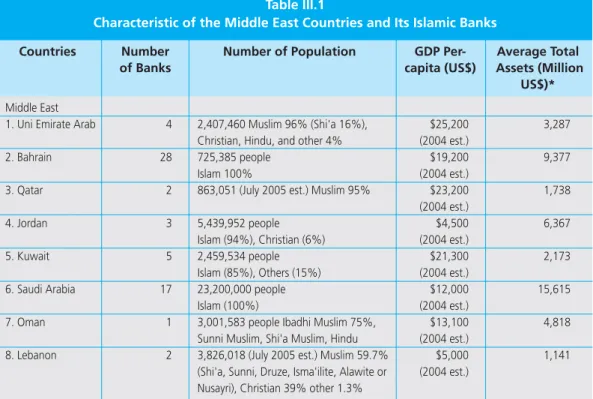

Along with this globalization, the emergence of the Islamic financial institution appears as a new phenomenon. Initially, the growth of Islamic financing coincided with the current account surpluses of the oil-exporting Islamic countries, particularly in the Middle East (Iqbal, 1997). Common motivations for adopting this system are that the Islamic banking model is not purely about profit maximization and that it is risk sharing.

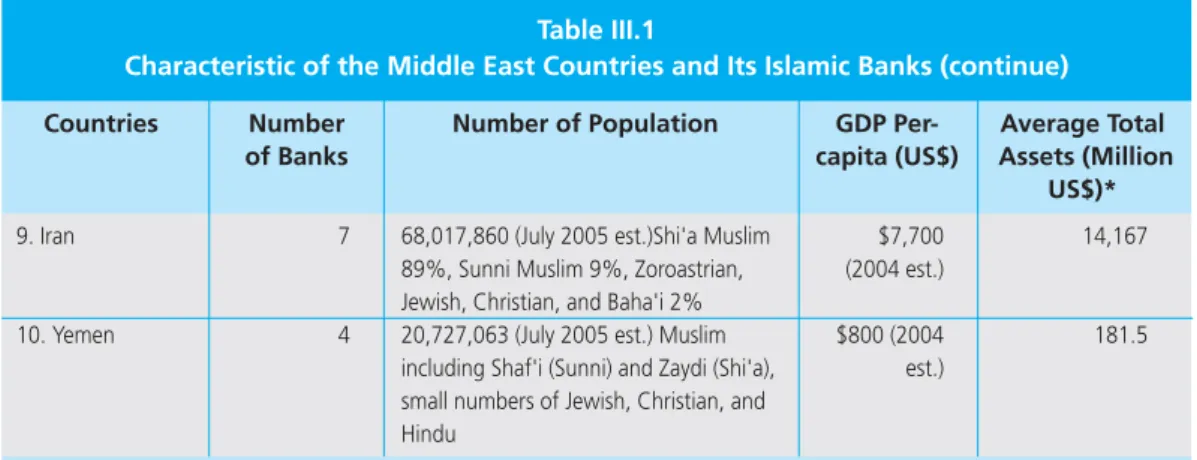

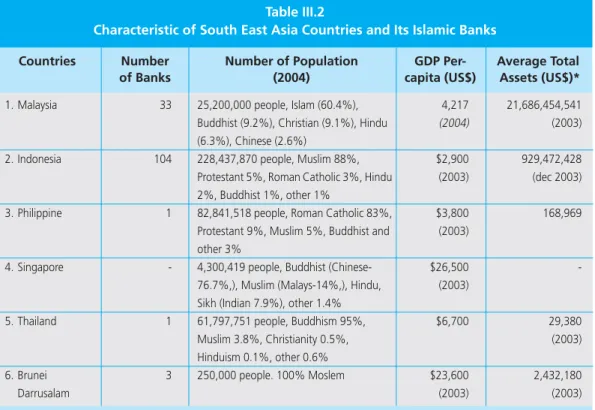

The total asset of the National Commercial Bank (NCB), the largest bank in Saudi Arabia, is more than 80 times that of the Yemeni banks, (The Banker, 2002). During the total capital base of Islamic banking increased from RM5.1 billion to RM6.8 billion (Annual Report of Central Bank of Malaysia, 2005). In its early stage, the share of Islamic banking in Indonesia is only 0.26% of total banking assets.

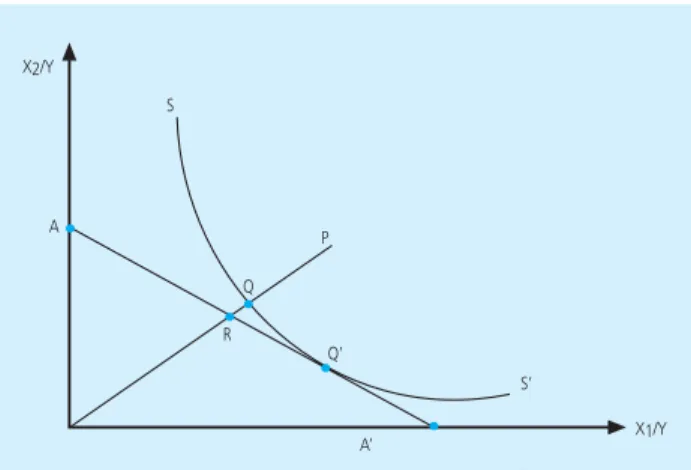

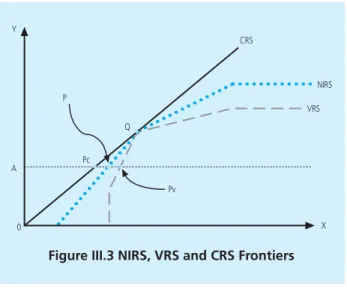

A comparative study of the efficiency and productivity of the Islamic banking industry in Southeast Asia and the Middle East is interesting for several reasons. In Figure III.1, the technical efficiency is measured by the ratio of the distance from the origin to the point Q over the distance from the origin to the point P. On the other hand, output-oriented efficiency measures address how many quantities of the outputs can be expanded for a given input level.

On this study, we choose the so-called Data Envelopment Analysis (DEA), one of the non-parametric classes, to analyze how efficient the Islamic banks can locate the opportunities and provide their assets to the borrowers as a measure of efficiency.

DEA-LIKE Model

In connection with our research objectives, it is possible to analyze the technical and scale efficiency either in CRS or other operating conditions. However, the potential measurement errors among the frontier firms can be a problem since DEA is a non-stochastic approach. The input distance function for firm i with respect to 2 periods, t and s, is defined using equation (III.6), where St={ (xt, yt) : xt ‡ yt} is the production technology that controls the transformation of inputs for period t and other variables corresponding to those previously stated:. III.6) The distance function above measures the smallest proportional change in input at period s to make the input-output set (xs, ys) at period s possible with the technology S t at period t.

The Malmquist productivity index comparing periods t and (t + 1) can then be determined using distance functions, . If we assume that there is no technical efficiency, then dit(xt, yt)= dit(xt+1, yt+1)=1, and the RHS of equation (III.7) will show only the rate of change of the index for the period ( t+1) in relation to period t. With this assumption, the Malmquist TFP index can calculate the change index for each observation for each pair of periods being compared.

If the index is greater than 1, then there has been an improvement in efficiency, vice versa. However, the above assumption is not realistic, rather we will believe to assume that the firm currently operates below their optimal technical efficiency; therefore. In an empirical application, production technology may change over time as a result of technical limits to best practice, better production techniques, new innovations, financial liberalization or due to higher competition.

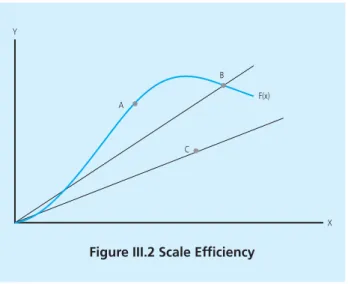

In addressing these possibilities, the Malmquist index allows us to distinguish between shifts in the production frontier (technological change; how much does the production frontier shift for any innovation or shock) and. By relaxing the CRS assumption and adopting a more realistic VRS, the efficiency change index can be decomposed into the components of pure efficiency change and volume efficiency change. The pure efficiency change index measures changes in the proximity of firms to the frontier, excluding scale effects, while scale efficiency indicates whether movements within the frontier are in the right direction to reach the CRS point.

Fortunately, the computer program DEAP Version 2.1 (Coelli, 1996) can provide all of the above types of measurements; (i) changes in constant returns to scale technical efficiency, (ii) changes in.

- Data

- Selection of Variables

- RESULT AND ANALYSIS

- Data Envelopment Analysis Results 1. Multi Stages Result

- CONCLUSION

The period was specifically chosen to see the impact of the financial crisis on the efficiency of the Islamic banks. One of the main problems in the investigation of bank efficiency is the difficulty of defining and measuring the concept of bank output (Casu and Molyneux, 2000). A classic sample is whether the deposit is treated as an input or as an output of the banking services.

Unlike the output approach that measures the bank's output based on the amount of accounts, the intermediation approach uses their value instead. Another reason why we choose the intermediation approach is the nature of Islamic banks, which is often claimed as a joint-stock firm, therefore their shares are highly tradable (Dar and Presley, 2000). Furthermore, the capital structure of an Islamic bank is accepted to be equity-based due to the dominance of shareholders' equity and investment deposits, which derive from the PLS principle (Muljawan, Dar, and Hall 2002).

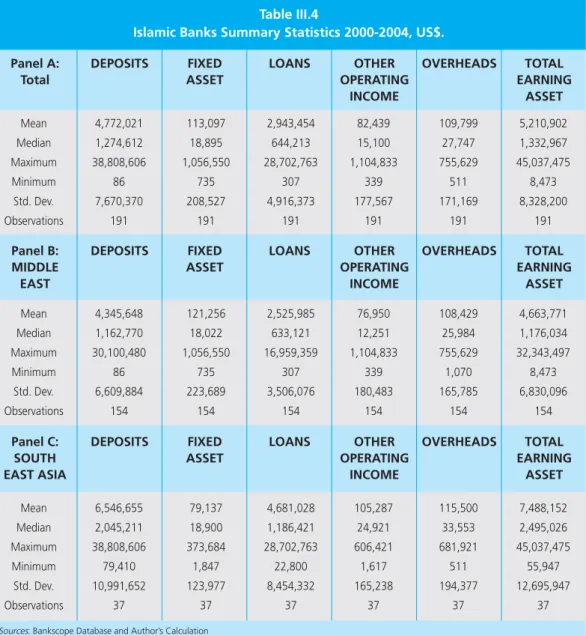

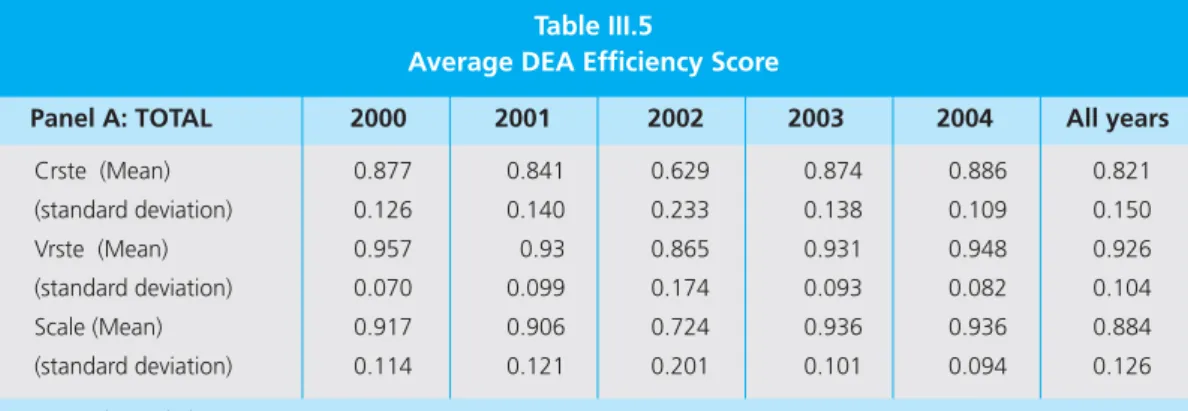

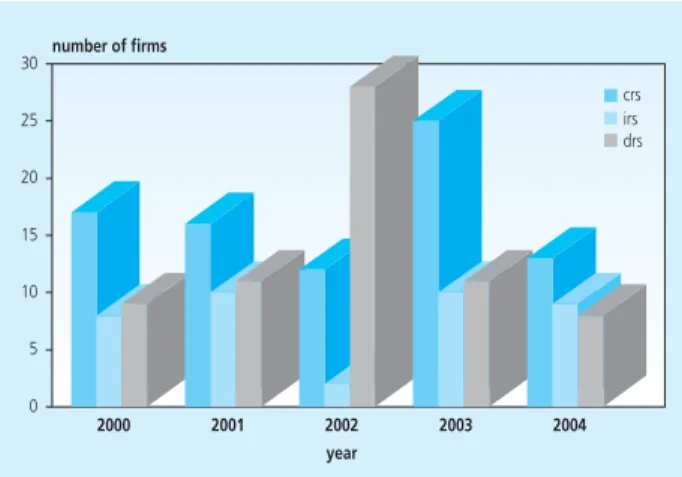

To get a preliminary insight into the data, we present a general description of the 6 variables above. This section reports the results of DEA efficiency analysis of the bank in our data. Therefore, we can examine the impact on the cost-effectiveness of the restructuring process and compare the banks in each region with the same benchmark.

The overall result shows that the average volume efficiency for all banks during the sample period was 88.4 percent, which means that the inefficiency due to the difference in actual operating volume for the most productive volume size is about 11.6 percent. 11 This was not surprising, as descriptive data analysis (Jarque-Bera statistics) shows a distribution of non-normality. As the national income of Middle Eastern countries has been driven by oil production (eg the contribution of oil to Bahrain's GDP is 70%), the financial sector is also sensitive to fluctuations in oil prices.

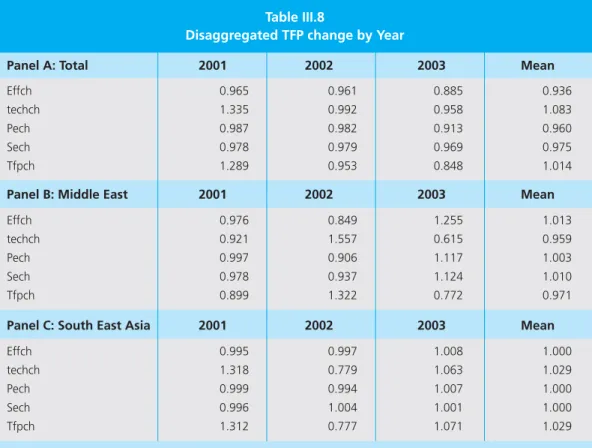

In contrast, the performance of Islamic banks in Southeast Asia had not much affected the aftermath of the attack. The overall result of the Malmquist analysis suggests that there is a decline in technical efficiency over the sample period. Finally, we can say that the Southeast Asian Islamic banks are more efficient than in the Middle East.

It could not address an important conceptual issue related to the data generation process and the issue related to the distribution of error terms. Jacques, ≈A Simultaneous Equations Estimation of the Impact of Prompt Corrective Action on Bank Capital and Risk,Δ Federal Reserve Bank of New York Economic Policy Review, p. Abdel H, ≈Performance Assessment of Islamic Banks: Some Evidence from the Middle East», paper presented at the Preceding for the annual meeting of the MEEA (Annual Meeting of the American Economic Association), New Orleans, Louisiana, January 4-7, 2001.

Weill, Banking Efficiency and European Integration: Productivity, Cost and Profit Approaches, 1998, papir fremlagt på SUERF's 21. Colloquium (Frankfurt, 15.√17. oktober 1998).