UNITED NATIONS CONFERENCE ON TRADE AND DEVELOMENT

Generalized System of Preferences

HANDBOOK ON THE SCHEME OF TURKEY

Disclaimer

This designation employed and the presentation of the material in this publication do not

imply the expression of any opinion whatsoever on the part of the Secretariat of the United

Nations concerning the legal status of any country, territory, city or area or of its authorities,

or concerning the delimitation of its frontiers or boundaries.

Preface

This handbook is a part of a series of publications aimed at helping exporters, producers and

government officials to utilize the trade opportunities available under the various GSP

schemes. The series comprises the following publications:

Publications in the Generalized System of Preferences series

•

Handbook on the Scheme of Australia (UNCTAD/ITCD/TSB/Misc.56)

•

Handbook on the Scheme of Bulgaria (UNCTAD/ITCD/TSB/Misc.67)

•

Handbook on the Scheme of Canada (UNCTAD/ITCD/TSB/Misc.66)

•

Handbook on the Scheme of the European Community

(UNCTAD/ITCD/TSB/Misc.25/Rev.2)

•

Handbook on the Scheme of Japan (UNCTAD/ITCD/TSB/Misc.42/Rev.3)

•

Handbook on the Scheme of New Zealand (UNCTAD/ITCD/TSB/Misc.48)

•

Handbook on the Scheme of Norway (UNCTAD/ITCD/TSB/Misc.29/Rev.1)

•

Handbook on the Scheme of Switzerland (UNCTAD/ITCD/TSB/Misc.28/Rev.1)

•

Handbook on the Scheme of Turkey (present volume)

•

Handbook on the Scheme of the USA (UNCTAD/ITCD/TSB/Misc.58)

•

List of GSP Beneficiaries (UNCTAD/ITCD/TSB/Misc.62/Rev.2)

•

AGOA: A preliminary Assessment (UNCTAD/ITCD/TSB/2003/1)

•

Negotiating Anti-Dumping and Setting Priorities Among Outstanding Issues in the

Post-Doha Scenario: A First Examination in the Light of Recent Practice and DSU

Jurisprudence (UNCTAD/ITCD/TSB/Misc.72)

•

Quantifying the benefits obtained by developing countries from the GSP

(UNCTAD/ITCD/TSB/Misc.52)

•

Trade Preferences for LDCs: An Early Assessment of Benefits and Possible

Improvement (UNCTAD/ITCD/TSB/2003/8)

For further information, please contact:

Ms. M. Mashayekhi

Head

Trade Negotiations and Commercial Diplomacy Branch

Division on International Trade in Goods and Services, and Commodities

United Nations Conference on Trade and Development

Palais des Nations

CH 1211 Geneva 10

Switzerland

Tel:

(+41 22) 917 5866; 917 4944

Fax:

(+41 22) 917 0044

E-mail:

gsp@unctad.org

Notes

The handbook on the Generalized System of Preferences (GSP) of Turkey has been prepared

by the UNCTAD secretariat based on the information provided by the Government of Turkey

in order to provide the general explanation of the scheme for officials and users who are in

charge of the GSP.

For further information on the GSP scheme of Turkey, readers are invited to contact:

Undersecertariat of Foreign Trade

Directorate of Imports

Inonu Bulv. No: 36, 06510 Emek, Ankara

Phone: +90 312 204 75 67 / +90 312 204 77 98

Fax: +90 312 212 87 65

E-mail: tasyurekh@dtm.gov.tr; berkerv@dtm.gov.tr

Contact Persons:

İ

smail Volkan Berker, Head of Section, Halil Serdar Ta

ş

yürek, Assistant

Foreign Trade Specialist

Undersecretariat of Customs

Directorate General for the EU and External Relations

Hükümet Meydani No.1

06100 Ulus

ANKARA

Phone: +90 312 306 82 86 / 306 80 80 / 306 80 83

Fax: +90 312 309 37 37

e-mail: bturel@gumruk.gov.tr

Contact person:

Contents

Page

Part I: General information on the GSP scheme of Turkey

Explanatory notes………..

1

1. Beneficiaries………

1

2. Product

coverage………. 1

3.

Depth of tariff cuts for GSP products……….

2

4. Graduation

mechanism

(country/sector)………. 2

Table

Table 1:

List of Turkey's GSP beneficiary countries and territories………...

3

Part II: Rules of origin under the GSP scheme of Turkey

1. Explanatory

notes……….

7

1.1.

Origin

criteria………

8

1.2.

Direct

consignment………... 11

1.3.

Documentary

evidence………. 11

2.

Consolidated decision on determination of origin of goods benefiting from preferential

regime for the purposes of the GSP………..

13

Annexes

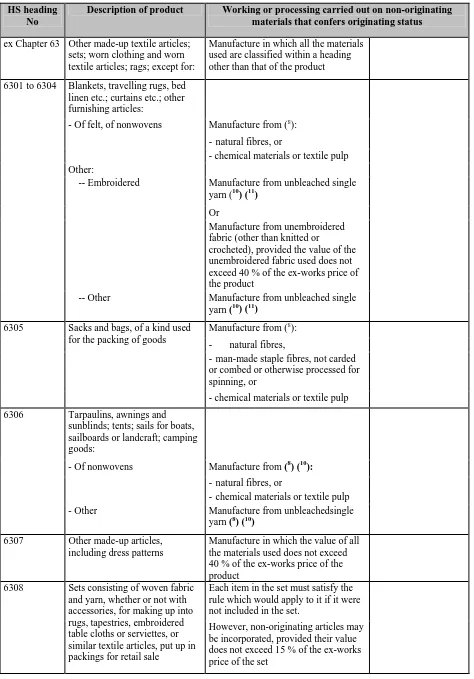

Annex I:

Introductory notes to the list in Annex II………...

37

Annex II:

List of working or processing required to be carried out on non-originating

materials in order that the product manufactured can obtain originating status....

45

Annex III:

Certificate of origin, Form A……….

113

Annex IV:

Movement certificate EUR.1 and application for movement certificate EUR.1...

119

Annex V:

Invoice declaration……….

127

Annex VI:

Working excluded from the Generalized System of Preferences, regional

cumulation……….

129

Annex VII:

List of the least developed

countries……….

131

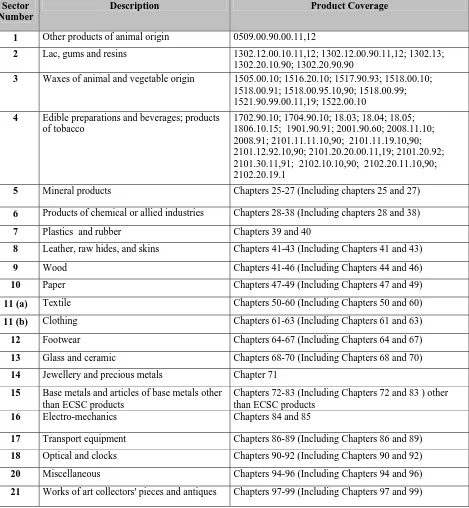

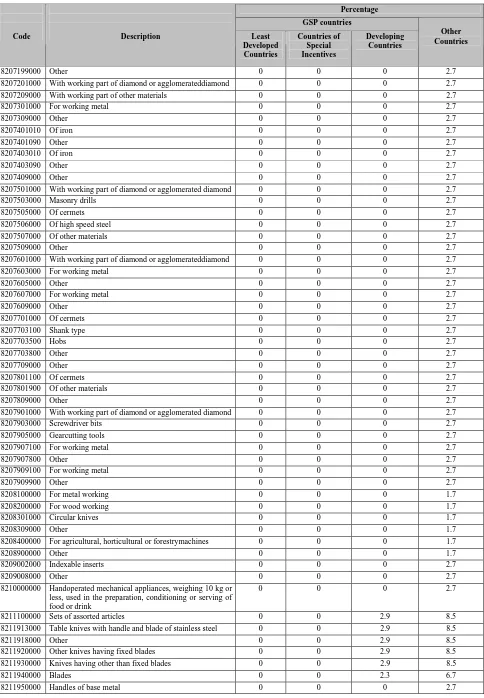

Part III: List of products covered under the GSP scheme of Turkey

Table 1:

List of products covered under the GSP scheme of Turkey, by sectors…………

133

PART I:

GENERAL INFORMATION ON THE GSP OF TURKEY

Explanatory Notes

The Generalized System of Preferences (GSP) aims at contributing to the economic

development of developing countries. GSP provides benefits to developing countries by

enabling qualified products to enter the markets of preference-giving countries at changing

rates from duty free to reductions in the MFN rate.

Turkey applied for association with the European Economic Community in 1959, one year

after the enforcement of the Treaty of Rome. The Ankara Agreement of 1963 and the

Additional Protocol of 1970 are two important documents which identify modalities and

calendars ensuring the future customs union and confirm the ultimate aim of full membership.

The customs union covering industrial products and processed agricultural products which

came into force on 1 January 1996 with Decision No 1/95 of The Turkey - EC

Association Council was an outcome of these calendars.

Article 16 of Decision No 1/95 of the Association Council states that “With a view to

harmonizing its commercial policy with that of the EC, Turkey shall align itself progressively

with the preferential customs regime of the EC within five years as from the date of entry into

force of this decision. This alignment will concern both autonomous regimes and preferential

agreements with third countries.”

Within this context, Turkey initiated a Generalized System of Preferences by harmonizing

with the EC’s GSP on 1 January 2002 and extended the system with the view of aiming to

align itself fully with the EC’s GSP scheme in the consecutive years. With the 2006 import

regime put into force at the beginning of the year, full aligment with the EC’s GSP scheme

has been achieved

.

1. Beneficiaries

Turkey grants preferential treatment to selected countries and territories which are classified

as developing countries and least developing countries by the World Bank in line with the EC

(see tables 1 and 2).

Beneficiary countries are announced annually in Annexes of the Import Regime Decree.

2. Product

coverage

Preferences are granted for all industrial products and certain agricultural products covered by

the EC’s GSP scheme. (See table 3).

While all customs

duties on products covered by Turkey's GSP scheme have been suspended

for the countries benefiting from the special incentive arrangements in line with the EC’s GSP

scheme, customs duties have been suspended or reduced in accordance with sensitivities of

the products covered by the GSP for developing countries.

3.

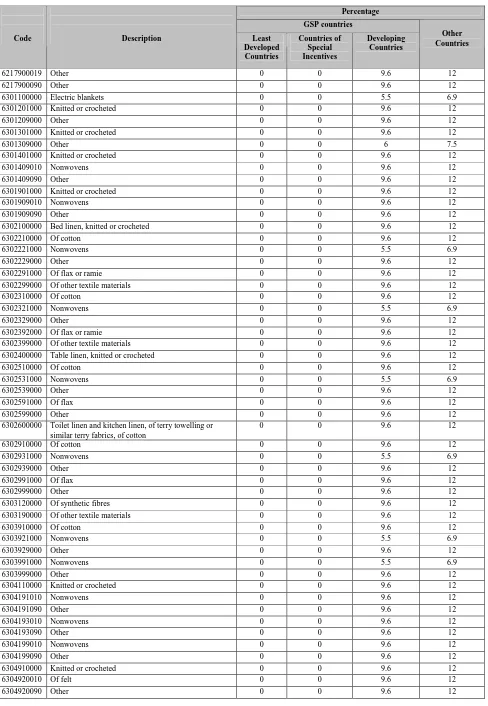

Depth of tariff cuts for GSP products

Preferences are differentiated according to the sensitivity of the products fully in harmony

with the EC’s. It is sufficient to differentiate between two product categories, namely

non-sensitive and non-sensitive products.

Tariff duties on non-sensitive products are entirely suspended, while duties on sensitive

products are subject to tariff reductions (3.5 points for ad valorem duties and 30 per cent for

specific duties)

.

Finally, Turkey adopted the same tariff duties with the EC, neither higher nor lower, for GSP

products.

Turkey has reserved the right to suspend preferential treatment for GSP products under certain

circumstances.

4.

Graduation mechanism (Country/Sector)

Turkey applied the graduation mechanism for the list concerned in line with the EC’s

application (see tables 3 and 4).

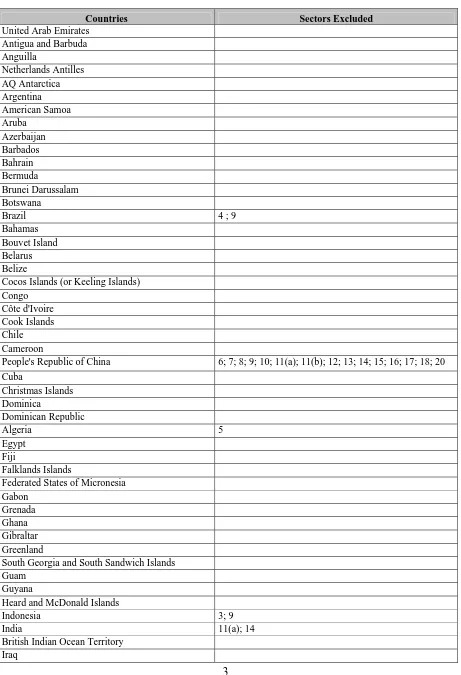

Table 1

A.

List of Turkey's GSP beneficiary countries and territories

Countries

Sectors Excluded

United Arab Emirates

Antigua and Barbuda

Anguilla

Netherlands Antilles

AQ Antarctica

Argentina

American Samoa

Aruba

Azerbaijan

Barbados

Bahrain

Bermuda

Brunei Darussalam

Botswana

Brazil

4 ; 9

Bahamas

Bouvet Island

Belarus

Belize

Cocos Islands (or Keeling Islands)

Congo

Côte d'Ivoire

Cook Islands

Chile

Cameroon

People's Republic of China

6; 7; 8; 9; 10; 11(a); 11(b); 12; 13; 14; 15; 16; 17; 18; 20

Cuba

Christmas Islands

Dominica

Dominican Republic

Algeria 5

Egypt

Fiji

Falklands Islands

Federated States of Micronesia

Gabon

Grenada

Ghana

Gibraltar

Greenland

South Georgia and South Sandwich Islands

Guam

Guyana

Heard and McDonald Islands

Indonesia

3; 9

India

11(a); 14

Countries

Sectors Excluded

Iran (Islamic Republic of)

Jamaica

Jordan

Kenya

Kyrgyzstan

St Kitts and Nevis

Kuwait

Cayman Islands

Kazakhstan

Lebanon

St Lucia

Libyan Arab Jamahiriya

Morocco

Marshall Islands

Macau

Northern Mariana Islands

Montserrat

Mauritius

Mexico

Malaysia

3

Namibia

New Caledonia

Norfolk Island

Nigeria

Nauru

Niue Island

Oman

French Polynesia

Papua New Guinea

Philippines

Pakistan

St Pierre and Miquelon

Pitcairn

Palau

Paraguay

Qatar

Russian Federation

6; 10; 15

Saudi Arabia

Seychelles

Santa Helena

Suriname

Syrian Arab Republic

Swaziland

Turks and Caicos Islands

French Southern territories

Thailand

14; 17

Tajikistan

Tokelau

Tonga

Trinidad and Tobago

Countries

Sectors Excluded

Uruguay

Uzbekistan

St Vincent and Northern Grenadines

Virgin Islands (British)

Virgin Islands (USA)

Viet Nam

Wallis and Futuna Islands

Mayotte

South Africa

17

Zimbabwe

B.

Beneficiary Countries of Special Incentive Arrangements

Bolivia Mongolia

Ecuador

Moldova (Republic of)

El Salvador

Nicaragua

Guatemala

Panama

Georgia Peru

Honduras

Sri Lanka

Colombia

Venezuela

Costa Rica

C.

Least Developed Countries (LDCs)

Afghanistan

Malawi

Angola Maldives

Bangladesh Mali

Benin

Mauritania

Bhutan

Mozambique

Burkina Faso

Myanmar*

Burundi

Nepal

Cape Verde

Niger

Djibouti

Central African Republic

Chad

Rwanda

Equatorial Guinea

Samoa

Eritrea

São Tomé and Príncipe

Ethiopia

Senegal

Gambia

Sierra Leone

Guinea

Solomon Islands

Guinea-Bissau

Somalia

Haiti

Sudan

Cambodia

Timor-Leste

Kiribati

Tanzania (United Republic of)

Comoros

Togo

Democratic Republic of Congo

Tuvalu

Lao People's Democratic Republic

Uganda

Lesotho

Vanuatu

Liberia

Yemen

Madagascar Zambia

* The preferences in all chapters granted under GSP are suspended for a temporary period for Myanmar. The

RULES OF ORIGIN UNDER THE GSP SCHEME OF TURKEY

1. Explanatory notes

In the context of the Generalized System of Preferences, Turkey has granted tariff preferences

to the beneficiary countries

1as from 1 January 2002 as a result of the customs union between

Turkey and the European Community which is based on Association Council Decision No

1/95 between Turkey and the European Community.

The rules of origin are regulated by the “Decision on Determination of Origin of Goods

Benefiting from Preferential Regime for the Purposes of the Generalised System of

Preferences No. 2001/3485” (hereinafter referred to as "Decision") which was published in

the Turkish Official Gazette on 30 December 2001 and amended by the Decisions which

were published in the Official Gazette of the Republic of Turkey on 9 October 2003/25254

and 20 March 2004/25408)

The Decision regulates the procedures and principles for determining the origin of goods

benefiting from the preferential regime at trade with Turkey for the purposes of the

Generalized System of Preferences. The provisions of the Decision are in accordance with the

ones of the “Commission Regulation No 1602/2000 amending Regulation No. 2454/93 laying

down provisions for the implementation of Council Regulation No 2193/92 establishing the

Community Customs Code” and Commission Regulation No 881/2003 of 21 May 2003.

Goods to benefit from preferential treatment under the Turkish GSP scheme must meet the

following main three requirements:

1.

The exporting country must be designated as the beneficiary country;

2.

The product must be eligible for the GSP treatment; and

3.

The product must meet the origin criteria.

Concerning the origin criteria, goods exported from the beneficiary country to Turkey must

comply with the requirements of rules of origin if they are to benefit from the preferential

tariff treatment, provided that they are under the GSP scheme. Goods not complying with the

rules of origin requirements will be denied preferential treatment and the normal duty rate will

apply to these goods.

The rules of origin under the Turkish GSP scheme comprise the following elements:

¾

Origin Criteria

¾

Direct Consignment

¾

Documentary Evidence

1