Internal Audit as part of the management structure had various functions within business operation structure. In summary, In the Procedure of the Petty Cash as an Internal Audit was the document that had to be checked by an Auditor.

START

In addition, the audit result was derived from the process of this vouching process which would later be confirmed by the management of AJ Corporation. After Marketing and Sales collected a payment from the customer, the fund could be paid in cash or review the receipt and then proceed with the data entry by the AJ Corporation cashier, creating documentation for each of these processed receipts. In AJ Corporation's warehouse inventory, inflow occurred in three ways: a purchase order, rejection, or sales return.

Distribution of warehouse in AJ Corporation daily when they received goods from the container wagon expedition (purchase order). Stock outflow for AJ Corporation was also based on the document called Good Issue document. Similarly, the analysis can also be used as the basis of explanation of the AJ Corporation management of the irregularities that occurred through March 2018 to March 2019.

In addition, AJ Corporation had an average of 167 transactions in a month in 2008. From the auditor's point of view, this cash deposit showed the flow of money coming into the account, while the overall transaction reflected how much money AJ Corporation was spending each month.

PETTY CASH REVERSING ENTRIES %

However, as a human being it is normal to make a mistake, the same happened at AJ Corporation. Although these entries are not always a sign of irregularities like an internal audit, the amount of these reversed entries was portraying a weakness in a system that factored in human error, it also shows how good and how diligent the resources are human resources at AJ Corporation and that there are many these contrasting notes may also indicate a bad signal that the need for better human resource was necessary. The assessment of the adequate effect of Internal Audit to suppress the error in entering data in the petty cash account can show how much percentage it decreases every month starting from about 10% at the beginning of 2018 until it becomes stable in about under 2% in each of the months throughout the year.

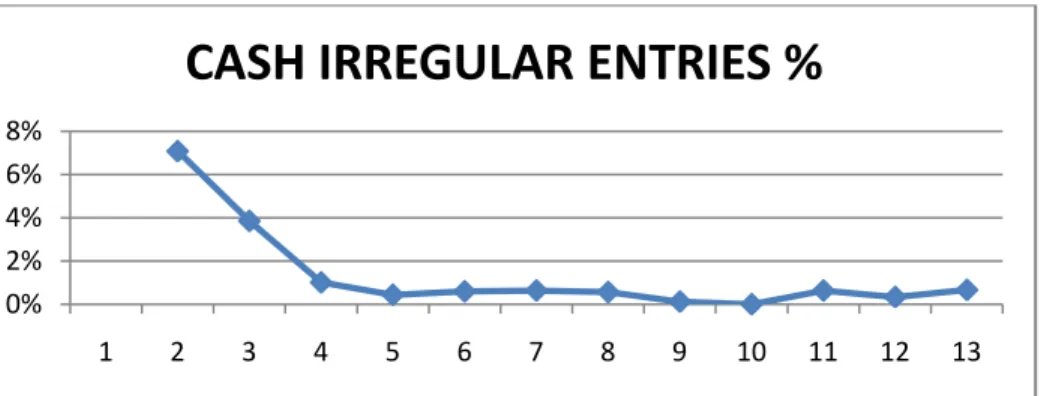

This sensitive matter was confirmed to the management of AJ Corporation to provide a clear explanation whenever this unvalidated data and document was not syncronized. In AJ Corporation all the unvalidated inputs and irregularities could be correctly identified with a good explanation during the year for auditing a petty cash account. Among the total data inputs in 2008 in the system, the irregular entries did not occur more than 5% in October and an average of 3 irregular entries in each month.

PETTY CASH IRREGULAR ENTRIES %

This could show how effective internal audit is in addressing the problem of irregularities in the real business situation. Satisfactorily, for each of these erratic entries had already been confirmed by a good explanation and no sinister reason behind the problem. The problem most commonly caused by the erratic entry was a missing document or signature, or false entries that have not yet been reversed.

In small change, an internal audit of AJ Corporation was counted every month. In general, the change in change was stable at zero from March to November and peaked in March. Based on this chart in petty cash, the difference between system and cash situation had an upward direction, it means that there is excess money in the system.

PETTY CASH COUNT DIFF

Out of 6,885 total transactions for the year in each month, AJ Corporation had an average of 573 transactions or 143 transactions each week. The bank deposit reflected the deposit made by AJ Corporation's accountant from the cash he regularly collected from the bank each month, on average AJ Corporation's management made 7 deposits each month, so about once or twice a week depending on the situation. Reversing entries in this cash account procedure has a similar definition to that in the petty cash audit procedure.

Percent of undo entries was calculated by undo entries divided by total data entry times by 100%. This percentage can represent the number of incorrect entries in the system. Of these items, April's reversal of bookings peaked at 9% revealing the effectiveness of internal audit to regulate management represented by the chart's stable figure throughout the year starting from the peak in April, a downward shift to November at 1% remained stable until March with about a 1 or 2% difference. Based on the agency theory in the real business situation at AJ Corporation, this created a good example that the agency theory was true as it could minimize the error based on the reverse bookings.

CASH REVERSING ENTRIES %

Briefly, irregularities are defined as problematic entries that need further confirmation by management before categorizing them as fraud in the records. In AJ Corporation as a peer interview with management staff in most cases these irregular entries have appeared as a result of almost the same reason as petty cash and until this report was made there is no substantial fact that could prove otherwise . Fortunately, according to the result of the audit and the confirmation of the management of AJ Corporation, the irregularities can be explained and by the end of the day there was no loss in AJ Corporation.

In the AJ Corporation Cash procedure, the calculation of cash is done correctly, although in many cases the money has already been deposited in the bank to keep money in the zero vault. This is in line with AJ Corporation's standard operating procedure which aimed to keep it as low as possible, the reason for this procedure being because the less money was inside the safe, the less risk of losing the money it contained. . The nature of the cash procedure which involved the substantial amount of money being collected by the AJ Corporation collector would naturally create a lot of risk.

CASH IRREGULAR ENTRIES %

In addition, this graph shows how a control in management works properly and management complies with the most important work regulations. Analysis of this table, as many zero numbers in the table show, could indicate how management conforms to their own principle of working environment. This may indicate a bad sign from the system or there was a change in a system that needs further confirmation.

Expected as a management confirmation of what was going on, there were changes in the system. The change in the system happened without any confirmation from management. An investigation was launched and an internal audit found that the bank deposit was normally entered on the day of the deposit, but it was changed in February that the deposit was entered into the system based on the day the money was collected, when in fact the deposit did not happen on the exact day the money was collected. This caused a problem in keeping the accounting books so that the data did not show the real date of the transaction.

OPNAME DIFF

The discrepancy was also properly investigated and the money was not lost the problem was only because the time in entering the data was not exactly the same as the money deposited in the bank. AJ was not a special case and the problem appeared many times in the management as well. Dead stock: When the product becomes too old and obsolete before it can be sold This can happen due to rebranding of the ink itself on the packaging etc.

Out of stock: Appears in the point when there is no product to sell in stock in AJ Corporation, it can happen in the specific article. Furthermore, other than these reasons, the human error in the data entries further contributed to this case. Coherent that the data gradually became stable at the almost zero difference in the last two stock survey worldwide in AJ Corporation.

TOTAL ITEM DIFF

The list of items that did not match the data could be seen to fall down from April to March, starting at 40 at the top list of items over 1900 down to around 20 in March 2019. This is also synchronized with different prices, while zero is the number she was looking for. Based on this data, it is safe to assume that in general, the presence of internal audit, the cooperation with AJ Corporation, the compliance of good management with the good management of the company was successfully implemented, that a great improvement was seen, and the director of AJ Corporation was also happy with the current improvement conditions.

TOTAL ITEM PRICE DIFF

Petty Cash Audit was already has a good comprehensive organizational coverage implemented in AJ Corporation standard operating procedure. The management of AJ Corporation also showed good coordination with an internal audit program, this could also indicate good compliance with company rules. In connection with the system change, there should be a procedure that regulates the regular meeting with AJ Corporation's personnel management for a fixed period.

A good suggestion with the cash Procedure audit Journal also had to be enforced in the business in AJ Corporation to create management for good governance. Therefore, for AJ Corporation, there is a good suggestion to use a barcode scanner system to improve the inventory and warehouse system into a better system. AJ Corporation must fully deliver on this promise, not just in 2018 and 2019, but all the time to create effective management compliance.