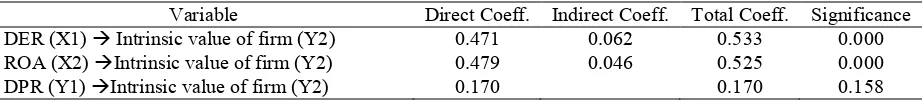

The Effect of Capital Structure, Profitability and Dividend Policy on Intrinsic Value of Firm

Teks penuh

Gambar

Dokumen terkait

A good dividend policy produces a balance between current dividends, future growth, and maximizing the company's stock price, which is called optimal dividend policy (Sitanala,

(2009), who reviewed the effect of family ownership and dividend payment in Indonesian firms, the influence of insiders, state enterprises, and foreign ownership on dividend

Second, the independent variables used are limited to profitability, debt policy, dividend policy, and investment decisions that affect the dependent variable on

*Corresponding author: zainudin@unkhair.ac.id The Effect of Debt Policies, Profitability, Managerial Ownership Structure, and Liquidity on Dividend Policy ZAINUDDIN* OKFITA

The results of this study indicate simultaneously the effect, profitability ratios and liquidity ratios, on real estate and property companies have a significant effect on capital

THE EFFECT FIRM SIZE ON COMPANY VALUE WITH PROFITABILITY AS INTERVENING VARIABLE AND DIVIDEND POLICY AS MODERATING VARIABLE Suci Atiningsih1, Khairina Nur Izzaty2 STIE BANK BPD

"THE EFFECT OF INTERNAL FACTORS ON CAPITAL STRUCTURE AND ITS IMPACT ON FIRM VALUE: EMPIRICAL EVIDENCE FROM THE FOOD AND BAVERAGES INDUSTRY LISTED ON INDONESIAN STOCK EXCHANGE 2013-

The Effect of Profitability, Liquidity, and Company Size on Firm Value Through Corporate Social Responsibility in LQ45 Companies Listed on the Indonesia Stock Exchange.. In