Expanding markets while improving health in Indonesia: Private health sector market in the JKN era. Her contribution to the study design, data collection and assessment of the report is immense. Interviews with key informants and desk research enabled us to analyze trends to better understand market movements in the private health sector.

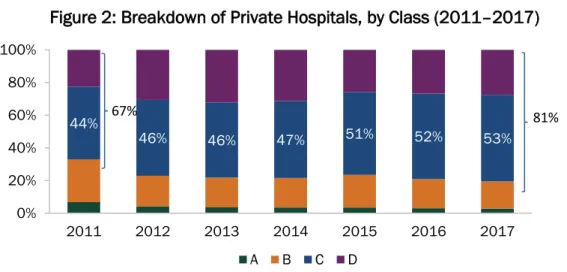

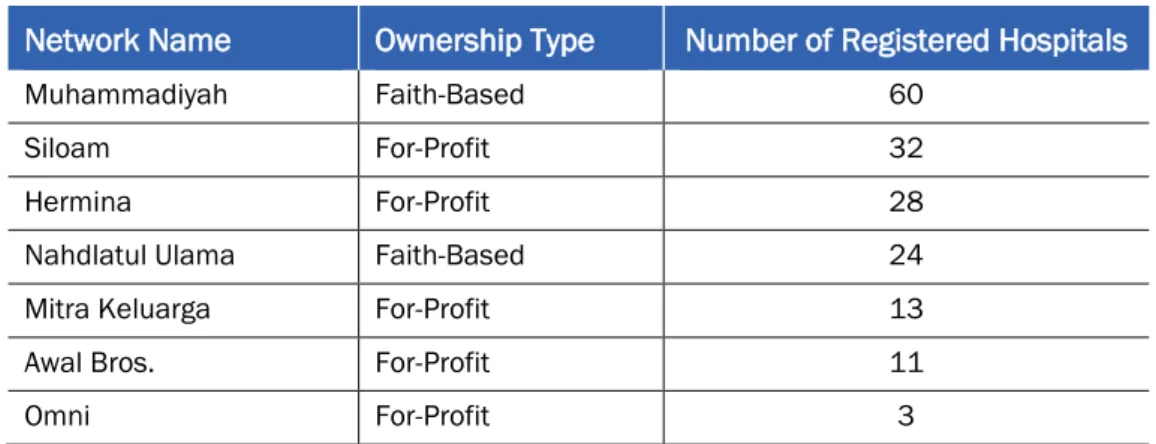

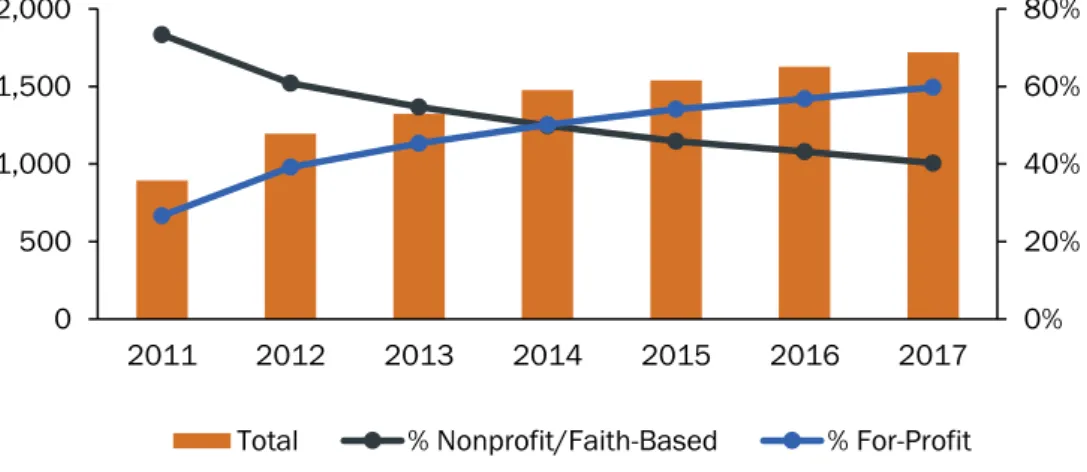

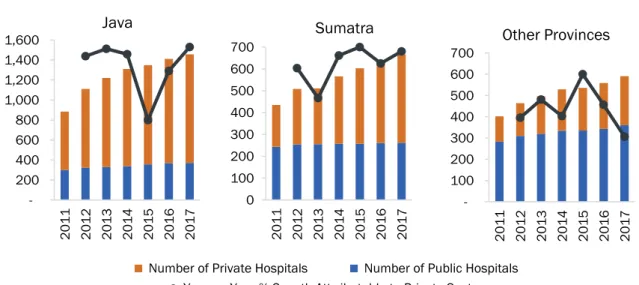

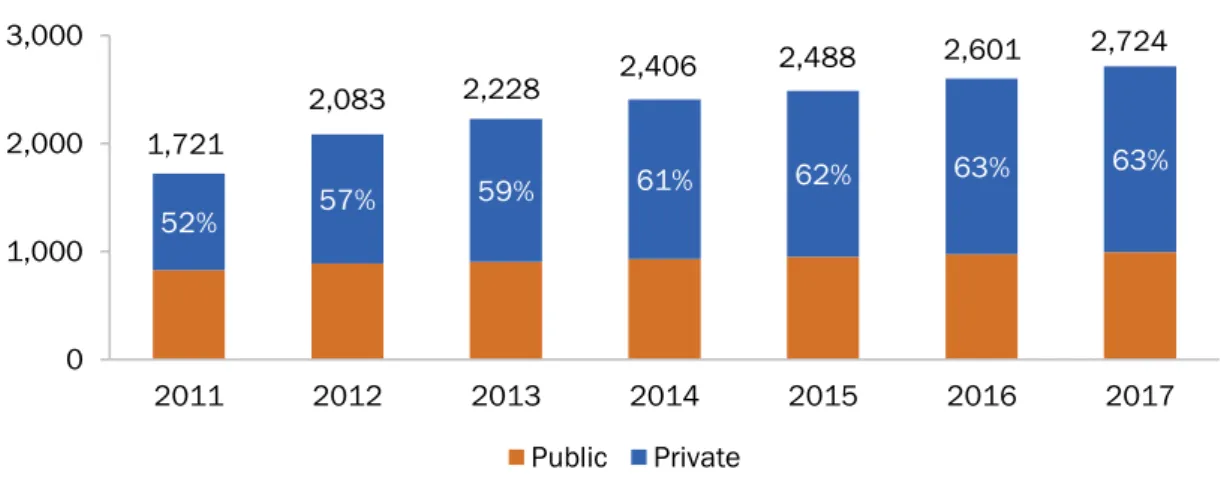

Key informant interviews enabled us to better understand why certain trends are seen in the private health sector. The recent growth in the number of private hospitals is mainly driven by an increase in for-profit hospitals (Figure 3). There are concerted efforts by the government to increase the number of accredited hospitals, especially in the public sector, with the target of reaching 481 hospitals by 2019.

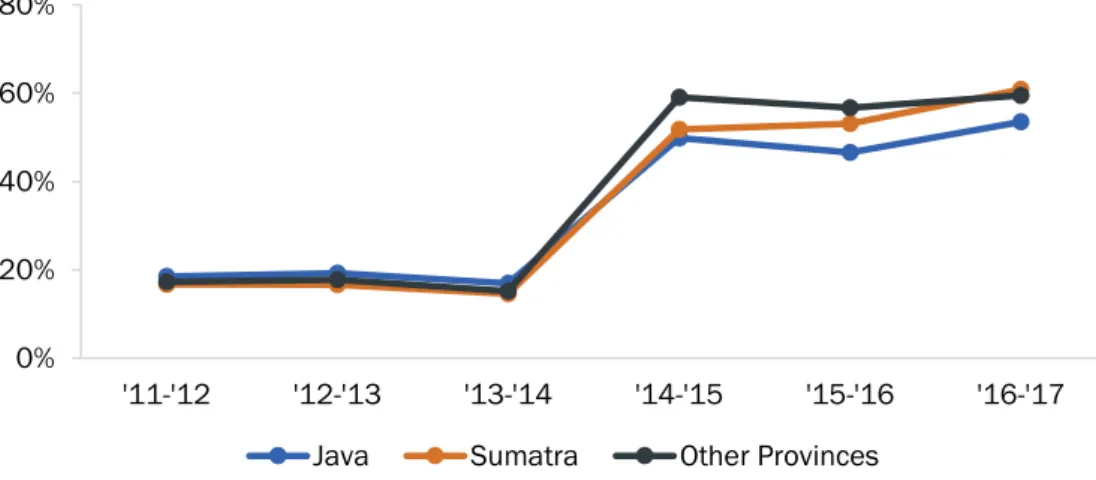

Market Change and Strategic Response in the JKN Era Are there new entrants to the private provider market, especially in regions previously unserved? The private sector is expanding its footprint in the eastern provinces, albeit not at a rapid pace. As Figure 5 shows, the provinces in the Java and Sumatra islands tend to see growth dominated by the private sector.

On the other hand, in the provinces outside Java and Sumatra, the proportion of new hospitals opened by the private sector has decreased since JKN initiation. By 2017, only 44 percent of the total increase in the number of hospitals in this geographic region was attributable to the private sector. The private sector is likely to expand into more rural areas and eastern Indonesia in the long term;.

The generic name of a drug is the name of the active ingredient in the drug. A negative impact of JKN is that MNCs are unable to compete in the generic product market. The current market price of drugs should be accurately reflected in the future fee review process.

Like the pharmaceutical industry, with the income of JKN there was an expectation of rapid growth in the medical device sub-sector. Market Change and Strategic Response in the JKN Era New entrants have entered the medical device market, particularly in previously unserved geographies. Sales are indeed increasing in some areas ... The impact is more product category specific.

Following JKN, the medical device market grew in every category except for patient aids (Figure 14).2 The largest growth was seen in diagnostic imaging, which grew by 56 percent, and consumables, which grew by 40 percent.

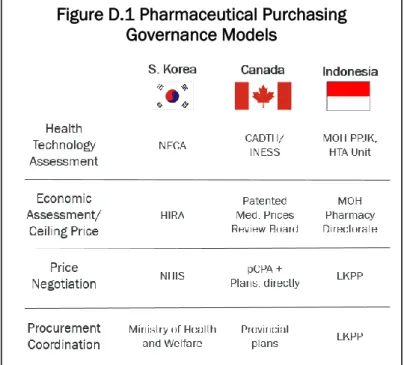

At the same time, pharmaceutical companies and medical device companies are working to have their products listed in the e-catalog, so that BPJS-K contract institutions would purchase their products. BPJS-K should be involved in the process of determining the quantities and prices of priority medicines that are routinely reimbursed or cause significant expenditures under the JKN, in cooperation with the Ministry of Health and LKPP. There are reasons for its wider inclusion in the procurement process, but the scope and feasibility require further discussion.

However, it is not clear whether the focus on price actually reflects the quality and ultimately the value of the product given its current use in the JKN system. While BPJS-K may not have the immediate knowledge, skills and systems to engage in the price negotiation process for priority products, further discussion is needed on how it can become more involved in this process with the LKPP. In the pharmaceutical and medical devices sector, this is likely to affect the sector's ability to increase its production capacity and R&D capacity.

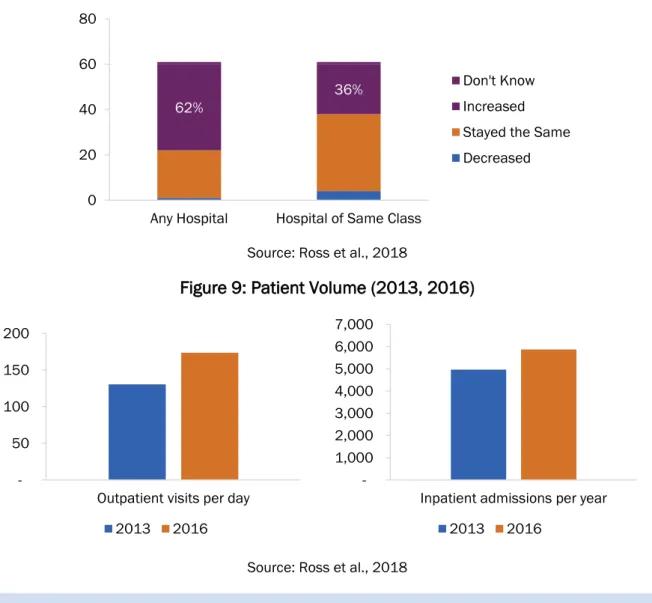

For pharmaceutical and medical device sub-sectors, further reduction of negative investment list restrictions may enable foreign skilled personnel to work and train others in Indonesia. Findings of a survey of private hospitals in Indonesia's era of Jaminan Kesehatan Nasional: The impact of contracts with national health insurance on services, capacity, income and expenditure. Has JKN encouraged an increase in the density of private facilities or services due to greater demand from members.

In Indonesia, this link with upstream entities performed HTA, Economic Assessments are not necessarily related to BPJS-K's selection of which drugs should be listed for exclusive reimbursement and they are not included in the price negotiation process. The current Indonesian system does not appear to show a systematic process - non-cap/filler products appear to be selected in an unsystematic manner and HTAs are being conducted afterwards, with no clear indication of how value will be assessed based on actual use of the product. There is a disconnect between what BPJS-K is paying as a fee versus what the price will be in the e-catalogue.

As a result, there is a potential impact on quality, product diversity and competition in the pharmaceutical market. The action plan specifies that the pharmaceutical and medical device industries prioritize the use of locally produced raw materials and that the government and private suppliers in the industries prioritize pharmaceutical preparations that use local raw materials and local medical devices. Furthermore, the action plan highlights a limitation in the lack of human resources with the skills and expertise in drug development and the need for technology transfer from MNCs.

At the same time, there is pressure on the companies to be more price conscious, as the prices in the e-catalog are falling. Regulation 17/2017 specifically stipulates that the pharmaceutical industry prioritizes the use of locally produced raw materials, and that public and private suppliers in the industry prioritize medical equipment using local raw materials.