The Effect of Earnings Management on Firm Value before and When IFRS Implementation, Modereted Life Cycle Company

Teks penuh

Gambar

Dokumen terkait

Meanwhile in Indonesia, Widhiastuti’s study (2011) shows that there is a decrease in the relevance value of accounting information due to earnings management in

This study aims to determine whether IFRS adoption will have a positive effect on earnings response coefficients of firms in Australia and the European Union (EU) and whether

The result of the research showed that firm size, leverage, profitability, and voluntary disclosure simultaneously had significant influence on Earnings Response Coefficient in

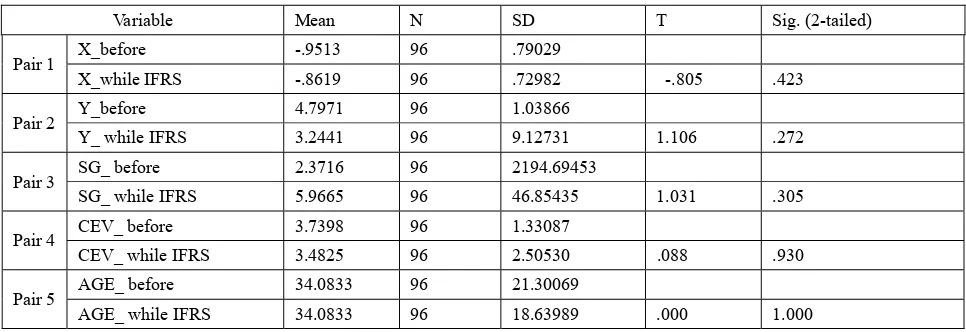

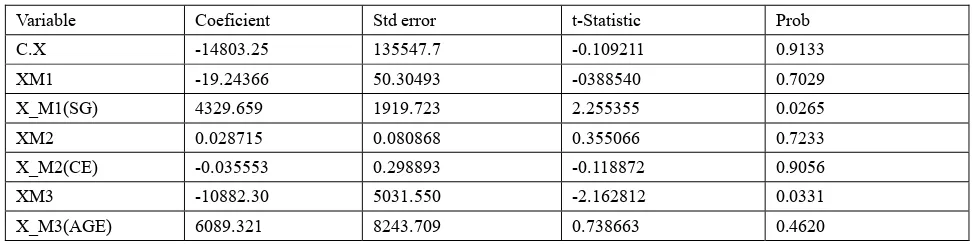

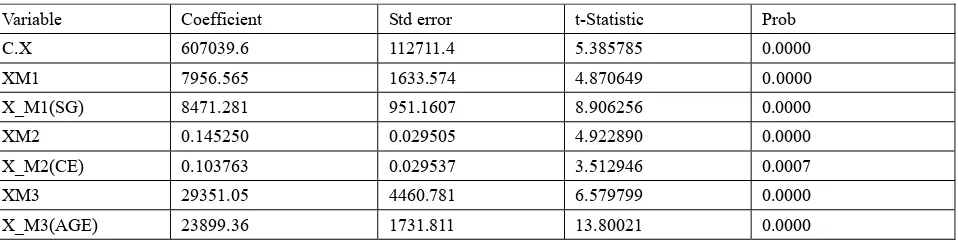

Abstract: This research aimed to examine whether earnings management (EM) proxied with the practice of accrual management (AM) and real activity manipulations

This study is expected to contribute to the development of the theory, especially the study of financial accounting of the positive accounting theory, firm size, earnings man- agement,

The results of the analysis and testing show that with control variable leverage and profitability, earnings management variables have a significant effect on firm value but not with

For independent variables, the study used accounting standards 1 if company adopt IFRS, 0 otherwise, and to test whether the effects of IFRS adoption on magnitude of earnings management

This study, as a replication of the study con- ducted by Phillips, Pincus and Rego 2003, is to test whether deferred tax expense is more powerful in detecting earnings management to