The Influence Of Equity Finsancing Funding Rate And Rate On Profitability Of Islamic Bank.

Teks penuh

Gambar

Dokumen terkait

The objective of this paper is to compare return and risk islamic discretionary funds and conventional discretionary funds in Indonesia as emerging market , by using

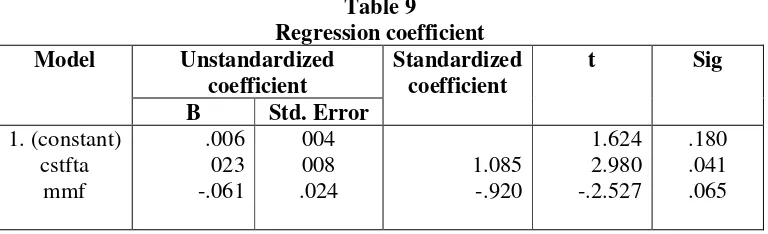

• The results obtained from this study show that funding by Islamic participation works based on participation between the agent and the bank in both losses and profits

Implementation rate service programs conducted by the DKI Islamic Bank are good and in accordance with the vision and mission of the bank that is DKI Islamic Bank is a good bank

The Factors Affecting the Brand Image of Islamic banks and Customer Loyalty of Islamic banks This study used all variables associated with the operation of Islamic banking

THE INFLUENCE OF SERVICE QUALITY, COMMITMENT AND CUSTOMER SATISFACTION ON CUSTOMER LOYALTY IN CHOOSING A ISLAMIC BANKS PENGARUH KUALITAS PELAYANAN, KOMITMEN DAN KEPUASAN

In regressions 2 and 6 we add the interactive dummy for Islamic banks from systemically important jurisdictions and find that the interest rate impact on sale-based financing is

Specifically, a one standard deviation increase in net stable funding ratio is associated with 17.16% - 23.92% increase in bank profitability as measured by ROAA.5 Since maturity

The results showed that the quality of Islamic services provided by the travel company and the trust of pilgrims have a significant influence on customer satisfaction felt by Umrah