Levin, “Central Bank Digital Currency and The Future of Monetary Policy,” NBER Working Paper Series, no. 28 Bank for International Settlements, “Central Bank Digital Currencies: Foundational Principles and Core Features,” 2020, https://www.bis.org/publ/othp33.pdf.

B. The Sovereign Power Over Money

In Indonesia, the definition of currency and money can be found in the Indonesian Currency Law, which regulates currency as money issued by the state and money as legal tender or legal tender.48 However, this law only regulates specific forms of money. declared as legal tender. From the concept of money as we discussed above, we can conclude that money is any kind of medium that serves to pay off debts, make payments or fulfill financial obligations.

C. The State Theory of Money

From the above explanation of money, including the relevant theories, we can see that no other party can create money as legal tender except the state and such creation is carried out through legislation. The circulation of money is also determined by the state, irrespective of the material, the purchasing power and the external value of money. First, CBDC must be issued as legal tender by the state represented by the central bank under the relevant constitutional framework.

The central bank as the agent of the state has sovereign power over currency, including creating a monetary system that circulates various forms of money, including digital. Currently, the Indonesian Currency Act gives such a mandate to the central bank to issue money as legal tender and stipulates that certain aspects of money as legal tender must be coordinated with the Ministry of Finance. The circulation of money as legal tender is necessary to underline the sovereign power of the state.

CBDC UNDER INDONESIAN LAW

Therefore, when the central bank launches CBDC as legal tender in Indonesia, the Indonesian currency law or other relevant legislation should be able to contain clear provisions about CBDC as legal tender.

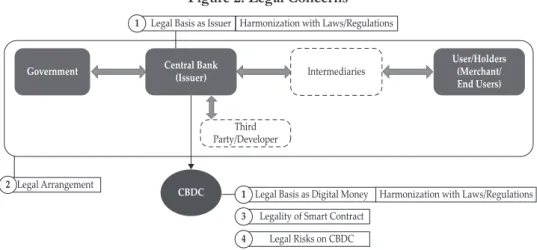

A. Legal Basis

With regard to the legal basis of CBDC in other countries, the Bahamas is the only country to have introduced legislative reforms related to CBDC, while Jamaica is still in a process to change its law to allow the Bank of Jamaica to issue CBDC from 74 Nigeria has also issued regulatory guidelines for the operation of its CBDC, namely e-Naira. The guidelines were issued to implement the Central Bank of Nigeria's mandate to issue legal tender in Nigeria.75 Other countries, such as Sweden, China and the Eastern Caribbean Monetary Union, are still preparing for legal reform , while Uruguay and Canada have no planned law reform. to address CBDC.76.

A.1. Legal Basis of CBDC as Money in Digital Form

Act 2020 (CBBA 2020) issued on July 27, 2020, which reads "[t]he currency of the Bahamas shall include notes, coins and electronic money issued by the Bank under the provisions of this Act." In the CBBA 2020, the electronic form of money is included as a new form of currency in the Bahamas. Furthermore, for its implementation, the central bank of the Bahamas issued BDDC Regulations 2021 which, among other things, stipulates wallet providers, issuance and distribution of BDDC, including the prohibition of interest payments and limits for the circulation and withdrawal of deposits.

A.2. Legal Basis for the Central Bank as the Issuer of CBDC

Regarding the institution authorized to issue and control the circulation of the Rupiah, the Indonesian Monetary Law regulates Bank Indonesia to determine the nominal value, features, design and material of the Rupiah as a central bank of the Republic of Indonesia to be determined in coordination with the government. 81 Furthermore, the process of planning, printing, issuing, distributing, revoking and withdrawing, and destroying the Rupiah (both banknotes and coins) must comply with such law. Under the Indonesian currency law, the process of issuing, distributing, canceling and withdrawing rupiah is solely the competence of Bank Indonesia, while the remaining process is carried out by Bank Indonesia in coordination with the government.82 If Indonesian currency law Digital rupiah as one of the forms of the Rupiah apart from banknotes and coins as suggested above, then the process of planning, printing, issuing, distribution, recall and withdrawal, and withdrawal of Rupiah must also cover digital form of Rupiah to provide a basis for Bank Indonesia in the performance of its tasks related to the Rupiah. Compare the regulations related to CBDC in other countries, for example in the Bahamas, according to article 1 para. p) of CBBA 2020, the functions of the Central Bank of the Bahamas included regulation and supervision of the issuance, provision and functioning of payment instruments, with or without the opening of an account, including the issuance of electronic money or any other forms of stored value.

Under this law, the Central Bank of the Bahamas has a solid legal basis for issuing the Sand Dollar as a virtual currency. This clause strengthens the legal basis of the Central Bank of the Bahamas to issue any kind of electronic money, including virtual currencies.

A.3. Harmonization with Existing Laws and Regulations

To ensure the protection of the rights of consumers/holders of CBDC, technical guidelines or core rules available for CBDC transactions should be revised regularly to accommodate the development of technology used in CBDC. In connection with this principle, it is necessary to examine a general principle of good faith when receiving goods, including money, in Indonesia. Regarding the status of ownership of CBDC in Indonesia as a movable and intangible asset, a thorough assessment should be made as to whether the existing articles of the ICC can also be given precedence over CBDC or perhaps the issuance of new laws/regulations to expand the concept of ownership of digital money or the concept of movable property may be the solution.

This assessment could address Gleeson's concerns regarding the transfer of digital currency as property, as discussed earlier, and considering the idea that assets transferred are debts owed to account holders. In addition, the Federal Reserve study shows that it is essential to consider how privacy and personal data are respected and protected in a CBDC arrangement.89 In relation to this concern, Nabilou proposed the use of CBDC technology, which is likely to be programmable. money capable of adapting various functions and smart contracts raises privacy concerns and therefore requires public central bank accountability, adequate safeguards and standards of judicial review.90 There is also a need to create a regulatory framework for CBDCs that can adopt technical safeguards data protection measures by prohibiting data collection by front-end applications.91 Privacy and data protection concerns regarding CBDCs in Indonesia should be addressed in relevant laws. Legislators should also consider evaluating current civil law and criminal procedure when cases related to CBDC transactions become available in the future, regarding, inter alia, evidence, forfeiture, and smart contract enforceability (including cross-border transactions).

A.4. Legal Relationships Among Relevant Parties

However, the legal principles, schedule, liability and treatment of funds, including the finality of payments under the Transfer of Funds Act, need to be reviewed to see if we can apply a similar legal construct to CBDC in Indonesia. With regard to intermediary institutions, holders of CBDC and third parties, the legal settlement depends on the characteristics and design of CBDC, whether it is CBDC in large or small, direct or indirect, account or token based , or other designs, and whether the central bank will collaborate with the third party in building the infrastructure, platform or technology for CBDC. The scope of each legal arrangement can be stated in regulation(s) that deal with the responsibility or liabilities and obligations between parties, including the treatment of CBDC as a legal claim against the central bank or intermediaries/agencies, the mechanism of authentication and transfer, the finality of the transaction, payment, intellectual property rights, etc.

In addition, the rules of ownership and transactions using CBDC and mechanism for consumer protection will also be predetermined by the central bank as an issuer of CBDC, adapted to the type of networks or technology, infrastructure and platforms used for CBDC. Nabilou studied the potential legal challenges that the central bank faces in issuing its digital currency and concluded that the nature of the legal challenges of CBDC will ultimately depend on its characteristics.93 For example, retail CBDC can asking central bank to intervene. roles and responsibilities in respect of the general public carried by private sector banks today by private sector banks in respect of their customers.94.

B. Smart (Legal) Contracts Related to CBDC

When the parties agree to exchange code, they have essentially agreed on how it will be written and are writing the code on the relevant distributed ledgers. When the code is executed, the transaction is executed, such as wire transfer or interparty payments, and then recorded in the distributed ledger. Under this model, the parties agree on the natural language contract before executing the established codes.

DLT can be in the form of “permissioned”, “permissionless”101 systems, or “consortium or permissioned DLT systems.102 Assuming that CBDC is created through DLT, central banks almost certainly use “permissioned” DLT networks, whereas central banks can fully control the participants including granting access to them on the network as well as setting the rules for the transactions.103 In contrast, "permissionless" DLT networks commonly used for Bitcoin and Ethereum allow public and full transaction transparency. If the CBDC is created through a permissioned network, central banks should , as the controlling authority, carefully lay down the rules of the networks, including the process of transactions, authentication and registration processes when conducting transactions related to the CBDC.105 Creation of "how-to".

C. Legal Risks on CBDC

CONCLUDING REMARKS

To complete this part of the discussion, the central bank and government, including relevant third parties, should be able to identify any legal risks and take measures to mitigate those risks. News Release: CBDC Role in Strengthening Central Bank Mandate Implementation”, accessed 18 July 2022, https://www.bi.go.id/. Central Bank Digital Currencies - Design Principles and Balance Sheet Implications." Bank of England - Staff Working Paper, No.