COMPARISON OF NEW NPP GENERATION COST, LEVELIZED TARIFF AND PROSPECT OF PBMR IN INDONESIA

Mochamad Nasrullah dan Elok S. Amitayani

Pusat Pengembangan Energi Nuklir, BATAN

Jl. Kuningan Barat, Mampang Prapatan, Jakarta Selatan 12710 Telp./Fax.: 021-5204243, Email: [email protected], [email protected]

ABSTRACT

COMPARISON OF NEW NPP GENERATION COST, LEVELIZED TARIFF AND PROSPECT OF PBMR IN INDONESIA.Nuclear power plant (NPP) is one of the solutions to overcome the electricity crisis in Indonesia. However, remembering the cost of capital and the late decision of the Indonesian Government made the NPP construction be postponed again. Despite the postponement National Nuclear Energy Agency (BATAN) began to prepare investigation on high temperature reactor (HTR) technology considering the increasingly developing technology on this reactor. One of HTR types is the Pebble Bed Modular Reactor (PBMR). This paper presents the comparison of new generation cost of PBMR and New NPP which is NPP of generation 3 with newer costs. The data was taken from various available studies like from Europe, the United States, South Korea, and South Africa is also presented. Results of the study showed that PBMR has cheaper generation cost and levelized tariff compared by other kinds of NPP. The generation cost varies between 4.435 cents$/kWh to 8.178 cents$/kWh and that PBMR was found to be the cheapest. The calculation of levelized tariff varies between 5.32 cents$/kWh to 11.97 cents$/kWh and again, the cheapest was that of PBMR. Besides producing electricity PBMR also has non electricity application; one to mention is the hydrogen (H2) production that could be used by many industries. For this case, nearly all the reactor’s energy is used for H2production with only a tiny amount sold to the grid. The hydrogen production cost is of 37.7 centsUS$/m3H2.Considering the high prospect of PBMR the government should consider the reactor as an option in Indonesia’s nuclear program.

Keywords: New NPP, PBMR, generation cost, levelized tariff, hydrogen production

ABSTRAK

PERBANDINGAN BIAYA PEMBANGKITAN LISTRIK PLTN, TARIF LISTRIK, DAN PROSPEK PBMR DI INDONESIA.Pembangkit listrik tenaga nuklir (PLTN) adalah salah satu solusi untuk mengatasi krisis listrik di Indonesia. Mengingat tingginya biaya capital dan lambatnya keputusan pemerintah membuat pembangunan PLTN tertunda. Di lain pihak teknologi PLTN di bidang reaktor temperatur tinggi (HTR) semakin berkembang sehingga reaktor jenis ini patut dipertimbangkan. Salah satu jenis HTR adalah Pebble Bed Modular Reactor (PBMR). Tulisan ini bertujuan membandingkan biaya pembangkitan PBMR dengan PLTN baru, yakni PLTN generasi ke-3 dengan perkembangan harga-harga terakhir. Data diambil dari beberapa studi seperti dari Eropa, Amerika Serikat, Korea Selatan, dan Afrika Selatan untuk PBMR. Biaya pembangkitan bervariasi antara 4.435 cents$/kWh sampai 8.178 cents$/kWh dengan PBMR merupakan yang termurah. Tarif listrik teraras berkisar antara 5.32 cents$/kWh sampai 11.97 cents$/kWh dan PBMR merupakan yang termurah juga. Selain untuk produksi listrik, PBMR juga bermanfaat untuk aplikasi non listrik, di antaranya produksi hidrogen. Hasil perhitungan menunjukkan harga produksi hidrogen PBMR mencapai 37.7 centsUS$/m3. Mengingat keuntungan yang ditawarkan PBMR, selayaknya reaktor ini menjadi opsi lain dalam program nuklir Indonesia.

Kata kunci: PLTN, PBMR, biaya pembangkitan, tarif teraras, produksi hydrogen

INTRODUCTION

The construction costs for electric utility investments have risen sharply over the past several years, due to factors beyond the industry’s control. Increased prices for material and manufactured components, rising wages, and a tighter market for construction project management services have contributed to an across-the-board increase in the costs of investing

in utility infrastructure. These higher costs show no immediate signs of abating.

dominating the current domestic energy mix. However, it unquestionably will create some environmental problems.

Nuclear energy is mentioned in the national energy policy as a possible energy to be developed in Indonesia when it is more economic, proliferation resistance, and environmentally friendly. The Introduction of NPP in Indonesia is not only to reach an optimum energy mix considering costs and environment, but also to relieve the pressure arising from increasing domestic demand for fossil energy. The role of NPP is clearly to stabilize and secure the supply of electricity, conserve strategic fossil energy resources and protect the environment from harmful pollutants as a result of the massif use of fossil fuels. According to the policy of energy in Indonesia about nuclear power plant (NPP) development, the first construction is planned in 2010 or 2011. However if up until 2010 the government has not issued the decision about the year of construction, the plan will have to be postponed.

The postponement of this NPP project will be influential in the policy of energy in Indonesia. National Nuclear Energy Agency (BATAN) began to prepare investigation about high temperature reactor (HTR) technology considering the developing technology of this reactor. The HTR program in Indonesia is based on the 2006 – 2009 National Research Agenda associated with the policy of optimal mixed energy resources and offers more roles to the new and renewable energy resources: “Assessment, evaluation and development of the concept of cogeneration nuclear plant for industrial heat process, electric generation and desalination”.

This objective gives an opportunity to the Pebble Bed Modular Reactor (PBMR) research as one of HTR types, since PBMR has capability to take a party as cogeneration nuclear plant producing heat that can be used for many industrial purposes. In the other hand, following the regulation on commercial NPP; that the technology should be proven or takes at least three years operation in the origin country, then the construction of HTR will begin as soon as 2019 or 2020 at most. This is just in accordance with the fact that the need of electricity and heat energy for industry will increase as the industry growth in Indonesia up until the next 10 years is estimated to increase together with the economic growth.

The calculation of PBMR economics is an important matter. The paper presents the comparison of PBMR and New NPP. The scope of the study would encompass the analysis of economic viability and financial viability. The economic viability would be analyzed by comparing the levelized generation cost for

electricity and the production cost for H2. Whereas the financial viability will assess the project’s feasibility from the feasibility criterion described in theory part including the levelized tariff.

The generation cost will be calculated using LEGECOST model, and the financial analysis will be done using financial spreadsheet from PT. PLN Persero. For the non-electricity application of PBMR, the H2production cost from this reactor is calculated separately using G4Econs model.

ECONOMIC AND FINANCIAL VIABILITY Levelized generation cost or busbar cost is generation cost per kWh that has been levelized, comprising capital cost, fixed O&M cost, variable O&M cost and fuel cost. LGC is used only to compare the generation cost of a generation option and that of alternative generation.

The levelized generation costs, unlike overnight construction costs, incorporate the full life cycle cost of nuclear power plant construction and operation. However, they are subject to greater uncertainty since, in addition to the assumptions embedded in the calculation of overnight construction costs, they also incorporate assumptions about construction time, plant life time, capacity factor, fuel costs and O&M costs.

The comparison of generation cost among different countries, or comparison between power plants of diferrent types of fuel, has to be made on comparable condition, and is normally made by using a method termed as discounted levelized cost. This is a levelized average cost, expressed in constant money, per unit of electricity sold to the grid by the plant, that is required to recover all of the total expenses, including the capital cost, operation and maintenance cost, and fuel cost, added with the cost of spent nuclear fuel handling and disposal, and the cost of decommissioning at the end of its life time.

The levelized generation cost (LGC) formula is:

LGC : Average Lifetime Levelized generation cost per kWh

I : total discounted capital expenditure to the first year of commercial operation date M : O&M cost per year

F : fuel cost

E : electricity production per year r : discount rate

The capital cost is disbursed for construction time cyears, so the total capital costIin the first year:

C : contingency cost K : overnight capital cost

St : percentage of disbursement overnight capital cost that expense in the year t in line of construction time

c : construction time

Overnight costKis the amount of money that will be expensed if capital expenditures be in one time. This amount does not consider the interest cost. It could be said that the overnight cost is a momentary expenses of capital before considering the cost of capital.

Interest during construction (IDC) is the interest that should be paid to the bank during the construction time as its disbursement. IDC is calculated with the formula [3]:

Cte: escalated component capital cost it : interest rate

To : year of NPP come into the commercial operation

t : capital disbursement time n : construction time

The financial feasibility of the project can be concluded from parameters as follow:

a. Internal Rate of Return (IRR) to be compared with Weigth Average Cost of Capital (WACC). If IRR > WACC then the project is feasible.

b. Net Present Value (NPV). If NPV > 0 then the project is feasible.

c. Pay Back period (PB). This describes the investment's rate of return without calculating time value of money

d. Benefit Cost ratio (BC). If the value of BC > 1 then the project is feasible.

3. METHODOLOGY 3.1. Case Development

Five cases will be developed in the study. The data for capital cost and fuel cost for each of the case follows various study:

Case-1 refers to the study of Tarjanne

(Europe),

Case-2 refers to the study of Harding (United States),

Case-3 refers to the study of Keystone (United States),

Case-4 refers to the study of OPR 1000 (South Korea) as, and

Case-5 refers to the study of PBMR (South Africa) from MIT.

The method of calculating the generation cost of New NPP (NPP of generation 3 with newer costs) and PBMR (NPP of generation 4) follows these steps:

Decide the technical and economic parameters of various New NPP and PBMR.

Calculate the generation cost from various New NPP and PBMR using LEGECOST program and compare the result.

Calculate the PBMR’s H2 production cost using G4Econs program.

Calculate the electricity levelized tariff of various New NPP and PBMR.

Economic Viability of New NPP and PBMR Capital Cost

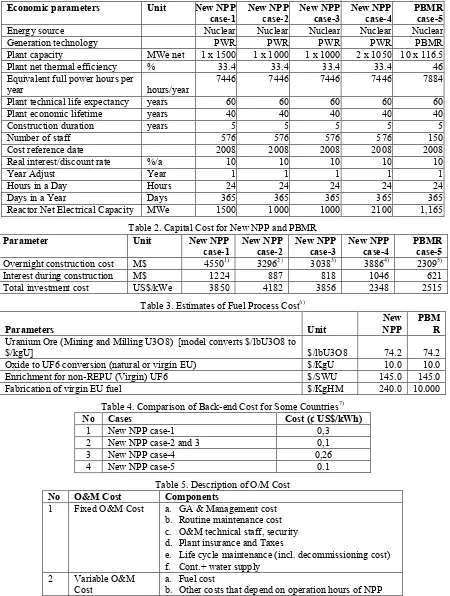

The technical and economic parameter of various New NPP and PBMR treated as base case follows Table 1.

The capital cost of new NPP and PBMR consists of overnight cost, comprising EPC (Engineering Procurement Construction) costs, development cost and other cost, as shown in Table 2. The estimates of New NPP, which included IDC, range from a low of $2,348 per kW to a high of $4,182 per kW. Meanwhile the overnight cost estimates of PBMR is 2309 millions US$ or 2515 US$/kWe.

Fuel Cost

a. Front-end Cost

The detail of fuel cost parameters of New NPP and PBMR to calculate the fuel cost are burn-up value, uranium price per kg, fuel process cost (conversion, enrichment, and fabrication), thermal efficiency and also capacity factor. Considering that the fuel technology development is heading for lower cost, the assumption of fuel process cost is based on February 2008 data as in Table 3. b. Back-end Cost

offsite. A literature survey indicates that the value of back-end cost differs from country to country as shown in Table 4. This back-end cost would cover on-site temporary storage and permanent storage in

the final repository. In the financial analysis, the cost of on-site storage is not accounted in the fuel cycle cost, but is accounted in the fixed O&M cost.

Table 1. Technical and Economic Data for New NPP and PBMR, 2008 Economic parameters Unit New NPP

case-1

New NPP case-2

New NPP case-3

New NPP case-4

PBMR case-5

Energy source Nuclear Nuclear Nuclear Nuclear Nuclear

Generation technology PWR PWR PWR PWR PBMR

Plant capacity MWe net 1 x 1500 1 x 1000 1 x 1000 2 x 1050 10 x 116.5

Plant net thermal efficiency % 33.4 33.4 33.4 33.4 46

Equivalent full power hours per

year hours/year

7446 7446 7446 7446 7884

Plant technical life expectancy years 60 60 60 60 60

Plant economic lifetime years 40 40 40 40 40

Construction duration years 5 5 5 5 5

Number of staff 576 576 576 576 150

Cost reference date 2008 2008 2008 2008 2008

Real interest/discount rate %/a 10 10 10 10 10

Year Adjust Year 1 1 1 1 1

Hours in a Day Hours 24 24 24 24 24

Days in a Year Days 365 365 365 365 365

Reactor Net Electrical Capacity MWe 1500 1000 1000 2100 1,165

Table 2. Capital Cost for New NPP and PBMR

Parameter Unit New NPP

case-1

New NPP case-2

New NPP case-3

New NPP case-4

PBMR case-5 Overnight construction cost M$ 45501) 32962) 30383) 38864) 23095)

Interest during construction M$ 1224 887 818 1046 621

Total investment cost US$/kWe 3850 4182 3856 2348 2515

Table 3. Estimates of Fuel Process Cost6)

Parameters Unit

New NPP

PBM R Uranium Ore (Mining and Milling U3O8) [model converts $/lbU3O8 to

$/kgU] $/lbU3O8 74.2 74.2

Oxide to UF6 conversion (natural or virgin EU) $/KgU 10.0 10.0

Enrichment for non-REPU (Virgin) UF6 $/SWU 145.0 145.0

Fabrication of virgin EU fuel $/KgHM 240.0 10.000

Table 4. Comparison of Back-end Cost for Some Countries7)

No Cases Cost (¢ US$/kWh)

1 New NPP case-1 0,3

2 New NPP case-2 and 3 0,1

3 New NPP case-4 0,26

4 New NPP case-5 0.1

Table 5. Description of O/M Cost No O&M Cost Components

1 Fixed O&M Cost a. GA & Management cost b. Routine maintenance cost c. O&M technical staff, security d. Plant insurance and Taxes

e. Life cycle maintenance (incl. decommissioning cost) f. Cont.+ water supply

2 Variable O&M Cost

a. Fuel cost

Table 6. Details of Fixed O&M Costs8)

Community Development US$ 10,465,000 10,465,000 10,465,000 10,465,000 10,465,000 GA & Mgt Cost US$ 5,680,520 5,680,520 5,680,520 1,893,507 2,148,152 Routine Maintenance Cost US$ 31,762,244 31,762,244 31,762,244 31,762,244 8,876,418 O & M Technical Staff, Security - Equiv US$ 32,113,142 32,113,142 32,113,142 10,704,381 1,348,218 Property Tax US$ 18,947 18,947 18,947 18,947 2,158,709 Plant Insurance US$ 10,000,556 7,051,014 6,498,214 8,305,888 2,158,709 Life Cycle Maintenance

(incl. Decommissioning Cost) US$ 52,077,501 21,477,222 21,477,222 61,283,481 23,674,460 Cont.+ Water Supply US$ 11,371,581 8,235,466 7,592,545 9,710,715 4,717,893

Total Fixed O&M Cost 153,489,492 116,803,555 115,607,834 134,144,162 55,547,561

O/M Cost

Operation and maintenance costs (O&M costs) cover expenses that are needed to run the operation of New NPP and PBMR. The level of O&M costs depends on the technology and the installed power capacity.

The O&M costs can be splited into two components: variable cost and fixed cost. Fixed O&M cost is associated with routine operational expenses that cover salaries of employees, cost of onsite spent fuel temporary storage, and auxiliary cost. The variable O&M cost covers fuel cost and other maintenance cost, and the nuclear fuel price would fluctuate from year to year. The variable O&M cost would depend on the operating hours of the New NPP and PBMR. The Description is shown in Table 5.

For the fixed O&M cost, it has been assumed that the amount is as shown in Table 6. The figure is estimated by inferencing some information from various references, but is adapted to suit the prevailing condition in Indonesia.

The variable O&M cost consists of expenses needed for maintenance of the power plant, maintenance of power plant building, and maintenance by outsourcing staff (off site staff). The figure of variable O&M cost is adopted from several study made by Tarjanne, 2008 for case 1, study of Harding and Keystones from USA for case 2 and case 3, study of OPR-1000 from South Korea for case 4 and study of PBMR-MIT from South Africa. The G&A and staff cost in case 1, 2, and 3 assumed 300% from salary National Private Electricity Indonesia. But for case 4 and 5 equated with salary National Private Electricity Indonesia.

Decommissioning cost is accounted in the O&M cost by retaining some amount of money every year from the initial date of operation to the end of plant economic life. The retained money along the years should be sufficient to finance the decommissioning work.

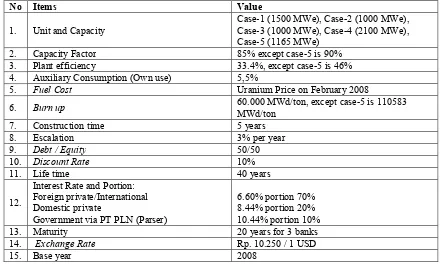

Financing Viability of New NPP and PBMR The financing study was conducted using secondary data taken from the results of previous studies, and other available references as mentioned in the list of reference. The data and assumptions for this purpose is seen on Table 7.

The NPP financing analysis initially requires economic calculation information such as the expense of electric power generation without the expense of transmission, or bus-bar cost. The financing study requires some parameters like IDC, fee, depreciation, viability analysis of financing like pay back period, WACC, IRR, NPV and others.

Financial analysis was performed following Built-Own-Operate scheme, but not fully BOO scheme, because there is government a share of about 10%. Therefore this scheme is conceived as a financing scheme by IPP representing a variant from BOO scheme. Technical data for NPP and PBMR are as mentioned above. The other assumptions are: construction time is 5 years and units start fully produce electricity in the beginning of 2019 (pessimistic assumption).

The financial model has already been developed with spread sheet basis. The work sheets present technical parameters, balance sheet, summary, production, IDC, investment disbursement, O&Mcost, fuel cost, etc.

Interest rate assumption follows the market, which is LIBOR + margin. At the moment US LIBOR is on the level 5.1%. The Indonesian risk is on the range between 1.5% and 2.5%. The range of margin also depends on the borrower. So that if we make a separation, for foreign private is LIBOR+1.5% and LIBOR+2.5%+tax.

should be added the Political Risk Insurance (PRI) that around 1.25% - 2%.

RESULTS AND DISCUSSION Economic Analysis

The economic analysis will discuss the levelized generation cost. The calculation of

levelized cost of power from new NPP and PBMR using LEGECOST are shown in Table 8. The levelized generation cost for Korea OPR 1000 (case-4) and PBMR (case 5) is at the level of 4 centsUS$/kWh, being PBMR the lowest for all cases at 4.435 centsUS$/kWh.

Table 7. Base Assumption for Financial Analysis

No Items Value

1. Unit and Capacity

Case-1 (1500 MWe), Case-2 (1000 MWe), Case-3 (1000 MWe), Case-4 (2100 MWe), Case-5 (1165 MWe)

2. Capacity Factor 85% except case-5 is 90%

3. Plant efficiency 33.4%, except case-5 is 46%

4. Auxiliary Consumption (Own use) 5,5%

5. Fuel Cost Uranium Price on February 2008

6. Burn up 60.000 MWd/ton, except case-5 is 110583

MWd/ton

7. Construction time 5 years

8. Escalation 3% per year

9. Debt / Equity 50/50

10. Discount Rate 10%

11. Life time 40 years

12.

Interest Rate and Portion: Foreign private/International Domestic private

Government via PT PLN (Parser)

6.60% portion 70% 8.44% portion 20% 10.44% portion 10%

13. Maturity 20 years for 3 banks

14. Exchange Rate Rp. 10.250 / 1 USD

15. Base year 2008

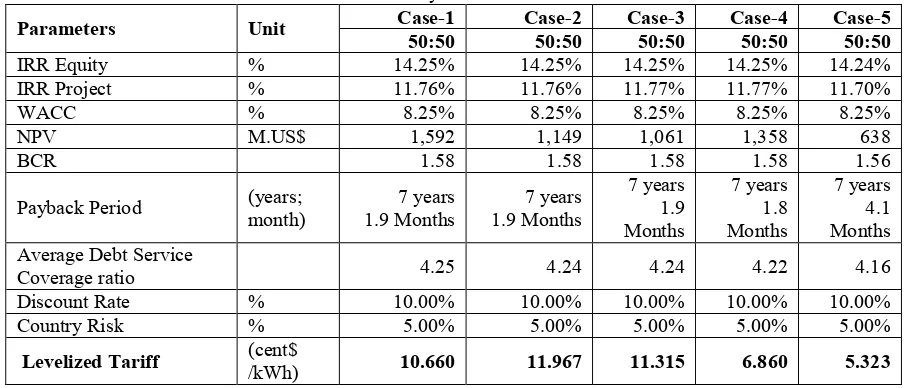

Financial Analysis

Using the same scenarios as in the economic calculation, the financial analysis result follows Table 9. All cases shows a higher IRR compared to WACC. The project’s IRR is nearly the same for all cases, 11.7% in average. This level of IRR is considered accepted for nuclear generation business. The highest NPV is obtained by case-1 which is the 1x1500 MWe PWR in Europe from Tarjanne study. The NPV tells the discounted net cash flow along the project lifetime when brought back to current time. This can be said as the project net profit considering time value of money. All projects are paid up, stated by the payback period parameter, in 7 years and several months. From any common sense, the sooner the payback the better the project is. The benefit to cost ratio (BCR) for all project, stating the ratio of revenues to all costs spent during the project life time, shows an average value of 1.5. The figure 1.5 tells that the project is economically beneficial. From the feasibility criterion driven in the theory part, it

can be concluded that all 5 projects are considered feasible. The levelized tariff for PBMR is the lowest of all cases.

the hydrogen price at hydrogen refueling station in Germany 0.32€/m3or 48 centsUS$/m3H2.

Table 8. Levelized Generation Costs for New NPP and PBMR

Parameter New

NPP case-1

New NPP case-2

New NPP case-3

New NPP case-4

PBMR case-5 Capital cost (mills$/kWh) 50.41 54.76 50.49 30.75 31.10 O&M cost (mills$/kWh) 17.10 20.69 20.53 10.67 6.78

Fuel cost (mills$/kWh) 6.33 6.33 6.33 6.33 6.47

Generation Cost (mills$/kWh)

73.84 81.78 77.34 47.75 44.35

Table 9. Financial Analysis for New NPP and PBMR

Case-1 Case-2 Case-3 Case-4 Case-5

Parameters Unit

50:50 50:50 50:50 50:50 50:50

IRR Equity % 14.25% 14.25% 14.25% 14.25% 14.24%

IRR Project % 11.76% 11.76% 11.77% 11.77% 11.70%

WACC % 8.25% 8.25% 8.25% 8.25% 8.25%

NPV M.US$ 1,592 1,149 1,061 1,358 638

BCR 1.58 1.58 1.58 1.58 1.56

Payback Period (years; month)

7 years 1.9 Months

7 years 1.9 Months

7 years 1.9 Months

7 years 1.8 Months

7 years 4.1 Months Average Debt Service

Coverage ratio 4.25 4.24 4.24 4.22 4.16

Discount Rate % 10.00% 10.00% 10.00% 10.00% 10.00%

Country Risk % 5.00% 5.00% 5.00% 5.00% 5.00%

Levelized Tariff (cent$

/kWh) 10.660 11.967 11.315 6.860 5.323

CONCLUSION

Based on the above analysis, conclusion can be made as the following:

The levelized generation comparison of all cases shows that the lowest being PBMR at 4.435 centsUS$/kWh. While the cheapest among New NPP is the Korea OPR-1000 at 4.775 centsUS$/kWh.

Based on the feasibility criterion, all cases is considered feasible with the levelized tariff of PBMR being the lowest of all cases at about 5.3 centsUS$/kWh, and the Korea OPR-1000 being the cheapest among new NPP at 6.86 centsUS$/kWh.

The PBMR in Indonesia has a very potential prospect considering from the aspect of economic and financing. Besides electric application, PBMR is also beneficial for non electric application such as for cogeneration, coal gasification, and coal liquifaction in industry. For the hydrogen production, the PBMR H2 production cost is 37.7 centsUS$/m3H2.

REFERENCES :

1. TARJANNE RISTO, KIVISTÖ AIJA, Faculty of Technology. Department of Energy and Environmental Technology Research report EN A-56, “Comparison Of Electricity Generation Costs” 2008

2. JIM HARDING, Economics of New Nuclear Power and Proliferation Risks in a Carbon-Constrained World, June 2007

3. The Keystone Center, “Nuclear Power Joint Fact-Finding”, June 2007

4. BATAN dan KHNP, “Joint Study on the Introduction of the First Nuclear Power Plant in Indonesia”, Jakarta, 2004

5. ANDREW C. KADAK, Ph.D MIT, High Temperature Gas Reactors, 2002

6. IAEA, TECHNICAL REPORTS SERIES No. 425, Vienna 2005

7. NUEXCO., (2008), ” Monthly Uranium Spot” http://www.uranium.info,

8. The University of Chicago, “The Economic Future of Nuclear Power, August 2004 9. The Study on the Economics, Financing and

(NPP) in relation to the Preparation Plans of the Construction of the First NPP in Indonesia, 2005

10. User’s Manual for G4-ECONS Version 2.0 A Generic EXCEL-based Model for Computation of the Projected Levelized Unit Electricity Cost (LUEC) and/or Levelized non-Electricity Unit Product Cost (LUPC) from Generation IV Systems, March 2008 11. IAEA, 2000, “Levelized Generation Cost

program”

12. National Electricity State (PLN) R&D, “Economics and Financing Viability software”, 2005