Keywords: Good Corporate Governance, Profitability (ROA), Board of Commissioners size, independent Board of Commissioners composition, institutional ownership, management ownership and Board of Directors size. Kata Kunci Good Corporate Governance, Profitability (ROA), Board of Commissioner size, independent Board of Commissioner composition, institutional ownership, management ownership and Board of Director size.

INTRODUCTION

LITERATURE REVIEW

RESEARCH METHODOLOGY

ANALYSIS AND DISCUSSION

CONCLUSIONS AND RECOMMENDATIONS

Research Background

Improving the company's profitability requires the use of good company management, so the company must implement Good Corporate Governance (GCG). 5 the interests of the owner, since the manager has the company information that is not owned by the owner (information asymmetry).

Problem Formulation

The corporate governance indicators used in this research are the size of the board of commissioners, the composition of the independent board of commissioners, institutional ownership, managerial ownership, board size and firm performance as measured by return on assets (ROA). Based on the description, the researcher was motivated to conduct a research entitled: "The effect of good corporate governance on an empirical study of the profitability of manufacturing companies listed on the Indonesian Stock Exchange.

Benefits of Research

This research is a good opportunity for the researcher to apply the theory, especially the theory in accounting and management in the world of actual practice that can improve the understanding of the researcher, especially in the context of good business management and its influence to the profitability . Apart from that, this research is beneficial to others, especially to investors, this research can be used as an evaluation report for the investor to choose the company they are willing to invest.

Basic of Theoretical 1. Agency Theory

Friedman (1962) states that the main purpose of the company is to maximize the prosperity of their owners. This suggests that the definition of stakeholders originally refers only to the owners of the company.

Good Corporate Governance

- The Size of Board Commissioners

Improve the efficiency and effectiveness of the work of the company's Board of Directors and management. Improve the quality of the relationship between the Board of Directors and the company's senior management. Good corporate governance has several principles; the principles of good corporate governance can certainly be applied to every aspect of business and throughout all levels of the company.

Board of Directors is charged with the management of the company and Board of Commissioners is responsible for supervising the Board of Directors. 21 Board of Commissioners has very important roles in the company, especially in the implementation of good corporate governance. The Board of Commissioners lies at the core of corporate governance which aims to ensure strategic guidance mechanism.

Independent Board of Commissioners

- The Ownership Structure

- The Size of Board Directors

- Profitability Analysis

Institutional ownership can indicate the presence of institutional investors who have strong corporate governance mechanisms that can be used to monitor the company's management (Tarjo, 2008). The board of directors is a party to a corporate entity tasked with the operation and management of the company. The board of directors is responsible for the company's dealings with external parties such as suppliers, customers, regulators and legal parties.

The profitability of the company will influence the policy of the investors regarding the investments made. As for the profitability of the company itself, it can be used as an evaluation of the effectiveness of the company's management. Profitability ratios aim to measure the performance of current business results, and profitability ratios are not tied to stocks (Ferdiana, 2012).

Previous Research

- Board of Commissioner’s Size on Profitability

- Independent Board of Commissioners Composition on Profitability Independent Board of Commissioners’ composition, it is defined as the

- Managerial Ownership on Profitability

The size of the number of managers in the company can indicate congruence between the interests of management and shareholders. Firms with high management ownership should have a higher return on firm assets. The small or large size of the company's board of directors affects how the process unfolds.

The board of directors is given the mandate to carry out activities within the company. The board of directors is fully responsible for all activities and management of the company to promote the interests of achieving the company's objectives. Therefore, board size plays a role in improving the company's profitability.

The Results of Previous Research

In contrast to Hardikasari (2011), Jensen (1993), Lipton and L'orsch (1992) and Yermack (1996) said that the company has a large size of the board of directors cannot do coordination, communication and decision making better than the company that has a smaller board of directors. Analysis of the implementation of good corporate governance (GCG) the effect of the implementation of corporate performance governance on the financial performance of banking performance in listed companies in the. In this study, which is the independent variable is the size of the Board of Commissioners, the independent composition of the Board of Commissioners, institutional ownership, managerial ownership, the size of the Board of Directors and the dependent variable is the measure of Profitability according to Return on Assets.

The effect of good corporate governance on profitability, empirical research on manufacturing companies listed on the Indonesian stock exchange, period 2012-2015. The independent variables in this study are the size of the Supervisory Board, the composition of the independent Supervisory Board, institutional ownership, management ownership and the size of the Board of Directors. The data on the size of the Supervisory Board, the composition of the independent Supervisory Board, the institutional ownership, the management ownership and the size of the Board of Directors, and the profitability are taken from the financial report of a listed manufacturing company in the period 2012-2015 on the Indonesian stock exchange.

Sampling Method

Data Collection Method

Data on the percentage of institutional ownership and managerial ownership are recorded in a received from equity in the notes to the company's financial statements. The total size and composition of the Board of Commissioners and the total size of the Board of Directors obtained from the notes to the company's financial statements.

Analysis Method

- Descriptive Statistical Analysis

- Classic Test Assumptions

Another way to test for normality is to look at the scatter of the data (dots) on the diagonal axis of the graph or look at the histogram of the residual. If the point extends around the diagonal line and follows the direction of the diagonal line, the regression model meets the assumptions of normality. If the point extends away from the line or diagonal and does not follow the direction of the diagonal, the regression model does not meet normality assumptions.

Multicollinearity test aims to test whether the regression model has found a correlation between the independent variables (Ghozali, 2013:105). According to Ghozali, the purpose of heteroscedasticity test is to test whether the regression model prevents the variance inequality of the residual from one observation to another observation. In this research, researcher used Glejser test for heteroscedasticity test, this test aims to test whether the regression model of the residual variance inequality occurs one different observation to observation.

Hypothesis Testing

- Independent Variable

- Dependent Variable

This research will tell us about the influence of the independent variables, the size of the Board of Commissioners (BOC), the composition of the Independent Board of Commissioners (INBOC), institutional ownership (IO), managerial ownership (MO) and the Board of Directors (BOD) ) in relation to subordinates. variable, Profitability. The independent variables are the size of the Board of Commissioners, the independent composition of the Board of Commissioners, institutional ownership, managerial ownership and the size of the Board of Directors, while the dependent variable is profitability measured by Return on Assets. The size of the Board of Commissioners (BoC) is a board member who is not an employee or a person who deals directly with the company and does not represent the shareholders and to supervise and provide guidance and direction to the management company.

Size of the Supervisory Board, measured by the number of Supervisory Board members in the company. The composition of the independent Supervisory Board is measured on the basis of the indicator percentage of Supervisory Board members from outside the company of all companies of the size of the Supervisory Board. The Board of Directors is empowered and fully responsible for effectively and efficiently managing the company to achieve the company's objectives. Size of the Board of Directors measured by the number of Board of Directors members in the company.

Description of Research Object

- Descriptive Statistics

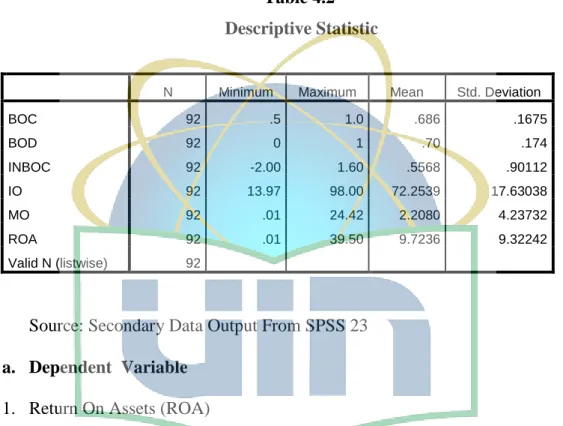

The companies' financial report must show the profit in their net income after tax. Descriptive statistics provide an overview of the minimum value, maximum value, mean (mean), and standard deviation of the data used in the study. According to analysis data from Table 4.2, which shows that the variable BOC has an average of 0.686. The minimum value is .5, the company is Sierad Produce Tbkand, the maximum value is 1.0, i.e. Astra International Tbk whereas the standard deviation value is 1675.

The minimum value is .0 which is Kimia farma Tbk and the maximum value is 1 which is Astra International while the standard deviation value is .174. According to analysis data from Table 4.2 which shows the variable Independent BOC composition has a mean of 0.5568. The minimum value is -2.00 which is Unggul Indah cahaya and the maximum value is 1.60 which is Bantoel International Investmen.

Figure 4.1: Normal Probability Plot of Standardized Residual

Classical Assumption Test

- Hypothesis Testing

From table 4.5 above, it can be seen the probability value of board size, independent board composition, institutional ownership, management ownership and board size>. From Table 4.7 above, it stated that Board of Directors (BoC) size and Institutional Ownership (IO), Independent Board of Commissioners composition (INBOC) and Managerial Ownership (MO) positively affect Return on Assets (ROA), while Board of Directors (BoD) ) size negatively affects the return on assets. It shows that the board of commissioners does not have a significant effect on the return on assets.

This shows that the board of directors does not have a significant influence on the return on assets. The result, consistent with previous research, including those conducted by Jensen (1993), Lipton and L'orsch (1992), and Yermack (1996), showed no significant effect of board size on profitability. This shows that the size of the independent board of commissioners has a significant impact on asset returns.

Implication

Recommendation

FCGI (Forum for Corporate Governance i Indonesien), “Jabatan Dewan Komisaris dan Komite Audit dalam Corporate Governance”, (Corporate Governance Seri Jilid II, 2001. Hardikasari, Eka, “Pengaruh Terhadap Penerapan Good Corporate Governance” om fiansielle resultater i bankindustrien noteret på den indonesiske børs (BEI) i Universitas Diponegoro, Semarang, 2011. Haryani, dkk 2011. “Pengaruh Mekanisme Corporate Governance Terhadap Kinerja: Transparansi Sebagai Variabel Intervening”, Simposium Akuntansi Nasional Aceh XIV .catatan pada Bursa Efek Indonesia (BEI) dan sarjana penanganan, Universitas Diponegoro, Semarang, 2011.

MonisaWati, Seperti, “Pengaruh Praktik Good Corporate Governance Terhadap Kinerja Keuangan Perusahaan di Bursa Efek Indonesia”, Jurnal Manajemen, Volume 01, Nomor 01, September 2012. Pengaruh mekanisme good corporate governance terhadap kinerja keuangan entitas perusahaan. Jurnal Teori & Manajemen Terapan Universitas Surabaya, No. 2, Agustus 2010. Yonedi dan Yulia. “Dampak Mekanisme Corporate Governance Terhadap Kinerja Perusahaan: Bukti Badan Usaha Milik Negara (BUMN) Indonesia”, Simposium Nasional Akuntansi 2011, Banda Aceh, 2011.

Descriptive Statistic