Refer to Important disclosures on the last of this report

Stock DataTarget price (Rp) Rp1,600

Prior TP (Rp) Rp1,600

Shareprice (Rp) Rp1,125

Upside/downside (%) +42.2

Sharesoutstanding (m) 3,561

Marketcap. (US$ m) 263

Government of Indonesia 51.0%

Public 49.0%

PT Indo Premier Sekuritas [email protected] +62 21 5793 1168

Strong 9M18 earnings, above expectation

Earnings grew by 64% in 9M18, above market expectation.

Record-high gross margin in 3Q18 of 16.9%.

New contract grew by 23% yoy in 9M18, but below expectation.

Maintain Buy with TP of Rp1,600.

Company’s strongest 9M achievement ever.

ADHI reported strong earnings of

Rp336bn in 9M18 (+64% yoy), which came above expectation forming 46%/42%

of our/consensus FY18F estimate, which was company’s strongest 9M

achievement ever (5-years average: 34%). Top line was growing by 8.2% yoy in

9M18, supported by robust growth in EPC and infrastructure segment of 110%

and 92% yoy, respectively. In quarterly basis, ADHI booked earnings of Rp123bn

in 3Q18 (+24% yoy, -12% qoq), forming 17% of consensus FY18 estimate.

Better profitability due to EPC and property segment.

Amid rising interest

expense to Rp344bn in 9M18 (17% yoy), there were margin expansions all across

the board supported by increase contribution from EPC and property segment to

7.5% and 6.2%, respectively (from: 3.9% and 5.0% in 9M17) which has better

margin. In 3Q18, ADHI booked record-high gross margin at 16.9% which mainly

supported by EPC and property segment which booked high margin at 17.2% and

19.5%, respectively. Going forward we believe ADHI to booked net margin of

4.3%/5.0% in FY18F/FY19F as ADHI take on more EPC and property projects.

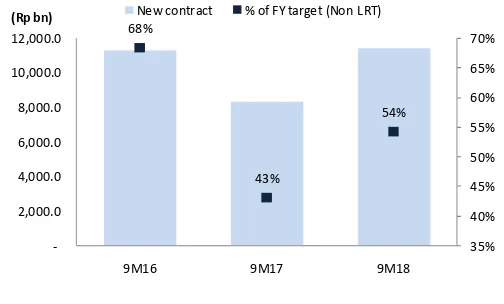

Low 9M18 new contract achievement.

Adhi Karya reported new contract of

Rp11.4tn in 9M18 (+37% yoy), forming 54%/50% of our/company’s FY18 target

of Rp23tn/Rp21tn. The new contracts are mainly contributed from building

projects by 65%, followed by Road and Bridge and Other Infrastructure with 20%

and 15%, respectively. Despite sluggish 9M18 contract achievement, we still

maintain our FY18F new contract target as we expect ADHI to book several major

projects in 4Q18 from Dam project (38%), Bridges (31%) and others (31%). As

of 9M18, ADHI has total orderbook of Rp26tn, which translate to

orderbook-to-revenue ratio of 1.7x providing modest profitability in FY19F.

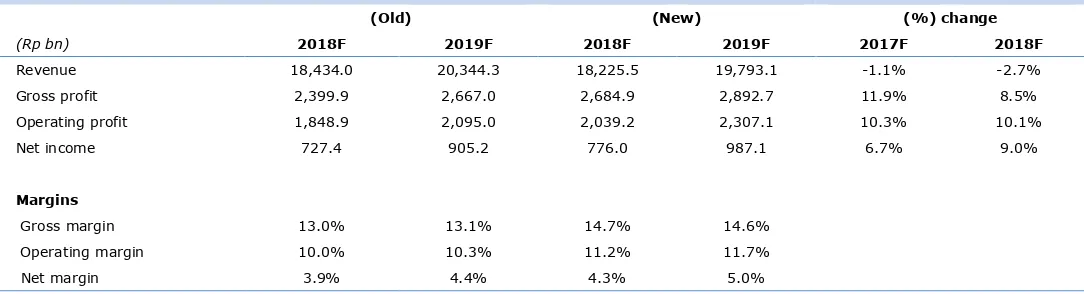

Maintain Buy with unchanged TP of Rp1,600.

We increase our FY18/FY19F

forecast by 7%/9% as EPC segment started to book positive margin in 3Q18.

However our DCF based TP is unchanged at Rp1,600/share, as we implement

higher gearing of 1.3x for FY18F (1H18:1.1x). ADHI currently trades at single

FY18F P/E of 5.2x, which is the second cheapest among its SOE contractor peers

(only behind WSKT with 4.5x FY18F P/E). Key risk to our call might come from

lower than expected contract achievement and another delay in turnkey project

payment.

Source: ADHI, IndoPremier Share Price Closing as of : 29-October-2018

2

Refer to Important disclosures on the last of this report

Fig. 1: Revenue by segments Fig. 2: New contract trend

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Increase contribution from EPC and Property segment Fig. 4: 9M18 Revenue segments

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Expect better margin going forward Fig. 6: 9M new contract achievement

Source: Company, IndoPremier Source: Company, IndoPremier

-2014A 2015A 2016A 2017F 2018F 2019F

Investment in infrastructure Real estates EPC Construction

(Rp bn)

2014A 2015A 2016A 2017A 2018F 2019F 2020F

(Rp bn) New Contract LRT

78% 85% 83% 85% 83% 83% 83%

Construction EPC Property Investment in infrastructure

Construction

2014A 2015A 2016A 2017F 2018F 2019F 2020F

Gross margin Operating margin Net margin

3

Refer to Important disclosures on the last of this report

Fig. 7: 9M18 result

(Rp bn) 9M18 9M17 YoY 3Q18 2Q18 QoQ % to Ours % to Cons

Revenue 9,432 8,715 8.2% 3,349 2,941 13.9% 51% 50%

Gross profit 1,489 1,012 47.1% 565 492 15.0% 62% 56%

Operating profit 1,104 765 44.3% 431 363 18.6% 60% 58%

Net income 336 205 63.6% 123 139 -11.9% 46% 42%

Margins

Gross margin 15.8% 11.6% 16.9% 16.7%

Operating margin 11.7% 8.8% 12.9% 12.4%

Net margin 3.6% 2.4% 3.7% 4.7%

Source: Company, IndoPremier

Fig. 8: Earnings change

(Old) (New) (%) change

(Rp bn) 2018F 2019F 2018F 2019F 2017F 2018F

Revenue 18,434.0 20,344.3 18,225.5 19,793.1 -1.1% -2.7%

Gross profit 2,399.9 2,667.0 2,684.9 2,892.7 11.9% 8.5%

Operating profit 1,848.9 2,095.0 2,039.2 2,307.1 10.3% 10.1%

Net income 727.4 905.2 776.0 987.1 6.7% 9.0%

Margins

Gross margin 13.0% 13.1% 14.7% 14.6%

Operating margin 10.0% 10.3% 11.2% 11.7%

Net margin 3.9% 4.4% 4.3% 5.0%

4

Refer to Important disclosures on the last of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 11,064 15,156 18,225 19,793 22,343

Cost of Sales (9,949) (13,098) (15,541) (16,900) (19,091)

Gross Profit 1,115 2,058 2,685 2,893 3,252

SG&A Expenses (456) (581) (792) (780) (894)

Operating Profit 659 1,477 1,893 2,112 2,358

Net Interest (95) (341) (449) (445) (480)

Forex Gain (Loss) 64 7 0 0 0

Others-Net (15) (185) (137) (101) (63)

Pre-Tax Income 613 957 1,307 1,567 1,815

Income Tax (298) (440) (529) (577) (647)

Minorities (2) (2) (2) (3) (3)

Net Income 313 515 776 987 1,165

Balance Sheet

Cash & Equivalent 3,365 4,131 4,650 4,140 4,155

Receivable 3,970 3,739 4,123 4,485 5,011

Inventory 131 3,683 3,562 3,712 3,979

Other Current Assets 9,368 13,264 14,918 16,620 18,487

Total Current Assets 16,835 24,818 27,252 28,957 31,632

Fixed Assets - Net 1,814 1,876 3,677 4,850 5,434

Goodwill 0 0 0 0 0

Non Current Assets 1,446 1,639 1,691 1,836 2,005

Total Assets 20,095 28,333 32,621 35,643 39,071

ST Loans 2,344 3,537 5,012 5,443 6,144

Payable 8,373 11,611 0 13,362 15,141

Other Payables 1,828 2,235 2,466 2,644 3,047

Current Portion of LT Loans 500 250 250 500 0

Total Current Liab. 13,044 17,633 19,302 21,950 24,332

Long Term Loans 1,428 4,665 6,612 6,208 6,364

Other LT Liab. 180 164 214 237 258

Total Liabilities 14,653 22,463 26,129 28,395 30,954

Equity 3,415 3,413 3,413 3,413 3,413

Retained Earnings 1,997 2,446 3,052 3,807 4,675

Minority Interest 10 11 12 13 14

Total SHE + Minority Int. 5,422 5,869 6,477 7,232 8,102

Total Liabilities & Equity 20,075 28,332 32,606 35,627 39,056

5

Refer to Important disclosures on the last of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 315 517 778 990 1,168

Depr. & Amortization 66 131 208 332 421

Changes in Working Capital 2,074 191 (434) 1,268 1,057

Others (301) (3,124) (3,425) (804) (997)

Cash Flow From Operating 2,154 (2,285) (2,872) 1,786 1,649

Capital Expenditure (1,257) (386) (2,062) (1,649) (1,175)

Others 163 104 145 163 145

Cash Flow From Investing (1,094) (283) (1,917) (1,486) (1,030)

Loans 1,153 4,181 3,422 277 357

Equity 1 0 0 0 0

Dividends (94) (94) (155) (233) (296)

Others (195) (447) (560) (588) (613)

Cash Flow From Financing 866 3,640 2,707 (544) (552)

Changes in Cash 1,926 1,072 (2,083) (244) 67

Financial Ratios

Gross Margin (%) 10.1 13.6 14.7 14.6 14.6

Operating Margin (%) 6.0 9.7 10.4 10.7 10.6

Pre-Tax Margin (%) 5.5 6.3 7.2 7.9 8.1

Net Margin (%) 2.8 3.4 4.3 5.0 5.2

ROA (%) 1.7 2.1 2.5 2.9 3.1

ROE (%) 5.9 9.1 12.6 14.4 15.2

ROIC (%) 5.2 5.2 5.6 6.1 6.6

Acct. Receivables TO (days) 84.8 70.2 61.3 61.4 59.7

Acct. Receivables - Other TO (days) 35.4 22.6 17.5 18.0 17.9

Inventory TO (days) 67.8 6.9 4.3 4.6 5.0

Payable TO (days) 272.6 278.4 272.3 269.3 272.5

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 78.8 144.0 183.3 168.0 154.4

Interest Coverage Ratio (x) 0.4 0.3 0.3 0.3 0.3

Net Gearing (%) 16.7 73.6 111.5 110.8 103.1

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS