DEVELOPING PAYROLL SYSTEM FOR EFFECTIVE TAX

PLANNING OF INCOME TAX ART. 21 IN COMPANY SS

TANGERANG

UNDERGRADUATE THESIS

SUBMITTED TO FULFILL PARTIAL REQUIREMENT OF

BACHELOR DEGREE IN ACCOUNTING

SUBMITTED BY:

GITARANI PRASTUTI

STD. ID: 040811615

TO

FACULTY OF BUSINESS AND ECONOMY AIRLANGGA

UNIVERSITY

Developing Payroll System for Effective Tax Planning

of Income Tax Art. 21 in Company SS Tangerang

Undergraduate Thesis

Submitted to fulfill partial requirement of Bachelor Degree in

Accounting

Submitted By:

GITARANI PRASTUTI

STD. ID: 040811615

TO

FACULTY OF BUSINESS AND ECONOMY AIRLANGGA UNIVERSITY

SURABAYA

UNDERGRADUATE THESIS

DEVELOPING PAYROLL SYSTEM FOR EFFECTIVE TAX

PLANNING OF INCOME TAX ART. 21 IN COMPANY SS

TANGERANG

SUBMITTED BY:

GITARANI PRASTUTI

STD. ID : 040811615

HAVE BEEN ACKNOWLEDGED AND WELL ACCEPTED BY THE COUNSELOR LECTURE,

SUPERVISOR,

ALFA RAHMIATI, SE.,MM.,Ak. AT THE DATE………

HEAD OF BACHELOR OF ACCOUNTING MAJOR,

Surabaya,………..

This thesis was complete and subject to be examined

Supervisor,

ACKNOWLEDGEMENTS

In The Name of Allah, Most Gracious, Most Merciful

Praise be to Allah, the Cherisher and Sustainer of the Worlds. I thank You with all of my heart, finally I finished my study which means also finish my undergraduate thesis on time. You are the one who keeps my spirit alive.

A special recognition goes to Mr. Muslich Anshori and his associates that I

can’t mention all as a Dean of Faculty of Business and Economics, Mr. Agus

Widodo SE., Ak. as being my Head Accounting Department for about three and half years, Mrs. Alfa Rahmiati SE., MM., Ak. as my thesis supervisor and

taxation specialization subject. You know Ma’am, I’m grateful could meet and

know you, moreover having you as my supervisor. I’m having a pleasure time

with you. Mrs. Amalia Rizky SE., MM., Ak. as my counselor lecturer, I thank you, with your great advice so I could develop myself well. Mrs. Devi S. Kalajanti SE., MM., Ak as English Class Supervisor. Ma’am, sure I’ll be missing your kindness and your sweet smile. Lecturers who inspired me; Mr. Khusnul Prasetyo as my favorite lecturer, Professor Tjiptohadi, your experience and support are inspiring me to dare to try something new . Mrs. Debby, your words are always be

remembered by me, and others that I can’t mention it all. With all of my heart

thank you for all of your knowledge and support.

Love and big hugs for my family, Mom and Dad, thank you for all of your support in any form. My Granny (deceased), thank you for your love and care, .Granny and Grandpa in Bandung, thank you and I love you. My two sweet bro;

Prabu and Pandu, though sometimes you’re so silly and spoilsport but hey, I miss

you really! LOL

Rahmat Rizal Alfaries, as partner of my heart, buddy, friend, and foe, thank

you for being with me ‘till now and what you’ve scarified for me. We’ve shared

laugh, smile, and cry together along this way.

My buddies from 39 SHS a.k.a Galan who always on my side, Lia Septiana a.k.a Roniii!! Roniku cintaku kapan kencan lagii?? Tar kalo gw dah pulang ngayeng yak?. Yawan Shiffer a.k.a Korve.Pe, masih jualan akua lu??kerja keras yak!!.kasian tu si anca nungguin lo dirumah, wkwkwkwk. Thank you for making me and roni ROFL all the time when we see ur photo! Muhammad Nurdiansyah a.k.a Ancaaaa. Ih si bos anca kmana aje sih lo?ga pernah nongol ni kalo di tag namanya. Thank you buddies for being my BBF ‘till now, kangen kaliaaan. My best friend Leny Andriyani a.k.a Jeeeenk!! Remember my last message for you, will ya?. My betsie in EC, Aulia Hidayati a.k.a Auul!! Thank you Auul for everything! Hey, come to my house, will ya? Ma boarding house friends; Dina, Iis, Mutia, Mbak Risna, Rara (thx for ur help anyway! *hugs), Winda, Anita, and

predecessors. My English Class friends, school friends, and others that I can’t

mention them all.

I also want to thank my internship friend; Indah, Diva, Reza, and Andreas.

katanya mau jalan-jalan??. Mr. Hans Aulia Utama Hasibuan as my Internship Supervisor at Central Bank, thank you for the great opportunity and your kindness.

Special thanks to my sweet and nice bro in Maldives, Jaiilam and Jaishan

Amir. I’m glad to know you, and sharing happiness with you. Hopefully I can go

to Maldives so I could meet you! My buddy Moataz Abdel Aziz a.k.a “Mo”. Thaaaaaank for dropping me by often; chewing fat with you is exiting, and laughing wid yew is superb! My sister-alike Fabiola Mendoza, thank you as being my great sis in SL,wow! I heard you just moved in to NZ, congrats sis! My nice Alexandrian friend; Batie, Amy, Sara, and Mido thank you for always tagging me nice story and poem. Also Mohammed, Sultan Patel, and Taimoor Ehsan, Sundar, and others, thank you for always keep our friendship bond stronger.

I thank peoples who are participating in the arrangement of this

undergraduate thesis directly or not. I never forget the people and friends I’ve lost,

or dream that have faded.

Last but not least, The researcher also wants to apologize of there is any mistake or undesired words created in this undergraduate thesis.

Surabaya, February 25th 2012

Statement of Declaration

I, (Gitarani Prastuti, 040811615), declare that:

1. My thesis is genuine and truly my own creation, and is not another’s person work made under my name, nor a piracy or plagiarism. This thesis has never been submitted to obtain an academic degree in Airlangga University or in any other universities/colleges.

2. This thesis doesn’t contains any work or opinion written or published by anyone, unless clearly acknowledged or referred to by quoting the author’s name and stated in the References.

3. This statement is true; if on the future this statement is proven to be dishonest and fraud, I agree to receive an academic sanction in the form of removal of the degree obtained through this thesis, and other sanctions in accordance with the prevailing norms and regulations in Airlangga University.

Surabaya,………..

Declared By,

Gitarani Prastuti,

ABSTRACT

Tax planning for income tax art.21 is an alternative way to reduce tax payable in a good manner. It could perform well if supported by a good payroll system. A good system is required to perform an effective and efficient business process, such as reduce paper redundancy and saving time, and reduce human error.

Company SS desires to perform business expansion in 2012. Hence, the company should prepare a good system and sufficient funds. To do so, Company SS wants to perform an effective tax planning in this part which is for income tax

art.21 collected from its’ employees that could create higher return for both

company and employees. To perform it smoothly, Company SS also supported by

developing its’ current payroll system to support business expansion and its’

taxation for payroll system.

Keywords: Tax Planning, Income Tax Art. 21, Payroll System

TABLE OF CONTENTS

COVER

APPROVAL LETTER

ACKNOWLEDGEMENT

ABSTRACT

CONTENTS

TABLE LIST

FIGURE LIST

ATTACHMENTS

CHAPTER I : INTRODUCTION………..……. 1

1.1Background………. 1

1.2Formulation of Problem………. 2

1.3Research Motivation……….. 2

1.4Contributions……….. 3

1.5Systematic Writing Proposal……….. 3

CHAPTER II : LITERATURE REVIEW……….. 5

2.1 Underlying Theories……… 5

2.1.1 Tax……….……….…... 5

2.1.2.1 Income Tax Art.21………. 6

2.1.2.2 Income Tax Art.21 Subject………. 7

2.1.2.3 Income Tax Art.21 Object……….. 9

2.1.2.4 Non-Taxable Income……….. 12

2.1.2.5 Taxable Income……….. 13

2.1.2.6 Calculation of Income Tax Art.21 and Income Tax Bracket………. 17

2.1.3 Tax Collection System………. 18

2.1.3.1 Official Assessment System……. 19

2.1.3.2 Self Assessment System………... 19

2.1.3.3 Withholding System……….. 19

2.1.3.3.1 Income Tax Art.21 Withholder……… 26

2.1.4 Additional Laws to Income Tax Art.21….. 26

2.1.5 Tax Planning………... 27

2.1.5.1 Tax Planning Framework………. 30

2.1.5.2 Tax Management……….. 31

2.2.1 Accounting Information System………... 34

2.2.2 Data Flow Diagram……… 35

2.2.3 Flowchart……… 36

2.2.4 Payroll and Payroll System………... 36

2.2.5 System Development……… 38

2.2.5.1 System Planning……… 39

2.2.5.2 System Analysis……… 39

2.2.5.3 System Design………... 41

2.2.5.4 System Implementation………... 42

2.2.6 Software………. 42

2.3 Previous Research………. 43

CHAPTER III……….. 45

3.1 Research Approach……….. 45

3.2 Research Scope………. 45

3.3. Data Type and Source………. 46

3.4 Data Collecting Procedure……….. 46

3.5 Analysis Technique……….. 48

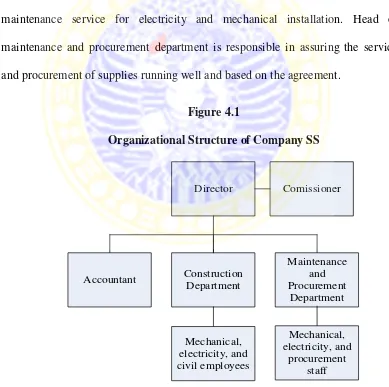

4.1 General View of Research Subject………..……… 57

4.1.1 History of Company SS……….. 57

4.1.2 Organizational Structure of Company SS……….…. 58

4.2 Research Result……… 60

4.2.1 Research Result through Existing

Procedure of Income Tax Art.21 Collection……… 60

4.2.2 Existing Company’s Payroll Policy……….. 62

4.2.3 Existing Payroll System……… 63

4.2.4 Research Result Description……… 71

4.2.4.1 Research Result through Withholding Method 71

4.2.4.2 Research Result through Company Policy….. 72

4.2.4.3 Research Result through Payroll System……. 73

4.3 Research Solution………. 75

4.3.1 Recommendation through Procedure of

Income Tax Art.21……….. 75

4.3.2 Recommendation through Company Policy……. 81

4.3.3 Recommendation through Company System…... 83

CHAPTER V……… 96

5.1 Conclusion……… . 96

5.2 Recommendation……….. 97

REFERENCES……….... 98

ATTACHMENTS……… 100

Salary Expense Recapitulation in 2010………. 100

Salary Expense Recapitulation in December 2010………... 101

Recapitulation of Income Tax Art.21 Expense For Permanent Employees in 2010………. 102

Recapitulation of Income Tax Art.21 Payable For Permanent Employees in 2010………..………. 103

Recapitulation of Income Tax Art.21 Payable For Permanent Employees in December 2010…………. 103

Recapitulation of Wage Expense in 2010………. 104

Recapitulation of Income Tax Expense in 2010………….. 105

Application of Gross-Up Method for Permanent Employee

In December 2010………... 107

Calculation of Tax Allowance for Permanent Employee

in 2010……….. 108

Calculation of Tax Allowance for Permanent Employee

in December 2010……...……….. 109

List of Tax Allowance for Non-Permanent Employee

in 2010……….. 110

Recapitulation of Wage Expense by Gross-Up Method

and Fringe Benefit for Non-Permanent Employees……. 111

Interview List………... 112

TABLE LISTS

Figure 2.1 –Input / Output Symbols……… 10

Figure 2.2 –Processing Flowchart……… 11

Figure 2.3 –List of Storage Symbols……… 12

Figure 2.4 –Flow and Miscellaneous Symbol…………..…… 13

Figure 2.5 – List of Non-taxable Income……….….. 33

Figure 2.6 –Taxable Income Layer………. 38

Figure 2.7 –Gross Up Calculation…... 41

Figure 2.8 –Tax Allowance Formula……….. 41

Figure 2.9 – Evaluation of Net, Gross, and Gross-up Method of Income Tax Art.21……….…. 43

Figure 2.10 – Evaluation of Comprehensive Income for each Income Tax Art.21 Method………..……… 45

Figure 2.11 –General Framework of Tax Planning………… 50

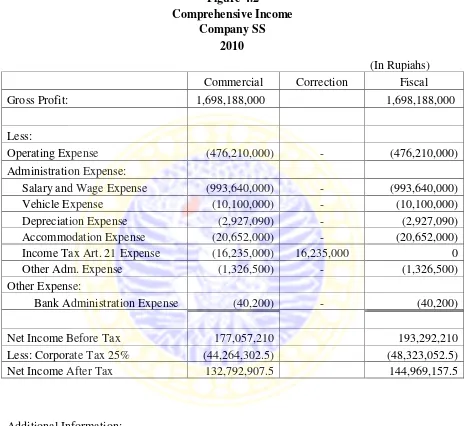

Figure 4.2 –Company SS Policies through Payroll…………. 63

Figure 4.5 –Salary Expense Recapitulation………. 70

Figure 4.6 –Salary Expense in December 2010……… 71

Figure 4.7 – Recapitulation of Income Tax Expense for Permanent Employee………... 72

Figure 4.8 – Recapitulation of Income Tax Expense for Permanent Employee in December 2010……. 72

Figure 4.10 – Recapitulation of Income tax Art.21 Expense for

Non-permanent Employees……….. 75

Figure 4.11 –Company’s Comprehensive Income in 2010……. 76 Figure 4.12 – Proposed Company Policies through Payroll

for Permanent Employees………. 82

Figure 4.13 - Proposed Company Policies through Payroll

for Non Permanent Employees………. 83

Figure 4.16 – Recapitulation of Gross-Up Method for

Permanent Employees……….. 94

Figure 4.17 - Recapitulation of Gross-Up Method for

Permanent Employees in December 2010……… 95

Figure 4.18 – Recapitulation of Income Tax Art. 21

Allowance For Permanent Employees………….. 96 Figure 4.19 - Recapitulation of Income Tax Art. 21

Allowance For Permanent Employees for

December 2010……….. 97

Figure 4.20 –Recapitulation of Meals Expense………... 99 Figure 4.21 – List of Tax Allowance – Non-permanent Employee 100 Figure 4.22 –Recapitulation of Wages………. 101 Figure 4.23 – Statement of Comprehensive Income after

Recommendation………. 102

Figure 4.24 – Evaluation through After Tax Income,

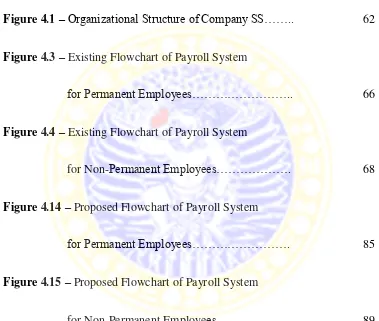

FIGURE LISTS

Figure 3.1 –Conceptual Thinking……….. 59

Figure 4.1 –Organizational Structure of Company SS…….. 62

Figure 4.3 – Existing Flowchart of Payroll System

for Permanent Employees……….. 66

Figure 4.4 – Existing Flowchart of Payroll System

for Non-Permanent Employees………. 68

Figure 4.14 – Proposed Flowchart of Payroll System

for Permanent Employees………. 85

Figure 4.15 – Proposed Flowchart of Payroll System

CHAPTER 1

INTRODUCTION

1.1 Background

Tax takes essential role in an economic condition of a country and becomes an obligation of the society in any kind of layer, in form of business or as individual tax payer. Society obtains facilities from government in form of public goods and services which are obtained by tax, such as public telephones, highways, bridges, etc.

Somehow, taxes turn out become encumbers for enterprises. Reluctant or not, taxes imposed company’s profit, hence they obligate to pay tax. Until now and then, taxes still become big dilemma from among of them. They are willing to pay just because the regulation said so.

Since the necessity between enterprises and government is different, enterprises are having tendencies to minimize tax. Tax planning is a treatment to

minimize yearly tax payable by taking advantage in regulation’s loopholes.

Company SS as business entity running its business in procurement goods and services. Planning for business expansion in 2012, Company SS tries to generate higher income tax return and develop its’ current payroll system and payroll policy. However, several limitations such as limited human resource becomes a big problem that should be considered why Company SS cannot

Facing those facts, an adequate tax planning for income tax art.21, developing the existing system and payroll policy improvement are several keys to enhance business’s performance.

1.2 Formulation of Problem

Toward the explanation above, the formulation of problems are:

1. “What is the best tax planning treatment for permanent employees and non-permanent employees of Company SS for greater after-tax return?” 2. “How to develop payroll system of Company SS in order to establish tax

planning for income tax art.21 and a good payroll policy?”

1.3 Research Motivation

The research motivations of this proposal are following:

1. Seek the implementation of tax planning for both permanent and non-permanent employee by considering the tax collection method applied and deductible expense based on the General Provision of Taxation Procedure. 2. Recognize tax savings generates by company

3. Recognize employees’ take home pay

4. Develop existing payroll system of Company SS that will accelerate the performance of tax planning of income tax art.21

1.4 Research Contributions

Several contributions are made for this research stated as following:

1. Provide information to company about the great impact on companies’ after -tax return by the implementation of -tax planning for company in treating -tax art. 21 and give recommendation for improvement and corrective actions for

its’ current payroll system and payroll policy

2. Give practical knowledge about the implementation of tax planning in field and payroll system development

3. As the reference for the next research within this field of research of the importance of tax planning and adequate payroll system particularly for income tax art.21

1.5 Systematic Writing Proposal

To make research become easier to understood, this research divide to some chapter consist of subchapter arranged systematically as follow:

CHAPTER I : INTRODUCTION

tax planning, the company must know the appropriate regulation and maintain the changing in order to run it well.

CHAPTER II : THEORETICAL REVIEW

This chapter contains underlying theories of payroll system, such as system planning, analysis, implementation and tax regulations.

CHAPTER III : RESEARCH METHODOLOGY

This chapter describes about the type of research, scope of research, types and source of data used, data collecting procedure, and technical analysis used.

CHAPTER IV: RESEARCH RESULT AND DISCUSSION

This chapter focuses on research result obtained from the research and observation done in Company SS in form of company’s general view, and continues with description of research result, discussion and evaluation.

CHAPTER V : CONCLUSION AND RECOMMENDATION

CHAPTER 2

LITERATURE REVIEW

2.1Underlying Theories 2.1.1 Tax

Tax is an obligation of society in any kind of layer. Almost all business activities can’t be separated from taxes and tax regulation. Thus, we need to completely understand tax regulation. Several tax expertise define term of tax; one of them is Prof. Dr. H. Rohmat Soemitro (Zain 2007:11) stated the term of tax as following:

“Tax is the conversion of public’s wealth to government’s inflow for

regular expenditures while its surplus are used to public saving that as the main

source to afford public investment”

Hence, we can conclude the criteria that related to the definition of tax are:

a. Collected by government, in this case represented by central or regional government where the collection is based on the amendment.

b. Utilize in affording government activities and expansion to provide public welfare.

c. Contribution to government that able to insisted, means if the tax payer is

negligent due to his/her obligation, then it’s able to claimed by force through

The budgetary function means tax becoming one of nation’s inflows to

afford the government activities and expansion. The budgetary function must be consistent with the regulated one; to regulate or establish social and economic policies in case to accelerate the establishment of social thriving. Such as regulate

or limiting the society’s consumption, doing the income redistribution, giving

incentives to the economic growth and investment, and others.

From business perspective, tax is a burden. Entrepreneurs will treat taxes as an unavoidable business reality. Those kind of impact means somewhat important, so that taxes is a components which must have a serious supervision, and becoming factor which decide businesses’ flow.

2.1.2 Income Tax

As stated in the fourth amendment to the law number 7 year 1983 regarding income tax (law number 36/2008), income is which is any increase in economic capability received or accrued by taxpayer, whether originating from Indonesia and outside Indonesia, which can be used for consumption or to increase the wealth of taxpayer, with the name and in whatever form.

2.1.2.1Income Tax Art. 21

regulation related to the implementation of income tax art. 21 are stated as following:

1. The Fourth Amendment to the Law Number 7 Year 1983 Regarding Income Tax (Law Number 36/2008) of general provisions of taxation procedures. 2. Regulation of the minister of finance number 254/PMK.03/2008 about

stipulation of part of income with respect to work of daily and weekly workers as well as other non-permanent workers not subject to the withholding of income tax

3. Government regulation of Indonesia Republic no. 94 year of 2010 regarding government regulations regarding the calculation of taxable income and income tax payment in certain period.

2.1.2.2Income Tax Art.21 Subject

As stated in the fourth amendment to the law number 7 year 1983 regarding income tax (law number 36/2008), income recipient who withheld income tax art. 21 are stated as following:

1. State officials including president, vice president, parliaments / assemblies consent of the governed, the local legislative provincial / city / district, supreme audit board, supreme court, supreme board consideration, the minister of state / young, attorney general, governor, regent, and mayor. 2. Civil employees, is central civil employees, regional civil employees, and

3. Employees, is any person, who is doing work under contract or employment agreement either written or not, including those doing job in the country or state owned enterprises or enterprises owned by region.

4. Permanent employees, is an individual who works to the employer, who receive or earn salary in certain amount at regular intervals, including members of the board of commissioners and the supervisory board which regularly and continuously participate in managing company's activities directly

5. Foreign employees, is an individual who does not reside in Indonesia not later than 183 days within a period of 12 months who receive or earn salary, honoraria and / or other compensation with respect to employment, services, and activities.

6. Irregular employees, is personal taxpayer who receive salary if only they work.

7. Pension Recipients, is an individual or their heirs who receive or obtain compensation for work performed in the past, including persons or their heirs who receive retirement savings or retirement allowance.

8. Recipients of honoraria, is individuals who receive or obtain compensation in connection with position, or related activities done by them.

Person or statutory bodies that are excluding as income tax art.21 subject are stated as following:

1. Diplomatic representatives and consular officers or other officials of foreign countries, and those who had been told they are working on and living with them, provided that:

a. Not Citizen Indonesia

b. Not receive or earn other income from outside the office in Indonesia c. State concerned to give reciprocal treatment

2. Official representatives of international organizations as referred to in the decision of finance ministers 576/KMK.04/2000 number as last amended by the finance minister's decision 601/KMK.03/2005 numbers along a. Not a citizen of Indonesia.

b. Not engaged in business or activity or other work to earn income in Indonesia.

2.1.2.3Income Tax Art. 21 Objects

Several income imposed by withholding tax art. 21 are stated as following:

pension benefits, children's education allowances, scholarships, insurance premiums paid by employers, and other regular income by any name; b. Income received or accrued by employees, former employees receiving

retirement or irregularly in the form of production services, bonuses, gratuities, leave allowances, holiday allowances, allowances for the new year, bonuses, annual premiums, and other similar income who are not permanent;

c. Daily wages, weekly wages, unit wage and piece rate received or obtained by temporary employees or freelance workers, as well as pocket money daily or weekly participants received education, training or apprenticeship which is a candidate for officer.

d. Ransom retirement, saving for old age or Old Age Security, severance pay and other similar payments in connection with termination of employment; e. Honorarium, allowance, gift or award with the name and in whatever form, commissions, scholarships, and other payments as benefits relating to employment, services, and activities undertaken by individual taxpayers in the country, consisting of:

1. Professionals (Lawyers, Accountants, Architects, Doctors, Consultants, Notary, Appraisers, and Actuaries).

2. Musicians, emcee, singer, comedian, movie star, the star of soap operas, commercials, director, film crew, photo model, the player plays, dancers, sculptors, painters and other artists;

3. Athlete;

5. Author, researcher, and translator;

6. Service providers in all areas including engineering, computer and application systems, telecommunications, electronics, photography, economic and social;

7. Advertising agencies;

8. Supervisors, project managers, members and providers of services to a committee, and participants of the hearing or meeting;

9. Bearer of the order or who finds a subscription; 10.Participants of the race;

11.Official merchandise vendors; 12.Foreign service officers insurance;

13.Participant education, training and apprenticeship are not employed or not as a prospective employee;

14.Multilevel marketing companies or distributors of direct selling and other similar activities.

15.Wages, salaries of honor, other benefits related to salary and remuneration or other benefits received are not fixed by the State Officers, Civil Servants and pensions and other benefits that are related to pensions received by retirees including widow or widower and / or their children.

Excluding the income tax collection of Article 21 are stated below:

2. Receipts in kind and enjoyment in any form provided by the taxpayer or the Government, not the exception granted by the Government other than the taxpayer or the taxpayer who is subject to final income tax and income tax imposed by a special calculating norms (deemed profit).

3. Pension contributions paid to pension funds that establishment has been approved by the Minister of Finance and Old Age Security contributions to the body administering Social Security paid by the employer,

4. Alms received by an individual who has the right of the agency or institution of Zakat established or approved by the Government.

5. Scholarships that meet certain requirements (art. 3 (1) Income Tax Act). Provisions are set further in the Regulation of the Minister of Finance No. 246/PMK.03/2008

2.1.2.4Non-Taxable Income

Figure 2.1

List of Non-taxable Income (NTI)

Status Monthly Yearly

Single with no dependants (S/0) IDR 1,320,000 IDR 15,840,000 Married with no dependants (M/0) IDR 1,430,000 IDR 17,160,000 Married with one dependant (M/1) IDR 1,540,000 IDR 18,480,000

Married with two dependants (M/2) IDR 1,650,000 IDR 19,800,000 Married with three dependants (M/3) IDR 1,760,000 IDR 21,120,000 Source: The Fourth Amendment to the Law Number 7 Year 1983 Regarding

Income Tax (Law Number 36/2008)

2.1.2.5Taxable Income

As stated in The Fourth Amendment to the Law Number 7 Year 1983 Regarding Income Tax (Law Number 36/2008), taxable income (TI) is a base of calculation to determine art. 21 payable received by personal taxpayer for a year. For resident taxpayer, there are two way in determining taxable income (TI); bookkeeping and norm. To determine the amount of the taxable income of a resident taxpayer and a permanent establishment, these shall remain non deductible:

a. Profit share by any name and in any form whatsoever, such as dividend, including dividend paid by an insurance company to a policy holder, and share of the remainder of business profit of a cooperative;

c. The formation or accumulation or reserve funds, except:

1. Uncollectible receivables reserve for a bank business and other business entity distributing credit, optional leasing consumer financing company and factoring company;

2. Reserve for insurance business, including social assistance reserve formed by the operating board of social security;

3. Guaranty reserve for deposit underwriting institution; 4. Reclamation cost reserve for a mining business; 5. Re-investment cost reserve for forestry business; and

6. Reserve of cost of closure and maintenance of industrial waste disposal place for waste treatment industry with the provision and requirements thereof stipulated by or on the basis of a regulation of the Minister of Finance;

d. Health insurance premium, accident insurance, life insurance, dual benefit insurance, and scholarship insurance, paid by the taxpayer individual person, except if paid by an employer and the premium is calculated as income for the relevant taxpayer.

f. The sum which exceeds fairness which is paid to a shareholder or to a party having special relationship as reward in connection with work done;

g. Wealth which is granted, assistance or contribution, and inheritance as intended in art.4 paragraph (3) letter a and letter b, except the donation as well as zakat (religious charity) received amil zakat agency or institution established or legalized by the government or compulsory religious donation of followers of religions recognized in Indonesia, which is amil zakat (charity) organization or amil zakat institution set up and legalized by the Government, with the provision thereof ruled by or the basis of a government regulation;

h. Income tax;

i. Cost imposed or expended for the personal interest of the taxpayer or any person becoming his/her dependent;

j. Salary paid to a member of association, firm, or comanditer (partially limited liability) company whose capital is not divided into dividends; k. Administrative sanction in the form of interest, fine, and rise and also

criminal sanction in the form of fine relating to the execution of law in the field of taxation.

a. Cost directly or indirectly related to business activity, among other: 1. Cost of material purchase;

2. Cost relating to work or service including wage, salary, honorarium, bonus, gratuity, and allowance granted in the form of money

3. Interest, rent royalty; 4. Travel expense; 5. Waste treatment cost; 6. Insurance premium;

7. Promotion and selling cost ruled by or on the basis of a regulation of the Minister of Finance;

8. Administrative cost

9. Taxes other than income tax;

b. Depreciation of expense to acquire a tangible asset and amortization of expense to acquire right and on other cost having a benefit period of more than one (1) year; c. Contribution to a pension fund the establishment of which has been legalized by

the Minister of Finance;

d. Loss due to the sale or transfer of asset owned and used in a company or owned to gain, collect and maintain income;

e. Loss arising from difference of foreign currency exchange rate;

f. Cost of company’s research and development activity executed in Indonesia;

i. Donation in the framework of national disaster mitigation with the provision thereof ruled by a government regulation;

j. Donation in the framework of research and development executed in Indonesia, with the provision thereof ruled by government regulation;

k. Cost of development of social infrastructure with the provision thereof ruled by a government regulation;

l. Donation of education facilities with the provision thereof ruled by a government regulation, and;

m. Donation on the framework of sports development with the provision thereof ruled by government regulation.

2.1.2.6Calculation of Income Tax Art. 21 and Income Tax Art. 21 Bracket

Steps in calculating income tax art.21for permanent employee are:

1. Set the gross salary received by the employee

2. Deduct the amount by certain allowances and profession cost (net salary) 3. Deduct net salary by non-taxable income (Taxable income)

4. Calculate the income tax art 21 payable by multiplying taxable income with income tax rate

The calculation of income tax. art 21 for permanent and non-permanent employees is quite different. Steps in calculating income tax art.21 for non-permanent employee are:

1. Set the wage received daily or monthly

3. If wage received daily above IDR 150,000, deduct the amount with NTI per day and multiple with tax rate. If no, then income tax art.21 will be imposed if wage received above NTI, by deducting the amount with NTI and multiple it with tax rate.

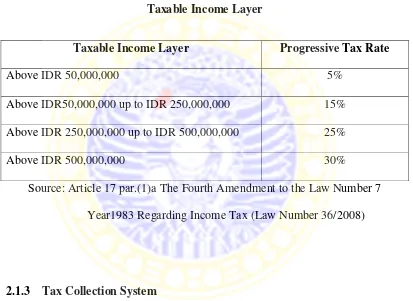

Income tax layer for personal taxpayer are stated below: Figure 2.2

Taxable Income Layer

Taxable Income Layer Progressive Tax Rate

Above IDR 50,000,000 5%

Above IDR50,000,000 up to IDR 250,000,000 15% Above IDR 250,000,000 up to IDR 500,000,000 25%

Above IDR 500,000,000 30%

Source: Article 17 par.(1)a The Fourth Amendment to the Law Number 7 Year1983 Regarding Income Tax (Law Number 36/2008)

2.1.3 Tax Collection System

Erly Suandi (2010:130) states “in general, there are three types of tax collection systems; official assessment system, self assessment system, and

2.1.3.1Official Assessment System

Official assessment system is tax collection method where the personnel’s tax payable is calculated and set by fescues. In this system, taxpayer is inactive to consider his/her tax payable. Tax payable occurs if the amount of tax payable already set by fescues.

2.1.3.2Self Assessment System

Self-assessment system is tax collection method which gives the right, trust, and responsibility to the tax payer to calculate, collect, and report the taxable income in accordance to tax regulation (Zain, 2007:113).

2.1.3.3Withholding System

Withholding system means that tax collection is accomplished by the third party. Withhold is used if the obligation to withhold the tax is on the party who pay the salary, for example is income tax art. 21. On the other hands, collecting where the obligation to collect is on the party who receive the payment, for example is value-added tax (VAT).

This system also prevents tax evasion since collecting or withholding tax literally does their job without considering who is withheld or collected, except the criteria which exempted from the GPT.

a. Net Method

Net method is a method in which the company as job provider bears

employees’ tax (Bwoga: 2007). Hence, by this method, the salary received by

employee is not deducted by income tax art.21 should be paid. The payment entries by net method are stated on the next page:

Salary expenses xxx

Art.21 Expense yyy*

Art.21 Liability yyy

Cash / Bank xxx

*Positive Fiscal Correction

b. Gross Method

In gross method, the company as job provider doesn’t withhold income tax art.21. In this method, the employee himself who is bears income tax art.21 owed (Bwoga: 2007).. The payment entries for gross method is:

Salary Expense xxx

Art.21 Liability aaa Cash / Bank bbb c. Gross-up Method

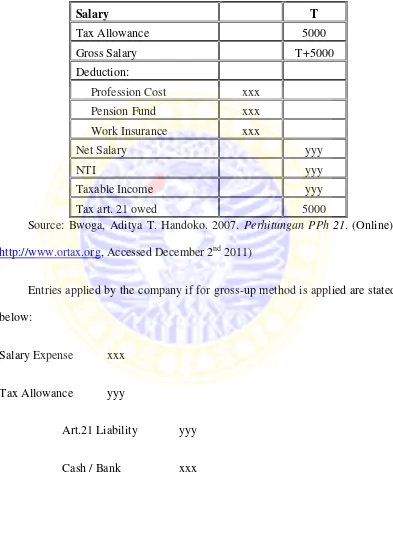

Figure 2.3 Gross Up Calculation

Salary T

Tax Allowance 5000

Gross Salary T+5000

Deduction:

Profession Cost xxx

Pension Fund xxx

Work Insurance xxx

Net Salary yyy

NTI yyy

Taxable Income yyy

Tax art. 21 owed 5000

Source: Bwoga, Aditya T. Handoko. 2007. Perhitungan PPh 21. (Online), http://www.ortax.org, Accessed December 2nd 2011)

Entries applied by the company if for gross-up method is applied are stated below:

Salary Expense xxx

Tax Allowance yyy

Art.21 Liability yyy

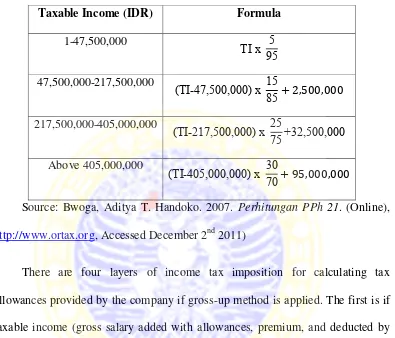

The formula of tax allowance for gross-up method is stated below:

Figure 2.4

Tax Allowance Formula for Gross-Up Method Taxable Income (IDR) Formula

1-47,500,000

TI x 55

47,500,000-217,500,000

(TI 47,500,000) x 15 5

217,500,000-405,000,000

(TI 217,500,000) x 2575 32,500,000

Above 405,000,000

(TI 405,000,000) x 3070

Source: Bwoga, Aditya T. Handoko. 2007. Perhitungan PPh 21. (Online), http://www.ortax.org, Accessed December 2nd 2011)

Figure 2.5

Evaluation of Net, Gross, and Gross-Up Method of Art.21

Detail Net Method Gross Method Gross-Up Method Salary a) IDR 60,000,000 IDR 60,000,000 IDR 60,000,000

Tax Allowance b) 0 0 1,837,895

Less:

Profession Cost c) (4,200,000) (4,200,000) (4,200,000) Life Insurance d) (2,400,000) (2,400,000) (2,400,000) Net Salary IDR 53,400,000 IDR 53,400,000 IDR 55,237,895

NTIe) (18,480,000) (18,480,000) (18,480,000)

TI IDR 34,920,000 IDR 34,920,000 IDR 36,757,895

IT Payable:

5% x TI IDR 1,746,000 IDR 1,746,000 IDR 1,837,895

Status Non-Deductible Expense

Employees’ Expense Deductible Expense

Income Received IDR 60,000,000 IDR 58,254,000 IDR 60,000,000 Per Month IDR 5,000,000 IDR 4,854,500 IDR 5,000,000

Entries occured :

1) Net method:

Salary expenses IDR 5,000,000

Art.21 Expense *145,500

Art.21 Liability IDR 145,500

Cash / Bank 5,000,000

2) Gross Method

Salary Expense IDR 5,000,000

Art.21 Liability IDR 145,500

Cash / Bank 4,854,500 3) Gross-Up Method

Salary Expense IDR 5,000,000

Tax Allowance 155,789*

Art.21 Liability IDR 155,789 Cash / Bank 5,000,000

*IDR 1,869,474/12

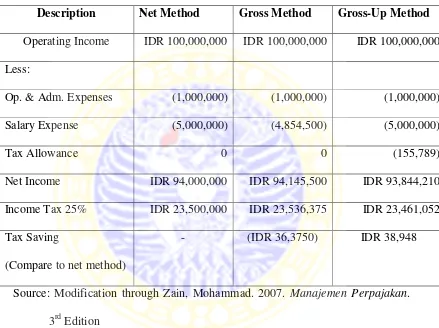

Figure 2.6

Evaluation of Comprehensive Income for Each Art.21 Disbursement Method

Description Net Method Gross Method Gross-Up Method Operating Income IDR 100,000,000 IDR 100,000,000 IDR 100,000,000 Less:

Op. & Adm. Expenses (1,000,000) (1,000,000) (1,000,000)

Salary Expense (5,000,000) (4,854,500) (5,000,000)

Tax Allowance 0 0 (155,789)

Net Income IDR 94,000,000 IDR 94,145,500 IDR 93,844,210 Income Tax 25% IDR 23,500,000 IDR 23,536,375 IDR 23,461,052 Tax Saving

(Compare to net method)

- (IDR 36,3750) IDR 38,948

Source: Modification through Zain, Mohammad. 2007. Manajemen Perpajakan. 3rd Edition

From the calculation and evaluation of three applicable methods, gross-up method is most advantageous for both employee and company. From the

company’s side, it creates lower income tax which generates high tax saving.

From the employee’s side, it enhance employee’s affluent by giving them tax

2.1.3.3.1 Withholder of Income Tax Art. 21

The withholder of income tax art.21 is the party who pay the cash relate to job or service rendered by the receiver. In amendment no.28 year of 2008 art. 21

(1) explained further in the DGT’s decision no.KEP-545/PJ/2000 art. 2 (1) party

who compel to accomplish the collection, withhold, and report art.21 is follow: a. Job providers, consist of individual of entity

b. Government treasurer

c. Pension funds, such as Social Security Workers (Social Security), PT Taspen, PT ASABRI

d. Companies and permanent establishment

e. Foundations, institutions, associations, clubs, mass organizations, social organizations, political and other organizations and international organizations that have been determined based on the Decree of the Minister of Finance

f. The steering committee

2.1.4 Additional Laws Related to Income Tax Art. 21

Underlying laws related to the accomplishment of tax art. 21 issued by government in form of amendments, government regulation, either finance

minister’s decision to the technical calculation accomplishment regulated on the

1. Law number 6 years 1983 as changed into amendment no. 28 year of 2008 regarding taxation general provision and procedure.

2. The Fourth Amendment to the Law Number 7 Year 1983 Regarding Income Tax (Law Number 36/2008)

3. Explanation of The Fourth Amendment to the Law Number 7 Year 1983 Regarding Income Tax (Law Number 36/2008).

4. PER-31/PJ/2009 of the withholding, collecting, and reporting procedure income tax article 21/26 related to job, service, and personal activity

5. DGT regulation 57/PJ/2009 of the change in decision of DGT no: PER-31/PJ/2009 of the technical procedure withholding, collecting, and reporting procedure income tax article 21/26 related to job, service, and personal activity

2.1.5 Tax Planning

Erly Suandy (200 :6) states term of tax planning as “the first step in tax management, consist of collecting and analyzing tax regulation by purpose in

taking actions that could be done for tax saving”. Another term of tax planning

comes from Zain (2007:67), who stated tax planning is a structured action related to consequence of the tax. The goal is how those controls could generate efficient amount of tax which will be transferred to the government, with what we called tax avoidance not tax evasion, which is an illegal act in tax boundaries. Though

those sound almost the same as criminal acts, but it’s clearly different between

Tjahjono & Husein (2005:447) also state advantage that could be generates from careful tax planning are stated as follow:

1. Cash disbursement saving. Tax as subtrahend element of income, becomes encumber bear by enterprise. By minimizing tax, cash disbursement to pay

tax can be allocated to other company’s necessities.

2. Managing cash flow. By well-planned tax planning, we can estimate our cash needed to pay tax and decide when we have to pay therefore company could arrange more precise budget.

Certain things become motivation of tax payer to establish tax planning, but it all derived from three of tax element:

1. Tax policy, is an alternative from various objective aim to accomplish in taxation system

2. Tax law, is a guidance or regulation that must be obeyed by tax payer in form

of government’s regulation, president’s regulation, minister of finance’s

regulation, and director general of tax.

Several measurements commonly used in measuring compliance of tax payer, such as:

a. Tax saving; is an effort done by tax payer in avoiding paying tax by not buying or consuming goods imposed by value-added tax (VAT) and reduce working hours to minimize income

b. Tax avoidance; is a type of effort by not to take an action that probably imposed by tax or effort by legally manipulate tax payer’s income which still in scope of tax regulation.

c. Tax evasion; is a type of effort done by tax payer to avoid tax with illegal action by hiding the true condition of tax subject.

Erly Suandi (2009:9) stated that certain thing must be considered in tax planning:

1. Tax planning must in the scope of tax regulation. If it is forced to violate taxation law, it become risk for tax payer and might endanger tax planning itself.

2. Make sense in business, since tax planning is inseparable part from global strategy both in long term and short term. Thus, irrelevant tax planning will devastate the planning itself.

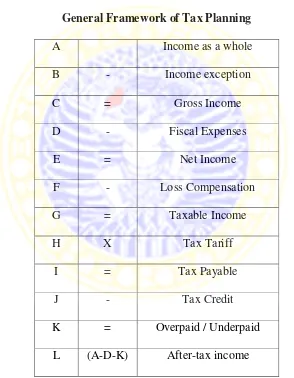

2.1.5.1Tax Planning Framework

Main goal of tax planning is to minimize tax payable and generate optimal tax saving. By using tax planning formula, we can minimize taxable income which imposed by tax tariff. The general formulation is stated on the next page:

Figure 2.2

General Framework of Tax Planning

A Income as a whole

B - Income exception

C = Gross Income

D - Fiscal Expenses

E = Net Income

F - Loss Compensation

G = Taxable Income

H X Tax Tariff

I = Tax Payable

J - Tax Credit

K = Overpaid / Underpaid L (A-D-K) After-tax income

2.1.5.2Tax Management

In theory, tax planning is part of tax management. Erly Suandi (2009:6)

states “ in common, tax management is a facility to accomplish appropriate tax

compulsion by minimizing the amount to generate desired return”. To do so, two certain conditions must be surpassing by applicant state as following:

1. Understand the Existing Regulations

By learning tax regulations, tax payer will obtain opportunities and loopholes of regulations that could be applied to trim down tax compulsion.

2. Perform Appropriate Bookkeeping

Bookkeeping is one of the most important requirements in serving financial information and become the first consideration in calculating tax payable of a company.

Conclusion can be inferred from section above is roles of tax management are stated as following:

1. Tax Planning

Is the first step in tax management, consist of collecting and analyzing tax regulation by purpose in taking actions that could be done for tax saving.

2. Tax Implementation

3. Tax Control

Has intention to guarantee tax compulsion whether it has been done as designed and fulfill both formal and material requirements.

2.1.5.3Implementation of Tax Planning in Enterprise

Several actions that could be taken to reduce enterprise’s tax payable are state as following:

1. Choose the Form of Business

This step is important to predict tax burden and non-tax factor should be paid by enterprise

2. Income Separation

Enterprise can establish corporate restructuring by creating several group of company (example as parent and subsidiary company)

3. Corporate Restructuring

It’s essential if some companies earn profit while loss occurring in one of

them, corporate restructuring by integration could reduce profit which will leads to lower income tax payable.

4. Providing Allowance in form of Money Instead of Fringe of Benefit

5. Provide Tax Allowance

Tax saving efforts could also be done by giving tax allowance to employees,

which will raise the operating expense and impact Company’s taxable income

directly.

2.2Systems, Data and Information

Organizations depend on information systems to stay competitive. Information is just as much a resource as plant and equipment. Productivity, which is crucial to staying competitive, can be increased through better information system. Romney (2009:26) states “a system is a set of two or more

interrelated components that interact to achieve a goal”. Another definition of

system comes from Bodnar (2010:1), who states “a system is a collection of

resources related such that certain objectives can be achieved”.

Systems are almost always composed for smaller subsystems, each performing a specific function important to and supportive of the larger system of which it is a part. For instance, the college of business is s system composed of various departments, each of which is a subsystem. Yet the college itself is a subsystem of the university.

1. Facts about the activities that take place 2. The resources affected by the activities 3. The people who participate in the activity

For instance, data need to be collected about a sales event. (e.g., the date of the sales, total amount), the resource being sold (e.g., the identity of goods and services, the quantity old and unit price), and the people who participated in the sale (e.g., the identity of the customer and the salesperson.

Information is a data that have been organized and processed to provide meaning to a user (Romney, 2009:27). User typically need information to make decisions or to improve the decision making process. As a general rule, user can make better decisions as the quality and quantity of information increase.

2.2.1 Accounting Information System

Bodnar (2010:1) states “an accounting information system (AIS) is a

collection of resources, such as people and equipment, designed to transform

financial and other data to information”. This information is communicated to a

wide variety of decision makers. Accounting information systems perform this transformation whether they are essentially manual systems or thoroughly computerized. Romney (2009:28) states there are six components of AIS:

1. The people who operate the system and perform various function

2. The procedures and instructions, both manual and automated involved in collecting, processing, and storing data about the organization’s activities 3. The data about the organization and its business process

5. The information technology infrastructure, including computers, peripheral devices, and network communications devices used to collect, store, process, and transmit data and information

6. The internal controls and security measures that safeguard the data in the AIS

Together, these six components enable an AIS to fulfill three important business functions:

1. Collect and store data about organizational activities, resources, and personnel.

2. Transform data into information that is useful for making decisions so management can plan, execute, control, and evaluate activities, resources, and personnel.

3. Provide adequate controls to safeguard the organization’s assets, including its data, to ensure that the assets and data are available when needed and the data are accurate and reliable.

2.2.2 Data Flow Diagram (DFD)

Laudon & Laudon (2010:523) states “data flow diagram as the primary tool for representing a system components processes and the flow of data between

them”. The data flow diagram offers logical graphic model of information flow,

2.2.3 Flowchart

A flowchart is an analytical technique used to describe some aspects of an information system in a clear, concise, and logical manner (Romney, 2009:92). Flowchart uses a standard set of symbols to describe pictorially the transaction processing procedures a company uses and the flow of data through a system. Flowcharting symbols can be divided into the following four categories:

1. Input/output symbols represent devices or media that provide input to or record output from processing operation.

2. Processing symbols either show what type or device used to store data that system is not currently using.

3. Storage symbol represent the device used to store data that the system is not currently using.

4. Flow and miscellaneous symbols indicate the flow of data and goods. They also represent such operations as where flowcharts begin or end, where decisions are made, and when to add explanatory notes to flowcharts. Figure of flow and miscellaneous symbol is stated on the next page:

2.2.4 Payroll and Payroll System

Payroll is the financial record of employees’ salaries, wages, bonuses, net

modification. Payroll processing is one area in which the law imposes not only a fine but a jail sentence for willful negligence in maintaining adequate records. Three critical areas of payroll system are:

a. Personnel

Bodnar (2010:294) argues” the personnel (employment) office is

responsible for placing people on the company’s payroll, specifying rates of pay,

and authorizing all deductions from pay”. All changes, such as adding or deleting employees changing pay rates, or changing levels of deductions from pay must be authorized by the personnel office. The personnel function is distinct from timekeeping and from the payroll preparation function.

b. Timekeeping

Bodnar (2010:294) argues “the timekeeping function is responsible for the preparation and control of time reports and job-time tickets”. An hourly employee

typically clocks on and off the job. At the end of a pay period, the employee’s

time card (or time report) indicates that the amount of time the employee was on the job and the time of which he or she expects to receive pay. Timekeeping is responsible for collecting and maintaining time cards or time reports, and reconciling these data with job time summary reports. Salaried employees typically do not clock on and off the job in the same manner as hourly employees.

If no accounting for time is required a supervisor’s approval usually is required to

c. Payroll

The term 'payroll' encompasses every employee of a company who receives a regular wage or other compensation (Lindsay, 2011). Some employees may be paid a steady salary while others are paid for hours worked or the number of items produced. All of these different payment methods are calculated by a payroll specialist and the appropriate paychecks are issued. Companies often use objective measuring tools such as timecards or timesheets completed by supervisors to determine the total amount of payroll due each pay period. Note that preparing payroll is independent of the preparation of the input data on which pay is based-the time reports and personnel data. Personnel data are received from the personnel office. Time reports are received from timekeeping. The payroll register details the computation of net pay (gross pay less deduction from pay). Paychecks are sent to cash disbursement for signature, review, and distribution. A copy of the payroll register is sent to accounts payable to initiate the recording of a voucher for the payroll.

2.2.5 System Development

system development project goes through essentially the same systems development life cycle: planning and analysis, design, and implementation.

2.2.5.1System Planning

System planning involves identifying subsystem within the information system that needs special attention for development (Bodnar, 2010:353). The objective is to identify problem areas that need to be dealt with either immediately or sometime in the future.

2.2.5.2System Analysis

System analyst describes what a system should do to meet information requirements (Laudon, 2010:517). System analyst begins after systems system planning has identified subsystems for development. The primary objectives of system analyst are:

1. Gain an understanding of the existing system (if one exist) 2. Identify and understand problems

3. Express identified problems in terms information needs and system requirements

4. Clearly identify subsystems to be given highest priority

Bodnar (2010:356) states there are four phases in system analysis state as follow:

1.Survey the present system

a. Gain a fundamental understanding of the operational aspects of the system

b. Establish a working relationship with the users of the system

c. Collect important data that are useful in developing the system design d. Identify specific problems that require focus in terms of subsequent

design efforts

2.Identify information needs

The second major phase of system analysis involves identifying information requirements for managerial decision making. In identifying information needs, the analyst studies specific decisions made by managers in terms of the information inputs, usually called information needs analysis.

3.Identify system requirements

The third phase involves specifying systems requirements. Such requirements can be specified in terms of inputs and outputs. The input requirements for a given subsystem specify the specific needs that must be met in order for that subsystem to achieve its objectives.

4.System analysis report

2.2.5.3System Design

System design is an orderly process that begins at very general level with the setting of objectives for a particular system (Bodnar,2010:366). The major steps in system design include evaluating design alternatives, preparing design specifications, and submitting a completed systems design reports.

At some point, the decision must be made as to whether the computer software is to be built from scratch or purchased. Although this seems to be a design decision, it should be made at the end of analysis phase. It is economically more feasible for many businesses, especially smaller one, to buy rather than build software. Purchase software packages have several advantages:

1.They are cheaper. The cost of development is carried by many purchasers rather than just the creator.

2.They are already debugged. If several other organizations have been using the package for some months, it is reasonably safe to assume that most of the bugs have been found and exterminated.

3.The company can try product before investing a great deal of money. With in-house software, it is possible to put months of development time into a program only to discover that it does not produce the desired results when it is done.

However, the main disadvantage to canned software packages (i.e.,

purchased software package) is that they rarely exact meets a company’s needs. It

may be necessary to modify software (which can be expensive, if not impossible)

2.2.5.4System Implementation

This is the last step of system development. After the system is created or purchased (if the company decided to buy software package), the company implements the system, creates feedback for the system and improvement (if any).

2.2.6 Software

Computer software consists of the detailed, preprogrammed instruction that control and coordinate the computer hardware components in an information system (Laudon, 2010:51). In other words, software is a conceptual entity which is a set of computer programs, procedures, and associated documentation concerned with the operation of a data processing system.

Program software performs the function of the program it implements, either by directly providing instructions to the computer hardware or by serving as input to another piece of software. The term was coined to contrast to the old term hardware (meaning physical devices). In contrast to hardware, software is intangible, meaning it "cannot be touched" Software is also sometimes used in a more narrow sense, meaning application software only. Sometimes the term includes data that has not traditionally been associated with computers, such as film, tapes, and records.

2.3Previous Research

Preceding research of Junitasari titled “Implementasi Perencanaan Pajak Atas

Metode Perhitungan Pajak Penghasilan Pasal 21 Di PT X Surabaya”. The case

described the preceding tax planning done by PT X was ineffective. Suggestion to change the method of income tax art.21 from net method to gross-up method is already done. Arise from the problems, the understanding of the availability regulation in any kinds of form and the right and careful calculation is recommended to establish successful tax planning. The company would be better to implement gross-up method since it can create a win-win between company and employees.

Similarities are occurred in the case, which is ineffective tax planning and the problem solving, which gross-up method is recommended for better tax planning. The diverse problems are the preceding research only emphasize in tax planning for permanent employees, evaluation to the existing method (gross method) and the recommended one (gross-up method), and evaluation of the implementation of recommended withholding method through yearly comprehensive income. This research tries to creates tax planning for both permanent and non permanent employees, make evaluation of each permitted withholding method of income tax art.21 and make evaluation from month to month of tax saving that could be generated and the influence through yearly comprehensive income.

Another researches by Asriyani for “Sistem Penggajian Karyawan Pada Perusahaan Daerah Air Minum (PDAM) Kabupaten Kudus” and Rachman

Pembangkitan Jawa Bali di Surabaya. Both problems examined were the effectiveness of payroll system in each company. Elements related to payroll system also examined. Research result shown several deficiencies in the system, especially for separation of duties and authorization function. Upgrading payroll system was recommended for better system. Summary from the research is payroll systems are the company should be strictly supervised and treated to prevent misuse and fraud. All relevant sections must be able to perform the duties in accordance with its function, so that payroll system can run smoothly.

CHAPTER 3

RESEARCH METHODOLOGY

3.1Research Approach

This research is using qualitative approach. Denzin K. and others (2005) state “qualitative research is a method of inquiry employed in many different academic disciplines, traditionally in the social sciences, but also in market and further contexts”.

The research type used is case study research. Yin (2008:23) defines “the case study research method as an empirical inquiry that investigates a contemporary phenomenon within its real-life context; when the boundaries between phenomenon and context are not clearly evident; and in multiple sources of evidence are used”.

3.2Research Scope

The research scope of this research is the payroll system and income tax art.21 withholding and collecting procedure. Several laws which included in this scope such as:

1. Amendment number 6 years 1983 as changed into amendment no.28 year of 2008 regarding general taxation provision and procedure.

2. Amendment number 36 year of 2008 as the fourth amendment to the law number 7 year 1983 regarding income tax

3.3Data Type and Source

The type and resource of the data in this research including qualitative and quantitative data, with data source stated as following:

a. Primary data; is data obtained in which the purpose of issuance is intended for this research only. A primary data obtain from this research is interview list.

b. Secondary data; is a data in which the purpose of issuance is not intended for this research. Secondary data obtained from this research are company SS statement of financial position, overwork recapitulation, salary recapitulation, and payroll policy.

3.4Data Collecting Procedure

As equal with the research procedure in general, in short, the data collecting procedure of this research are:

1. Preliminary Survey

Preliminary survey is performed to get company’s general view and its

current condition. General information of Company SS such as general business, policy, working procedure and condition are obtained during the preliminary survey of research.

2. Literature Review

(2007), accounting information system book by Bodnar (2010) and management information system book by Laudon & Laudon (2010), Romney and Steinbart (2009), Hall (2008).

3. Field Research

Trochim B. (1999) states “field research can be considered either as a broad approach to qualitative research or a method of gathering qualitative data”. The

essential idea is that the researcher goes “into the field” to observe the

phenomenon in its natural state or in situ. The research carried out through:

a. Observation

Langley (1988) states “observation involves looking and listening very carefully”. Payroll system and implementation of income tax art.21 are observed in this research. This research also observes the procedure and implementation of payroll policy performed by employees of Company SS.

b. Interview