Struk:turAktiva,

Profitabilitas

dan KebijakanDividen

Terhadap Struktur

Pendanaan.Medan: Sekolah

Pascasarjana Universitas Sumatera Utara (Thesis, Unpublish).Titman,

Sheridan, andrsyplakov,

sergey.(2006)..{

DynamicModel

of optimal

Capital Structure. McCombs Research Paper SeriesNo.

FIN-03-06.Uyanto, Stanislaus, S. (2009). Pedoman Analisis Data dengan SPSS, Edisi Ketiga. Yogyakarta: Graha Ihnu.

werdiniarti,

Endang,

Tri.

(2007).

Analisis

Faktor-Faktor

Yang

Mempengaruhi StrukturModal

(Studi Empiris padaIndustri Manufaktur

yang Terdaftardi

BEJ

Periode

Tahun

2000t-2004).

Semarang:

Magister

Manajemen Universitas Diponegoro (Thesis, Unpiblish).