C

O N TIN G EN T

C

REDIT

R

ISK

M

A N A G EM EN T

S

YSTEM

O

N

B

A N KS

P

ERFO RM A N C E IN

I

N DO N ESIA

Teddy Oswari

Dharma T. Ediraras1

ABTRA C T

We present in this article the findings froam a study on Contingent of credit risk management system in moderating of the organization's performance, using contextual approach, which consists of four main variables, namely the business strategy, company culture, external environment and organizational structure. Here, this article provides an essentiay different. It relies on modeling through contextual variabilities which are surrounded and interacted within credit division and these moderating on organization performance. In addition, and unlike the contingenty theory and accounting management perspective the study ointeraction process between contingent variables with credit risk management systems in moderating banks performance in Indonesia. The development of qualitative description and verificative analyses of model, our study included insights from (1) structured close interviews with credit managers of 79 commercial banks which was selected within simple random sampling method by a set of questionare instrument, and (2) a statistical analysis of data from the 2004 through 2008 annual report of Indonesia Central Bank (BI). Our focused here is centered on the practical insight that came out of the study, rather than on the technical details such credit scoring that led us to those insights.

IN TRO DUC TIO N

The phenomenon of Disintermediation happens in America is the beginning of the emergence of credit crunch issue, inhibition of banking credit as a result of very tight monetary policy to tackle inflation by the Federal Reserve. Results summary of several

1

Teddy Oswary is an Assistant Professor of Finance, Banking and Risk Management at Economic Faculty, Gunadarma University, Jl. Margonda Raya No. 100 Pondok Cina, Depok 16424, West Java, Indonsia; phone: 62-21-78881112; Fax: 62-21-7872829; e-mail: [email protected]. Dharma T. Ediraras is associate Professor in Accounting, Auditing and Accounting Information System at Economic faculty,Gunadarma Univrsity, Jl. Margonda Raya No. 100 Pondok Cina, Depok 16424, West Java, Indonsia; phone: 62-21-78881112 Ext. 476; Fax: 62-21-7872829; e-mail: [email protected]. The Authors thank Prof. Nopirin,Business and Economic Faculty, Gadjah Mada University, Yogyakarta and Prof. Tov Assogbavi, Laurentia University, Canada their interest, helpful, advise and comments in this research. And also thank all opponents at Doctoral Program in Economic, Gunadarma University, all Respondents and anonymous referees who commented on previous versions of the article. This article was subject to double-blind peer review.

studies, such as Stiglitz and Weiss (1981); Bernanke and Lown (1991); Great et., Al. (2001); Lesmana (2006) revealed a reduction in bank credit as a result of the sharp decline in banking activities in credit to the business world and encourage the banks to handle credit risk is more cautious with more adequate facilities.

Government efforts to encourage increased bank credit made through a credit guarantee and banking business plan evaluation as a form of evaluation to determine how much banks make internal preparations and handling of externally for credit risk that may occur. Kunreuther and Heal (2002); Lesmana (2006) suggested need for independent security as a form of security for the credit risk of banks disbursed credit risk

management model as a specific form of2 credit risk management anticipated that

accurate. Giesecke (2002) suggests the study of the failure of the fulfillment of obligations by the debtor to see one of the factors is imperfect information or investors owned banks. Failure may result in transmission of financial harm to investors or banks in approving credit.

Credit risk management is a joint activity of the identification, measurement, remedy selection and control and supervision of credit risk. Modeling credit risk management activities and facilities needed to run the application causing the creation of a simple model of anticipation, but it may reflect the credit risk monitoring are contained in each of the debtors through the quality management of banking operations. The model is expected to be implemented by banks in assessing the level of monitoring and understanding the factors that cause high levels of credit risk of each debtor.

Bank for International Settlements suggest the existence of the development of credit risk portfolio model of banking. The agreement which was implemented in 1988 and became the standard in the World Bank as the bank's capital requirement is the standard approach of using an assessment model / internal maximum load for the assessment of credit risk portfolio and the necessary calculations. (Basel Committee on Banking Supervision, 2000). Motivation in this study is to analyze the interaction effects of variables kontijensi with credit risk management systems, studies on credit risk management divisions of commercial banks in Indonesia through validity and reliability testing Burns 2002; Vickery 2004; Dietsch dan Petey 2002; Ieda et., al. 2000).3

Changes in banking structure has been experienced by Indonesia before the crisis, such as the Annual Report of the BI in 2004 declared the period 2000 to 2003, seen some indicators of banking performance continued to improve as reflected by the increase in total assets, fund raising, asset quality, capital and bank profitability . Although the amount of bank credit continued to increase, but credit management is still far from expected. This is because the bank lending is still hampered by the procedures and

credit management system in addition to the high risk world of business.2

2 Changes in banking structure has been experienced by Indonesia before the crisis, such as the

1988 enactment of the policy package in October 1998 (Pakto 1988) which provide a wider space for the bank to increase the potential intermediary.

3 Methodology portfolio credit risk models require an assessment of the possibility of negligence

The impact of banking crisis in 1997 as a result of the lack of guidelines and standards for credit risk management that are used in Indonesian banking. Bank of International Settlements has made regulations that have got a global banking deal to be implemented in a secure banking transactions, one of which includes provisions to manage credit risk. Credit risk management is a serious problem for Indonesia's banking if you want to be recognized globally. Efforts should be made to answer to these problems is the need for research that can create models of credit risk management through the interaction of contingency variables that are expected to be used as a standard to be applied in banking in Indonesia. Research model should have reasonable accuracy, so it can be developed and applied with the support of historical data, concepts and conditions of banking credit management system.

BI data shows, the value of bank credit during the first quarter of 2009 fell IDR 11.5 trillion from the position in December 2008 amounted to USD 1342.1 billion. The problem of bad debts that appear on the banking in Indonesia within the last 15 years are fairly common. Therefore, the attention of researchers to identify and study the internal mechanisms, management systems, resources and standards of banking operations in the process of loan approval is appropriate and correct. This attention appears related to the need to identify in the application of credit risk management in a transparent and consistent, so that leakage of credit that still occur can be minimized. The motivation of this research is to make a contingency variable interaction model with credit risk management system on organizational performance, empirical studies on credit risk management divisions of commercial banks in Indonesia.

This article reviews the strengthening credit risk management system of changes in competitive strategy, corporate culture, external environment and organizational structure of banking and can contribute to the success of the overall credit disbursement in order to improve the performance of the banking and economic growth in Indonesia.

CURREN TMETHO DS

Contingency theory is used to analyze the design, management and research systems on management accounting systems to provide information that can be used by companies for various purposes (Otley 1980) and to face competition (Mia and Clarke 1999). Contingency approach is based on the premise that there is no system in the field of management research that can be used universally within the organization various environments (Otley 1980; Muslichah 2003; Faisal 2006). Contingency approach in

this research, is used to evaluate environmental factors, culture and strategies that allegedly can cause the system to the management of a company becomes more effective. Several previous studies using the contingency approach to examine the relationship between contextual variables (information technology, competitive strategy and environment) on information systems and performance, such as Chong and Chong (1997), Chenhall and Morris (1986); Abernethy and Bouwens (2000 .) Sawitri (2006), Faisal (2006) states that organizations need to consider these contextual variables of a system for information generated becomes more effective. Traditionally dominated by management accounting information financial information, but in its development also

The results Mia and Clarke (1999) states that the use of information on an organization's systems can help managers and organizations to adopt and implement their plans in response to the competitive environment. Mia and Clarke (1999) also concluded that the increasingly intensive market competition, the performance of the organization for the better. Chenhall and Morris (1986) stated that perceived environmental uncertainty is an important contingency factor, because it can make the process of planning and control more difficult. Gordon and Narayanan (1984), Faisal (2006); Yurniwati (2003) stated that environmental uncertainty associated with

organizational performance.

Research Porter (1985), Govindarajan and Fisher (1990); Yasukata and Kobayashi (2001) reveals there are two types of strategy in business research, namely corporate and competitive strategy. Business corporate strategy focuses on what and how to manage competition. While the competitive strategy focus on creating competitive advantage in the face of competition (cost leadership and differentiation).

Many phenomena that explains the research on risk and risk management in various banking industry in many countries, including Indonesia. Therefore, researchers try to use the contingency approach to explain the link between credit risk management systems on organizational performance in this case is a commercial bank.

Research and Hrycay Carey (2001) tried to compare the data on credit risk model parameters between the rating agency (rating agency) with the internal ratings made by financial institutions (internal rating). The result is the character of time series data, internal rating is better than agency ratings. The problems that can interfere in the internal ratings-determination is the interference of internal / management, thus allowing less runs with optimal management and may reduce the quality of the both rating.

Our approach here is essentially different. It relies on modeling through contextual variabilities which are surrounded and interacted within credit division and these moderating on organization performance. In addition, and unlike the contingenty theory and accounting management perspective, we adopt Yasukata dan Kobayashi (2001) model.

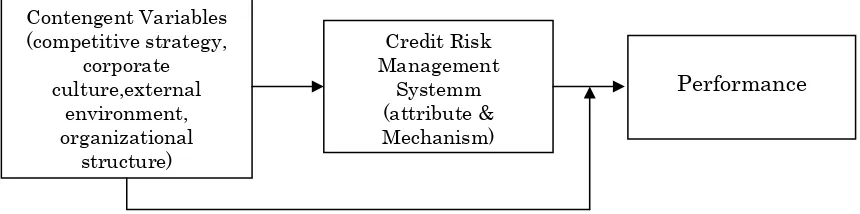

Thus the control of a system of research work unit management, contingency theory holds that the most appropriate control system, which the organization depends on the circumstances surrounding or within the organization and Fisher (1995). The flow of thought this research was made on the basic needs framework of contingency research Otley (1980) as follows.

Figure 1.

Structure of Moderating and Causal Analysis Model

Methods of data processing is done in 2 (two) step process, first, using descriptive statistics and analysis of variance (ANOVA) in explaining the competition strategy, corporate culture, external environment conditions, forms of credit risk management system is in a group different banking industry. Second, bivariate analysis / interaction approach with multiple regression model with the following equation ekonomtrisebagai.

Y = α + β1 X1 + β2 X2 + β3 + β4 X3 X5 + X4 + β5 β6 β7 X1.X3 X1.X2 + + + β8 X1.X4 β9X1.X5 + e

Where:

Y = organizational performance

α, β1, β2, β3, β4, β5, β6, β7, β8, β9 = unstandardized regression coefficient X1 = credit risk management system

X2 = competitive strategy X3 = corporate culture

X4 = the external environment X5 = organizational structure

X1.X2 = interaction of credit risk management systems with competitive strategy X1.X3 = interaction of credit risk management system with corporate culture

X1.X4 = interaction of credit risk management system with the external environment X1.X5 = interaction of credit risk management systems with organizational structures

Simultaneously, this model analyzes the interaction effect caused by the competitive strategy, corporate culture, external environment and organizational structure of credit risk management systems to organizational performance. How big is the contribution caused by the influence of contingency variables on organizational performance improvement in this regard is a commercial bank. After testing hipetesis, conducted a comparative analysis of the results of studies of secondary data. Secondary data in the form of a description of how far the financial ratios of the financial statements of banks that have been made uniform in a certain format to provide information on improving the overall banking performance. Is in line with the results of the analysis of primary data on improving organizational performance of commercial banks.

Object of observation in this study is the business unit strategy, corporate culture, external environment, organizational structure, credit risk management systems and organizational performance. This research was conducted on commercial banks that have run the credit risk management process for 4 (four) years, the period from January 2005 until December 2008. Subject of research is the director/manager/head of credit risk management of commercial banks in Indonesia. A total of 97 banks involved in the determination of the number of samples proportional to the number of samples in each group of commercial banks as follows. (1) Commercial Banks Government (Persero) amounting to 5 banks with the number of samples taken only 4 banks; (2) National Private Banks Foreign Exchange amounted to 32 banks with a number of samples taken only 24 banks; (3) National Private Banks Non-Foreign Exchange amounted to 36 banks with a number of samples taken only 27 banks; (4) Regional Development Bank amounting to 24 banks with a number of samples taken only 19 banks; (5) Mixed Banks amounted to 20 banks with a number of samples taken only 15 banks and (6 ) foreign banks amounted to 11 banks with the number of samples taken only 8 banks.

contacted via phone and went straight to the object of research (2) through Internet technology by sending an email containing a questionnaire to the commercial banks that have a website or email address and (3) attended a seminar or a meeting of association / banking associations to distribute the questionnaire on that occasion. Processing data collected from the questionnaires and data collection conducted skunder in 4 (four) steps, namely: editing, entry, tabulation and analysis of data using Microsoft Excel and assistance applications SPSS v.16. Given the model in this study is a model of causality (relationship/causal effect), then to test the hypothesis statistical testing instruments used in research models.

BA NKIN G CREDIT RISK MA N A G EM EN T SYSTEM IN IN DO N ESIA

Referring to the results of the research analysis Kunreuther and Heal (2002); Martin (2003); Lesmana (2006) comes the need to re-examine the role of the private and public sectors in building an efficient strategy of prevention and protection of the fatal problems in order to reduce the frequency of occurrence and the potential effect generated. All parties associated with the loan are expected to contribute in the formation of anticipatory model of credit risk management through contextual variables pengidentifikasin / kontijensi in accordance with existing regulations in order security of credit risk management application can be enhanced.

Aguais and Rosen (2001a) suggested the main advantage in running a credit risk management, among others: Improving credit risk transfer pricing between new loans and portfolio management functions, reduce bad debts and credit volatility, develop credit risk of liquidity instruments that lead to decision-trading and hedging (hedging) the better, more effective management of regulatory and economic capital, allocation of credit risk capital more efficiently through a clear distinction of the various business opportunities, transparency of credit risk better, mproving the adequacy of human resources, systems, methodologies and internal data.

Basel Committee on Banking Supervision (2000) explained as a process, framework for

for shareholders (shareholder value) (2) reduce the likelihood of pressure on financial capability (financial distress). (3) to maintain operating margin (operating margin).

Application of credit risk management by commercial banks in Indonesia have been carried out basically against all debtors. However, there are still many problems in determining the lending policies in accordance with principles and rules of the BI. This leads to the preliminary research that aims to obtain a reinforcement model of credit risk management system in accordance with the conditions and empirical data for commercial banks to assess the application of competition strategy, the bank in lending culture, external environment and organizational structure.

Credit risk is the risk that occurs due to failure pihal opponent (counterparty) in fulfilling its obligations. Approach model and estimation of individual credit risk has become a very important consideration for practitioners and researchers in the banking sector after the monetary crisis in 1997/1998 ago. Lesmana (2006) describes the main problems of data modeling is the lack of non-performing loans (bad) with a proper time sequence. But according to researchers, research has not been found in various countries that observe, measure and analyze the role of competitive strategy, corporate culture in this bank, the external environment and organizational structure of the establishment of a credit risk management system optimum, in order to create a compliance risk pengidentifikasin, risk measurement and risk management to run appropriate mechanisms and policies to minimize errors in the provision of credit to debtors.

Research Hamerle and Rosch (2004) which uses data on German banking credit management, obtain the correlation between economic sector credit / business being poured, but not a serious problem, this study does not emphasize the role of credit risk management as a matter that needs special attention . In addition to internal credit rating, compliance management system creates a strong credit risk is one business that has an important role in determining the feasibility of lending to each debtor.

BI has the right to issue regulations related to banking management in Indoneisa. BI requires banks to have a system of management (management), credit risk is accurate and comprehensive, because of the increasing complexity of credit risk will increase the need for sound corporate governance practices (good governance) through the functions of identification, measurement, monitoring and controlling credit risk. Obligations stated in the letter referred to the BI Regulation 5/8/PBI/2003 number dated 19 May 2003 and Circular Letter number 5/21/DPNP September 29, 2003 in force starting January 1, 2004 and has been implemented as of December 31, 2004.

BI previously only requires that banks make credit risk rating based on the assessment of asset quality, as stated in Decree number 31/147/KEP/DIR BI November 12, 1998. The quality of productive assets determined based on business prospects, financial condition and repayment ability of debtors in five classes / categories, namely current, special mention, substandard, doubtful and loss. Assessment with conventional approaches produce less accurate ratings, because its methods only perform qualitative approach, where the risk of moral hazard that exist on a credit analyst (subjective) contribute to the necessity to approach the quantitative (objective), that is by making and strengthening internal risk rating risk control system involving contingency variables can be accounted for based on historical data bank.

The provisions concerning the obligation to apply risk management of credit issued in 2003 above, making the Indonesian banking system should improve itself, especially in the search for models in anticipation of a comprehensive credit risk management and sustainable for the banks in Indonesia. Discussion of this section is limited to a description of the creation of interaction models of contingency variables on credit risk management system that is able to contribute to the improved performance of commercial banks according to the rules of BI, because the need for further evidence on the effectiveness of BI regulation in question.

Commercial banks generally do not have a model of anticipation of credit risk management. The condition was reflected by soaring non-performing loans at the time of monetary crisis and the emergence of post-credit crunch crisis (late 1997) until early 2001 as found by the Great and his colleagues (2001). Credit crunch causing delays intermediation function of banks, because banks are still traumatized by the credit crunch happened. The observation further concluded that one cause of the problem loans are not yet implemented the model in anticipation of adequate credit risk management &comprehensive.

According to banking analyst Tony A. Prasetiantono, the government's desire to project the growth of bank lending at 25% level for sustaining economic growth in 2009 of 6% is considered difficult to achieve. For credit growth will be lower because of liquidity problems that have not been safe. Based on the experience of recent years, if bank lending grew 4 then economic growth will grow 1 (4 vs. 1). So the Indonesian economy for 2009 could grow by 6% in 2009, the bank credit growth must be at least 24%. The problem is whether this can be achieved when the economy such as now, the bank credit in 2009 will only grow a maximum of 20% and is expected to sustain economic growth of 5%. The cause is not going to credit the rapid growth in 2009 is the banks will put the brakes on credit expansion to avoid NPL (non performing loans / NPL), which is expected to rise. In October 2008 the NPL ratio of banks amounted to 3.34%. Along with the increasing number of corporate performance is disrupted by the global crisis, the NPL problem will be more severe in 2009. Because the business does not have enough confidence from the global crisis. Meanwhile, although the benchmark interest rate or BI rate began to fall. The decline in lending rates significantly new can be felt in the second half of 2009. "In the first semester of 2008, the BI rate would indeed continue to fall but not to lower auto loan interest rates, because banks still face liquidity that is not safe. (2009 Hard Target Achieved Credits, Media Indonesia, 2009).

in this research can contribute to a model that is quite simple and easily applied by national banks in implementing credit risk management function in accordance with the provisions of the BI.

MO DERA TIN G EFFEC T O N BA NKS PERFO RM A N C E

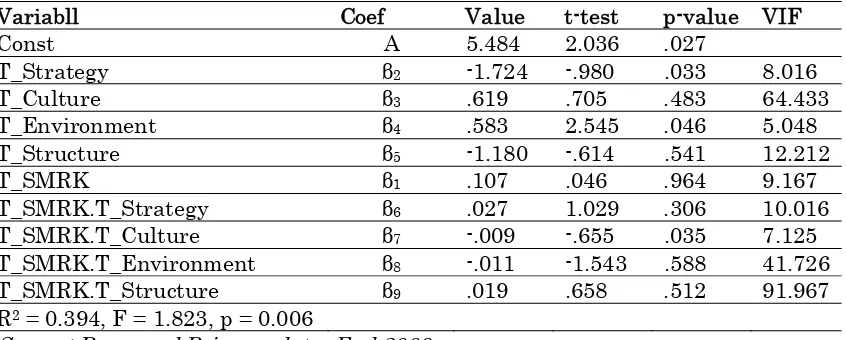

Tabel 1.

Overall Interaction of Mutiple Regression

Variabll Coef Value t-test p-value VIF

Const Α 5.484 2.036 .027

T_Strategy β2 -1.724 -.980 .033 8.016

T_Culture β3 .619 .705 .483 64.433

T_Environment β4 .583 2.545 .046 5.048

T_Structure β5 -1.180 -.614 .541 12.212

T_SMRK β1 .107 .046 .964 9.167

T_SMRK.T_Strategy β6 .027 1.029 .306 10.016

T_SMRK.T_Culture β7 -.009 -.655 .035 7.125

T_SMRK.T_Environment β8 -.011 -1.543 .588 41.726

T_SMRK.T_Structure β9 .019 .658 .512 91.967

R2 = 0.394, F = 1.823, p = 0.006

Source: Processed Primary data, End 2009.

Table 1. visible results of the analysis that reflect indications of multicollinearity. Opinions Supriyono (2003) stated researchers can perform the next stage by removing the identified variables led to multicollinearity. The next step is to find a model that research has not indicated the emergence of multicollinearity problems.

Tabel 2.

Simplify Multiple Regression Model

Variabel Coef Value t-test p-value VIF

const Α 8.235 2.146 .012

T_Culture β3 1.644 1.165 .018 11.149

T_SMRK β1 2.083 1.332 .098 12.368

T_SMRK.T_Strategy β6 2.001 1.068 .288 11.391

T_SMRK.T_Culture β7 6.286 1.103 .027 7.382

T_SMRK.T_Environment β8 -2.577 -1.312 .076 6.807

R2 = 0.534, F = 10.025, p = 0.041

Source: Processed Primary data, End 2009.

Y = 8.235 + 2.083 SMRK + 1.644 Culture + 2.001 SMRK.Strategy + 6.286 SMRK.Environment – 2.577 SMRK.Credit Risk + e.

Strengthen the corporate culture in moderating the relationship of contingency between credit risk management systems with organizational performance, in addition to competitive strategy and organizational structure. These results are consistent with PT Bank Mandiri (Persero) Tbk, which states that one of the problems in managing the banking system in order to report on its development is cultural diversity of employees

In the management of credit risk.

PT Bank Central Asia, Tbk has implemented a risk management structure throughout the organization, in the form of general policy and control tools to ensure consistency of credit risk management practices as a whole as well as other risks. In 2008, PT Bank Central Asia, Tbk recorded the value of Capital Adequacy Ratio (CAR) of 15.79%. Non Performing Loan (NPL) is quite low at 0.60%. Loan to Deposit Ratio (LDR) of 54.65%. This shows the credit division is supported by a group of credit risk managers who beranggung responsible for assessing and managing risks associated with the proposed business. Application of a work culture that is professional, open system and strict control on the overall credit risk manager is responsible for developing and implementing policies, procedures and oversight. Assessment and monitoring of this process is done by credit risk management unit, while the consistency of their implementation is monitored by internal audit unit.

Another important function of credit risk management unit is to monitor and systematically assess the bank's risk profile, assess the impact of the risk of a new product or service, setting out the procedures and methods of portfolio management, as well as helping the credit division in developing awareness and adherence to the principles of management credit risk in question.

Carelessness in managing corporate cultural differences, of course lead to low employee psychological contract fulfillment, and ultimately less beneficial impact on employee attitudes and performance in providing quality service to customers, then there are differences in the perception of corporate culture that can disrupt organizational

performance improvement overall.

Credit risk can not be avoided by the banks, because without risk there would be no increase in revenue. By the end of 2006, PT Bank Mega, Tbk recorded value of the Capital Adequacy Ratio (CAR) of 15.92%. Non Performing Loan (NPL) is quite low at 1.68%. Loan to Deposit Ratio (LDR) of 42.70%. This shows PT Bank Mega, Tbk is a prudent bank (orderly) in business. Analysis of problem loans (NPLs) in PT Bank Mega, Tbk increased to 2.0% in mid-June 2009 from 1.2% at the end of 2008, primarily due to increase in substandard loans in the segment of corporate credit (up to 92% of the increase in NPLs), this makes management of PT Bank Mega, Tbk evaluate the standards of credit risk management policies through an emphasis on cultural orientation in a process, not the attitude of avoiding risks. Other efforts by the management of PT Bank Mega, Tbk is actively restructuring because of the greater challenges in managing credit risk in order to reduce the impact of the approved loan impairment. Credit quality is very influential in growing climate and regulate the granting of loans that have a high risk, must be balanced with the performance or

However, the decision granting the credit to be guaranteed, whether to give more credit to income levels and high returns, or too risky, because it can lead to potential risks in the business. Credit risk management will assist in determining the level of acceptable risk through the evaluation of the credit management system to analyze all the contextual factors that may affect it, in order to know the quality and feasibility of all credit requests will be accepted or rejected. Once credit is granted, the conditions of the customer must be monitored and if there is signs of deterioration of the customer's position will be known, then the risk of possible late payment can be anticipated at an

early stage.

Application of differentiation in competitive strategy gives considerable influence on the management of credit risk. Seeing the results of the range of values besaing sistemmanajemen credit risk strategy that gives meaning respondents indicated that the higher the competition strategy, the higher the contribution given to the risk management system to reduce the credit risk that occurs and has had a great need for improving the performance of commercial banks. Another meaning of this empirical testing is the increase in credit risk management strategy is a significant result from the influence of competitive strategy as a contingency variable. The results of this study support the research of Miller and Friesen (1982), Govindarajan and Fisher (1990); Sawitri (2006) which prove the implementation of competitive strategy have an impact big enough to pengandalian systems in manufacturing companies and service companies.

Respondents in the group of West Sumatra BPD, BPD West Java (Banten, West Java), West Kalimantan BPD, BPD Lampung, Bengkulu BPD, BPD DKI Jakarta, East Java BPD, BPD BPD Bali and South Sumatra overall competitive strategy of differentiation, it is described by socialization of excellence in the areas of banking products in development efforts through research, marketing and long-term usefulness, so that local banks can apply preventive measures in the face of competition from other banks and give confidence to investors about the credit products offered by many of the benefits of ease. Competitive strategy variables can terggambarkan contribution to the credit risk management system through sexual interaction.

Impact of interactions that occur can be explained from the application of a process orientation, orientation on the job, are professional, open system, strict control and pragmatic in the corporate culture provides the greatest value and positive influence on credit risk management systems to increase organizational performance. Seeing the results of the range values the company culture shown through a score of answers respondents give meaning that the higher the orientation in the process, orientation on the job, be professional, open system, strict control and pragmatic applied to the company, the higher the contribution given to the management system risk to reduce credit risk occurring and impact large enough to increase the performance of commercial banks. This proves empirically testing provides substantial value in the management of credit risk when compared with the influence of other contingency variables. The results of this study support the research of Hofstede et., Al. (1990), Lin and Germain (2003) which revealed that the implementation of the corporate culture affect the system

pengandalian systems and improve organizational performance.

the maximum effort in achieving corporate objectives in the face many risks and problem solving process. Dimensions on the job tend oriented completion of the work and run the charge of the boss. Dimensions is a professional culture at the company led to the work plans the future and focus on the job. Culture is an open system which is already open for interacting with all parties, internally and externally. Culture emphasizes strict controls on services to customers on time for the mechanism to operate effectively and efficiently. Cultural dimensions pragmatic attempt to provide better service to customers, with the hope of a result of services provided. Corporate culture can strengthen relationships and major contribution to the credit risk management system through sexual interaction.

The higher the value of organizational structure through the implementation of job descriptions, standard procedures and regulations made by the company through the interactions that occur more and give a positive influence on credit risk management systems to increase organizational performance. This is evident from the range of values organizational structure through which organizational structure is shown through a score of respondents' answers. Empirical testing shows that the increase in credit risk management standards provide a large enough effect on improving credit risk management system from the influence of organizational structure. The results of this study support the research of Bassett and Carr (1986), Murray (1990) which revealed that the structure of the organization have an impact on a division in rangkan

pengandalian improve company performance.

Respondents in the group of foreign commercial banks, like ABN Amro Bank, American Express Bank Ltd, Citibank NA, Standard Chartered Bank and The Bank of Tokyo Mitsubishi UFJ Ltd. put forward the process of formalization of the implementation of employee job descriptions, work procedures and regulations have been implemented with good and lead to the service of excellence and commitment to strict procedural and rule on the employees in serving customers. While the delegation of authority within the company is very rare considering the amount of risk that may occur in lending decisions for customers. Departementalisasi and employee specialization run integrated with other parts, so that the focus of work in providing credit rating submitted by customers in accordance with the measures and mechanisms that have been determined. Contribution to organizational structure reflected in credit risk management system through sexual interaction.

CO M PA RA TIV E AN A LYSIS O F BA N KS PERFO RM A N C E

According to Bank Indonesia's regulations, a commercial bank shall at least have a CAR of 8%. Best standards of NPLs by Bank Indonesia is if the NPL is below 5%. LDR best standard by Bank Indonesia is 85% -110% and the best standards according to Bank Indonesia's ROA is 1.5%. (Annual Report of Bank Indonesia, 2008)

After obtaining the results of CAR, NPL, LDR and ROA in 97 commercial banks in Indonesia (Annex J), we then analyzed the overall bank performance by comparing the performance of commercial banks using secondary data, the period from 2004 to 2008 with the performance of commercial banks through the analysis primary data.

CAR, NPL 4.78%, 87.67% and ROA LDR 1.95% to PT Bank Mandiri (Persero) Tbk. PT Bank Negara Indonesia (Persero) Tbk has an average value of the ratio of 16:51% CAR, NPL 4.90%, 88.72% and ROA LDR 1:59%, PT Bank Rakyat Indonesia (Persero) Tbk has an average rating of 16.93% CAR, NPL 4:00 %, LDR of 86.15% and 4.91% ROA and PT Bank Tabungan Negara (Persero) have an average value of the ratio of 18:04% CAR, NPL 3.85%, 86.08% and ROA LDR 1.80%, this ratio is very good overall and in line when compared with analysis of data that is processed through a questionnaire study, with an average rating of 20.00 above the middle value, meaning that the performance of state commercial banks (Persero) is much better than any other commercial bank competitors. On average the bank's capital adequacy ratio (CAR) for each bank has exceeded the standards set by Bank Indonesia, the calculation of the ratio means the ratio of bank capital with the capital adequacy above 100%.

The ratio of earning assets (NPL) for each bank is earning assets classified as current, while the ratio of total bank loans with the amount of funds received by the bank (LDR) is very good and in accordance with the standard provisions of Bank Indonesia, mean height bank's ability to pay back obligations to our customers who have invested their funds with the number of credit extended to the debtor, the higher the ratio the higher the LDR liquidity levels. Ratio to measure the ability of bank management in a profit / earnings as a whole (ROA) in each bank within a period of 5 years is very good and above the standard provisions of the Bank Indonesia rate, this suggests that the higher the ROA of a bank the greater the profit rate achieved and the better position the bank in terms of asset usage.

The results of performance analysis of the National Private Bank Foreign Exchange period 2004 - 2008 has an average rating of the bank's capital adequacy ratio (CAR) is very good for all banks, because it exceeds the standards set by Bank Indonesia, meaning no capital adequacy ratio which is owned by all National Private Bank Foreign Exchange below 8%, the bank capital ratios exceed minimum capital adequacy owned by each bank. The ratio of earning assets (NPL) for most of the banks have with the quality of current assets, only PT Bank Bumiputera Indonesia, PT Bank Kesawan and PT Bank NPL ratio above which has a Bank Indonesia regulation, meaning that the management of productive assets for the three banks substandard , because the average loan amount is very big problem.

middle value, meaning that overall performance is worse than the other competitors of

commercialbanks .

The results of performance analysis of Non National Private Bank Foreign Exchange period 2004 - 2008 had an average value of bank capital adequacy (CAR) is good for all banks, because it exceeds the standards set by Bank Indonesia, meaning no capital adequacy ratio which is owned by all National Private Banks Non Open to below 8%, the bank capital ratios exceed the minimum capital adequacy owned by each bank. The ratio of earning assets (NPL) for most of the bank is earning assets classified as current, only PT Anglomas International Bank, PT Bank International Executive and PT Bank Swaguna having NPL ratio above the prevailing Bank Indonesia, 5%, meaning that the management of productive assets to third The bank's substandard, because the average loan amount is very big problem.

There are nine banks, PT Bank Akita, PT Bank Harfa, PT Bank International Business, PT Bank Fama International, PT Bank Ina Perdana, PT Bank Economic Welfare, PT Prima Master Bank, PT Bank Sinar Harapan Bali and PT Bank National Savings Pensioners who have the ratio of total bank loans with the amount of funds received by the bank (LDR) is very good and in accordance with the standard provisions of the Bank of Indonesia, means the average low capacity of National Private Banks Non Open in back pay liability to its customers who have invest their funds, the lower the ratio of LDR will get low liquidity levels. Ratio to measure the ability of bank management in the overall profits (ROA) in each bank within a period of 5 years are mostly very good and above the standard provisions of the Bank Indonesia rate which is 1.5%, only PT Bank Harfa, PT Bank The International Executive, PT Bank Harda International, PT Prima Master Bank, PT Bank Mayora and PT Bank Royal Indonesia, which has a ratio below 1.5% ROA, the smaller the mean ROA of a bank the smaller the profit level achieved and the worse the position of these banks in terms of use of the asset. This proves the overall performance of National Private Banks Non Open less good and in line when compared with the analysis of data that is processed through a questionnaire study, with an average value of 18.96 under the middle value, meaning that overall performance is worse than commercial bank competitors Other or approximately equal to the National Private Bank Foreign Exchange.

Results of Regional Development Banks performance analysis period 2004 - 2008 has an average rating of the bank's capital adequacy ratio (CAR) is very good for all banks, because it exceeds the standards set by Bank Indonesia, meaning no capital adequacy ratio which is owned by all Banks National Private Exchange under 8%, the bank's capital ratios exceed the minimum capital adequacy owned by each bank. The ratio of earning assets (NPLs) to all banks have with the quality of current productive assets, under the terms of Bank Indonesia which is 5%, meaning that the management of productive assets for all banks are smooth, because the average number of troubled loans is small.

gain (ROA) in each bank within a period of 5 years for all banks is very good and above the standard requirements of Bank Indonesia that is above 1.5%, this proves that the ability of management all Regional Development Banks in the gain is high. The greater the ROA of a bank then the level of profit achieved by the banks are getting bigger and better position the bank in terms of asset usage. This proves the overall performance of the Regional Development Banks are less good and in line when compared with the analysis of data that is processed through a questionnaire study, with an average value of 20.79 under the middle value, meaning that overall performance is worse than commercial banks or other competitors is approximately equal to the National Private Bank Private Bank Foreign Exchange and National Non-Foreign Exchange.

Results Mixed Commercial Bank performance analysis period 2004 - 2008 has an average rating of the bank's capital adequacy ratio (CAR) is good for all banks, because it exceeds the standards set by Bank Indonesia, meaning no capital adequacy ratio which is owned by all Commercial Banks mixture below 8%, the bank capital ratio exceeds the minimum capital adequacy of each bank owned. The ratio of earning assets (NPL) for most of the bank is earning assets classified as current, only PT Bank BNP Paribas Indonesia, PT Bank Commonwealth, PT Bank Maybank Indocorp, PT Bank Capital Indonesia, PT Bank OCBC Indonesia PT China Trust Indonesia and PT Bank Resona who have NPL ratios above the prevailing Bank Indonesia, 5%, meaning that the management of productive assets to the seven bank's substandard, because the average amount of credit is a very big problem.

Mixture of Commercial Banks, there are only two banks, PT Bank DBS Indonesia and PT Bank Resona Pedania which has a ratio of total bank loans with the amount of funds received by the bank (LDR) is very good and in accordance with the standard provisions of Bank Indonesia, mean on average, low capacity of Mixed Commercial Bank in paying back its obligation to our customers who have invested their funds, the lower the ratio of LDR, the lower the level of liquidity is owned by the bank. While the ratio to measure the ability of bank management in the overall profits (ROA) in each bank within a period of 5 years for all banks is very good and above the standard provisions of the Bank Indonesia rate is 1.5%, meaning a greater ROA bank the greater the level of benefits to be gained and the better position the bank in terms of asset usage. This proves the overall performance of commercial banks is less good mixture and not in line when compared with the analysis of data that is processed through a questionnaire study that states the performance of commercial banks is a good mix, with an average rating of 21.60 above the middle value, meaning that performance overall worse than the other competitors of commercial banks or near the same with National Private Bank Foreign Exchange, National Private Bank Non-Bank Foreign Exchange and Regional Development.

While the ratio to determine the total amount of loans the bank with the amount of funds received by the bank (LDR), only Bank of America, NA which has a very good LDR and in accordance with the standards of the Bank Indonesia is between 85% -110%, mean low capacity of nearly all in Foreign Banks to pay back obligations to our customers who have invested their funds, the lower the ratio of the LDR it will have an impact on bank liquidity levels get low. Ratio to measure the ability of bank management in the overall gain (ROA) in each bank within a period of 5 years almost all banks are very good and above the standard requirements of Bank Indonesia that is above 1.5%, only American Express Bank LTD which has a value below 1.5% ROA, this proves that the entire management capabilities within the Foreign Commercial Banks gain is high. The greater the ROA of a bank then the level of profit achieved by the banks are getting bigger and better position the bank in terms of asset usage. Overall prove that the performance of the Foreign Commercial Banks is not good and not in line when compared with the analysis of data that is processed through a questionnaire study, which shows the average score of 20.50 over the middle value, meaning that overall performance is worse than the other competitors of commercial banks or approximately equal to the National Private Bank Foreign Exchange, National Private Bank Non-Bank Foreign Exchange and Regional Development and Commercial Bank Mixture.

IM PLIC A SIO N A N D CO N C LUSIO N

This article characterizes informed respondents’ strengthness in conducting credit risk management system. The main implication of this study is to give impetus to the banking sector, especially the BI to issue a policy in dealing with credit risk more carefully. Mainly focuses on contextual factors such as attention to strategy, culture and the accuracy of personal determination in strengthening the quality of lending to all customers (without exception), making decisions that are not only concentrated on the boss, the emphasis on process and mechanism in a feasibility lending standards, compliance in performing the procedure and reduces the delegation of authority in the selection process the credit. Thus setting the limits of credit risk, the determination of eligibility period of time to measure the level of credit risk measurement and management mechanism of credit and reduce the possibility of financial management pressures and maintain operating margins can run well and according to banking purposes.

The results of this study can then be used as a basis for strengthening the banking credit risk management system as a whole. The success of credit leakage pengantisipasian sizable impact on improving banking performance. This can be targeted by the Bank to encourage more banks that go public, in other words more and more people are involved in monitoring the performance of commercial banks. Another impact of this policy is to BI to create new regulations to reduce the share composition of bank owners, so the bank will not be used as a tool to facilitate private business, to more transparency and accountability in line with management responsibilities of public funds.

growth, due to high investment and working capital invested to all productive sectors

and potential.

Strengthening credit risk management system, estimate the quality and predictability of credit risk management in accordance with the provisions of BI applied consistently by commercial banks in Indonesia, thus providing a new focus on banking in anticipation of the credit risk management and the need to pay special attention to analyzing competitive strategy, corporate culture and organizational structure as strengthening the internal banking system. Furthermore, this study gives an idea of the banking regulator of BI in improving the function of monitoring and anticipation of credit risk management that must be run by commercial banks in Indonesia

The results of this study can be summarized as follows.

1. Competitive strategy, corporate culture and organizational structure influence on credit risk management system of commercial banks in Indonesia, except the external environment. This is consistent with the results of the study Miller and Friesen (1982), Govindarajan (1988), Govindarajan and Fisher (1990) and Syafruddin (2001) contingency variables have a positive relationship and influence on management control system. This is perfecting the supervision system of compliance-based regulation (compliant based) into bebasis risk. Supervision should be more active, such as through the implementation of early warning systems (early warning system) terahadap emergence of risk. The better the job description, procedures and regulations, the small level of delegation of authority, the high level of complexity departementalisasi and specializes in work that is applied by the company, the greater the opportunity to reduce credit risks that occur.

2. Credit risk management system has a relatively large effect on the performance of commercial banks in Indonesia. This is consistent with the results of research Govindarajan and Fisher (1990), Koach and Scott (2000), which states that the more effective control system, the company increased the company's performance. If the credit risk management systems are applied consistently and compliance, as the basis for strengthening policies for commercial banks to anticipate the credit leakage occurred during the performance of banks is increasing. The more often the bank to identify and use the tools of risk control in the selection process of granting credit, the more significant levels of risk measurement mechanisms in conducting credit analysis, tighter supervision and control risk in credit approval, the greater the opportunity to reduce credit risk occurring and increasing the performance of commercial banks in Indonesia.

4. The performance of commercial banks in Indonesia as a whole is very good and the line between primary and secondary data. Performance of State Commercial Banks (Persero) is the best, in other words the performance of state commercial banks (Persero) is relatively better than the performance of five commercial banks group of other competitors.

Finally our study has some suggestions for future studies, and concerns with limitations of this study, such as follow.

1. Menggunakan data credit scoring dan value at risk (VAR) yang lebih determinastik,

2. To extract and increase the number of research unit /respondents and diversify into marketing, operational, finance and other management functions at commercial banks.

3. To conduct Risk based audit regulary, and

4. To cover other contingenty variables, such as banking information system technology, bank size, decentralizationi, and

5. Long period of Bank operationalization, more than 10 years (time series) and crossectional seconder data.

REFEREN C ES

Abernety, M. A. dan Jan, Bouwens (2000). The Consequences of Customization on

Managemen Accounting System Design, Accounting Organizations and Society. Vol.

25. 221-241.

Aguais, Scott D. dan L. R. Forest (2000). The Future of Risk-Adjusted Credit Pricing in Financial Institutions. The RMA Journal. November 2000.

Aguais, Scott D. L. R. Forest dan D. Rosen (2001). Building A Credit Risk Valuation Framework for Loan Instruments. Algorithmic LLP.

Aguais, Scott D. L. R. Forest dan D. Rosen (2001a). Building a Credit Risk Valuation Framework for Loan Instruments. Commercial Lending Review.

Aguais, Scott D. dan D. Rosen (2001b). Enterprise Credit Risk Management. Algorithmics Publications Research.

Agung, Juda (1998). Financial Deregulation and Bank lending channel in Developing Countries: The case of Indonesia. Asian Economic Journal, September. 12(3): 273-294.

Agung, Juda (2000). Financial Constraints, Firms Investment and the Channel of Monetary Policy in Indonesia. Applied Economics. Volume 32(13): 1637-1646 (10).

Penyebab dan Implikasi Kebijakan, Direktorat Riset Ekonomi dan Kebijakan Moneter BI.

Alexander, Carol dan E. Sheedy (2004). The Professional Risk Managers' Handbook: A Comprehensive Guide to Current Theory and Best Practices (1st ed.). Wilmington, DE: PRMIA Publications.

Allen, Franklin. dan Gale, Douglas (2000). Financial Contagion. The Journal of Political Economy. 108: 1-33.

Almilia, L. S. dan Winny H. (2005). Analisis Rasio Camel Terhadap Prediksi Kondisi Bermasalah pada Lembaga Perbankan Perioda 2000 – 2002. Jurnal Akuntansi dan Keuangan. Vol.7 No.2. Nopember 2005.

Altman, E. I. dan Saunders, A. (1998). Credit Risk Measurement: Developments over the Last 20 Years. Journal of Banking & Finance 21: 1721-1742.

Altman, E. I. (2002). Corporate Distress Prediction Models in a Turbulent Economic and Basel II Environment. Stern School of Business, New York, September 2002.

Angerer X. W. (2004). Empirical Studies on Risk Management of Investors and Banks. Dissertation. The Ohio State University.

Anthony, R. N. dan V. Govindarajan (1995). Management Control System. The Irwin. United States of America.

Anthony, R. N. dan V. Govindarajan (2000). Management Control Systems. The McGraw-Hill Companies, Inc.

Back, Barbro. Laitenen, T. Sere, K. dan Wezel, M. V. (1996). Choosing Bankruptcy Predictors Using Discriminant Analysis, Logit Analysis and Genetic Algorithms. Turky Center for Computer Science. September 1996.

Basel Committee on Banking Supervision, (1997). Core Principles for Effective Banking Supervision. Bank for International Settlements, Basel, Switzerland (April).

Basel Committee on Banking Supervision, (2000). Principles for the Management of Credit Risk. Bank for International Settlements. Basel. Switzerland (September).

Basel Committee on Banking Supervision, (2001). A Consultative Document the New Basel Capital Accord. Basel Switzerland. Bank for International Settlements, January 2001.

Basel Committee on Banking Supervision, (2001). An Explanatory Note the New Basel Capital Accord. Basel Switzerland. Bank for International Settlements. January 2001.

Bassett, G dan Carr, A. (1986). Role Sets and Organization Structure. Leadership and Organization Development Journal. 17(4):37-45.

Bessis, J. (1998) Risk Management in Banking, John Wiley & Sons Ltd. West Sussex. England.

Brownell, P. (1981). Participation in the Budgeting Process, Locus of Control and Organizational Effectiveness. The Accounting Review: 844-860.

Burns, P. (2002). Retail Credit Risk Modeling and the Basel Capital Accord. Discussion Paper 02-1. Philadelphia.

Carey, Maark dan Hrycay, Mark (2001). Parameterizing Credit Risk Models With Rating Data. Journal of Banking and Finance. 25:1. Januari 2001.

Chenhall, R.H. dan D. Morris (1986). The Impact of Structure, Environment and Interdependence on the Perceived Usefulness of Management Accounting Systems. The Accounting Review: 16-35.

Cho, Woon Y. (2005). Contingency Theory of Group Communication Effectiveness in Korean Organizations: Influence of Fit between Organizational Structural Variables and Group Relational Climate on Communication Effectiveness. Dissertation. Texas A & M University. August 2005.

Chong, V. K. dan K. Ming Chong (1997). Strategic Choices, Environmental Uncertainty and SBU Performance: A Note of the Intervening Role of Management Accounting

Systems. Accounting and Business ResearchVol. 27 No. 4.: 268-276.

Cooper, D. R. dan C. W. Emory (1996) Business Research Method. USA, Richard Irwin Inc.

Denison, Daniel R. dan A. K. Mishra (1995). Toward a Theory of Organizational Culture and Effectiveness. Organization Science, Vol. 6, No. 2, pp. 204-223.

Dermine, J. (1986). Deposit Rates, Credit Rates and Bank Capital. Journal of Banking and Finance No. 10: 99-114.

Derviz, Alexis dan Kadlcakova, Narcisa (2001). Methodological Problem of Quantitative Credit Risk Modeling in the Czech Economy. Czech National Bank.

Dietsch M. dan J. Petey (2002). “The Credit Risk in SME Loans Portfolios: Modeling Issues. Pricing and Capital Requirements”. Journal of Banking and Finance.

Direktorat Penelitian dan Pengaturan Perbankan. (2003). Pedoman Standar Penerapan Manajemen Risiko bagi Bank Umum. BI. 29 September 2003.

Dutta, M. (2002). Management Control System. S. Chand & Company Ltd. New Delhi. India.

Dwirandra, A. A. N. B. (2007). Pengaruh Interaksi Ketidakpastian Lingkungan, Desentralisasi dan Luas Lingkup Informasi Akuntansi Manajemen Terhadap Kinerja Manajerial. Buletin Studi Ekonomi. Vol. 12 No. 2.

Bisnis dengan Pendekatan Partial Least Square. Simposium Nasional Akuntansi IX. Ikatan Akuntan Indonesia.

Fisher, J. G. (1995). Contingency Based Research on Management Control System: Categorization by level of Complexity. Journal of Accounting Literature 14: 24-53.

Fisher, J. G. (1998). Contingency Theory, Management Control Systems and Firm Outcomes: Behavioral Research in Accounting.

Fishman, J. S. (2001). Operating, Finance and Risk. Basel Committee on Banking Supervision. Bank for International Settlements. May, 2001. http://www.bis.org/bcbs/cacomments.htm.

Fraser, D. R. B. E. dan J. W. Kolari (2001). Commercial Banking: The Management of Risk. Cincinnati. Ohio. South-Western College Publishing.

Fredianto, R. dan Zulaikha (2001). Hubungan Antara Lingkungan Eksternal, Orientasi Strategi dan Kinerja Perusahaan (Studi Terapan pada Industri Manufaktur Menengah Kecil di Kotamadya Semarang). Simposium Nasional Akuntansi IV. Ikatan Akuntan Indonesia.

Gerken, Charlotte (2004). Best Practices in Risk Management and Risk Measurement. The UK Financial Services Regulator’s Perspective. July 2004.

Ghoshal, Sumantra (1994). Linking Organizational Context and Managerial Action: The Dimensions of Quality of Management. Strategic Management Journal, Vol. 15, 91-112.

Ghozali, Imam (2002). Aplikasi Analisis Multivariat dengan Program SPSS. Badan Penerbit Universitas Dipenogoro. Semarang. Hal.133.

Giesecke, Kay (2002). Default Compensator, Incomplete Information, and the Term Structure of Credit Spreads. Humbold University. August 2002.

Glennon, Dennis C. (1998). Issues in Model Design and Validation. Office of The Comptroller of The Currency (Credit Risk Modeling, Robert A. Klein and The Glenlake Publishing Company. 1998)

Gordon, L.A. dan Narayanan (1984). Management Accounting System, Perceived Environmental Uncertainty and Structure: An Empirical Investigation. Accounting Organization and Society. Vol. 9.: 33-47.

Govindarajan V. dan A. K. Gupta (1985). Linking Control System to Business Unit Strategy: Impact on Performance. Accounting, Organizations and Society 10: 51-66.

Govindarajan V. (1986). Impact of Participation in the Budgetary Process on Attitudes and Performance: Universalistic and Contingency Perspectives. Decisions Sciences. Fall: 496-516.

Govindarajan V. dan J. G. Fisher (1990). Strategy, Control System and Resource Sharing: Effects on Business Unit Performance. Academy of Management Journal 33(2): 259-285.

Gujarati, D. (1995). Basic Econometrics. 3rd Edition. McGraw-Hill. New York.

Gup, Benton E. (2003). The New Basel Capital Accord: Is 8% Adequate?. Working Paper Series. SRRN-id440881. July 2003.

Hadi, S. (1986). Metodologi Research. Yogyakarta. UGM.

Hadi, S. (1988). Statistik. Yogyakarta. Dani Offset.

Hair, J. F., R. E. Anderson dan W. C. Black (1995). Multivariate Data Analysis. Macmillan Publishing Co. New York.

Hall, M. (2004). “The effect of Comprehensive Performance Measurement Systems on Role Clarity, Psychological, Empowerment and Managerial Performance”. Global Management Accounting Research Symposium.

Hambrick, D. C. dan D. Lei (1985). Toward and Empirical Prioritization of Contingency Variables for Business Strategy. Academy of Management Journal 28: 763-788.

Hamel, G. dan C. K. Prahalad (1994). Competing for the Future. Boston. Mass: Harvard Business School Press.

Hamerle, Alfred dan Rosch, Daniel (2004). Parameterizing Credit Risk Models. University of Regensburg.

Hendricks, Kevin. Menor, Larry dan C. Wiedman (2004). Adoption of the Balanced Scorecard: A Contingency Variables Analysis. Proceeding Seminars. School of Accounting and Finance. Canada. University of Waterloo.

Henry, J. F. (2006). Organization Culture and Performance Measurement System.

Accounting, Organizations and Society31: 77-103.

Hirsch, Maurice L. (1994). Advanced Management Accounting. Cincinnati, Ohio: South Western Publishing Co.

Hofstede, G., B. Nuejien, Ohayv, D. D. dan G. Sanders (1990). Measuring Organizational Cultures: A Qualitative and Quantitative Study across Twenty Cases. Administrative Science Quarterly. 35: 286-316

Ieda, Akira, Marumo, K., dan T. Yoshiba (2000). A Simplified Method for Calculating the Credit Risk of Lending Portfolios. Working Paper Series. Institute for Monetary and Economic Studies Bank of Japan.

Indriantoro N. (1999). Aliran-aliran Pemikiran Alternatif dalam Akuntansi. Jurnal Ekonomi dan Bisnis Indonesia. 14(3): 101-105.

Indriantoro N. (2000). An Empirical Study of Locus of Control and Cultural Dimensional as Moderating Variables of the Effect of Participative Budgeting on Job Performance and Job Satisfaction. Jurnal Ekonomi dan Bisnis Indonesia. 15(1): 97-114.

Ittner, C.D., Larcker, D.F. dan T. Randall (2003). Performance implications of Strategic Performance Measurement in Financial Services Firms. Accounting, Organizations and Society 28: 715-741.

Jackson, Patricia dan Perraudin, William (1999). The Nature of Credit Risk: The Effect of Maturity, Type of Obligor and Country of Domicile. Financial Stability Review. November 1999.

Jermias, Johnny dan Gani, Lindawati (2005). Ownership Structure, Contingent Fit and Business Unit Performance: A Research Model and Empirical Evidence. The International Journal of Accounting. Vol.40: 65-85.

Kajian Stabilitas Keuangan. BI. September 2005.

Kaplan, R.S. dan D. P. Norton (1996). Translating Strategy into Action: the Balanced Scorecard. Boston, Harvard Business School Press.

Khomsyiah dan Indriantoro, N., (2000). Metodologi Penelitian Akuntansi Keperilakuan: Pendekatan Filsafat Ilmu. Jurnal Bisnis dan Akuntansi 2(2): 89-102.

Kim, Juno (2005). A Credit Risk Model for Agricultural Loan Portfolios under the New Basel Capital Accord. Dissertation. Texas A & M University. May 2005.

Klynveld, Piet, Peat, W. Barclay, Marwick, James dan G. Reinhard (1999). Best Practices In Risk Management: Private and Public Sectors Internationally. Treasury Board of Canada Publications.

Koach, Timothy dan Mc D. Scott (2000). Bank Management. Fourth Worth: The Dryden Pers. Chapter 3-5.

Koopman, Siem, Jan dan A. Lucas (2003). Business and Default Cycles for Credit Risk. Tinbergen Institute Discussion Paper. July 2003

Kunreuther, Howard dan Heal, Geoffrey (2002). Interdependent Security. University of Pennsylvania and Columbia University. Desember 2002.

Le Roux, E. (2005). The Validity of the Assessment Centre in Predicting Managerial Performance of Business Development Managers. Dissertation. University of Pretoria.

Lesmana, Iwan (2006). Model Manajemen Risiko Kredit Komersial/Korporasi Jangka Pendek Bank Umum Swasta Nasional, Disertasi, Universitas Gunadarma.

Perusahaan. Simposium Nasional Akuntansi VI. Surabaya. Ikatan Akuntan Indonesia Kompartemen Akuntansi Pendidik.

Lin, Xiaohua dan R. Germain (2003). Organizational Structure, Context, Customer Orientation, and Performance: Lessons from Chinese State-Owned Enterprises. Strategic Management Journal, Vol. 24, No. 11, pp. 1131-1151.

Mardiyah, A. A. dan Gudono (2001). Pengaruh Ketidakpastian Lingkungan dan Desentralisasi terhadap Karakteistik Sistem Akuntansi Manajemen. Jurnal Riset Akuntansi Indonesia. 4(1): 1-27.

Martin B. (2003). Financial And Econometric Models For Credit Risk Management. Dissertation. Universit¨at Fridericiana zu Karlsruhe. 2003.

Mia, L dan B. Clarke (1999). Market Competition, Management Accounting Systems and Business Unit Performance. Management Accounting Research. Vol.10.: 137-158.

Miller, D. dan P. Friesen (1982). Innovation in Conservative and Entrepreneurial Firm: Two Models of Strategic Momentum. Strategic Management Journal 3: 1-25.

Muermann, Alexander dan U. Oktem (2002). The Near – Miss Management of Operational Risk. The Journal of Risk Finance: 25-35.

Muslichah (2003). The Effect of Contextual Variables on Management Accounting System Characteristics and Managerial Performance, Simposium Nasional Akuntansi VI.

Murray, D. (1990). The Performance Effect of Participative Budgeting: An Integration of Interviening and Moderating Variables. Behavioral in Accounting. Vol.2: 104-113.

O'Hara, M. (1983). A Dynamic Theory of the Banking Firm. The Journal of Finance 38: 127-140.

Otley, David. T. (1980). The Contingency Theory of Management Accounting:

Achievement and Prognosis. Accounting Organization and Society. Vol. 5.: 413-428.

Otley David. T. dan A. Berry (1980). Control, Organization and Accounting. Accounting, organization and society. 231-244.

Peraturan BI No. 3/23/PBI/2001 tentang amendemen pada PBI No. 3/10/PBI/2001 tentang Prinsip Mengenal Nasabah.

Polonchek, John. dan Miller, Ronald K., (1999). Contagion Effect in the Insurance Industry. The Journal of Risk and Insurance, 66: 459-475.

Pondeville, S. M. (2000). The Control System in The Environmental Management Framework. Working paper IPA Young Scholars Colloquium: 13.

Porter, M. E. (1980). Competitive Strategy. New York. Macmillan Publishing Co.

Putra, E. P. dan A. Naim (2000). Budaya Perusahaan dan Intensitas Peran Akuntansi Manajemen: Penelitian Empiris pada Perusahaan-perusahaan di Indonesia. Simposium Nasional Akuntansi III. Jakarta. Ikatan Akuntan Indonesia.

Riyanto, B. (2001). Alternative Approachto Examining a Contingency Model in Accounting Research: a Comparison. Jurnal Riset Akuntansi, Manajemen, Ekonomi. 1(1): 13-32.

Rybczynski, T. (1997). A New Look at the Evolution of the Financial System, in J. Revell

(ed.), The Recent Evolution of Financial Systems. (Macmillan, London).

Santomero, A., (1984). Modeling the Banking Firm. Journal of Money, Credit and Banking 16: 576-602.

Santoso, Singgih (2001). Buku Latihan SPSS Statistik Parametrik. Elex Media Komputindo. Jakarta.

Sawitri, Peni (2006). Pengaruh Interaksi Variabel Kontijensi Dengan Sistem pengendalian Manajemen Terhadap Kinerja Unit Bisnis Strategi. Disertasi, Universitas Gunadarma, Jakarta.

Schmit, M. (2004). Credit Risk in the Leasing Industry. Journal of Banking & Finance 28: 811-833.

Schonbucher, Phillip J. (2000). Factor Models for Portfolio Credit Risk. Bonn University. Desember 2000.

Sekaran, U. (1992). Research Methods for Business: A Skill Building Approach. Second Edition. John Wiley & Son, Inc.

Stiglitz, J. E. dan A. Weiss (1981), Credit Rationing in Markets with Imperfect Information. The American Economic Review: 393-410, June 1981.

Sumodiningrat, G. (1999). Ekonometrika Pengantar. Yogyakarta. BPFE.

Supriyono, R. A. (2003). Hubungan Partisipasi Penganggaran dan Kinerja Manajer: Peran Keckupan ANggaran, Komitmen Organisasi, Asimetri Informasi, Slak ANggaran dan Peresponan Keinginan Sosial. Disertasi Program Studi Ilmu Manajemen Pascasarjana. Fakultas Ekonomi. Universitas Indonesia.

Swift, J. A. (1995). Introduction to Modern Statistical Quality Control and Management. St. Lucie Press.

Syafrudin, M. (2001). Pengaruh Moderasi Dinamika Lingkungan pada Sistem Kontrol Akuntasi dan Kinerja Perusahaan. Jurnal Riset Akuntansi Indonesia 4(1): 99-110.

Townsend, Robert M. dan J. Yaron (2001). The Credit Risk-Contingency System of an Asian Development bank. Journal of Economics Perspectives. Vol.3. Oct, 2001.

Treacy, W.F., dan M. Carey (2000). Credit Risk Rating Systems at Large U.S. Banks. Journal of Banking & Finance 24: 167-201.

Umar, Husain (2004). Metode Penelitian Untuk Skripsi & Tesis Bisnis. Jakarta. Rajawali Press.

Vickery J. I. (2004). Essays in Banking and Risk Management. Dissertation. Massachusetts Institute of Technology.

Wilson, T. C. (1997). Measuring and Managing Credit Portfolio Risk; Part I: Modeling Systemic Default Risk. The Journal of Lending & Credit Risk Management.

Yasukata K. dan T. Kobayashi, (2001). Performance Measurement and Evaluation System in View of Strategic Management Control: A Survey of Management Accounting Practice in Japan. Asia Pacific Management Review 6(1): 53-72.

Yurniwati (2003). Pengaruh Lingkungan Bisnis Eksternal dan Perencanaan St

rategik Terhadap Kinerja Perusahaan Manufaktur. Disertasi. Universitas Padjajaran. Desember 2003.

__________________, Bagaimana Mencari Bank yang Sehat?. Rubrik Ekonomi. Bisnis Indonesia. 23 Desember 2007. Hal. 4.

__________________, Target Kredit Perbankan 2009 Sulit Dicapai. Media Indonesia. Januari 2009. Hal. 9.

__________________, Laporan Tahunan BI 2003, BI.

__________________, Laporan Tahunan BI 2004, BI.

__________________, Laporan Tahunan BI 2005, BI.

__________________, Laporan Tahunan BI 2006, BI.

__________________, Laporan Tahunan BI 2007, BI.